Automated Material Handling Amh Market Report

Published Date: 22 January 2026 | Report Code: automated-material-handling-amh

Automated Material Handling Amh Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automated Material Handling (AMH) market, detailing trends, forecasts, and market dynamics from 2023 to 2033. It covers market size, growth rates, regional insights, and major players in the industry.

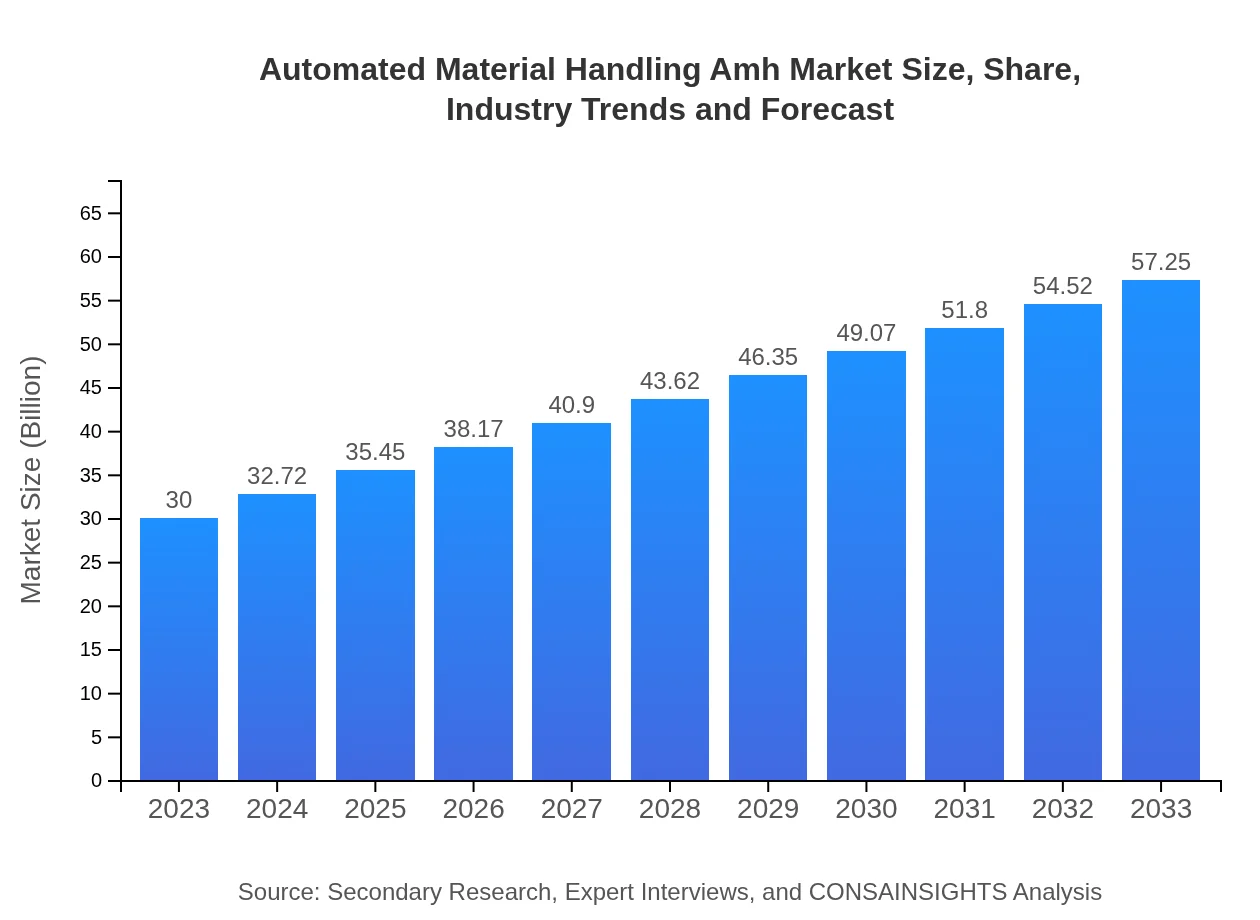

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $57.25 Billion |

| Top Companies | Siemens AG, KION Group AG, Honeywell Intelligrated, Rockwell Automation, Dematic |

| Last Modified Date | 22 January 2026 |

Automated Material Handling Amh Market Overview

Customize Automated Material Handling Amh Market Report market research report

- ✔ Get in-depth analysis of Automated Material Handling Amh market size, growth, and forecasts.

