Artificial Sweeteners Market Report

Published Date: 31 January 2026 | Report Code: artificial-sweeteners

Artificial Sweeteners Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the artificial sweeteners market, including insights on market size, regional performance, segmentation, and trends from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

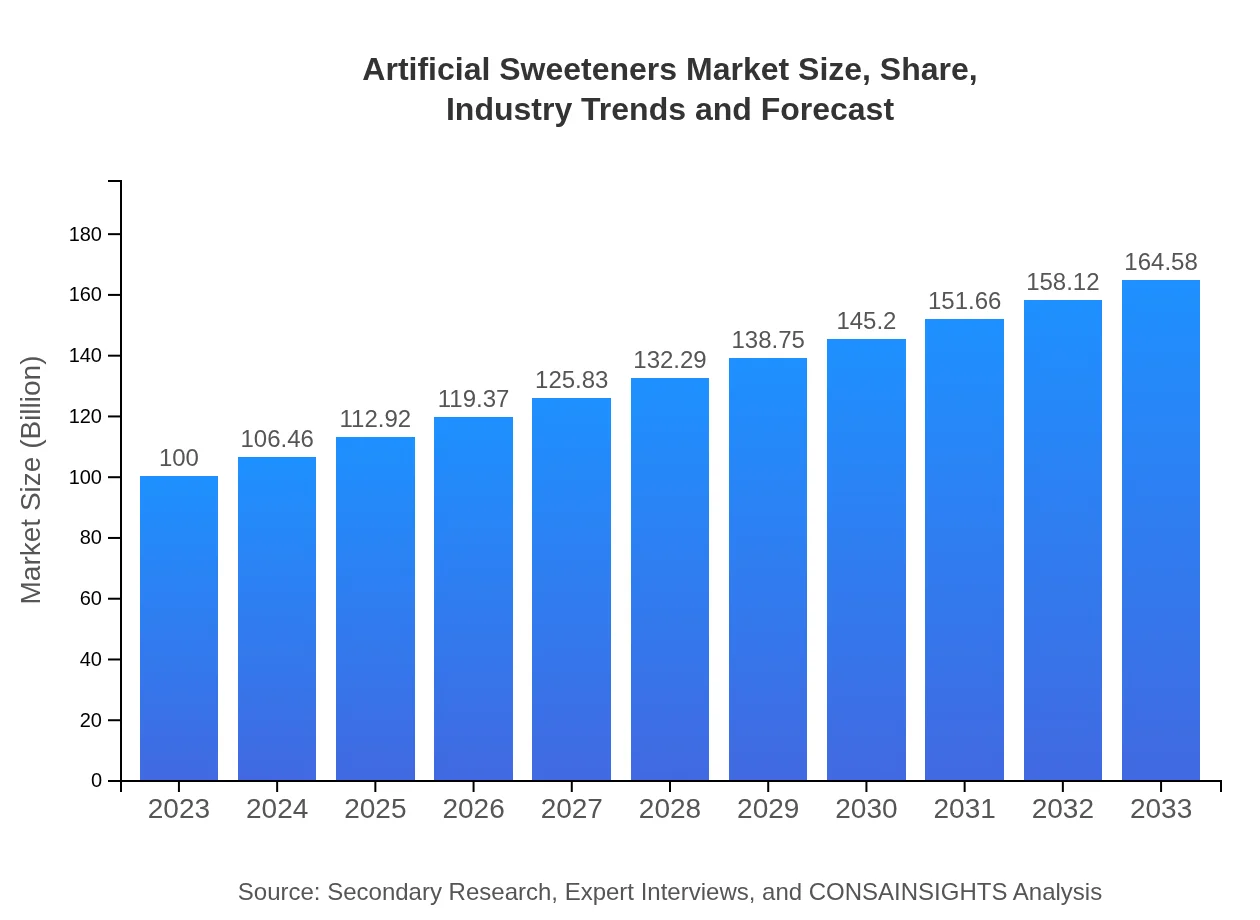

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | The Coca-Cola Company, PepsiCo, Inc., Cargill, Incorporated, Ajinomoto Co., Inc., Sweeteners Plus |

| Last Modified Date | 31 January 2026 |

Artificial Sweeteners Market Overview

Customize Artificial Sweeteners Market Report market research report

- ✔ Get in-depth analysis of Artificial Sweeteners market size, growth, and forecasts.

