Artificial Lift Market Report

Published Date: 22 January 2026 | Report Code: artificial-lift

Artificial Lift Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Artificial Lift market from 2023 to 2033, offering insights into market size, trends, regional analysis, segment performance, leading players, and future forecasts.

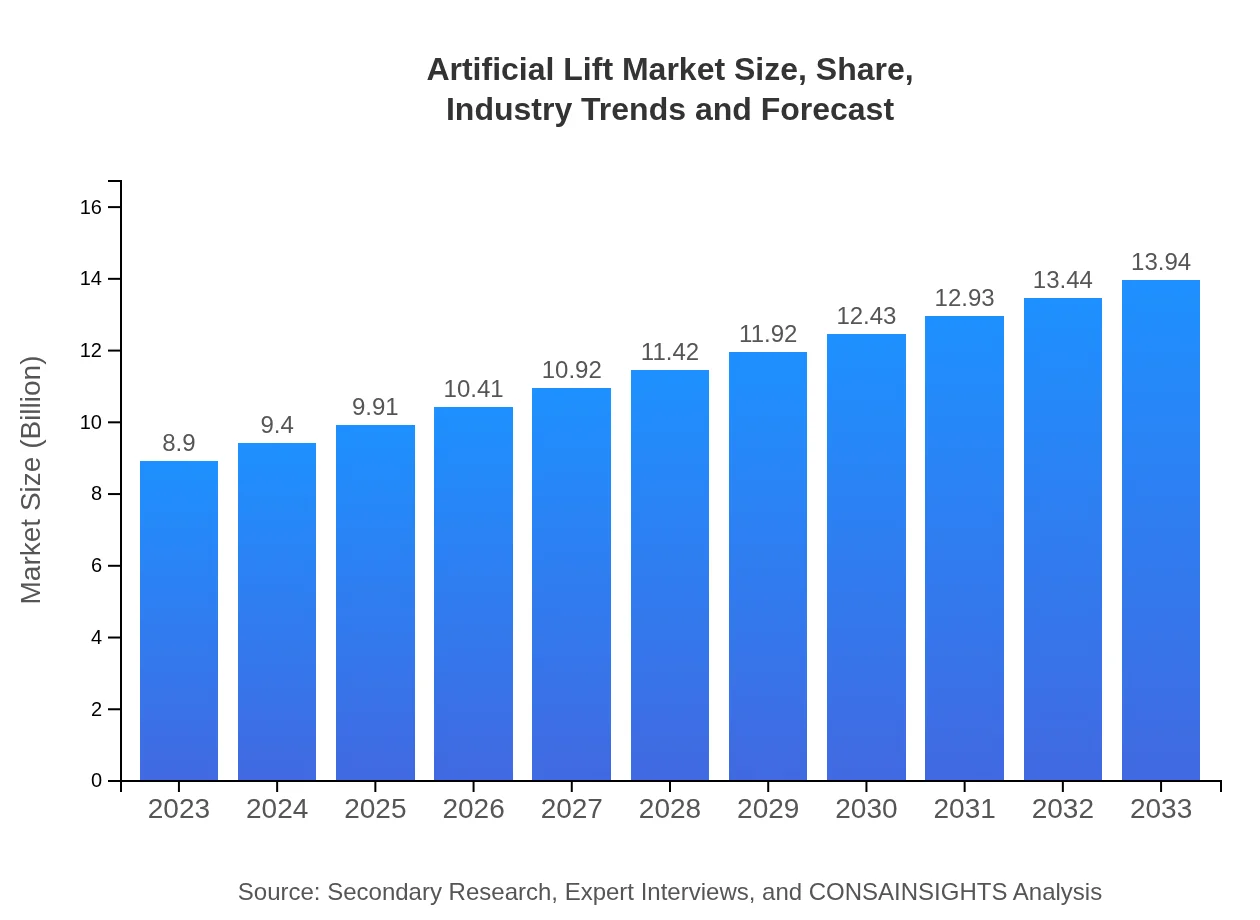

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.90 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $13.94 Billion |

| Top Companies | Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International |

| Last Modified Date | 22 January 2026 |

Artificial Lift Market Overview

Customize Artificial Lift Market Report market research report

- ✔ Get in-depth analysis of Artificial Lift market size, growth, and forecasts.

