Artillery Ammunition Market Report

Published Date: 03 February 2026 | Report Code: artillery-ammunition

Artillery Ammunition Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Artillery Ammunition market, focusing on market size, trends, and forecasts from 2023 to 2033. It includes insights into segmentation by product type, technology, and regional performance, guiding stakeholders in informed decision-making.

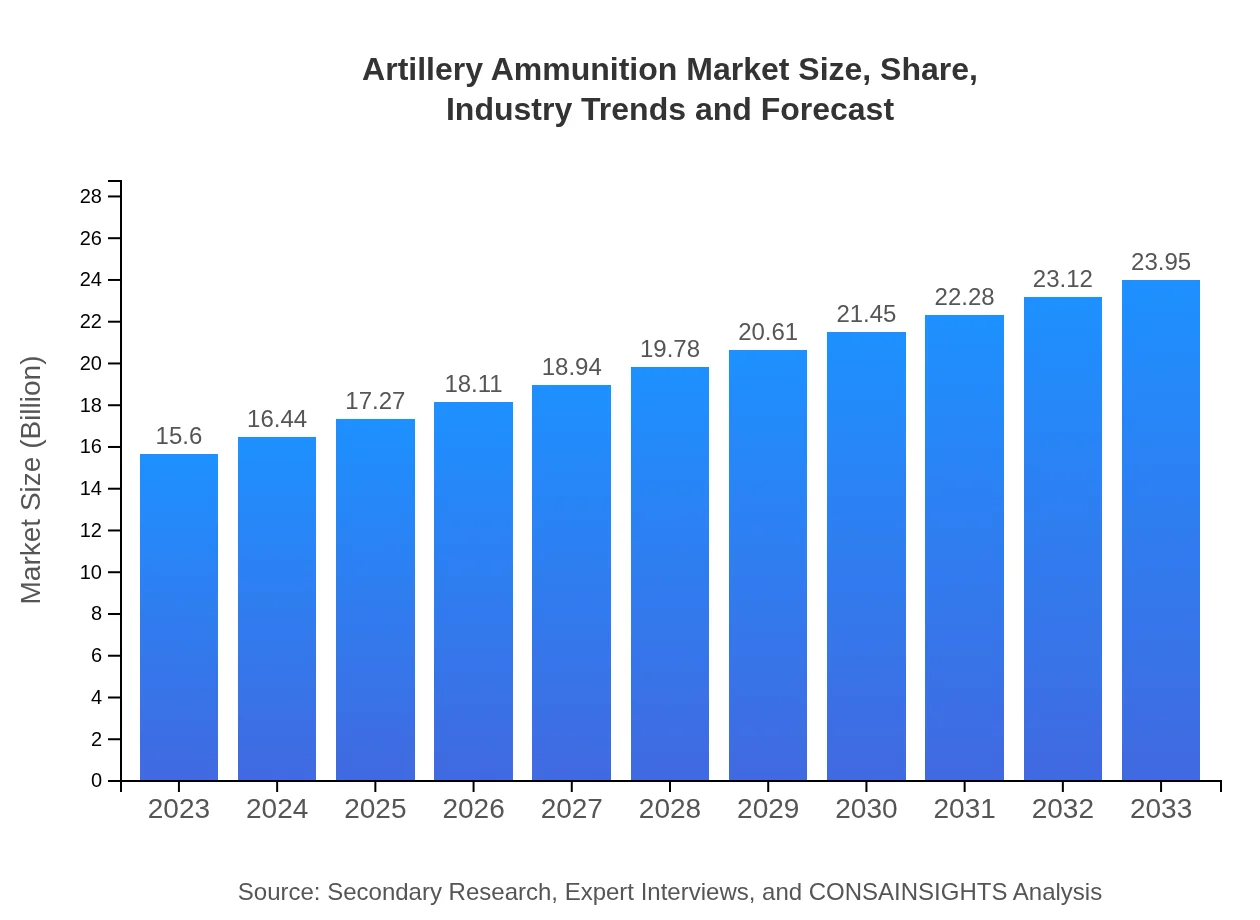

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 4.3% |

| 2033 Market Size | $23.95 Billion |

| Top Companies | BAE Systems, Rheinmetall AG, General Dynamics, Northrop Grumman, Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Artillery Ammunition Market Overview

Customize Artillery Ammunition Market Report market research report

- ✔ Get in-depth analysis of Artillery Ammunition market size, growth, and forecasts.

