Artillery Systems Market Report

Published Date: 03 February 2026 | Report Code: artillery-systems

Artillery Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the global Artillery Systems market, covering a detailed analysis of market conditions, sizes, trends, and growth forecasts from 2023 to 2033. It aims to equip stakeholders with actionable data and foresights for informed decision-making.

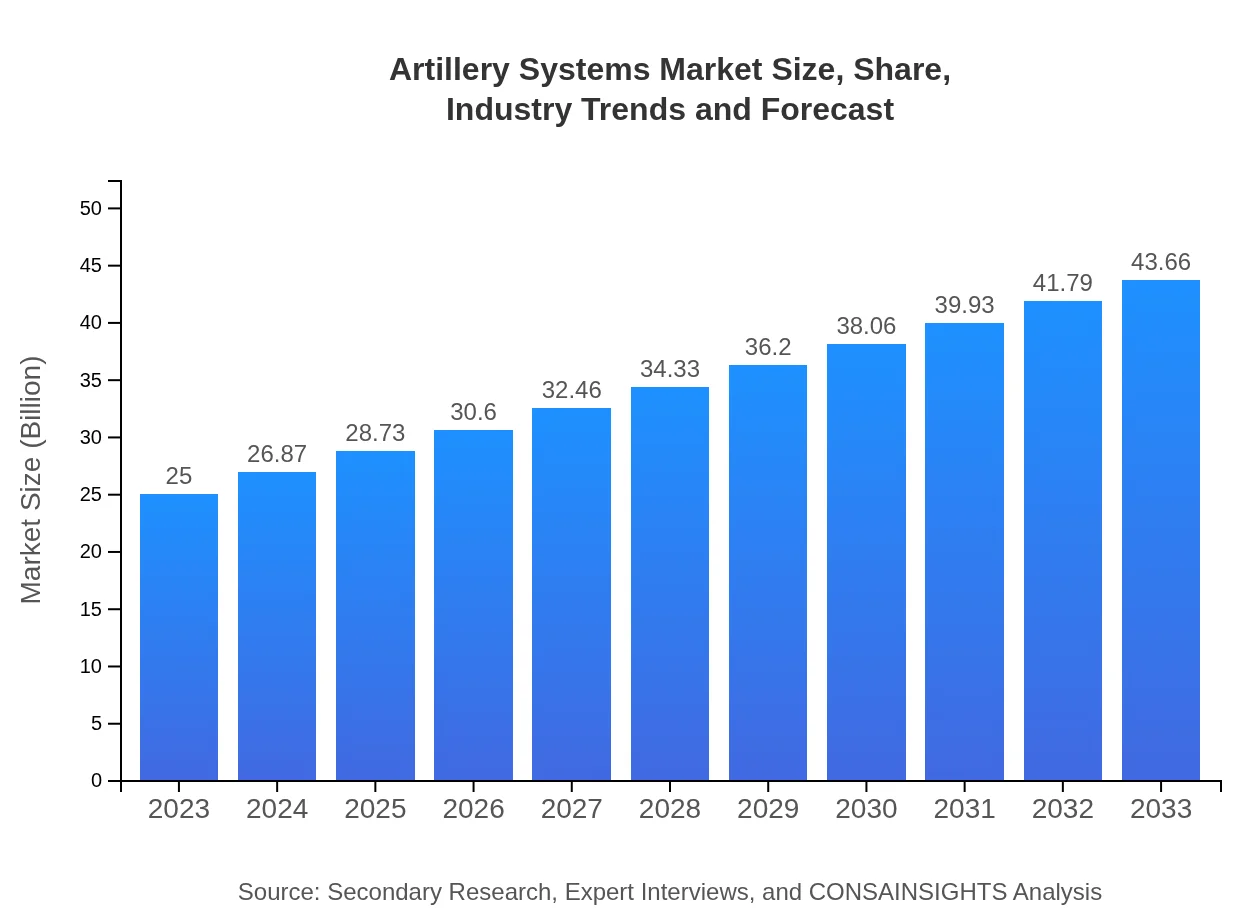

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $43.66 Billion |

| Top Companies | BAE Systems, Rheinmetall AG, Lockheed Martin, General Dynamics |

| Last Modified Date | 03 February 2026 |

Artillery Systems Market Overview

Customize Artillery Systems Market Report market research report

- ✔ Get in-depth analysis of Artillery Systems market size, growth, and forecasts.

