Automated Analyzers Market Report

Published Date: 22 January 2026 | Report Code: automated-analyzers

Automated Analyzers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automated Analyzers market, covering key insights, market size, trends, and forecasts from 2023 to 2033.

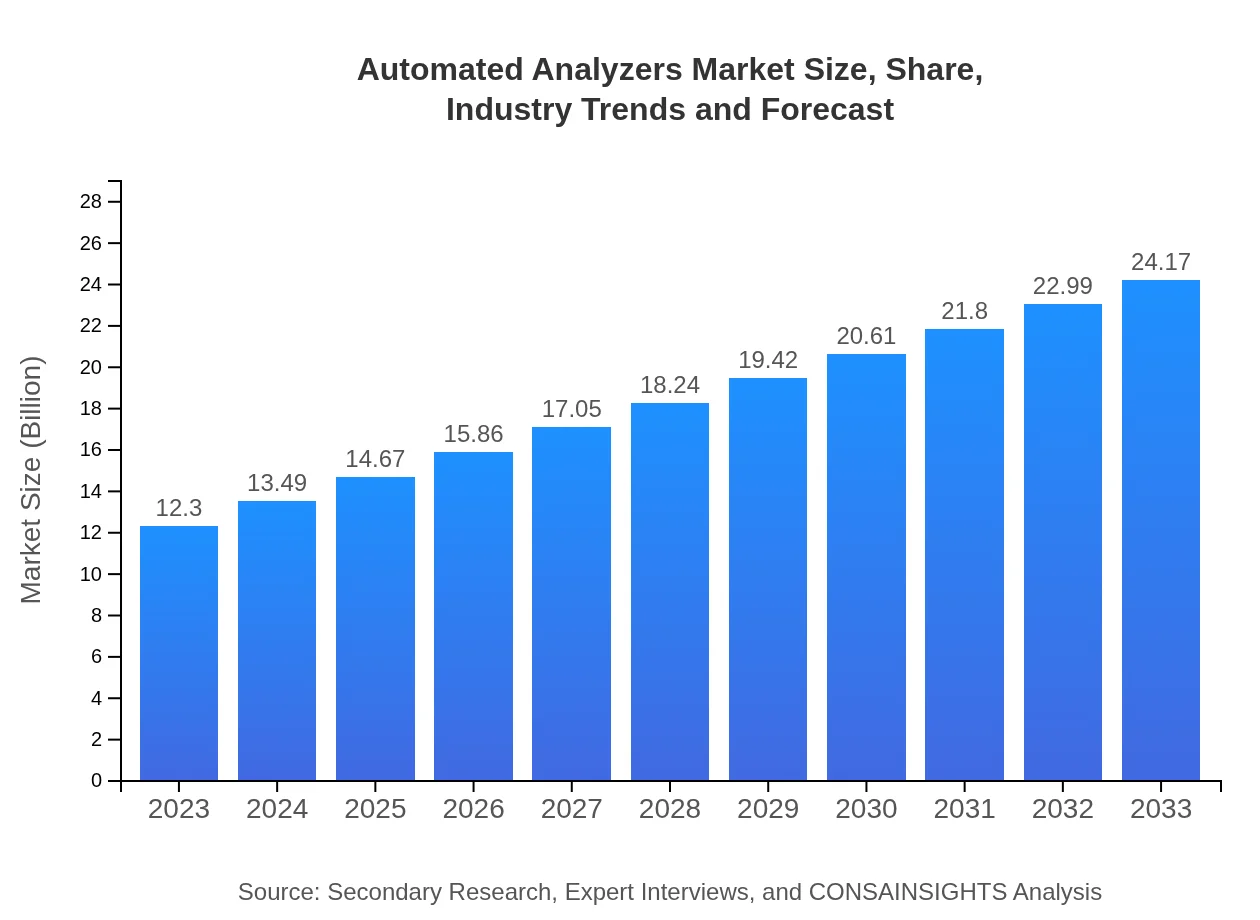

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.17 Billion |

| Top Companies | Abbott Laboratories, Thermo Fisher Scientific, Roche Diagnostics, Siemens Healthineers, Danaher Corporation |

| Last Modified Date | 22 January 2026 |

Automated Analyzers Market Overview

Customize Automated Analyzers Market Report market research report

- ✔ Get in-depth analysis of Automated Analyzers market size, growth, and forecasts.

