Attitude And Heading Reference Systems Market Report

Published Date: 03 February 2026 | Report Code: attitude-and-heading-reference-systems

Attitude And Heading Reference Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Attitude and Heading Reference Systems market, outlining key insights from 2023 to 2033. It encompasses market size, growth forecasts, regional analysis, segmentation, industry dynamics, and the competitive landscape.

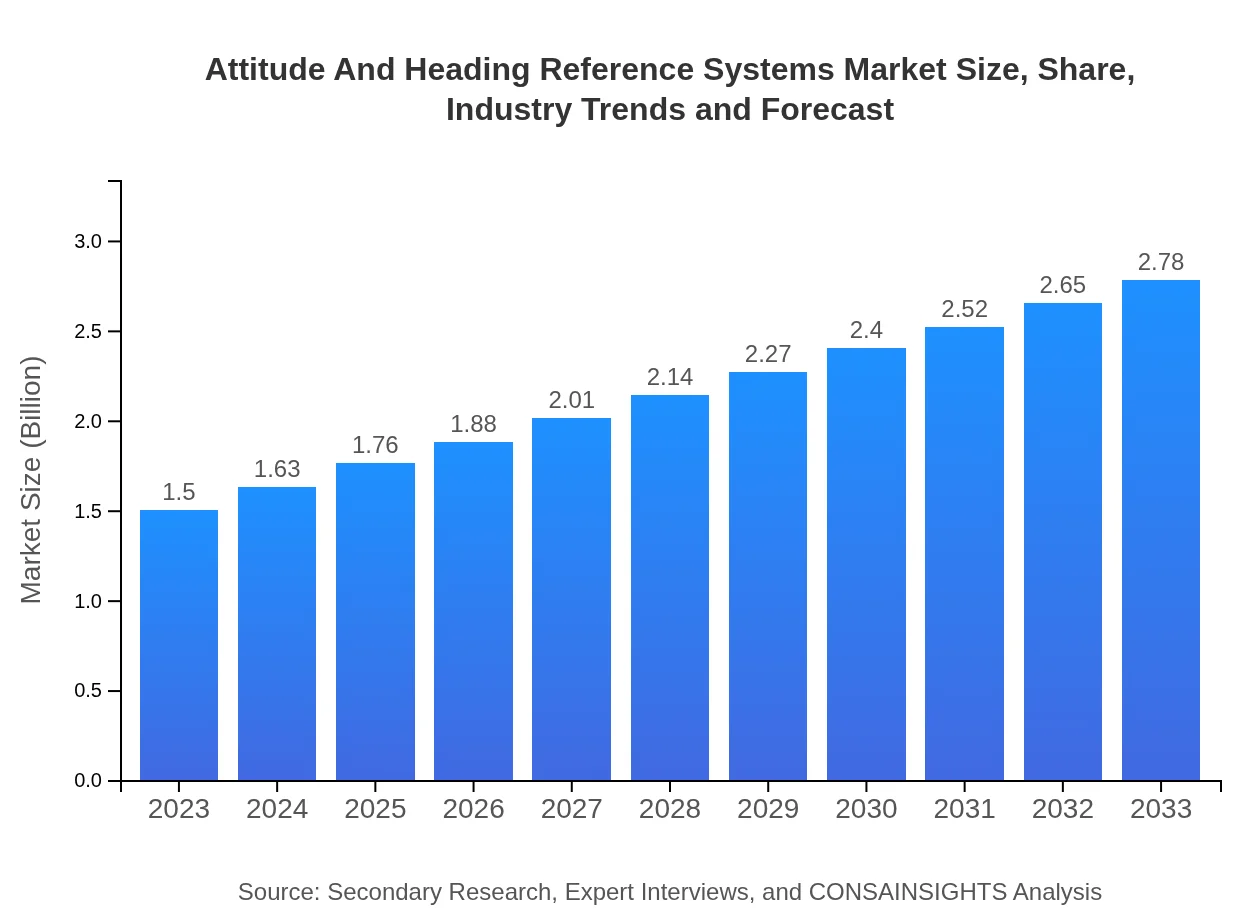

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Honeywell International Inc., Northrop Grumman Corporation, Thales Group, Raytheon Technologies Corporation, Sick AG |

| Last Modified Date | 03 February 2026 |

Attitude And Heading Reference Systems Market Overview

Customize Attitude And Heading Reference Systems Market Report market research report

- ✔ Get in-depth analysis of Attitude And Heading Reference Systems market size, growth, and forecasts.

