Automated Fingerprint Identification System Market Report

Published Date: 31 January 2026 | Report Code: automated-fingerprint-identification-system

Automated Fingerprint Identification System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automated Fingerprint Identification System market from 2023 to 2033, covering market trends, segmentation, regional insights, technology advancements, and future forecasts.

| Metric | Value |

|---|---|

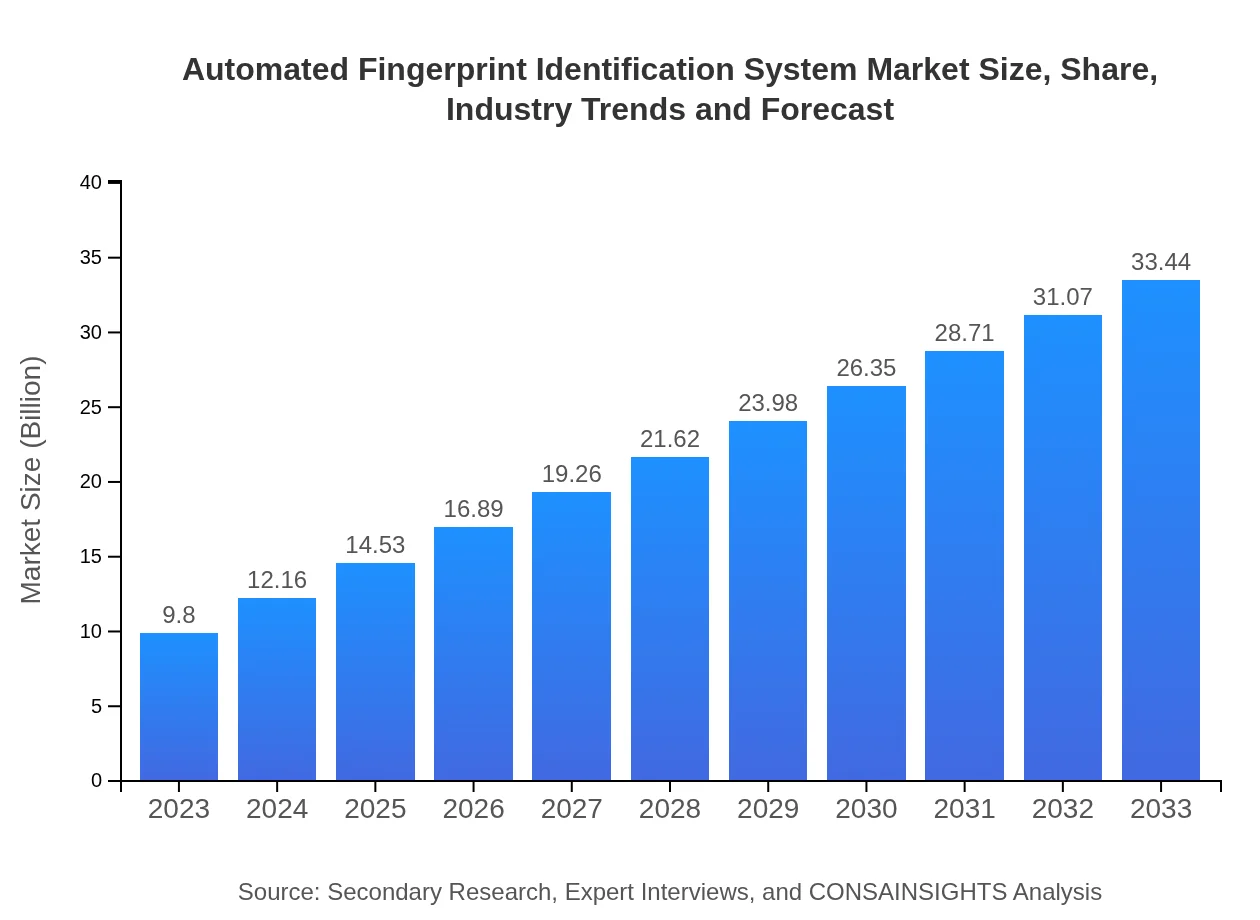

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.80 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $33.44 Billion |

| Top Companies | NEC Corporation, Interstate Technology and Regulatory Council (ITRC), Crossmatch Technologies, Gemalto, Fujitsu |

| Last Modified Date | 31 January 2026 |

Automated Fingerprint Identification System Market Overview

Customize Automated Fingerprint Identification System Market Report market research report

- ✔ Get in-depth analysis of Automated Fingerprint Identification System market size, growth, and forecasts.

