Aseptic Processing Market Report

Published Date: 31 January 2026 | Report Code: aseptic-processing

Aseptic Processing Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Aseptic Processing market, covering essential insights such as market size, growth projections, segmentation, and regional dynamics for the forecast period from 2023 to 2033.

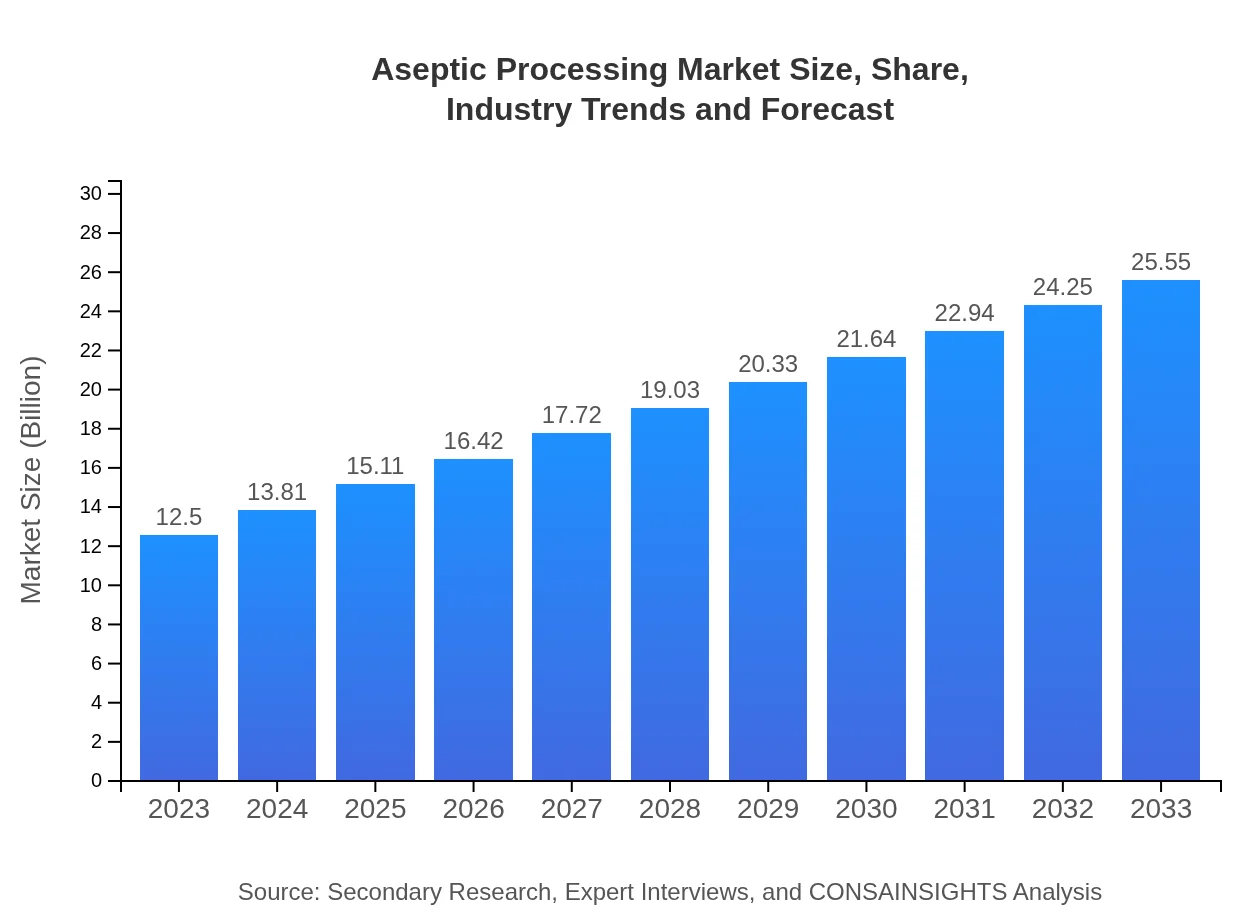

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $25.55 Billion |

| Top Companies | Tetra Pak, Becton Dickinson and Company, GEA Group, Stevanato Group |

| Last Modified Date | 31 January 2026 |

Aseptic Processing Market Overview

Customize Aseptic Processing Market Report market research report

- ✔ Get in-depth analysis of Aseptic Processing market size, growth, and forecasts.