- ✔ Understand Artificial Sweeteners's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Artificial Sweeteners

What is the Market Size & CAGR of Artificial Sweeteners market in 2033?

Artificial Sweeteners Industry Analysis

Artificial Sweeteners Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Artificial Sweeteners Market Analysis Report by Region

Europe Artificial Sweeteners Market Report:

Europe's market for artificial sweeteners is anticipated to grow from USD 31.53 billion in 2023 to USD 51.89 billion by 2033, driven by stringent health and wellness trends, as well as regulations that encourage lower sugar usage in food products.Asia Pacific Artificial Sweeteners Market Report:

In the Asia Pacific region, the artificial sweeteners market is projected to rise from USD 19.41 billion in 2023 to USD 31.94 billion by 2033. This growth is supported by increasing disposable incomes and a preference for healthier food options among consumers.North America Artificial Sweeteners Market Report:

North America is poised to remain a market leader, growing significantly from USD 33.68 billion in 2023 to USD 55.43 billion by 2033. Factors influencing this growth include stringent regulatory regulations on sugar consumption and innovations in product formulations that cater to health-conscious consumers.South America Artificial Sweeteners Market Report:

The South American market, valued at USD 6.43 billion in 2023, is expected to grow to USD 10.58 billion by 2033. Factors contributing to this growth include a burgeoning health-conscious populace and rising demand for sugar substitutes amidst changing dietary habits.Middle East & Africa Artificial Sweeteners Market Report:

The artificial sweeteners market in the Middle East and Africa is expected to progress from USD 8.95 billion in 2023 to USD 14.73 billion by 2033, influenced by growing urbanization and dietary shifts towards healthier options.Tell us your focus area and get a customized research report.