- ✔ Understand Automated Analyzers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Analyzers

What is the Market Size & CAGR of Automated Analyzers market in 2023?

Automated Analyzers Industry Analysis

Automated Analyzers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Analyzers Market Analysis Report by Region

Europe Automated Analyzers Market Report:

Europe's market is projected to expand from $3.38 billion in 2023 to $6.64 billion by 2033, driven by stringent regulations in healthcare and environmental testing, alongside technological advancements in analyzers.Asia Pacific Automated Analyzers Market Report:

The Asia Pacific region is expected to witness significant growth, with market size projected to increase from $2.39 billion in 2023 to $4.70 billion by 2033. Factors include a large population, investments in healthcare infrastructure, and rising disease prevalence, driving demand for advanced diagnostic solutions.North America Automated Analyzers Market Report:

North America leads the market with a size of approximately $4.58 billion in 2023, projected to reach $9.00 billion by 2033. Significant investments in healthcare technology, the prevalence of chronic diseases, and a growing emphasis on early diagnosis are major contributing factors.South America Automated Analyzers Market Report:

In South America, the market is anticipated to grow from $0.89 billion in 2023 to $1.75 billion by 2033. The growth is attributed to increasing healthcare expenditure and an expanding pharmaceutical sector, which demands more automated testing solutions.Middle East & Africa Automated Analyzers Market Report:

The Middle East and Africa market is expected to grow from $1.06 billion in 2023 to $2.09 billion by 2033 as the region invests in healthcare reform, improving laboratory infrastructure, and increased demand for automated analyzers.Tell us your focus area and get a customized research report.

