Asset Integrity Management Market Report

Published Date: 22 January 2026 | Report Code: asset-integrity-management

Asset Integrity Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Asset Integrity Management market, highlighting key insights on market size, growth trends, regional analysis, and industry forecasts covering 2023 to 2033.

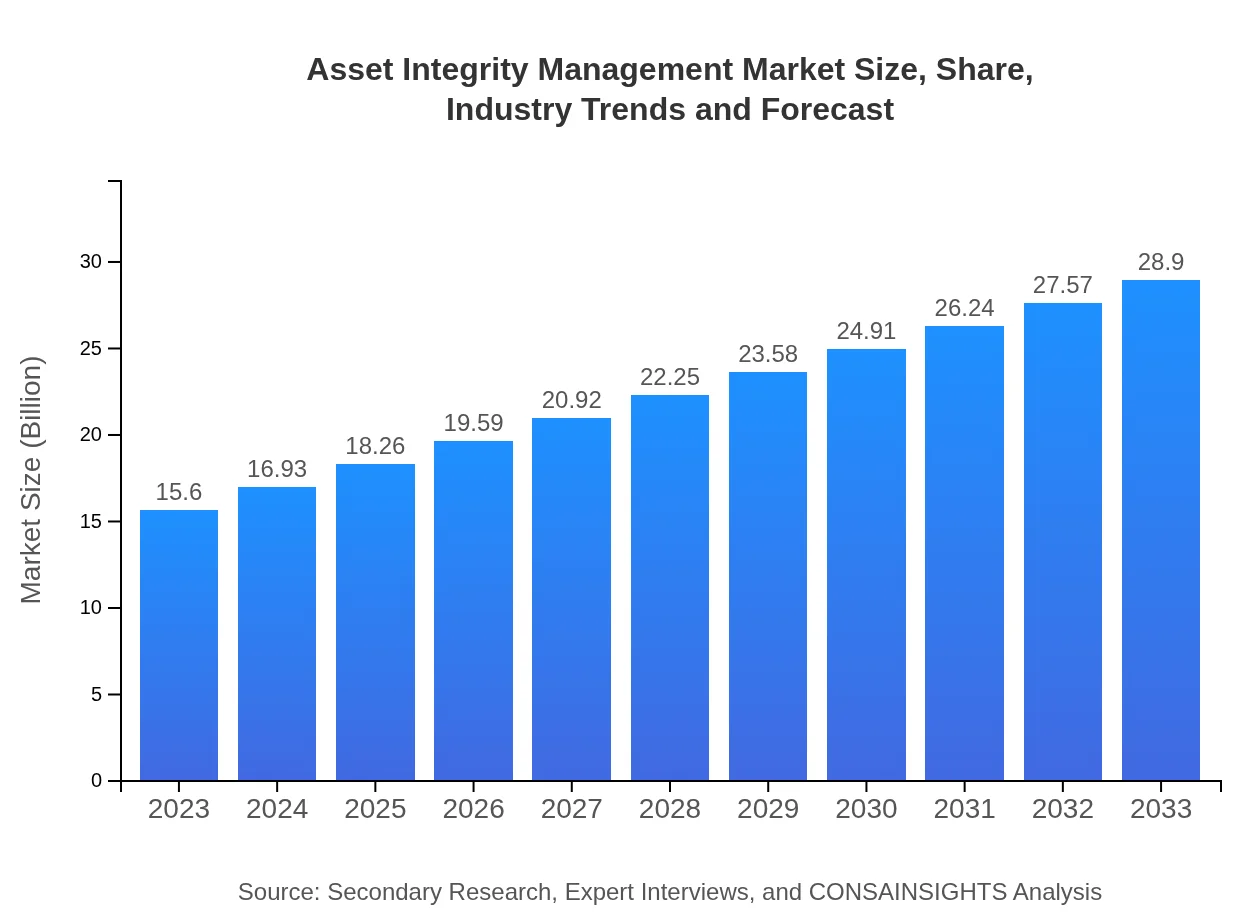

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $28.90 Billion |

| Top Companies | SGS SA, Bureau Veritas, Intertek Group plc, DNV GL |

| Last Modified Date | 22 January 2026 |

Asset Integrity Management Market Overview

Customize Asset Integrity Management Market Report market research report

- ✔ Get in-depth analysis of Asset Integrity Management market size, growth, and forecasts.

