Artificial Intelligence In Accounting Market Report

Published Date: 31 January 2026 | Report Code: artificial-intelligence-in-accounting

Artificial Intelligence In Accounting Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Artificial Intelligence In Accounting industry, detailing market size, growth projections, regional insights, and competitive landscape from 2023 to 2033. It aims to equip stakeholders with in-depth knowledge of trends and forecasts in this evolving market.

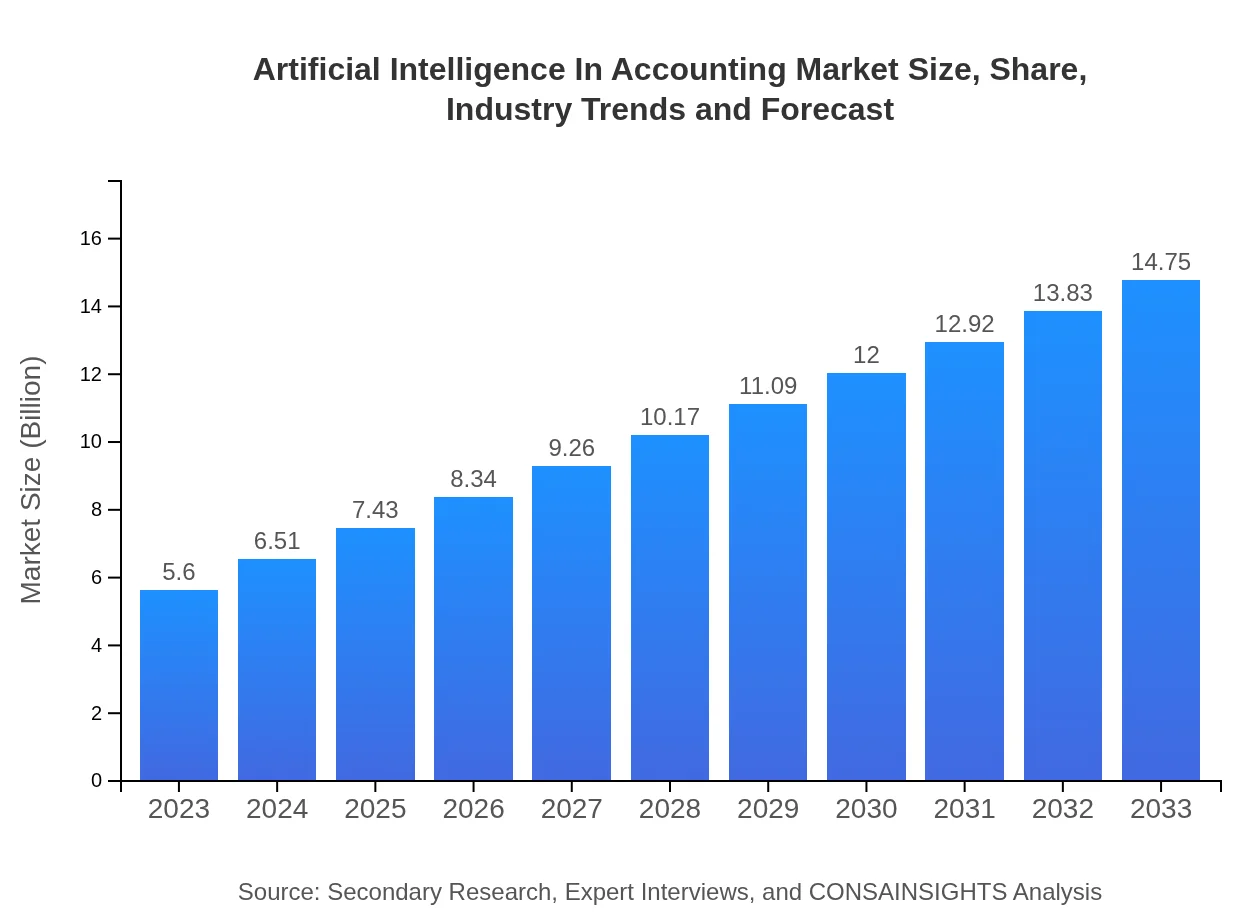

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $14.75 Billion |

| Top Companies | Intuit Inc., Xero Limited, UiPath Inc., Sage Group plc., BlackLine, Inc. |

| Last Modified Date | 31 January 2026 |

Artificial Intelligence In Accounting Market Overview

Customize Artificial Intelligence In Accounting Market Report market research report

- ✔ Get in-depth analysis of Artificial Intelligence In Accounting market size, growth, and forecasts.

