Artificial Lift System Market Report

Published Date: 22 January 2026 | Report Code: artificial-lift-system

Artificial Lift System Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Artificial Lift System market, including insights into market size, trends, segments, and forecasts from 2023 to 2033. It aims to provide a comprehensive overview of the current market landscape, key players, and future growth opportunities.

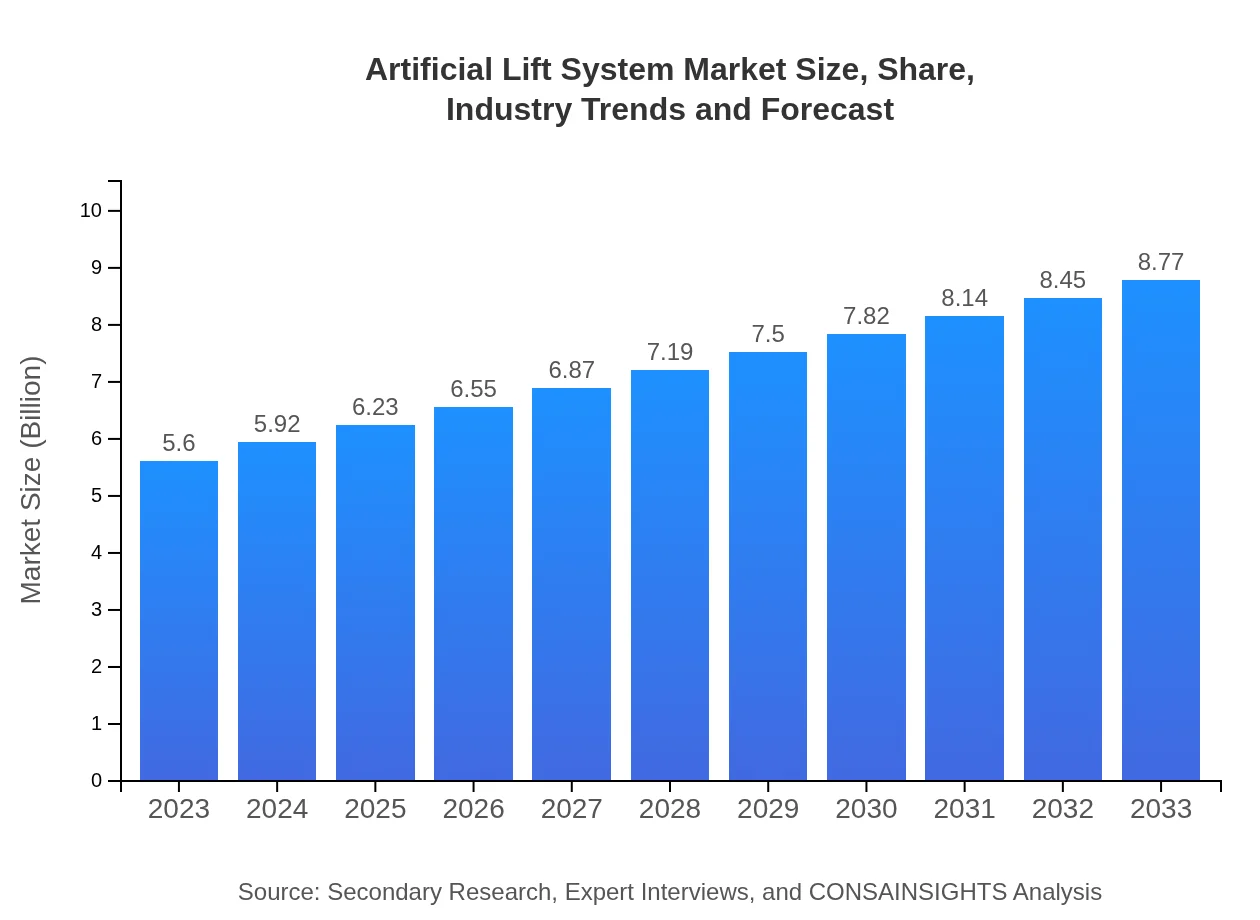

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $8.77 Billion |

| Top Companies | Halliburton, Schlumberger, Baker Hughes, Weatherford |

| Last Modified Date | 22 January 2026 |

Artificial Lift System Market Overview

Customize Artificial Lift System Market Report market research report

- ✔ Get in-depth analysis of Artificial Lift System market size, growth, and forecasts.