- ✔ Understand Attitude And Heading Reference Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Attitude And Heading Reference Systems

What is the Market Size & CAGR of Attitude And Heading Reference Systems market in 2023?

Attitude And Heading Reference Systems Industry Analysis

Attitude And Heading Reference Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Attitude And Heading Reference Systems Market Analysis Report by Region

Europe Attitude And Heading Reference Systems Market Report:

The European market is anticipated to grow from $0.41 billion in 2023 to $0.75 billion by 2033. The region emphasizes regulatory requirements for safety in aviation and automotive sectors. Countries like Germany and the UK are making substantial investments to enhance aviation safety and explore new navigation technologies.Asia Pacific Attitude And Heading Reference Systems Market Report:

The Asia Pacific region held a market size of approximately $0.30 billion in 2023 and is expected to grow to $0.56 billion by 2033. The rapid growth of the aerospace and automotive sectors, coupled with significant government investments in defense, enhances the region's market potential. Countries like China and India are leading players, with increasing demands for precise navigation technologies.North America Attitude And Heading Reference Systems Market Report:

North America, as a leading market, recorded a size of $0.55 billion in 2023 and is projected to grow to $1.03 billion by 2033. The growth is fueled by the advancements in the aerospace sector, high defense expenditure, and increasing demand for automotive safety features, positioning the region as a hub for AHRS innovation.South America Attitude And Heading Reference Systems Market Report:

In South America, the market size was about $0.10 billion in 2023, expected to reach $0.18 billion by 2033. Growth in the region is driven by the expanding automotive industry, with countries like Brazil and Argentina exploring advanced navigation systems to improve safety standards. However, economic fluctuations pose challenges.Middle East & Africa Attitude And Heading Reference Systems Market Report:

The Middle East and Africa market was valued at $0.14 billion in 2023 and is projected to reach $0.26 billion by 2033. The growth is spurred by increased defense spending, growth in the aviation sector, and enthusiastic investment in smart technologies that improve navigation precision.Tell us your focus area and get a customized research report.

