Atomic Fluorescence Spectrometers Market Report

Published Date: 22 January 2026 | Report Code: atomic-fluorescence-spectrometers

Atomic Fluorescence Spectrometers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Atomic Fluorescence Spectrometers market, highlighting trends, market size, growth rates, and forecasts from 2023 to 2033. Insights into regional performance and competitive landscape are also included.

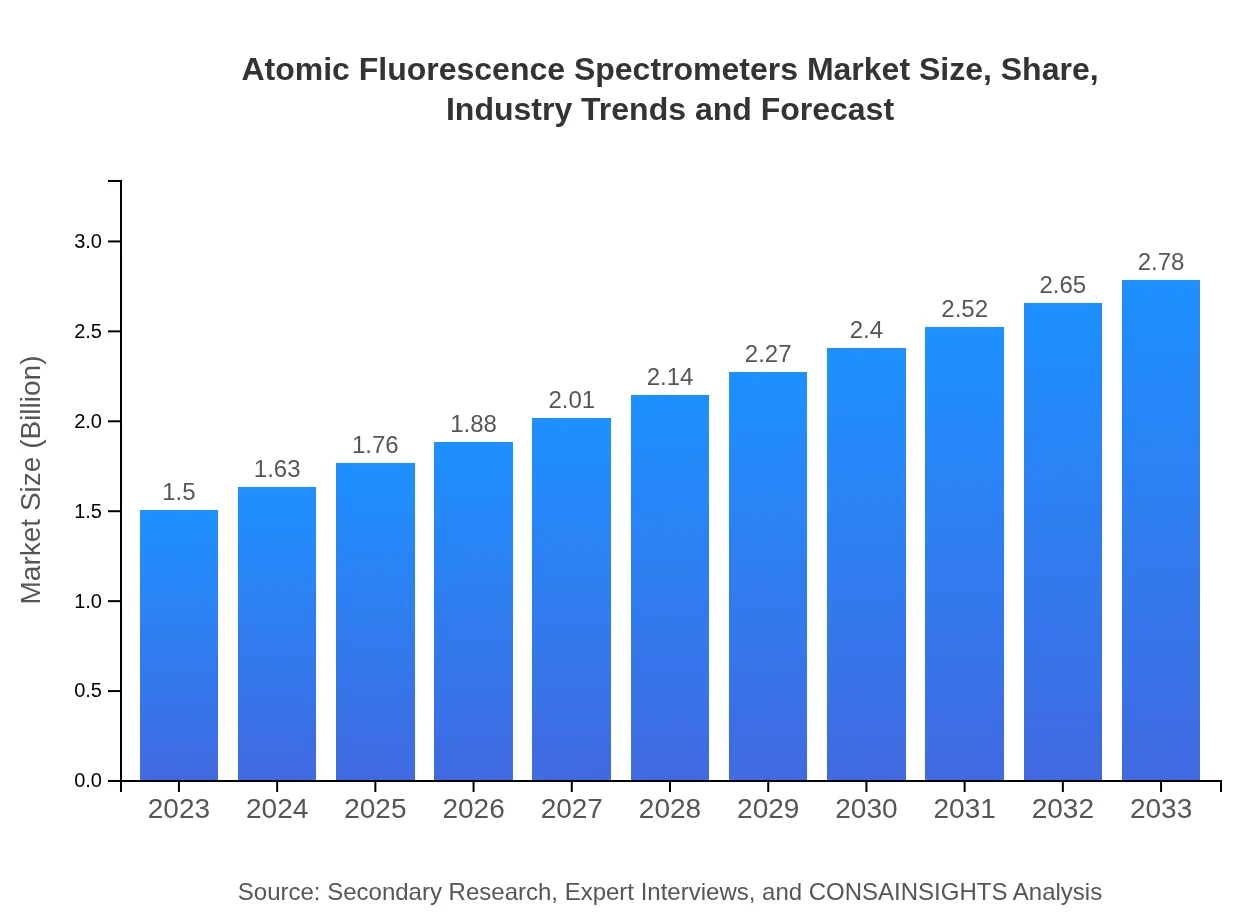

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | PerkinElmer, Agilent Technologies, Omega Engineering |

| Last Modified Date | 22 January 2026 |

Atomic Fluorescence Spectrometers Market Overview

Customize Atomic Fluorescence Spectrometers Market Report market research report

- ✔ Get in-depth analysis of Atomic Fluorescence Spectrometers market size, growth, and forecasts.