- ✔ Understand Artificial Lift System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Artificial Lift System

What is the Market Size & CAGR of Artificial Lift System market in 2023?

Artificial Lift System Industry Analysis

Artificial Lift System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Artificial Lift System Market Analysis Report by Region

Europe Artificial Lift System Market Report:

The European Artificial Lift System market is projected to expand from USD 1.49 billion in 2023 to USD 2.34 billion by 2033. The urgency for enhanced recovery techniques in offshore oil fields, coupled with regulatory push towards environmental sustainability, is driving the market.Asia Pacific Artificial Lift System Market Report:

The Asia Pacific region is experiencing substantial growth, with the market size projected to grow from USD 1.19 billion in 2023 to USD 1.86 billion in 2033. This can be attributed to increasing offshore and onshore oil exploration activities in countries like China, India, and Australia, and the need for enhanced production systems in mature fields.North America Artificial Lift System Market Report:

In North America, the market is expected to grow from USD 1.81 billion in 2023 to USD 2.83 billion by 2033. The U.S. shale boom and advancements in fracking technology significantly fuel growth. The region's focus on energy independence further propels investment in artificial lift systems.South America Artificial Lift System Market Report:

The South American market for Artificial Lift Systems is anticipated to increase from USD 0.50 billion in 2023 to USD 0.78 billion by 2033. Notable growth is expected in Brazil and Argentina, driven by expanding oil production and exploration activities in the region.Middle East & Africa Artificial Lift System Market Report:

For the Middle East and Africa, the market is expected to grow from USD 0.61 billion in 2023 to USD 0.96 billion by 2033. The region's substantial oil reserves and planned expansions in oil infrastructure fuel demand for advanced artificial lift technologies.Tell us your focus area and get a customized research report.