- ✔ Understand Aseptic Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aseptic Processing

What is the Market Size & CAGR of Aseptic Processing market in 2023?

Aseptic Processing Industry Analysis

Aseptic Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aseptic Processing Market Analysis Report by Region

Europe Aseptic Processing Market Report:

The European Aseptic Processing market is forecasted to grow from $3.92 billion in 2023 to $8.02 billion by 2033. The demand for high-quality food and beverages, along with pharmaceutical products governed by stringent EU regulations on safety and quality, bolster the growth. Sustainability initiatives are also driving innovations, aligning with consumer preferences for environmentally friendly production methods.Asia Pacific Aseptic Processing Market Report:

In the Asia Pacific region, the Aseptic Processing market is projected to grow from $2.25 billion in 2023 to $4.59 billion by 2033, reflecting robust growth fueled by increasing urbanization, demand for processed foods, and advancements in manufacturing technologies. Countries like India and China are expected to lead this growth, supported by rising disposable incomes and a large population base.North America Aseptic Processing Market Report:

North America leads the market, projected to increase from $4.75 billion in 2023 to $9.70 billion by 2033. The region's stringent regulations concerning food and drug safety, alongside advanced technological adoption in manufacturing processes, solidify its market position as key players innovate to meet these regulations and consumers' health-focused demands.South America Aseptic Processing Market Report:

The South American Aseptic Processing market is expected to expand from $0.58 billion in 2023 to $1.18 billion in 2033. Growing investments in the food and pharmaceutical industries, along with an increase in exports of processed food products, contribute to this market. However, challenges such as economic volatility may impact growth rates.Middle East & Africa Aseptic Processing Market Report:

Expected to grow from $1.01 billion in 2023 to $2.06 billion by 2033, the Middle East and Africa region is experiencing increasing investments in health infrastructure, coupled with a growing consumer base seeking safer food and beverage options. Aseptic processing is becoming essential as local industries evolve and modernize their practices to adapt to international safety standards.Tell us your focus area and get a customized research report.

