Auditing Services Market Report

Published Date: 31 January 2026 | Report Code: auditing-services

Auditing Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Auditing Services market, covering key insights into market size, growth rates, segmentation, and trends from 2023 to 2033.

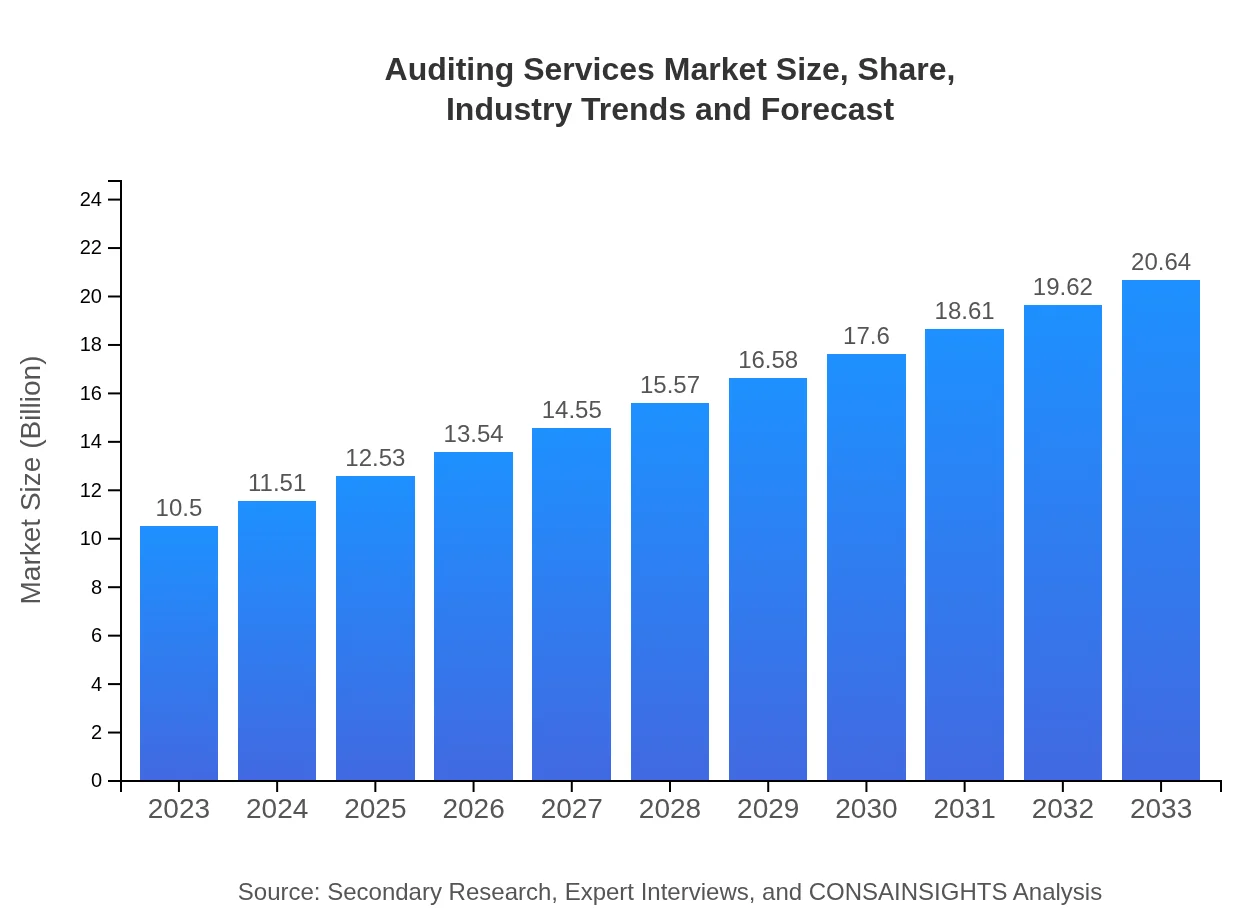

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG, Grant Thornton |

| Last Modified Date | 31 January 2026 |

Auditing Services Market Overview

Customize Auditing Services Market Report market research report

- ✔ Get in-depth analysis of Auditing Services market size, growth, and forecasts.