- ✔ Understand Artillery Ammunition's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Artillery Ammunition

What is the Market Size & CAGR of Artillery Ammunition market in 2023?

Artillery Ammunition Industry Analysis

Artillery Ammunition Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Artillery Ammunition Market Analysis Report by Region

Europe Artillery Ammunition Market Report:

The European market is forecasted to expand from $3.91 billion in 2023 to $6.01 billion by 2033. Regional security concerns, defense cooperation initiatives, and modernization of NATO forces are propelling investments into artillery ammunition.Asia Pacific Artillery Ammunition Market Report:

The Asia-Pacific region is projected to see a market increase from $3.22 billion in 2023 to $4.95 billion by 2033. The growth is fueled by rising defense budgets in countries like India, China, and Japan, amid regional conflicts and border tensions.North America Artillery Ammunition Market Report:

North America, led by the U.S., anticipates market growth from $6.00 billion in 2023 to $9.22 billion by 2033. The region's robust military spending, technological advancements, and deployment of next-gen artillery systems significantly drive this growth.South America Artillery Ammunition Market Report:

In South America, the market is expected to grow from $0.44 billion in 2023 to $0.68 billion by 2033. The rise is linked to modernization plans and increased military expenditure, although economic challenges may temper growth rates.Middle East & Africa Artillery Ammunition Market Report:

The Middle East and Africa region is expected to increase from $2.02 billion in 2023 to $3.10 billion by 2033, driven by ongoing conflicts, military reforms, and significant arms procurements.Tell us your focus area and get a customized research report.