- ✔ Understand Artificial Intelligence In Accounting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Artificial Intelligence In Accounting

What is the Market Size & CAGR of Artificial Intelligence In Accounting market in 2023?

Artificial Intelligence In Accounting Industry Analysis

Artificial Intelligence In Accounting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Artificial Intelligence In Accounting Market Analysis Report by Region

Europe Artificial Intelligence In Accounting Market Report:

Europe's market, valued at $1.78 billion in 2023, is expected to grow to $4.69 billion by 2033. Countries such as Germany, the UK, and France are at the forefront of AI adoption in accounting, driven by stringent regulatory compliance requirements and a strong focus on innovation in financial services.Asia Pacific Artificial Intelligence In Accounting Market Report:

In 2023, the Asia Pacific region's market size for Artificial Intelligence in Accounting stands at $1.04 billion, with a forecasted growth to $2.74 billion by 2033. This growth is driven by increasing digitalization among businesses, especially in countries like China, India, and Japan. The increasing number of tech startups and investments in AI research and development further bolster the market's expansion in the region.North America Artificial Intelligence In Accounting Market Report:

North America leads the market with a size of $2.00 billion in 2023, projected to grow to $5.26 billion by 2033. High adoption of advanced technologies, significant venture capital investments, and a mature financial services sector contribute to this dominance. Furthermore, regulatory pressures for compliance are prompting businesses to leverage AI solutions.South America Artificial Intelligence In Accounting Market Report:

The South American market for Artificial Intelligence in Accounting is valued at $0.43 billion in 2023 and is expected to reach $1.13 billion by 2033. The region is witnessing a gradual adaptation to AI technologies, predominantly in Brazil and Argentina, where businesses are exploring AI applications for improving resource management and compliance.Middle East & Africa Artificial Intelligence In Accounting Market Report:

The Middle East and Africa (MEA) market for Artificial Intelligence in Accounting is estimated at $0.35 billion in 2023, growing to $0.92 billion by 2033. The region is gradually embracing AI technologies, particularly in the UAE and South Africa, influenced by growing awareness of AI benefits in enhancing accounting efficiencies.Tell us your focus area and get a customized research report.

