Aspiration And Biopsy Needles Market Report

Published Date: 31 January 2026 | Report Code: aspiration-and-biopsy-needles

Aspiration And Biopsy Needles Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aspiration and Biopsy Needles market, offering insights into market size, trends, segmentation, and forecasts from 2023 to 2033. Key findings include analysis by regions, product types, and emerging technological advancements in the industry.

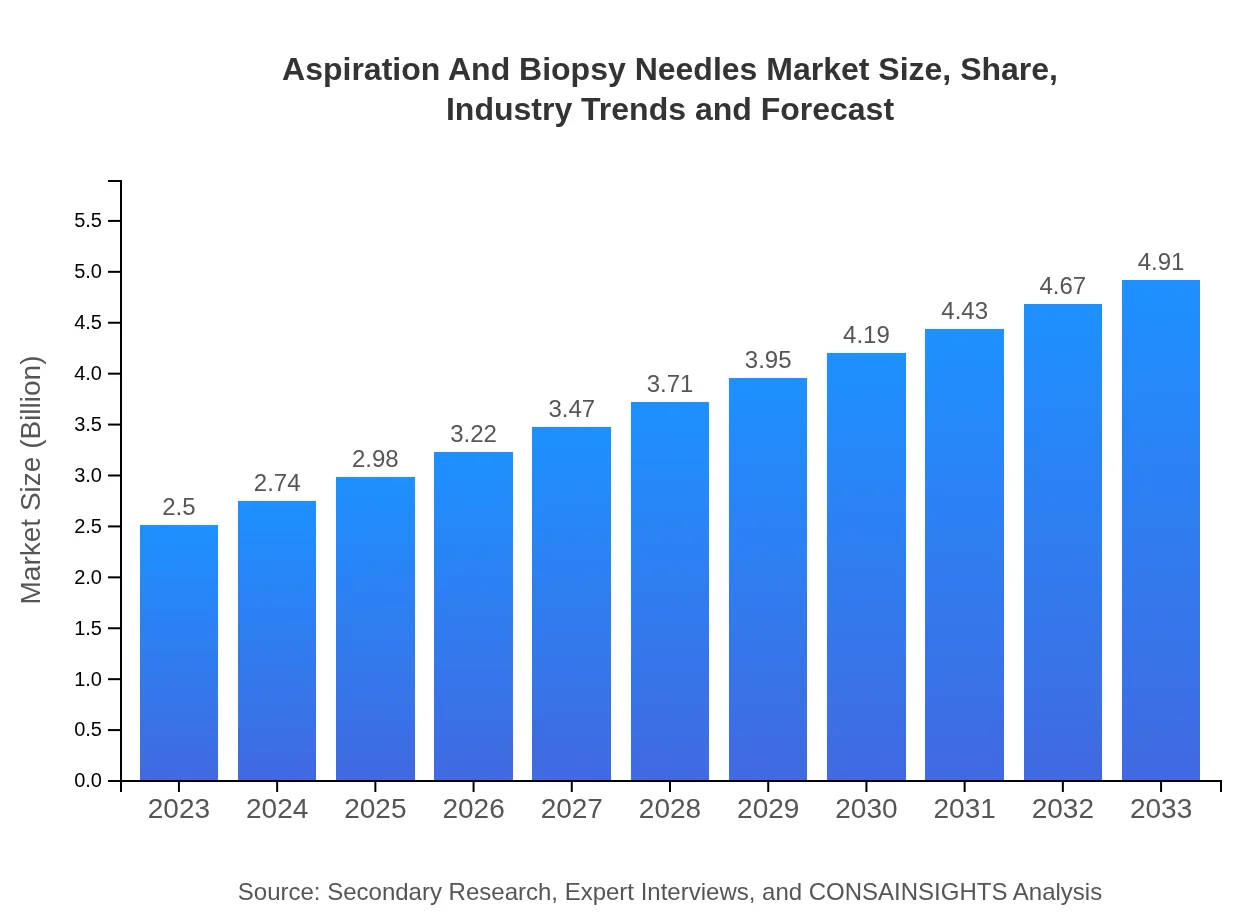

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Smith & Nephew, Becton Dickinson and Company (BD), Medtronic |

| Last Modified Date | 31 January 2026 |

Aspiration And Biopsy Needles Market Overview

Customize Aspiration And Biopsy Needles Market Report market research report

- ✔ Get in-depth analysis of Aspiration And Biopsy Needles market size, growth, and forecasts.