- ✔ Understand Asset Integrity Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Asset Integrity Management

What is the Market Size & CAGR of Asset Integrity Management market in 2023?

Asset Integrity Management Industry Analysis

Asset Integrity Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Asset Integrity Management Market Analysis Report by Region

Europe Asset Integrity Management Market Report:

Europe's market is estimated at $4.64 billion in 2023 and projected to reach $8.59 billion by 2033. The region's demand for asset integrity solutions is significantly driven by stringent regulations concerning safety and environmental protection across multiple industries.Asia Pacific Asset Integrity Management Market Report:

Asia Pacific is witnessing robust growth in the Asset Integrity Management market, valued at $2.92 billion in 2023 and expected to reach $5.41 billion by 2033. The region's growth is driven by rapid industrialization, increased investments in infrastructure, and developing regulatory frameworks focused on asset safety and performance.North America Asset Integrity Management Market Report:

The North American market, valued at $5.71 billion in 2023, is expected to reach $10.58 billion by 2033. This surge is attributed to technological advancements and heavy investment in asset integrity initiatives, alongside a strong regulatory landscape driving safety compliance.South America Asset Integrity Management Market Report:

In South America, the market size is estimated at $1.00 billion in 2023 and projected to grow to $1.86 billion by 2033. This growth is primarily influenced by the oil and gas sector's expansion and the increasing focus on sustainability practices among corporations.Middle East & Africa Asset Integrity Management Market Report:

The Middle East and Africa region's Asset Integrity Management market is valued at approximately $1.33 billion in 2023, with projections to grow to $2.46 billion by 2033. This growth is supported by the region's rich oil and gas sector, which emphasizes the need for robust asset management practices.Tell us your focus area and get a customized research report.

