Automated Container Terminal Market Report

Published Date: 22 January 2026 | Report Code: automated-container-terminal

Automated Container Terminal Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automated Container Terminal market, covering market size, trends, and growth forecasts from 2023 to 2033. Insights and detailed data across various segments and regions are included to assist stakeholders in making informed decisions.

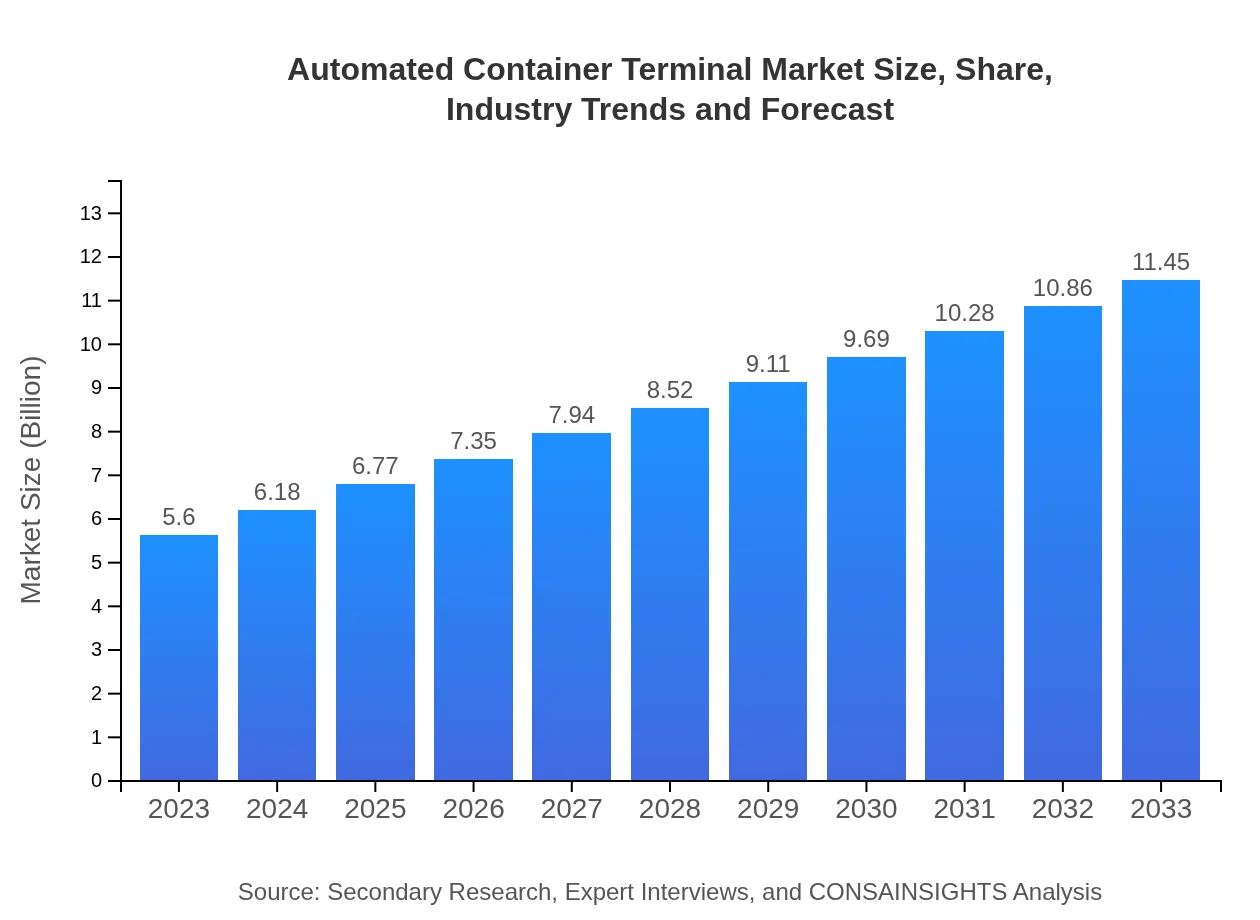

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Konecranes, Cavotec, ABB, Terex |

| Last Modified Date | 22 January 2026 |

Automated Container Terminal Market Overview

Customize Automated Container Terminal Market Report market research report

- ✔ Get in-depth analysis of Automated Container Terminal market size, growth, and forecasts.