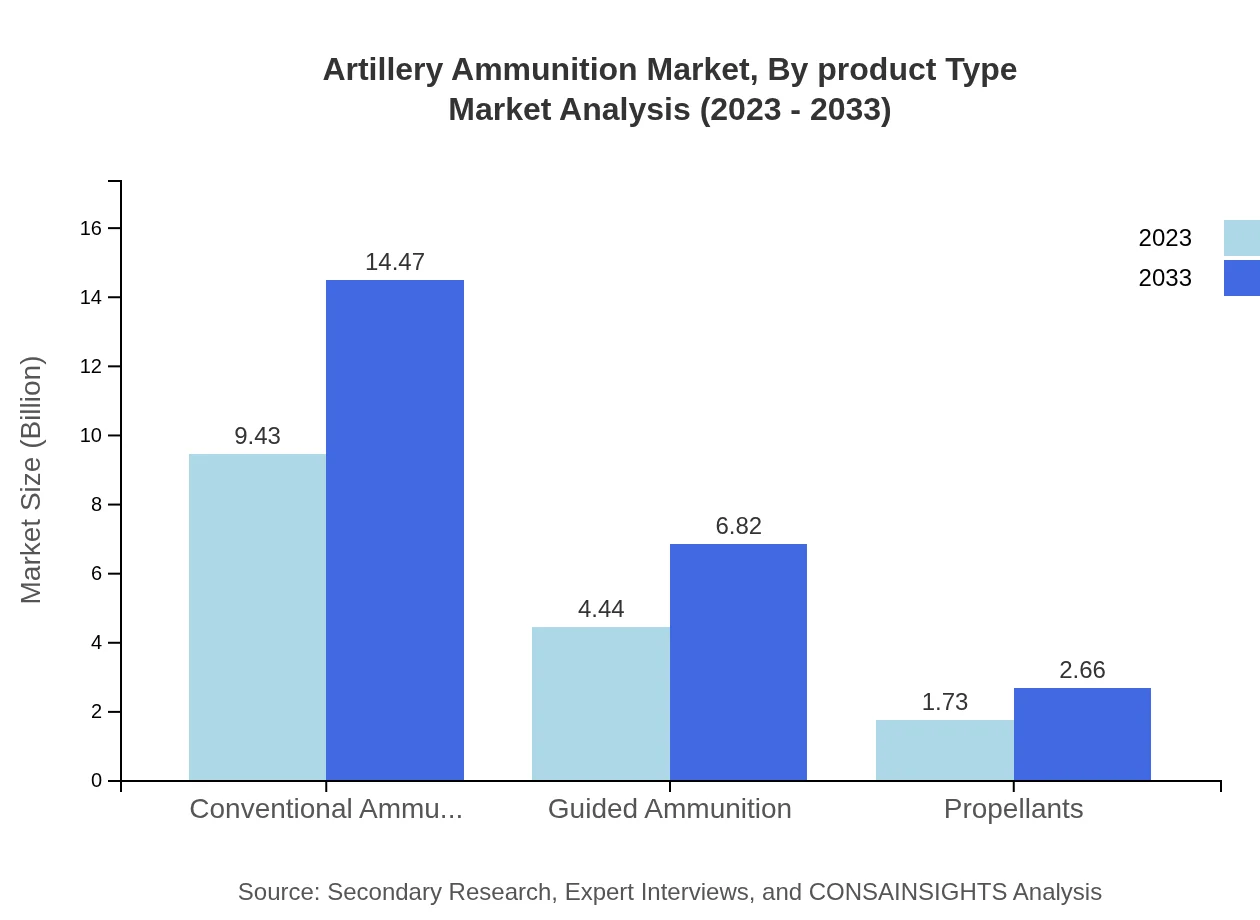

Artillery Ammunition Market Analysis By Product Type

By 2033, conventional ammunition is projected to hold a significant market size of $14.47 billion, representing a 60.43% share of the segment. Guided ammunition will grow to approximately $6.82 billion, capturing 28.46% of the market. This indicates persistent demand for traditional artillery while also highlighting the shift towards precision-guided munitions.

