Automated Material Handling Equipment Market Report

Published Date: 22 January 2026 | Report Code: automated-material-handling-equipment

Automated Material Handling Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automated Material Handling Equipment market, projecting trends and growth from 2023 to 2033. It covers market size, industry insights, segmentation, regional analysis, and leading companies, offering valuable information for stakeholders and investors.

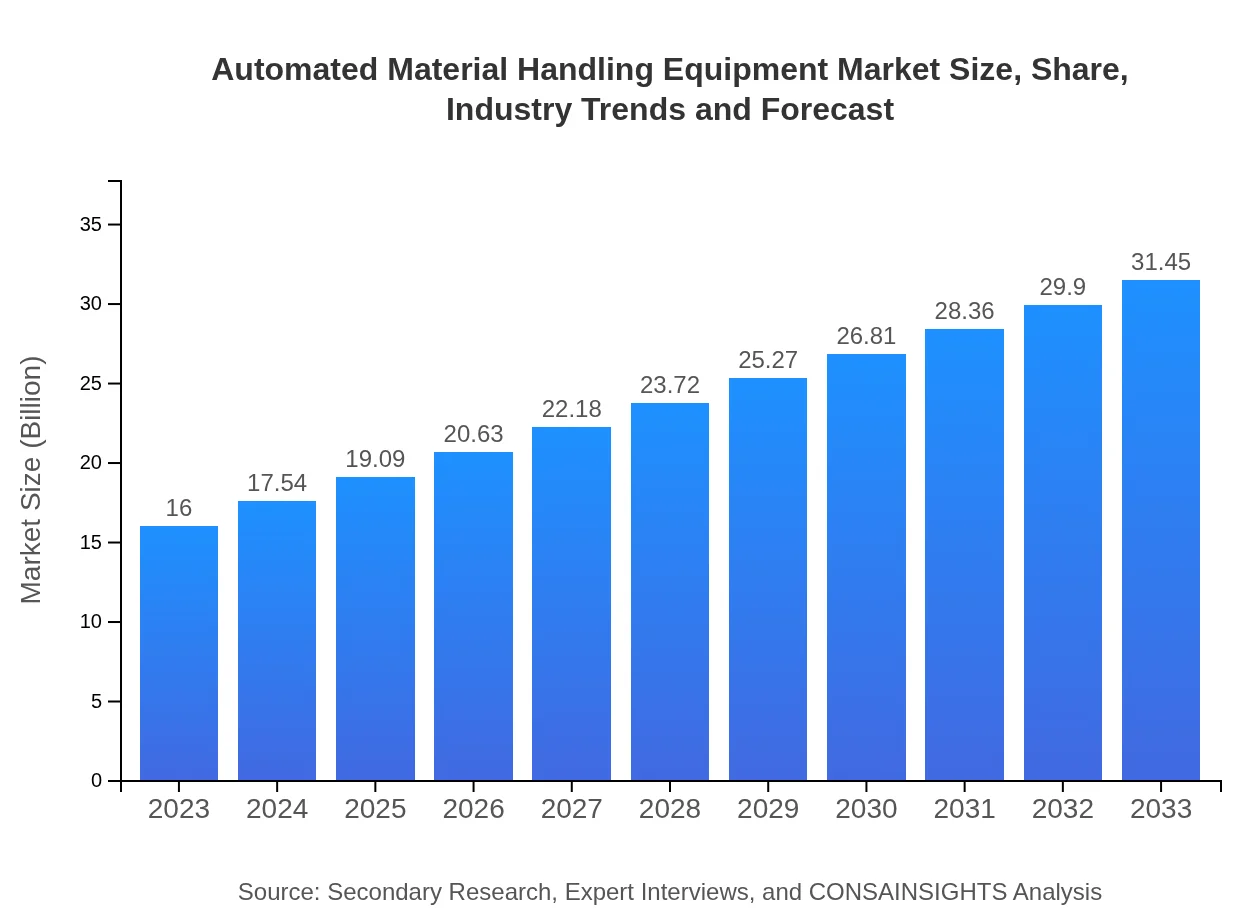

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $16.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $31.45 Billion |

| Top Companies | Dematic Corporation, Honeywell Intelligrated, Siemens AG, Kardex Remstar, ABB Robotics |

| Last Modified Date | 22 January 2026 |

Automated Material Handling Equipment Market Overview

Customize Automated Material Handling Equipment Market Report market research report

- ✔ Get in-depth analysis of Automated Material Handling Equipment market size, growth, and forecasts.