- ✔ Understand Aspiration And Biopsy Needles's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aspiration And Biopsy Needles

What is the Market Size & CAGR of Aspiration And Biopsy Needles market in 2023?

Aspiration And Biopsy Needles Industry Analysis

Aspiration And Biopsy Needles Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aspiration And Biopsy Needles Market Analysis Report by Region

Europe Aspiration And Biopsy Needles Market Report:

The European market is projected to grow from USD 0.77 billion in 2023 to USD 1.51 billion in 2033. Key growth drivers include technological advancements, an increase in healthcare spending, and a growing aging population experiencing higher rates of chronic diseases.Asia Pacific Aspiration And Biopsy Needles Market Report:

The Asia-Pacific region is anticipated to witness considerable growth, with the market size increasing from USD 0.45 billion in 2023 to USD 0.89 billion by 2033. Factors such as rising healthcare expenditure, increasing prevalence of diseases requiring biopsy, and growing investments in medical infrastructure drive growth in this region.North America Aspiration And Biopsy Needles Market Report:

North America is the largest market, valued at USD 0.91 billion in 2023 and projected to reach USD 1.79 billion by 2033. The established healthcare system, high adoption rates of advanced biopsy techniques, and significant research funding contribute to this dominance.South America Aspiration And Biopsy Needles Market Report:

The South American market, though smaller, shows potential growth from USD 0.15 billion in 2023 to USD 0.30 billion in 2033. Factors contributing to growth include improved healthcare access and rising awareness of early disease detection.Middle East & Africa Aspiration And Biopsy Needles Market Report:

The market in the Middle East and Africa is expected to expand from USD 0.22 billion in 2023 to USD 0.43 billion by 2033. Rising investments in healthcare improvements and increasing prevalence of chronic diseases are pivotal to market growth in this region.Tell us your focus area and get a customized research report.