- ✔ Understand Automated Fingerprint Identification System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Fingerprint Identification System

What is the Market Size & CAGR of Automated Fingerprint Identification System market in 2023?

Automated Fingerprint Identification System Industry Analysis

Automated Fingerprint Identification System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Fingerprint Identification System Market Analysis Report by Region

Europe Automated Fingerprint Identification System Market Report:

In Europe, the market is expected to rise from $3.41 billion in 2023 to $11.64 billion by 2033. Stringent regulations regarding identity verification and an increase in security threats contribute to this growth.Asia Pacific Automated Fingerprint Identification System Market Report:

The Asia Pacific region is witnessing rapid technological adoption, with the market growing from $1.85 billion in 2023 to $6.32 billion by 2033. The demand in countries like China and India stems from increasing populational security measures and urbanization.North America Automated Fingerprint Identification System Market Report:

North America remains a leader in the AFIS market, projected to grow from $3.26 billion in 2023 to $11.11 billion by 2033. The region's advanced infrastructure and extensive application in law enforcement and financial services significantly drive growth.South America Automated Fingerprint Identification System Market Report:

In South America, the AFIS market size is projected to expand from $0.36 billion in 2023 to $1.21 billion by 2033. The focus is primarily on enhancing public safety measures and improving the criminal justice system.Middle East & Africa Automated Fingerprint Identification System Market Report:

The Middle East and Africa are projected to see growth from $0.92 billion in 2023 to $3.15 billion by 2033. The rising focus on national security and large-scale government initiatives to deploy biometric technologies fuel this region's market.Tell us your focus area and get a customized research report.