- ✔ Understand Artillery Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Artillery Systems

What is the Market Size & CAGR of Artillery Systems market in 2023?

Artillery Systems Industry Analysis

Artillery Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Artillery Systems Market Analysis Report by Region

Europe Artillery Systems Market Report:

Europe's Artillery Systems market is projected to grow from $8.37 billion in 2023 to $14.62 billion by 2033, driven by NATO's collective defense initiatives and increased budgets in response to emerging security threats, particularly from Eastern Europe.Asia Pacific Artillery Systems Market Report:

The Asia Pacific region is expected to witness substantial growth in the Artillery Systems market, projected to reach $8.33 billion by 2033, up from $4.77 billion in 2023. The surge is attributed to the increasing military expenditures of countries like India and China, alongside heightened regional tensions that drive modernization efforts.North America Artillery Systems Market Report:

North America remains a dominant player, with the market expected to rise from $8.10 billion in 2023 to $14.15 billion by 2033. The United States leads defense spending, fostering technological advancements in artillery systems and supporting ongoing military operations globally.South America Artillery Systems Market Report:

In South America, the market is anticipated to grow from $2.44 billion in 2023 to $4.27 billion by 2033. This growth is fueled by collaborations between governments and defense manufacturers to enhance military capabilities, albeit at a slower pace compared to other regions.Middle East & Africa Artillery Systems Market Report:

The Middle East and Africa region is set to expand from $1.31 billion in 2023 to $2.30 billion by 2033. Geopolitical instabilities and conflicts necessitate bolstered military capabilities, leading to higher investments in artillery systems across several nations.Tell us your focus area and get a customized research report.