- ✔ Understand Auditing Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Auditing Services

What is the Market Size & CAGR of Auditing Services market in 2023?

Auditing Services Industry Analysis

Auditing Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Auditing Services Market Analysis Report by Region

Europe Auditing Services Market Report:

Europe's Auditing Services market stands at USD 2.76 billion in 2023, anticipated to expand to USD 5.43 billion by 2033. The growth is largely attributed to stringent European Union regulations and a focus on corporate governance and accountability among businesses.Asia Pacific Auditing Services Market Report:

In 2023, the Asia Pacific Auditing Services market is valued at USD 2.19 billion, projected to grow to USD 4.31 billion by 2033. The region's growth is driven by rapid industrialization, increased foreign investments, and a stringent regulatory environment, leading to heightened demand for auditing services across various sectors.North America Auditing Services Market Report:

North America dominates the Auditing Services market with a value of USD 3.78 billion in 2023, forecasted to reach USD 7.44 billion by 2033. The region's mature regulatory landscape and high demand for compliance and risk management audits drive consistent growth.South America Auditing Services Market Report:

The South American market for Auditing Services is currently valued at USD 0.89 billion in 2023 and is expected to reach USD 1.74 billion by 2033. Key drivers include increasing foreign investments and a growing emphasis on compliance and transparency among local businesses amid economic recovery.Middle East & Africa Auditing Services Market Report:

The Middle East and Africa region is valued at USD 0.88 billion in 2023 and expected to reach USD 1.72 billion by 2033. Increasing economic diversification and strengthening regulatory frameworks drive the growth of auditing services in this region.Tell us your focus area and get a customized research report.