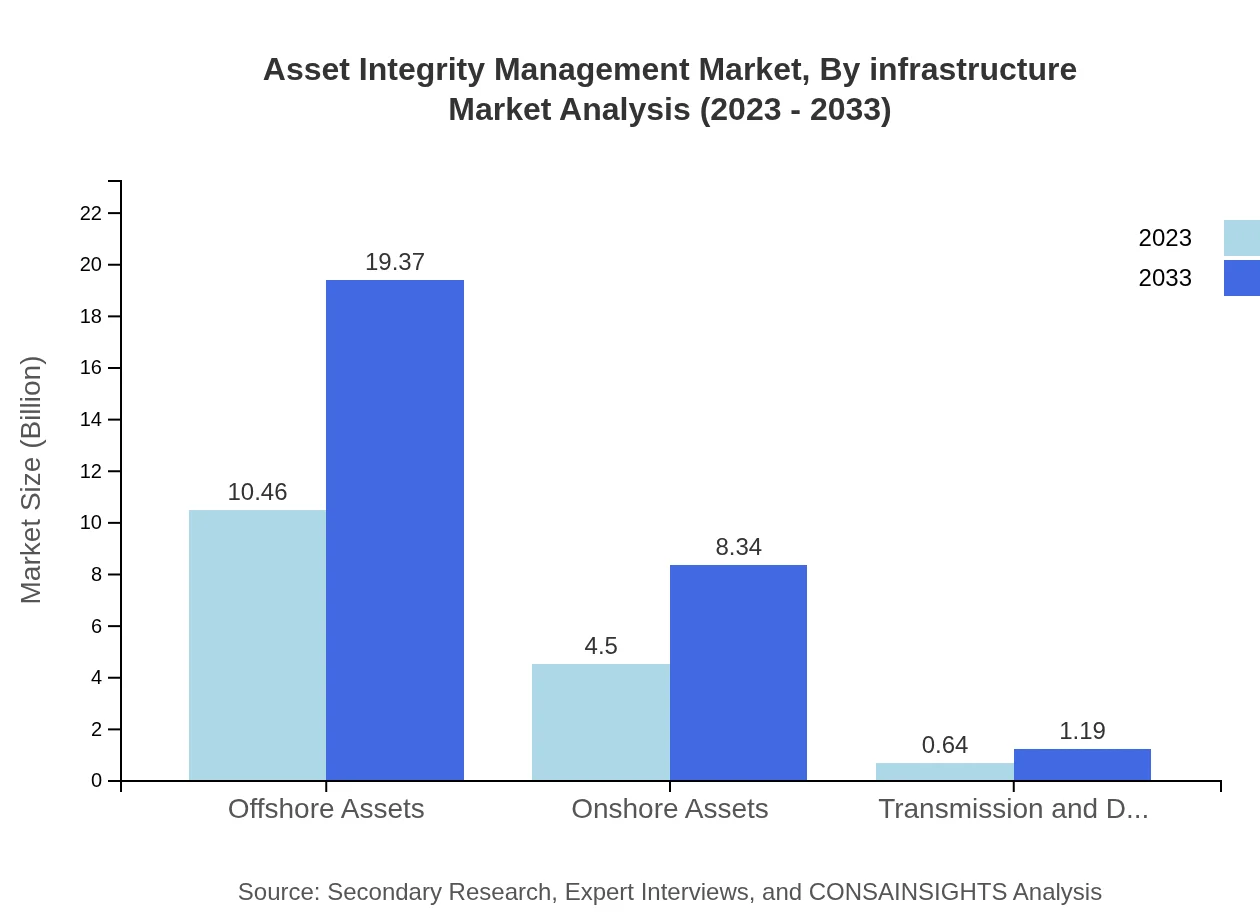

Asset Integrity Management Market Analysis By Infrastructure

In terms of infrastructure, offshore assets dominate the market, valued at $10.46 billion in 2023, expected to reach $19.37 billion by 2033, representing a significant share due to the heavy reliance on maritime resources. Onshore assets follow, currently valued at $4.50 billion, with predictions of reaching $8.34 billion. Transmission and distribution systems represent niche but critical segments, growing from $0.64 billion to $1.19 billion as maintenance and safety become paramount in energy distribution.