- ✔ Understand Automated Container Terminal's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Container Terminal

What is the Market Size & CAGR of Automated Container Terminal market in 2023?

Automated Container Terminal Industry Analysis

Automated Container Terminal Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Container Terminal Market Analysis Report by Region

Europe Automated Container Terminal Market Report:

Europe's Automated Container Terminal market is expected to see growth from $1.71 billion in 2023 to $3.50 billion by 2033. The region’s focus on sustainable transport and logistics is influencing terminal operators to embrace automation.Asia Pacific Automated Container Terminal Market Report:

The Asia Pacific region is projected to experience substantial growth, with the market size expanding from $1.01 billion in 2023 to $2.07 billion by 2033. The region’s rapid urbanization, increasing trade, and government investments in port infrastructure are the key growth drivers.North America Automated Container Terminal Market Report:

North America, projected to reach $4.26 billion by 2033 from a market size of $2.08 billion in 2023, is witnessing increased automation in ports driven by technological advancements and growing operational efficiencies required by shipping lines.South America Automated Container Terminal Market Report:

In South America, the market is expected to grow from $0.52 billion in 2023 to $1.07 billion by 2033. Infrastructure improvements and the demand for efficient logistics solutions in the region's burgeoning economies will support this growth.Middle East & Africa Automated Container Terminal Market Report:

The Middle East and Africa region shows a positive market trend, anticipating growth from $0.27 billion in 2023 to $0.55 billion by 2033. Rising trade within the region and the enhancement of maritime infrastructure are central to this development.Tell us your focus area and get a customized research report.

