Asset Performance Management Market Report

Published Date: 22 January 2026 | Report Code: asset-performance-management

Asset Performance Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Asset Performance Management (APM) market, focusing on key trends, market size, technological advancements, and regional insights. The forecast period spans from 2023 to 2033, providing a detailed outlook on growth opportunities and market dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | IBM, Siemens , GE Digital, Schneider Electric |

| Last Modified Date | 22 January 2026 |

Asset Performance Management Market Overview

Customize Asset Performance Management Market Report market research report

- ✔ Get in-depth analysis of Asset Performance Management market size, growth, and forecasts.

- ✔ Understand Asset Performance Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Asset Performance Management

What is the Market Size & CAGR of Asset Performance Management market in 2033?

Asset Performance Management Industry Analysis

Asset Performance Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Asset Performance Management Market Analysis Report by Region

Europe Asset Performance Management Market Report:

Europe is experiencing steady growth in the APM market, valued at $3.08 billion in 2023 and projected to reach $6.29 billion by 2033. Stringent regulations regarding asset management and sustainability drive significant investments in APM solutions.Asia Pacific Asset Performance Management Market Report:

The Asia Pacific region, with a market size of $2.04 billion in 2023 and forecasted to reach $4.17 billion by 2033, is witnessing significant investments in digital infrastructure. The growing industrial sector, especially in countries like China and India, propels demand for APM solutions.North America Asset Performance Management Market Report:

North America leads the APM market with a size of $3.77 billion in 2023, expected to double to $7.70 billion by 2033. The advanced technological infrastructure and early adoption of IoT solutions play pivotal roles in market expansion.South America Asset Performance Management Market Report:

In South America, the APM market is smaller, with a valuation of $0.64 billion in 2023, projected to grow to $1.32 billion by 2033. Efforts to enhance operational efficiencies in key industries like mining and energy are major contributing factors.Middle East & Africa Asset Performance Management Market Report:

The Middle East and Africa are poised for growth, with current market valuation at $0.97 billion in 2023, set to reach $1.99 billion by 2033. The rising need for operational excellence in oil and gas industries significantly boosts APM adoption.Tell us your focus area and get a customized research report.