- ✔ Understand Automated Material Handling Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Material Handling Equipment

What is the Market Size & CAGR of the Automated Material Handling Equipment market in 2023?

Automated Material Handling Equipment Industry Analysis

Automated Material Handling Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Material Handling Equipment Market Analysis Report by Region

Europe Automated Material Handling Equipment Market Report:

The European market is set to grow from $4.70 billion in 2023 to $9.24 billion by 2033. Factors contributing to this growth include stringent labor regulations, a push for higher efficiency in supply chains, and increasing investments in sustainable technologies. Major economies such as Germany, the UK, and France are leading the adoption of automated solutions across various industries.Asia Pacific Automated Material Handling Equipment Market Report:

In the Asia Pacific region, the Automated Material Handling Equipment market is expected to grow from $2.95 billion in 2023 to $5.79 billion by 2033. This rapid expansion is driven by a burgeoning manufacturing base, investments in smart factories, and the e-commerce boom, especially in countries like China and India. The integration of robotics and automation technologies into production lines is also fuelling growth.North America Automated Material Handling Equipment Market Report:

North America leads the market with a value of $6.21 billion in 2023, projected to reach $12.21 billion by 2033. The region's dominance is attributed to technological advancements, high adoption rates of automation in manufacturing, and significant investments from key players in automation technologies. The growing focus on improving operational efficiency across sectors further solidifies North America's market position.South America Automated Material Handling Equipment Market Report:

The South American market is anticipated to increase from $1.10 billion in 2023 to $2.15 billion by 2033. Key drivers include an uptick in logistics activities and a focus on modernizing supply chain operations amidst economic recovery. However, challenges such as regulatory hurdles and limited infrastructure investment could impact the pace of growth.Middle East & Africa Automated Material Handling Equipment Market Report:

The Middle East and Africa market is projected to increase from $1.04 billion in 2023 to $2.05 billion by 2033. The region is gradually adopting automation in logistics and warehousing, driven by rising demand for efficient supply chains. However, political instability and economic variability in certain areas pose potential risks to market growth.Tell us your focus area and get a customized research report.