- ✔ Understand Artificial Lift's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Artificial Lift

What is the Market Size & CAGR of the Artificial Lift market in 2023?

Artificial Lift Industry Analysis

Artificial Lift Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Artificial Lift Market Analysis Report by Region

Europe Artificial Lift Market Report:

The European market is anticipated to experience growth from $2.47 billion in 2023 to $3.87 billion by 2033, driven by a rising focus on energy security and more efficient extraction technologies in the North Sea and other areas.Asia Pacific Artificial Lift Market Report:

The Asia Pacific region is projected to see significant growth in the Artificial Lift market, with a market size expected to rise from $1.74 billion in 2023 to $2.72 billion by 2033. This growth is driven by increasing investments in energy infrastructure and a rising number of offshore and onshore projects.North America Artificial Lift Market Report:

North America is expected to maintain its leading position in the market with a size projected to grow from $2.92 billion in 2023 to $4.57 billion by 2033, largely owing to technological advancements and significant shale oil production activities.South America Artificial Lift Market Report:

In South America, the market for Artificial Lift is forecasted to grow from $0.86 billion in 2023 to $1.35 billion in 2033. The region's vast oil reserves and increased exploration activities are key factors supporting this growth.Middle East & Africa Artificial Lift Market Report:

The Middle East and Africa region is set to grow from $0.91 billion in 2023 to $1.43 billion by 2033, underpinned by the ongoing focus on maximizing oil recovery amidst changing energy policies.Tell us your focus area and get a customized research report.

