Aspartame Market Report

Published Date: 31 January 2026 | Report Code: aspartame

Aspartame Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aspartame market, covering market size, growth projections, and segment performance from 2023 to 2033. Insights into industry trends, regional dynamics, and key players are also included to facilitate strategic decision-making.

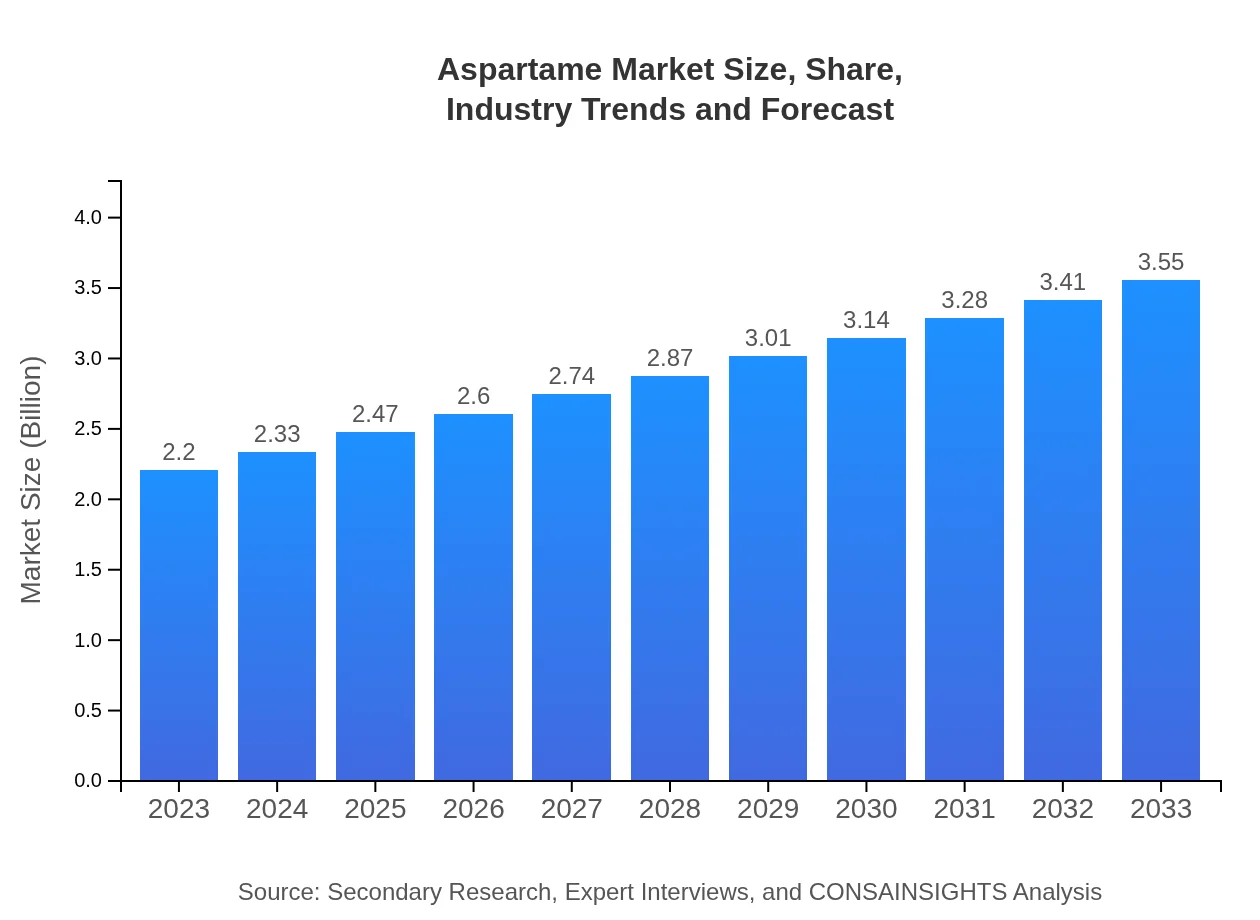

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.20 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $3.55 Billion |

| Top Companies | NutraSweet, Ajinomoto, Merisant |

| Last Modified Date | 31 January 2026 |

Aspartame Market Overview

Customize Aspartame Market Report market research report

- ✔ Get in-depth analysis of Aspartame market size, growth, and forecasts.