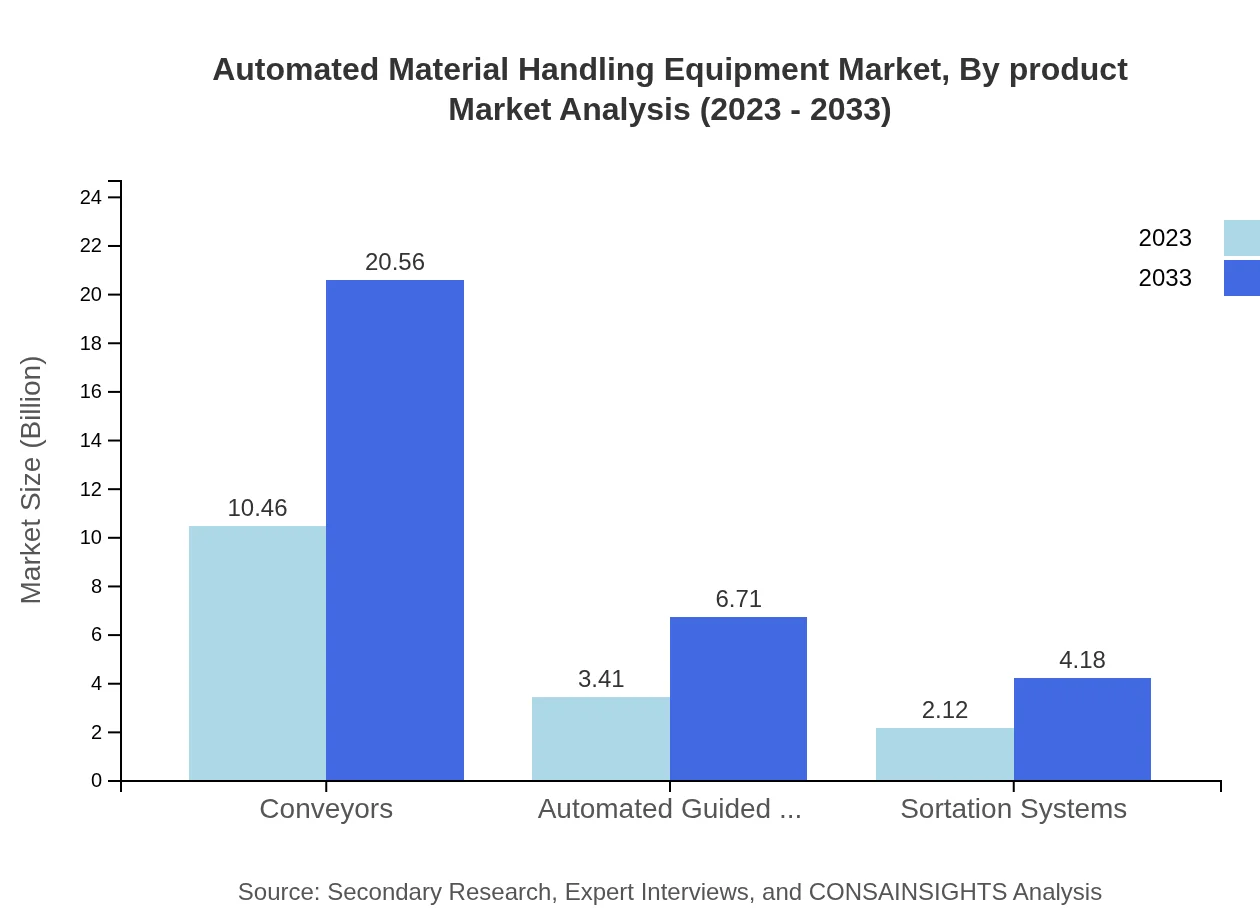

Automated Material Handling Equipment Market Analysis By Product

The product segment reveals that conveyors are the largest contributor, valued at $10.46 billion in 2023, with an expected growth to $20.56 billion by 2033. Conveyors account for a market share of 65.38% in the Automated Material Handling Equipment sector, demonstrating their indispensable role in material transport and storage. AGVs follow, with a market size of $3.41 billion and a share of 21.34%, reflecting their growing utilization in logistics and manufacturing sectors.