- ✔ Understand Automated Material Handling Amh's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Material Handling Amh

What is the Market Size & CAGR of Automated Material Handling Amh market in 2023 and 2033?

Automated Material Handling Amh Industry Analysis

Automated Material Handling Amh Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Material Handling Amh Market Analysis Report by Region

Europe Automated Material Handling Amh Market Report:

The European market is anticipated to grow from $10.17 billion in 2023 to $19.41 billion by 2033. Factors such as stringent regulations regarding operational efficiency and the increasing demand for high-speed automation in warehouses are major drivers.Asia Pacific Automated Material Handling Amh Market Report:

In 2023, the Asia Pacific Automated Material Handling market size was valued at $5.44 billion and is projected to reach $10.39 billion by 2033. The region is witnessing strong growth due to rapid industrialization, increasing e-commerce activities, and government initiatives supporting automation.North America Automated Material Handling Amh Market Report:

North America held a market size of $9.90 billion in 2023, with projections reaching $18.89 billion by 2033. The region is a leader in adopting automation technologies driven by innovations in robotics and a strong focus on enhancing operational efficiencies in logistics and warehousing.South America Automated Material Handling Amh Market Report:

The South American market was valued at $2.29 billion in 2023 and is expected to grow to $4.37 billion by 2033. Factors such as urbanization, growth in manufacturing sectors, and rising logistics efficiency needs are influencing this market’s trajectory.Middle East & Africa Automated Material Handling Amh Market Report:

The Middle East and Africa market size was $2.20 billion in 2023 and is expected to increase to $4.20 billion by 2033. The growth is being aided by infrastructural developments and rising demand for automated solutions in logistics.Tell us your focus area and get a customized research report.

