Atherectomy Devices Market Report

Published Date: 31 January 2026 | Report Code: atherectomy-devices

Atherectomy Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an exhaustive analysis of the Atherectomy Devices market, exploring trends, regional dynamics, competitive landscapes, and future forecasts from 2023 to 2033.

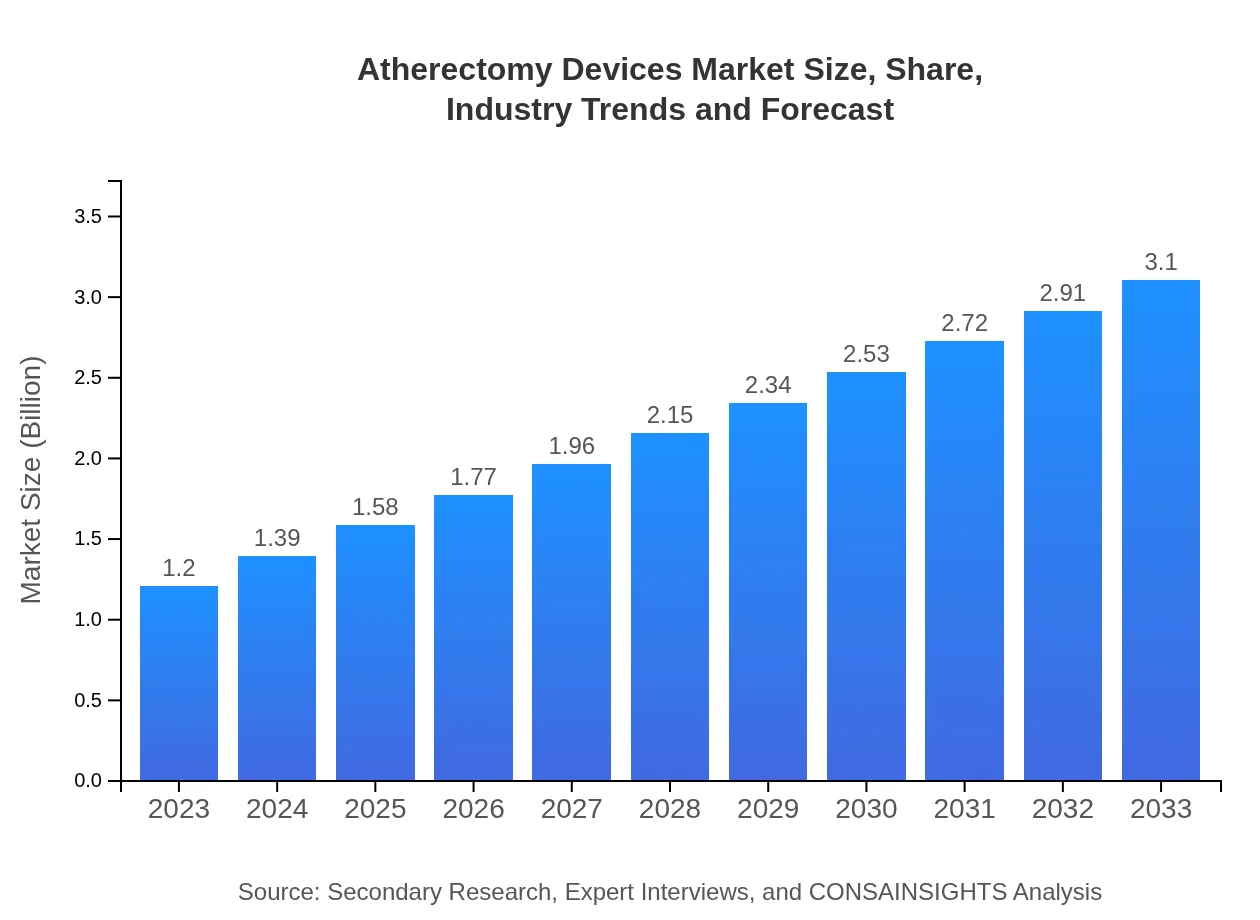

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 9.6% |

| 2033 Market Size | $3.10 Billion |

| Top Companies | Boston Scientific Corporation, Medtronic , Abbott Laboratories, C.R. Bard |

| Last Modified Date | 31 January 2026 |

Atherectomy Devices Market Overview

Customize Atherectomy Devices Market Report market research report

- ✔ Get in-depth analysis of Atherectomy Devices market size, growth, and forecasts.

