Aseptic Packaging Market Report

Published Date: 02 February 2026 | Report Code: aseptic-packaging

Aseptic Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Aseptic Packaging market from 2023 to 2033, including market dynamics, size forecasts, trends, and an in-depth regional analysis, facilitating strategic decision-making for stakeholders in this evolving industry.

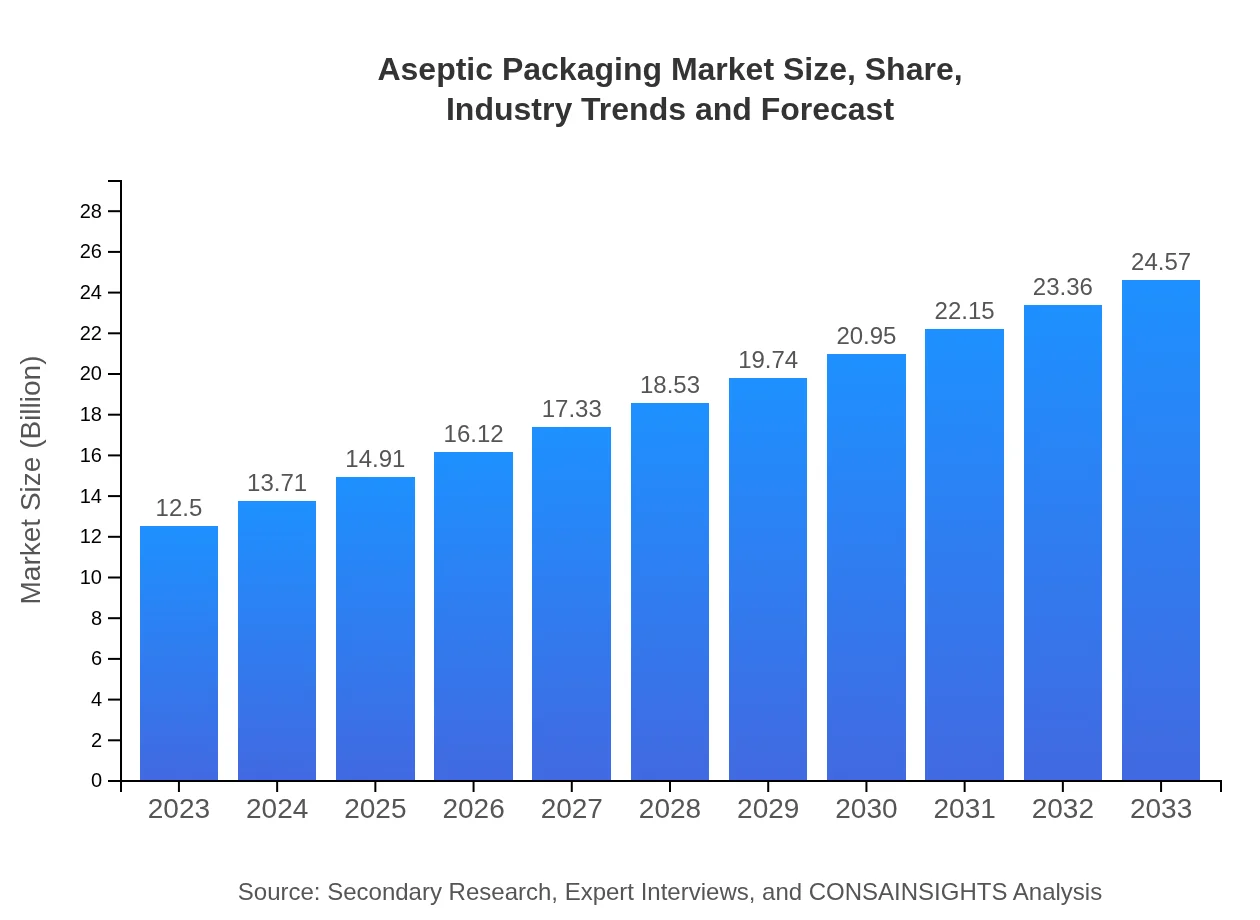

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Tetra Pak, SIG Combibloc, Elopak, Mondi Group |

| Last Modified Date | 02 February 2026 |

Aseptic Packaging Market Overview

Customize Aseptic Packaging Market Report market research report

- ✔ Get in-depth analysis of Aseptic Packaging market size, growth, and forecasts.