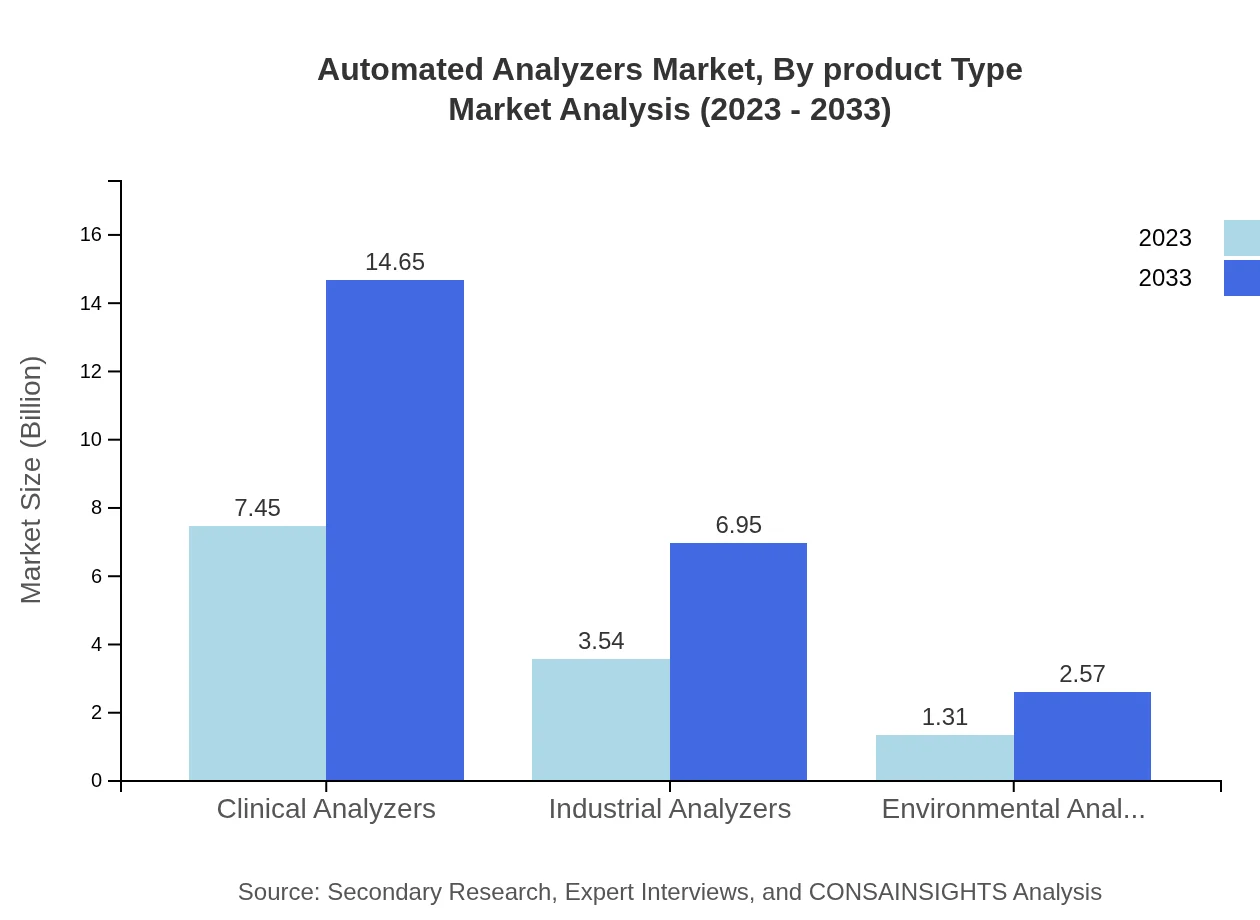

Automated Analyzers Market Analysis By Product Type

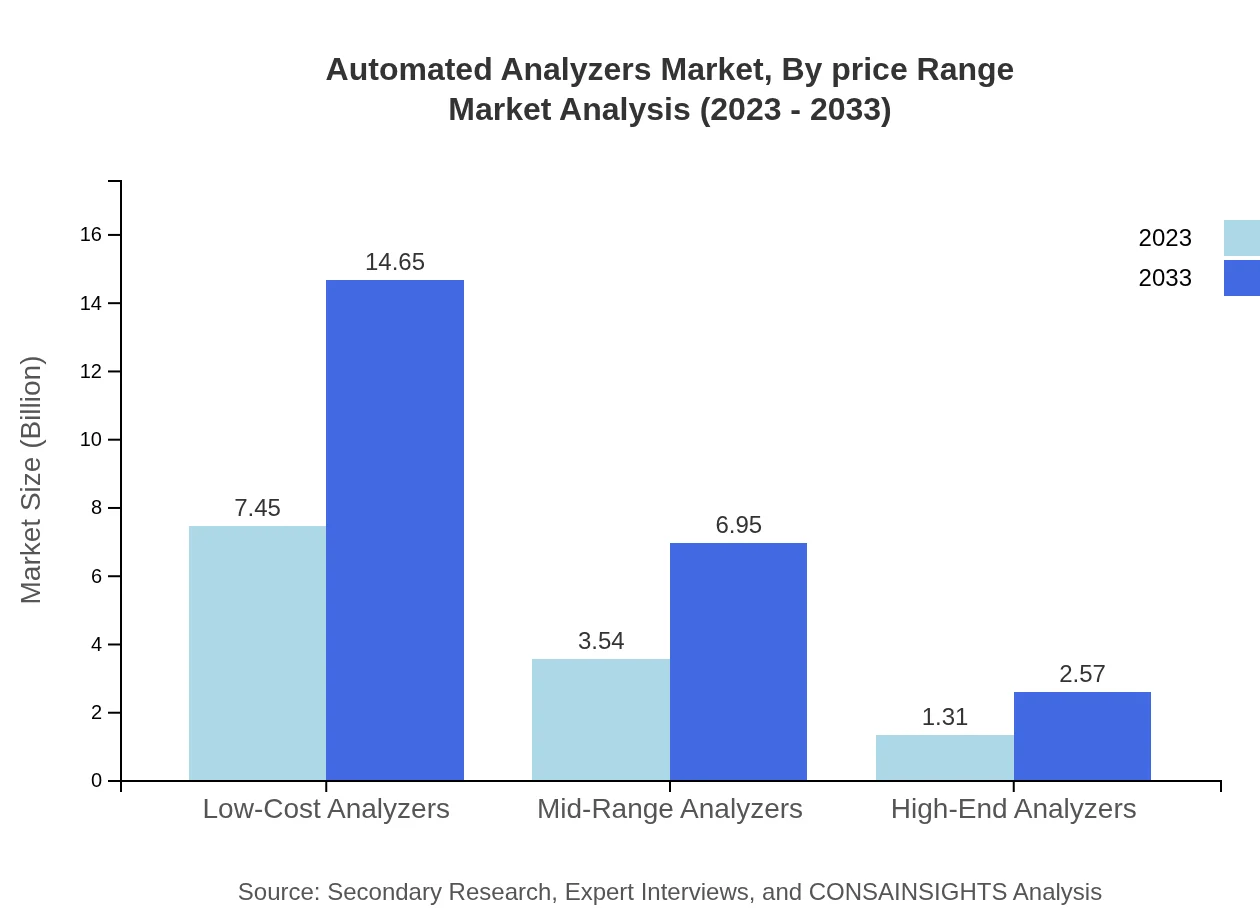

The Automated Analyzers market by product type highlights the distinct performance of various categories. Low-cost analyzers dominate with a market size of $7.45 billion in 2023, projected to increase to $14.65 billion by 2033, showcasing strong demand, particularly in resource-limited settings. Mid-range analyzers and high-end analyzers follow, with respective sizes of $3.54 billion and $1.31 billion in 2023, growing to $6.95 billion and $2.57 billion by 2033, as technological advancements bridge the gap between cost and performance.