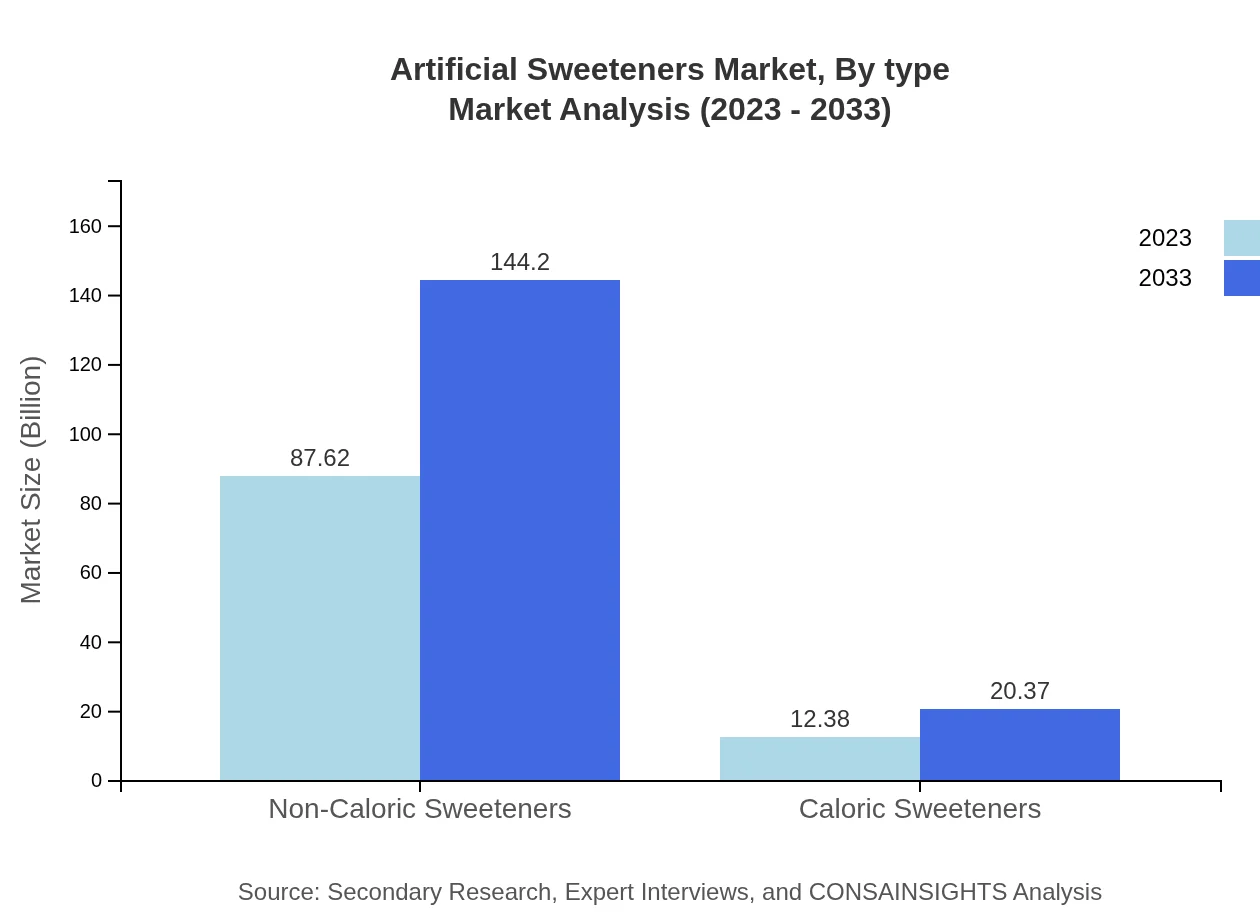

Artificial Sweeteners Market Analysis By Type

Non-caloric sweeteners lead the market with a size of USD 87.62 billion in 2023, projected to rise to USD 144.20 billion by 2033. Caloric sweeteners, while smaller, also show growth, moving from USD 12.38 billion to USD 20.37 billion in the same period.