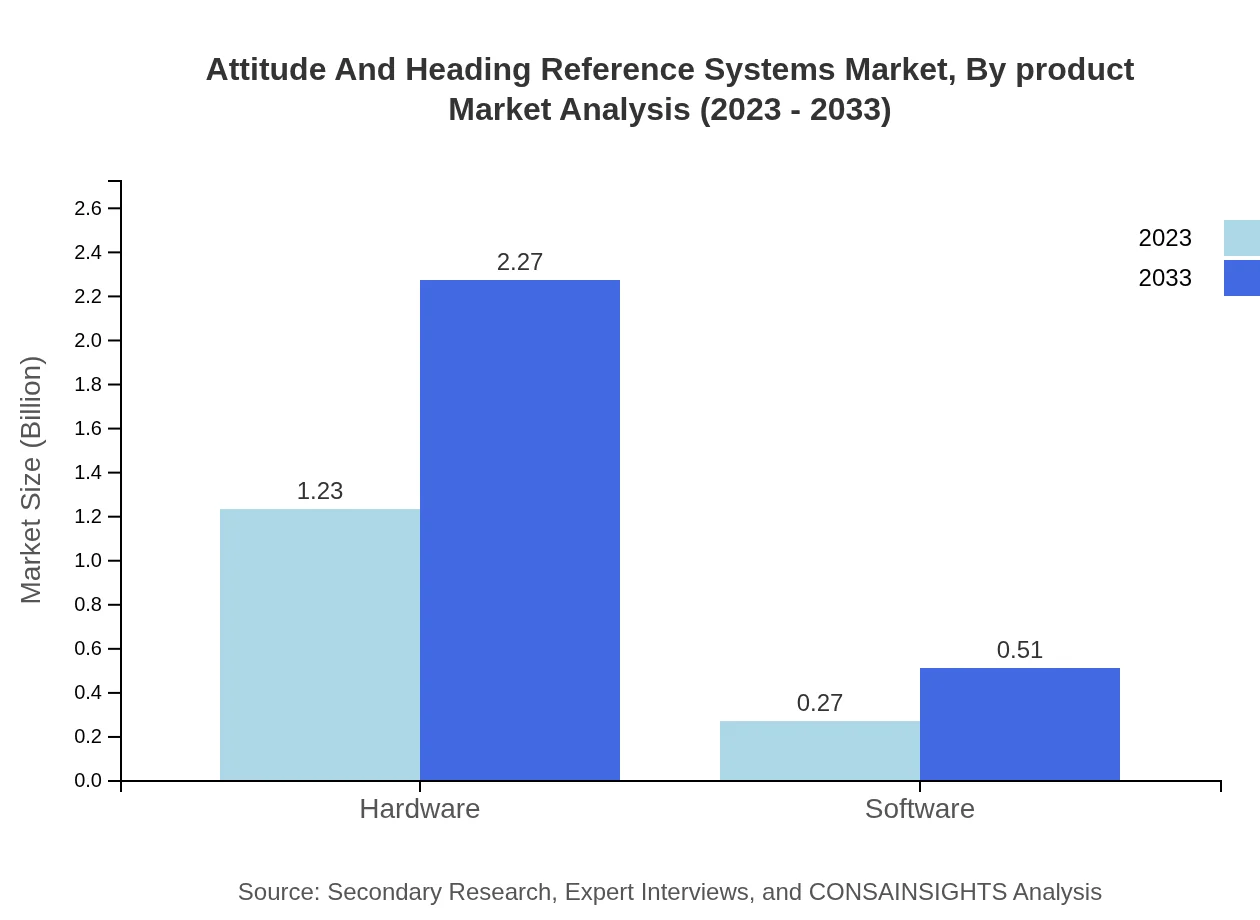

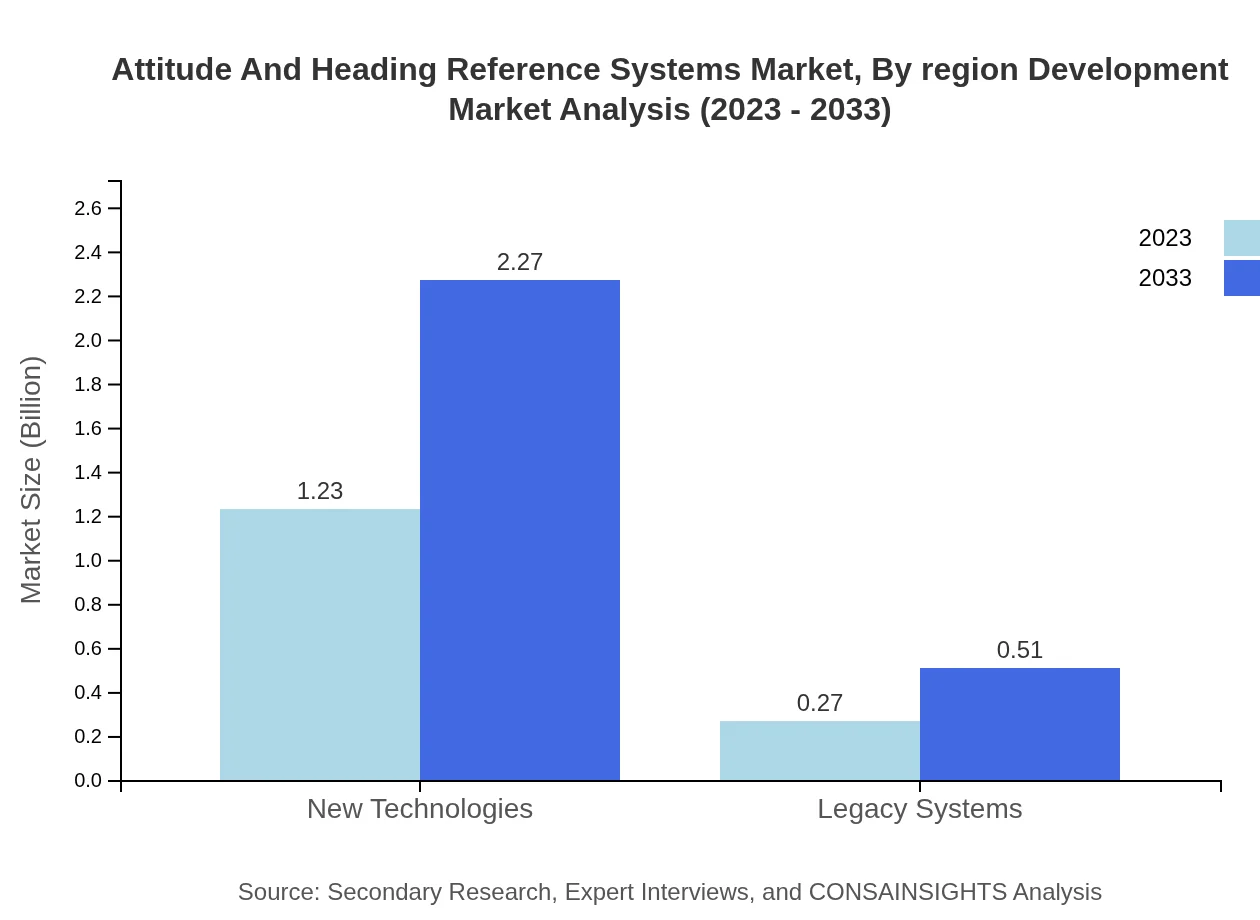

Attitude And Heading Reference Systems Market Analysis By Product

The product segment of the Attitude and Heading Reference Systems market isolates hardware and software, where hardware, which includes gyroscopes and accelerometers, dominated with a projected market size of $1.23 billion in 2023 and expected growth to $2.27 billion by 2033. Conversely, software is growing more slowly, from $0.27 billion in 2023 to $0.51 billion by 2033.