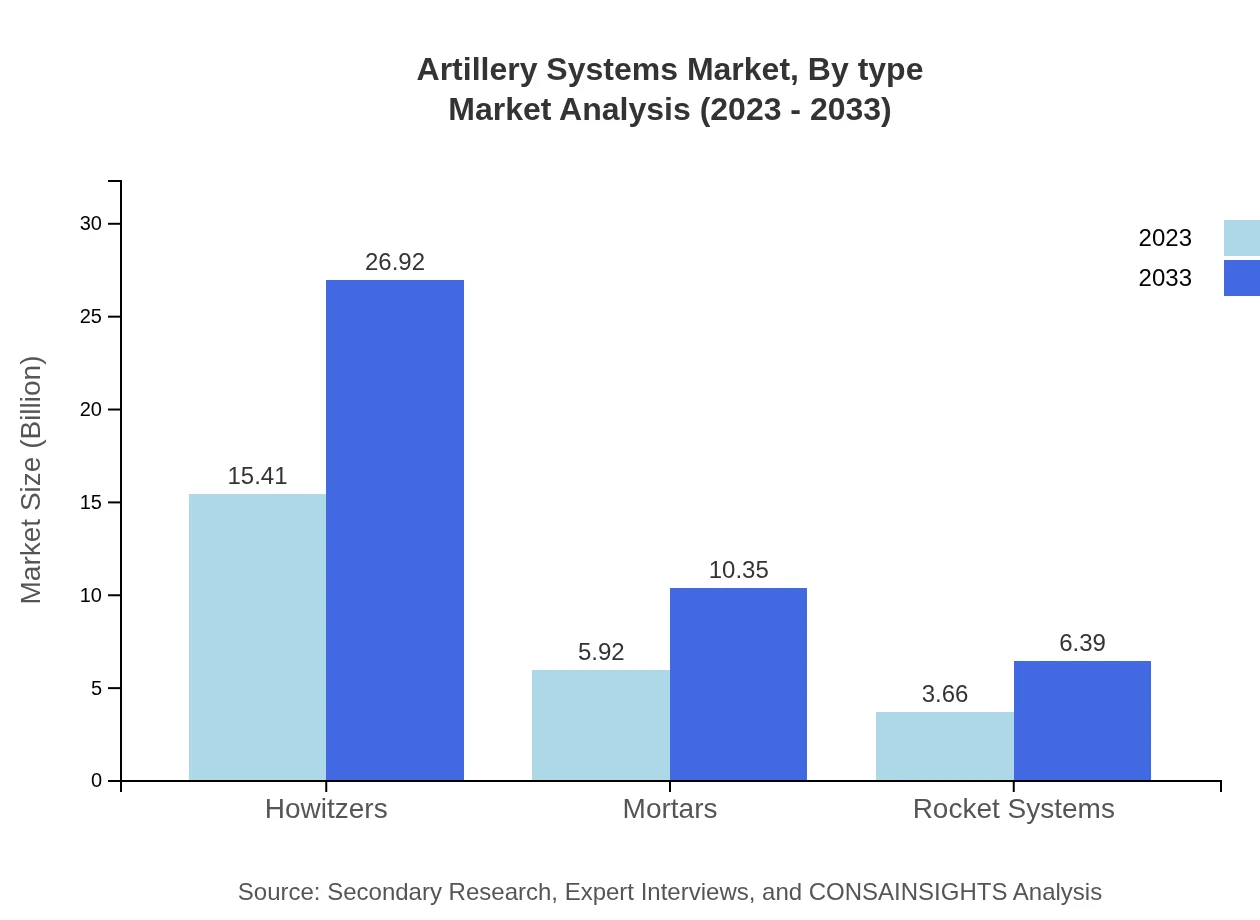

Artillery Systems Market Analysis By Type

The segment analysis shows that Howitzers lead the market with a size of $15.41 billion in 2023, expanding to $26.92 billion by 2033, representing a 61.66% market share over the decade. Mortars follow closely, starting at $5.92 billion in 2023 and reaching $10.35 billion by 2033 (23.7% market share). Rocket Systems contribute $3.66 billion in 2023, growing to $6.39 billion (14.64% share) by 2033.