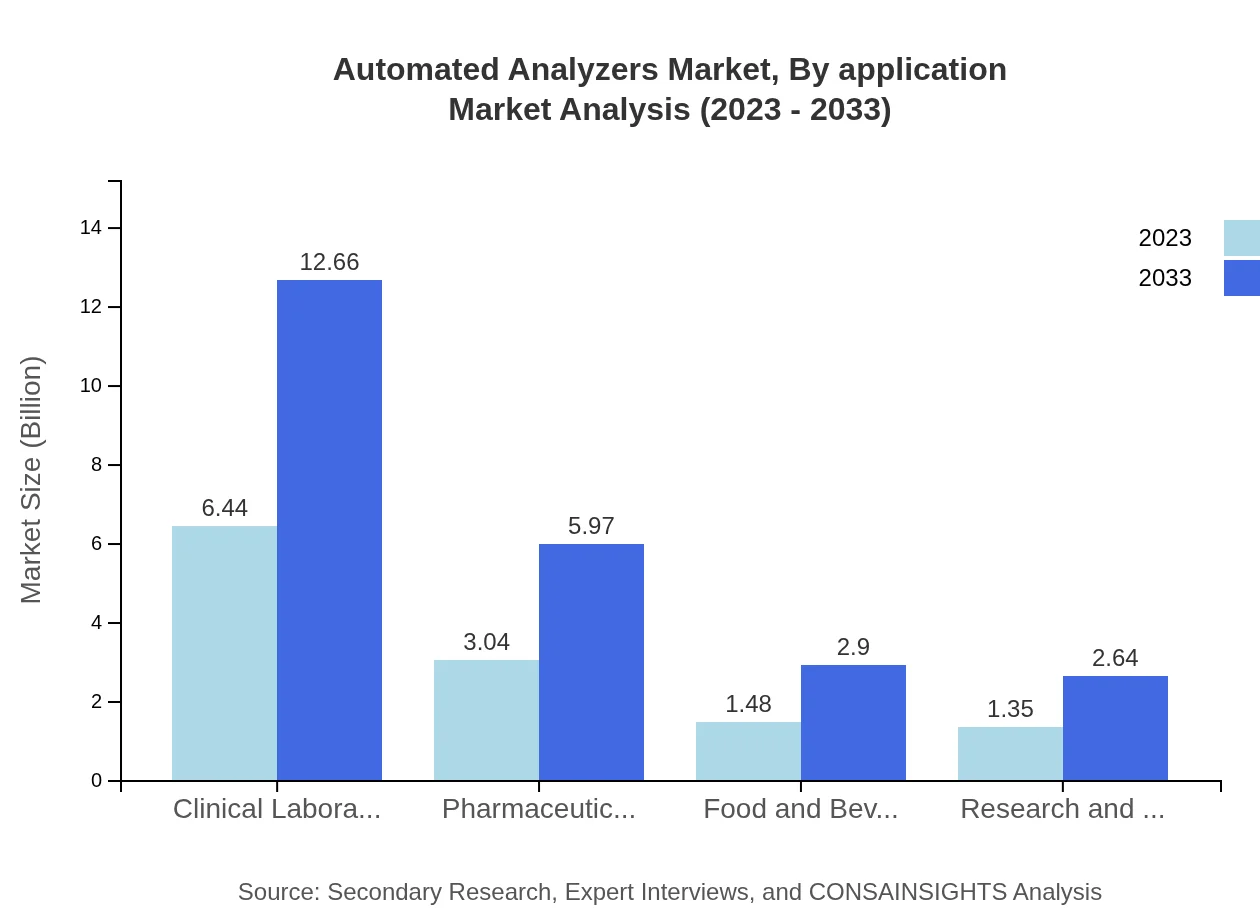

Automated Analyzers Market Analysis By Application

In terms of application, clinical laboratories hold a significant share, generating $6.44 billion in 2023 with stability expected through 2033. Diagnostic laboratories and environmental testing also represent sizeable market segments, projected to grow from $3.04 billion to $5.97 billion and from $1.35 billion to $2.64 billion, respectively, as demands for quality assurance increase in various industries.