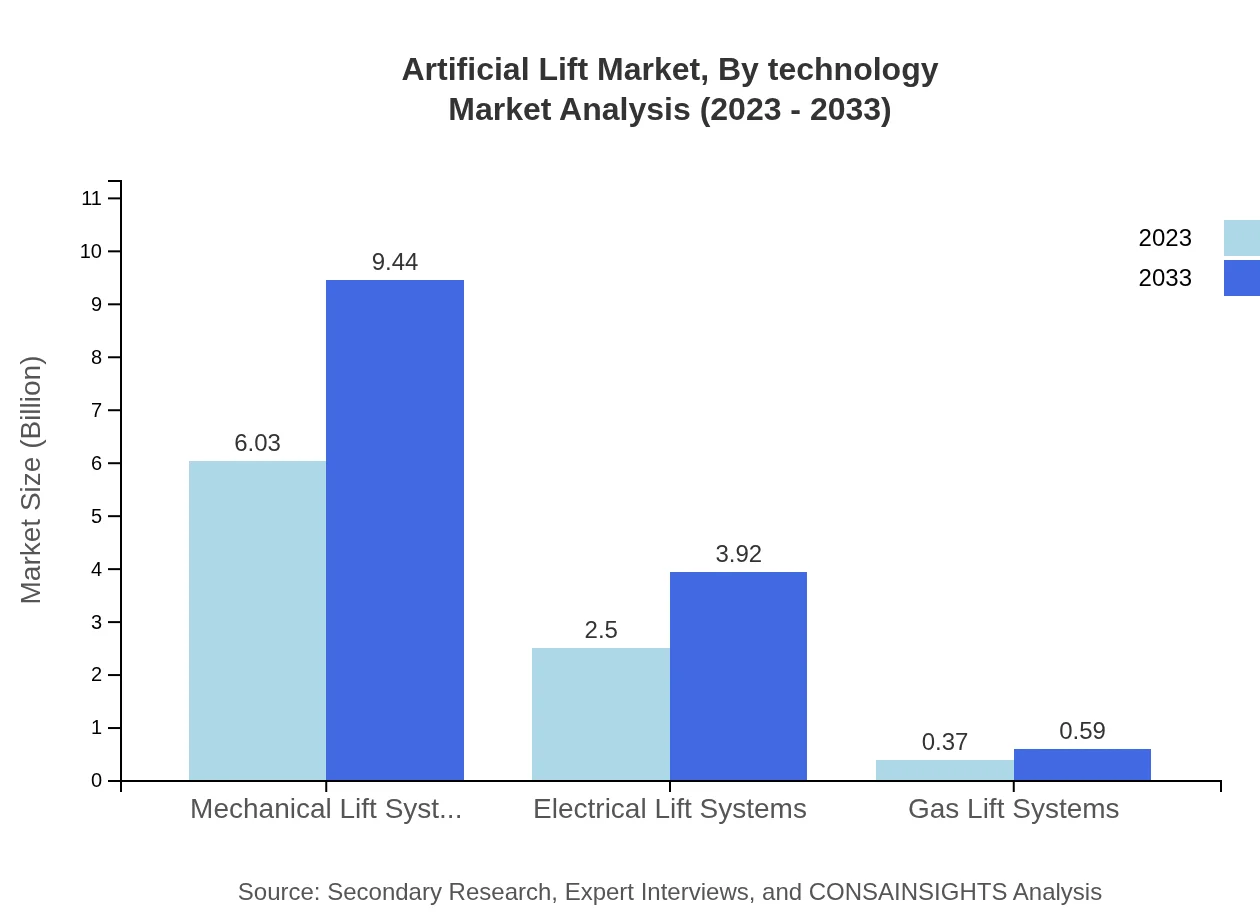

Artificial Lift Market Analysis By Technology

In 2023, the Mechanical Lift Systems segment leads the market with a size of $6.03 billion, expected to grow to $9.44 billion by 2033. This segment remains dominant due to its effectiveness in enhancing oil recovery. The Electrical Lift Systems segment is valued at $2.50 billion now and is forecasted to reach $3.92 billion in the same period, reflecting a growing preference for energy-efficient solutions. The Gas Lift Systems segment, currently at $0.37 billion, is projected to grow to $0.59 billion, indicating its niche but steady demand.