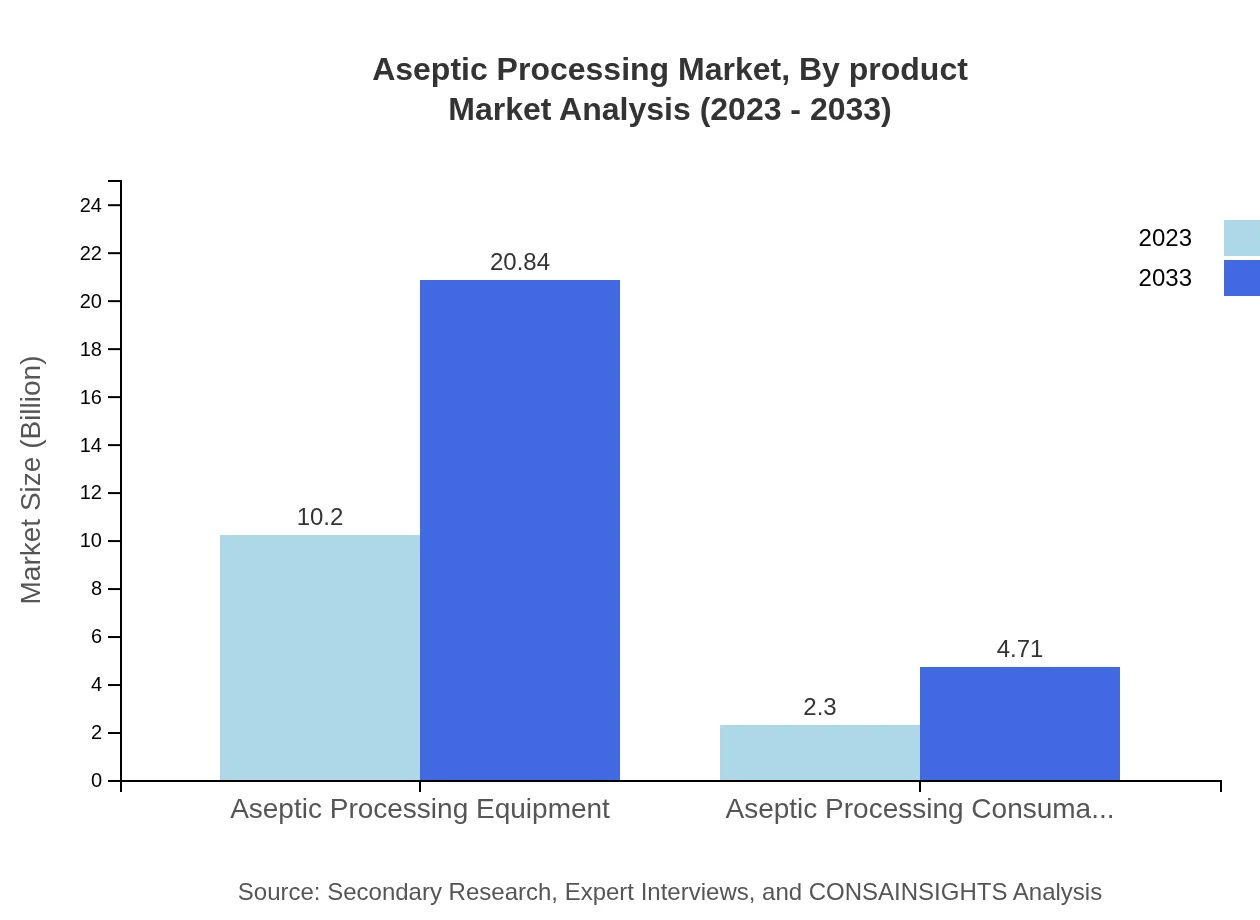

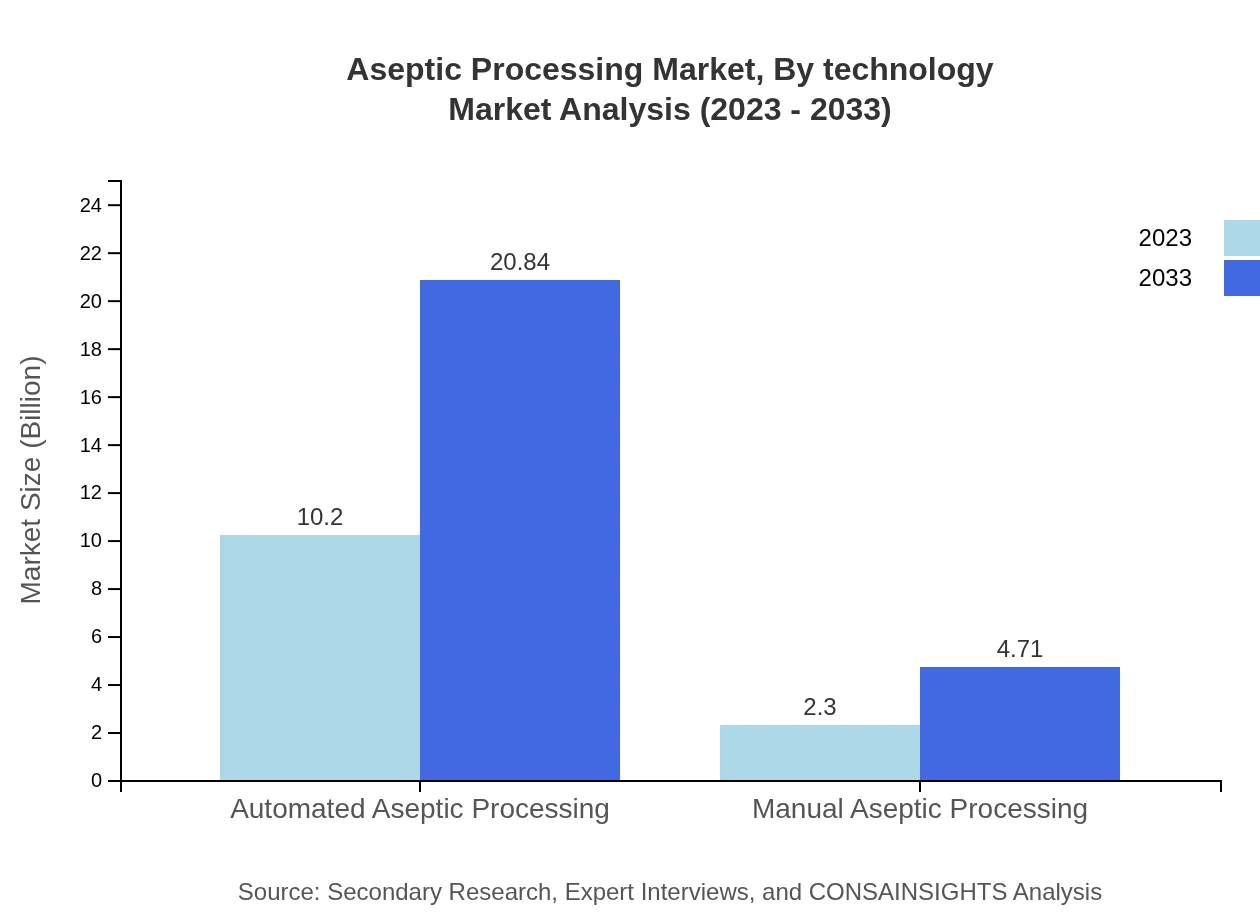

Aseptic Processing Market Analysis By Product

The Aseptic Processing market is segmented by product into Aseptic Processing Equipment and Aseptic Processing Consumables. In 2023, the equipment segment, valued at $10.20 billion, is expected to grow to $20.84 billion by 2033, while consumables will increase from $2.30 billion to $4.71 billion. This increasing demand for equipment underscores the industry's shift towards automated processing.

