Aromatic Solvents Market Report

Published Date: 02 February 2026 | Report Code: aromatic-solvents

Aromatic Solvents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aromatic Solvents market, detailing key insights and future forecasts from 2023 to 2033, including market size, growth trends, segmentation, industry leaders, and regional analyses.

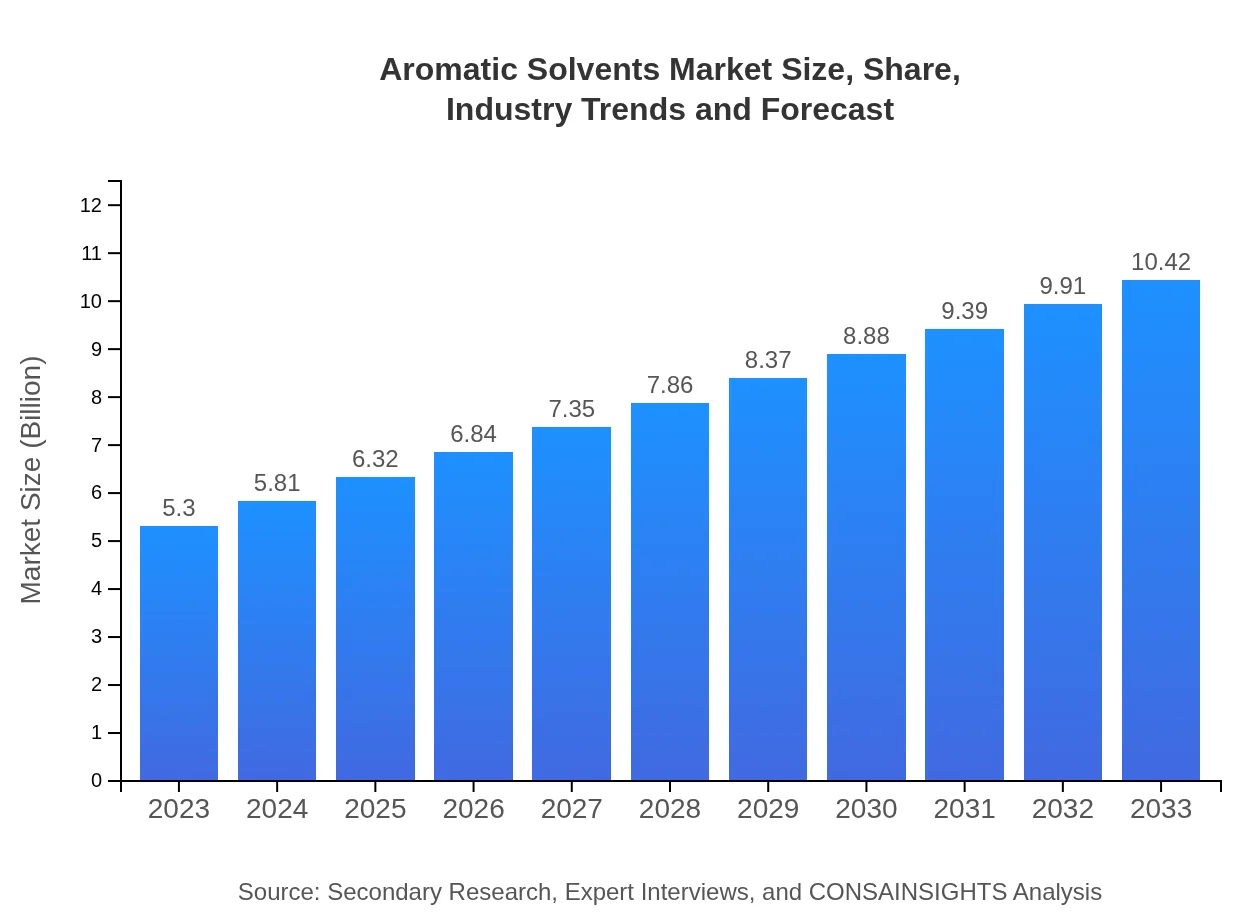

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.42 Billion |

| Top Companies | BASF SE, ExxonMobil Chemical, Dow Chemical Company, Shell Chemical, SABIC |

| Last Modified Date | 02 February 2026 |

Aromatic Solvents Market Overview

Customize Aromatic Solvents Market Report market research report

- ✔ Get in-depth analysis of Aromatic Solvents market size, growth, and forecasts.