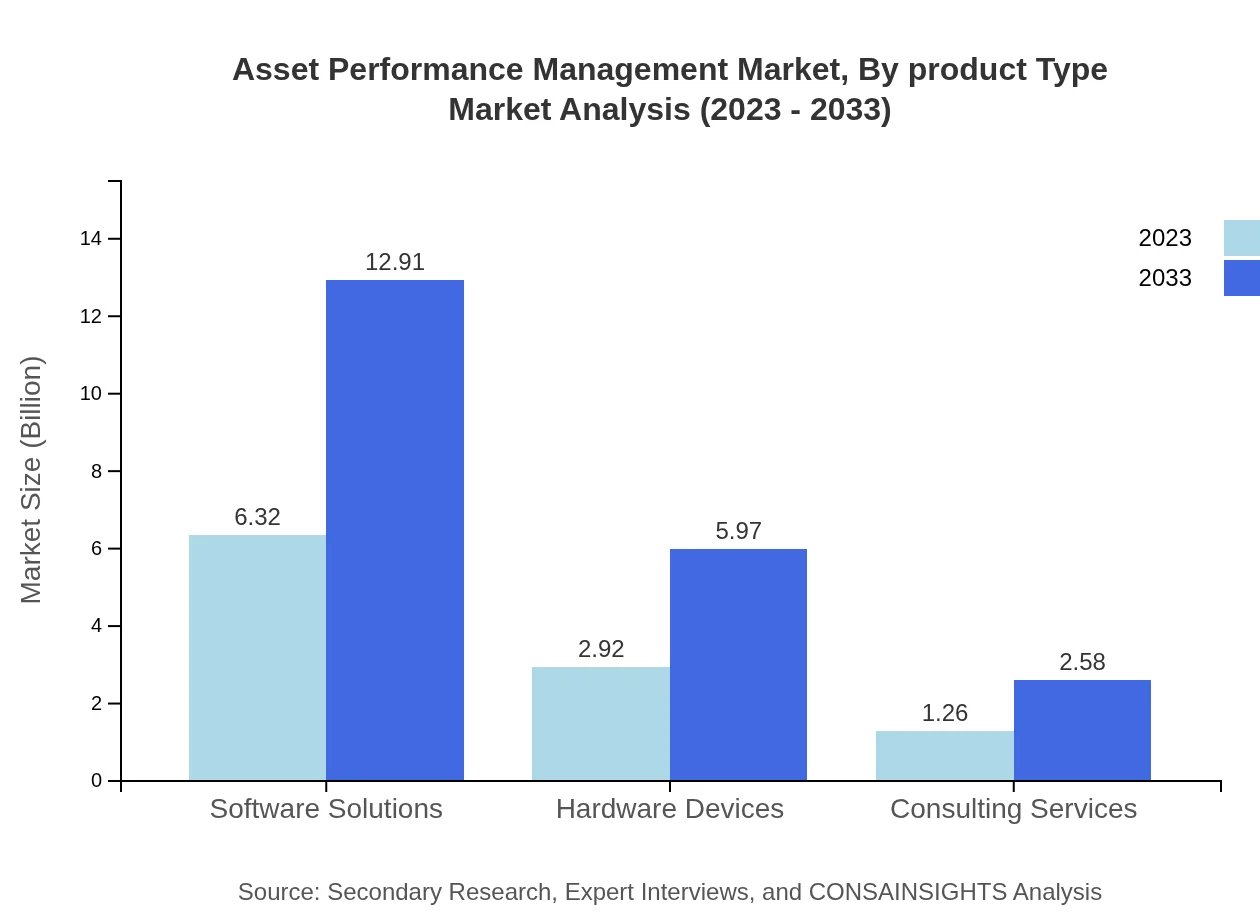

Asset Performance Management Market Analysis By Product Type

The key product types in the APM market comprise software solutions, hardware devices, and consulting services. Software solutions hold the largest market share, contributing significantly to overall revenue, while hardware devices are essential for monitoring physical assets.