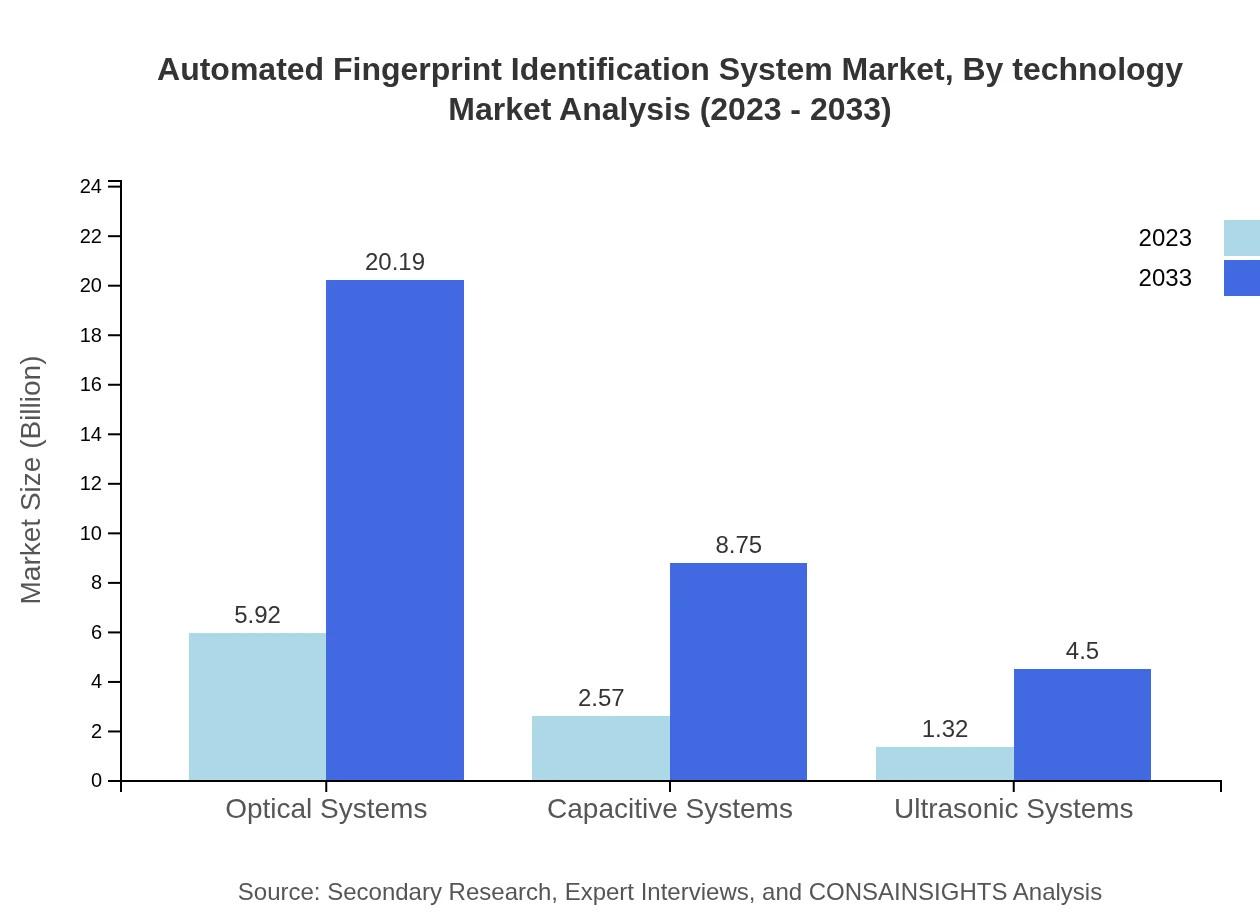

Automated Fingerprint Identification System Market Analysis By Technology

The analysis of the AFIS market by technology reveals that optical systems dominate due to their affordability and reliability. Capacitive systems are gaining traction, particularly in smartphones and portable devices, while ultrasonic systems are emerging due to their accuracy in difficult conditions.