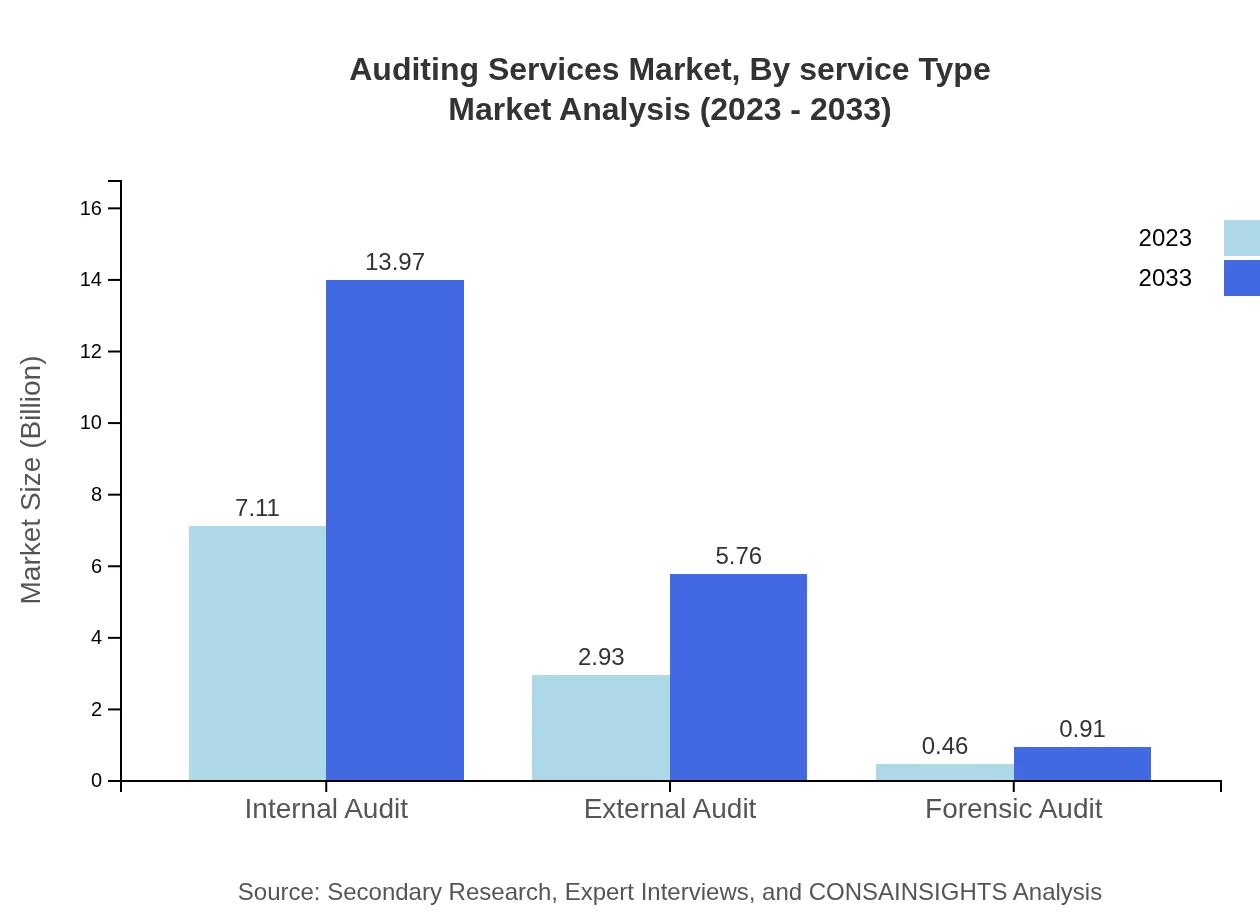

Auditing Services Market Analysis By Service Type

The market is significantly influenced by various service types, including Internal Audits, External Audits, and Forensic Audits. Internal Audits dominate with a market size of USD 7.11 billion in 2023 and projected to grow to USD 13.97 billion by 2033. External Audits contribute USD 2.93 billion and are expected to reach USD 5.76 billion in the same period. Forensic Audits, though smaller, are seeing growth due to increasing fraud detection requirements.