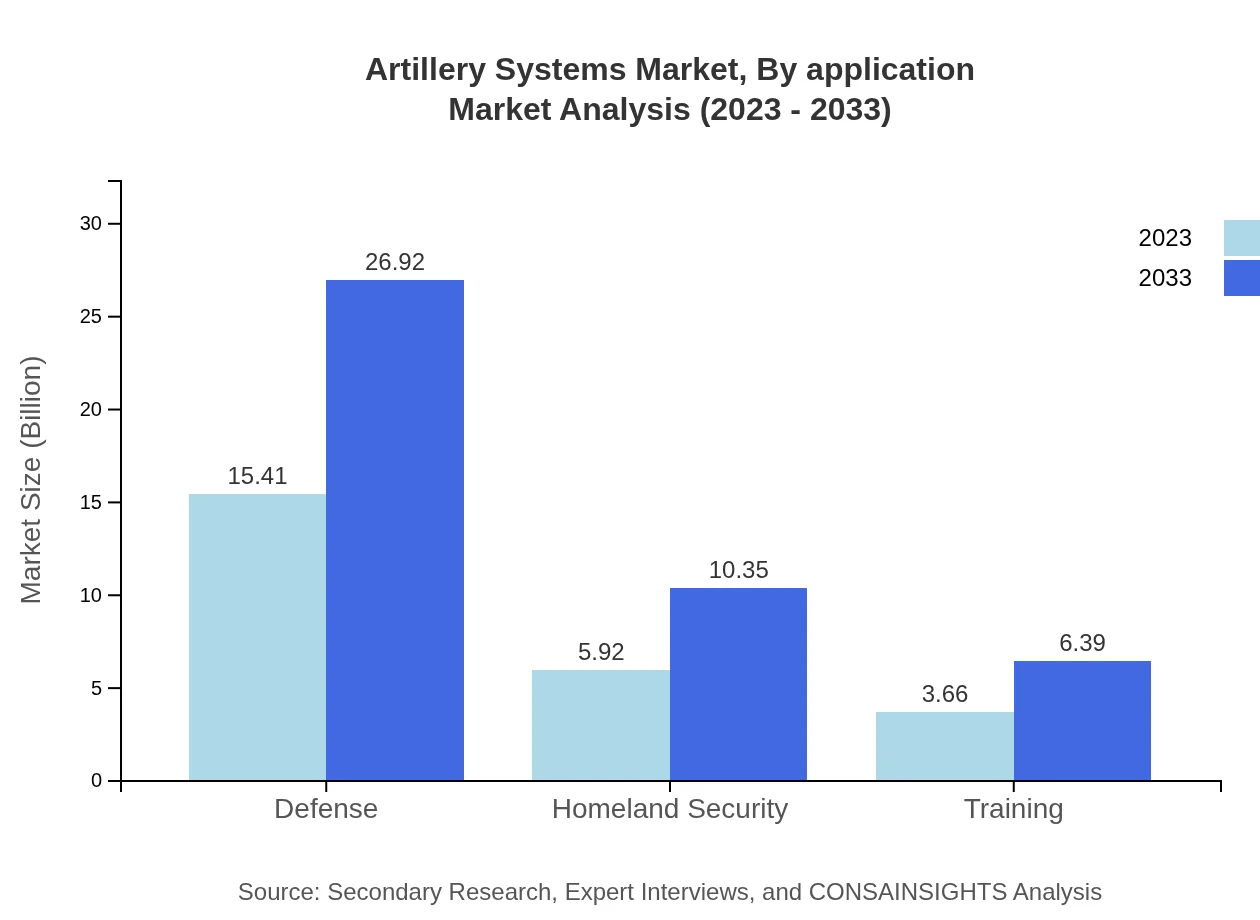

Artillery Systems Market Analysis By Application

The application landscape for artillery systems includes Defense, Homeland Security, and Training. The Defense segment commands a significant share, projected at $15.41 billion in 2023, increasing to $26.92 billion by 2033. Homeland Security applications will grow from $5.92 billion to $10.35 billion, and Training-related artillery systems will see an increase from $3.66 billion to $6.39 billion over the same period.