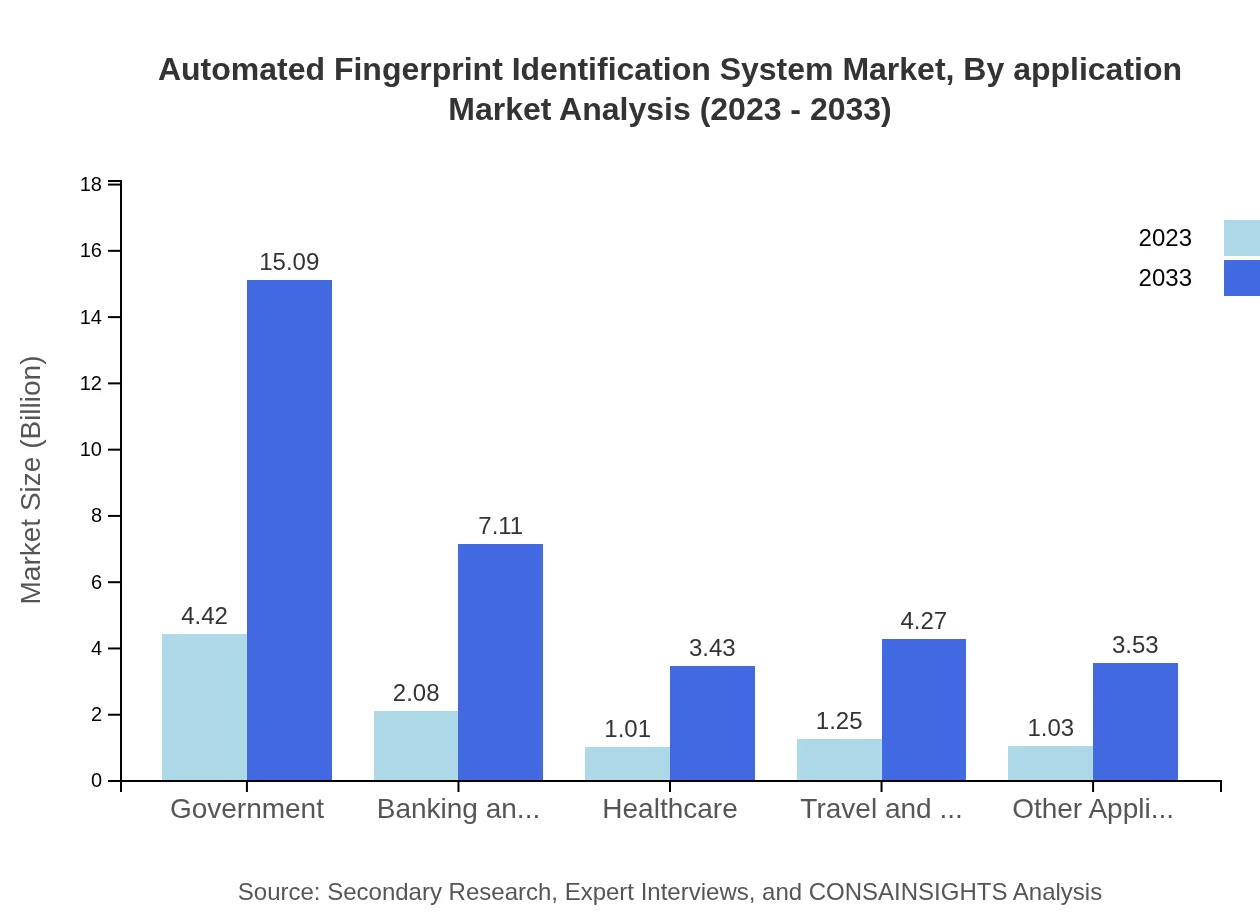

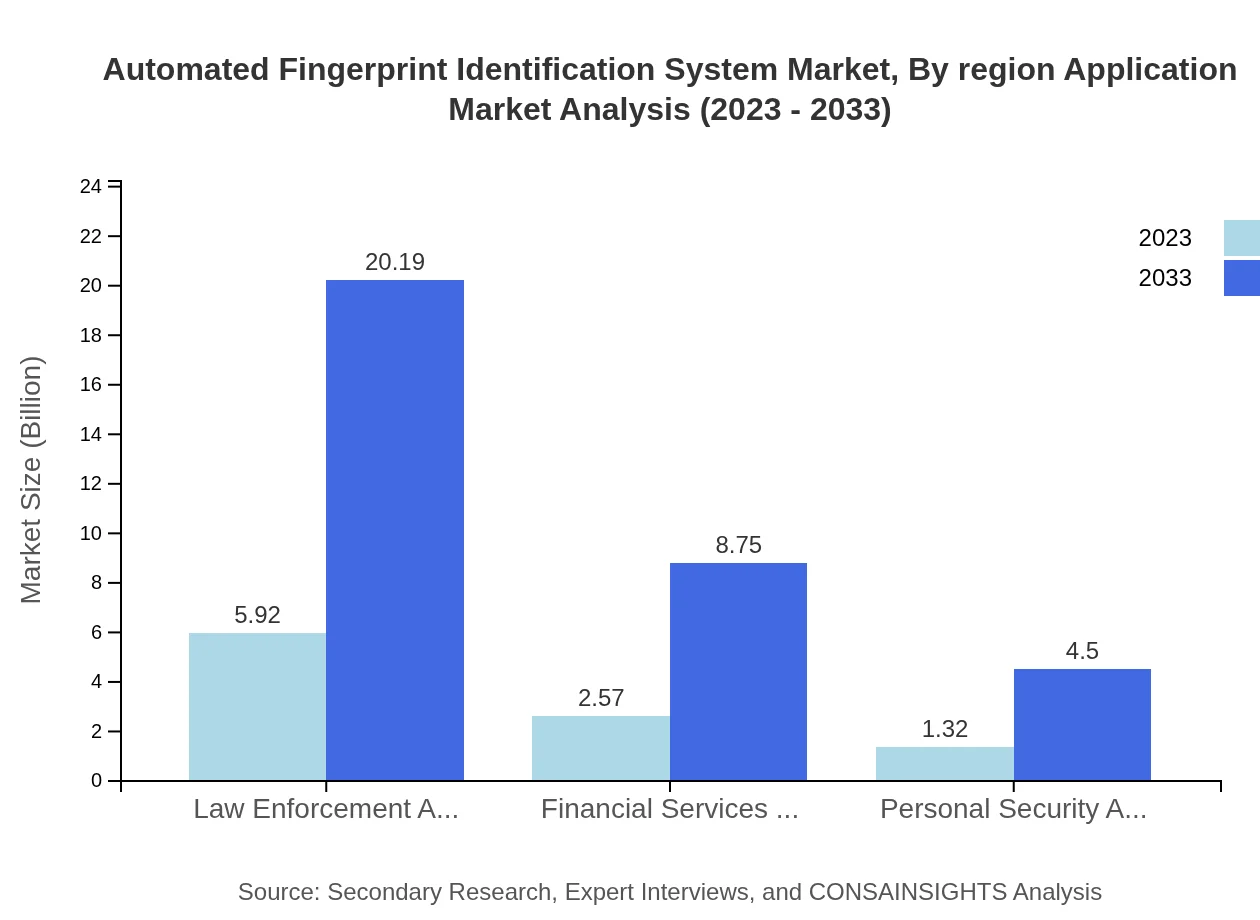

Automated Fingerprint Identification System Market Analysis By Application

In terms of application, the law enforcement segment leads, driven by the need for criminal identification and prevention. Other significant applications include banking, healthcare, and personal security, emphasizing the broad utility of fingerprint technologies.