- ✔ Understand Aseptic Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aseptic Packaging

What is the Market Size & CAGR of Aseptic Packaging market in 2023?

Aseptic Packaging Industry Analysis

Aseptic Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aseptic Packaging Market Analysis Report by Region

Europe Aseptic Packaging Market Report:

The European Aseptic Packaging market is set to grow from 3.20 billion USD in 2023 to 6.29 billion USD by 2033. Rigorous health and safety standards, coupled with the rising popularity of convenient food products, are significant drivers. The region is at the forefront of sustainable packaging innovations, with manufacturers focusing on eco-friendly alternatives and advanced technology solutions.Asia Pacific Aseptic Packaging Market Report:

The Asia Pacific Aseptic Packaging market was valued at approximately 2.59 billion USD in 2023 and is expected to grow to nearly 5.08 billion USD by 2033. The growth is largely driven by rising disposable income, urbanization, and evolving consumer lifestyles across emerging economies such as India and China. Increased investments in the food and beverage sectors and expanding pharmaceutical industries further support this trend.North America Aseptic Packaging Market Report:

North America represents one of the largest Aseptic Packaging markets, valued at approximately 4.64 billion USD in 2023, expected to reach 9.12 billion USD by 2033. Strong demand from the food and beverage sector, driven by health-conscious consumers favoring easy-to-use packaging options, is propelling growth. Furthermore, advancements in packaging technology and sustainability initiatives among major brands bolster the market.South America Aseptic Packaging Market Report:

In South America, the market is projected to grow from 0.92 billion USD in 2023 to 1.82 billion USD by 2033. The growth is aided by increasing demand for packaged foods, innovative packaging solutions, and greater access to modern retail channels. Countries like Brazil and Argentina are showing significant growth potential due to improving economic conditions and changing consumer preferences.Middle East & Africa Aseptic Packaging Market Report:

The Aseptic Packaging market in the Middle East and Africa is projected to expand from 1.15 billion USD in 2023 to around 2.26 billion USD by 2033. Sterilization practices and growing awareness regarding food safety are pivotal for market growth. Additionally, increasing investments in the food and pharmaceutical sectors are driving demand for Aseptic Packaging solutions in this region.Tell us your focus area and get a customized research report.