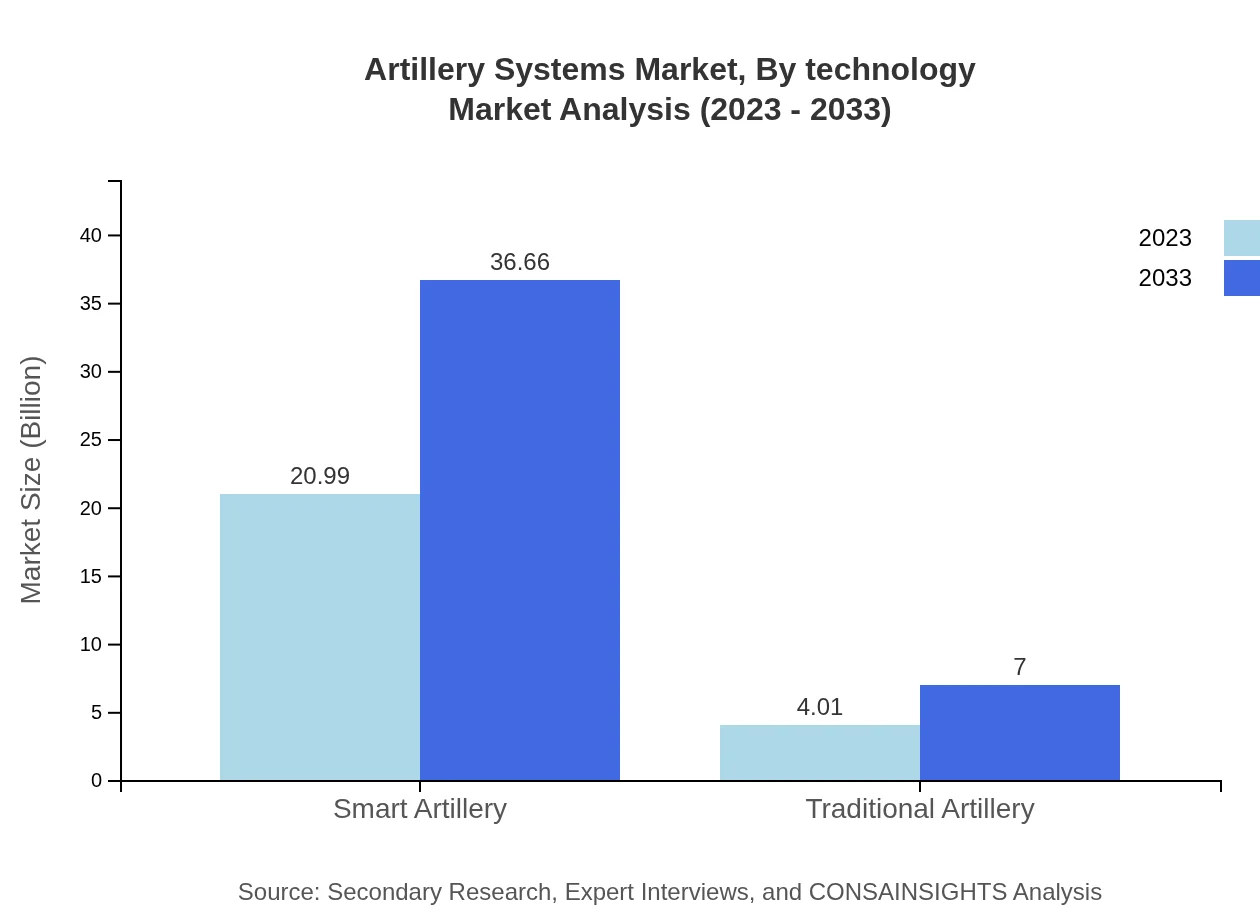

Artillery Systems Market Analysis By Technology

Technological advancements in artillery systems emphasize smart technologies, automations, and enhanced targeting systems. Smart Artillery is expected to grow from $20.99 billion to $36.66 billion, holding an 83.97% market share by 2033. Traditional artillery systems will maintain a presence, with growth from $4.01 billion to $7.00 billion.