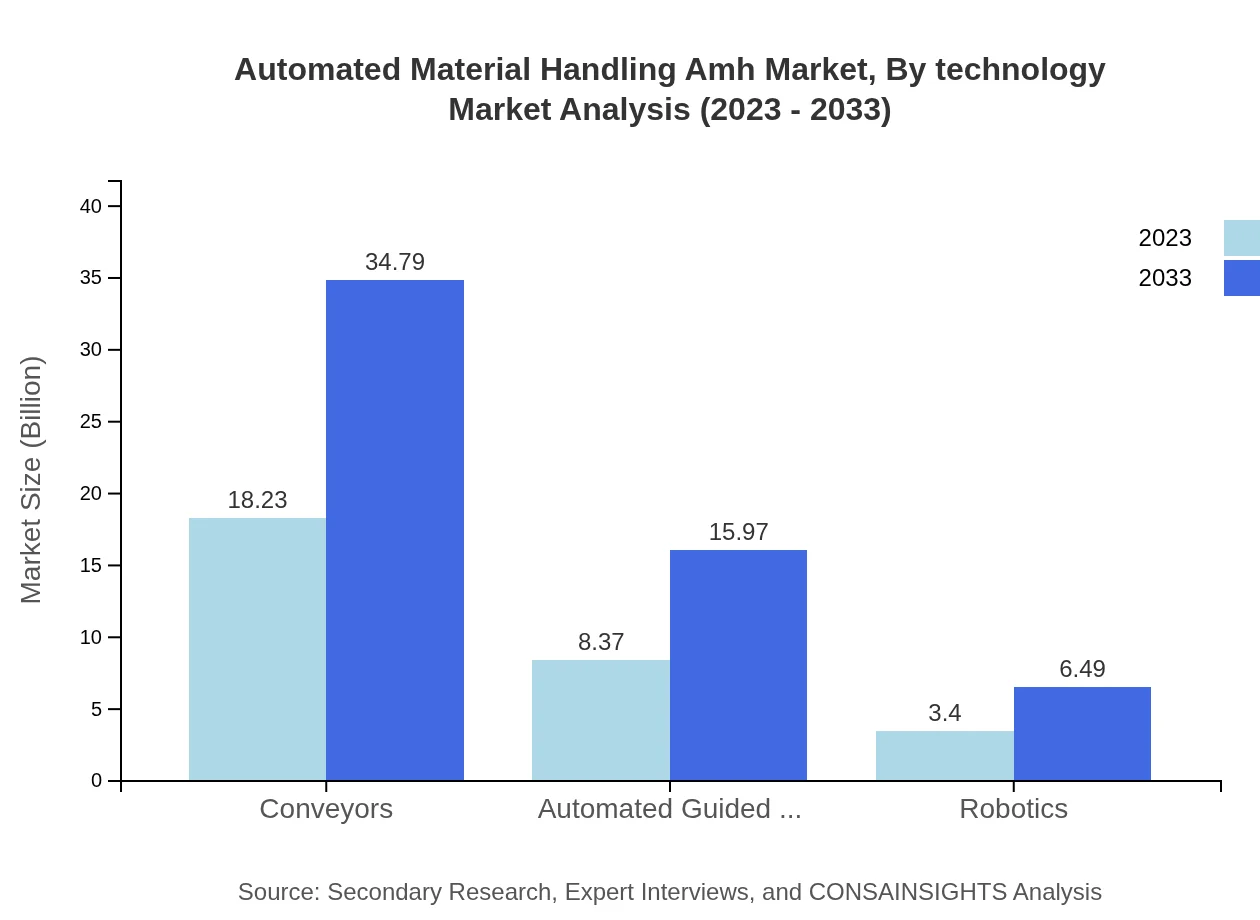

Automated Material Handling Amh Market Analysis By Technology

The AMH market by technology includes hardware components such as conveyors and Automated Guided Vehicles (AGVs), which dominate the market with a size of $18.23 billion in 2023, anticipated to grow to $34.79 billion by 2033.