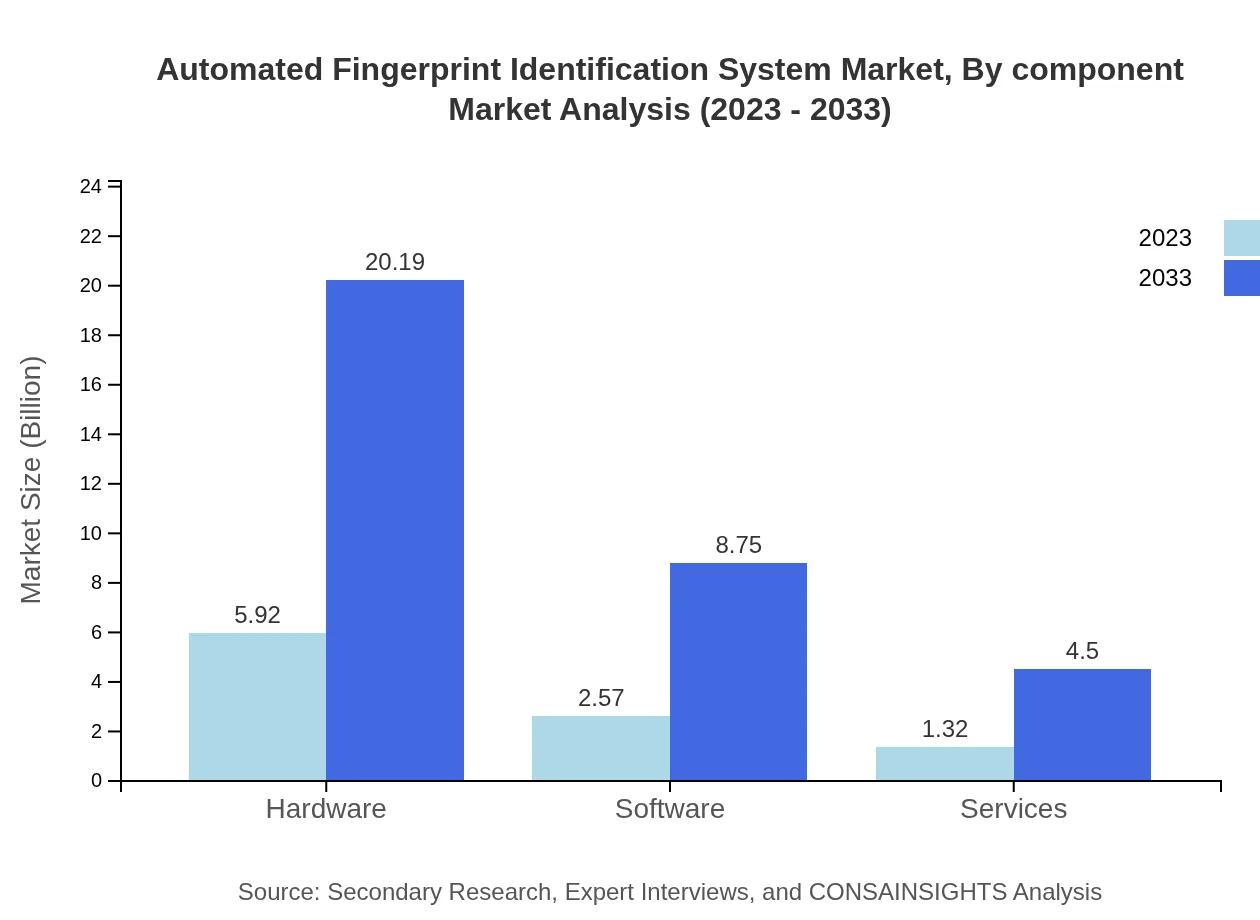

Automated Fingerprint Identification System Market Analysis By Component

The hardware segment represents a substantial portion of the market, particularly fingerprint scanners and enrollment systems. Software solutions are essential for data management, analysis, and integration with existing security systems.

