Asset Management Market Report

Published Date: 31 January 2026 | Report Code: asset-management

Asset Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Asset Management market, including insights on current conditions, market size, trends, and projections for growth from 2023 to 2033.

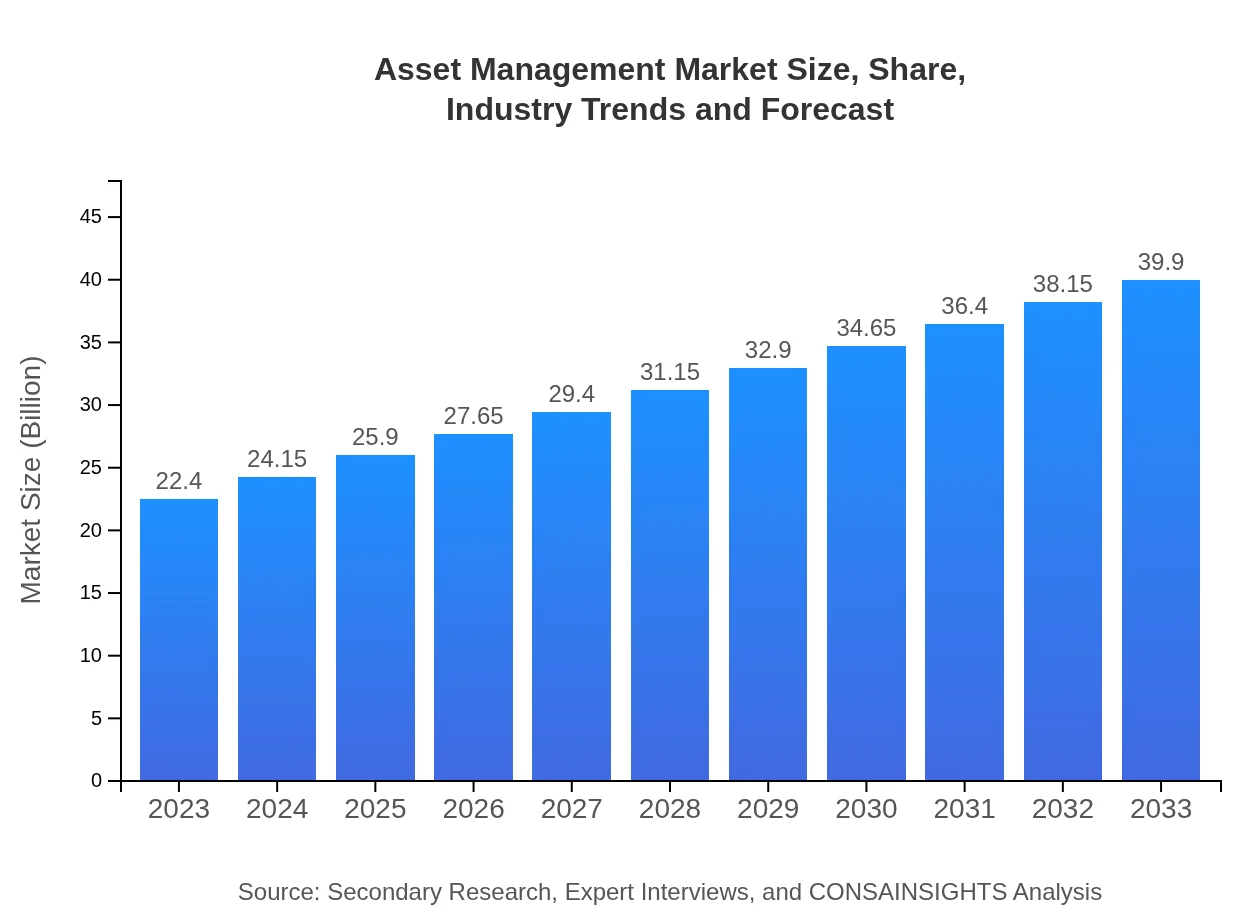

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $22.40 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $39.90 Billion |

| Top Companies | BlackRock , Vanguard, Fidelity Investments, State Street Global Advisors |

| Last Modified Date | 31 January 2026 |

Asset Management Market Overview

Customize Asset Management Market Report market research report

- ✔ Get in-depth analysis of Asset Management market size, growth, and forecasts.