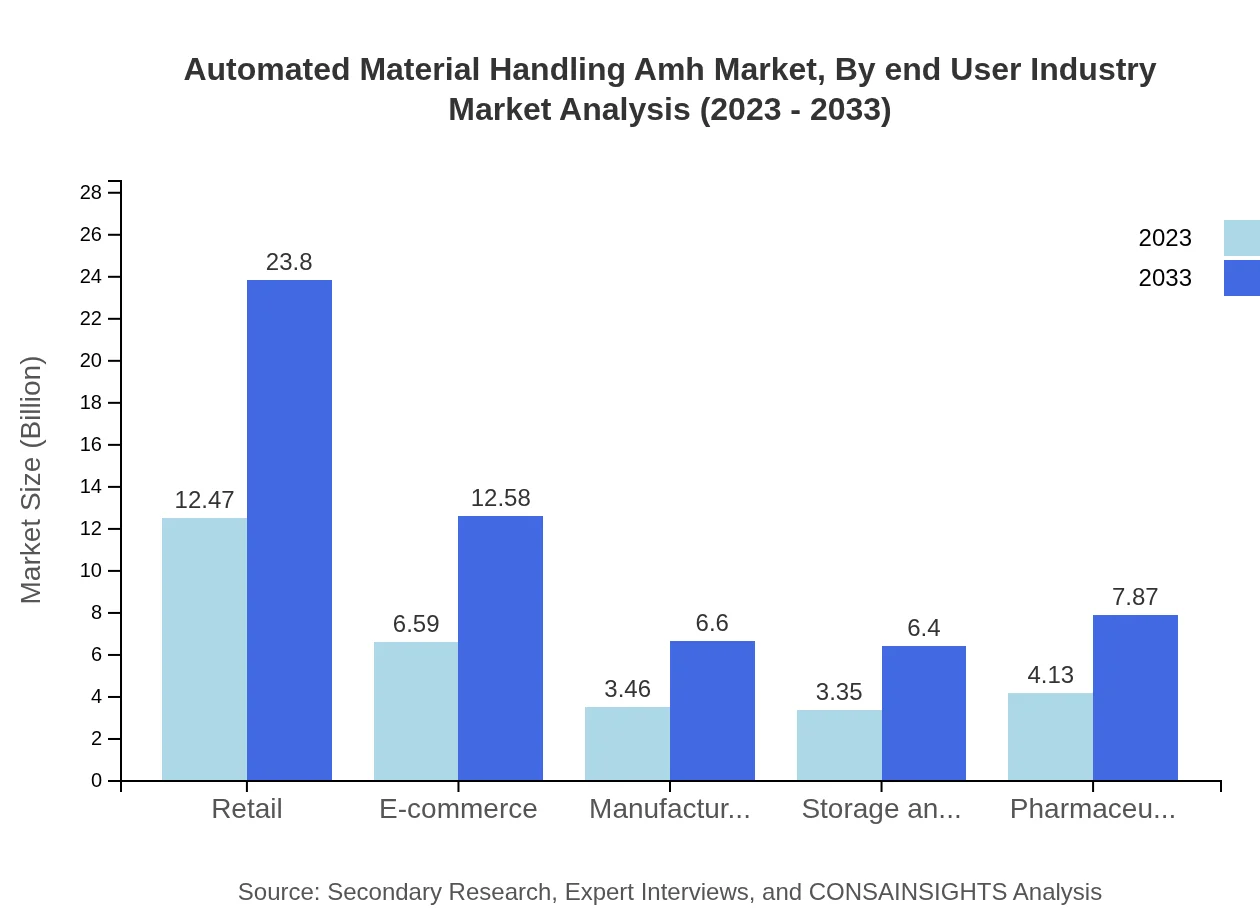

Automated Material Handling Amh Market Analysis By End User Industry

The key industries utilizing AMH technologies include retail, e-commerce, and manufacturing, with retail accounting for a market size of $12.47 billion in 2023 and projected to reach $23.80 billion by 2033.