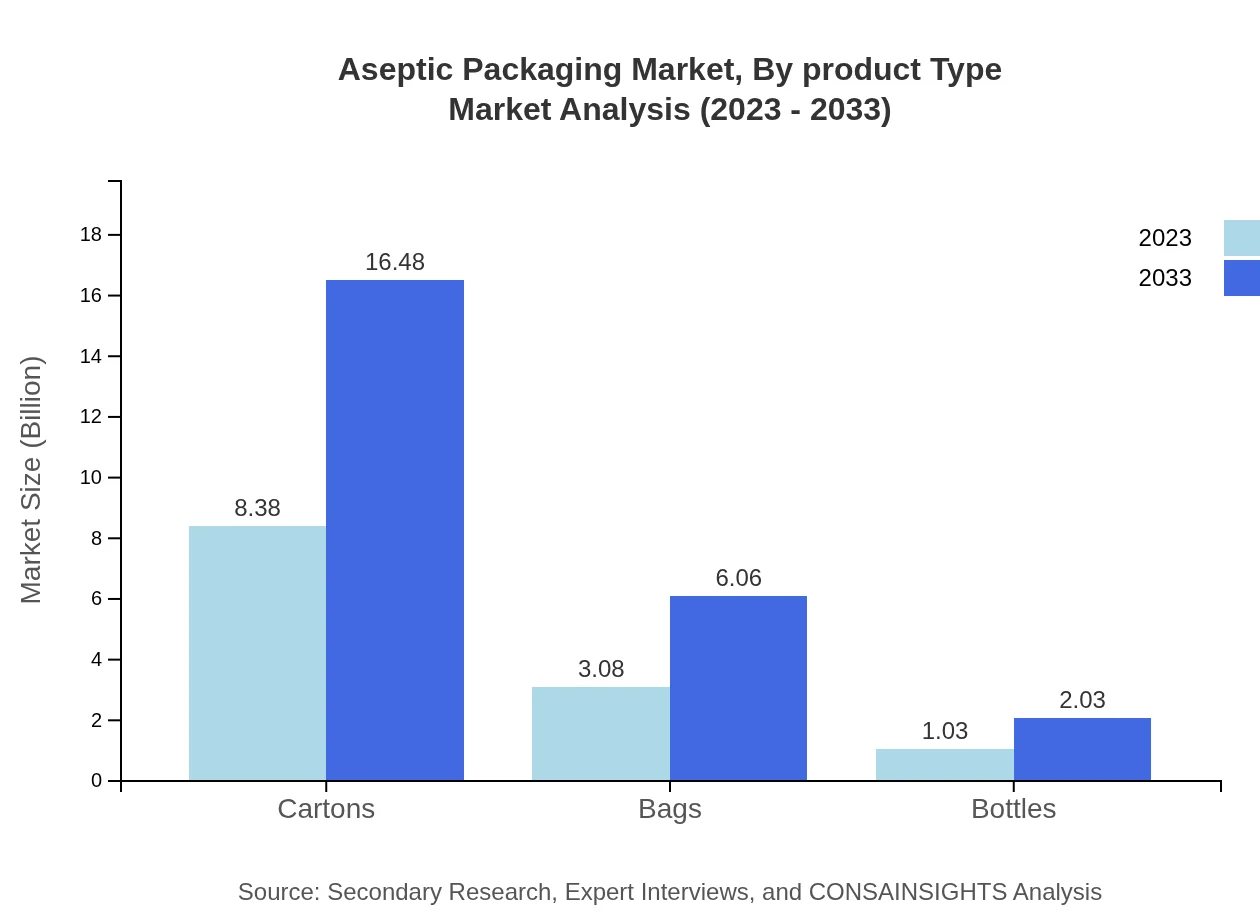

Aseptic Packaging Market Analysis By Product Type

The product type segment dominates the Aseptic Packaging market, with cartons, bags, and bottles being the primary formats. Cartons uphold the largest share, accounting for 67.07% in 2023, followed by bags and bottles. The increasing preference for lightweight and recyclable options among consumers is enhancing carton usage across industries.

