Automated Mining Equipment Market Report

Published Date: 22 January 2026 | Report Code: automated-mining-equipment

Automated Mining Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automated Mining Equipment market, detailing market trends, size, segmentation, and regional insights, covering the forecast period from 2023 to 2033.

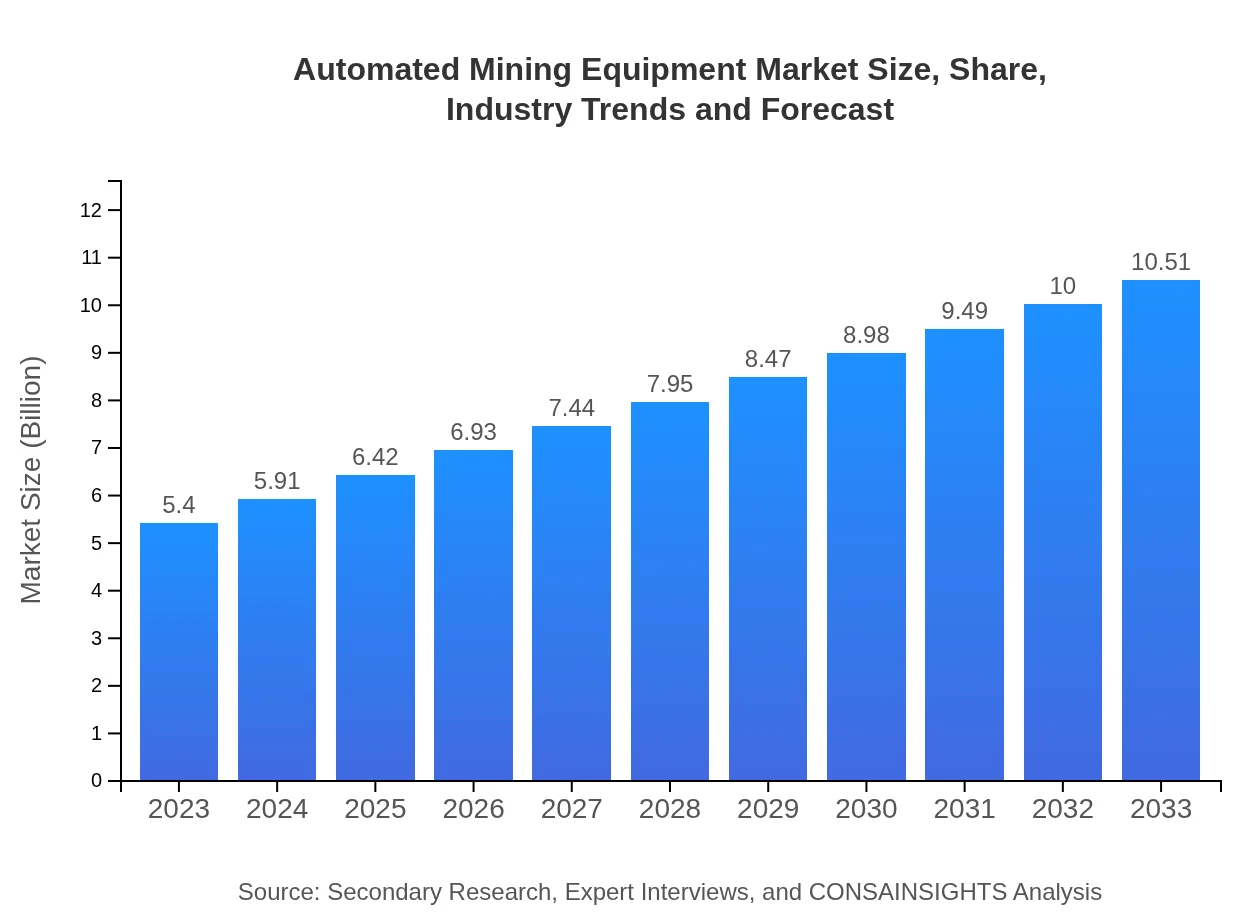

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $10.51 Billion |

| Top Companies | Caterpillar Inc., Komatsu Ltd., Atlas Copco AB, Sandvik AB |

| Last Modified Date | 22 January 2026 |

Automated Mining Equipment Market Overview

Customize Automated Mining Equipment Market Report market research report

- ✔ Get in-depth analysis of Automated Mining Equipment market size, growth, and forecasts.

- ✔ Understand Automated Mining Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Mining Equipment

What is the Market Size & CAGR of Automated Mining Equipment market in 2023?