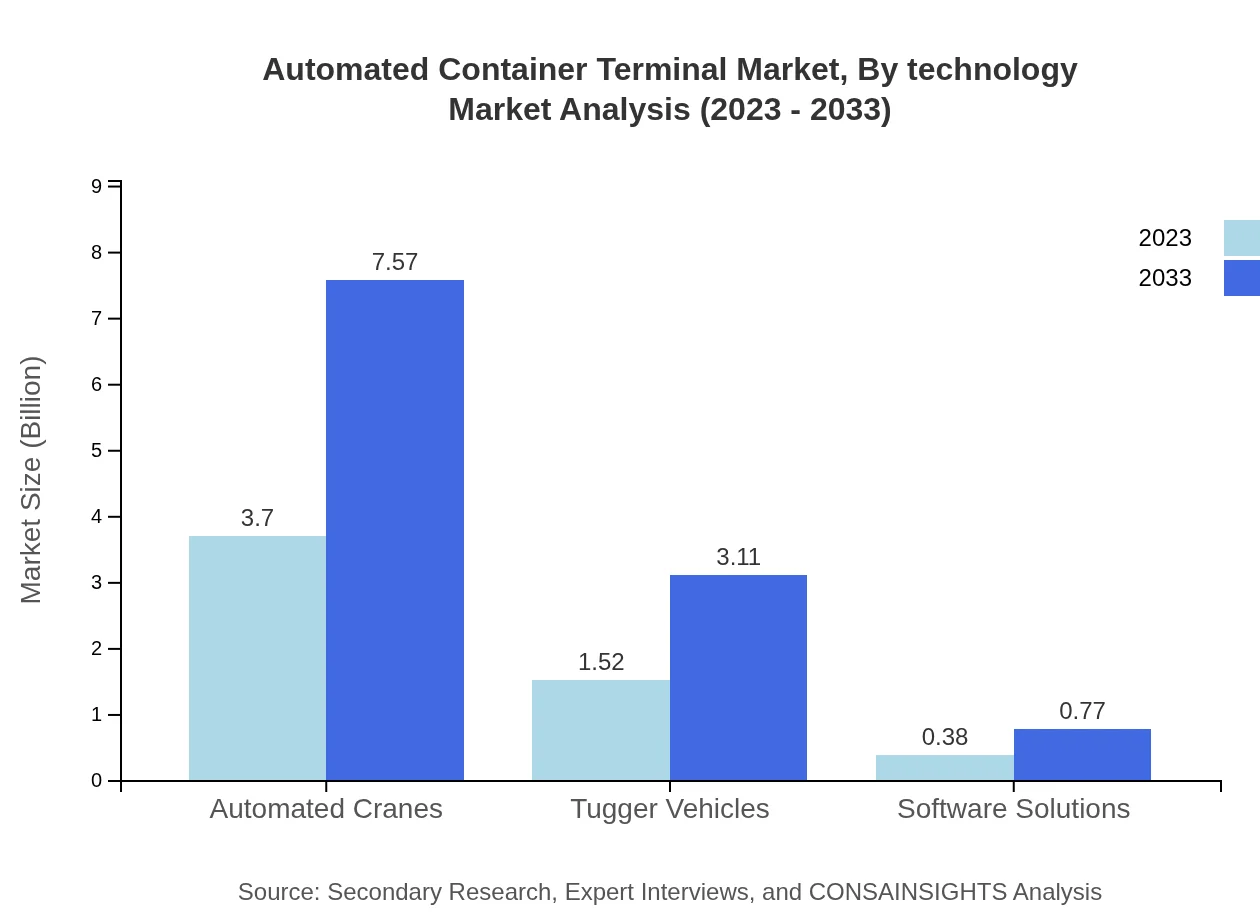

Automated Container Terminal Market Analysis By Technology

The technology segment of the Automated Container Terminal market is dominated by automated cranes, which represent a major portion of the market, growing from $3.70 billion in 2023 to $7.57 billion by 2033, reflecting a significant share of 66.11%. Software solutions are also gaining traction, expected to increase from $0.38 billion to $0.77 billion, showcasing the strong reliance on technology to enhance operational efficiency.