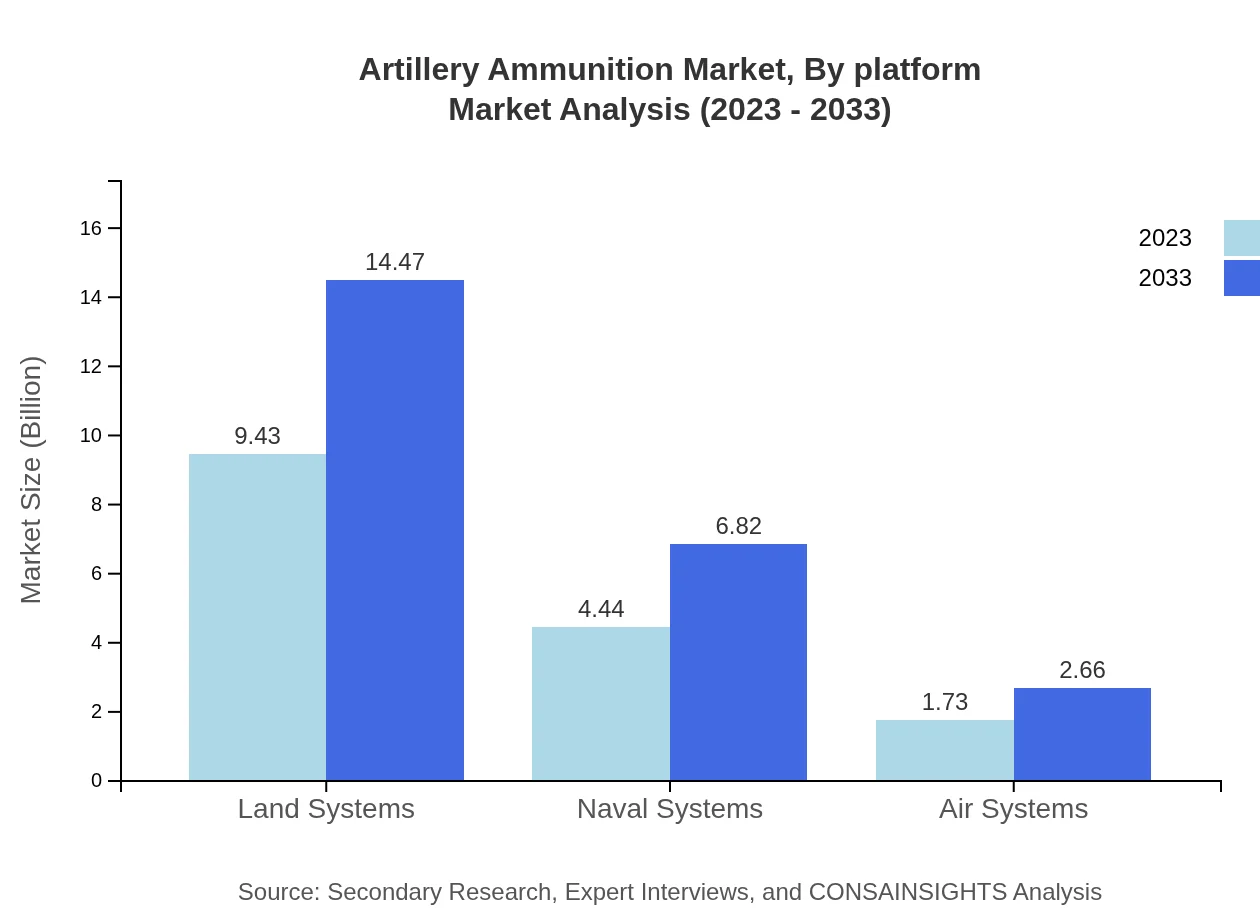

Artillery Ammunition Market Analysis By Platform

Land systems dominate the segment with a market size growth to $14.47 billion by 2033. The naval system segment is projected to reach approximately $6.82 billion, while air systems will follow, growing to about $2.66 billion, reflecting an investment into diverse platforms.