- ✔ Understand Atomic Fluorescence Spectrometers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Atomic Fluorescence Spectrometers

What is the Market Size & CAGR of Atomic Fluorescence Spectrometers market in 2023?

Atomic Fluorescence Spectrometers Industry Analysis

Atomic Fluorescence Spectrometers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Atomic Fluorescence Spectrometers Market Analysis Report by Region

Europe Atomic Fluorescence Spectrometers Market Report:

Europe experienced a market size of $0.45 billion in 2023 with projections of growing to $0.84 billion by 2033. The region is characterized by high demand for AFS in pharmaceutical applications and environmental monitoring, largely due to regulatory frameworks promoting safety.Asia Pacific Atomic Fluorescence Spectrometers Market Report:

The Asia Pacific region held a market size of $0.25 billion in 2023 and is forecasted to grow to approximately $0.47 billion by 2033. The region's growth is propelled by increasing industrial applications and expanding research activities in academic institutions, particularly in countries like China and India.North America Atomic Fluorescence Spectrometers Market Report:

North America dominated the market with a size of $0.57 billion in 2023, expected to increase to $1.06 billion by 2033. The growth is attributed to the presence of advanced research facilities and stringent safety regulations prompting the adoption of AFS in various sectors.South America Atomic Fluorescence Spectrometers Market Report:

In South America, the market size was $0.09 billion in 2023 and is anticipated to reach $0.17 billion by 2033. The demand is primarily driven by government initiatives to enforce environmental regulations and enhance food safety standards.Middle East & Africa Atomic Fluorescence Spectrometers Market Report:

In the Middle East and Africa, the market was valued at $0.13 billion in 2023 and is expected to grow to $0.25 billion by 2033. Growth factors include increasing investments in healthcare and environmental sectors, focusing on advanced analytical solutions.Tell us your focus area and get a customized research report.