- ✔ Understand Aromatic Solvents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aromatic Solvents

What is the Market Size & CAGR of Aromatic Solvents market in 2023?

Aromatic Solvents Industry Analysis

Aromatic Solvents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aromatic Solvents Market Analysis Report by Region

Europe Aromatic Solvents Market Report:

Europe's aromatic solvents market is forecasted to grow from $1.43 billion in 2023 to $2.81 billion by 2033. The region has seen a shift towards sustainable practices, with manufacturers increasingly focusing on environmentally-friendly solvent alternatives.Asia Pacific Aromatic Solvents Market Report:

The Asia-Pacific region is projected to grow from $1.05 billion in 2023 to $2.07 billion by 2033, driven by rapid industrialization and urbanization. Countries like China and India are significantly contributing to this growth with their expanding paint and coatings industries.North America Aromatic Solvents Market Report:

North America, valued at $1.88 billion in 2023, is anticipated to reach $3.69 billion by 2033. The market's growth is powered by advances in automotive manufacturing and stringent environmental policies promoting the use of low-VOC solvents.South America Aromatic Solvents Market Report:

In South America, the market is expected to increase from $0.45 billion in 2023 to $0.88 billion in 2033. The growth is largely influenced by increasing construction activities and a rising demand for adhesives in the region.Middle East & Africa Aromatic Solvents Market Report:

In the Middle East and Africa, the market size is expected to increase from $0.49 billion in 2023 to $0.97 billion by 2033, driven by infrastructural development and a growing chemicals sector, particularly in the UAE and South Africa.Tell us your focus area and get a customized research report.