- ✔ Understand Aspartame's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aspartame

What is the Market Size & CAGR of Aspartame market in 2023?

Aspartame Industry Analysis

Aspartame Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aspartame Market Analysis Report by Region

Europe Aspartame Market Report:

The European Aspartame market is estimated to grow from $0.69 billion in 2023 to $1.12 billion by 2033. The region’s increasing adoption of healthy lifestyles and the demand for sugar-free products significantly impact market growth. Countries like Germany, the UK, and France lead the market, supported by stringent food safety regulations and consumer preferences for low-calorie alternatives.Asia Pacific Aspartame Market Report:

The Asia Pacific region is projected to experience significant growth, with the market reaching approximately $0.71 billion by 2033, up from $0.44 billion in 2023. Rapid urbanization, changing consumer lifestyles, and a growing middle-class population drive the demand for low-calorie products in countries like China and India. Moreover, an increasing focus on health and wellness significantly boosts market opportunities in this region.North America Aspartame Market Report:

North America holds a significant share of the Aspartame market, projected to grow from $0.73 billion in 2023 to about $1.18 billion by 2033. The U.S. remains the largest consumer, driven by a high demand for low-calorie food and beverage options. The region's well-established food safety regulations also enhance consumer confidence in artificial sweeteners, further driving sales.South America Aspartame Market Report:

In South America, the Aspartame market is expected to grow from $0.17 billion in 2023 to $0.27 billion by 2033. The growth is attributed to rising health awareness among consumers and the growing popularity of diet products. Brazil and Argentina are key markets, with increasing investments in the food and beverage sectors supporting market development.Middle East & Africa Aspartame Market Report:

The Middle East and Africa market for Aspartame is anticipated to increase from $0.17 billion in 2023 to $0.27 billion by 2033. The demand for sweeteners is growing due to changing dietary patterns and an increase in lifestyle-related health issues. South Africa and the UAE are emerging as key markets due to their expanding food and beverage sectors.Tell us your focus area and get a customized research report.