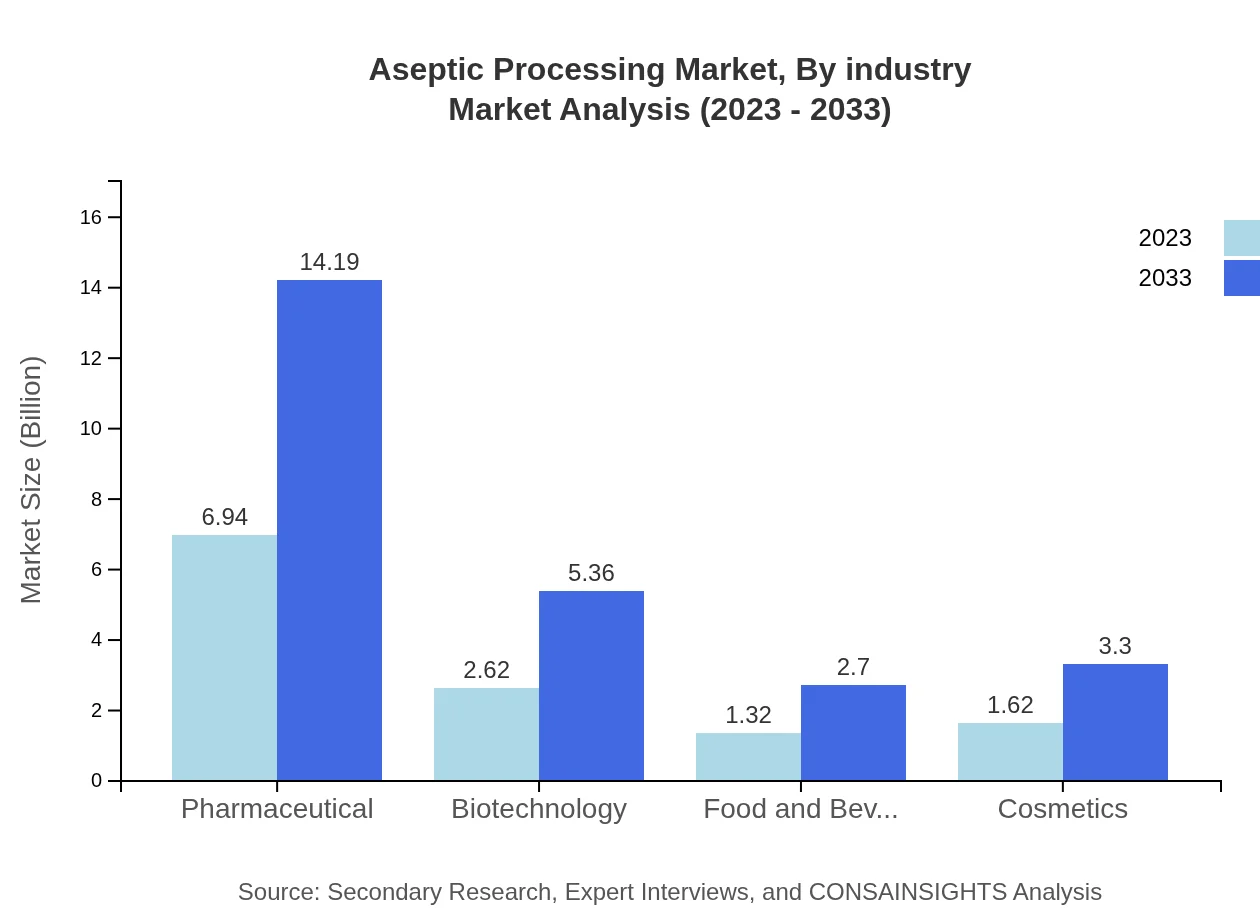

Aseptic Processing Market Analysis By Industry

The primary sectors utilizing Aseptic Processing include Pharmaceuticals, Biotechnology, Food and Beverage, and Cosmetics. The Pharmaceutical sector is projected to grow from $6.94 billion in 2023 to $14.19 billion by 2033, while the Biotechnology sector increases from $2.62 billion to $5.36 billion in the same period. The Food and Beverage market shows significant growth due to increasing consumer demand for longer-shelf-life products, anticipated to rise from $1.32 billion to $2.70 billion.