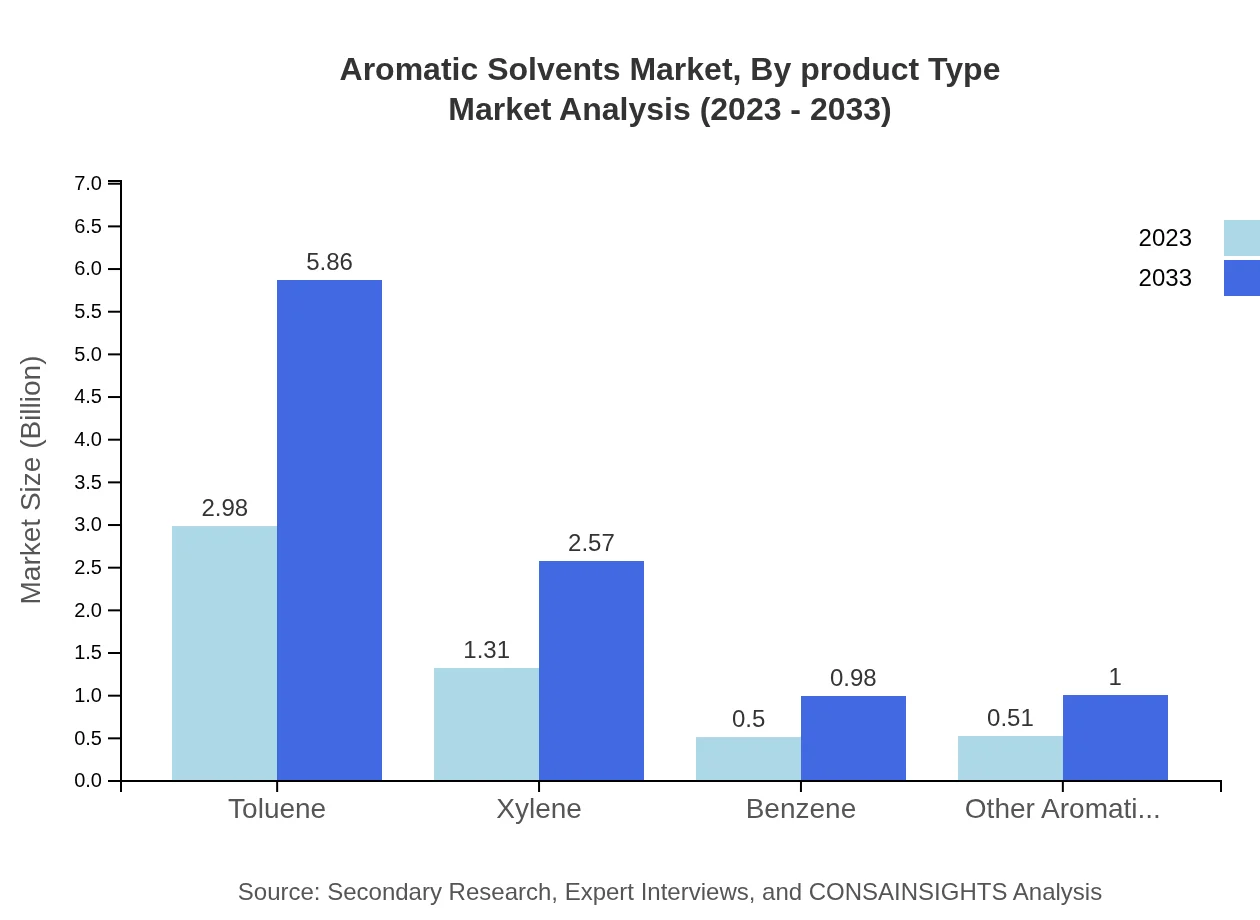

Aromatic Solvents Market Analysis By Product Type

The product types in the aromatic solvents market include Toluene, Xylene, Benzene, and others. Toluene holds the largest share at 56.29% in 2023, with expected growth to 5.86 billion by 2033. Xylene follows, expected to grow significantly due to its versatile applications in coatings and adhesives. Benzene also plays a crucial role, particularly in chemical manufacturing, despite facing regulatory scrutiny.