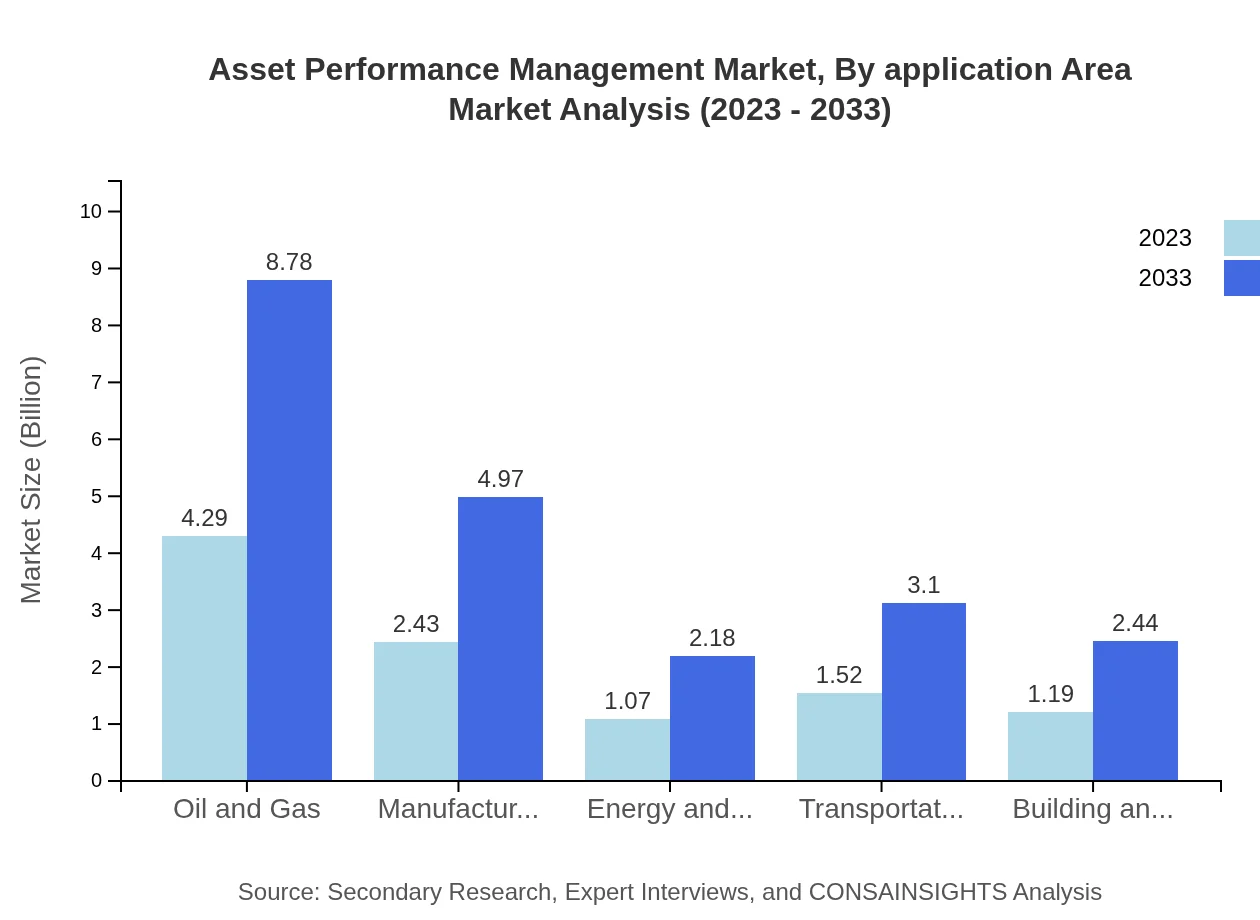

Asset Performance Management Market Analysis By Application Area

Industries such as oil and gas lead the APM market in utilization, accounting for about 40.9% market share in 2023. Other sectors, including manufacturing and transportation, are also critical as they leverage APM for efficiency and risk management.