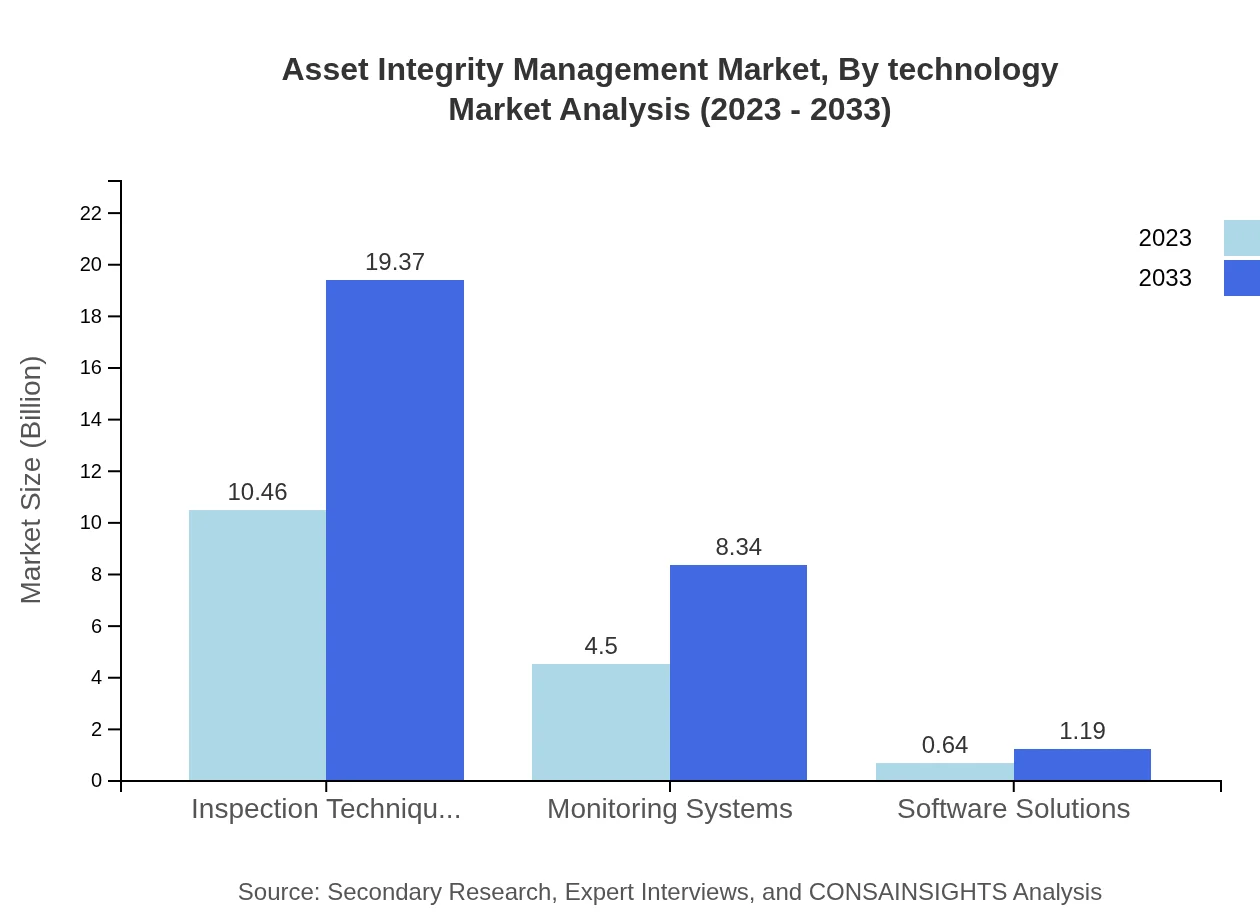

Asset Integrity Management Market Analysis By Technology

The market's technological landscape is evolving, with inspection techniques leading the way. This segment is expected to grow from $10.46 billion in 2023 to $19.37 billion by 2033. Monitoring systems also play a crucial role, expanding from $4.50 billion to $8.34 billion as companies leverage IoT and AI for enhanced monitoring capabilities. Software solutions are starting to gain traction, with a projected growth from $0.64 billion to $1.19 billion as digital transformation trends accelerate.