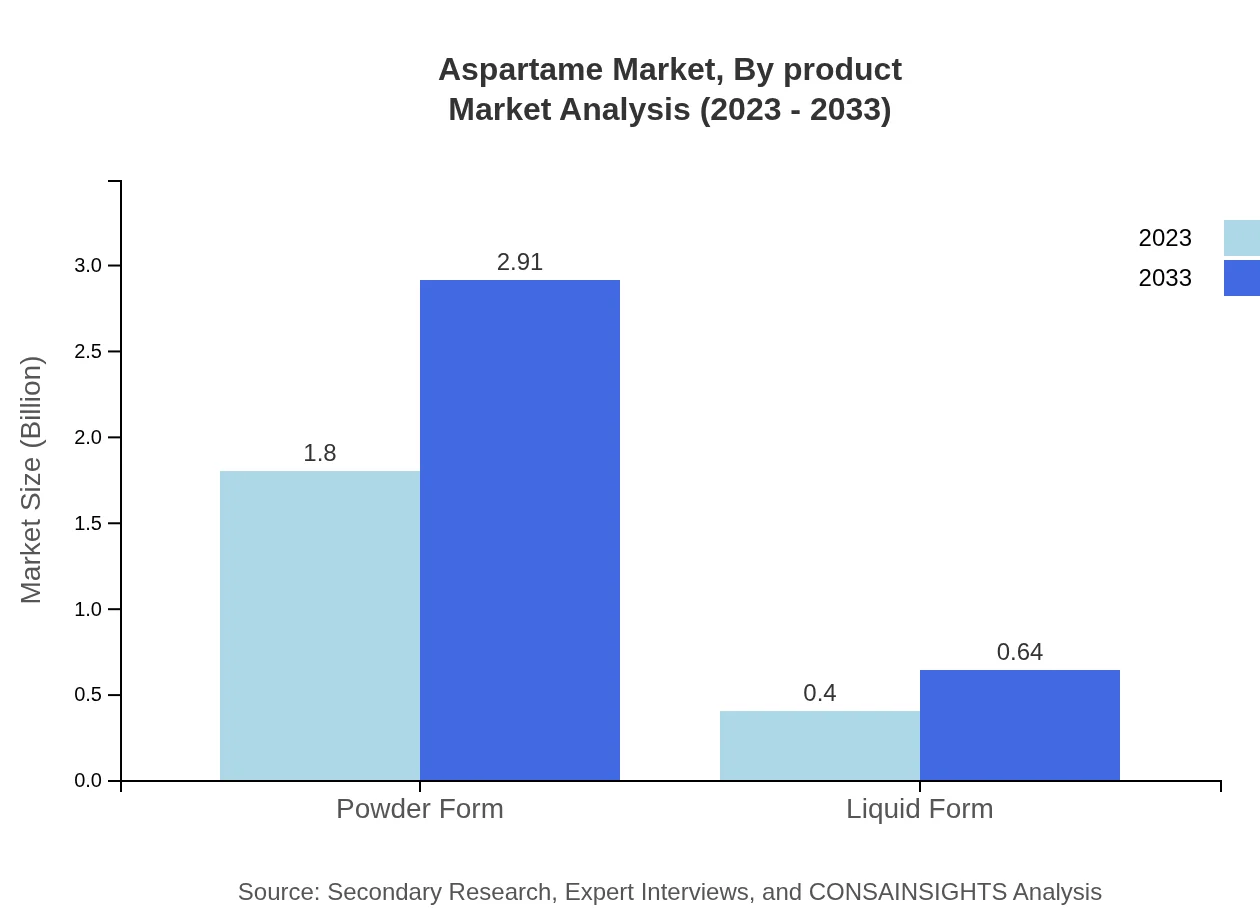

Aspartame Market Analysis By Product

In product type analysis, the powder form of Aspartame is leading the market, with a size of around $1.80 billion in 2023 and expected to grow to $2.91 billion by 2033, maintaining a market share of 81.94%. The liquid form, while smaller, also shows growth from $0.40 billion to $0.64 billion, representing an 18.06% share in 2023.