- ✔ Understand Asset Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Asset Management

What is the Market Size & CAGR of Asset Management market in 2023?

Asset Management Industry Analysis

Asset Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Asset Management Market Analysis Report by Region

Europe Asset Management Market Report:

Europe's Asset Management market is anticipated to rise from $6.22 trillion in 2023 to $11.08 trillion by 2033. Factors driving this growth include regulatory changes aimed at enhancing transparency, increased interest in sustainable investment strategies, and a flourishing wealth management sector, particularly in Western European countries such as Germany, the UK, and France.Asia Pacific Asset Management Market Report:

In the Asia Pacific region, the Asset Management market is expected to grow from $4.31 trillion in 2023 to $7.68 trillion by 2033. This growth can be attributed to rising disposable incomes, an increasing number of high-net-worth individuals, and a strong shift towards savings and investments. Countries like China and India are seeing robust development in financial markets and infrastructure, enhancing wealth management capabilities.North America Asset Management Market Report:

North America remains a dominant player in the Asset Management market, with a projected increase from $8.38 trillion in 2023 to $14.93 trillion by 2033. The region benefits from a well-established financial services framework, high levels of institutional investment, and growing adoption of technology in portfolio management. The push towards ESG investments is significantly influencing asset allocation patterns within the market.South America Asset Management Market Report:

The South American Asset Management market is projected to expand from $2.05 trillion in 2023 to $3.64 trillion by 2033. Factors such as increased foreign investments, growing retirement funds, and improving financial literacy among the populace are driving this growth. Additionally, Brazil and Argentina are emerging as key players in attracting global asset managers.Middle East & Africa Asset Management Market Report:

The Middle East and Africa Asset Management market is projected to grow from $1.44 trillion in 2023 to $2.56 trillion by 2033. Wealth creation initiatives and a growing number of sovereign wealth funds are key contributors to this growth. The region's focus on diversification of investment portfolios is also leading to increased demand for various asset management services.Tell us your focus area and get a customized research report.