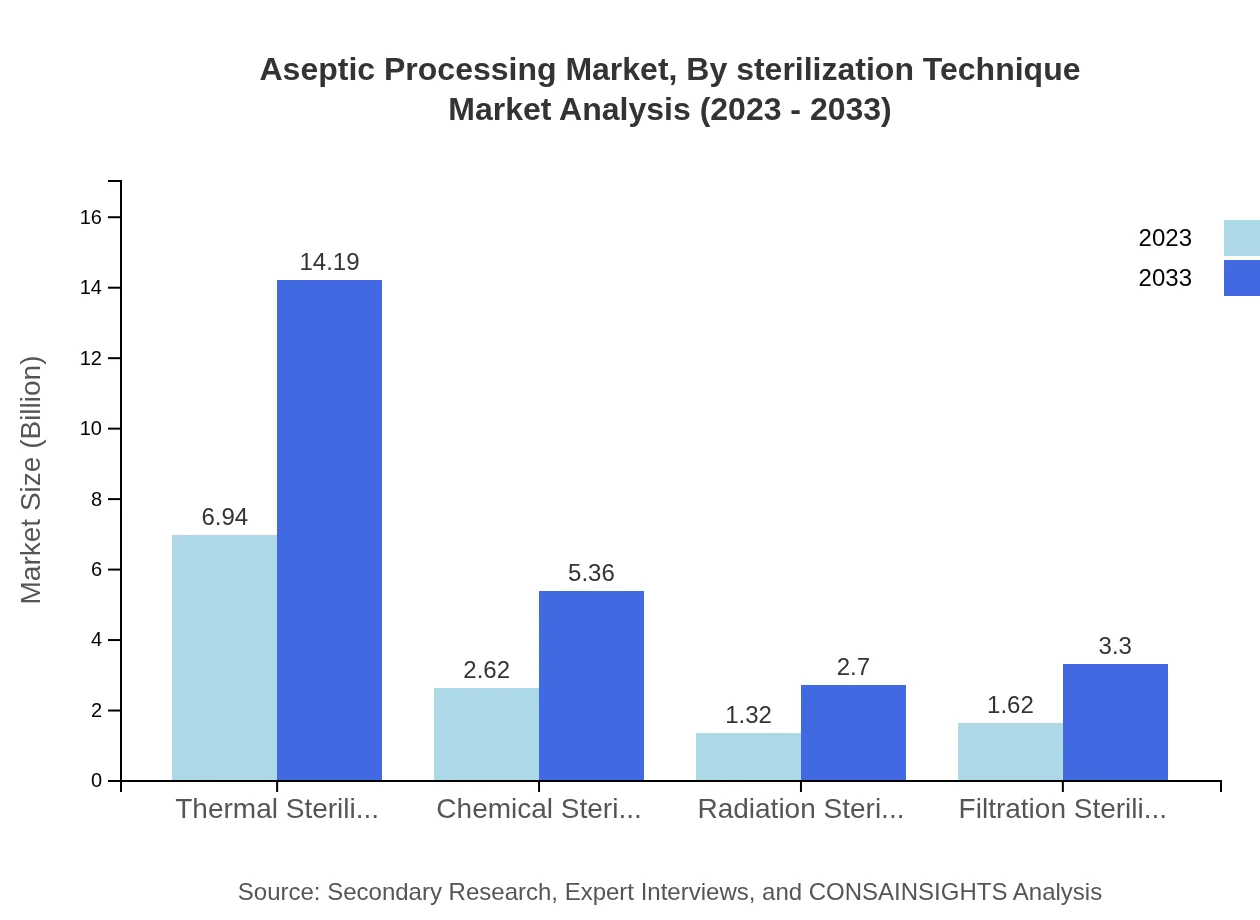

Aseptic Processing Market Analysis By Sterilization Technique

Key sterilization techniques in Aseptic Processing include Thermal Sterilization, Chemical Sterilization, Radiation Sterilization, and Filtration Sterilization. Thermal Sterilization dominates with a market size of $6.94 billion in 2023, growing to $14.19 billion by 2033. In contrast, Chemical Sterilization will rise from $2.62 billion to $5.36 billion, driven by diverse applications across industries.