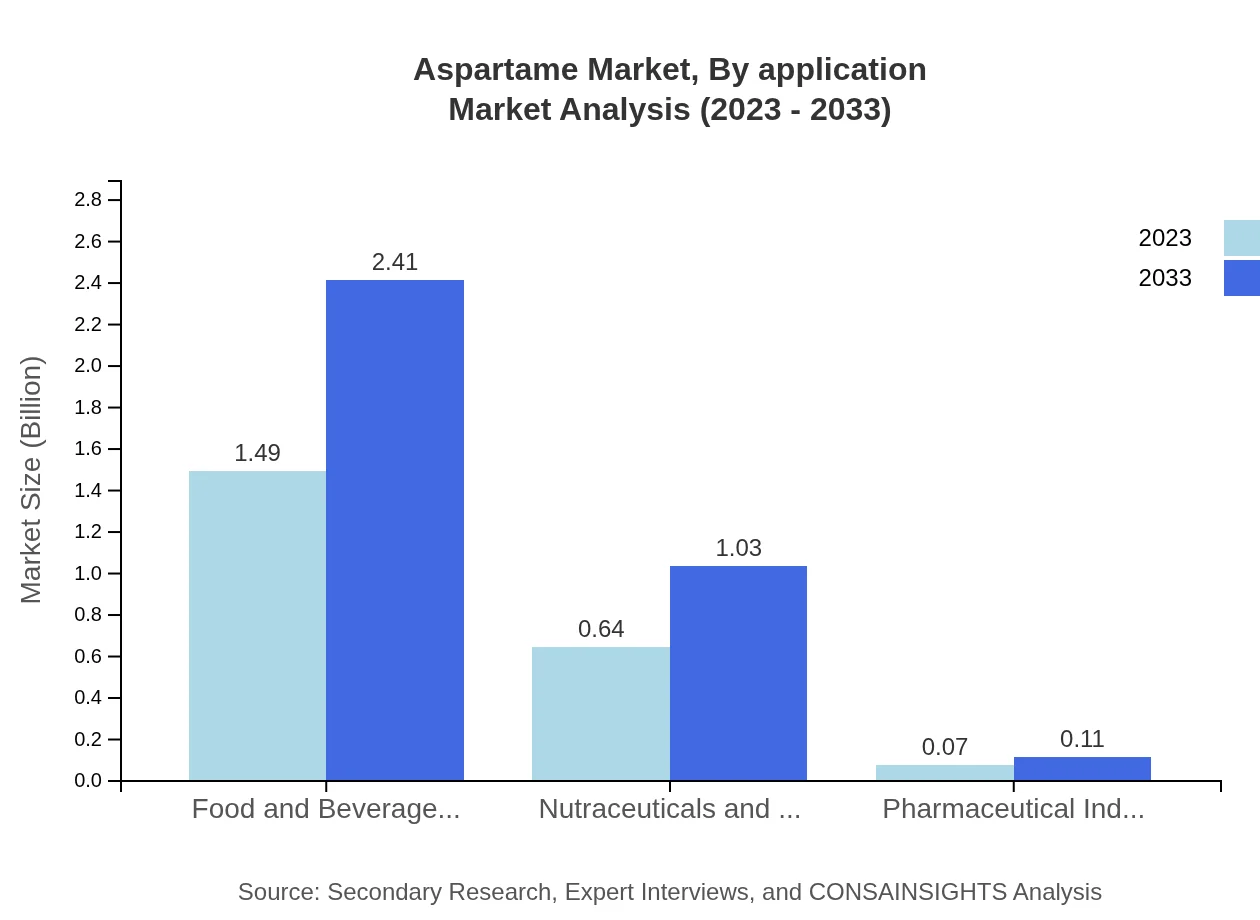

Aspartame Market Analysis By Application

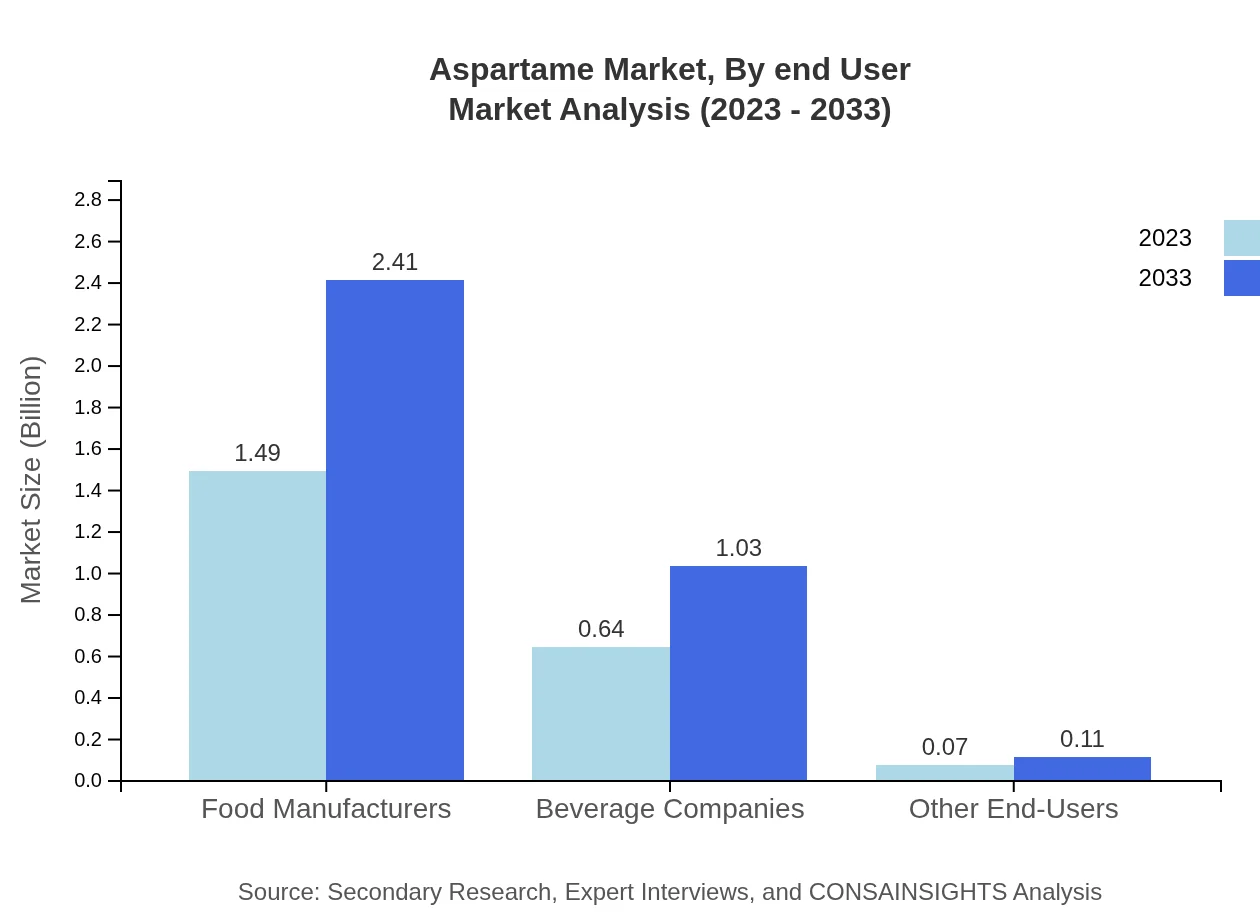

In application analysis, food manufacturers occupy the largest share, growing from $1.49 billion in 2023 to $2.41 billion by 2033. Beverage companies follow, with a market size increasing from $0.64 billion to $1.03 billion between 2023 and 2033, reflecting their significant role in the Aspartame market dynamics.