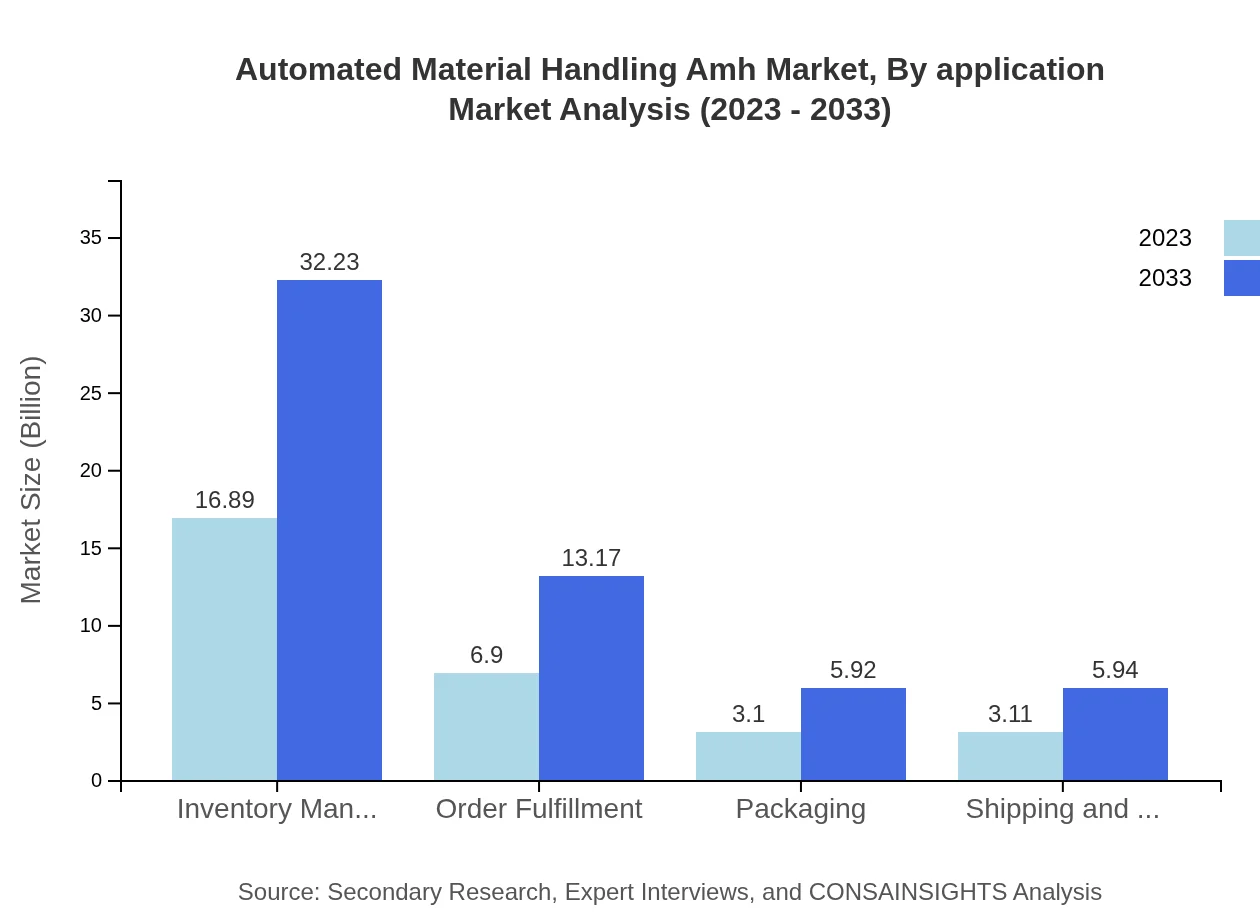

Automated Material Handling Amh Market Analysis By Application

Applications such as inventory management and order fulfillment are significant, where inventory management alone had a size of $16.89 billion in 2023, expected to expand to $32.23 billion by 2033.