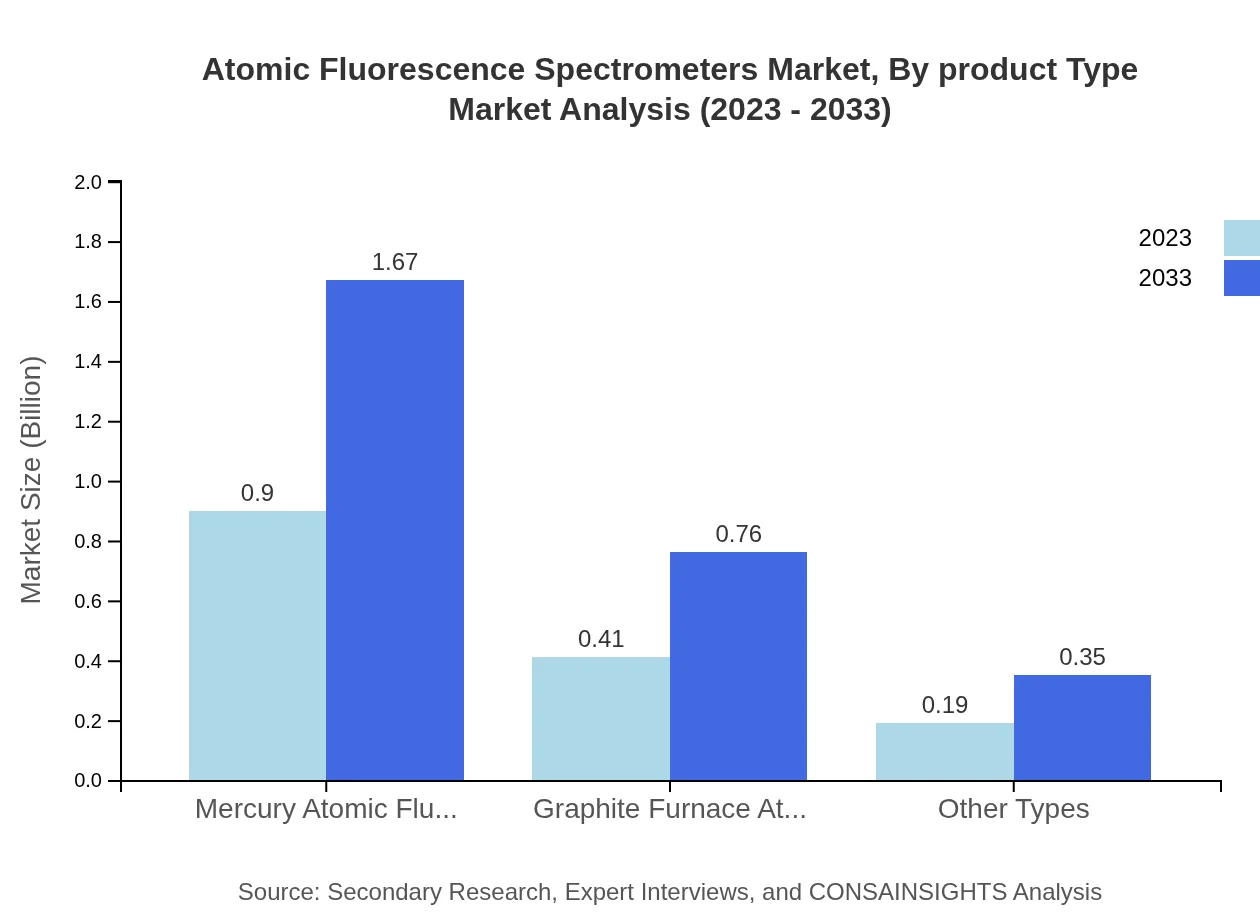

Atomic Fluorescence Spectrometers Market Analysis By Product Type

Different product types within the Atomic Fluorescence Spectrometers market include Mercury Atomic Fluorescence Spectrometers, Graphite Furnace AFS, and other types. Mercury AFS accounted for a substantial share of 60.03% in 2023 and is projected to grow by 7.31% CAGR until 2033. Graphite Furnace AFS, while smaller, is significant, making up approximately 27.48% of the market share, indicating strong demand for precise elemental analysis in laboratories.