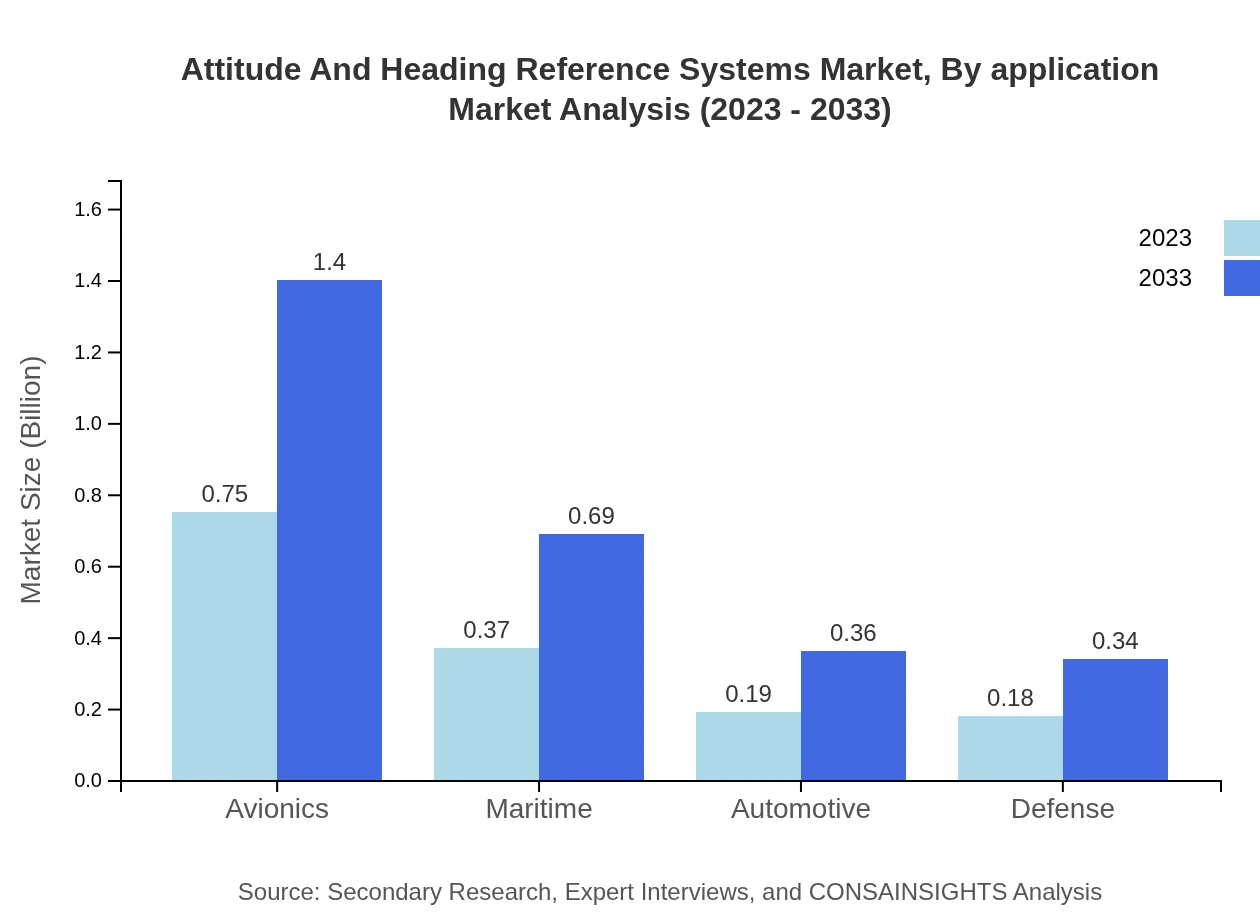

Attitude And Heading Reference Systems Market Analysis By Application

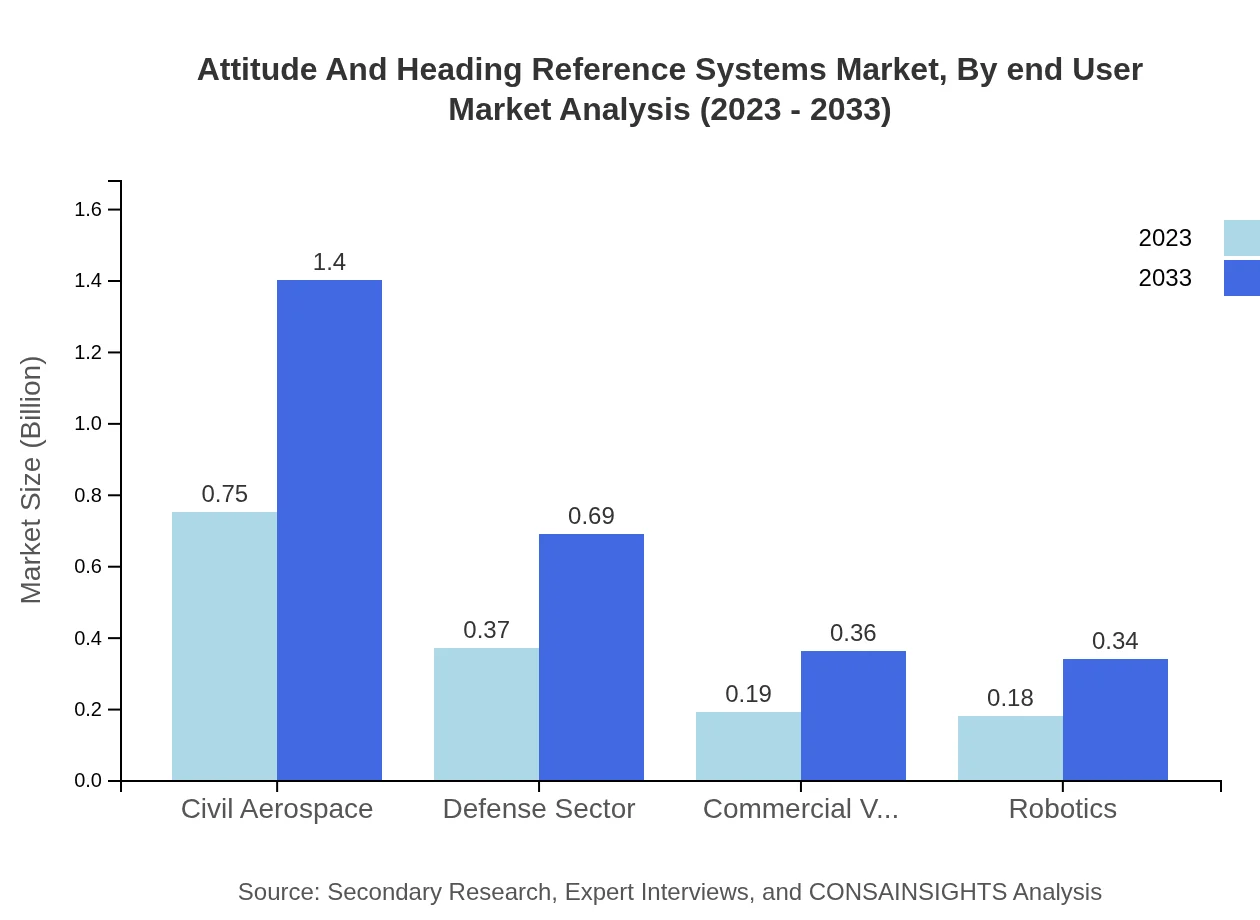

Applications encompass civil aerospace, defense, commercial vehicles, maritime, and robotics. The civil aerospace segment alone was valued at approximately $0.75 billion in 2023, experiencing substantial growth anticipated to reach $1.40 billion by 2033 due to regulatory safety measures and heightened air traffic.