- ✔ Understand Atherectomy Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Atherectomy Devices

What is the Market Size & CAGR of Atherectomy Devices market in 2023?

Atherectomy Devices Industry Analysis

Atherectomy Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

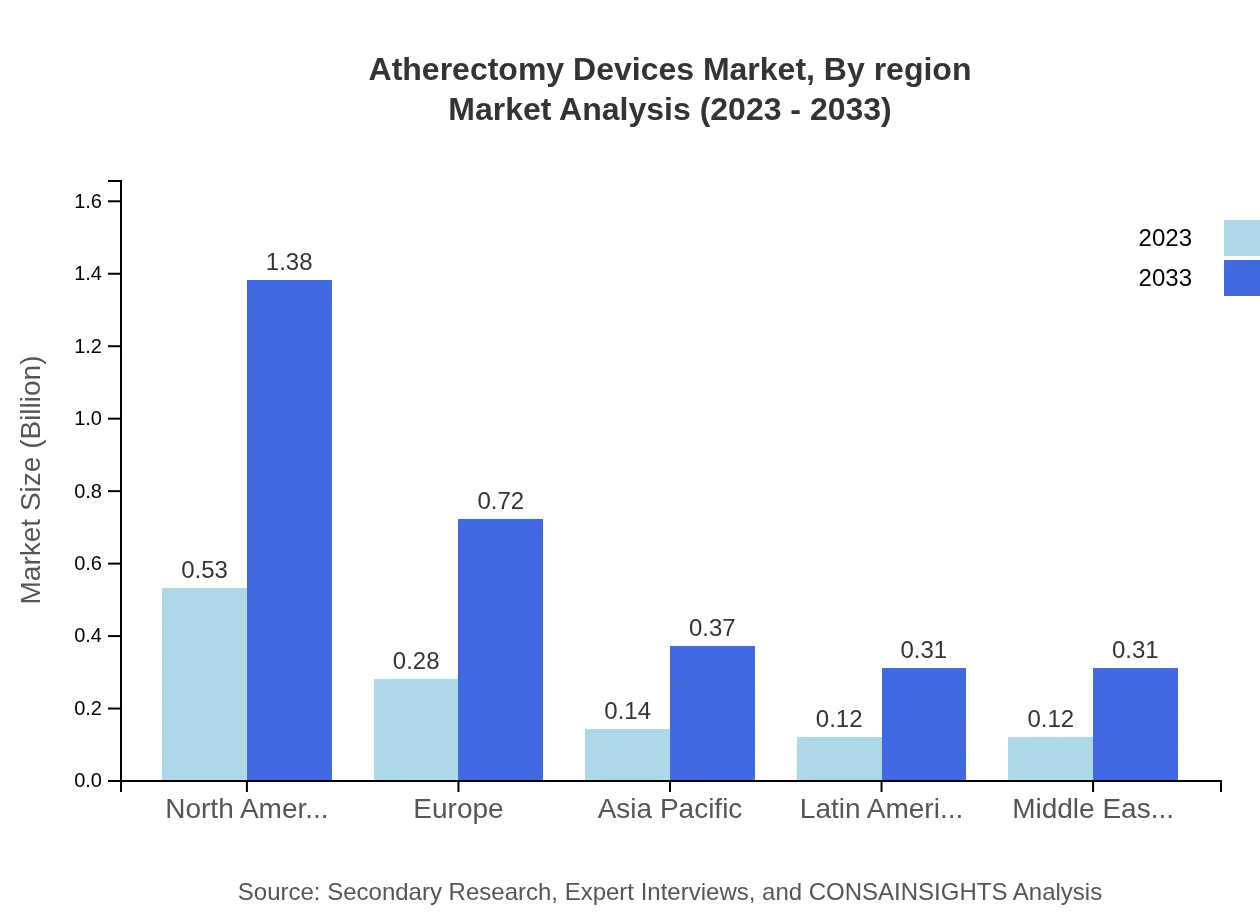

Atherectomy Devices Market Analysis Report by Region

Europe Atherectomy Devices Market Report:

The European market is projected to grow from $0.29 billion in 2023 to $0.74 billion by 2033. Growing aging population and rising prevalence of cardiovascular diseases are critical factors behind this growth.Asia Pacific Atherectomy Devices Market Report:

In the Asia-Pacific region, the market size in 2023 is estimated at $0.25 billion, projected to grow to $0.65 billion by 2033. Increasing prevalence of lifestyle diseases and improved healthcare access are key growth drivers.North America Atherectomy Devices Market Report:

North America holds a significant market share, with a valuation of $0.45 billion in 2023, anticipated to grow to $1.16 billion by 2033. This growth is powered by technological advancements and high demand for innovative treatment options.South America Atherectomy Devices Market Report:

For South America, the market was valued at $0.08 billion in 2023, expected to reach $0.20 billion by 2033. Growing investments in healthcare infrastructure and awareness of cardiovascular conditions are pivotal.Middle East & Africa Atherectomy Devices Market Report:

In the Middle East and Africa, the market size in 2023 is $0.13 billion, anticipated to grow significantly to $0.34 billion by 2033, driven by increased healthcare investments and innovation in cardiovascular therapeutics.Tell us your focus area and get a customized research report.

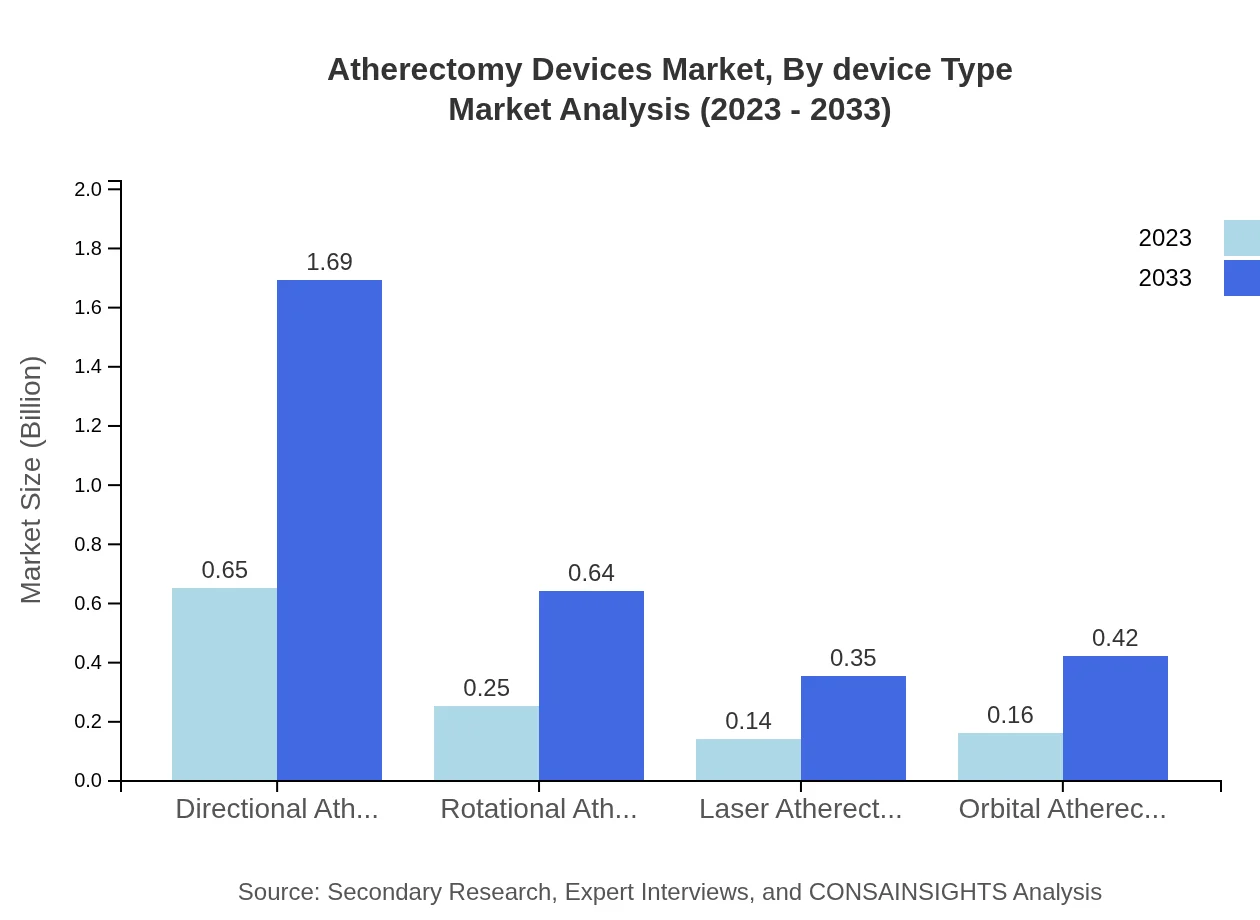

Atherectomy Devices Market Analysis By Device Type

The market segmentation by device type includes directional, rotational, laser, and orbital atherectomy devices. In 2023, directional atherectomy devices comprise a substantial share, valued at $0.65 billion, and are projected to rise to $1.69 billion by 2033. Rotational devices currently stand at $0.25 billion, expected to grow to $0.64 billion, illustrating increasing acceptance due to their effectiveness. Meanwhile, laser and orbital devices maintain niche positions with shares of $0.14 billion and $0.16 billion respectively in 2023, rising steadily by 2033.