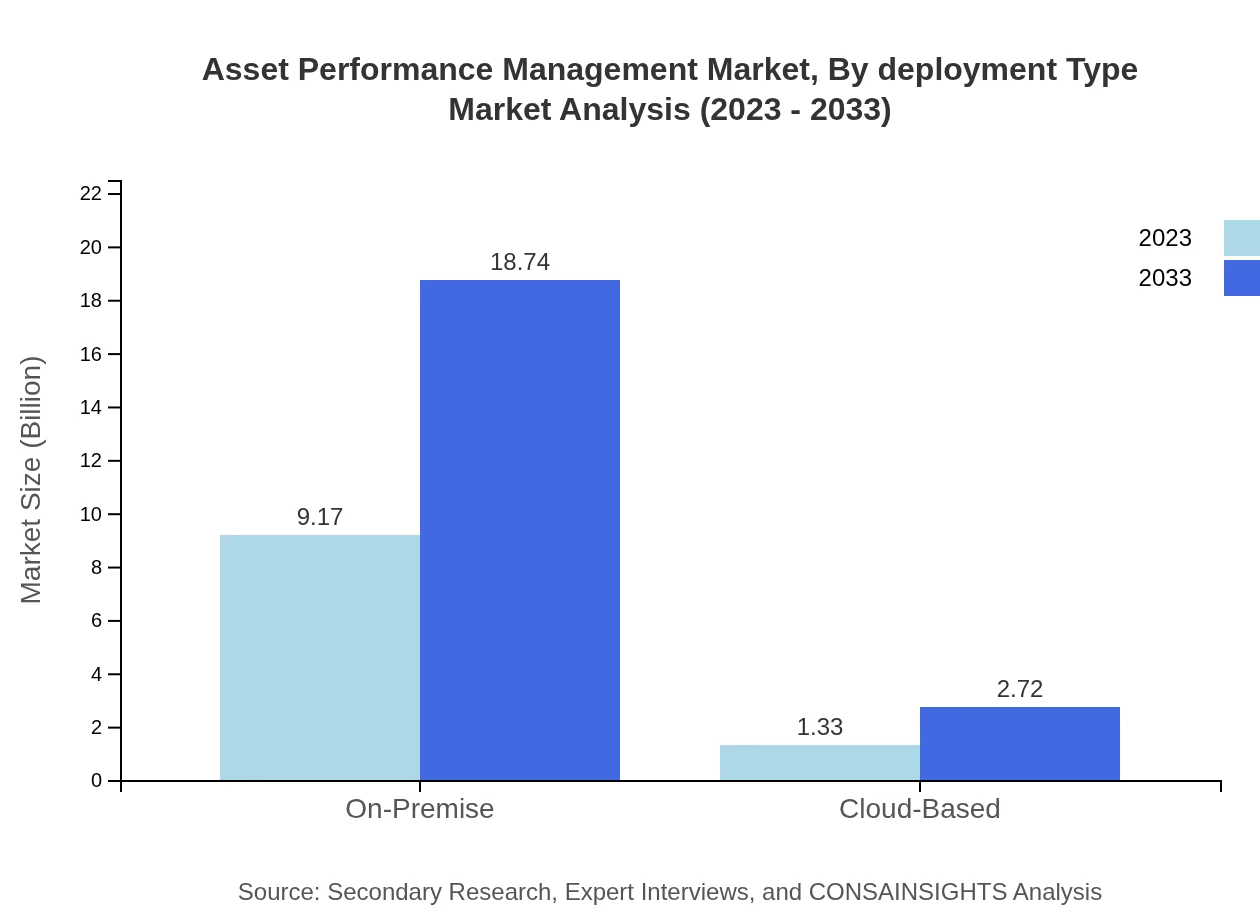

Asset Performance Management Market Analysis By Deployment Type

The APM market is segmented by deployment type into cloud-based and on-premise solutions. On-premise solutions dominate the market due to traditional infrastructure, while cloud-based deployment is gaining traction due to scalability and cost-effectiveness.