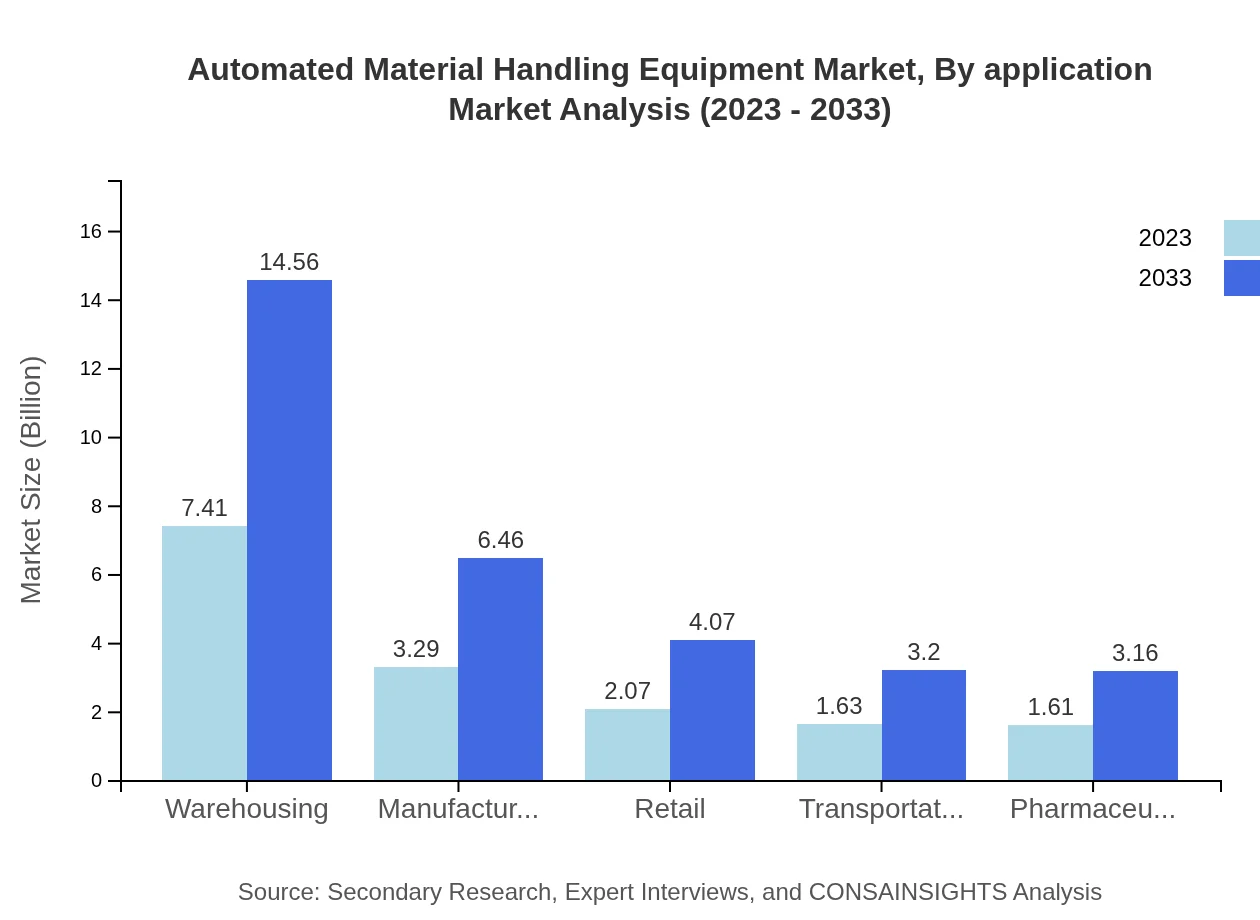

Automated Material Handling Equipment Market Analysis By Application

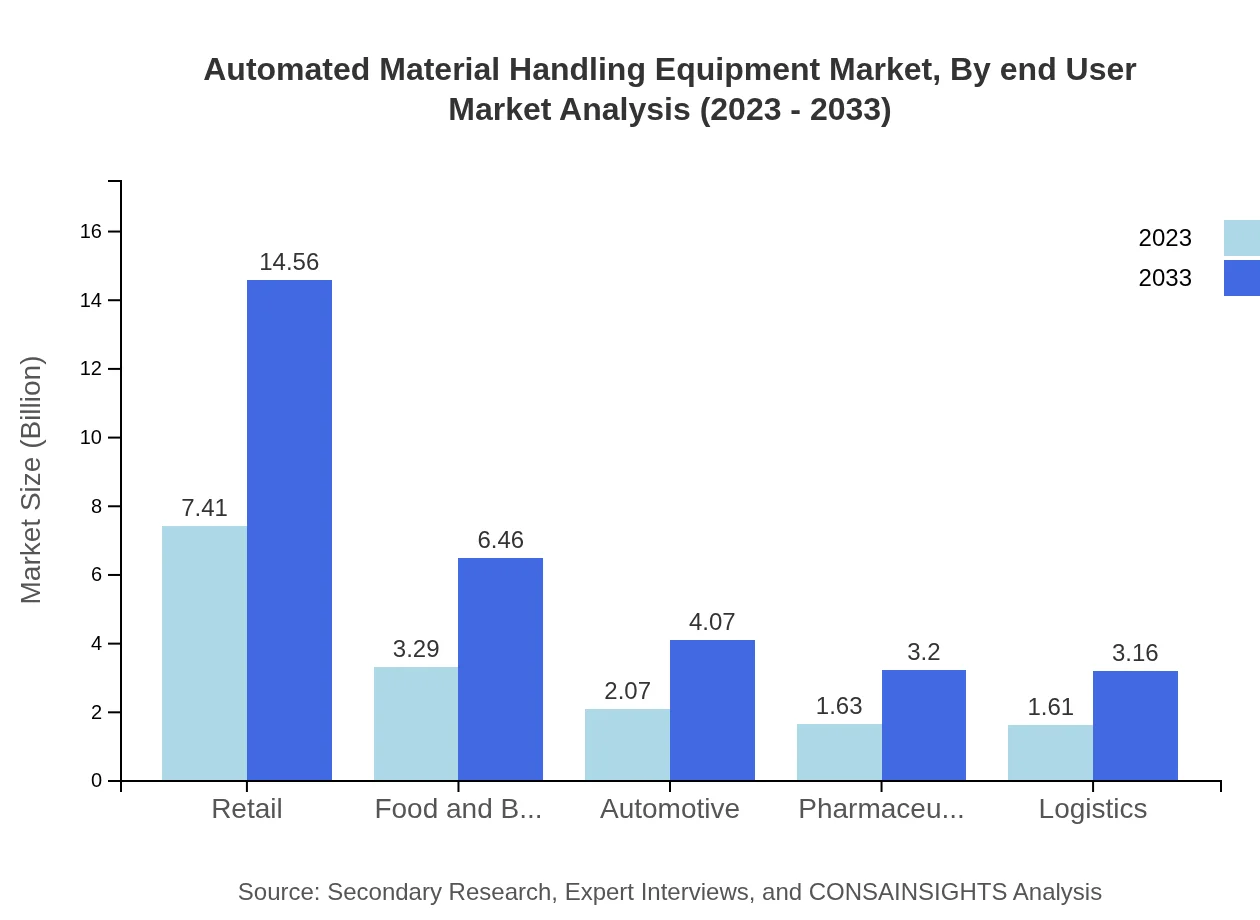

Analyzing by application, retail leads with a market size of $7.41 billion in 2023, anticipated to grow to $14.56 billion by 2033. This segment reflects the critical nature of automated systems in managing inventory and enhancing customer service. Other significant applications include warehousing and logistics, primarily driven by increased e-commerce activity.