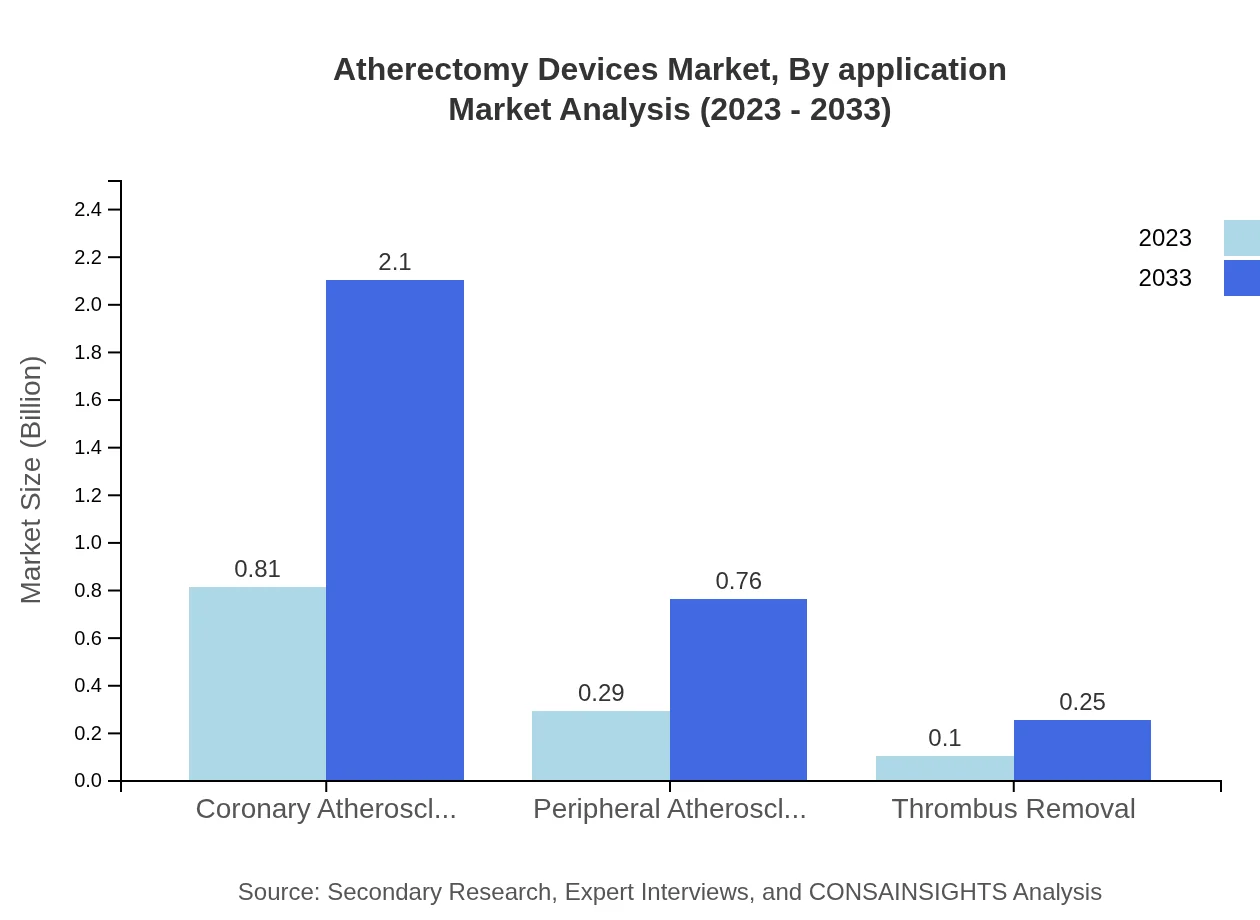

Atherectomy Devices Market Analysis By Application

The application-based segmentation showcases coronary atherosclerosis dominating the market, accounting for $0.81 billion in 2023 and projected to reach $2.10 billion by 2033. Peripheral atherosclerosis follows with a size of $0.29 billion in 2023 and expected growth patterns similar to coronary applications, driven by increased interventions.