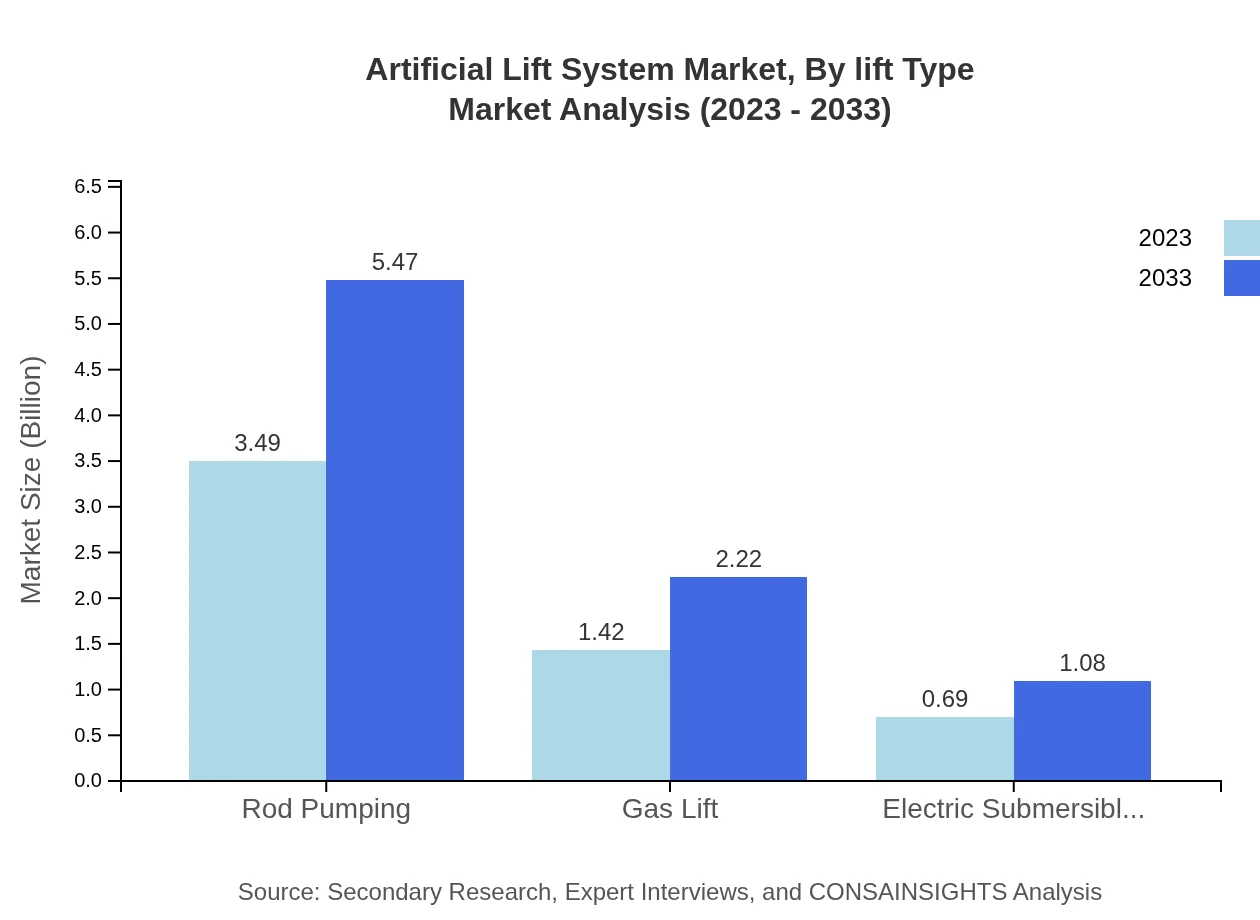

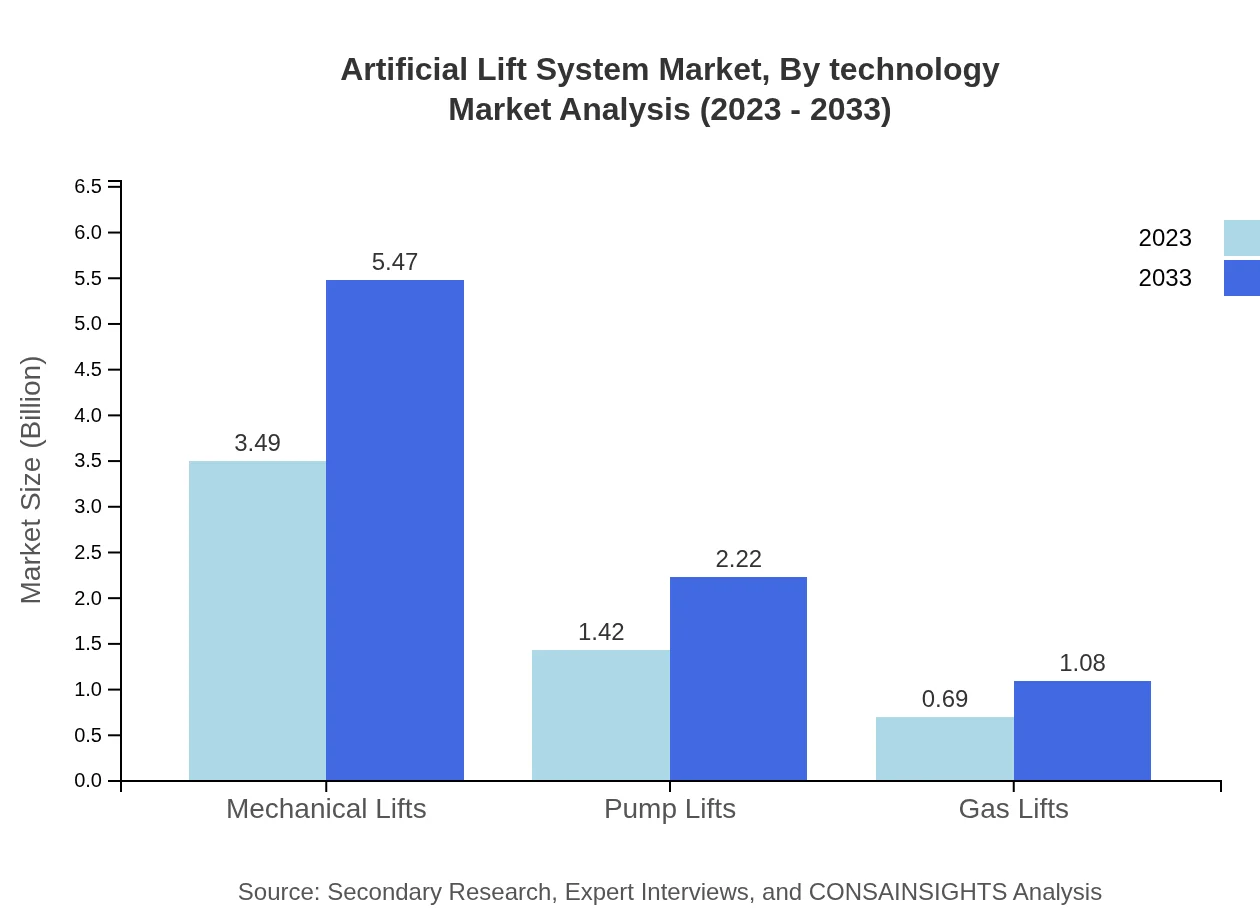

Artificial Lift System Market Analysis By Lift Type

In 2023, the Equipment segment dominates the market with a share of 62.32%, translating to a market size of USD 3.49 billion. Projections indicate this segment will reach USD 5.47 billion by 2033. Services, which account for 25.31% share (USD 1.42 billion) in 2023, are expected to grow to USD 2.22 billion. Technology segments, including Electric Submersible Pumps and Mechanical Lifts, represent significant growth areas with corresponding market sizes of USD 0.69 billion in 2023 expected to reach USD 1.08 billion by 2033.