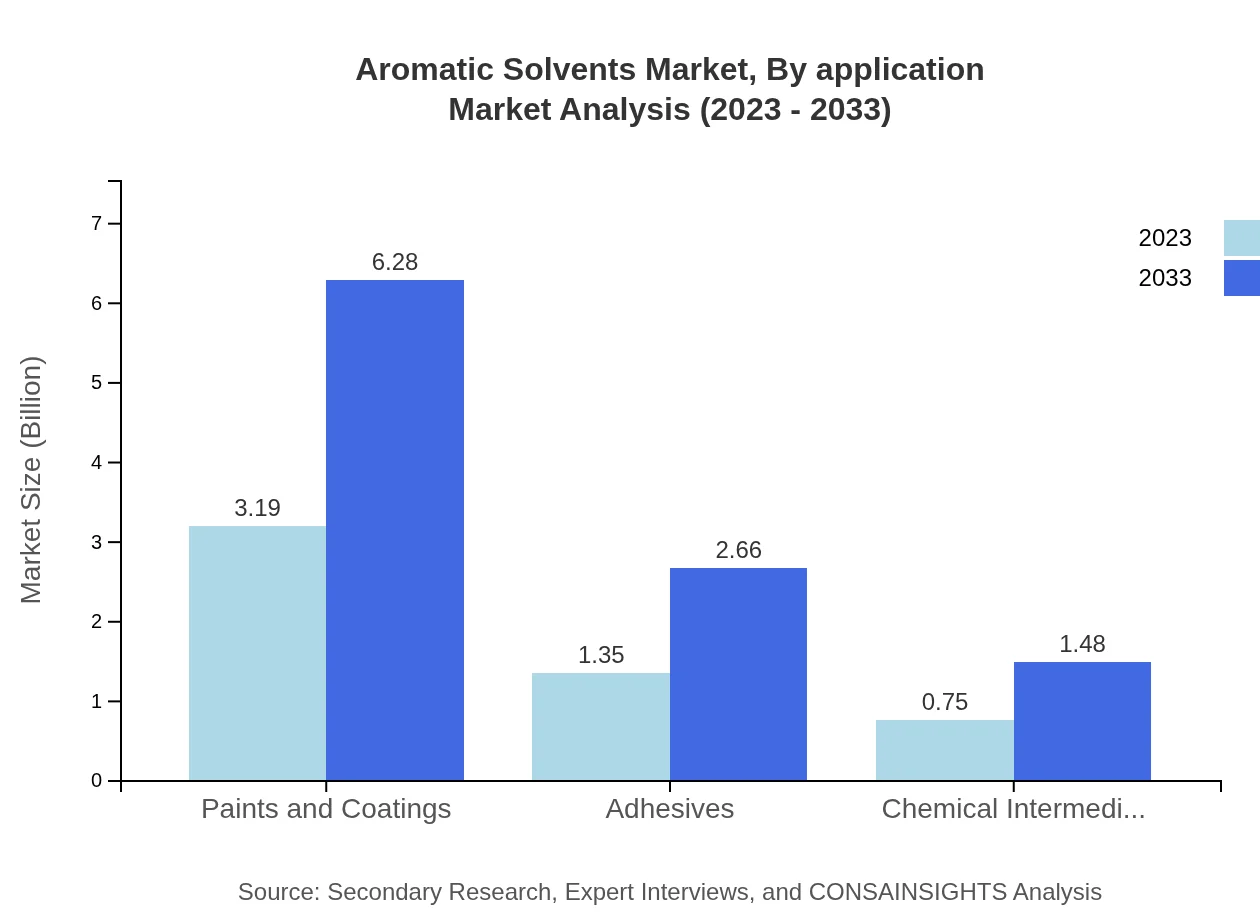

Aromatic Solvents Market Analysis By Application

The segment of Paints and Coatings is the dominant application area, representing 60.28% of the market in 2023, anticipated to reach 6.28 billion by 2033. Adhesives follow closely behind, holding 25.52% share and marking an uptrend due to construction industry dynamics. Chemical intermediates also show significant growth potential as the demand for specialized chemicals increases.