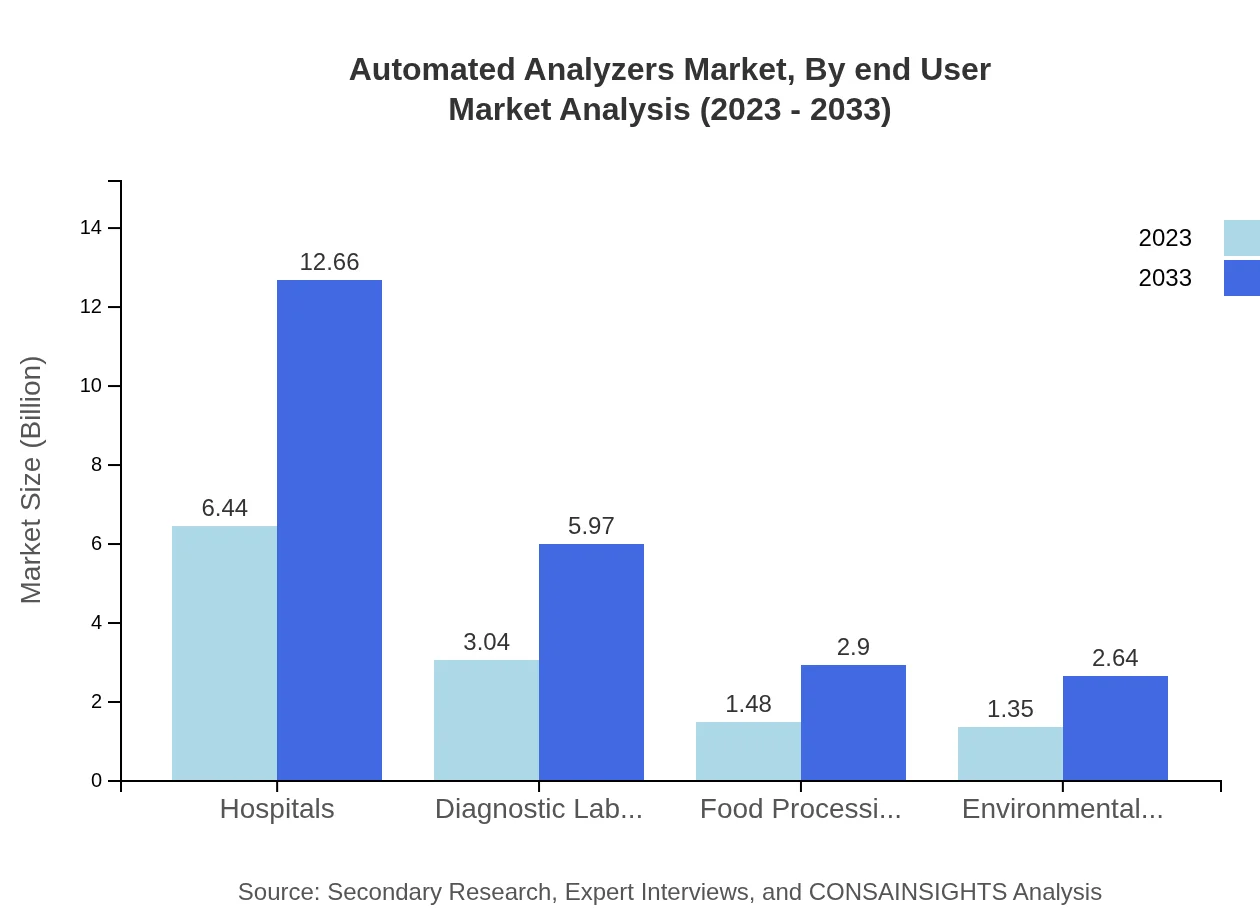

Automated Analyzers Market Analysis By End User

Research settings and clinical laboratories occupy a pivotal market share, with hospitals leading at $6.44 billion in 2023 and remaining constant through 2033. Their reliance on precise measures and high-volume diagnostics solidifies their role, while other segments, like pharmaceutical industries, also see growth driven by regulatory requirements.