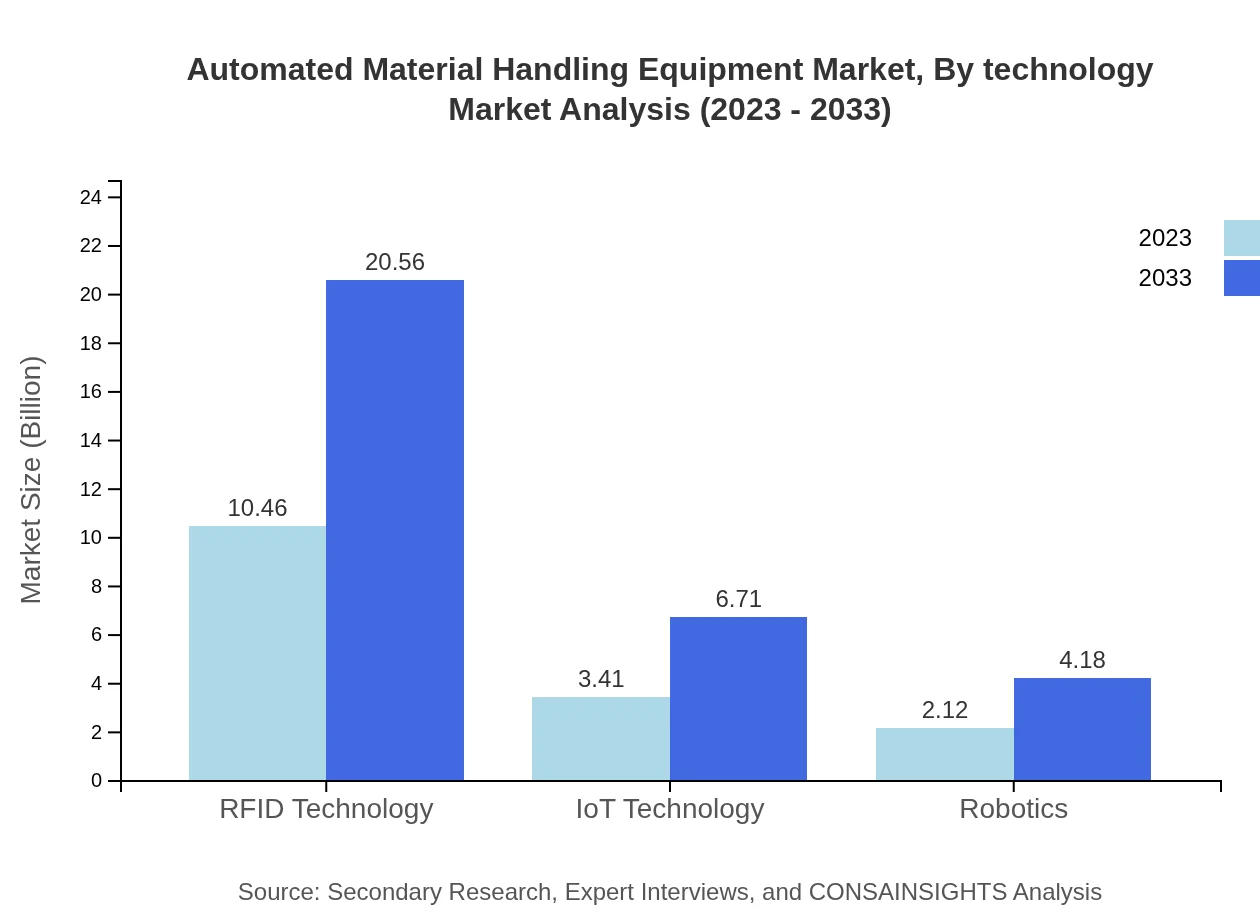

Automated Material Handling Equipment Market Analysis By Technology

Technology-wise, RFID technology commands the largest share with a market size of $10.46 billion in 2023, expected to reach $20.56 billion by 2033. Its effectiveness in inventory management and tracking significantly boosts its demand across various sectors. IoT technology is also prominent, with a market share of 21.34%, integrating seamlessly into automated solutions for enhanced real-time data analytics.

Automated Material Handling Equipment Market Analysis By End User

Segmented by end-user industries, the manufacturing sector holds a key position with a market size of $3.29 billion in 2023, expected to double by 2033. The automotive and pharmaceutical sectors also demonstrate significant growth potential as automation becomes critical for maintaining precision and efficiency.