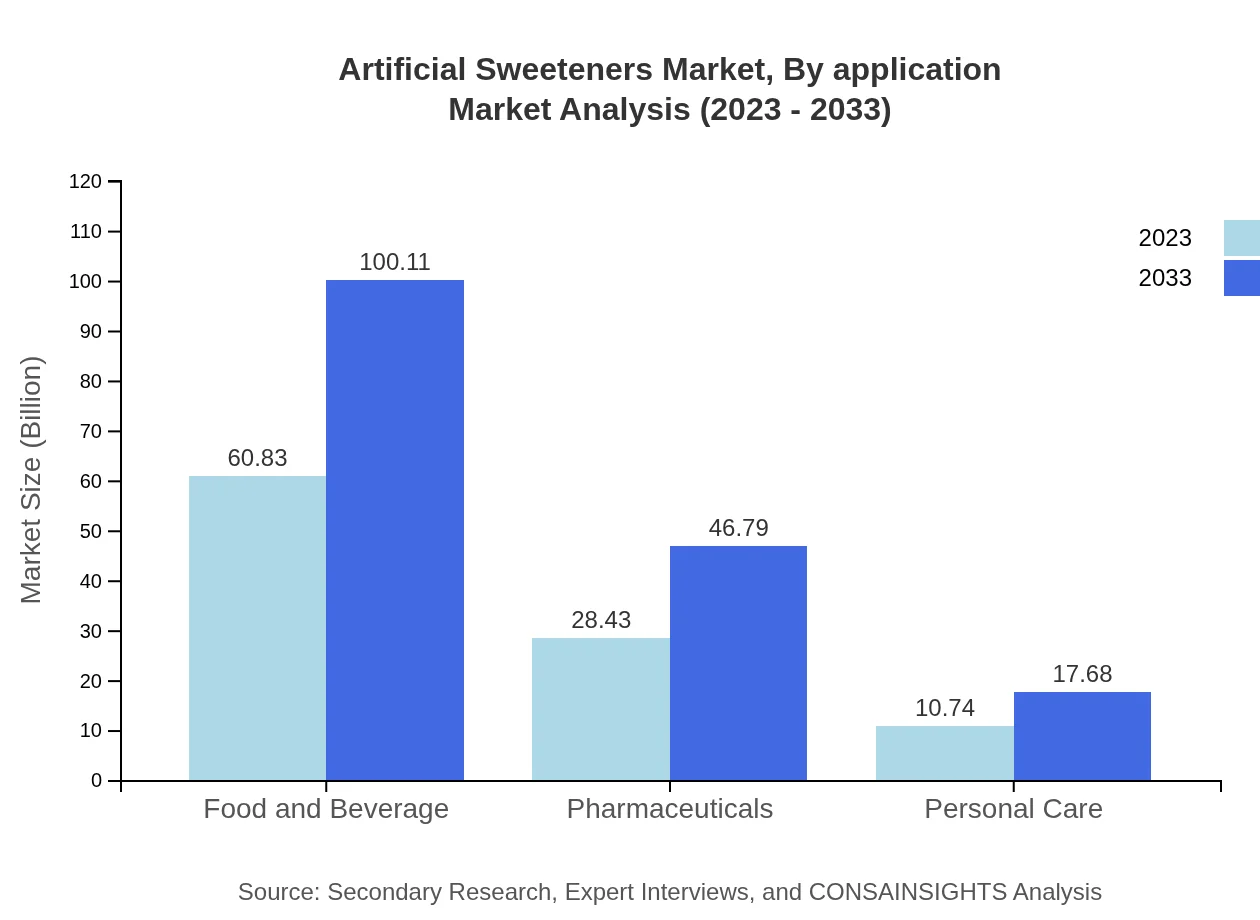

Artificial Sweeteners Market Analysis By Application

The food and beverage sector dominates the market, starting at USD 60.83 billion in 2023 and expected to reach USD 100.11 billion by 2033, while the pharmaceutical sector also shows substantial growth from USD 28.43 billion to USD 46.79 billion.