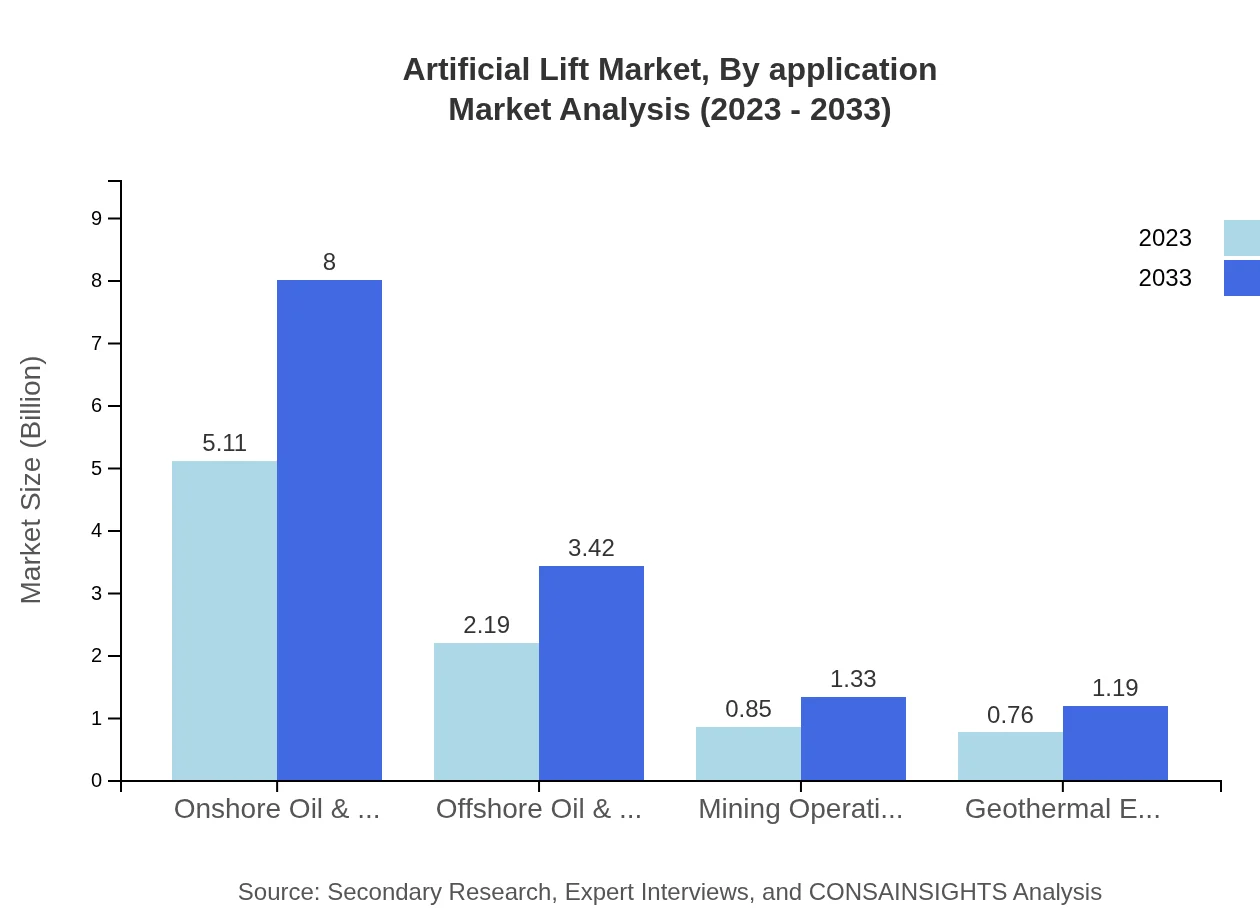

Artificial Lift Market Analysis By Application

The Oil and Gas Industry accounts for the largest share in the market, valued at $6.03 billion in 2023 and projected to reach $9.44 billion. Mining Industry applications follow, expected to rise from $2.50 billion in 2023 to $3.92 billion by 2033. Geothermal Energy also has a steady presence, with its market size anticipated to grow from $0.37 billion to $0.59 billion, driven by increasing renewable energy initiatives.