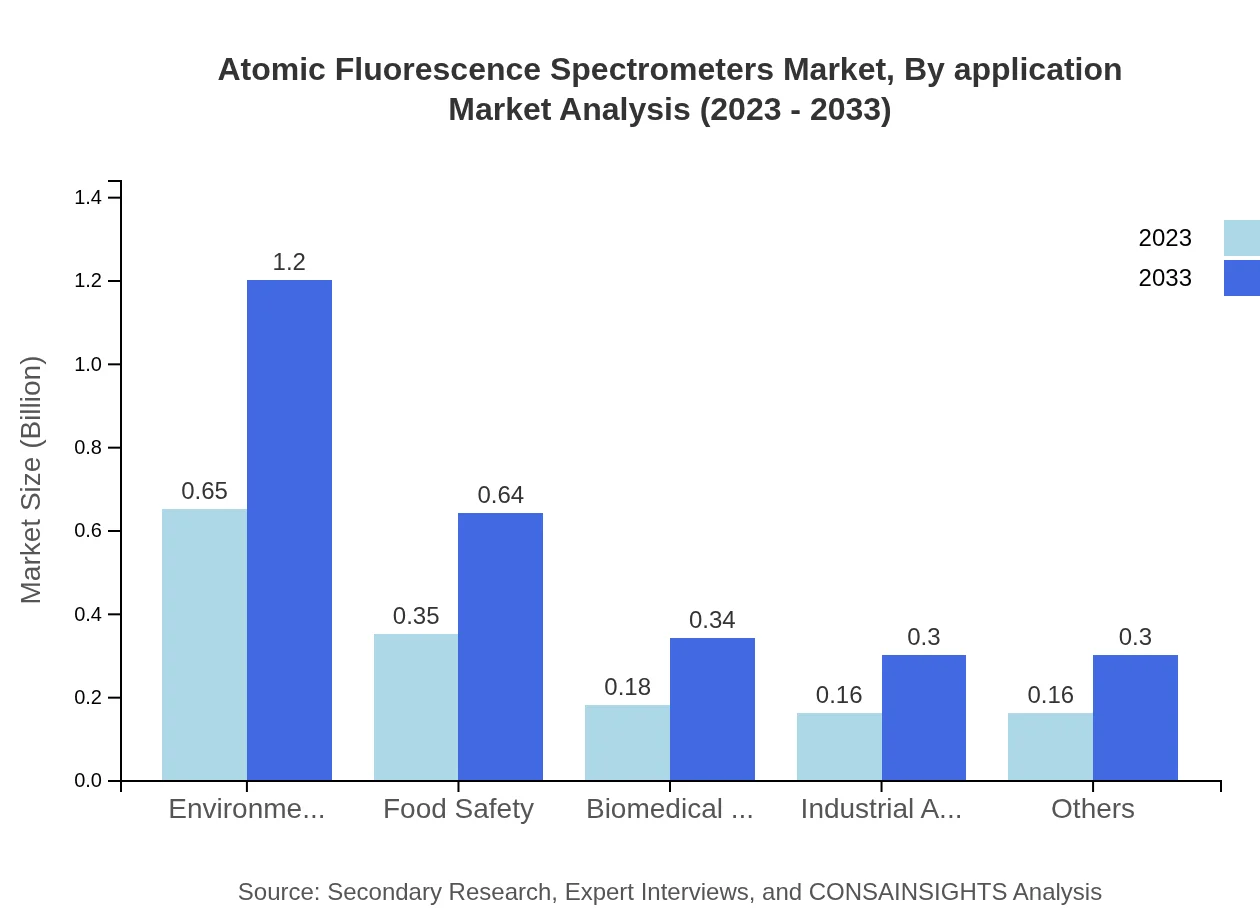

Atomic Fluorescence Spectrometers Market Analysis By Application

Applications of Atomic Fluorescence Spectrometers span several sectors, with Environmental Analysis and Food Safety being the largest. Environmental applications held a 43.3% share in 2023, while Food Safety accounted for 23.06%. These segments are expected to see continuous growth due to rising health and safety standards globally.