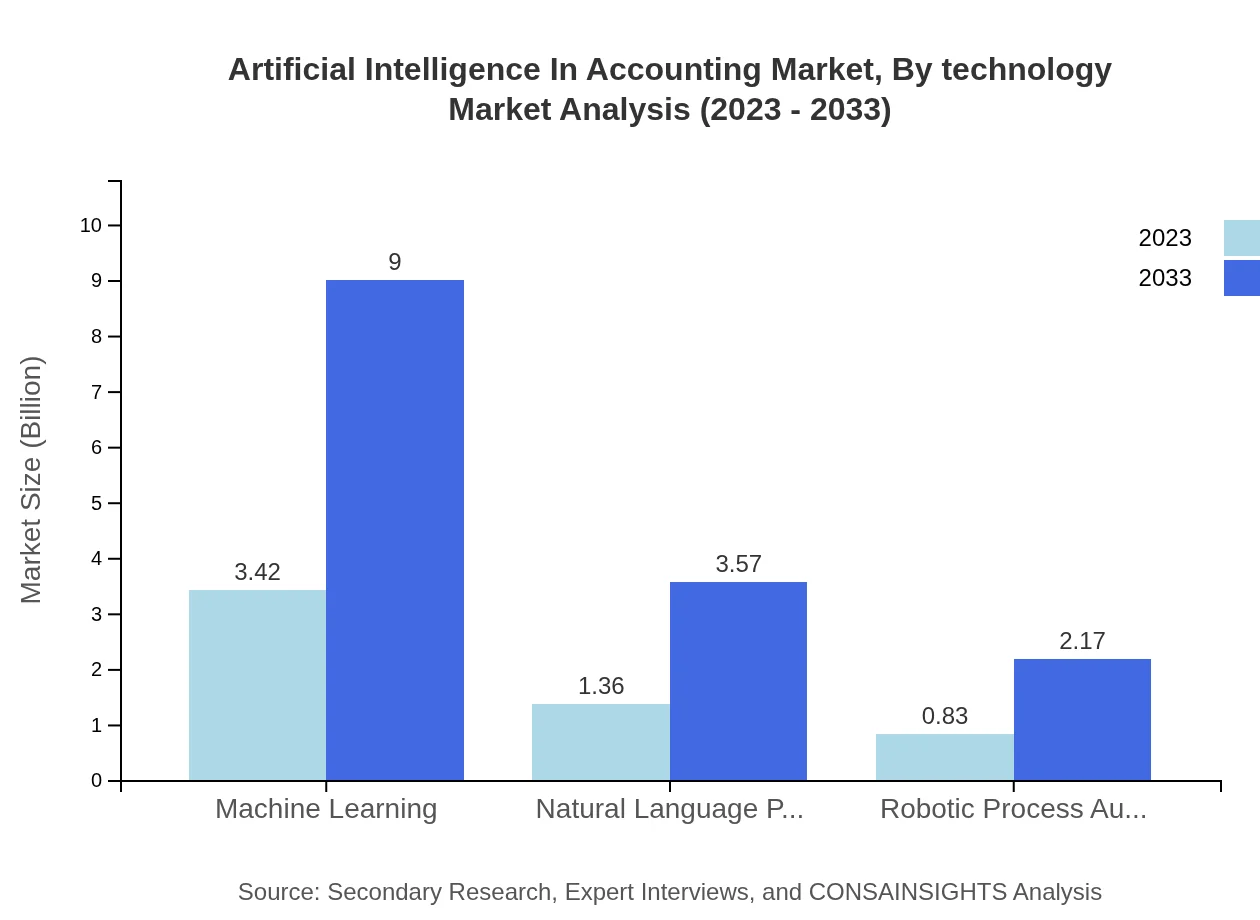

Artificial Intelligence In Accounting Market Analysis By Technology

Machine Learning is a leading segment, projected to grow from $3.42 billion in 2023 to $9.00 billion by 2033, holding a 61.02% market share throughout the period. Natural Language Processing is also on the rise, increasing from $1.36 billion to $3.57 billion, maintaining a 24.24% market share. Robotic Process Automation, while smaller, shows potential growth from $0.83 billion to $2.17 billion, reflecting a 14.74% share.