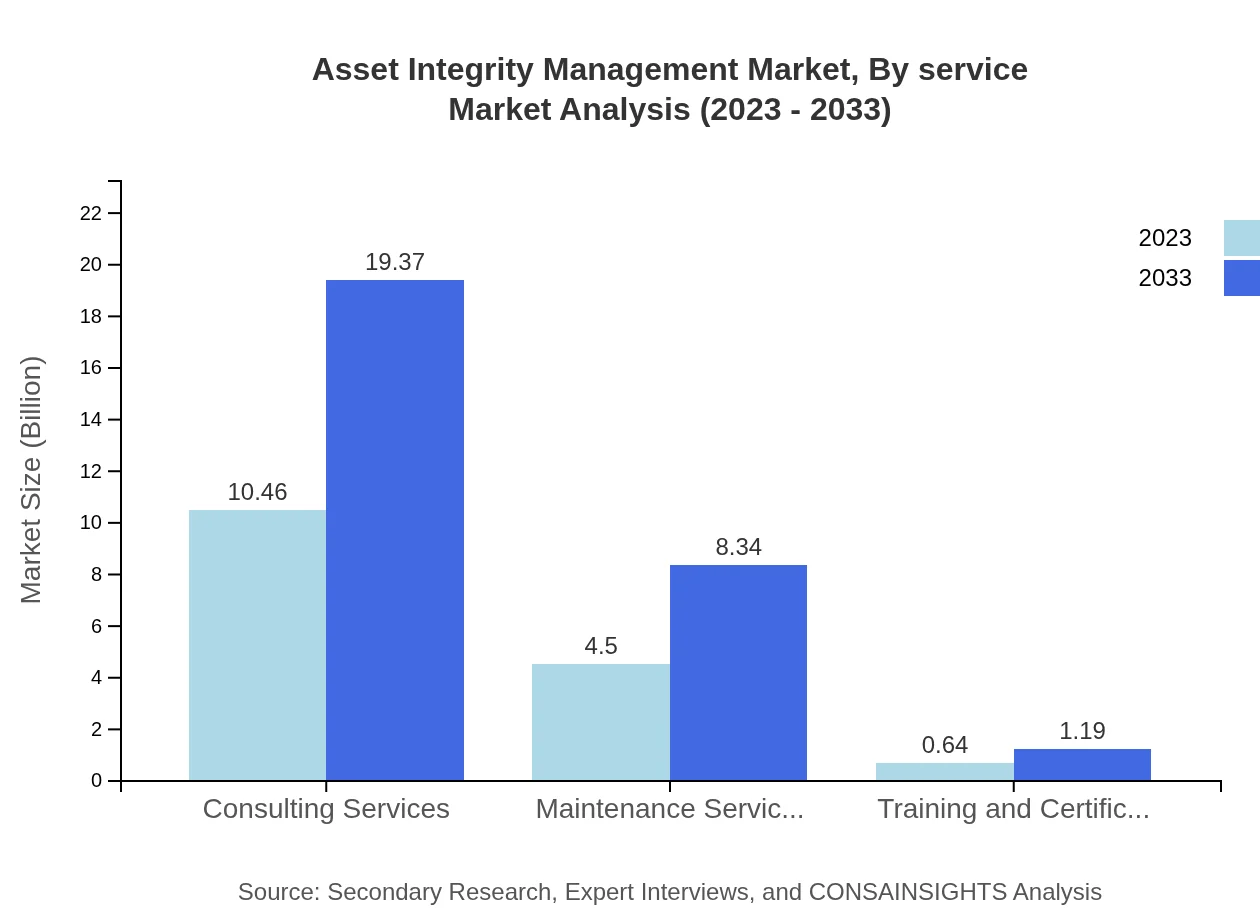

Asset Integrity Management Market Analysis By Service

Consulting services take the lead in the AIM market, holding a share of $10.46 billion in 2023, projected to rise to $19.37 billion by 2033. Maintenance services also play a significant role in the market, expected to grow from $4.50 billion to $8.34 billion. Training and certification services remain crucial for workforce development, showing steady growth trends from $0.64 billion to $1.19 billion as industry demands for skilled labor increase.