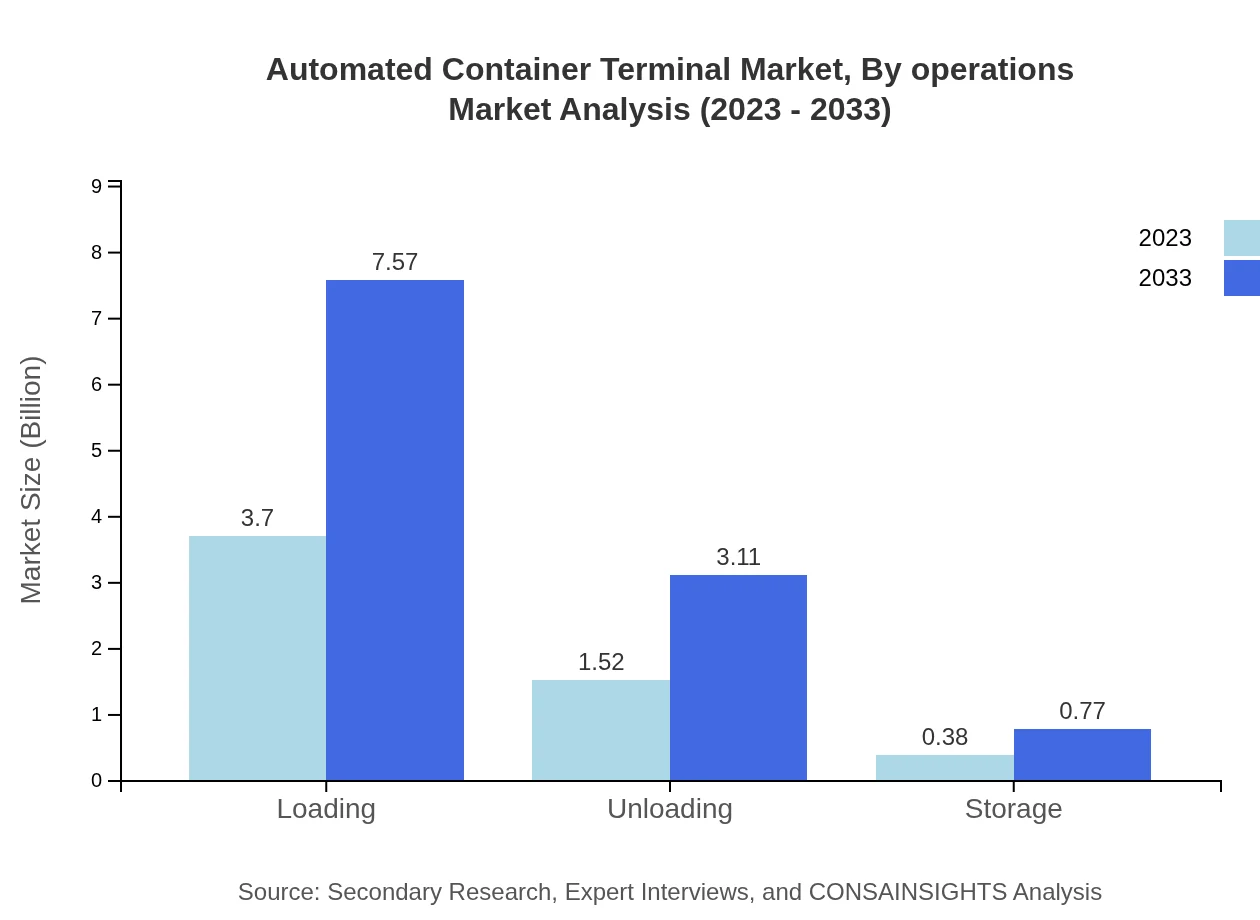

Automated Container Terminal Market Analysis By Operations

The operational segment shows significant growth potential, particularly in loading and unloading operations. Loading operations alone are projected to achieve a market size of $7.57 billion by 2033, while unloading will expand to $3.11 billion. This indicates the industry's focus on streamlining these core functionalities through automation.