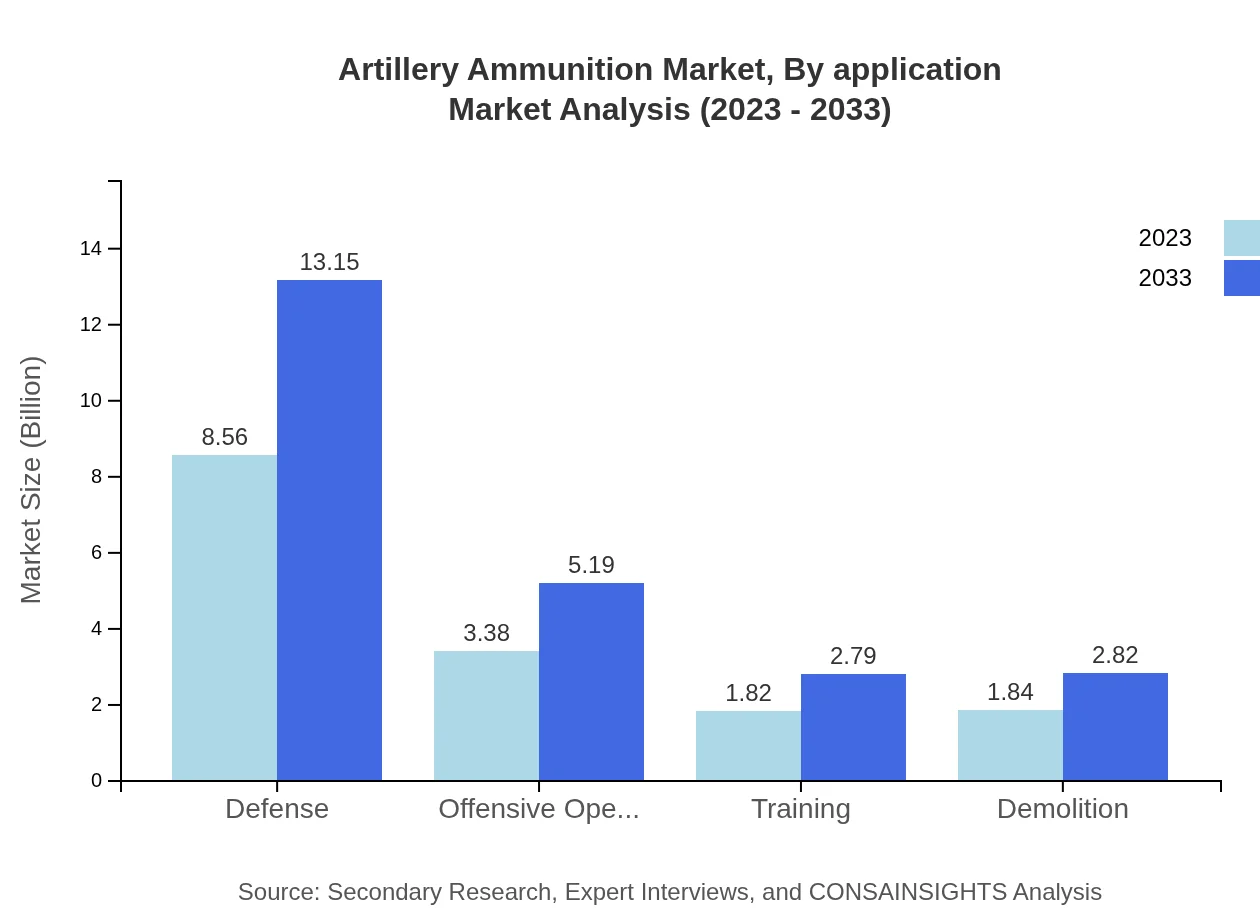

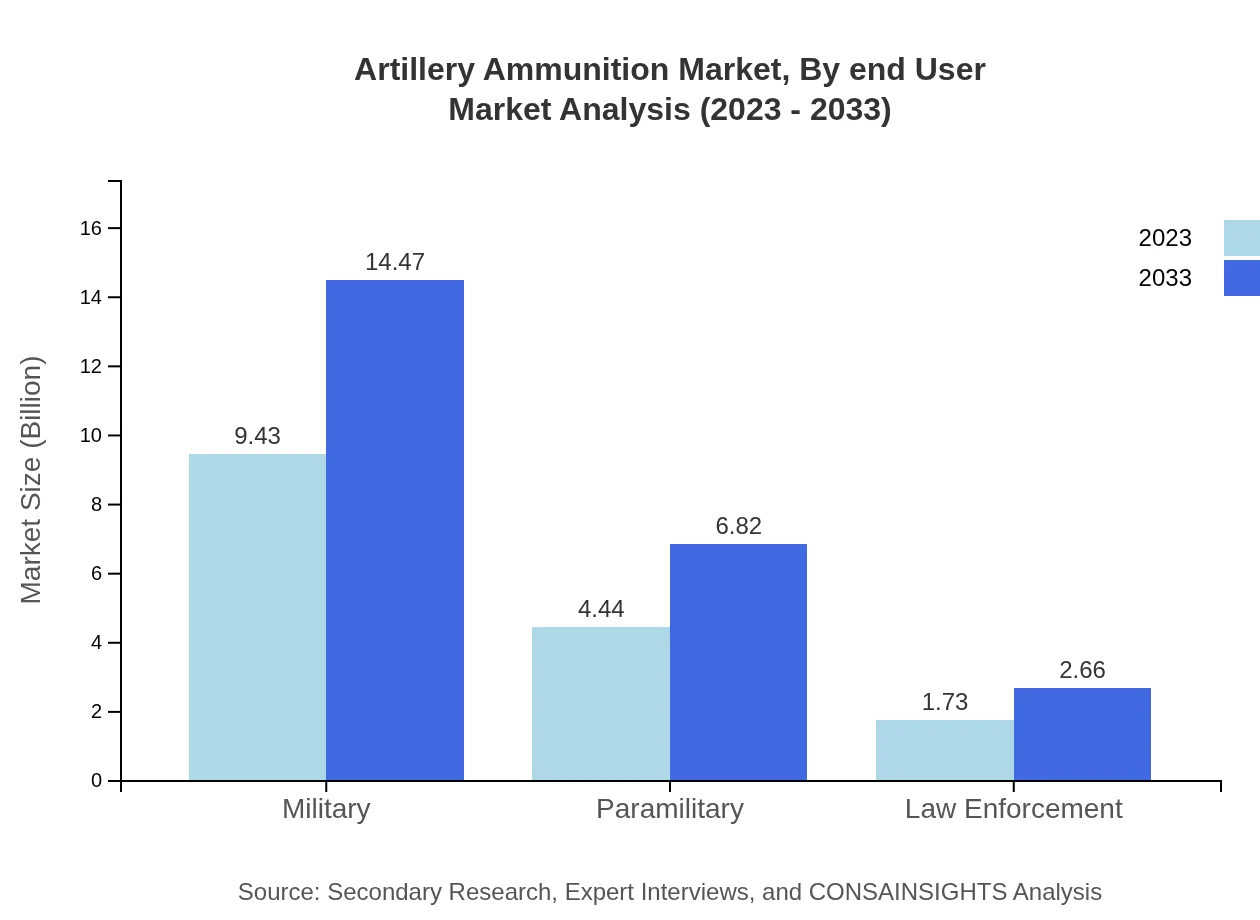

Artillery Ammunition Market Analysis By Application

The military application is anticipated to account for the largest market share, with a size increasing to approximately $14.47 billion by 2033. The paramilitary segment is estimated to expand to $6.82 billion, while law enforcement applications will grow to about $2.66 billion, affirming the importance of artillery in various operational contexts.

Artillery Ammunition Market Analysis By End User

Governments and military defense departments will continue to be the primary end-users, contributing substantially to market growth. By 2033, defense sectors are expected to retain around 54.89% of the overall market share, driven by ongoing military operations worldwide.