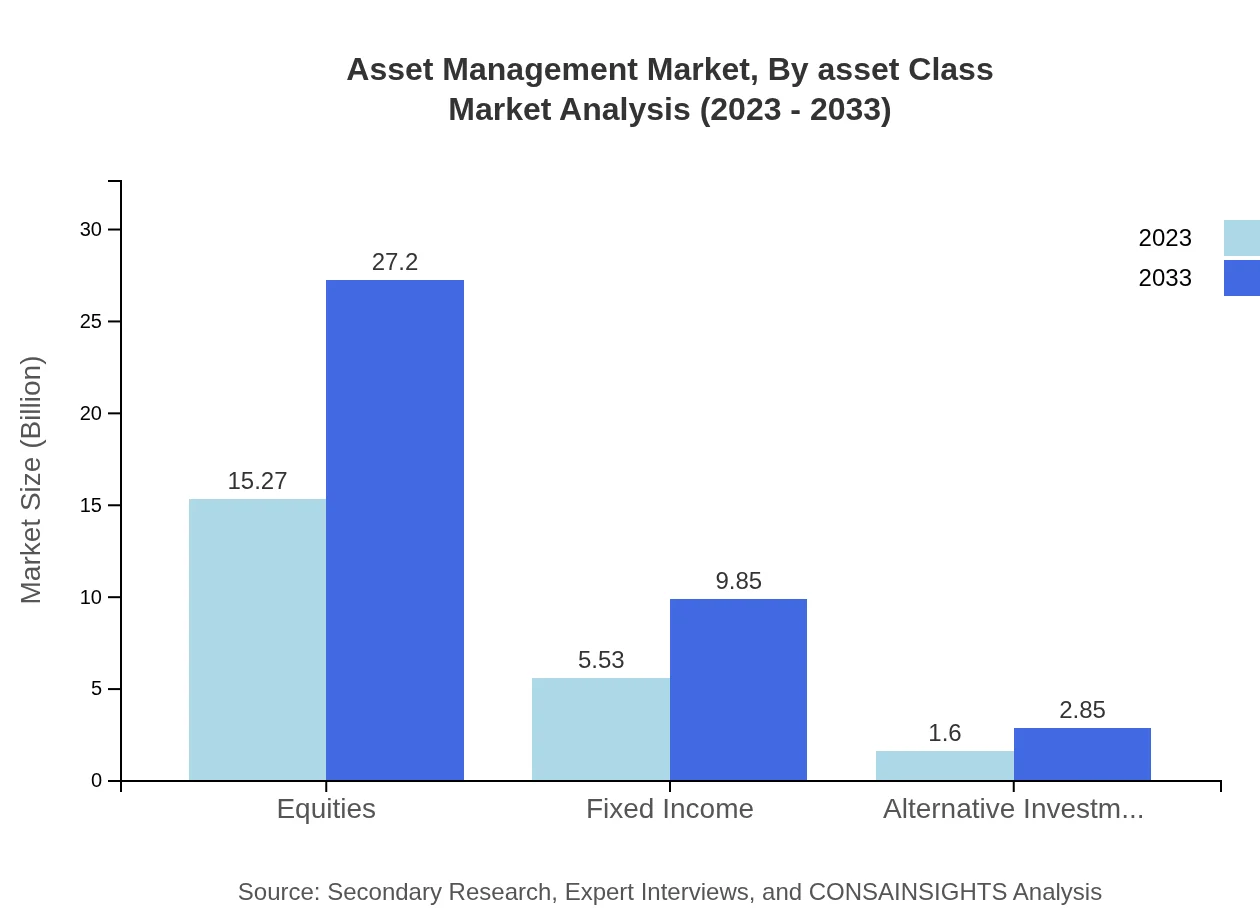

Asset Management Market Analysis By Asset Class

Equities dominate the Asset Management market, with a size of $15.27 trillion in 2023, projected to reach $27.20 trillion by 2033, retaining a market share of 68.17%. Fixed Income stands at $5.53 trillion and is expected to grow to $9.85 trillion. Alternative Investments are gaining traction, expected to grow from $1.60 trillion to $2.85 trillion, reflecting a trend towards portfolio diversification.