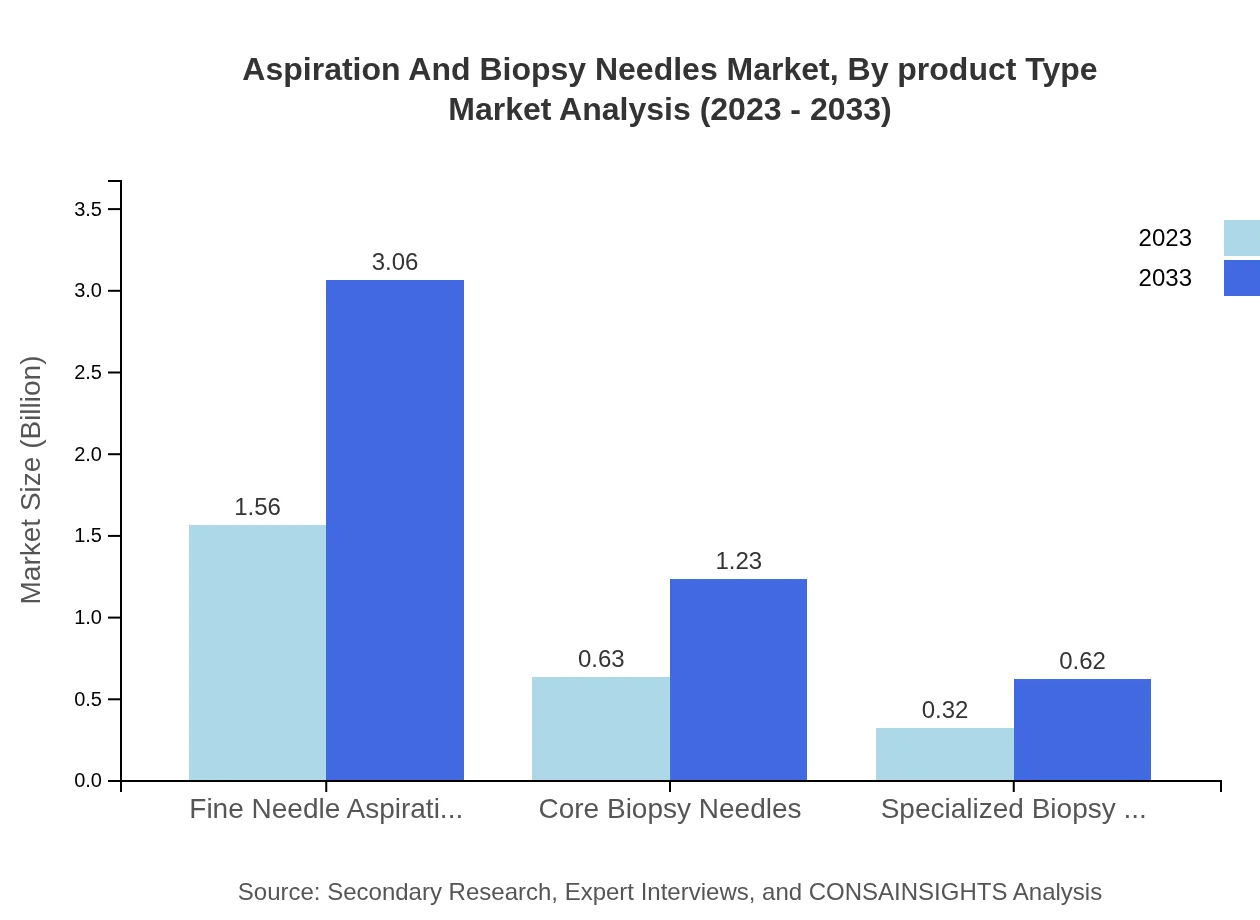

Aspiration And Biopsy Needles Market Analysis By Product Type

The market is divided primarily into Fine Needle Aspiration Needles, Core Biopsy Needles, and Specialized Biopsy Needles. Fine Needle Aspiration Needles dominate the segment, generating USD 1.56 billion in 2023 and expected to reach USD 3.06 billion by 2033. Core Biopsy Needles and Specialized Biopsy Needles follow with significant respectively shares of USD 0.63 billion and USD 0.32 billion in 2023, facilitating essential diagnostic processes.