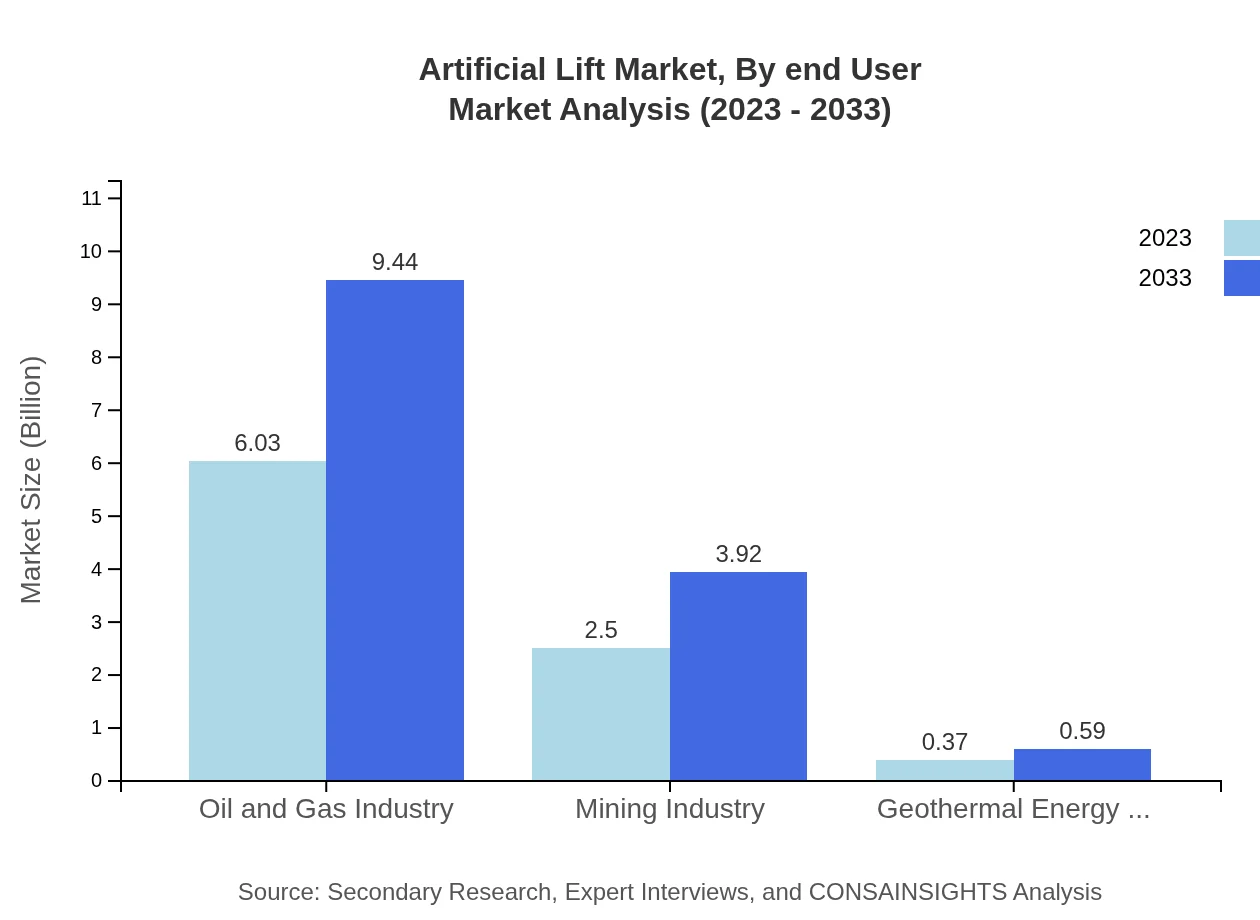

Artificial Lift Market Analysis By End User

The primary end-user of Artificial Lift is the Oil and Gas sector, which holds a market share of 67.7% as of 2023, remaining stable through 2033. The Mining Operations segment holds a significant share of 28.09%, reflecting its importance in mineral extraction activities. The Geothermal Energy segment, while smaller, commands a wild share of 4.21%.