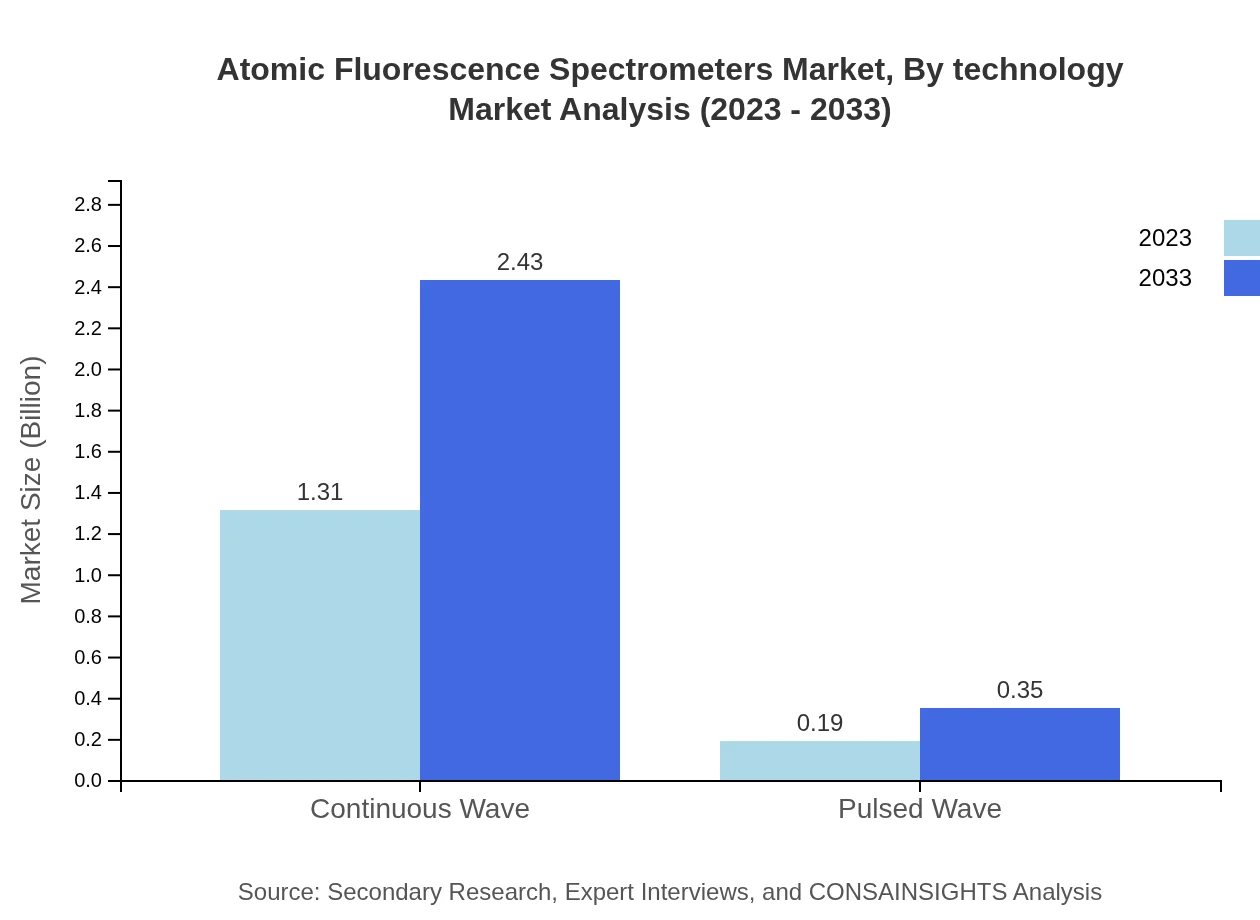

Atomic Fluorescence Spectrometers Market Analysis By Technology

The market for Atomic Fluorescence Spectrometers can be analyzed based on technology types: Continuous Wave and Pulsed Wave. Continuous Wave is leading with a remarkable 87.43% share in 2023 due to its efficiency and widespread adoption in laboratories. Pulsed Wave, while smaller at 12.57%, is gaining traction in niche applications.