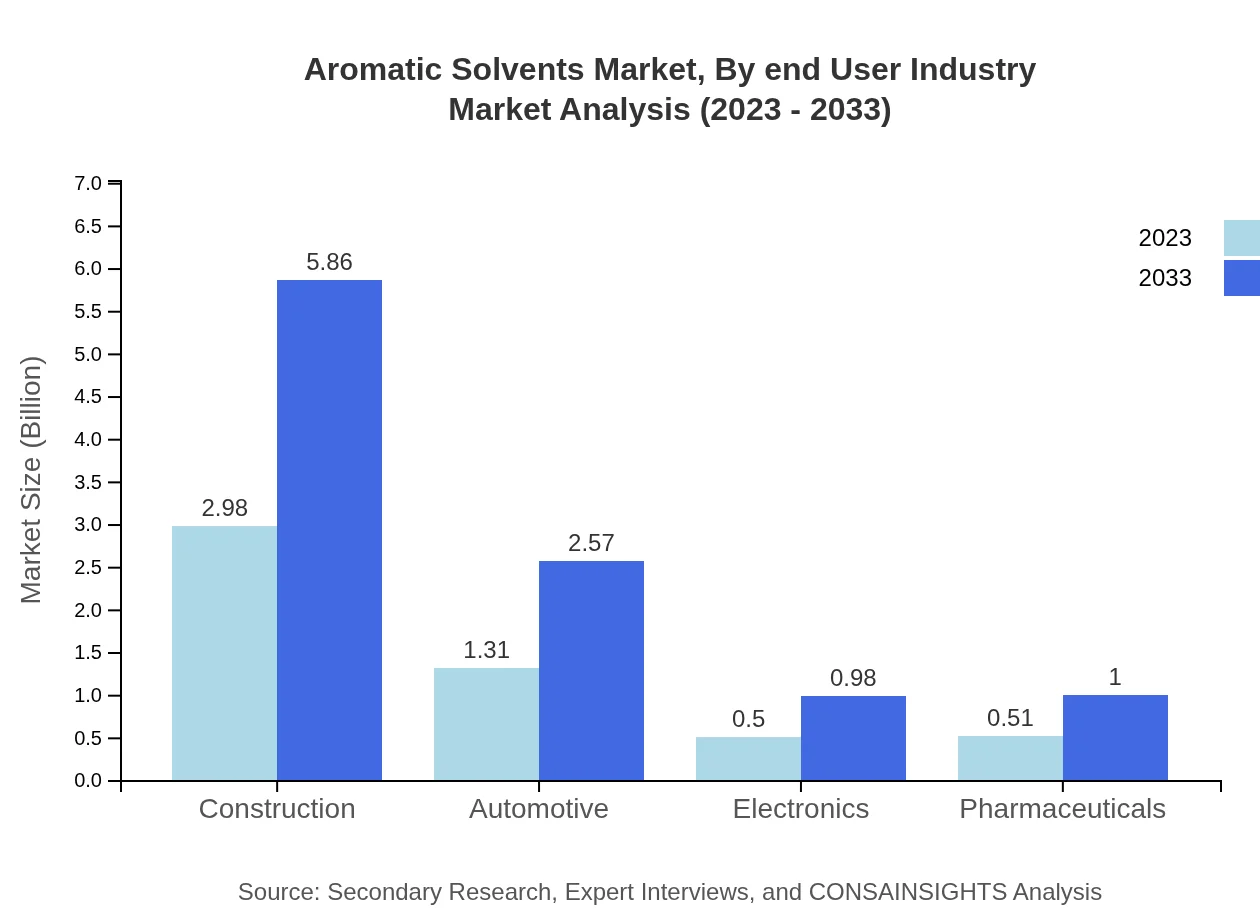

Aromatic Solvents Market Analysis By End User Industry

Key end-user industries are Construction, Automotive, Electronics, Pharmaceuticals, and others. The Construction industry constitutes a significant portion of the market, valued at 56.29% in 2023, while Automotive represents 24.69%. As economic growth propagates in emerging markets, these industries are projected to expand significantly, further driving solvent consumption.