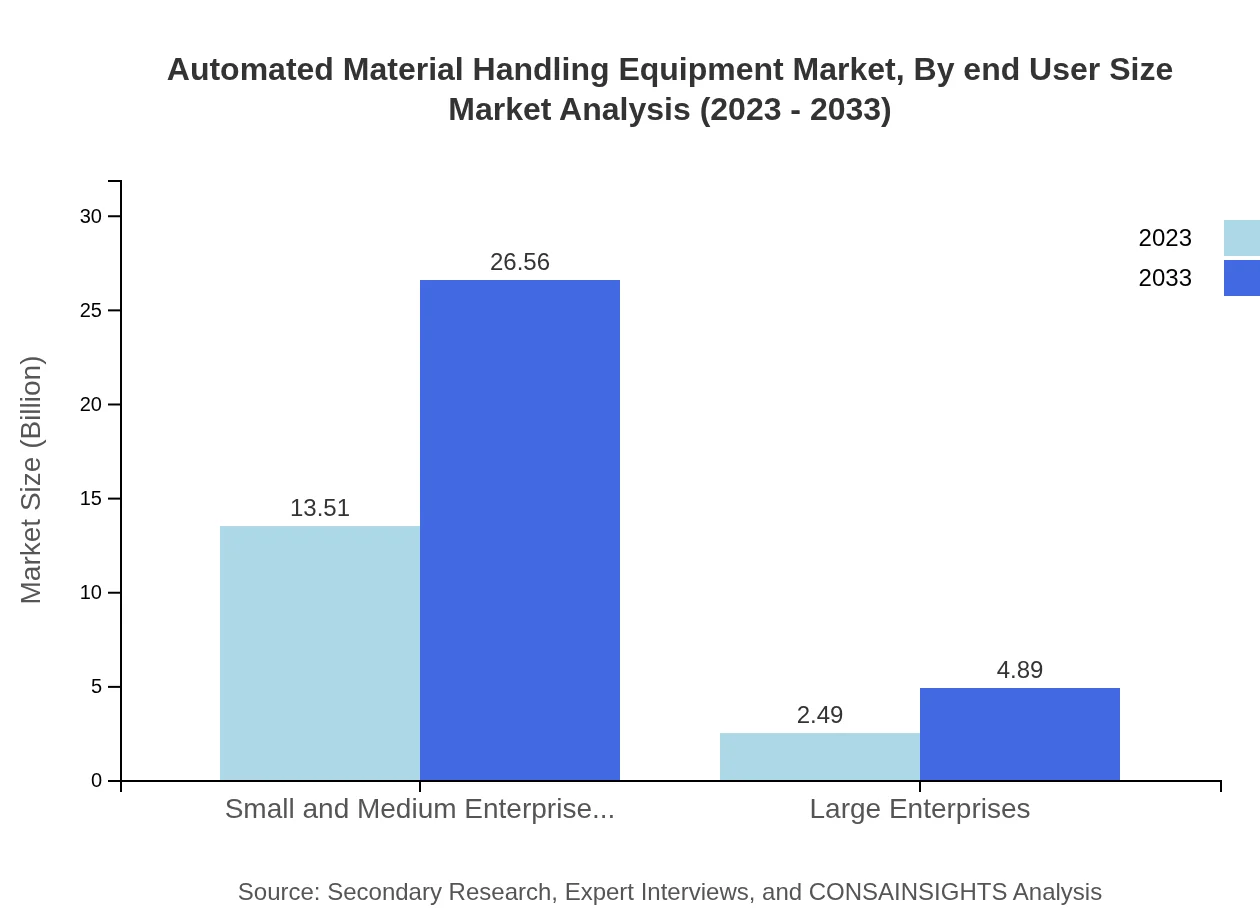

Automated Material Handling Equipment Market Analysis By End User Size

In terms of end-user size, small and medium enterprises (SMEs) dominate the market with a size of $13.51 billion expected to grow to $26.56 billion by 2033, representing 84.46% of the market share. This trend highlights the growing accessibility of advanced material handling solutions for smaller players within the industry.

Automated Material Handling Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Automated Material Handling Equipment Industry

Dematic Corporation:

Dematic is known for its innovative warehouse automation systems and integrated logistics solutions, specializing in automated storage and retrieval systems.Honeywell Intelligrated:

Honeywell Intelligrated provides automated material handling solutions that enhance operational efficiency and safety for various industries, including retail and eCommerce.Siemens AG:

Siemens offers comprehensive automation solutions including advanced manufacturing systems, making significant contributions to the material handling equipment market.Kardex Remstar:

Kardex Remstar specializes in automated storage solutions and logistics systems tailored to improve efficiency for warehouses and distribution centers.ABB Robotics:

ABB Robotics provides state-of-the-art robotic solutions for material handling, significantly impacting the automation landscape across multiple sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of automated Material Handling Equipment?

The global market size for Automated Material Handling Equipment is projected at $16 billion in 2023, with an estimated CAGR of 6.8% through 2033. The market encompasses various equipment types and functionalities, driving innovation and adaptation across sectors.

What are the key market players or companies in this automated Material Handling Equipment industry?

Key players in the Automated Material Handling Equipment market include prominent firms such as Dematic, Daifuku, and Honeywell Intelligrated, focused on delivering integrated solutions and advanced robotics to enhance operational efficiency within diverse industries.

What are the primary factors driving the growth in the automated Material Handling Equipment industry?

Growth in the Automated Material Handling Equipment industry is primarily driven by increasing demand for efficient supply chain solutions, advancements in robotics and AI technologies, and a surge in e-commerce, necessitating improved warehousing and logistics operations.

Which region is the fastest Growing in the automated Material Handling Equipment market?

Among the regions, North America exhibits the fastest growth in the automated-material-handling-equipment market, projected to expand from $6.21 billion in 2023 to $12.21 billion by 2033, driven by robust manufacturing and logistics sectors.

Does ConsaInsights provide customized market report data for the automated Material Handling Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Automated Material Handling Equipment industry, allowing clients to access detailed insights and forecasts relevant to their business context.

What deliverables can I expect from this automated Material Handling Equipment market research project?

From the Automated Material Handling Equipment market research project, expect comprehensive reports, market forecasts, segmentation analysis, regional insights, and in-depth profiles of key players along with actionable recommendations for strategic decision-making.

What are the market trends of automated Material Handling Equipment?

Current market trends in Automated Material Handling Equipment include an increased focus on automation, rising interest in smart technologies like IoT and robotics, and growing investments in sustainable and efficient warehousing practices across various industries.