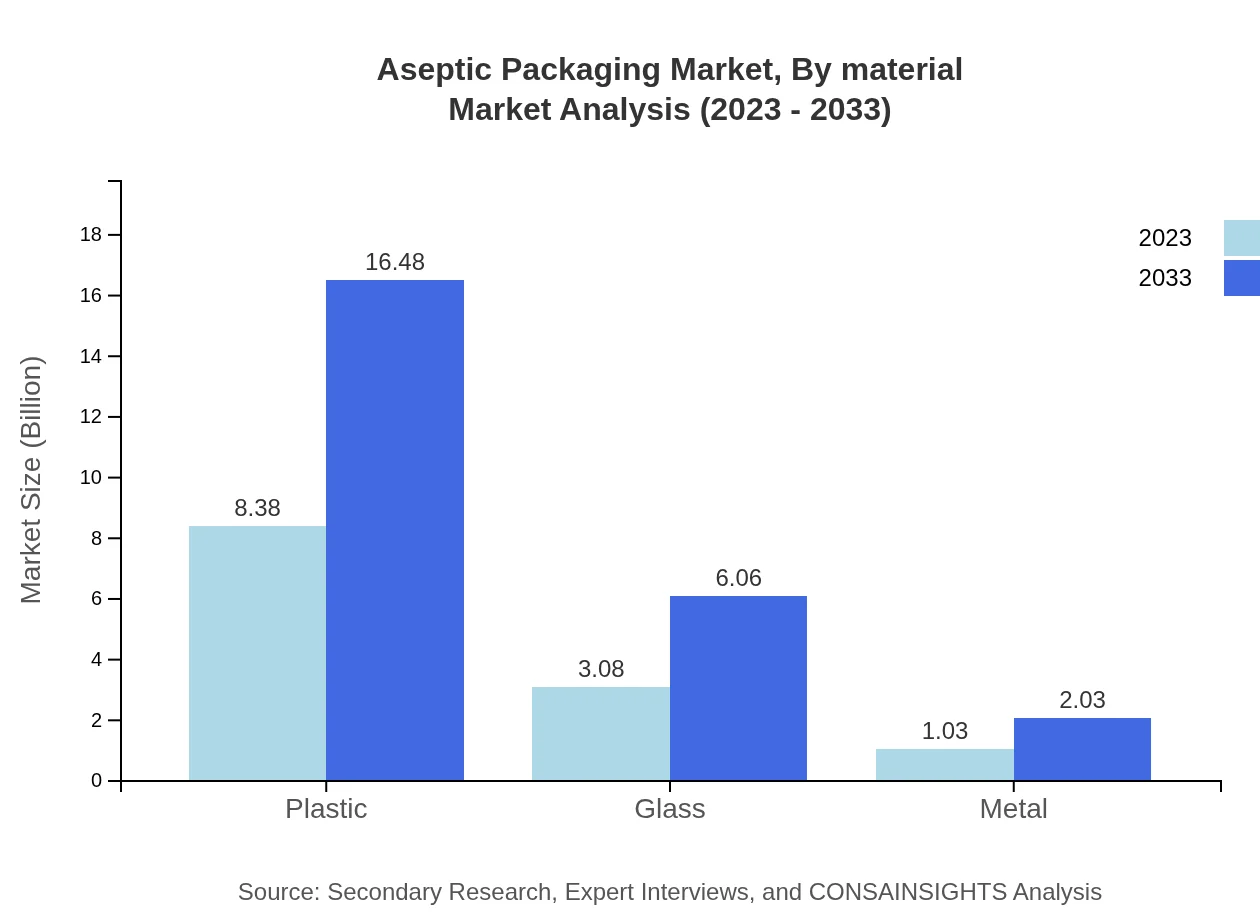

Aseptic Packaging Market Analysis By Material

The material segment highlights the diverse options used in Aseptic Packaging. Plastics lead the market, with a share of 67.07% in 2023, reflecting their versatility and cost-effectiveness. Glass retains about 24.65% due to its inert nature and premium perception, while metals represent an 8.28% share, favored for specific applications requiring durability.