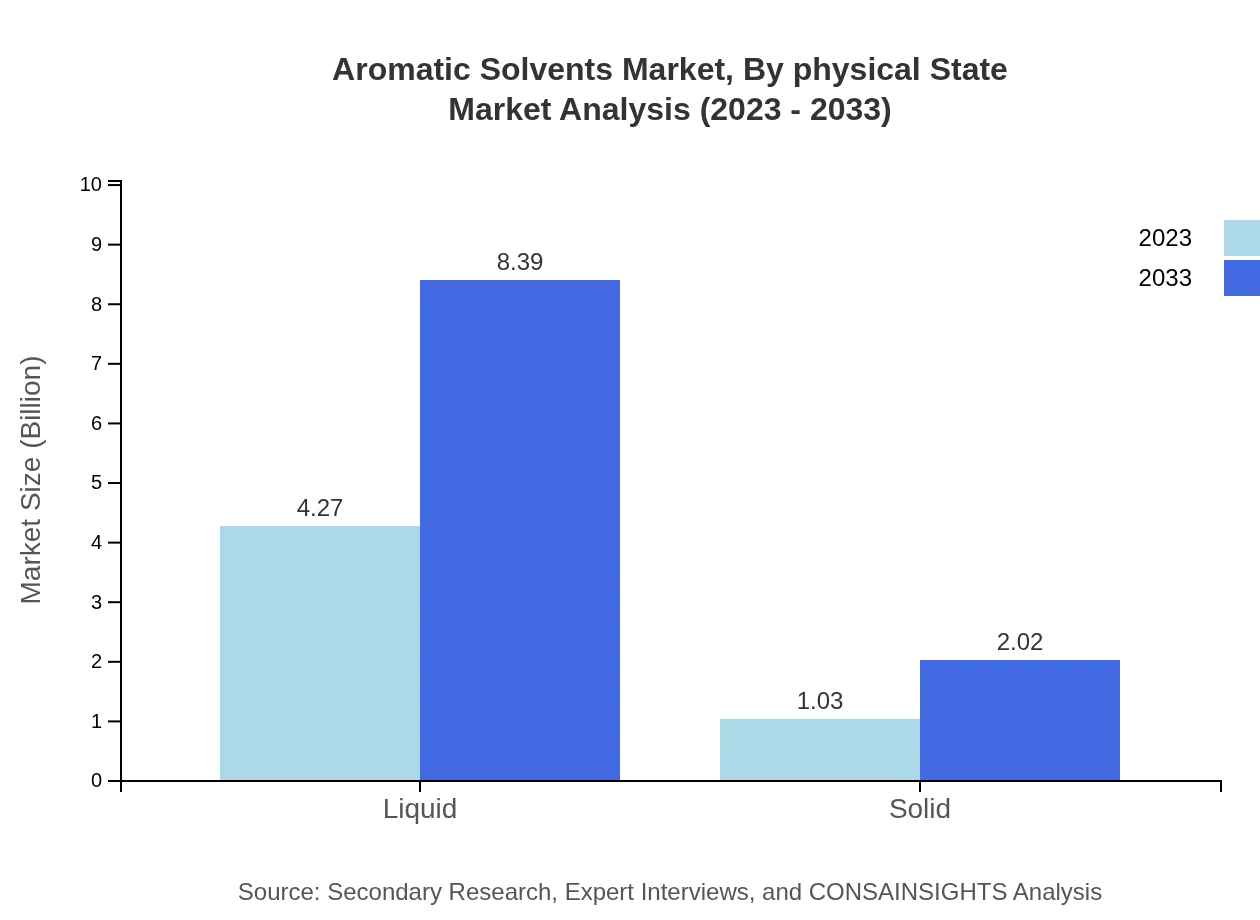

Aromatic Solvents Market Analysis By Physical State

The market is primarily divided into liquid and solid solvents, with liquid variants comprising 80.58% share in 2023 and expected to grow in parallel with demand in various applications, including paints and coatings which predominantly utilize liquid solvents for formulations.

Aromatic Solvents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aromatic Solvents Industry

BASF SE:

BASF is a leading global chemical company that offers a wide range of products including aromatic solvents, focusing on sustainable solutions and innovation in chemical formulations.ExxonMobil Chemical:

ExxonMobil is a major player in the solvent market, known for producing high-quality aromatic solvents that meet strict industry standards and performance requirements.Dow Chemical Company:

Dow Chemical is recognized for its advanced chemical manufacturing capabilities and a diverse portfolio of aromatic solvents, with strong emphasis on sustainability and environmental compliance.Shell Chemical:

Shell is a prominent entity in hydrocarbon production, providing a broad range of aromatic solvents, and is actively investing in renewable solutions.SABIC:

SABIC is one of the largest petrochemical companies globally, offering a variety of aromatic solvents and focusing on developing innovative chemical solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of aromatic Solvents?

The aromatic solvents market is valued at approximately 5.3 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.8%, projecting significant growth throughout its forecasted period up to 2033.

What are the key market players or companies in this aromatic solvents industry?

Key players in the aromatic solvents market include major companies such as ExxonMobil, BASF SE, and Huntsman Corporation, which are leading the industry by offering innovative solutions and expanding their product portfolios to capture market share.

What are the primary factors driving the growth in the aromatic solvents industry?

The growth in the aromatic solvents industry is primarily driven by increasing demand in paints and coatings, rising industrial activities, and advancements in chemical formulations that offer better performance and eco-friendly alternatives.

Which region is the fastest Growing in the aromatic solvents?

The fastest-growing region in the aromatic solvents market is expected to be North America, with a projected growth from a market size of 1.88 billion in 2023 to approximately 3.69 billion by 2033, reflecting significant expansion.

Does ConsaInsights provide customized market report data for the aromatic solvents industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the aromatic solvents industry, ensuring that the research aligns with individual business objectives and insights.

What deliverables can I expect from this aromatic solvents market research project?

Deliverables from the aromatic solvents market research project typically include comprehensive reports, detailed market analysis, sector insights, trend forecasts, and strategic recommendations tailored to enhance business decision-making.

What are the market trends of aromatic solvents?

Current market trends in the aromatic solvents industry include a shift towards sustainable materials, improved efficiency in production processes, and innovations in product applications catering to various industries such as automotive and construction.