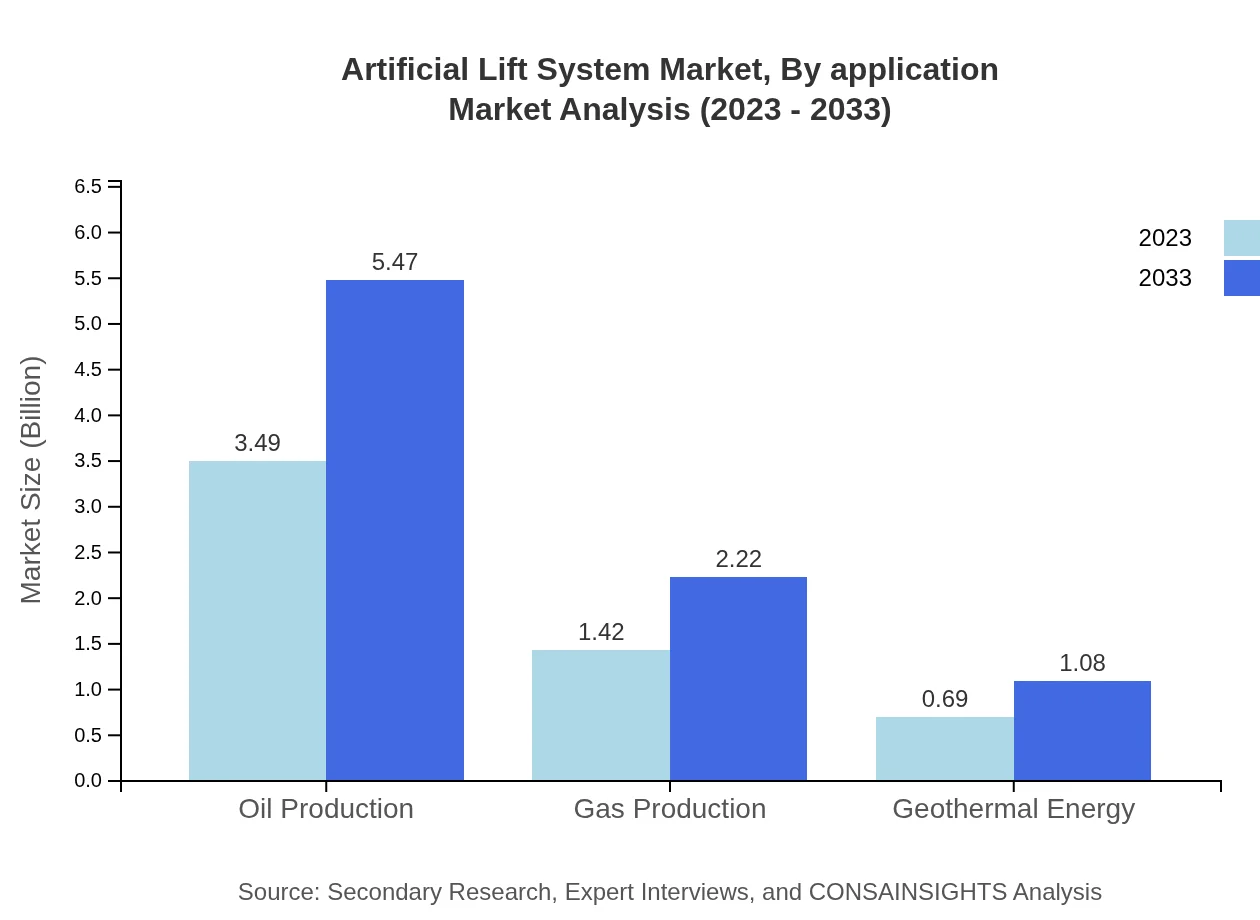

Artificial Lift System Market Analysis By Application

The market segmentation by application highlights oil production as the predominant sector, holding a 62.32% share with a valuation of USD 3.49 billion in 2023. This segment is anticipated to grow robustly due to rising demand for oil and high production efforts, potentially reaching USD 5.47 billion by 2033. Gas production, with a 25.31% market share (USD 1.42 billion) in 2023, is also projected to grow, driven by increasing natural gas extraction initiatives worldwide.