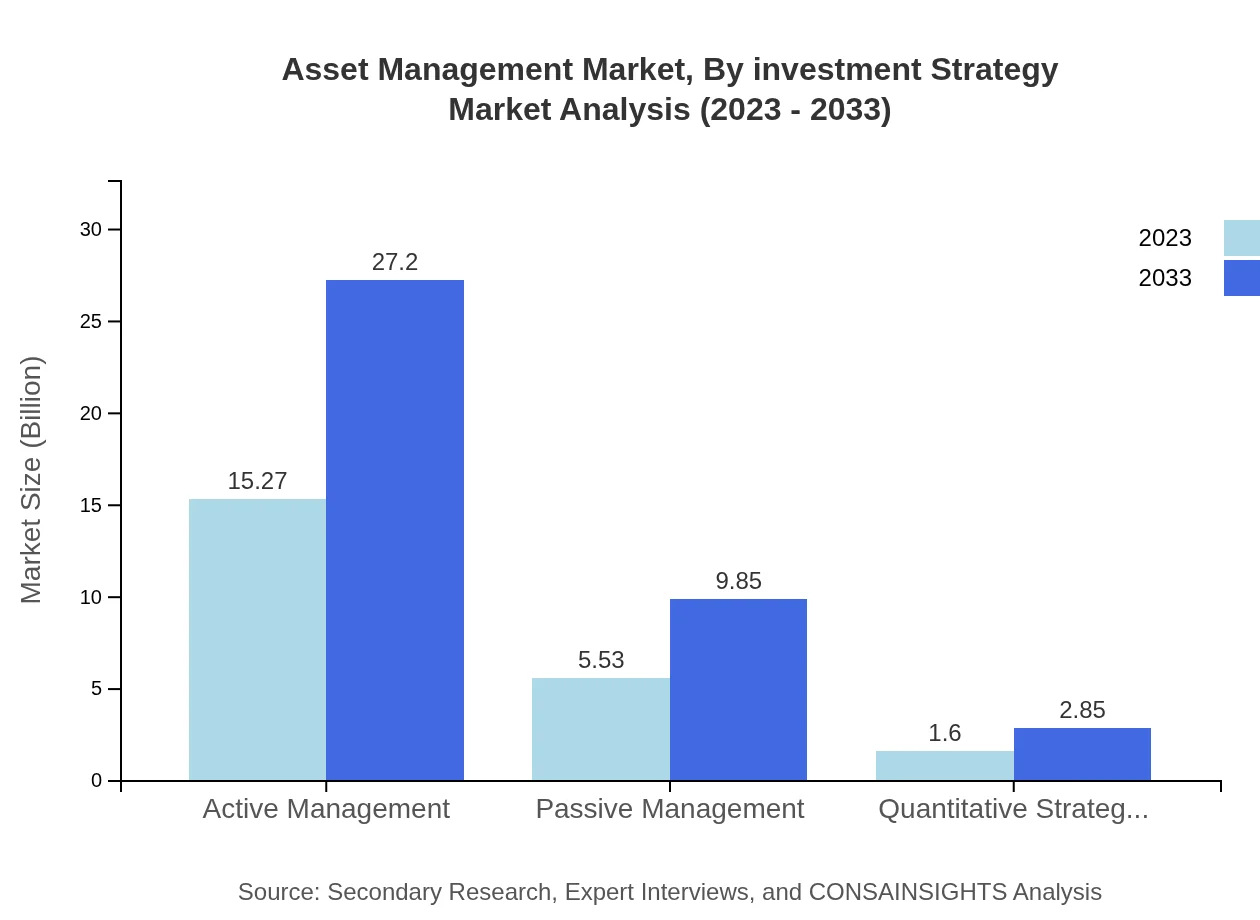

Asset Management Market Analysis By Investment Strategy

Active Management strategies will continue to lead the market with a size of $15.27 trillion, growing to $27.20 trillion by 2033, sustaining a 68.17% market share. Passive Management is also growing, rising from $5.53 trillion to $9.85 trillion, matching a share of 24.68%. Quantitative Strategies, though a smaller segment, are expected to grow from $1.60 trillion to $2.85 trillion, reflecting innovative approaches in investment.