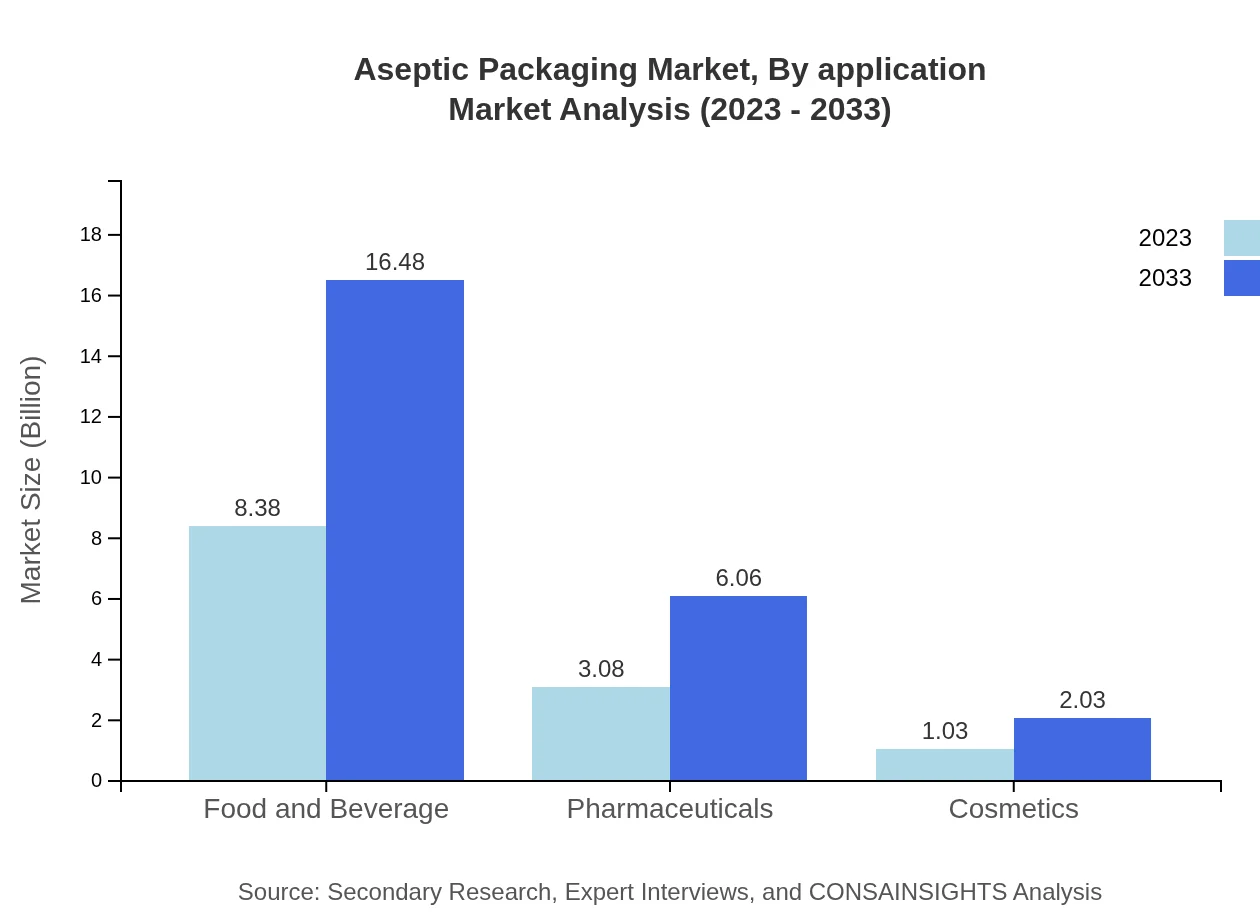

Aseptic Packaging Market Analysis By Application

In terms of application, the food and beverage sector holds the largest share with 67.07% as of 2023, driven mainly by high demand for safe, long-term storage solutions. The pharmaceutical sector, covering 24.65% of the market share, showcases the importance of hygiene and safety in drug packaging.