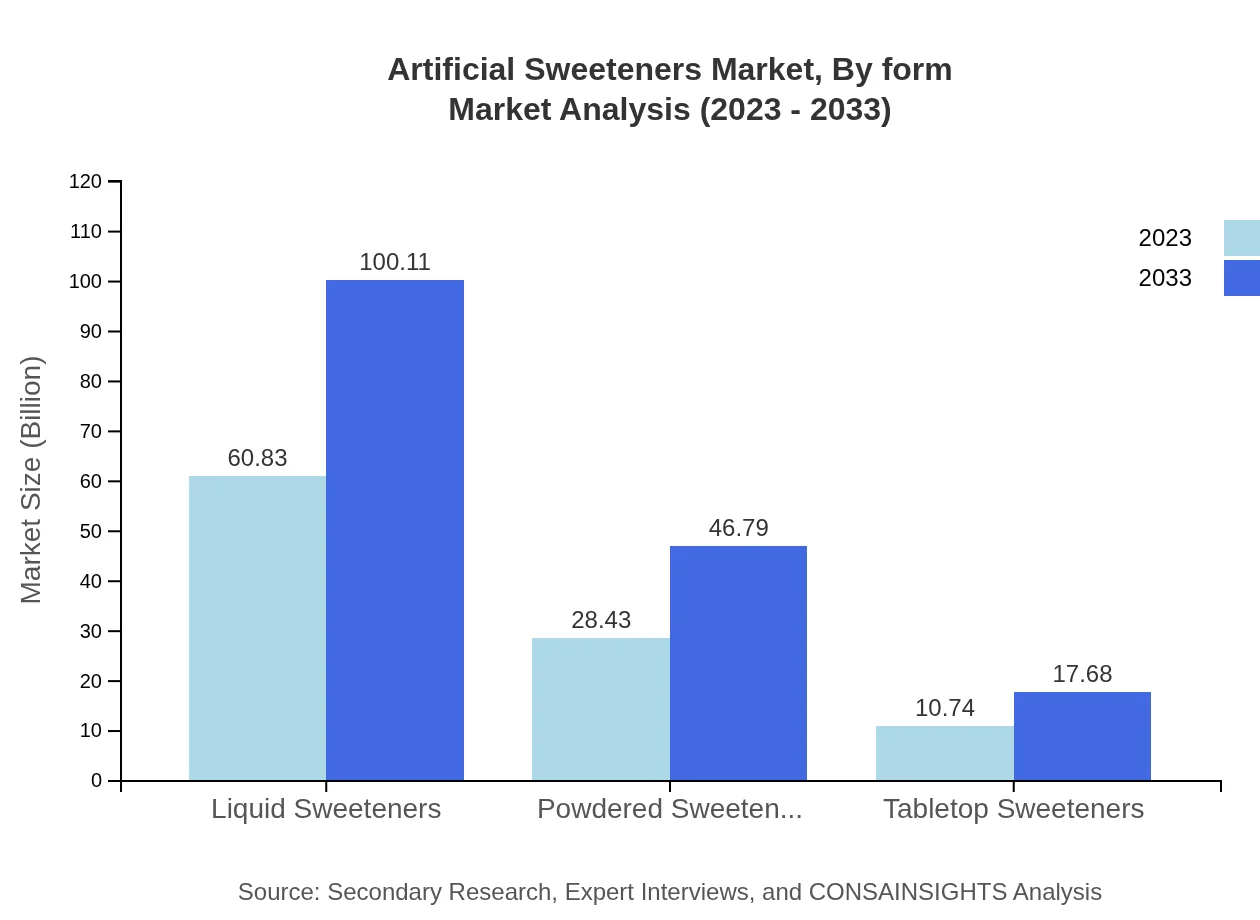

Artificial Sweeteners Market Analysis By Form

Liquid sweeteners constitute the largest segment, estimated at USD 60.83 billion in 2023 and anticipated to grow to USD 100.11 billion by 2033. Powdered sweeteners are also significant, expanding from USD 28.43 billion to USD 46.79 billion.