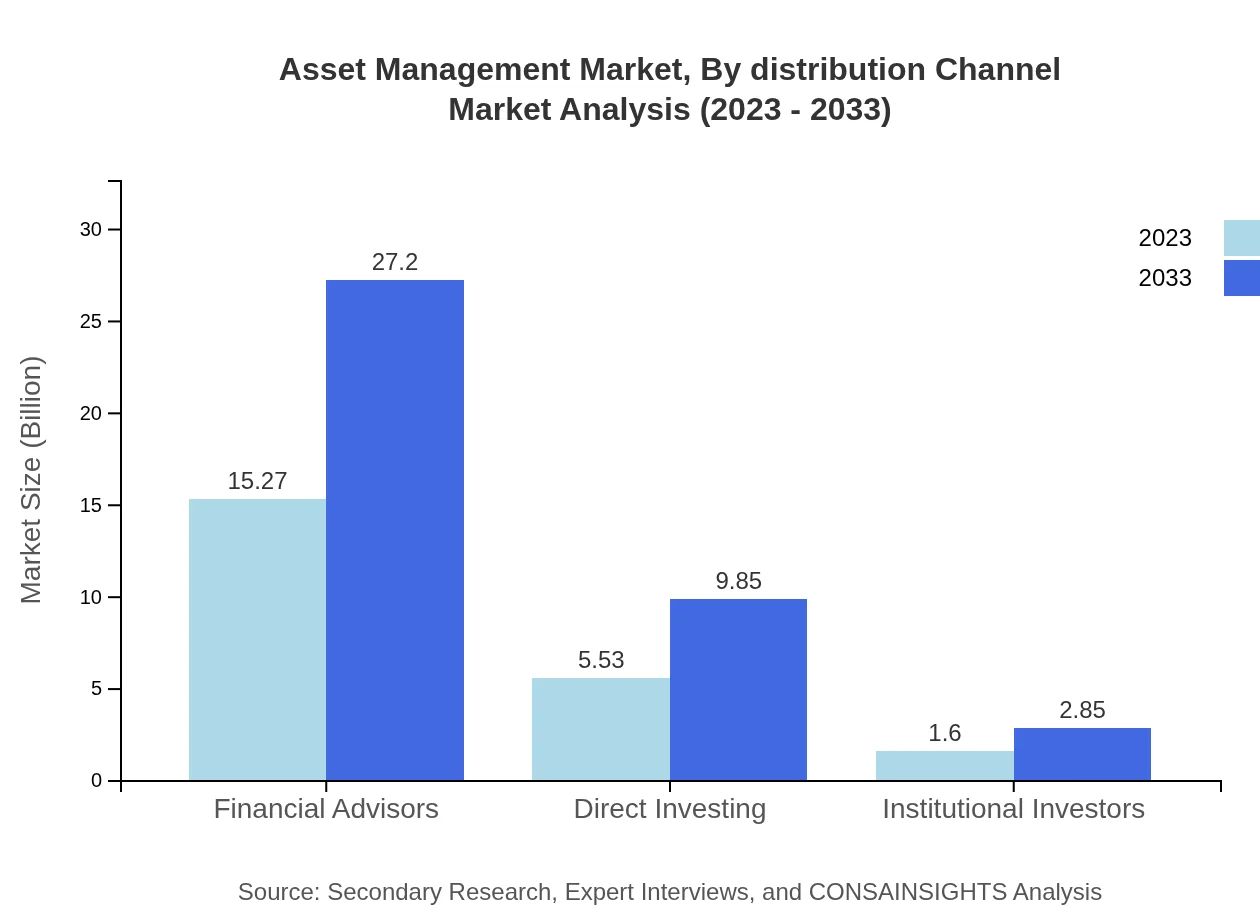

Asset Management Market Analysis By Distribution Channel

Financial Advisors will command a significant portion of the market, growing from $15.27 trillion to $27.20 trillion, maintaining a 68.17% share. Direct Investing channels will also grow from $5.53 trillion to $9.85 trillion, catering to an increasingly informed investor base looking for self-directed investment options.