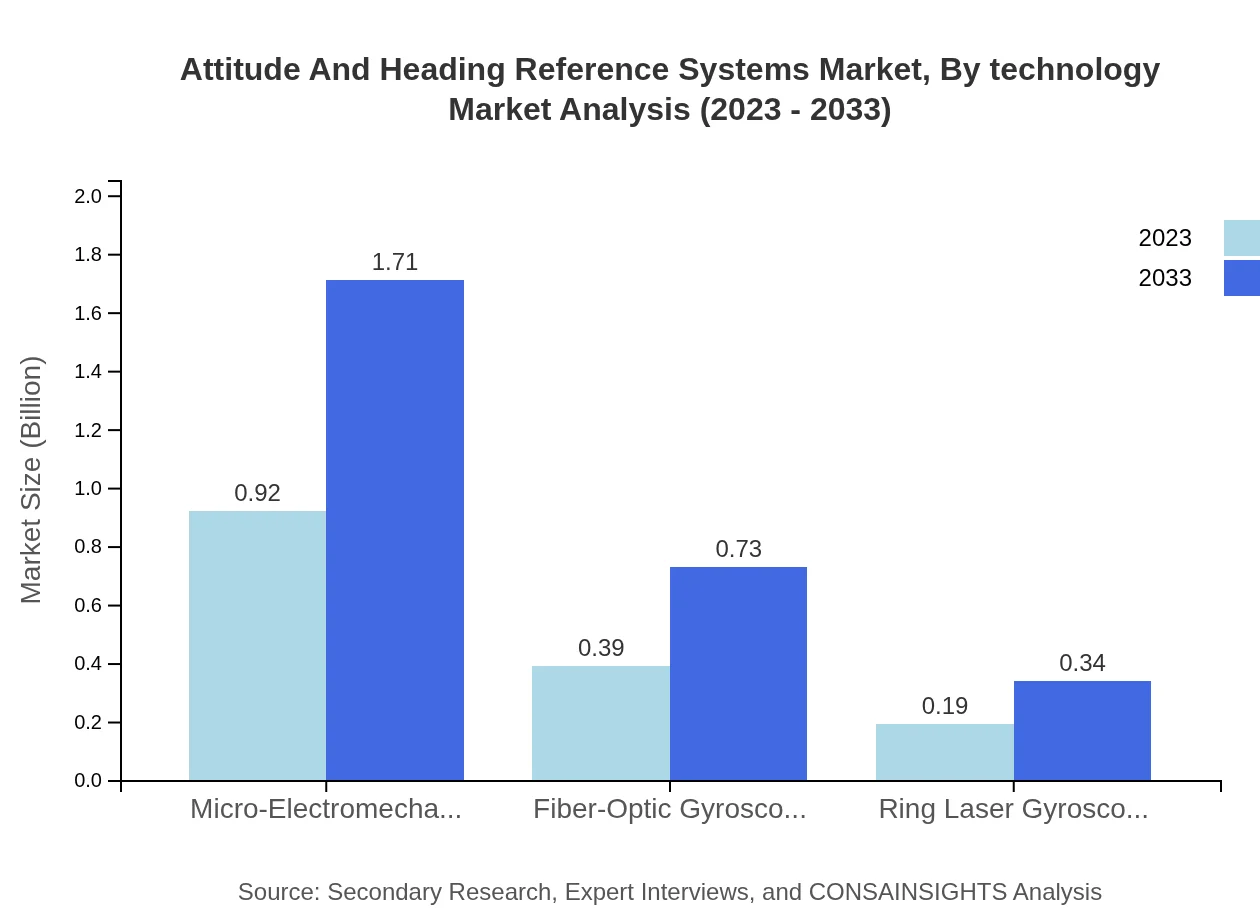

Attitude And Heading Reference Systems Market Analysis By Technology

Technological advancements drive the segmentation between MEMS, fiber-optic gyroscopes, and ring laser gyroscopes. MEMS continues to dominate with a share of 61.36% owning a size of $0.92 billion in 2023, while fiber-optic gyroscopes follow with a 26.28% share, creating room for further technological advancement.

Attitude And Heading Reference Systems Market Analysis By End User

The end-user segment reveals major contributors: the aerospace sector reaches $0.75 billion, defense at $0.37 billion, and automotive at $0.19 billion in 2023. Each sector needs tailored AHRS solutions impacting market dynamics significantly.

Attitude And Heading Reference Systems Market Analysis By Region Development

The market distinguishes between new technologies and legacy systems, where new technologies dominate with a share of 81.7% generating a value of $1.23 billion in 2023, suggesting a robust move towards innovation and sophistication in AHRS technologies.

Attitude And Heading Reference Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Attitude And Heading Reference Systems Industry

Honeywell International Inc.:

A leader in providing aerospace and automotive products, offers advanced AHRS technologies that enhance navigation precision across various applications.Northrop Grumman Corporation:

Specializes in defense and aerospace systems, contributing significantly to the development of robust AHRS for military and commercial aviation.Thales Group:

A prominent player in the aerospace and defense sector, known for its innovative navigation solutions, significantly impacting the AHRS market.Raytheon Technologies Corporation:

Provides advanced aerospace and defense technologies, contributing to precision navigation systems including AHRS.Sick AG:

Known for advanced sensor technology, they are crucial in developing precise orientation and navigation systems.We're grateful to work with incredible clients.

FAQs

What is the market size of attitude And Heading Reference Systems?

The global market size for attitude-and-heading reference systems is $1.5 billion in 2023 with a projected CAGR of 6.2% through 2033, reflecting sustained demand across various sectors.

What are the key market players or companies in this attitude And Heading Reference Systems industry?

Key players in the attitude-and-heading reference systems market include major aerospace and defense manufacturers, electronics firms, and software developers specialized in navigation and positioning technologies.

What are the primary factors driving the growth in the attitude And Heading Reference Systems industry?

The growth in the attitude-and-heading reference systems industry is driven by rising demand for advanced navigation systems in aerospace, increased military spending, and advancements in sensor technologies such as MEMS and fiber-optic gyroscopes.

Which region is the fastest Growing in the attitude And Heading Reference Systems?

The North American region is the fastest-growing market for attitude-and-heading reference systems, expanding from $0.55 billion in 2023 to an estimated $1.03 billion by 2033, led by a strong aerospace sector.

Does ConsaInsights provide customized market report data for the attitude And Heading Reference Systems industry?

Yes, ConsaInsights offers customized market report data specifically tailored to the needs of clients in the attitude-and-heading reference systems industry, ensuring relevant insights for strategic decisions.

What deliverables can I expect from this attitude And Heading Reference Systems market research project?

Deliverables from the attitude-and-heading reference systems market research project include comprehensive market analysis, growth forecasts, competitive landscape overview, and segmented insights across different regions and applications.

What are the market trends of attitude And Heading Reference Systems?

Current trends in the attitude-and-heading reference systems market include the increasing integration of new technologies, growth in civil aerospace applications, and rising usage of robotic systems for precision navigation.