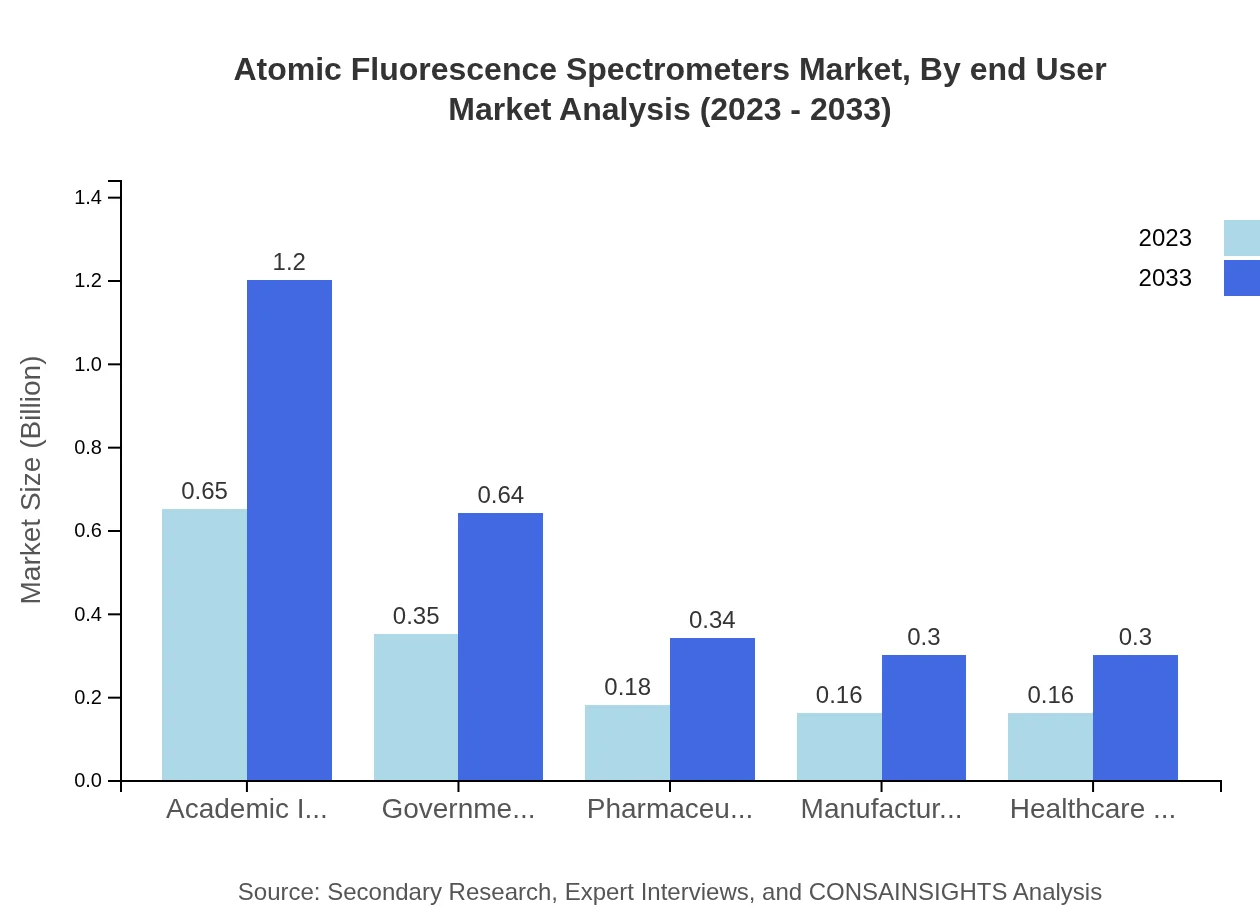

Atomic Fluorescence Spectrometers Market Analysis By End User

Key end-users of Atomic Fluorescence Spectrometers include academic institutions, government laboratories, and healthcare facilities. Academic institutions are the largest segment, capturing 43.3% of the market share. This segment is poised for growth driven by increased research funding and an emphasis on high-quality scientific education.