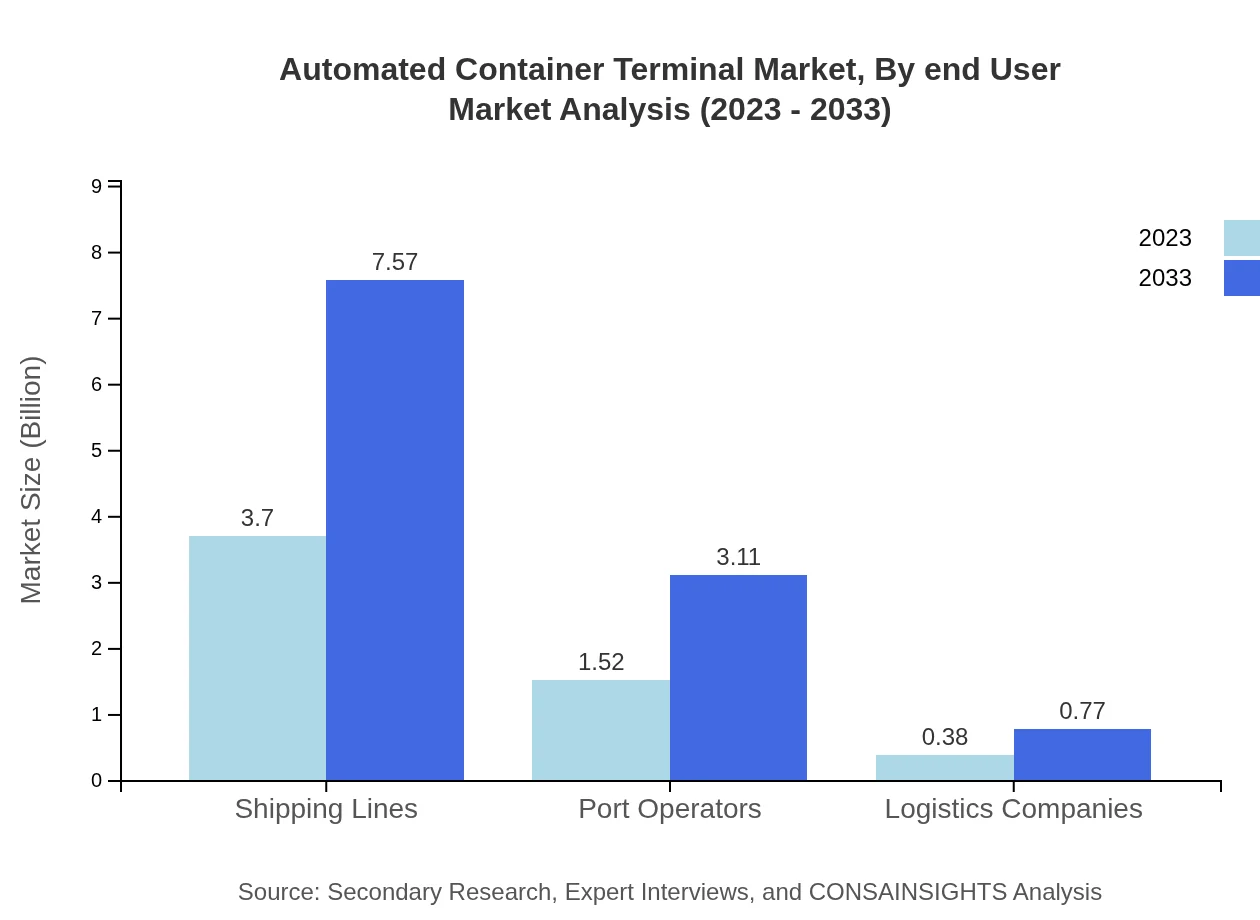

Automated Container Terminal Market Analysis By End User

The major players in the end-user segment consist of shipping lines, which lead the market with a substantial share of 66.11%. Port operators hold a significant portion of the market as well, showing an expected rise from $1.52 billion in 2023 to $3.11 billion in 2033.