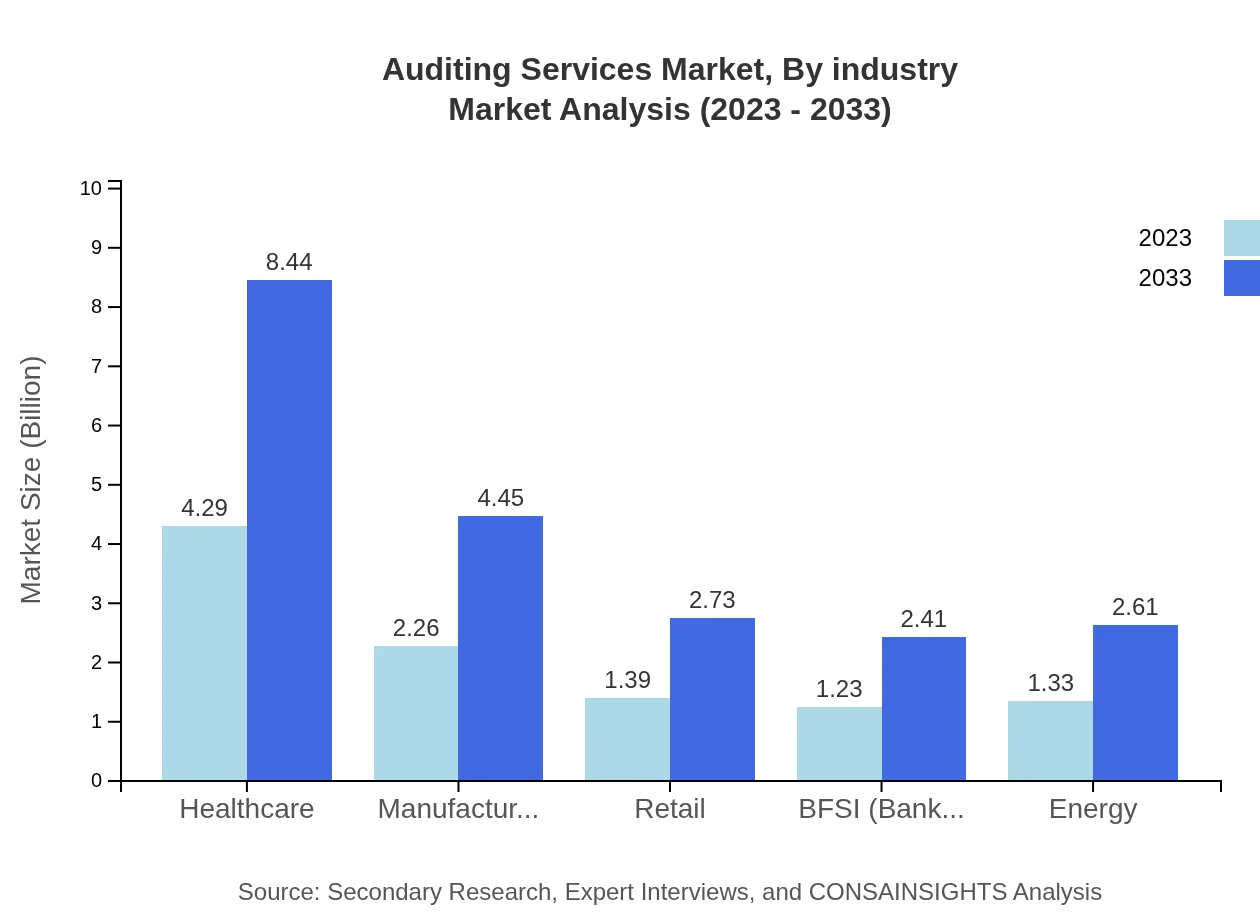

Auditing Services Market Analysis By Industry

The Healthcare sector leads the industry segment with a market value of USD 4.29 billion in 2023 and projected to reach USD 8.44 billion by 2033. Other key industries include Manufacturing at USD 2.26 billion and Retail at USD 1.39 billion in 2023. The BFSI sector also holds significant value at USD 1.23 billion, reflecting the industry's increasing regulatory pressures.