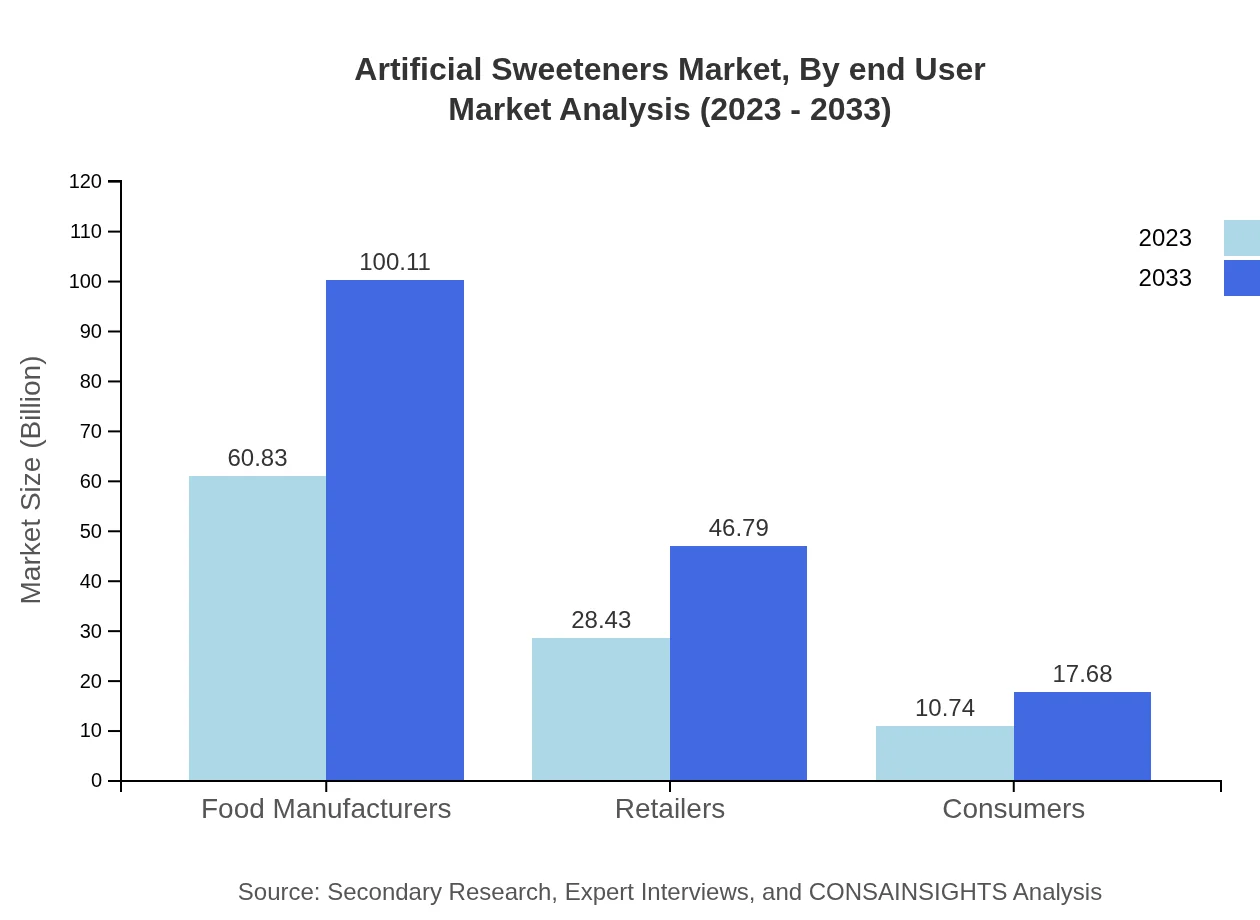

Artificial Sweeteners Market Analysis By End User

Food manufacturers take a lion's share of the market with a size of USD 60.83 billion in 2023, projected to grow to USD 100.11 billion by 2033. Retailers and consumers, while smaller segments, also show growth trends.