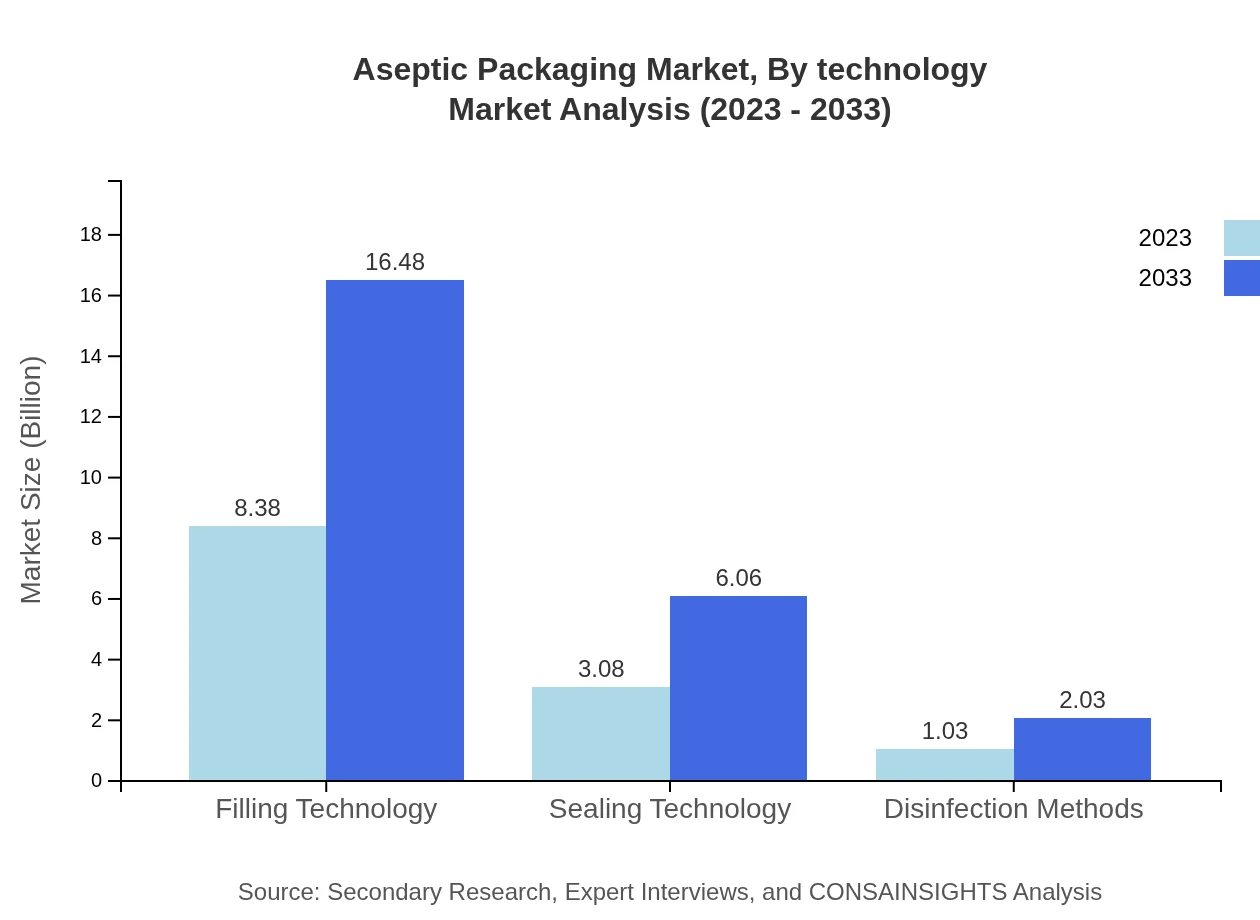

Aseptic Packaging Market Analysis By Technology

Filling technology dominates the market, accounting for a substantial 67.07% in 2023. It is essential for ensuring product sterility during packaging. Sealing technology closely follows with a share of 24.65%, reflecting its critical role in maintaining product integrity during transport and storage.