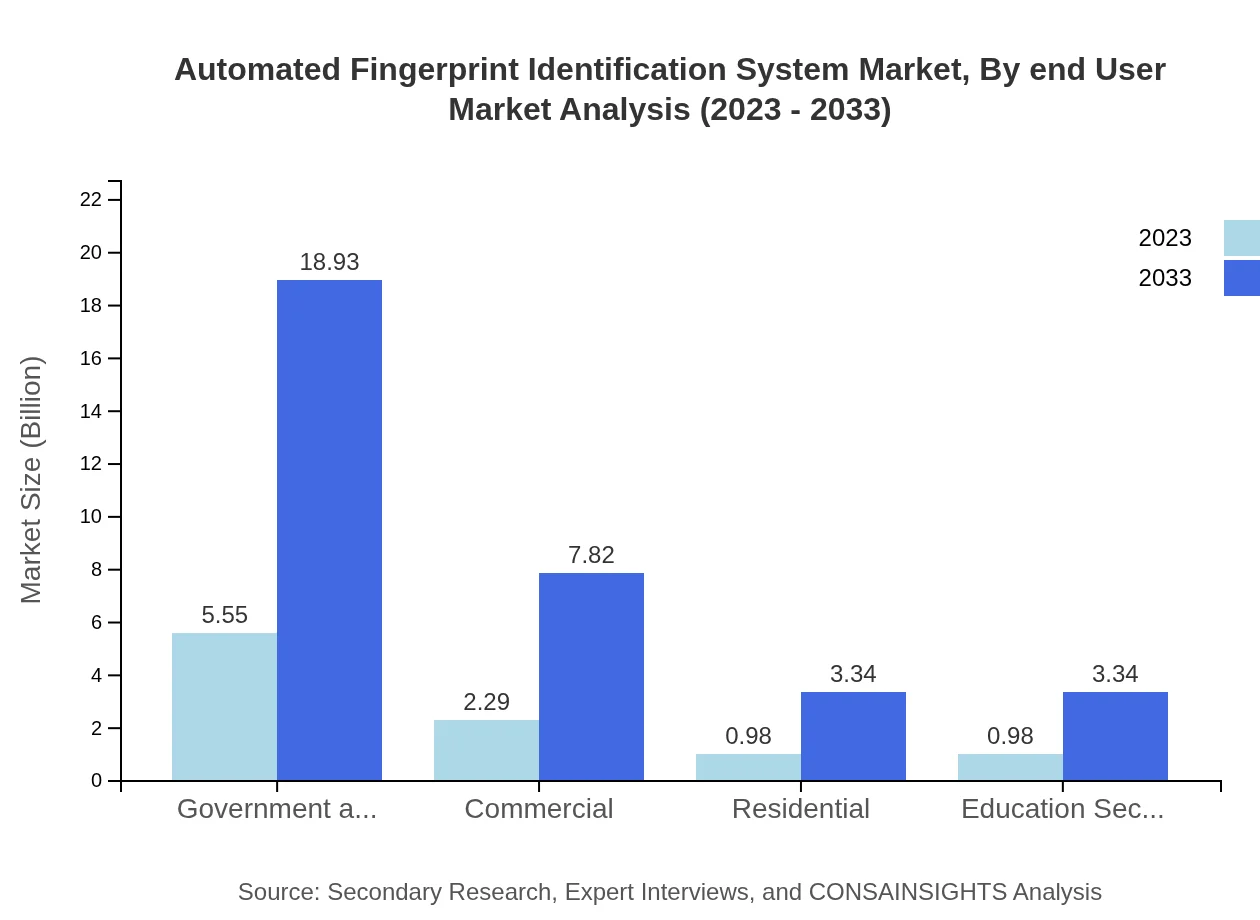

Automated Fingerprint Identification System Market Analysis By End User

Key end-users include governmental agencies, banks and financial institutions, and healthcare facilities, all requiring robust identity verification to mitigate fraud and enhance security systems.

Automated Fingerprint Identification System Market Analysis By Region Application

Regionally, North America and Europe demonstrate the highest demand for AFIS applications across law enforcement and financial sectors, with Asia-Pacific quickly catching up due to advancements and investments in biometric technologies.

Automated Fingerprint Identification System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Fingerprint Identification System Industry

NEC Corporation:

A leader in biometric solutions, NEC Corporation offers advanced fingerprint identification systems used in various applications, from law enforcement to border control.Interstate Technology and Regulatory Council (ITRC):

The ITRC provides guidance and support in the development and implementation of advanced fingerprint identification standards in various regulatory environments.Crossmatch Technologies:

Specializes in biometric identity management solutions which include fingerprint scanning and identification technologies utilized primarily in law enforcement.Gemalto:

A significant player in digital security, Gemalto provides fingerprint scanning capabilities integrated within its identity management solutions for various governmental applications.Fujitsu:

Offers a range of biometric technologies, including fingerprint recognition systems, catering primarily to security and identification needs in corporate and governmental sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of automated fingerprint identification system?

The automated fingerprint identification system market is currently valued at approximately $9.8 billion and is projected to grow at a CAGR of 12.5% over the next decade, highlighting its significant potential in security and identification sectors.

What are the key market players or companies in this automated fingerprint identification system industry?

Key players in the automated fingerprint identification system market include companies like NEC Corporation, HID Global Corporation, Thales Group, MorphoTrust USA, and Suprema, which are driving innovation and competing in hardware, software, and service segments.

What are the primary factors driving the growth in the automated fingerprint identification system industry?

The growth of the automated fingerprint identification system market can be attributed to increasing security concerns, advancements in biometric technology, rising cases of identity fraud, and the need for efficient access control systems in various sectors.

Which region is the fastest Growing in the automated fingerprint identification system?

Asia Pacific is notably the fastest-growing region in the automated fingerprint identification system market, with anticipated growth from $1.85 billion in 2023 to $6.32 billion by 2033, reflecting increasing investments in security infrastructure.

Does ConsaInsights provide customized market report data for the automated fingerprint identification system industry?

Yes, Consainsights offers customized market reports tailored to specific needs, enabling stakeholders to gain targeted insights related to various aspects of the automated fingerprint identification system industry.

What deliverables can I expect from this automated fingerprint identification system market research project?

Deliverables from the automated fingerprint identification system market research project typically include comprehensive market analysis, segmentation data, competitive landscape insights, regional trends, and forecasts, helping inform strategic decision-making.

What are the market trends of automated fingerprint identification system?

Current trends in the automated fingerprint identification system market include the shift towards mobile biometric solutions, integration with IoT devices, enhanced focus on multi-modal biometric systems, and increasing adoption across government and commercial sectors.