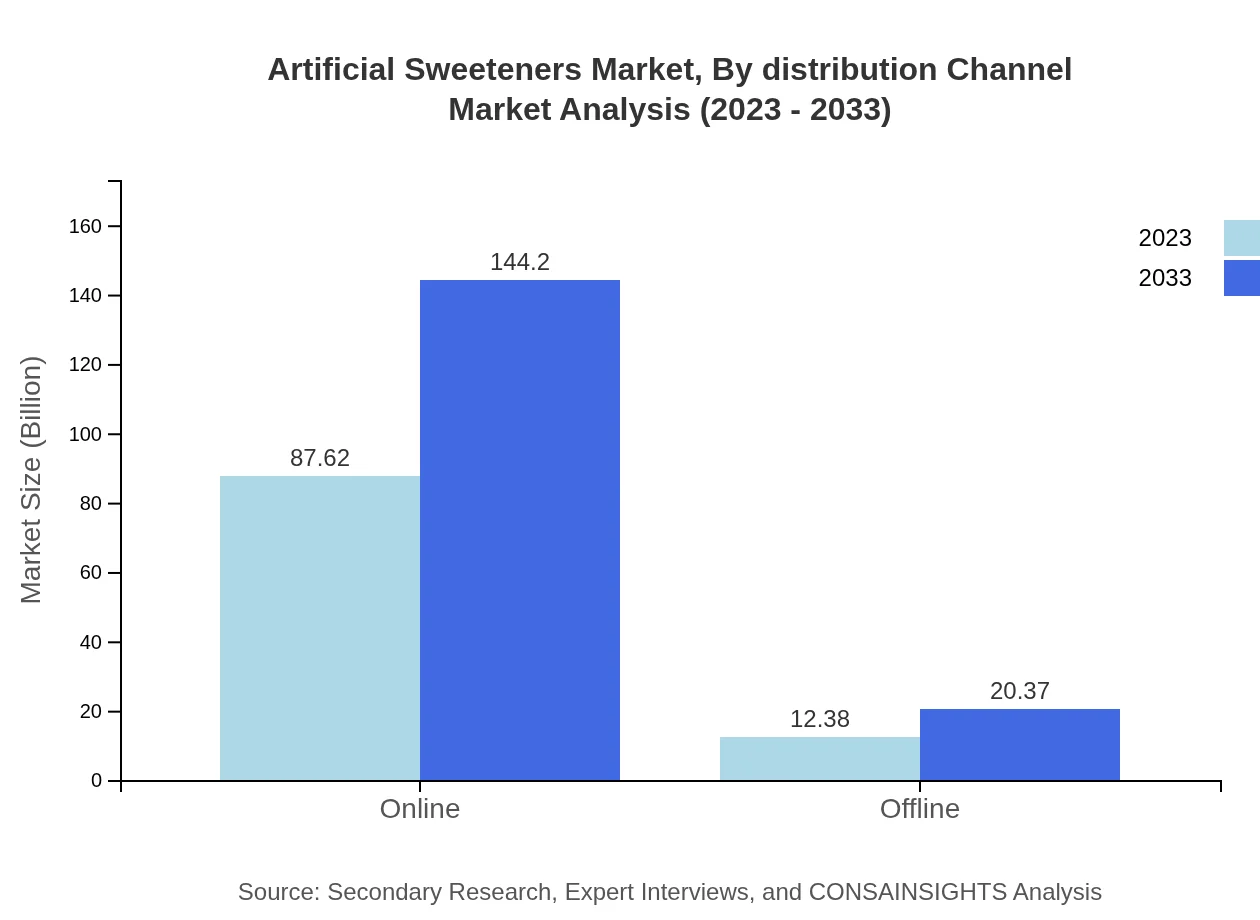

Artificial Sweeteners Market Analysis By Distribution Channel

Online sales of artificial sweeteners are noteworthy, starting at USD 87.62 billion in 2023, expected to reach USD 144.20 billion by 2033, while offline channels account for a smaller share but maintain consistent growth.

Artificial Sweeteners Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Artificial Sweeteners Industry

The Coca-Cola Company:

A major player in the food and beverage industry, The Coca-Cola Company utilizes artificial sweeteners extensively in its products to cater to the health-conscious segment.PepsiCo, Inc.:

PepsiCo is a key competitor providing a variety of low-calorie products that incorporate artificial sweeteners, aiming to satisfy consumer demand for healthier options.Cargill, Incorporated:

Cargill is a significant manufacturer of food products and sweeteners, including a selection of innovative artificial sweeteners that serve multiple applications in food and beverages.Ajinomoto Co., Inc.:

As a leader in amino acids and sweeteners, Ajinomoto contributes significantly to the artificial sweeteners market with a focus on health and wellness solutions.Sweeteners Plus:

A specialized company that provides a range of artificial sweetening agents targeted towards the food, beverage, and pharmaceutical industries.We're grateful to work with incredible clients.

FAQs

What is the market size of artificial sweeteners?

The artificial sweeteners market size is projected to grow from $100 million in 2023 to significant levels by 2033, with a CAGR of 5% during this period. This growth is driven by increasing consumer demand for low-calorie alternatives.

What are the key market players or companies in this artificial sweeteners industry?

Key players in the artificial sweeteners market include major food manufacturers, pharmaceutical companies, and retailers that dominate the market. These companies drive innovation and market strategies to meet evolving consumer preferences and regulatory standards.

What are the primary factors driving the growth in the artificial sweeteners industry?

The artificial sweeteners industry is primarily driven by factors such as rising health consciousness, demand for low-calorie food products, and the expansion of the food and beverage sector. Additionally, increased awareness of diabetes and obesity trends fuels market demand.

Which region is the fastest Growing in the artificial sweeteners market?

The fastest-growing region in the artificial sweeteners market is projected to be Asia Pacific, with the market size expanding from $19.41 million in 2023 to $31.94 million by 2033, reflecting significant growth trends due to urbanization and changing dietary preferences.

Does Consainsights provide customized market report data for the artificial sweeteners industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the artificial sweeteners industry. Clients can obtain detailed insights that align with their business objectives and market understanding.

What deliverables can I expect from this artificial sweeteners market research project?

Deliverables from the artificial sweeteners market research project typically include comprehensive reports, data analysis, market forecasts, competitive landscape assessments, and targeted insights into consumer trends and preferences.

What are the market trends of artificial sweeteners?

Current market trends in artificial sweeteners feature a shift towards natural sweeteners, growing innovation in product formulations, and an increasing preference for health-oriented products across food and beverage sectors, emphasizing low-calorie and non-caloric options.