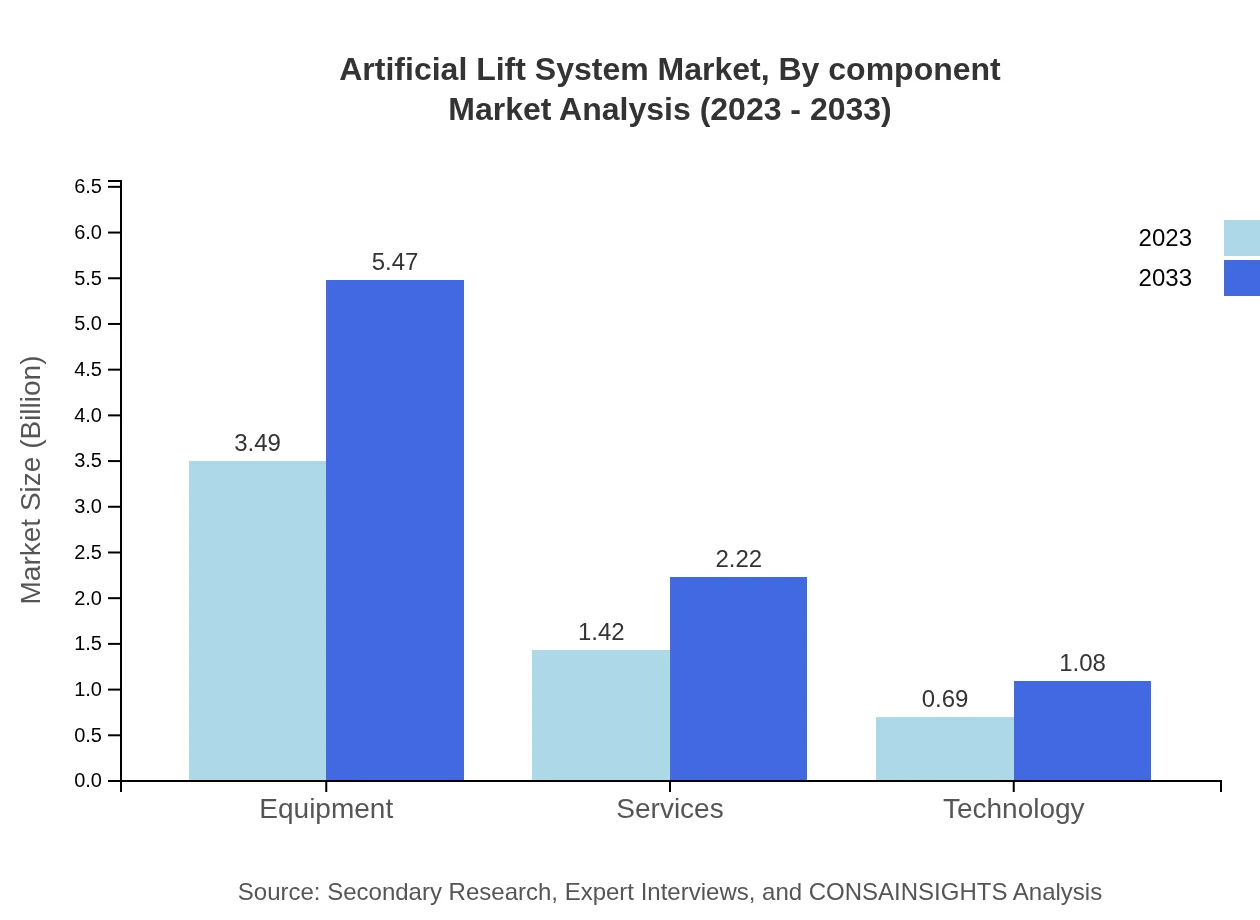

Artificial Lift System Market Analysis By Component

The breakdown of the market by component shows that Equipment is the largest segment, accounting for a 62.32% share in 2023, with a market value of USD 3.49 billion. This component's growth trajectory is associated with technological advancements and increasing demand for efficient production techniques. Services make up 25.31% of the market, showing significant growth potential as companies look to partner with service providers for efficiency optimization.

Artificial Lift System Market Analysis By Technology

Technological advancements play a critical role in the Artificial Lift System market. The Rod Pumping technology leads the market with a market size of USD 3.49 billion (62.32% share) in 2023, projected to increase to USD 5.47 billion by 2033. Gas Lift technology and Electric Submersible Pumps also exhibit growth potential, aimed at addressing operational challenges and improving recovery rates in diverse well conditions.

Artificial Lift System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Artificial Lift System Industry

Halliburton:

Halliburton is recognized for its comprehensive oilfield services, providing innovative artificial lift solutions that enhance production efficiency across various reservoir conditions globally.Schlumberger:

Schlumberger is a market leader offering advanced technology and integrated services for the oil and gas industry, specializing in both traditional and modern artificial lift methods.Baker Hughes:

Baker Hughes, an energy technology company, provides cutting-edge artificial lift systems, focusing on reliability and efficiency to optimize oil and gas production.Weatherford:

Weatherford offers a broad range of artificial lift solutions tailored for enhanced oil recovery and production efficiency, with a strong emphasis on innovative technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of Artificial Lift System?

The Artificial Lift System market is estimated to reach a size of $5.6 billion by 2033, growing from $3.49 billion in 2023, in line with a CAGR of 4.5% throughout the forecasted period.

What are the key market players or companies in this Artificial Lift System industry?

Some of the key players in the Artificial Lift System industry include Schlumberger, Halliburton, Baker Hughes, Weatherford International, and Tenaris. These companies lead through innovative technologies and extensive market reach.

What are the primary factors driving the growth in the Artificial Lift System industry?

Key growth factors include the rising global energy demand, advancements in drilling technologies, and increasing oil and gas production activities. Additionally, the need for efficient extraction methods further propels market expansion.

Which region is the fastest Growing in the Artificial Lift System?

The fastest-growing region in the Artificial Lift System market is North America, projected to grow from $1.81 billion in 2023 to $2.83 billion by 2033, largely driven by technological advancements and increased drilling activities.

Does ConsaInsights provide customized market report data for the Artificial Lift System industry?

Yes, ConsaInsights offers customized market research reports tailored to meet the specific needs of clients in the Artificial Lift System industry, providing detailed insights and data.

What deliverables can I expect from this Artificial Lift System market research project?

Expect comprehensive deliverables including market size data, trend analysis, competitive landscape insights, regional market assessments, and strategic recommendations tailored to the Artificial Lift System market.

What are the market trends of Artificial Lift System?

Market trends indicate a shift towards increased automation, enhanced efficiency of extraction technologies, and the growing adoption of Electric Submersible Pumps, which is projected to maintain a significant share by 2033.