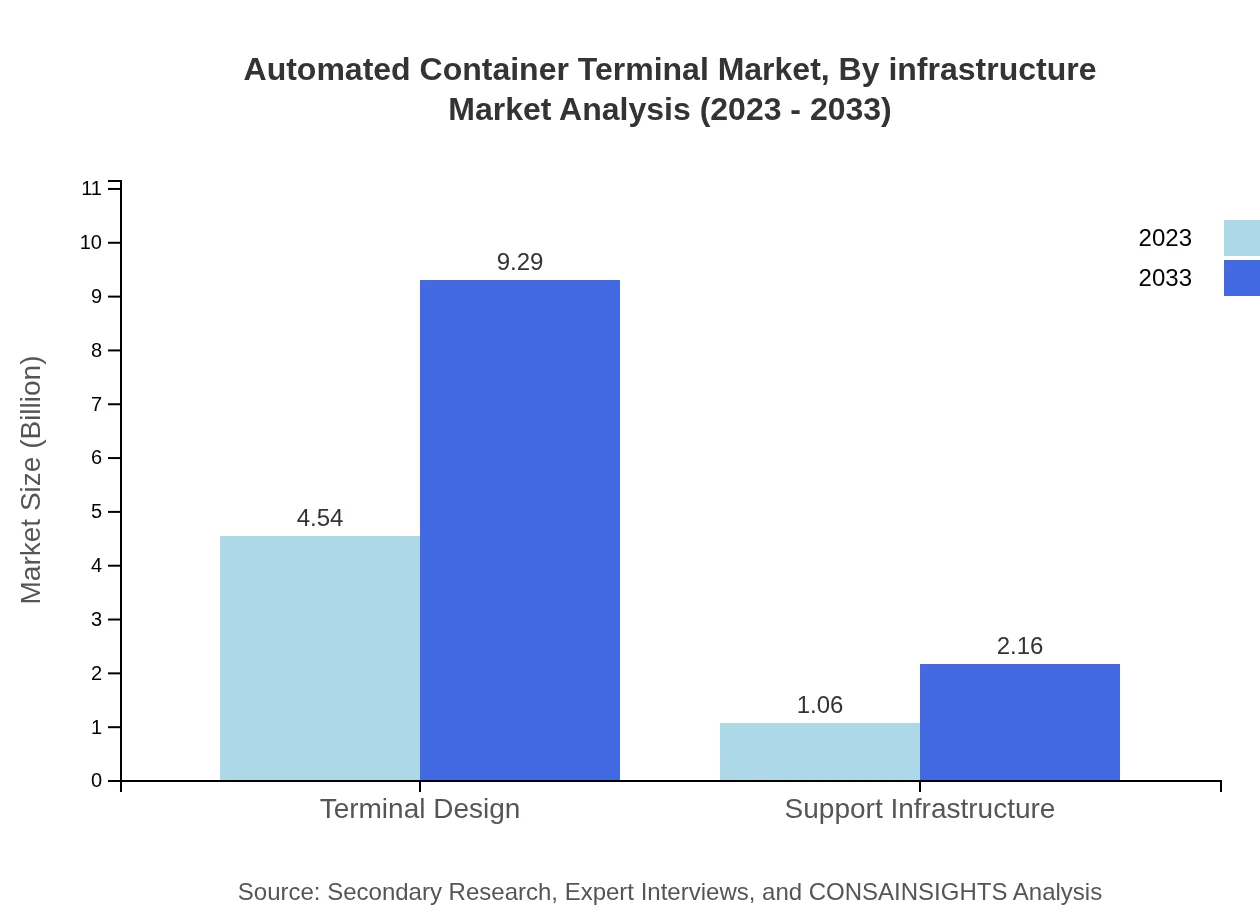

Automated Container Terminal Market Analysis By Infrastructure

In terms of infrastructure, the automated container terminal market emphasizes greenfield developments, which account for 81.13% of the total market. Greenfield developments are projected to grow significantly from $4.54 billion in 2023 to $9.29 billion in 2033, highlighting the importance of new, state-of-the-art facilities in the industry.