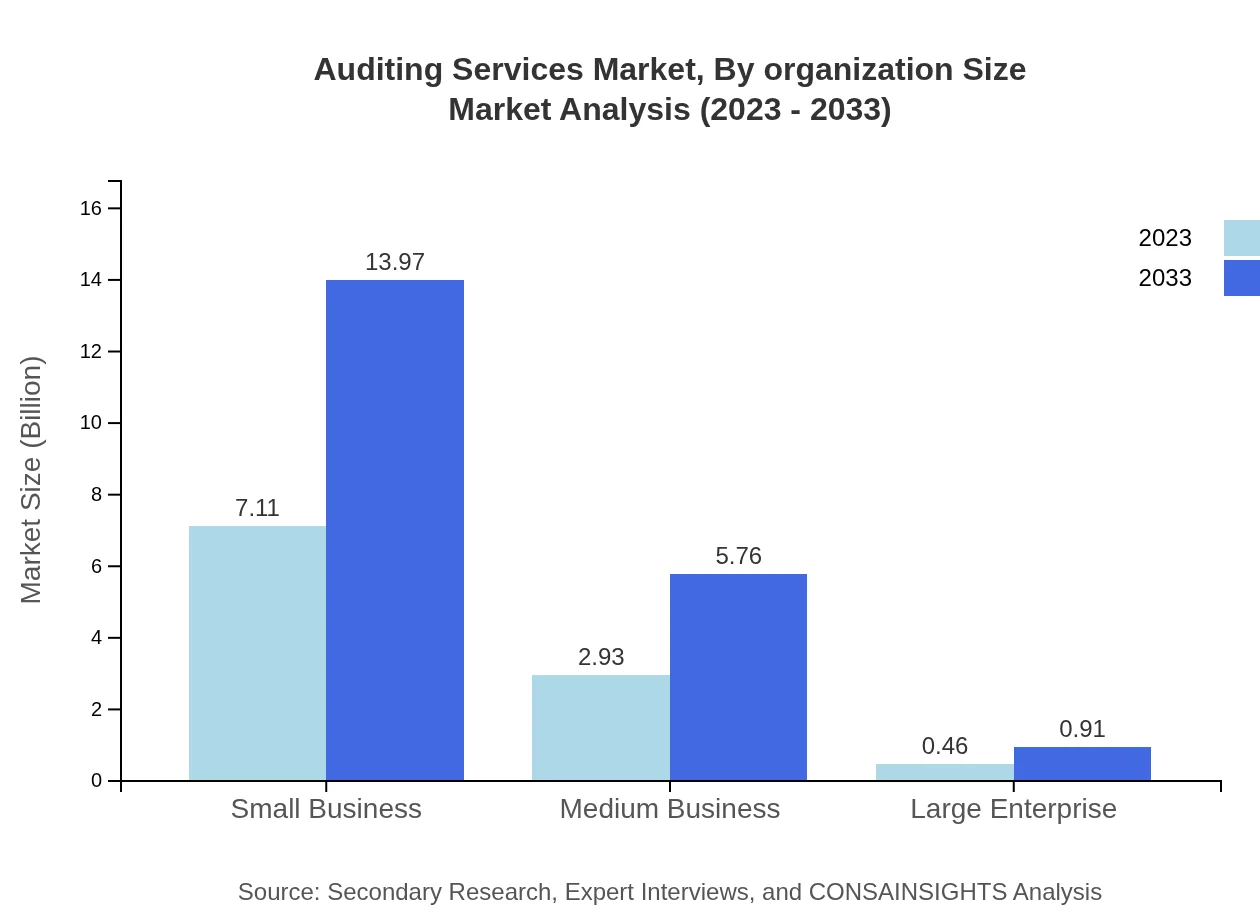

Auditing Services Market Analysis By Organization Size

The segmentations by organization size show that Small Businesses dominate the market, valued at USD 7.11 billion and expected to grow to USD 13.97 billion by 2033. Medium Businesses and Large Enterprises also contribute but at lower values, responding to increasing demands for compliance and risk audits.