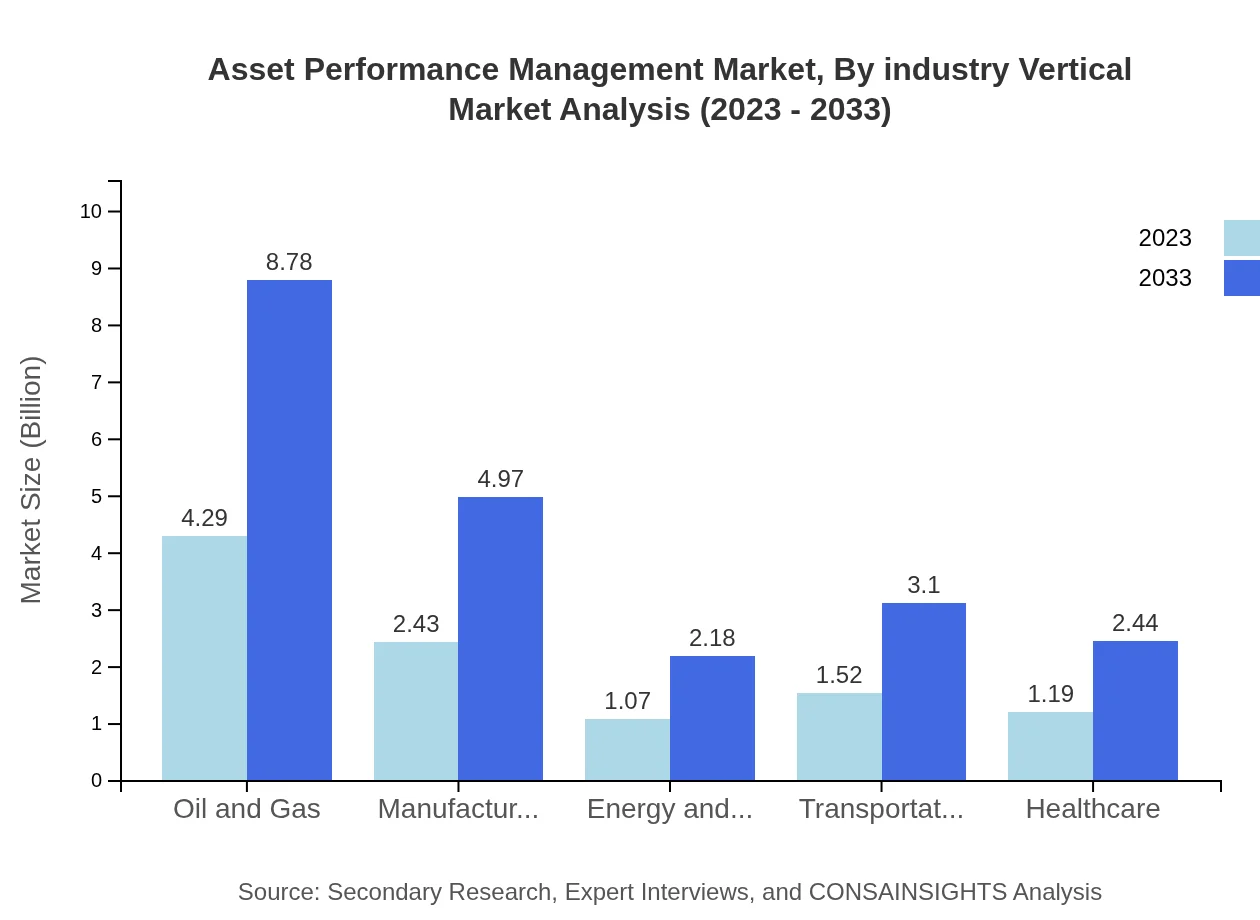

Asset Performance Management Market Analysis By Industry Vertical

The key industry verticals for APM include oil and gas, manufacturing, energy utilities, and transportation. Each sector uniquely contributes to overall growth, with oil and gas being the largest segment followed by manufacturing and transportation, leveraging APM for predictive maintenance.