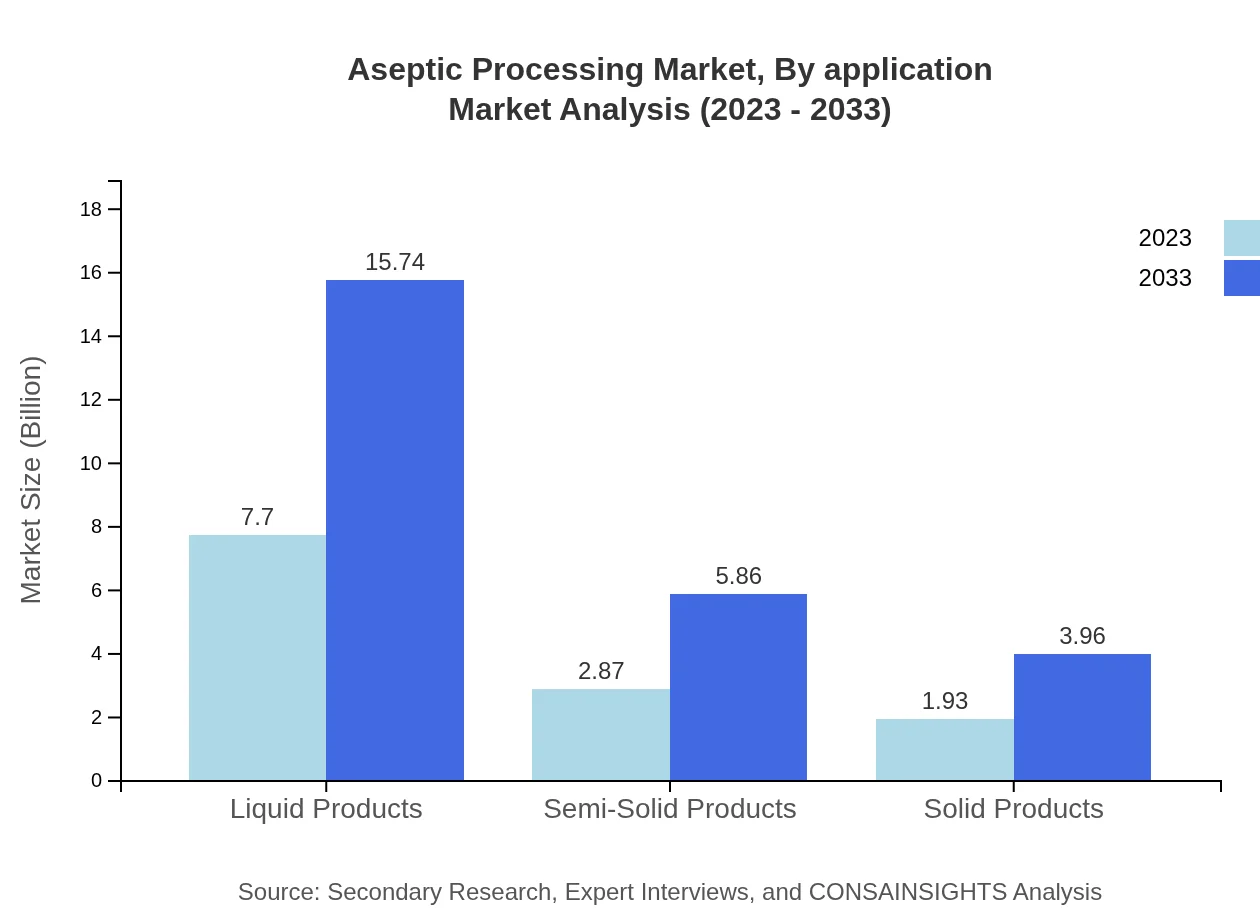

Aseptic Processing Market Analysis By Application

The applications of Aseptic Processing encompass Liquid Products, Semi-Solid Products, and Solid Products. Liquid Products lead with a projected growth from $7.70 billion in 2023 to $15.74 billion by 2033. Semi-Solid Products will follow with an anticipated rise from $2.87 billion to $5.86 billion, while Solid Products are also expected to grow significantly in response to evolving consumer preferences.

Aseptic Processing Market Analysis By Technology

The technological landscape within Aseptic Processing is dominated by automated systems, which account for 81.57% market share in 2023, totaling $10.20 billion, increasing to a projected $20.84 billion by 2033. This emphasizes a trend towards efficiency and scalability in aseptic production, as automation minimizes human error and improves productivity.

Aseptic Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aseptic Processing Industry

Tetra Pak:

Tetra Pak is renowned for its innovative aseptic processing and packaging solutions, especially in dairy and beverage sectors, emphasizing sustainability and efficiency in food processing.Becton Dickinson and Company:

Becton Dickinson is a leader in medical technology, providing sophisticated aseptic processing solutions for pharmaceuticals, ensuring safety and compliance in drug manufacturing.GEA Group:

GEA Group specializes in food processing technologies and equipment, enhancing the preservation and safety of various food products through advanced aseptic solutions.Stevanato Group:

Stevanato Group focuses on pharmaceutical packaging and solutions, developing innovative systems that uphold stringent aseptic processing standards for health products.We're grateful to work with incredible clients.

FAQs

What is the market size of aseptic Processing?

The aseptic processing market is valued at $12.5 billion in 2023, with a projected CAGR of 7.2%. This growth trend indicates increasing demand and innovation within the pharmaceutical, biotechnology, food and beverage, and cosmetics sectors.

What are the key market players or companies in this aseptic processing industry?

Key players in the aseptic processing industry include global leaders like Siemens AG, Syntegon Technology, Tetra Pak, and Ecolab. Their focus on innovation and sustainable practices drives the market forward.

What are the primary factors driving the growth in the aseptic processing industry?

Growth in aseptic processing is driven by increasing health standards, rising demand for packaged food, advancements in sterilization technologies, and the expansion of the pharmaceutical industry, particularly in biologics and biosimilars.

Which region is the fastest Growing in the aseptic processing?

The fastest-growing region in the aseptic processing market is Europe, projected to grow from $3.92 billion in 2023 to $8.02 billion by 2033, highlighting the region's robust pharmaceutical and food sectors.

Does Consainsights provide customized market report data for the aseptic processing industry?

Yes, Consainsights offers customized market report data tailored to the aseptic processing industry, addressing specific client needs and providing insights into market dynamics, trends, and competitive landscapes.

What deliverables can I expect from this aseptic processing market research project?

Deliverables from the aseptic processing market research project include comprehensive market analysis reports, trend forecasting, competitive positioning summaries, and detailed profiles of key market players and segments.

What are the market trends of aseptic processing?

Current trends in aseptic processing include the rise of automated systems, a focus on sustainability in packaging, increased use of biotechnology, and innovations in sterilization methods to enhance product safety and shelf life.