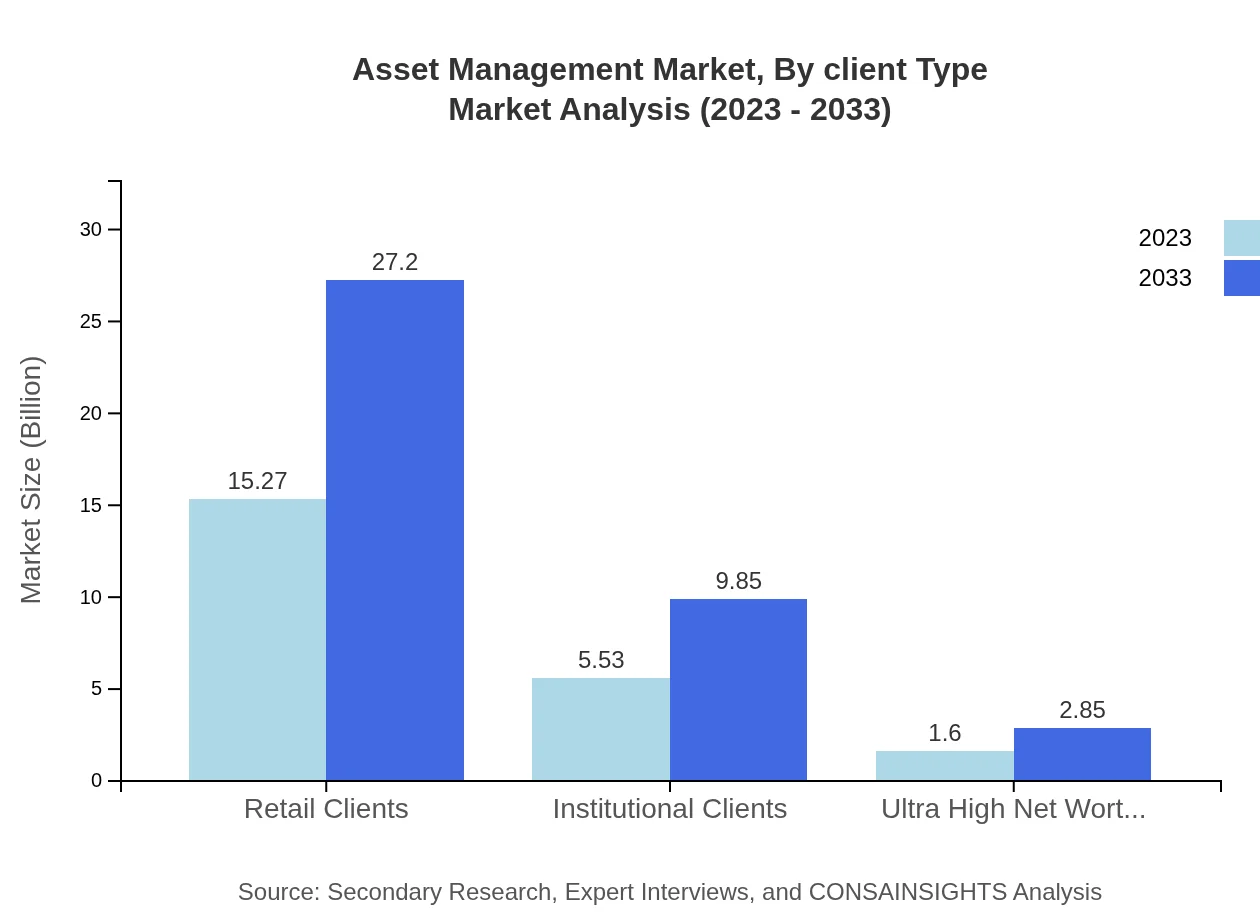

Asset Management Market Analysis By Client Type

Retail Clients dominate with a market size of $15.27 trillion, expected to reach $27.20 trillion by 2033. Institutional Clients currently stand at $5.53 trillion with significant growth prospects to $9.85 trillion. Ultra High Net Worth Individuals are projected to grow from $1.60 trillion to $2.85 trillion, marking their increasing significance in wealth management.

Asset Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Asset Management Industry

BlackRock :

BlackRock is the largest asset manager globally, offering a wide range of solutions across equity, fixed income, cash management, and alternative investments. The company is known for its iShares ETF product line.Vanguard:

Vanguard is one of the largest asset management companies, primarily known for its low-cost index funds. It emphasizes a fiduciary responsibility to its investors.Fidelity Investments:

Fidelity Investments offers investment solutions across various asset classes and is recognized for its robust retirement planning services and wealth management expertise.State Street Global Advisors:

State Street Global Advisors is a premier asset management firm, particularly noted for its strength in index and quantitative investing through SPDR ETFs.We're grateful to work with incredible clients.

FAQs

What is the market size of asset Management?

The asset management market is projected to reach $22.4 billion by 2033, growing at a CAGR of 5.8%. This growth is fueled by increasing investments and demand for diverse asset management solutions.

What are the key market players or companies in the asset management industry?

Key players in the asset management industry include major financial institutions and investment firms specializing in equities, fixed income, and alternative investments, both for retail and institutional clients.

What are the primary factors driving the growth in the asset management industry?

Growth in the asset management sector is driven by increasing wealth, demand for investment diversity, technological advancements, and favorable economic conditions encouraging investment worldwide.

Which region is the fastest Growing in the asset management sector?

North America is the fastest-growing region in the asset management sector, projected to reach $14.93 billion by 2033, followed closely by Europe at $11.08 billion.

Does ConsaInsights provide customized market report data for the asset management industry?

Yes, ConsaInsights offers customized market reports tailored to specific data needs and focus areas within the asset management industry, providing detailed insights for stakeholders.

What deliverables can I expect from this asset management market research project?

Expect comprehensive reports including market size, growth forecasts, segment analysis, competitive landscape, and regional insights tailored to specific business needs.

What are the market trends of asset management?

Current market trends include a shift towards passive management strategies, increased focus on ESG investments, and technological integration for enhanced portfolio management efficiency.