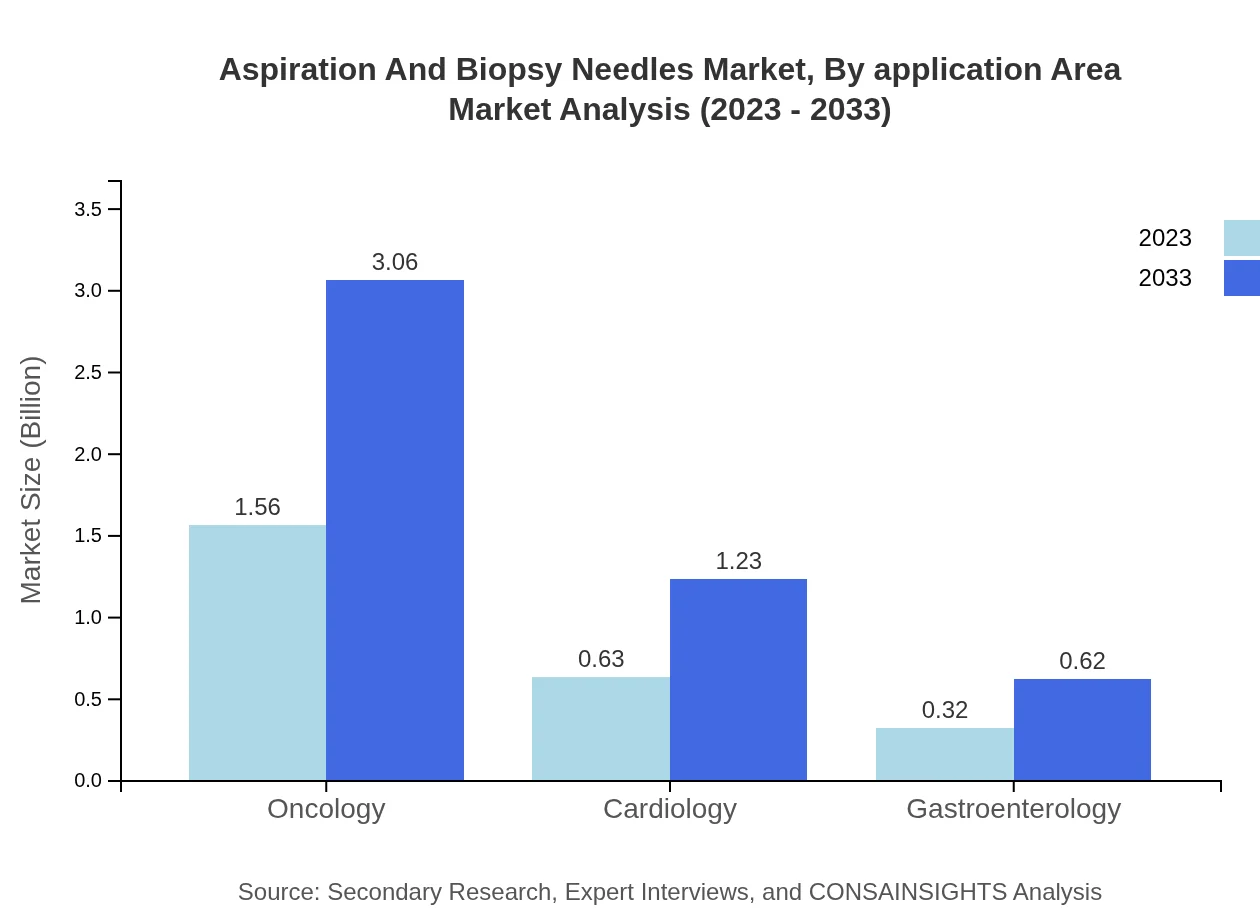

Aspiration And Biopsy Needles Market Analysis By Application Area

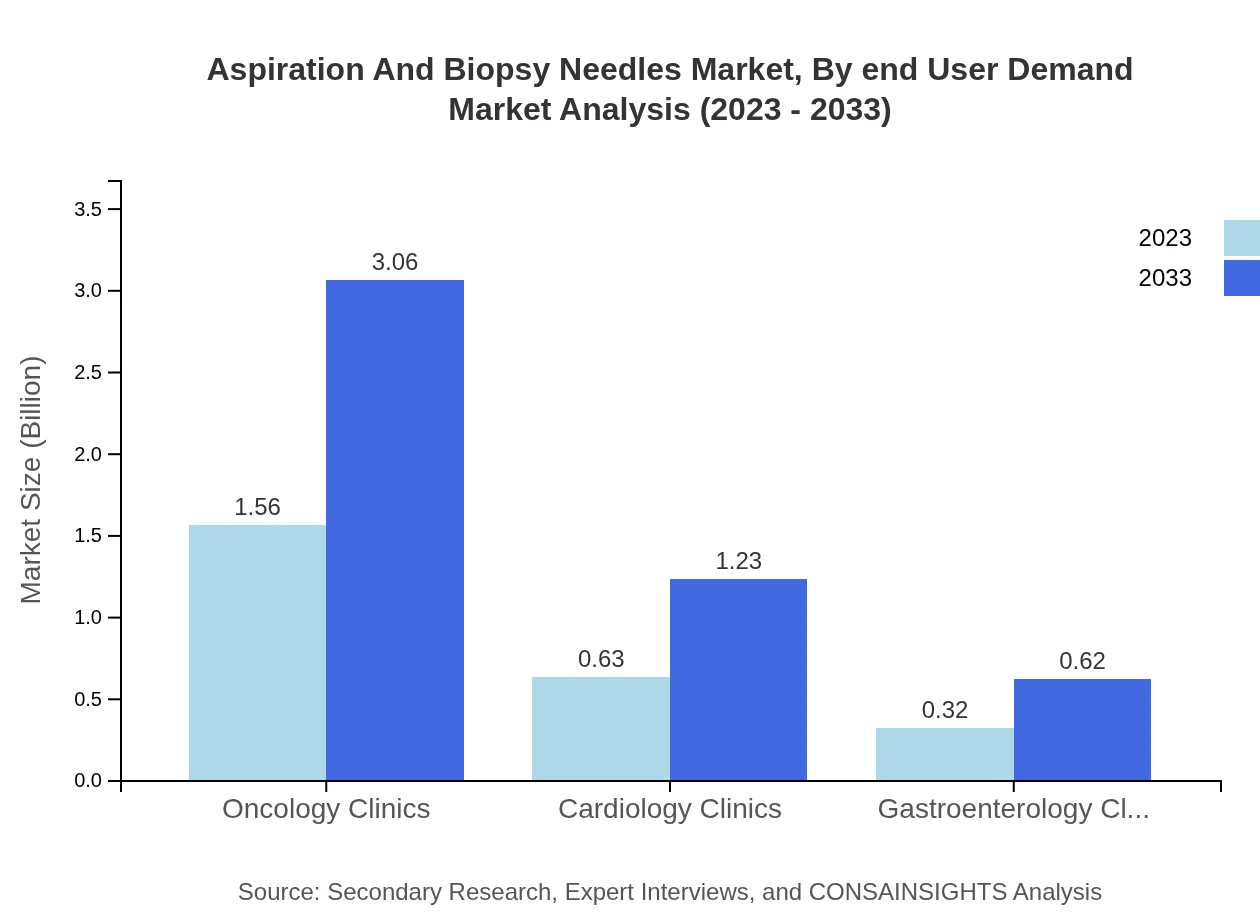

In application areas, oncology leads with a market size of USD 1.56 billion in 2023, growing to USD 3.06 billion by 2033. Cardiology and gastroenterology also contribute significantly, with respective sizes of USD 0.63 billion and USD 0.32 billion in 2023, demonstrating the need for accurate diagnostic tools across medical fields.