Automated Mining Equipment Industry Analysis

Automated Mining Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Mining Equipment Market Analysis Report by Region

Europe Automated Mining Equipment Market Report:

Europe's market for Automated Mining Equipment is projected to grow from $1.77 billion in 2023 to $3.44 billion by 2033. Countries like Sweden and Finland are at the forefront of integrating automation into their mining practices, focusing on sustainability and reducing environmental impacts.Asia Pacific Automated Mining Equipment Market Report:

The Asia Pacific region held an estimated market value of $0.94 billion in 2023, projected to double to $1.84 billion by 2033, driven by rising mineral exploration and increased investments in mining automation. Countries like Australia and China are leading in adopting advanced mining technologies, resulting in enhanced operational efficiencies.North America Automated Mining Equipment Market Report:

North America is a prominent player in the Automated Mining Equipment market, starting at a market size of $1.95 billion in 2023 and projected to grow to $3.80 billion by 2033. The region's robust mining sector, particularly in the U.S. and Canada, is embracing automation technologies to enhance operational efficiencies, driven by technological advancements.South America Automated Mining Equipment Market Report:

In South America, the market size for Automated Mining Equipment was valued at $0.41 billion in 2023, expected to reach $0.80 billion by 2033. The region's growth is supported by active mining activities in countries like Brazil and Chile, with a focus on automation to cope with labor shortages and improve safety measures.Middle East & Africa Automated Mining Equipment Market Report:

The Middle East and Africa market was valued at $0.32 billion in 2023 and is projected to reach $0.63 billion by 2033. The region is gradually adopting automated solutions, particularly in nations like South Africa, where advancements are being made in mining productivity amidst resource challenges.Tell us your focus area and get a customized research report.