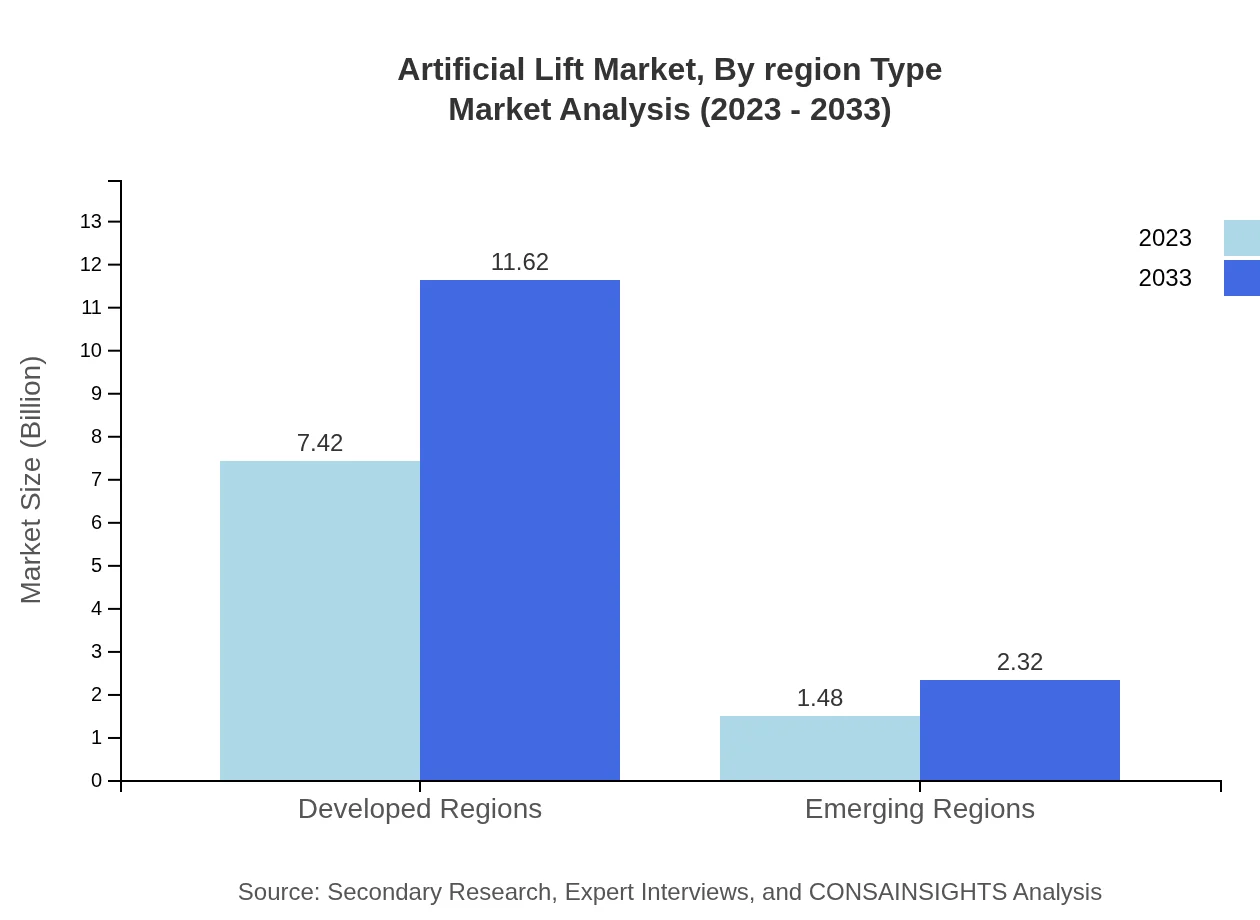

Artificial Lift Market Analysis By Region Type

Developed Regions dominate the market, accounting for 83.35% share, valued at $7.42 billion in 2023 and expected to reach $11.62 billion by 2033. Emerging Regions, although smaller at 1.48 billion currently, are set to grow to $2.32 billion, highlighting the shifting focus towards development and energy needs in those areas.

Artificial Lift Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Artificial Lift Industry

Schlumberger Limited:

A global leader in oilfield services, Schlumberger offers advanced artificial lift solutions designed to optimize production rates and enhance recovery processes across various oil and gas applications.Halliburton Company:

Halliburton is a leading provider of technology and services for the energy sector, renowned for its extensive suite of artificial lift systems that streamline production and energy efficiency.Baker Hughes Company:

Baker Hughes is known for its state-of-the-art artificial lift technology and innovative solutions tailored to improve oil recovery and production performance in complex environments.Weatherford International:

Weatherford offers a wide range of artificial lift products that ensure optimized performance in various oil and gas operations, driving efficiency and profitability for clients worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of artificial Lift?

The artificial lift market is valued at approximately $8.9 billion in 2023, with a projected compound annual growth rate (CAGR) of 4.5%, indicating robust growth anticipated through 2033.

What are the key market players or companies in this artificial Lift industry?

Key players in the artificial lift market include Schlumberger, Halliburton, Baker Hughes, Weatherford, and GE Oil & Gas, which dominate with innovative technologies and extensive market reach.

What are the primary factors driving the growth in the artificial lift industry?

Growth factors include increasing global energy demand, advancements in extraction technologies, rising investments in oil and gas exploration, and a surge in mature field production requiring enhanced recovery techniques.

Which region is the fastest Growing in the artificial lift?

Asia Pacific is the fastest-growing region, expected to rise from $1.74 billion in 2023 to $2.72 billion by 2033, driven by escalating energy needs and investment in infrastructure.

Does ConsaInsights provide customized market report data for the artificial Lift industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, providing personalized insights and data analysis for the artificial lift industry.

What deliverables can I expect from this artificial Lift market research project?

Deliverables typically include detailed market analysis, segment insights, regional assessments, competitive landscape breakdowns, and actionable recommendations for strategic decision-making.

What are the market trends of artificial Lift?

Current trends in the artificial lift market include increasing automation, the integration of IoT technologies, and a focus on sustainability, aiming for more efficient and environmentally friendly extraction methods.