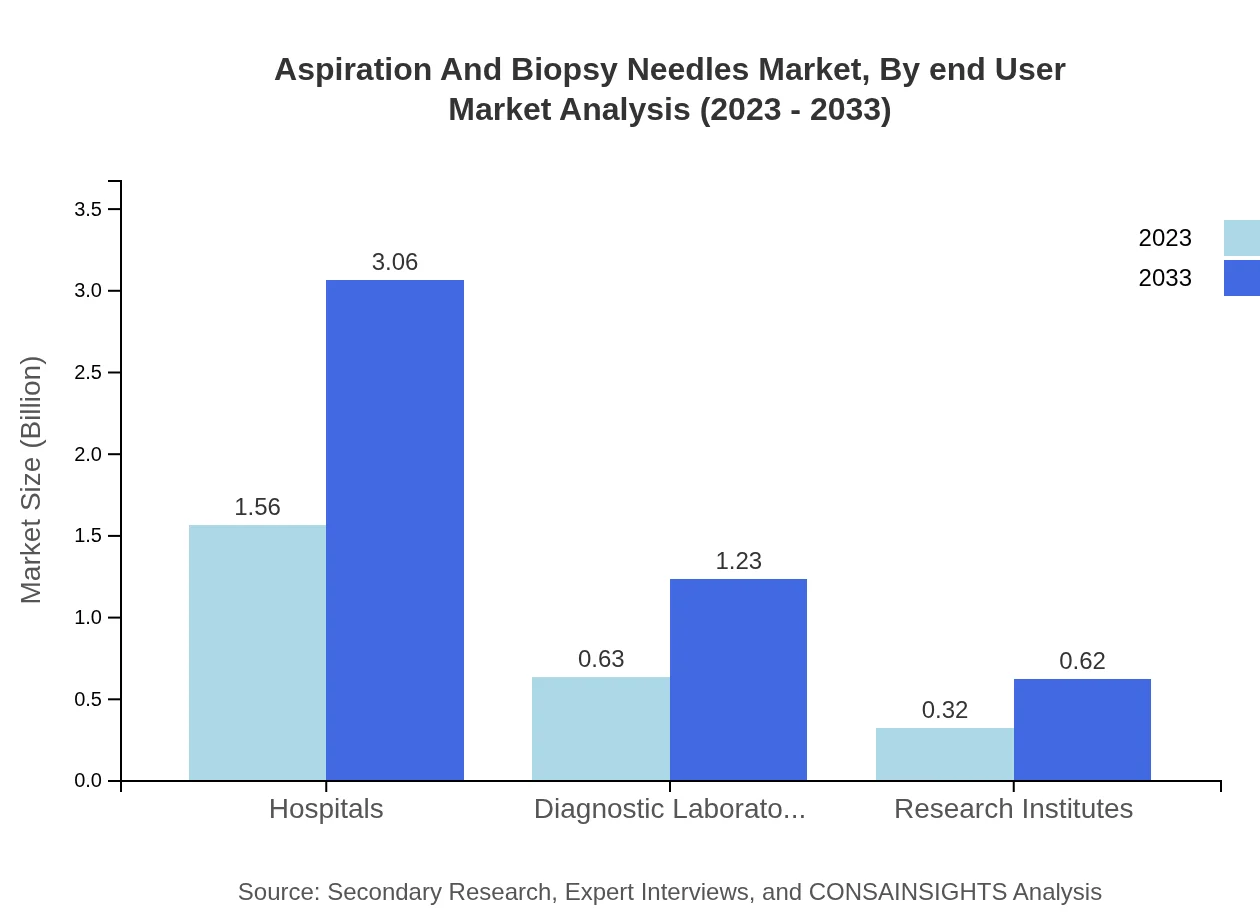

Aspiration And Biopsy Needles Market Analysis By End User

The end-user segment is dominated by hospitals, expected to maintain a market share of 62.29% throughout the analyzed period. Diagnostic laboratories and research institutes hold smaller shares but are crucial in research and early diagnostic procedures, with respective market sizes of USD 0.63 billion and USD 0.32 billion in 2023.