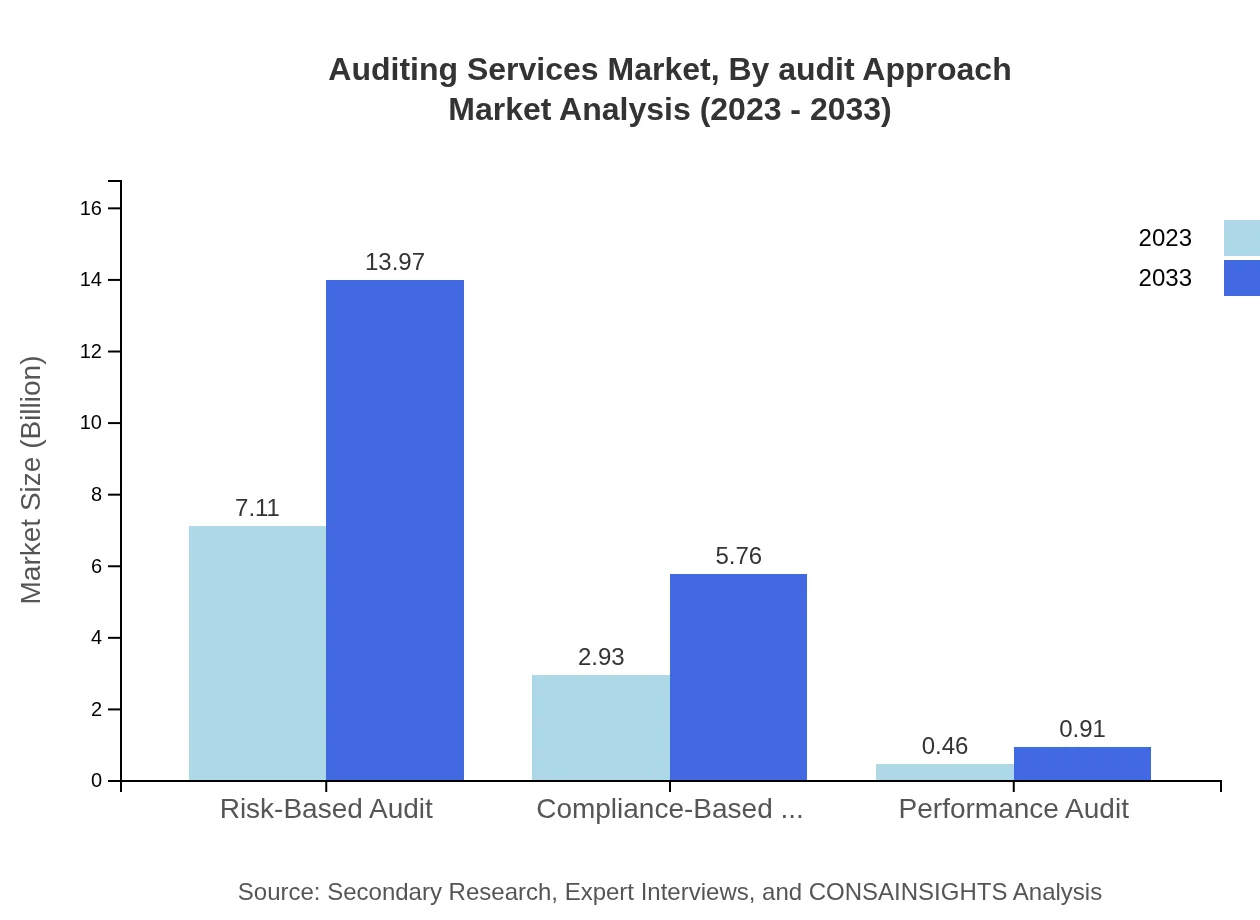

Auditing Services Market Analysis By Audit Approach

The market segmentation by audit approach indicates dominance of Risk-Based Audits, which currently have a market size of USD 7.11 billion and are expected to reach USD 13.97 billion by 2033. Compliance-Based Audits follow closely with a market of USD 2.93 billion and expected growth. These trends reflect a shift towards proactive risk management.