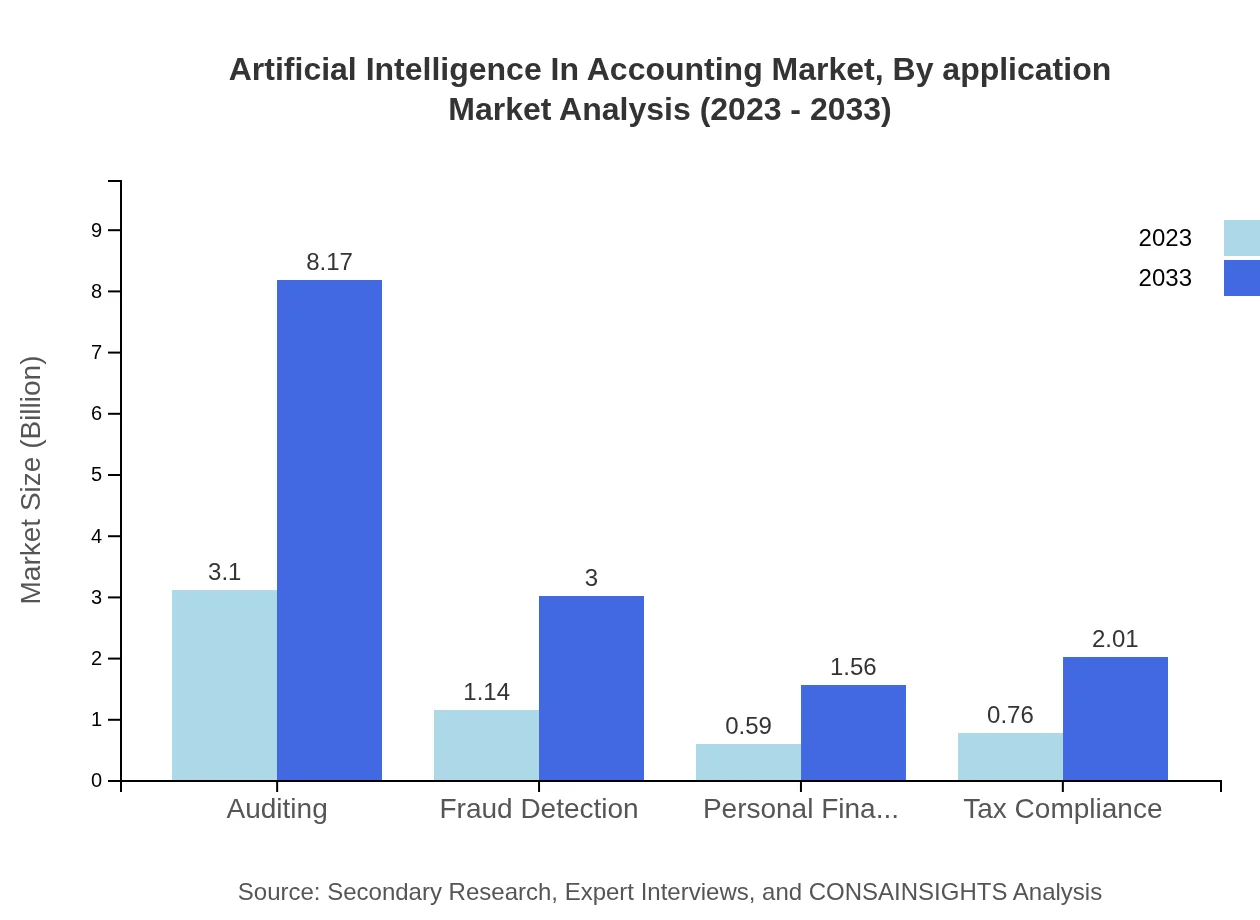

Artificial Intelligence In Accounting Market Analysis By Application

Auditing represents the largest application segment within the accounting industry, with a market size growth from $3.10 billion in 2023 to $8.17 billion by 2033, which corresponds to a 55.42% market share. Fraud Detection follows, expected to grow from $1.14 billion to $3.00 billion with a market share of 20.37%. Other applications include tax compliance and personal finance management, growing in significance as organizations adopt AI solutions.