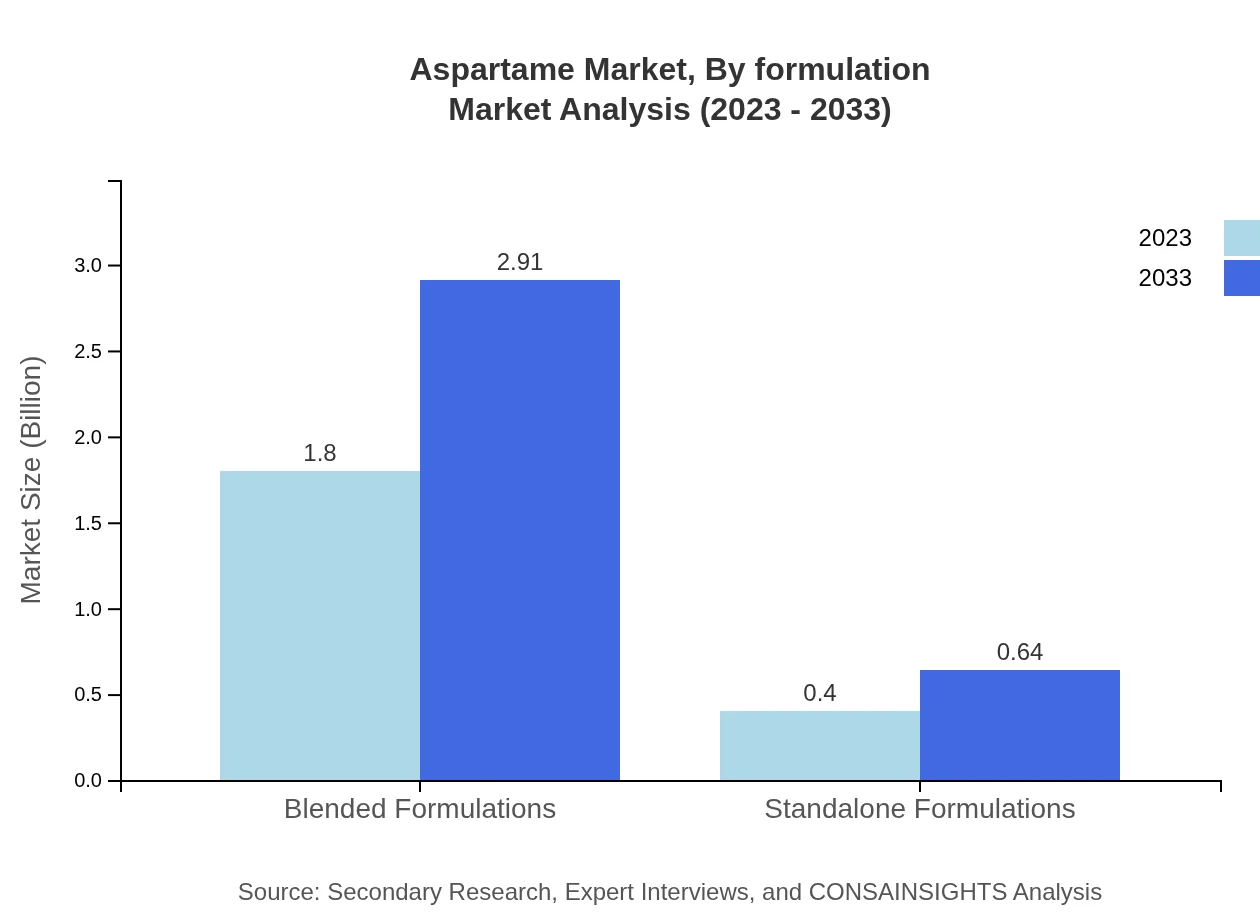

Aspartame Market Analysis By Formulation

The market for blended formulations of Aspartame is projected to lead, growing from $1.80 billion in 2023 to $2.91 billion by 2033, retaining a substantial portion of the market share at 81.94%. Standalone formulations, while smaller, are also expected to increase from $0.40 billion to $0.64 billion, reflecting a trend towards customized dietary products.

Aspartame Market Analysis By End User

By end-user analysis, the food and beverage industry predominantly drives the Aspartame market, growing from $1.49 billion in 2023 to $2.41 billion by 2033, maintaining a share of 67.9%. The nutraceuticals and supplements segment is also significant, expected to rise from $0.64 billion to $1.03 billion, indicating a shift towards healthier lifestyle products.

Aspartame Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aspartame Industry

NutraSweet:

One of the pioneers in the Aspartame industry, NutraSweet provides innovative sugar substitutes and maintains a strong market presence through extensive R&D investments.Ajinomoto:

A leading global manufacturer of Amino Acids and Aspartame, Ajinomoto plays a key role in setting industry standards and developing new applications for Aspartame.Merisant:

Merisant is known for its sweetener brands like Equal and Sweet 'N Low, contributing significantly to consumer awareness and acceptance of Aspartame-based products.We're grateful to work with incredible clients.

FAQs

What is the market size of aspartame?

The global aspartame market is valued at approximately $2.2 billion in 2023, with a projected CAGR of 4.8% over the next ten years, indicating steady growth driven by increasing demand across various applications.

What are the key market players or companies in the aspartame industry?

Key players in the aspartame market include giant food manufacturers and beverage companies such as NutraSweet, Ajinomoto, and others focusing on innovation and expanding production capabilities to meet consumer needs.

What are the primary factors driving the growth in the aspartame industry?

Factors such as rising health consciousness, increasing demand for low-calorie products, and the expansion of food and beverage applications are significantly driving the growth of the aspartame market across different regions.

Which region is the fastest Growing in the aspartame market?

The Asia Pacific region is witnessing significant growth, with the market expected to increase from $0.44 billion in 2023 to $0.71 billion by 2033, fueled by rapid urbanization and changing dietary habits.

Does ConsaInsights provide customized market report data for the aspartame industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, including detailed insights into the aspartame industry, market segmentation, and regional analysis.

What deliverables can I expect from this aspartame market research project?

Deliverables include comprehensive market analysis reports, segmentation data, insights into key players, consumer trends, and forecasts for market size and growth across different regions.

What are the market trends of aspartame?

Current trends indicate a surge in demand for aspartame in low-calorie and diet products, alongside emerging applications in nutraceuticals and expansion in markets such as Asia Pacific.