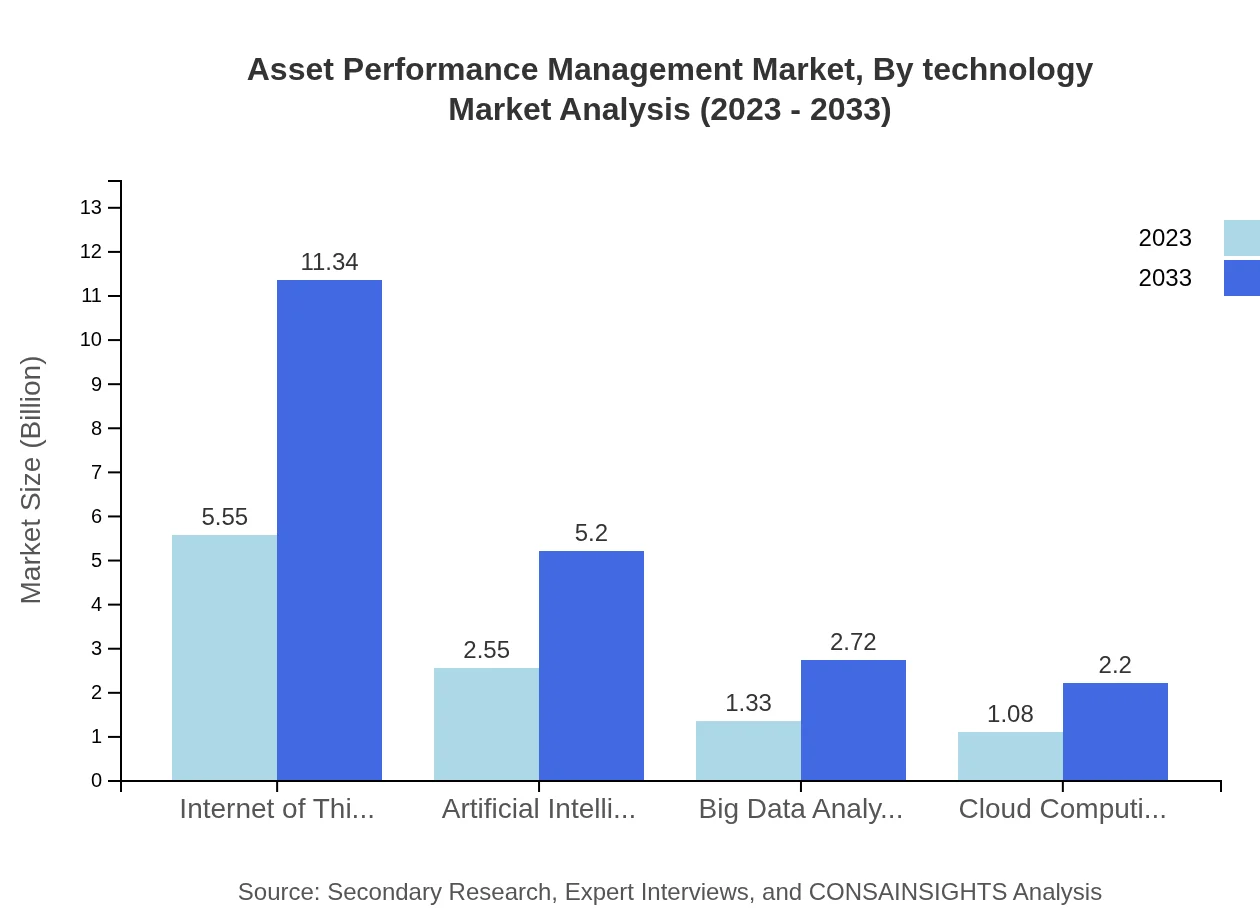

Asset Performance Management Market Analysis By Technology

Technologies such as IoT, AI, and big data analytics are crucial in the APM landscape. IoT technology leads market growth, with a dominant share of more than 50%, while AI & machine learning applications are critical for predictive analytics key for effective decision-making.

Asset Performance Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Asset Performance Management Industry

IBM:

IBM is a key player in the APM domain, providing software solutions that integrate AI and IoT technologies for enhanced asset management and operational efficiency.Siemens :

Siemens offers a range of APM solutions emphasizing automation and digitalization, focusing on smart infrastructure and sustainable practices within various industries.GE Digital:

GE Digital specializes in software applications for industrial asset performance management that leverage analytics and machine learning to optimize asset utilization.Schneider Electric:

Schneider Electric is known for its APM offerings that promote efficient energy management and sustainability across industrial sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of Asset Performance Management?

The Asset Performance Management market is valued at 10.5 billion in 2023, with an expected CAGR of 7.2% forecasted to grow significantly by 2033, reflecting the increasing demand for efficient asset management across industries.

What are the key market players or companies in the Asset Performance Management industry?

Key players in the Asset Performance Management sector include global leaders like Siemens, IBM, GE Digital, and Honeywell, known for their innovative technologies and comprehensive solutions in monitoring and optimizing asset performance.

What are the primary factors driving the growth in the Asset Performance Management industry?

The growth of the Asset Performance Management industry is driven by increasing adoption of IoT technologies, the need for operational efficiency, regulatory compliance, and advancements in AI and data analytics improving predictive maintenance strategies.

Which region is the fastest Growing in the Asset Performance Management?

The asset performance management market is witnessing rapid growth in North America, projected to expand from $3.77 billion in 2023 to $7.70 billion by 2033, driven by industrialization and technological adoption.

Does ConsaInsights provide customized market report data for the Asset Performance Management industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific requirements in the Asset Performance Management industry, allowing stakeholders to access comprehensive insights and actionable intelligence.

What deliverables can I expect from this Asset Performance Management market research project?

Deliverables from the Asset Performance Management market research project include detailed analysis reports, trends forecasts, competitive landscape insights, and segmented data that aid strategic decision-making for stakeholders.

What are the market trends of Asset Performance Management?

Current trends include the rise of IoT and AI integration, increased demand for real-time data analytics, growth in predictive maintenance solutions, and transitioning to cloud-based management systems, shaping the future of asset performance.