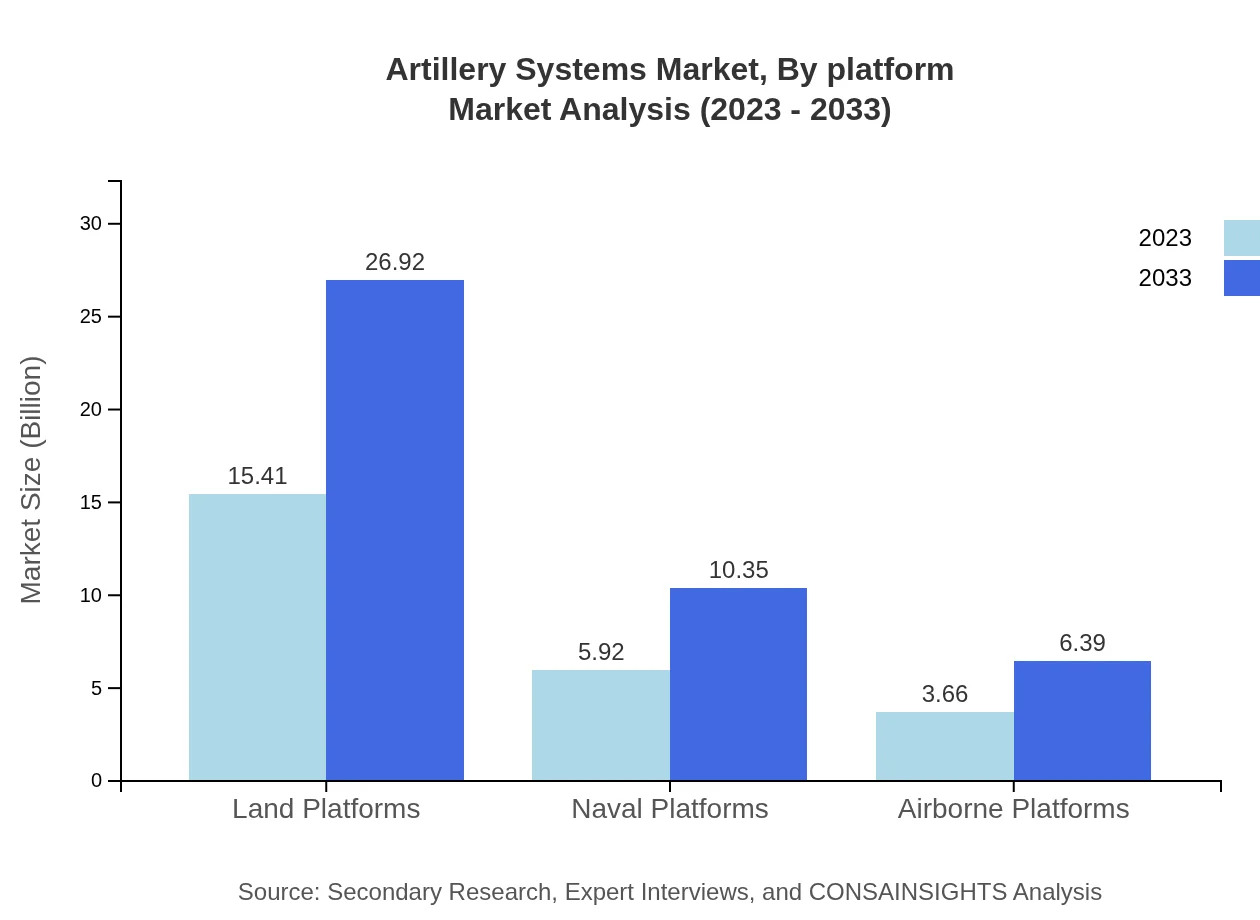

Artillery Systems Market Analysis By Platform

Artillery systems are deployed across various platforms, including Land, Naval, and Airborne systems. Land Platforms currently dominate the market at $15.41 billion, projected to reach $26.92 billion by 2033. Naval Platforms are forecasted to grow from $5.92 billion to $10.35 billion, with Airborne Platforms rising from $3.66 billion to $6.39 billion, highlighting the diversification in deployment strategies.

Artillery Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Artillery Systems Industry

BAE Systems:

A leading defense contractor specializing in advanced howitzer systems and military hardware development, BAE Systems significantly contributes to improving artillery systems for global military forces.Rheinmetall AG:

Germany-based Rheinmetall AG is renowned for its excellence in ammunition and artillery systems, focusing on delivering integrated solutions to enhance military operational capabilities.Lockheed Martin:

As a major player in defense technologies, Lockheed Martin is involved in innovative artillery solutions, emphasizing modernization and strategic military capabilities in its offerings.General Dynamics:

General Dynamics is engaged in artillery system development, contributing to state-of-the-art technology implementations in artillery platforms and ammunition systems for various armed forces.We're grateful to work with incredible clients.

FAQs

What is the market size of artillery Systems?

The global artillery systems market is currently valued at approximately 25 billion dollars, with a projected CAGR of 5.6%. This growth reflects increasing investments in modernizing military capabilities across various nations.

What are the key market players or companies in this artillery Systems industry?

Key players in the artillery systems market include Lockheed Martin, BAE Systems, Northrop Grumman, and Rheinmetall AG. These companies lead in technology development and global supply chains, catering to both defense and military branches.

What are the primary factors driving the growth in the artillery Systems industry?

The growth in the artillery systems market is driven by rising defense budgets, geopolitical tensions, and advancements in technology. Enhanced focus on precision strike capabilities further propels innovation and deployment of artillery systems.

Which region is the fastest Growing in the artillery Systems?

The fastest-growing region for the artillery systems market is Europe, projected to grow from 8.37 billion in 2023 to 14.62 billion by 2033, reflecting increased military spending and modernization efforts in response to security challenges.

Does ConsaInsights provide customized market report data for the artillery Systems industry?

Yes, ConsaInsights offers tailored market report data for the artillery systems industry. Clients can request specific insights aligned with their business needs, including market segmentation and competitive analysis.

What deliverables can I expect from this artillery Systems market research project?

The artillery systems market research project will deliver comprehensive reports including market analysis, forecasts, segmentation data, competitive landscape, and trends, providing valuable insights to inform strategic decision-making.

What are the market trends of artillery Systems?

Key market trends include the shift toward smart artillery systems, increasing autonomy in defense technology, and a focus on joint military operations. Additionally, there is a notable rise in demand for mobile and versatile artillery units.