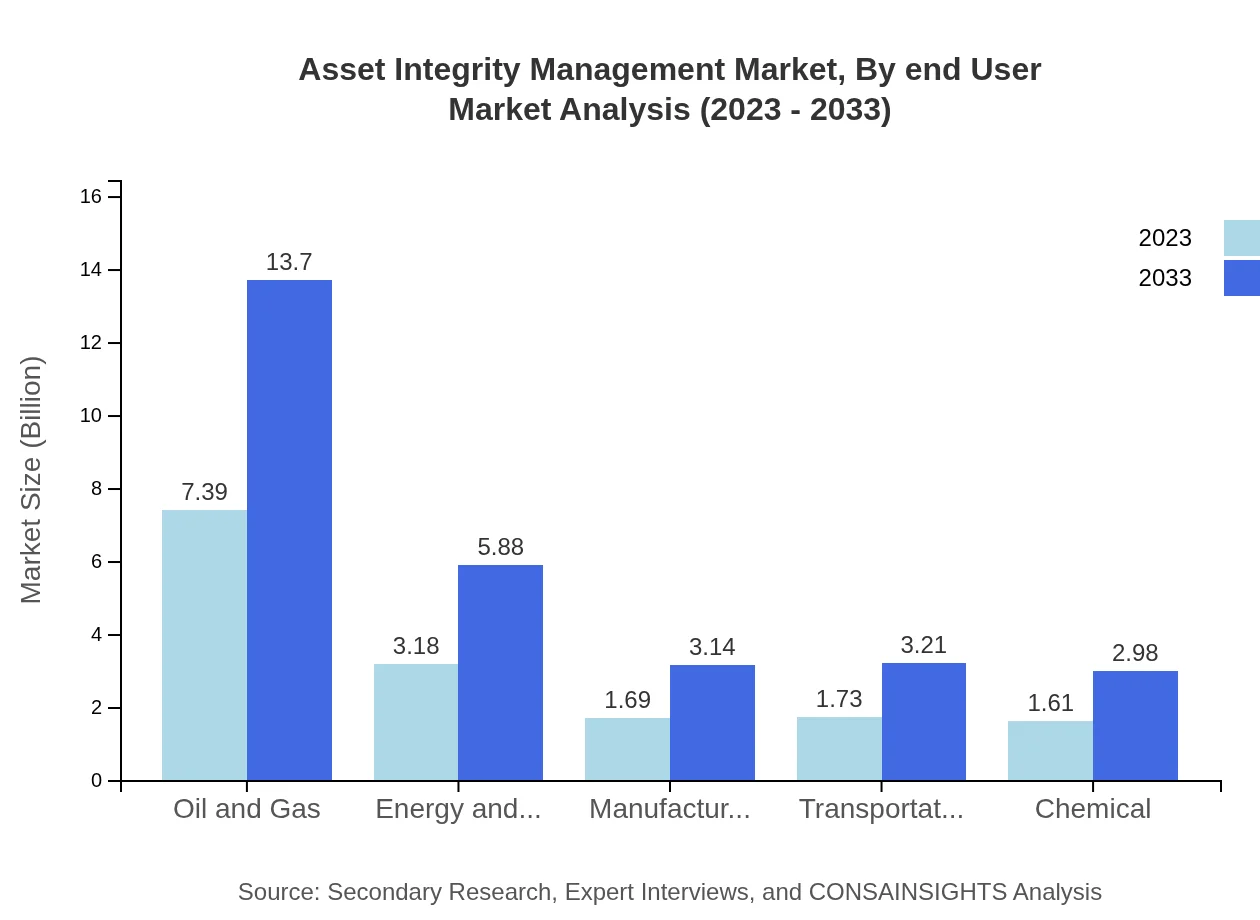

Asset Integrity Management Market Analysis By End User

The oil and gas industry remains the largest end-user of AIM solutions, forecasted to grow from $7.39 billion in 2023 to $13.70 billion by 2033, due to ever-increasing pressure for safety and regulatory compliance. Energy and utilities also maintain a substantial market size, expected to reach from $3.18 billion to $5.88 billion. Manufacturing, transportation, and chemical sectors represent further significant contributors, highlighting the multifaceted applications of asset integrity practices across industries.

Asset Integrity Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Asset Integrity Management Industry

SGS SA:

SGS is a global leader in inspections, verification, testing, and certification. They offer comprehensive asset integrity management services that help clients improve safety and efficiency.Bureau Veritas:

Bureau Veritas provides a broad range of solutions including asset integrity services, focusing on risk management, compliance, and increased sustainability for their clients.Intertek Group plc:

Intertek Group offers a range of services for asset integrity management, including inspection, testing, and certification, helping clients in maintaining the integrity of their operations.DNV GL:

DNV GL provides assurance and risk management services, maintaining asset integrity in critical processes across various sectors, notably in maritime and energy.We're grateful to work with incredible clients.

FAQs

What is the market size of asset Integrity Management?

The asset integrity management market size was valued at $15.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.2%, predicting a substantial rise by 2033 as industries enhance their maintenance and inspection strategies.

What are the key market players or companies in this asset Integrity Management industry?

Key players in the asset integrity management industry include companies like Intertek, Bureau Veritas, and DNV GL, who are recognized for their innovative solutions and robust service offerings, contributing significantly to market dynamics and competition.

What are the primary factors driving the growth in the asset Integrity Management industry?

The growth in the asset integrity management industry is primarily driven by increasing regulatory compliance, the need for operational efficiency, and advancements in technology such as IoT and AI, all facilitating improved risk management and asset performance.

Which region is the fastest Growing in the asset Integrity Management?

The fastest-growing region in asset integrity management is projected to be North America, with a market size expanding from $5.71 billion in 2023 to $10.58 billion in 2033, led by industrial advancements and heightened focus on infrastructure maintenance.

Does ConsaInsights provide customized market report data for the asset Integrity Management industry?

Yes, ConsaInsights offers customized market report data for the asset integrity management industry, tailored to specific client requirements, enabling strategic decision-making based on in-depth and relevant market insights.

What deliverables can I expect from this asset Integrity Management market research project?

You can expect comprehensive deliverables including detailed market analysis reports, segment insights, competitive landscape evaluations, and growth forecasts that assist in understanding market dynamics and potential business opportunities.

What are the market trends of asset Integrity Management?

Market trends in asset integrity management indicate a significant shift towards digital solutions, enhanced inspection techniques, and a rising focus on offshore assets management, with strong growth particularly in monitoring systems and consulting services.