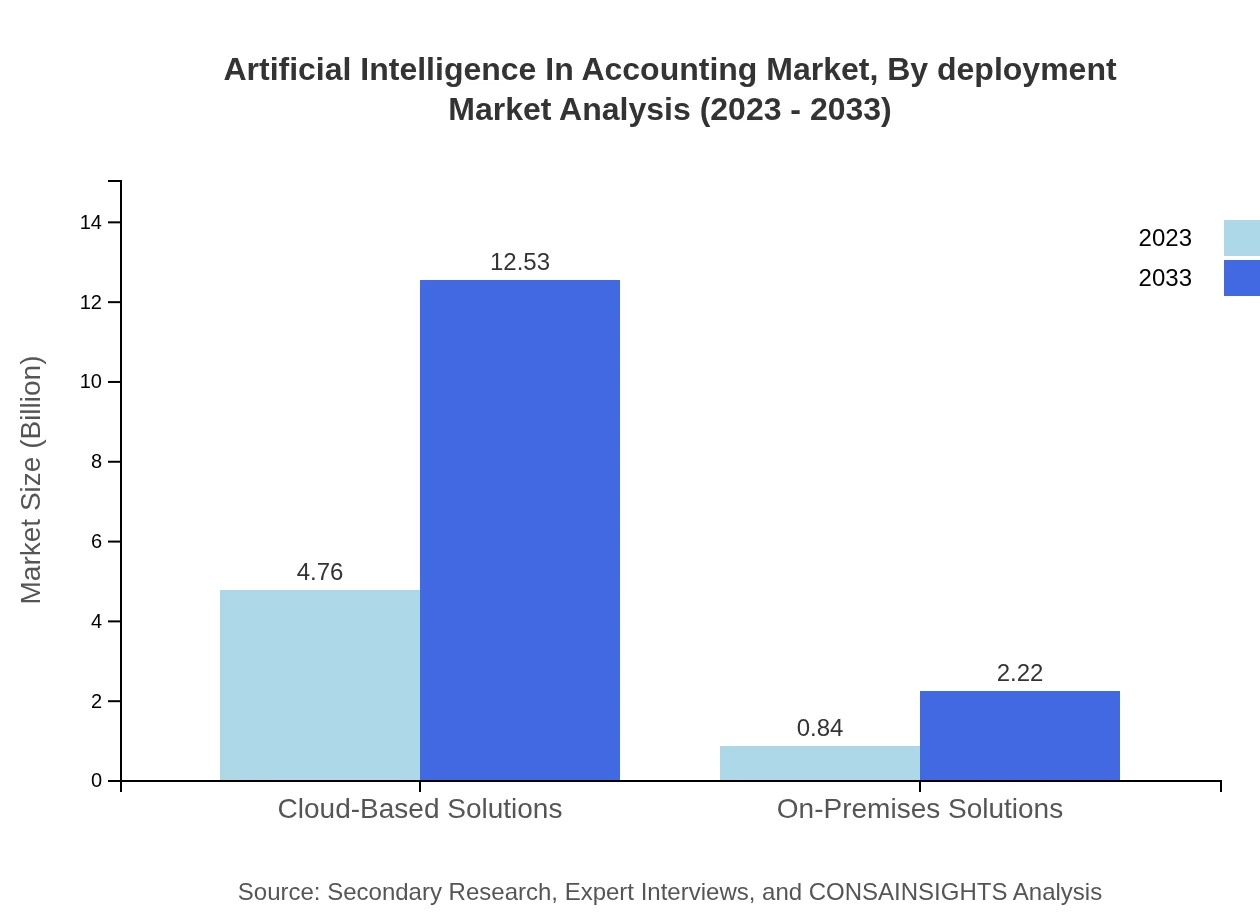

Artificial Intelligence In Accounting Market Analysis By Deployment

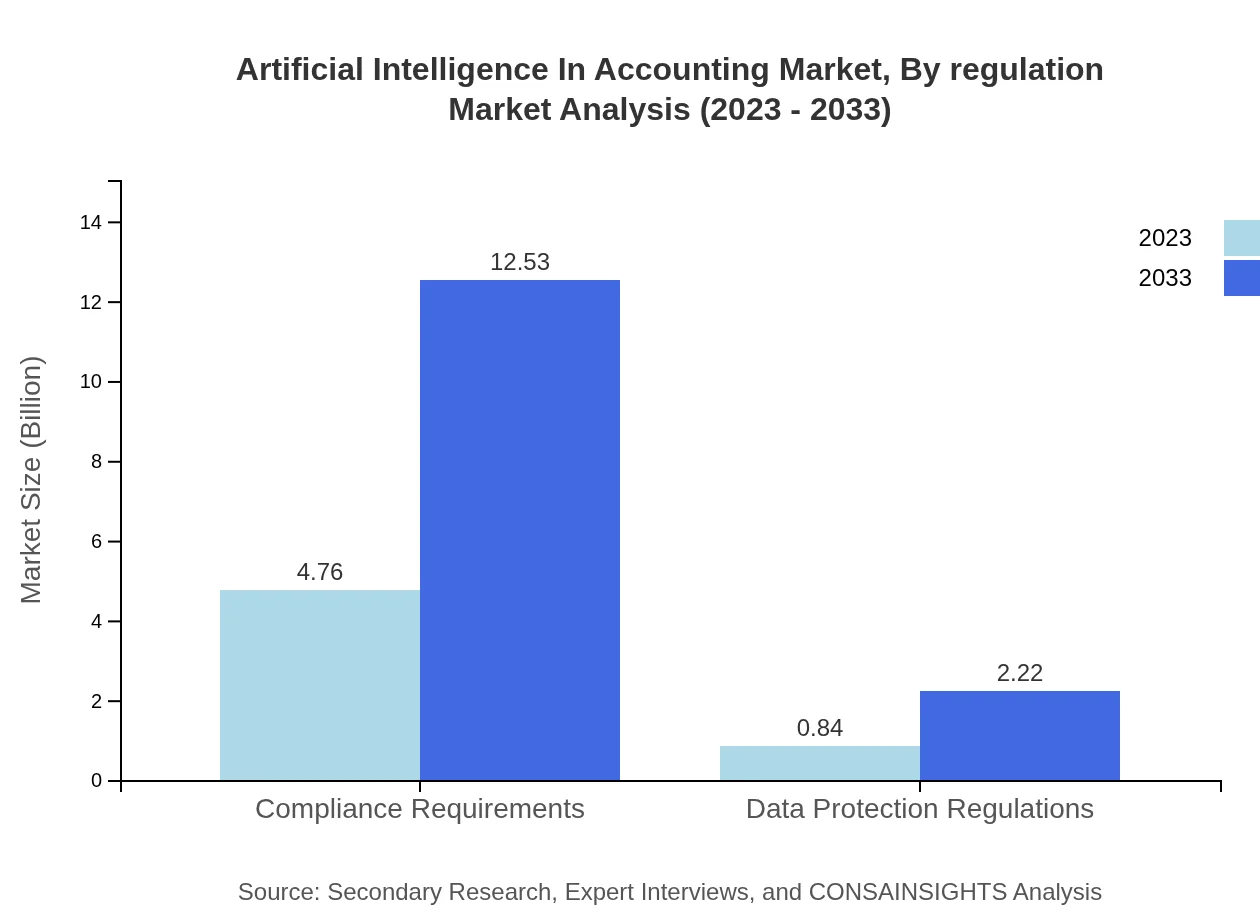

Cloud-Based Solutions dominate with a market size of $4.76 billion in 2023, increasing to $12.53 billion by 2033, capturing an 84.97% share. On-Premises Solutions are valued at $0.84 billion, growing to $2.22 billion, holding a share of 15.03%. The shift towards cloud-based platforms is propelled by their scalability and accessibility.