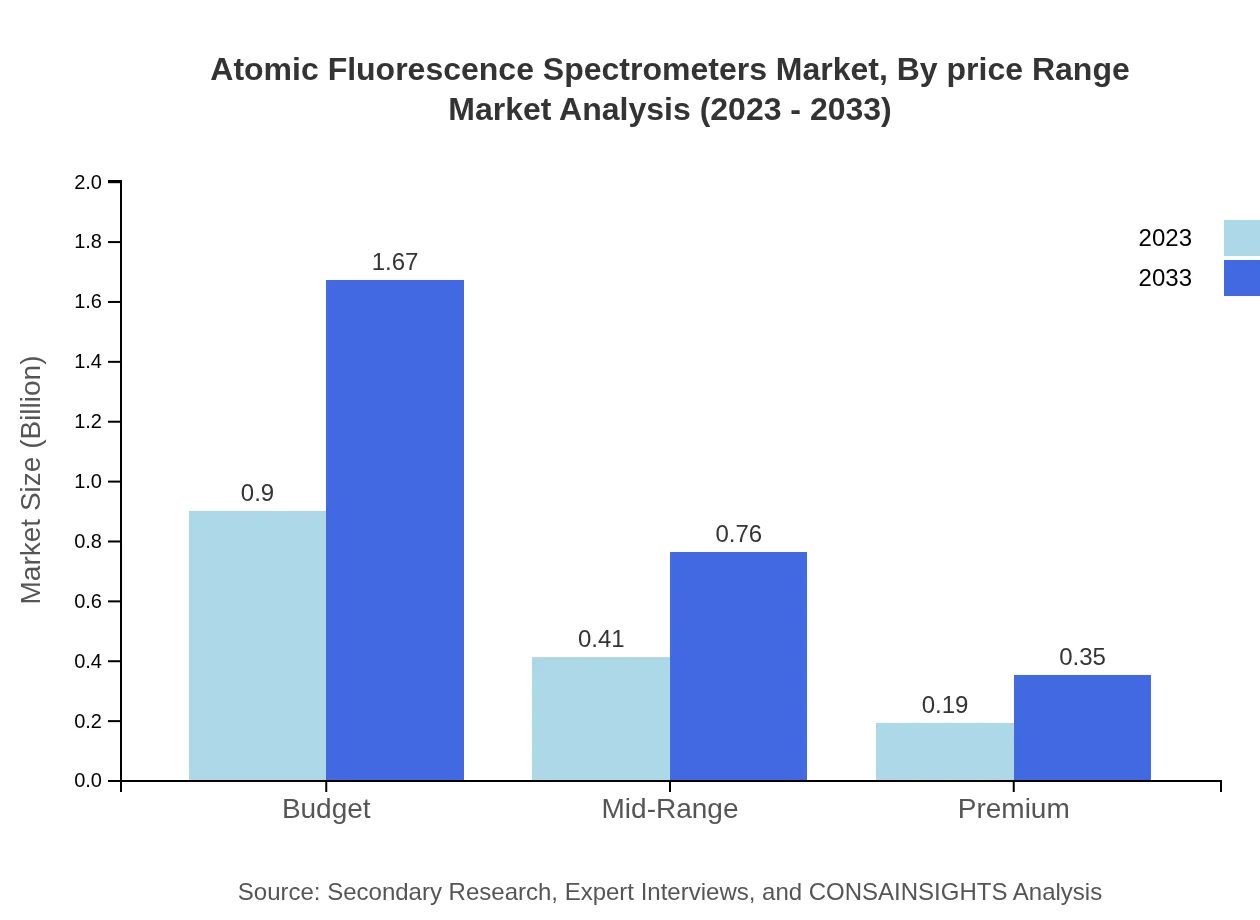

Atomic Fluorescence Spectrometers Market Analysis By Price Range

The price range segmentation includes budget, mid-range, and premium products. Budget models held a 60.03% market share in 2023, appealing to educational institutions and small laboratories. Mid-range products captured 27.48%, with premium solutions focusing on high-performance applications in advanced research settings.

Atomic Fluorescence Spectrometers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Atomic Fluorescence Spectrometers Industry

PerkinElmer:

A leading provider of software, tools, and technology for diagnostics and analytics, particularly in the field of environmental monitoring and bioanalysis.Agilent Technologies:

Known for its innovative solutions in laboratory equipment, Agilent offers a range of atomic fluorescence spectrometers that enhance precision and reliability in elemental analysis.Omega Engineering:

A key player in the instrumentation market, Omega specializes in manufacturing high-quality atomic fluorescence spectrometers used across various industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of atomic Fluorescence Spectrometers?

The atomic fluorescence spectrometers market is projected to reach approximately $1.5 billion in 2023, with a compound annual growth rate (CAGR) of 6.2% anticipated through 2033, indicating robust industry growth in the forthcoming decade.

What are the key market players or companies in the atomic Fluorescence Spectrometers industry?

Key players in the atomic fluorescence spectrometers market include leading manufacturers and technology companies specializing in analytical instruments. These companies drive innovation and competitive dynamics through research and development.

What are the primary factors driving the growth in the atomic Fluorescence Spectrometers industry?

Growth in the atomic fluorescence spectrometers market is driven by rising demand for accurate analytical techniques in research, environmental monitoring, and pharmaceuticals, along with technological advancements enhancing instrument outcomes and usability.

Which region is the fastest Growing in the atomic Fluorescence Spectrometers?

The North American region exhibits the fastest growth in the atomic fluorescence spectrometers market, with market size increasing from $0.57 billion in 2023 to $1.06 billion by 2033, attributed to expanding research facilities and environmental regulations.

Does ConsaInsights provide customized market report data for the atomic Fluorescence Spectrometers industry?

Yes, ConsaInsights offers tailored market reports for the atomic fluorescence spectrometers industry, catering to specific client needs and providing in-depth analysis on market trends, competitive landscape, and growth opportunities.

What deliverables can I expect from this atomic Fluorescence Spectrometers market research project?

Deliverables from the atomic fluorescence spectrometers market research project typically include a comprehensive report outlining market size, growth forecasts, competitive analysis, and insights into key segments and regional dynamics.

What are the market trends of atomic Fluorescence Spectrometers?

Current market trends for atomic fluorescence spectrometers include increasing adoption in academic institutions, government laboratories, and rising interest in environmental safety and health applications, driving innovation in product development and utilization.