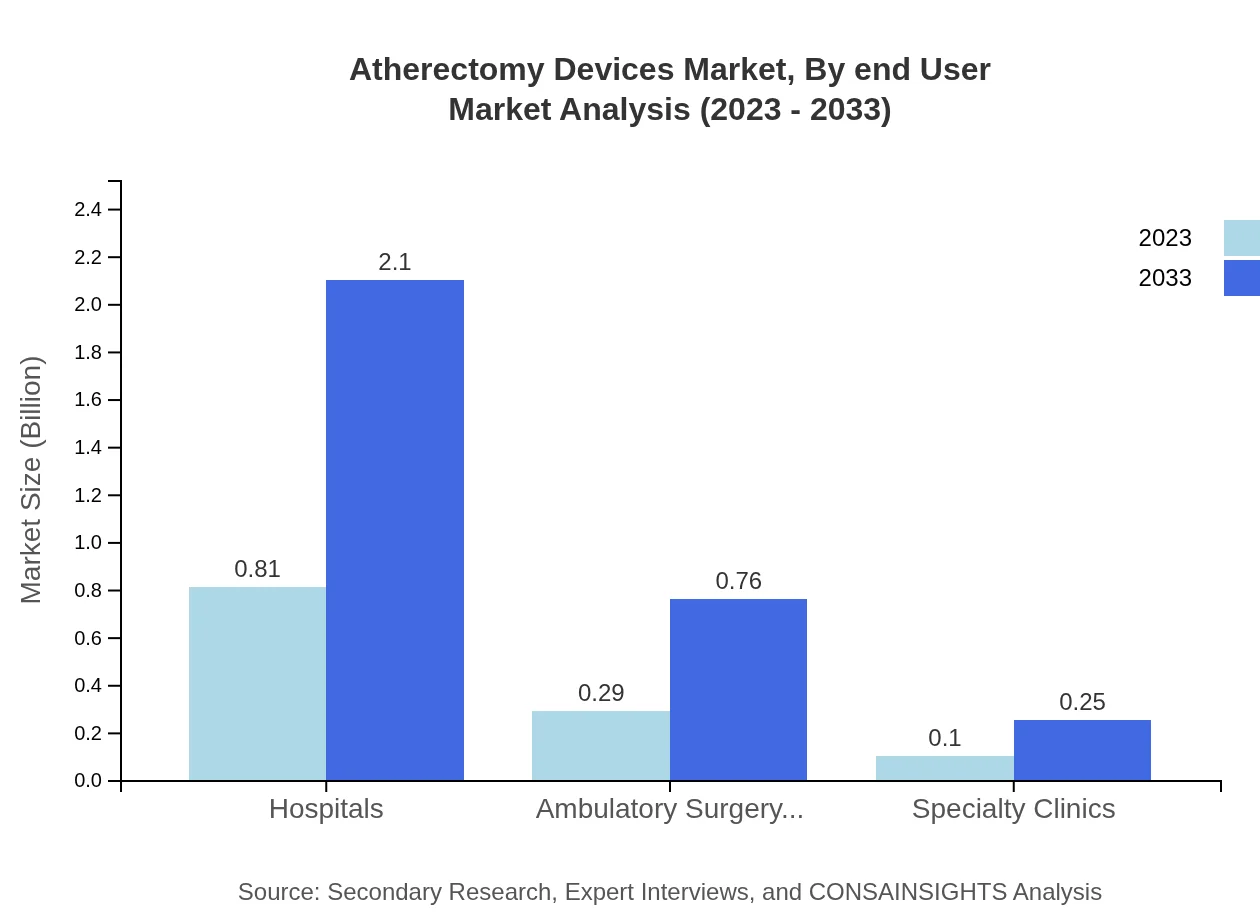

Atherectomy Devices Market Analysis By End User

Hospitals are the primary end-user, representing $0.81 billion in 2023 and anticipated to grow to over $2.10 billion by 2033, reflecting their utilitarian role in complex cardiovascular procedures. Ambulatory Surgery Centers and specialty clinics lead in specific segments, anticipated to account for $0.29 billion and $0.10 billion respectively, with robust growth portfolios as outpatient care expands.

Atherectomy Devices Market Analysis By Region

Regional insights underscore North America's dominance in the market, expected to hold a steady share. Europe is also marking significant growth indicating solid investment in cardiovascular care. Emerging markets in Asia-Pacific and Latin America are increasingly participating, fostering competitive dynamics and innovation within the sector.

Atherectomy Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Atherectomy Devices Industry

Boston Scientific Corporation:

A leading company in the medical devices arena, Boston Scientific is known for its broad range of innovative products that enhance patient care quality in cardiovascular health.Medtronic :

Medtronic operates at the forefront of medical technology with a robust portfolio of cardiovascular devices including atherectomy systems, fostering improved treatment outcomes.Abbott Laboratories:

Abbott is a key player providing outstanding atherectomy solutions while focusing on advanced research to pioneer next-generation cardiovascular products.C.R. Bard:

C.R. Bard specializes in innovative device technologies, establishing impressive market presence through significant contributions to the atherectomy devices landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of atherectomy Devices?