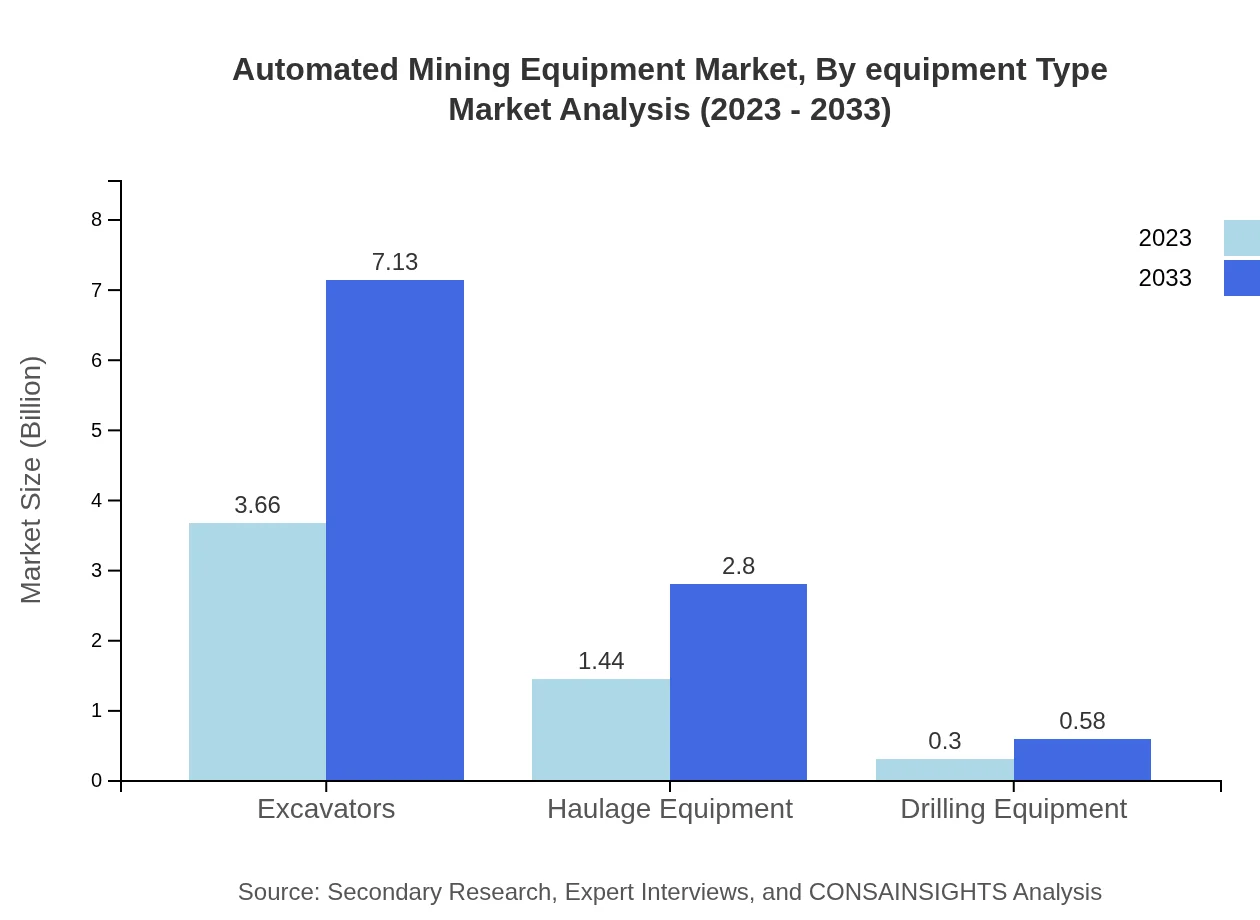

Automated Mining Equipment Market Analysis By Equipment Type

In 2023, the Automated Mining Equipment market by equipment type is dominated by excavators, which held a market size of $3.66 billion, representing a 67.82% market share. This segment is expected to grow to $7.13 billion by 2033. Haulage equipment and drilling equipment follow, with respective size estimates of $1.44 billion and $0.30 billion in 2023, highlighting significant potential for automation in these areas.

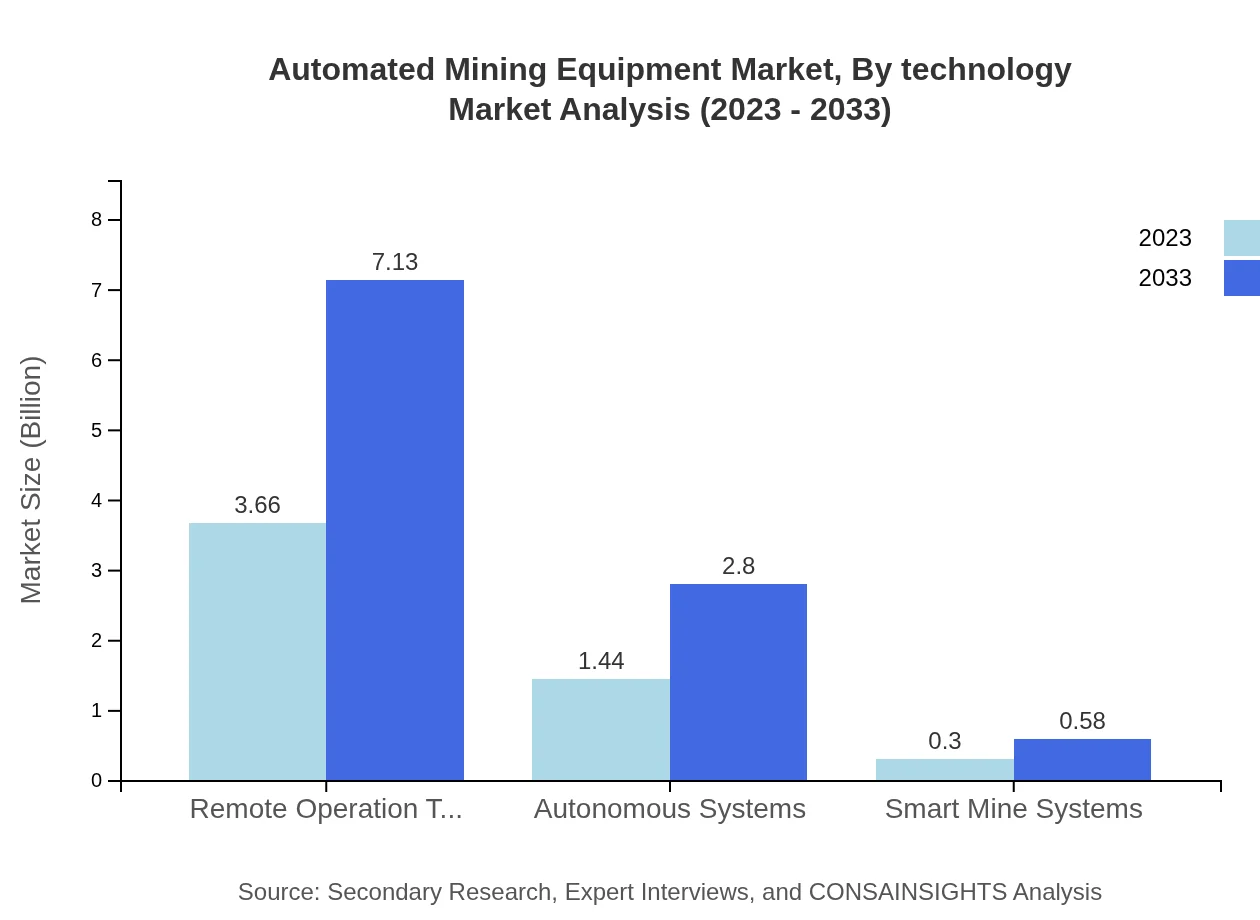

Automated Mining Equipment Market Analysis By Technology

Remote operation technology is the leading segment, accounting for a market size of $3.66 billion (67.82% share) in 2023 and anticipated to reach $7.13 billion by 2033. Autonomous systems and smart mine systems, while smaller in size, are also growing significantly, reflecting the industry's shift towards high-tech mining solutions.