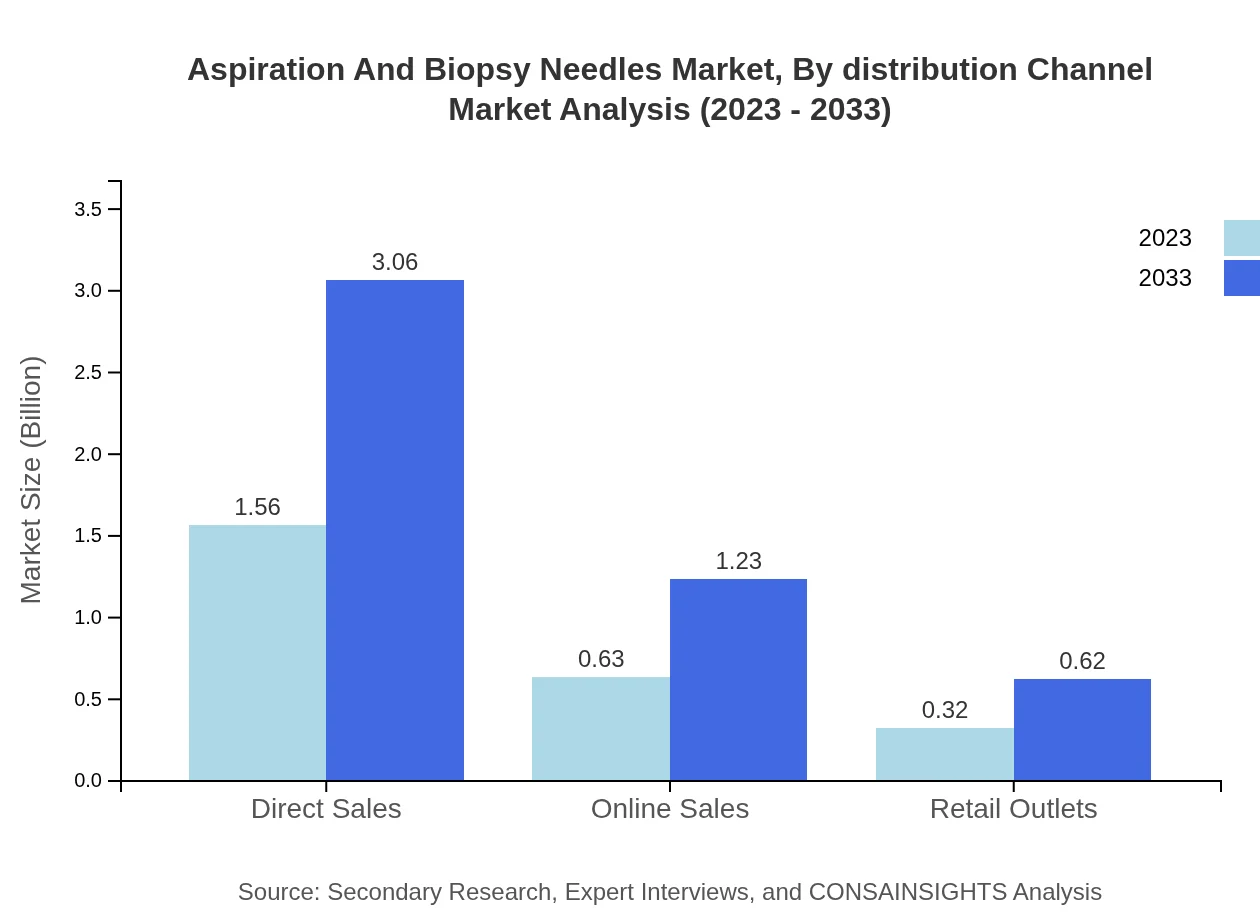

Aspiration And Biopsy Needles Market Analysis By Distribution Channel

In distribution channels, direct sales capture the largest share, with a market size of USD 1.56 billion in 2023, indicating a dominant trend towards traditional sales methods. However, online sales are quickly rising in popularity, projected to increase from USD 0.63 billion in 2023 to USD 1.23 billion by 2033, driven by the growing trend of e-commerce in medical supplies.

Aspiration And Biopsy Needles Market Analysis By End User Demand

The overall demand growth in end-user segments highlights that hospitals and diagnostic laboratories will remain key players, contributing to a substantial share of market growth. The anticipated increase in demand for biopsy procedures directly influences market projections, with hospitals expected to grow significantly by 2033.

Aspiration And Biopsy Needles Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aspiration And Biopsy Needles Industry

Smith & Nephew:

Smith & Nephew is a global medical technology company that develops and sells innovative products for the healthcare sector, with a strong focus on minimally invasive procedures.Becton Dickinson and Company (BD):

BD is renowned for its advanced medical devices and technologies, including a diverse range of biopsy needles that cater to various diagnostic needs.Medtronic :

Medtronic is a leader in medical technology and therapies, providing specialized biopsy products and solutions aimed at improving patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of aspiration And Biopsy Needles?

The aspiration and biopsy needles market is valued at approximately $2.5 billion in 2023 and is expected to reach a significant figure by 2033. The industry is anticipated to maintain a CAGR of 6.8%, reflecting continuous growth in demand.

What are the key market players or companies in this aspiration And Biopsy Needles industry?

Key players in the aspiration and biopsy needles market include prominent medical device manufacturers known for their innovation. Companies compete by developing advanced needle technologies to improve diagnostic accuracy and patient safety.

What are the primary factors driving the growth in the aspiration And Biopsy Needles industry?

Growth in the aspiration and biopsy needles market is driven by increasing prevalence of cancer and chronic diseases, advancements in medical technology, rising awareness of early diagnosis, and a growing demand for minimally invasive procedures.

Which region is the fastest Growing in the aspiration And Biopsy Needles?

The fastest-growing region in the aspiration and biopsy needles segment is North America, projected to grow from $0.91 billion in 2023 to $1.79 billion by 2033. Europe and Asia Pacific also exhibit significant growth during the same period.

Does ConsaInsights provide customized market report data for the aspiration And Biopsy Needles industry?

Yes, ConsaInsights offers customized market report data for the aspiration and biopsy needles industry, ensuring that clients receive tailored insights that fit their specific research and business needs.

What deliverables can I expect from this aspiration And Biopsy Needles market research project?

From the aspiration and biopsy needles market research project, you can expect detailed reports, segmented market data, insights on competitive landscape, market trends analysis, and customized charts and graphs for better comprehension.

What are the market trends of aspiration And Biopsy Needles?

The market trends for aspiration and biopsy needles indicate a shift towards the adoption of digital technologies, increased collaboration for research innovations, enhanced needle designs for patient comfort, and a focus on sustainable manufacturing practices.