Artificial Intelligence In Accounting Market Analysis By End User

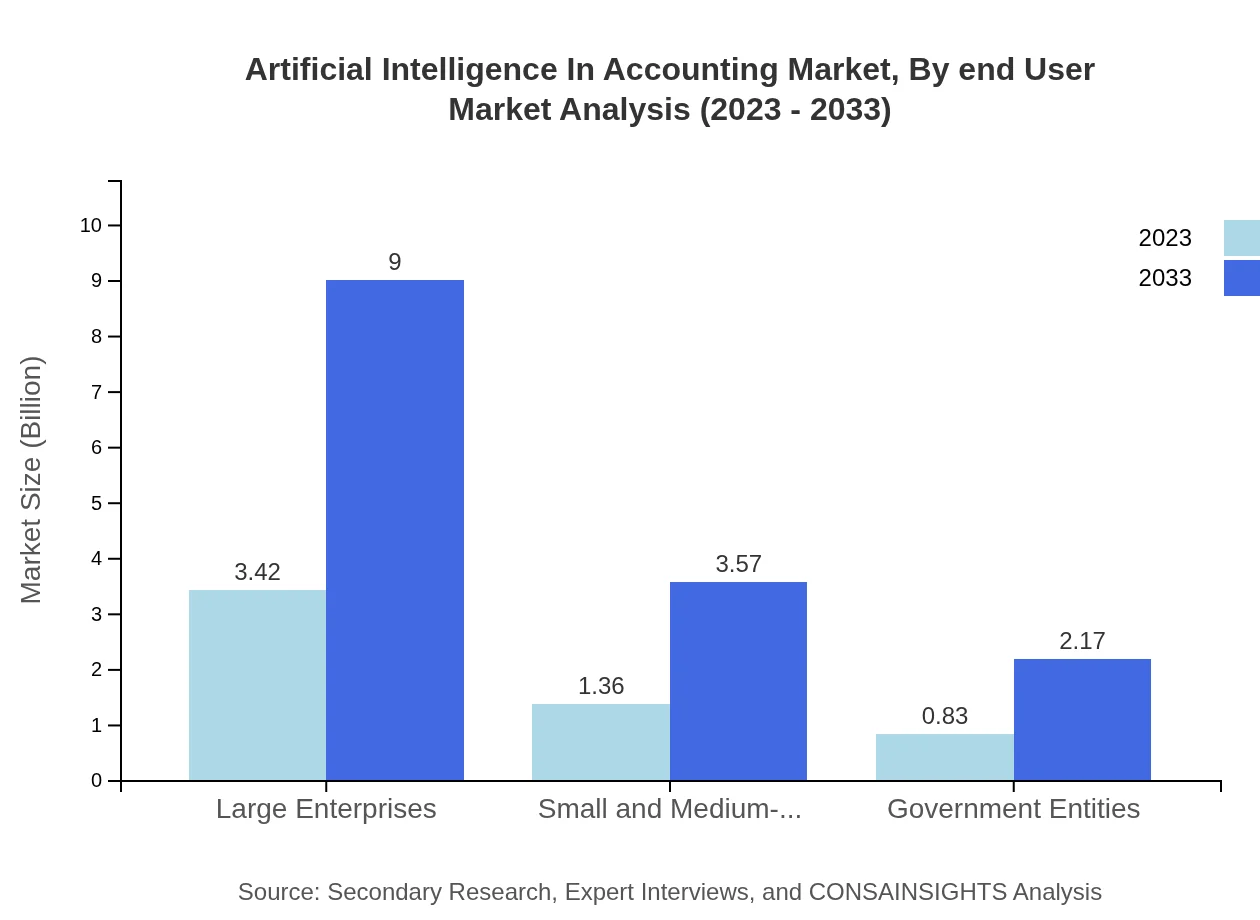

Large Enterprises lead the market, growing from $3.42 billion in 2023 to $9.00 billion with a market share of 61.02%. Small and Medium-Sized Enterprises are also a significant segment, expected to grow from $1.36 billion to $3.57 billion with a share of 24.24%. Government Entities are projected to grow from $0.83 billion to $2.17 billion, representing 14.74% of the market.

Artificial Intelligence In Accounting Market Analysis By Regulation

Compliance Requirements drive a substantial segment, with a market size of $4.76 billion in 2023, expected to grow to $12.53 billion by 2033, and maintaining an 84.97% share. Data Protection Regulations are also critical, projected to increase from $0.84 billion to $2.22 billion reflecting a 15.03% share.

Artificial Intelligence In Accounting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Artificial Intelligence In Accounting Industry

Intuit Inc.:

A leading provider of financial software solutions, Intuit integrates AI into its products to enhance bookkeeping, tax preparation, and financial management for individuals and businesses.Xero Limited:

Known for its cloud-based accounting software, Xero leverages AI to facilitate real-time financial reporting and automated invoicing solutions, catering primarily to SMEs.UiPath Inc.:

Pioneering in robotic process automation, UiPath enhances accounting workloads with AI-driven automation, promoting efficiency in routine accounting activities.Sage Group plc.:

Sage provides cloud-based accounting solutions with integrated AI functionalities, helping organizations streamline financial operations and compliance tasks worldwide.BlackLine, Inc.:

Specializing in financial automation technologies, BlackLine employs AI to improve accuracy and speed in the month-end closing process, helping finance teams achieve compliance rapidly.We're grateful to work with incredible clients.

FAQs

What is the market size of artificial Intelligence In Accounting?

The artificial intelligence in accounting market is projected to be valued at approximately $5.6 billion in 2023, with a robust CAGR of 9.8%, indicating substantial growth potential in the coming decade.

What are the key market players or companies in this artificial Intelligence In Accounting industry?

Prominent players include Intuit, Xero, Sage, and IBM. These companies are pivotal in developing AI solutions that enhance accounting processes, improving efficiency, accuracy, and compliance.

What are the primary factors driving the growth in the artificial Intelligence In Accounting industry?

Key factors include increasing automation in accounting, rising demand for data analytics, the need for cost-effective solutions, and advancements in AI technologies, which enhance accuracy and decision-making.

Which region is the fastest Growing in the artificial Intelligence In Accounting?

The fastest-growing region is North America, expected to grow from $2.00 billion in 2023 to $5.26 billion by 2033, driven by technological advancements and increased adoption of AI among enterprises.

Does ConsaInsights provide customized market report data for the artificial Intelligence In Accounting industry?

Yes, ConsaInsights offers tailored market report data that caters to specific needs in the artificial intelligence in accounting sector, addressing various parameters and insights that firms may require.

What deliverables can I expect from this artificial Intelligence In Accounting market research project?

Expect comprehensive reports, market trend analyses, competitor assessments, regional breakdowns, and segmented insights to guide strategic decision-making in the artificial intelligence in accounting field.

What are the market trends of artificial Intelligence In Accounting?

Trends include a shift towards cloud-based solutions, increasing emphasis on machine learning, and growing integration of natural language processing and robotic process automation in accounting tasks.