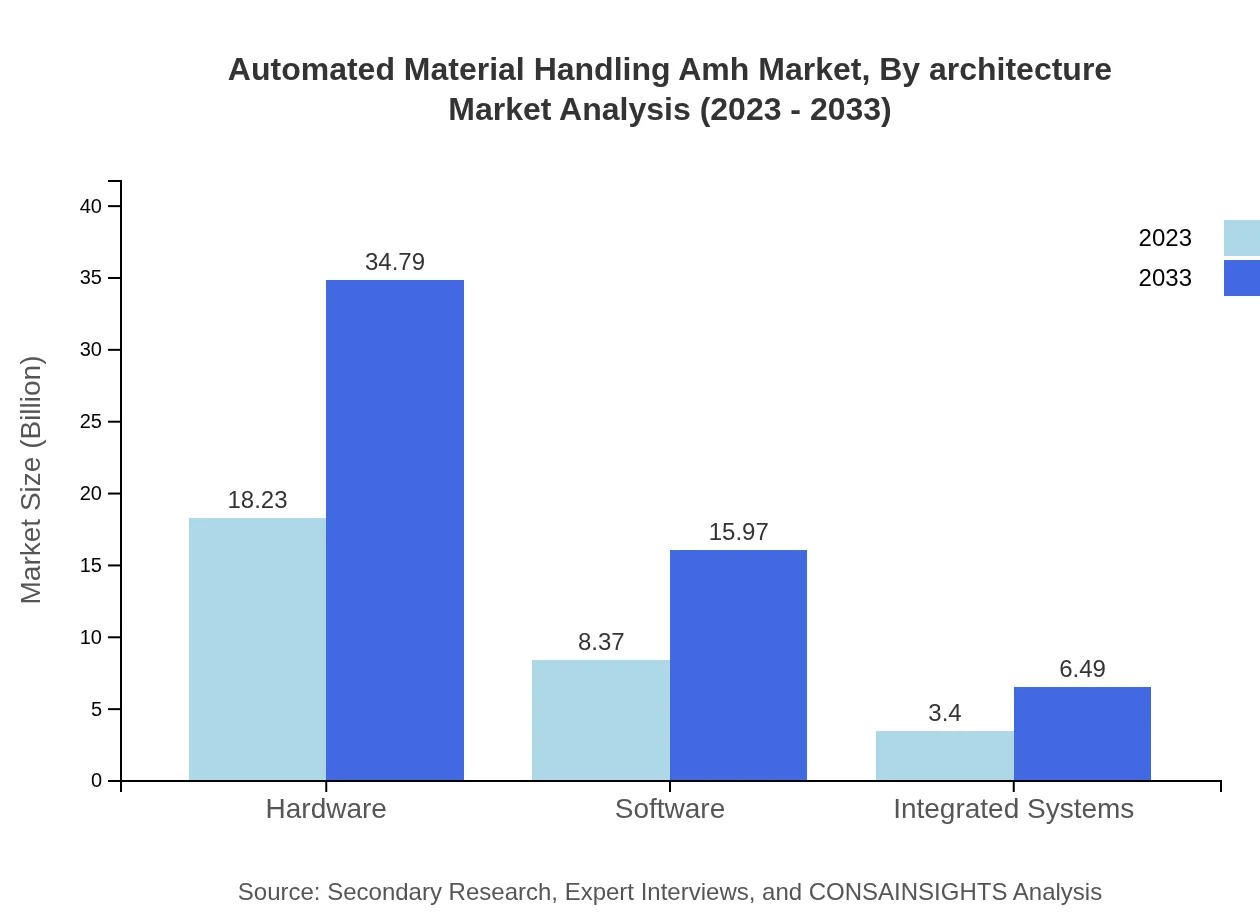

Automated Material Handling Amh Market Analysis By Architecture

Segmenting by system architecture indicates a growing preference for integrated systems that streamline operations across various functions, showing a progressive market shift towards smart ecosystems.