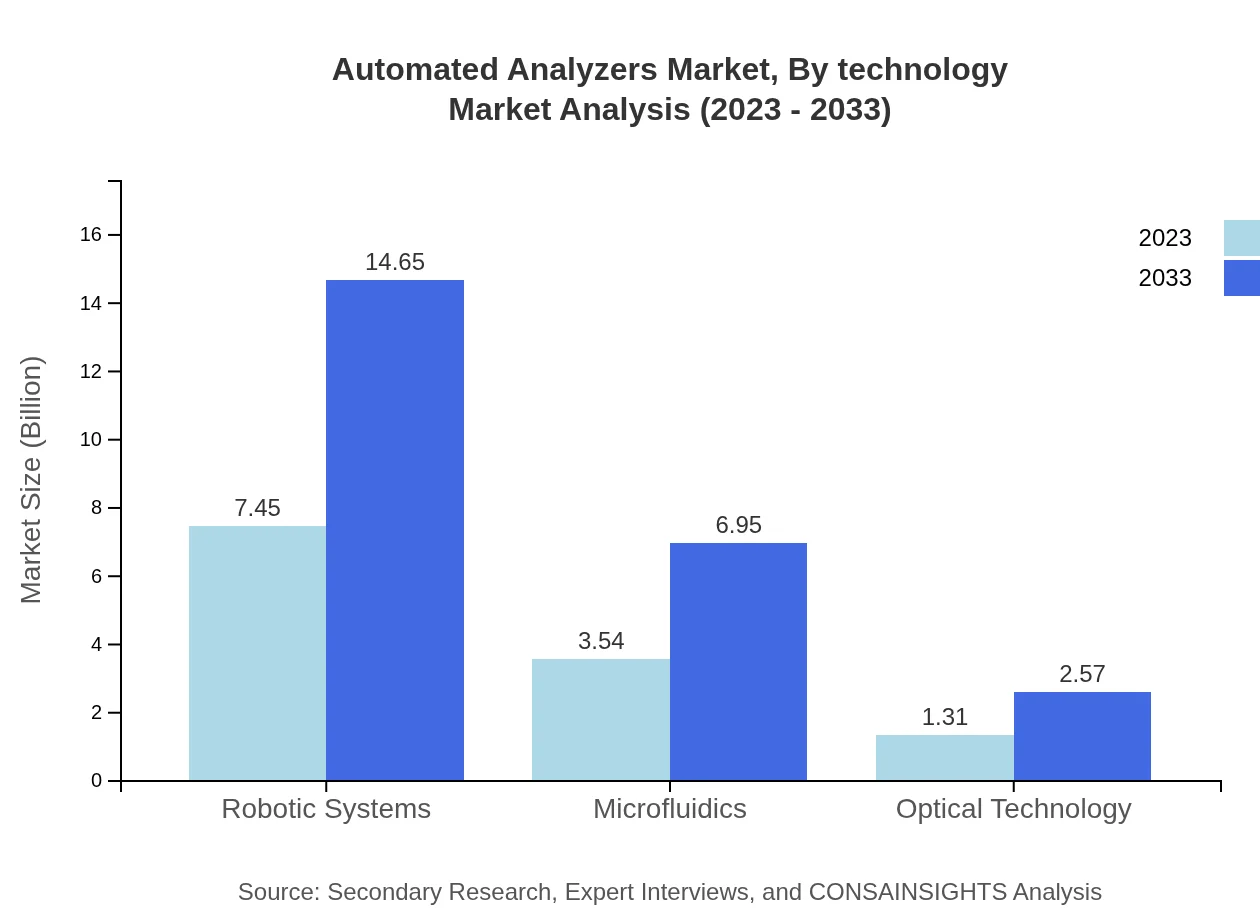

Automated Analyzers Market Analysis By Technology

Technology-wise, microfluidics and robotic systems are emerging as notable trends in automated analyzers with respective shares of 28.76% and 60.59% in 2023, enhancing efficiency and accuracy in analytical processes.

Automated Analyzers Market Analysis By Price Range

The price range segmentation reveals a preference for low-cost analyzers (60.59%) among end-users, which account for $7.45 billion in 2023, reflecting the necessity for affordability without compromising on quality, especially in developing regions.

Automated Analyzers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Analyzers Industry

Abbott Laboratories:

Abbott Laboratories is a global healthcare company that specializes in the development of advanced diagnostic solutions, particularly in the area of automated analyzers for clinical diagnostics.Thermo Fisher Scientific:

Thermo Fisher Scientific is a leader in the realm of scientific services, including providing automated analytical instruments focusing on reliability and performance in various laboratory settings.Roche Diagnostics:

Roche Diagnostics is recognized for innovative healthcare solutions, providing an extensive line of automated analyzers that enhance testing efficiency in laboratories worldwide.Siemens Healthineers:

Siemens Healthineers stands out for its comprehensive portfolio in diagnostic imaging and laboratory diagnostics, producing cutting-edge automated analyzers that improve healthcare workflows.Danaher Corporation:

Danaher Corporation specializes in life sciences and diagnostics, offering a range of automated analyzers that meet the needs of clinical and industrial applications, emphasizing high accuracy.We're grateful to work with incredible clients.

FAQs

What is the market size of automated Analyzers?

The global automated analyzers market is valued at approximately $12.3 billion in 2023, with a projected CAGR of 6.8% until 2033. This growth is driven by increasing demand for efficient lab solutions across healthcare and environmental sectors.

What are the key market players or companies in the automated Analyzers industry?

Prominent players in the automated analyzers market include major companies like Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, and Thermo Fisher Scientific. These entities influence market dynamics through innovation and strategic partnerships.

What are the primary factors driving the growth in the automated Analyzers industry?

Key growth drivers for the automated analyzers market encompass technological advancements, a rise in chronic diseases necessitating testing, and the demand for automation in laboratories to enhance efficiency and accuracy.

Which region is the fastest Growing in automated Analyzers?

North America is the fastest-growing region in the automated analyzers market, projected to expand from $4.58 billion in 2023 to $9.00 billion by 2033. This growth is fueled by advancements in healthcare infrastructure and increasing healthcare investments.

Does ConsaInsights provide customized market report data for the automated Analyzers industry?

Yes, ConsaInsights offers customized market reports for the automated analyzers industry. Clients can request tailored insights to meet their specific business needs and strategic planning.

What deliverables can I expect from this automated Analyzers market research project?

Deliverables from the automated analyzers market research project typically include detailed market analysis, growth forecasts, competitive landscape overviews, and consumer behavior insights to aid strategic decision-making.

What are the market trends of automated Analyzers?

Current market trends in automated analyzers highlight a shift towards integration of AI in diagnostic processes, increased demand for point-of-care testing, and growing adoption of portable analyzing devices across various industries.