Automated Container Terminal Market Analysis By Market Type

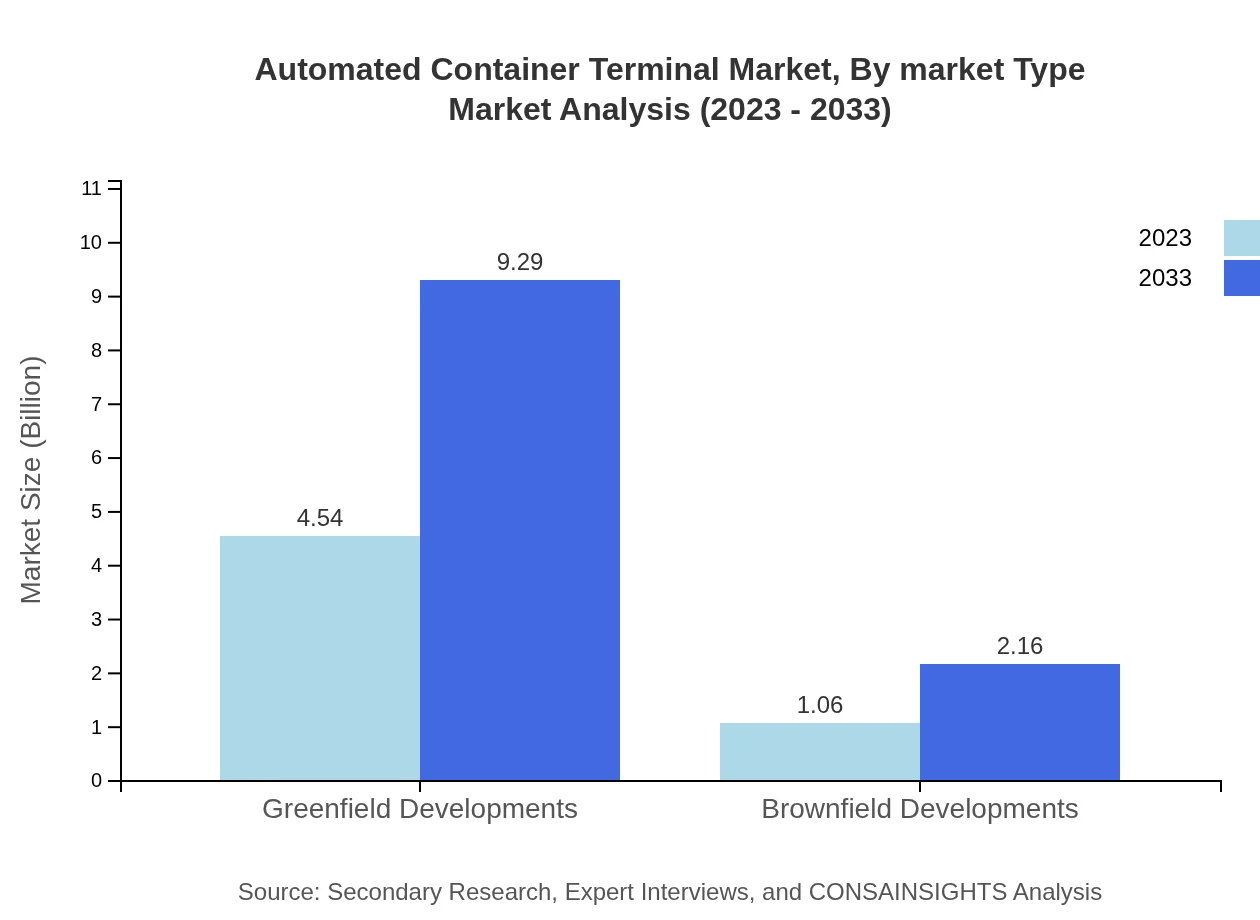

Market type analysis indicates a balanced division between greenfield and brownfield developments. Greenfield projects dominate the market due to new investments, while brownfield projects, though smaller, also contribute to the overall modernization efforts with anticipated growth from $1.06 billion to $2.16 billion by 2033.

Automated Container Terminal Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Container Terminal Industry

Konecranes:

A leader in container handling equipment, Konecranes provides innovative automated solutions that enhance operational efficiencies, catering to global shipping needs.Cavotec:

Cavotec offers advanced automation technologies like shore power and automated mooring systems, supporting sustainable shipping operations worldwide.ABB:

Providing robotics and automation solutions, ABB enhances productivity and safety in shipping terminals with industry-leading technologies.Terex:

A recognized player in the heavy equipment market, Terex delivers advanced container handling equipment and automation solutions tailored for ports.We're grateful to work with incredible clients.

FAQs

What is the market size of automated Container Terminal?

The automated container terminal market is valued at approximately $5.6 billion with an expected CAGR of 7.2% from 2023 to 2033, reflecting growth in technology integration and operational efficiency.

What are the key market players or companies in the automated Container Terminal industry?

Key players include major shipping and logistics companies, port operators, and technology firms specializing in automation solutions, significantly shaping the industry's landscape.

What are the primary factors driving the growth in the automated Container Terminal industry?

Growth drivers include increased trade volumes, demand for efficiency, advancements in automation technology, and the need for improved supply chain management solutions.

Which region is the fastest Growing in the automated Container Terminal?

Asia Pacific is expected to witness rapid growth, with market projections escalating from $1.01 billion in 2023 to $2.07 billion in 2033, driven by trade expansion and infrastructure investments.

Does ConsaInsights provide customized market report data for the automated Container Terminal industry?

Yes, ConsaInsights offers tailored market reports that can be customized based on specific client needs, focusing on detailed insights and data relevant to the automated container terminal sector.

What deliverables can I expect from this automated Container Terminal market research project?

Deliverables typically include comprehensive market analysis, data segmentation by region and technology, trend evaluations, and actionable insights tailored for strategic planning.

What are the market trends of automated Container Terminal?

Key trends include increased adoption of smart technologies, integration of IoT and AI for improved efficiency, a rising emphasis on sustainability, and ongoing infrastructure upgrades across global ports.