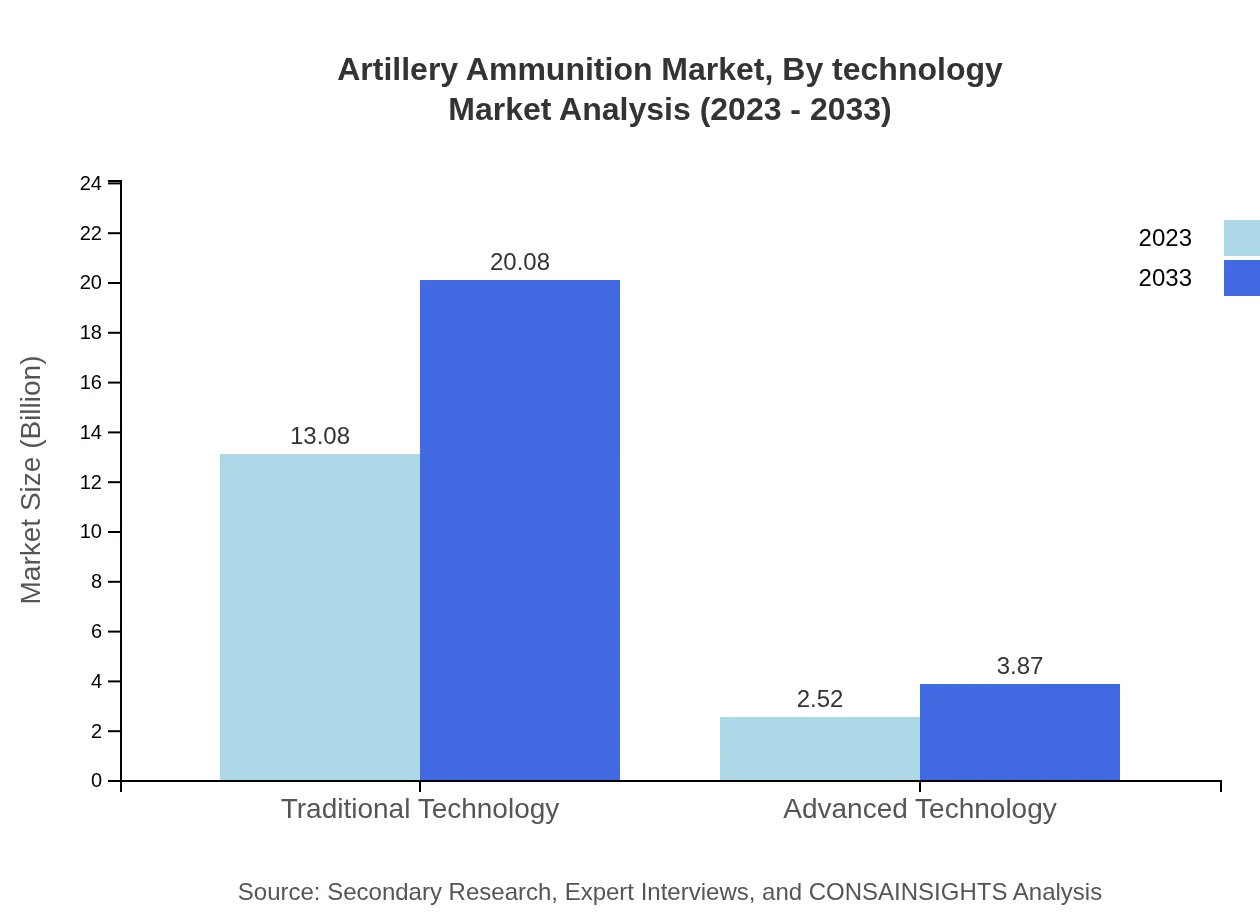

Artillery Ammunition Market Analysis By Technology

Traditional technology remains the backbone of the market, contributing $20.08 billion by 2033. Advanced technology in artillery munitions is also expected to witness growth, reaching $3.87 billion, showing a transition towards more sophisticated and effective solutions.

Artillery Ammunition Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Artillery Ammunition Industry

BAE Systems:

BAE Systems is a global defense, aerospace, and security company, recognized for its advanced artillery systems and ammunition solutions, contributing significantly to modernization strategies for armed forces.Rheinmetall AG:

Rheinmetall AG is a leading European specialist in artillery ammunition and munitions. The company invests heavily in research to enhance the capabilities of its ammunition, including guided systems that improve accuracy and operational effectiveness.General Dynamics:

General Dynamics is a prominent defense contractor known for producing various military equipment, including artillery ammunition. Their focus on innovative solutions positions them as a key player in the artillery ammunition market.Northrop Grumman:

Northrop Grumman provides advanced tech solutions for defense and aerospace. The company manufactures a wide range of ammunition and contributes to developing next-generation artillery technology.Lockheed Martin:

Lockheed Martin is a global security and aerospace company, renowned for its extensive portfolio in precision-guided munitions and sophisticated artillery solutions for military applications.We're grateful to work with incredible clients.

FAQs

What is the market size of artillery Ammunition?

The global artillery-ammunition market is projected to reach $15.6 billion by 2033, expanding at a CAGR of 4.3%. This growth reflects increased military expenditures and advancements in artillery technology.

What are the key market players or companies in this artillery Ammunition industry?

Notable players in the artillery-ammunition market include defense contractors like Raytheon Technologies, BAE Systems, and Northrop Grumman, who are known for their significant contributions to military and defense logistics.

What are the primary factors driving the growth in the artillery Ammunition industry?

Growth drivers include rising geopolitical tensions, increased defense budgets, and advancements in ammunition technology. Additionally, modernization efforts among armed forces to enhance operational efficiency contribute significantly to market expansion.

Which region is the fastest Growing in the artillery Ammunition market?

North America leads the artillery-ammunition market with a projected increase from $6.00 billion in 2023 to $9.22 billion by 2033. Europe follows closely, highlighting strong military investments in both regions.

Does ConsaInsights provide customized market report data for the artillery Ammunition industry?

Yes, ConsaInsights offers tailored market report data for the artillery-ammunition sector, ensuring clients can access specific insights based on their unique requirements and strategic objectives.

What deliverables can I expect from this artillery Ammunition market research project?

Deliverables include comprehensive reports detailing market size, growth projections, competitive analysis, and segment insights, as well as qualitative evaluations of key trends shaping the artillery-ammunition landscape.

What are the market trends of artillery Ammunition?

Key trends involve the shift towards automation and smart munitions, increased reliance on data-driven targeting systems, and a growing focus on sustainable and environmentally friendly artillery solutions.