The atherectomy devices market is expected to reach $1.2 billion by 2033, growing at a CAGR of 9.6%. This growth signifies the rising demand for minimally invasive vascular procedures globally.

What are the key market players or companies in this atherectomy Devices industry?

Key market players include major medical device manufacturers like Boston Scientific, Medtronic, and Abbott Laboratories. These companies drive innovation and development in atherectomy technology, enhancing market competitiveness.

What are the primary factors driving the growth in the atherectomy Devices industry?

Growth factors include increasing prevalence of cardiovascular diseases, advancements in atherectomy technologies, and rising demand for minimally invasive surgeries. Moreover, an aging population contributes significantly to market expansion.

Which region is the fastest Growing in the atherectomy Devices?

North America leads the atherectomy devices market with a projected growth from $0.45 billion in 2023 to $1.16 billion by 2033. This region's growth is driven by technological advancements and high healthcare expenditure.

Does ConsaInsights provide customized market report data for the atherectomy Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the atherectomy devices industry. This ensures unique insights that align with current market dynamics.

What deliverables can I expect from this atherectomy Devices market research project?

Deliverables include comprehensive market analysis reports, regional breakdowns, segment insights, competitive landscape assessments, and forecasts for market growth and trends over the next decade.

What are the market trends of atherectomy Devices?

Market trends show a rising adoption of directional and rotational atherectomy devices, increasing focus on outpatient procedures, and shifts towards using advanced technologies like laser atherectomy for better patient outcomes.