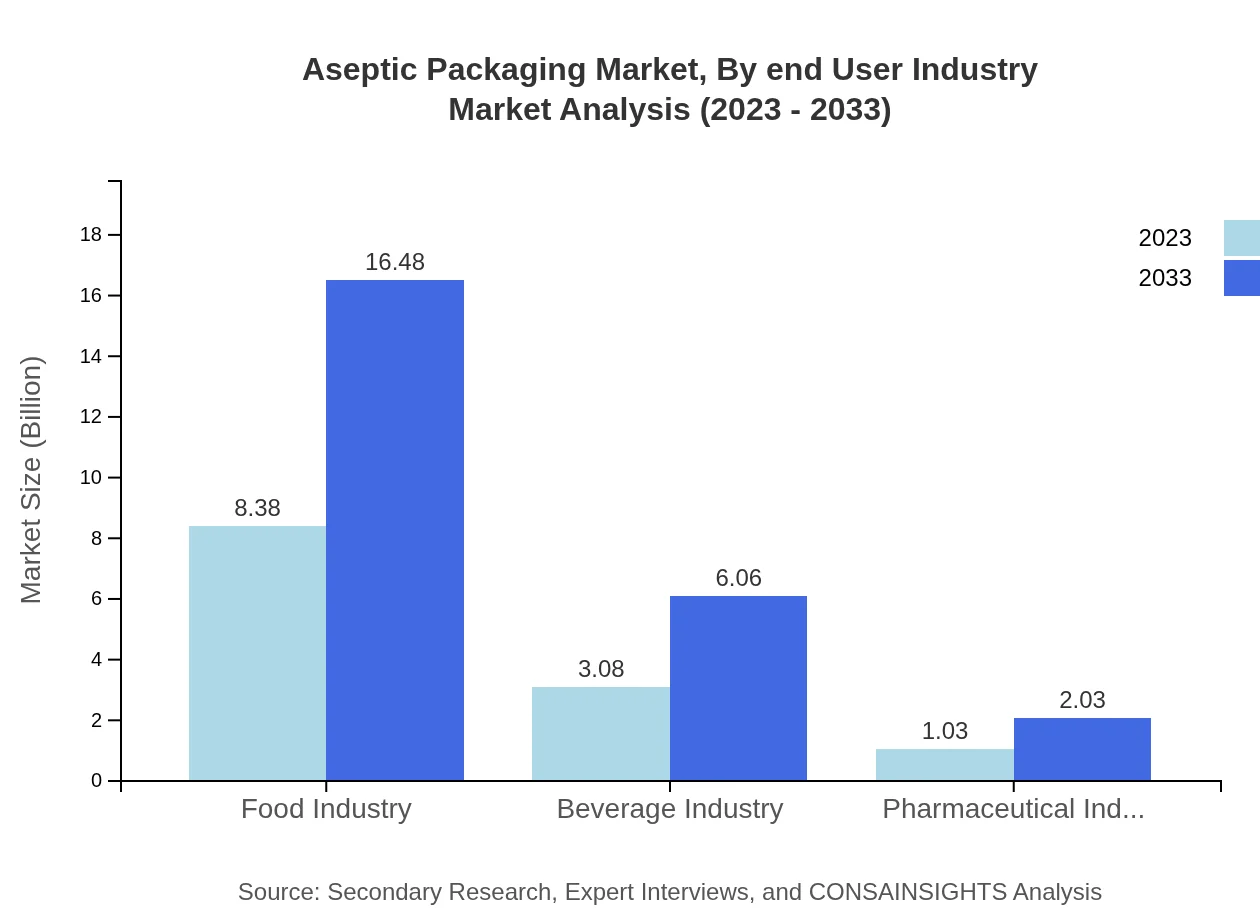

Aseptic Packaging Market Analysis By End User Industry

In the end-user industry segment, the food industry leads with a considerable market share of 67.07%, followed by the beverage and pharmaceutical sectors. The food industry's growth is supported by increasing consumer preferences for safe, long-shelf-life products, and innovations that cater to health trends.

Aseptic Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aseptic Packaging Industry

Tetra Pak:

A global leader in food processing and packaging solutions, Tetra Pak is known for its innovative corrugated cartons that ensure product safety and extend shelf life.SIG Combibloc:

SIG Combibloc specializes in manufacturing carton packs and filling machines for beverages and food, emphasizing sustainability and efficiency in their operations.Elopak:

Elopak provides sustainable packaging solutions, particularly in the liquid food sector, using renewable materials to enhance the ecological footprint of packaging.Mondi Group:

Mondi is a global integrated packaging and paper company, focused on developing innovative packaging solutions that are reliable and protect product integrity.We're grateful to work with incredible clients.

FAQs

What is the market size of aseptic packaging?

The aseptic packaging market is valued at approximately USD 12.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching significant figures by 2033. This growth highlights the rising demand across various applications.

What are the key market players or companies in this aseptic packaging industry?

Key players in the aseptic packaging industry include major companies like Tetra Pak, Sig Combibloc, and Elopak, known for their innovative technologies and robust product portfolios that drive competition and growth.

What are the primary factors driving the growth in the aseptic packaging industry?

Key growth drivers include increasing consumer demand for longer shelf-life products, a rise in health-consciousness leading to hygienic packaging solutions, and advancements in manufacturing technologies facilitating efficiency and sustainability.

Which region is the fastest Growing in the aseptic packaging?

The fastest-growing region in the aseptic packaging market is Asia Pacific, with its market size projected to grow from USD 2.59 billion in 2023 to USD 5.08 billion by 2033, due to rising food consumption and urbanization.

Does ConsaInsights provide customized market report data for the aseptic packaging industry?

Yes, ConsaInsights offers tailored market report data for the aseptic packaging industry, enabling organizations to gain insights specific to their needs and strategic goals through personalized research projects.

What deliverables can I expect from this aseptic packaging market research project?

Clients can expect comprehensive reports detailing market size, growth forecasts, competitive analysis, consumer insights, and recommendations for market entry or expansion in the aseptic packaging sector.

What are the market trends of aseptic packaging?

Trends in the aseptic packaging market include increased adoption of sustainable materials, advancement in smart packaging technologies, and a growing focus on convenience and safety in product delivery across various sectors.