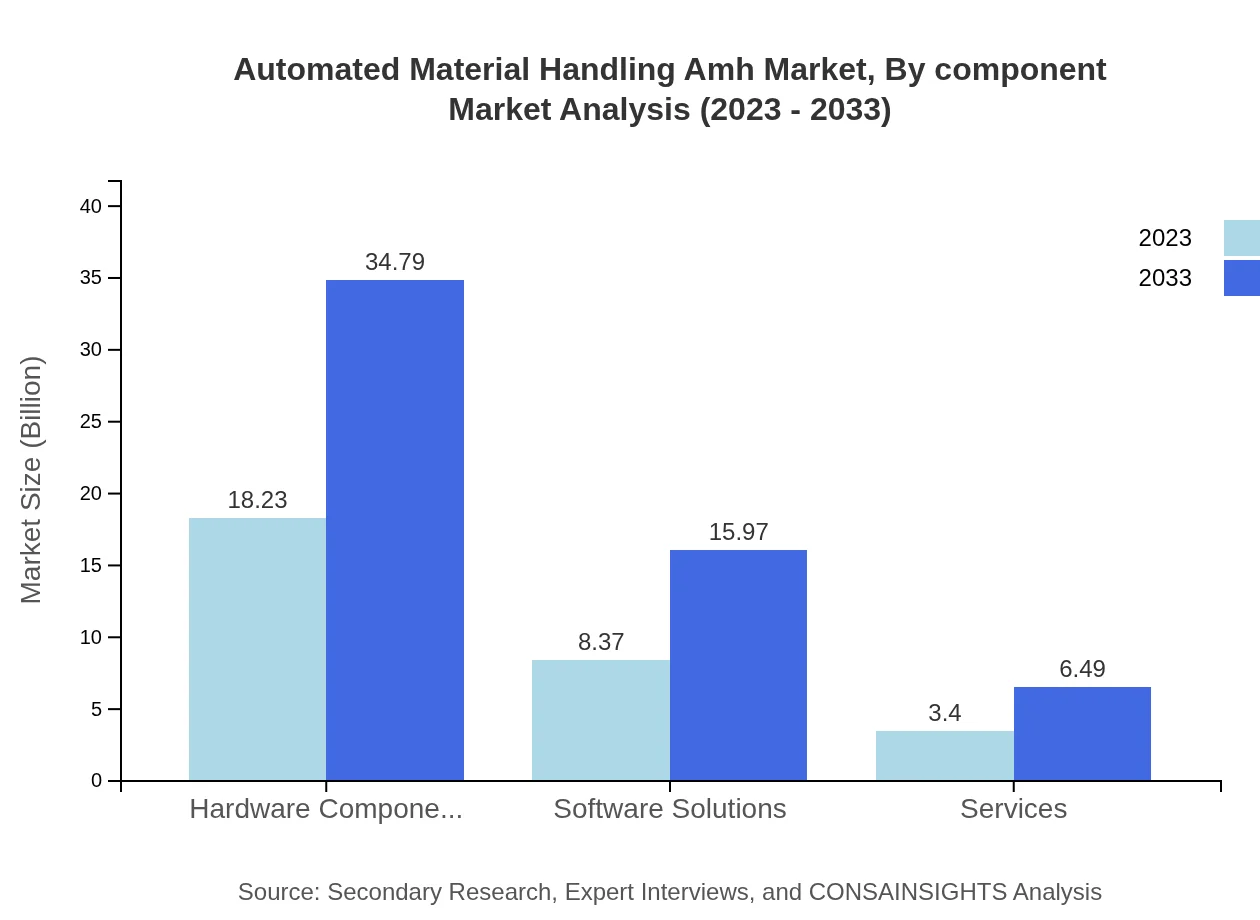

Automated Material Handling Amh Market Analysis By Component

The component analysis highlights the dominance of hardware, with a significant share of 60.77% registered in 2023, reflecting the essential role of physical systems in automation.

Automated Material Handling Amh Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Material Handling Amh Industry

Siemens AG:

A global leader in AMH solutions, Siemens is recognized for its innovative automation systems enhancing productivity and efficiency in various industries.KION Group AG:

KION Group specializes in automated intralogistics solutions and provides a wide portfolio that includes Automated Guided Vehicles and high-performance warehouses.Honeywell Intelligrated:

Honeywell Intelligrated focuses on integrated automation systems allowing companies to optimize their supply chain and improve operational efficiencies.Rockwell Automation:

Known for their focus on industrial automation, Rockwell offers comprehensive solutions that include software and control systems for material handling.Dematic:

Dematic provides intelligent supply chain solutions, integrating systems that enhance warehouse efficiency and order fulfillment processes.We're grateful to work with incredible clients.

FAQs

What is the market size of Automated Material Handling (AMH)?

The global Automated Material Handling (AMH) market is valued at approximately $30 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.5%, forecasting significant growth through 2033.

What are the key market players or companies in the Automated Material Handling (AMH) industry?

Key players in the Automated Material Handling industry include leading firms such as Dematic, Swisslog, KION Group, and Honeywell Intelligrated, which dominate the market through innovation and strategic partnerships.

What are the primary factors driving the growth in the Automated Material Handling (AMH) industry?

Growth in the Automated Material Handling industry is driven by the increasing demand for efficient warehouse solutions, advancements in robotics and AI technologies, and the rise of e-commerce, necessitating improved logistics and distribution efficiency.

Which region is the fastest Growing in the Automated Material Handling (AMH)?

Asia Pacific is the fastest-growing region in the Automated Material Handling market, expected to grow from $5.44 billion in 2023 to $10.39 billion by 2033, driven by industrial expansion and technological advancements.

Does ConsaInsights provide customized market report data for the Automated Material Handling (AMH) industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the Automated Material Handling industry, ensuring clients receive relevant data and insights for informed decision-making.

What deliverables can I expect from this Automated Material Handling (AMH) market research project?

Clients can expect comprehensive deliverables such as detailed market analysis, projections, segmentation insights, competitive landscape assessment, and strategic recommendations tailored to the Automated Material Handling industry.

What are the market trends of Automated Material Handling (AMH)?

Key market trends in Automated Material Handling include rising automation adoption, integration of IoT and AI for operational efficiency, growth in e-commerce logistics, and a shift towards smart warehouse technologies for enhanced productivity.