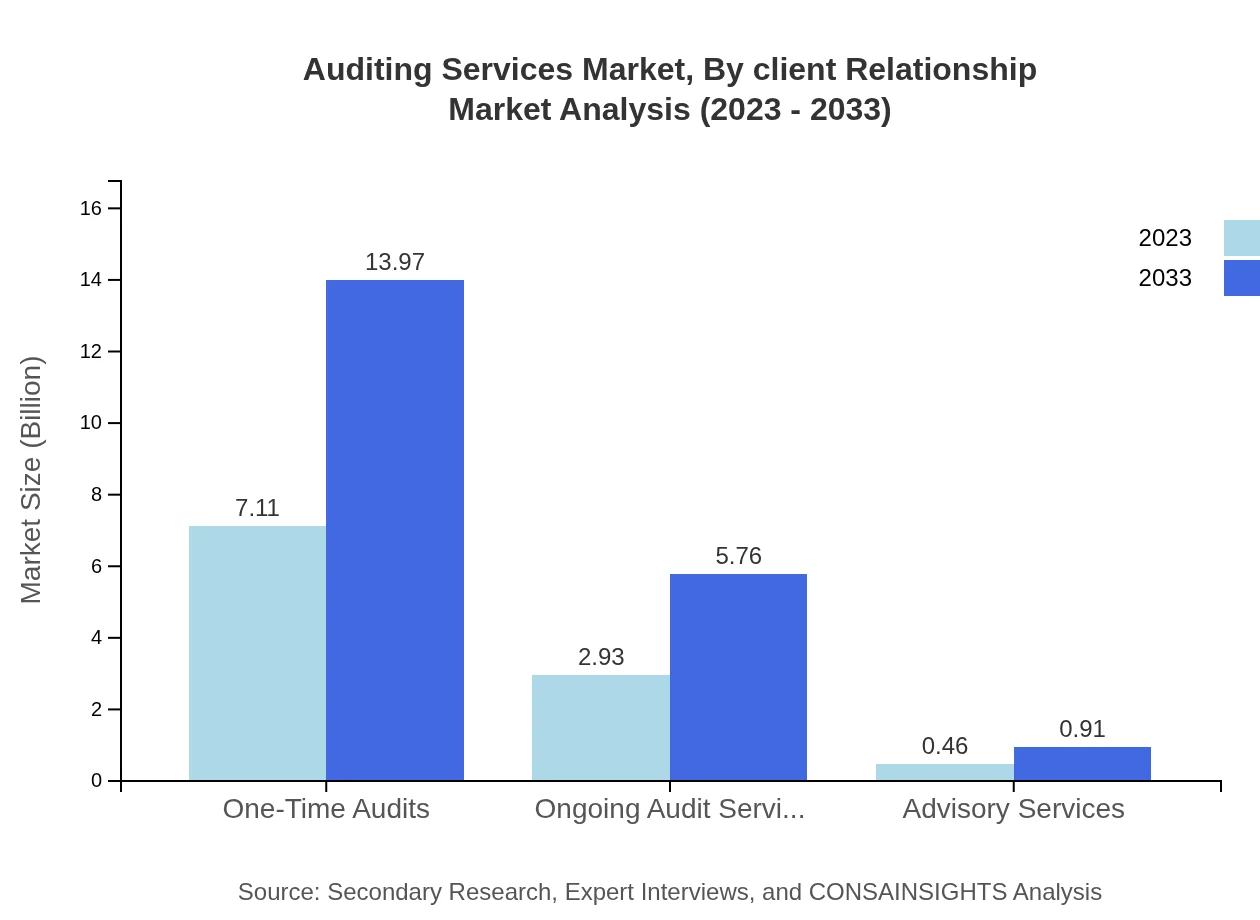

Auditing Services Market Analysis By Client Relationship

In terms of client relationships, One-Time Audits are significant, valued at USD 7.11 billion and projected to grow to USD 13.97 billion by 2033. Ongoing Audit Services also play a crucial role, emphasizing the shift to continuous monitoring and compliance in the market.

Auditing Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Auditing Services Industry

Deloitte:

Deloitte is one of the Big Four accounting firms providing audit, tax, consulting, and financial advisory services globally. Their innovative audit solutions leverage advanced technology to ensure compliance and enhance efficiency.PricewaterhouseCoopers (PwC):

PwC offers comprehensive auditing services known for integrating technological advancements in their audits. They play a crucial role in helping organizations achieve compliance and build stakeholder confidence.Ernst & Young (EY):

EY is recognized for its robust auditing methodologies and commitment to quality and integrity in financial reporting. Their global reach and expert teams support a diverse client base.KPMG:

KPMG delivers high-quality auditing, tax, and advisory services. Their focus on innovation and understanding of local markets enables them to provide tailored solutions to clients worldwide.Grant Thornton:

Grant Thornton is a leading global network of independent assurance, tax, and advisory firms specializing in mid-market auditing services. They prioritize building trust and transparency through their audit processes.We're grateful to work with incredible clients.

FAQs

What is the market size of auditing Services?

The auditing services market is currently valued at $10.5 billion, with a projected CAGR of 6.8%. This growth indicates increasing demand for compliance and financial security across various sectors.

What are the key market players or companies in this auditing Services industry?

The key players in the auditing services industry include major firms like Deloitte, PwC, EY, and KPMG, along with numerous smaller regional and niche firms providing specialized services.

What are the primary factors driving the growth in the auditing Services industry?

Factors driving growth include regulatory compliance requirements, increasing market complexity, technological advancements, and rising demand for risk management solutions across various industries.

Which region is the fastest Growing in the auditing Services?

The fastest-growing region in auditing services is North America, expected to grow from $3.78 billion in 2023 to $7.44 billion by 2033, indicating a robust market opportunity.

Does ConsaInsights provide customized market report data for the auditing Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the auditing-services industry, ensuring clients receive relevant and actionable insights.

What deliverables can I expect from this auditing Services market research project?

Expect deliverables such as comprehensive reports, market analysis, segmentation data, competitive landscape assessments, and actionable recommendations for market entry or expansion.

What are the market trends of auditing Services?

Current trends include increased automation in auditing processes, emphasis on cybersecurity audits, and growing demand for sustainability audits as companies prioritize ESG (Environmental, Social, and Governance) criteria.