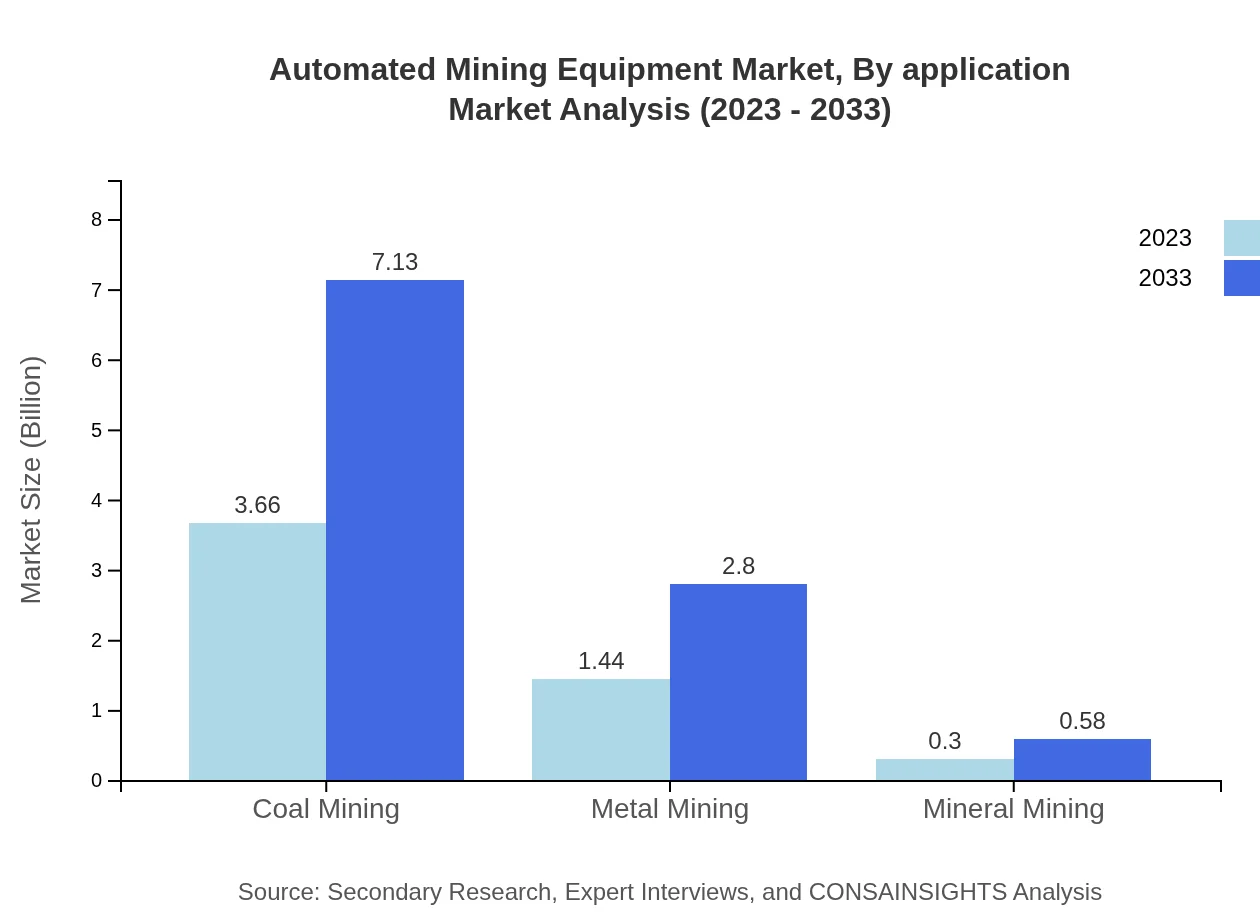

Automated Mining Equipment Market Analysis By Application

The coal mining segment holds a substantial portion of the market with a size of $3.66 billion (67.82% share) in 2023, projected to expand to $7.13 billion by 2033. Metal and mineral mining are also significant segments, supporting the widespread adoption of automation technologies to enhance extraction processes.

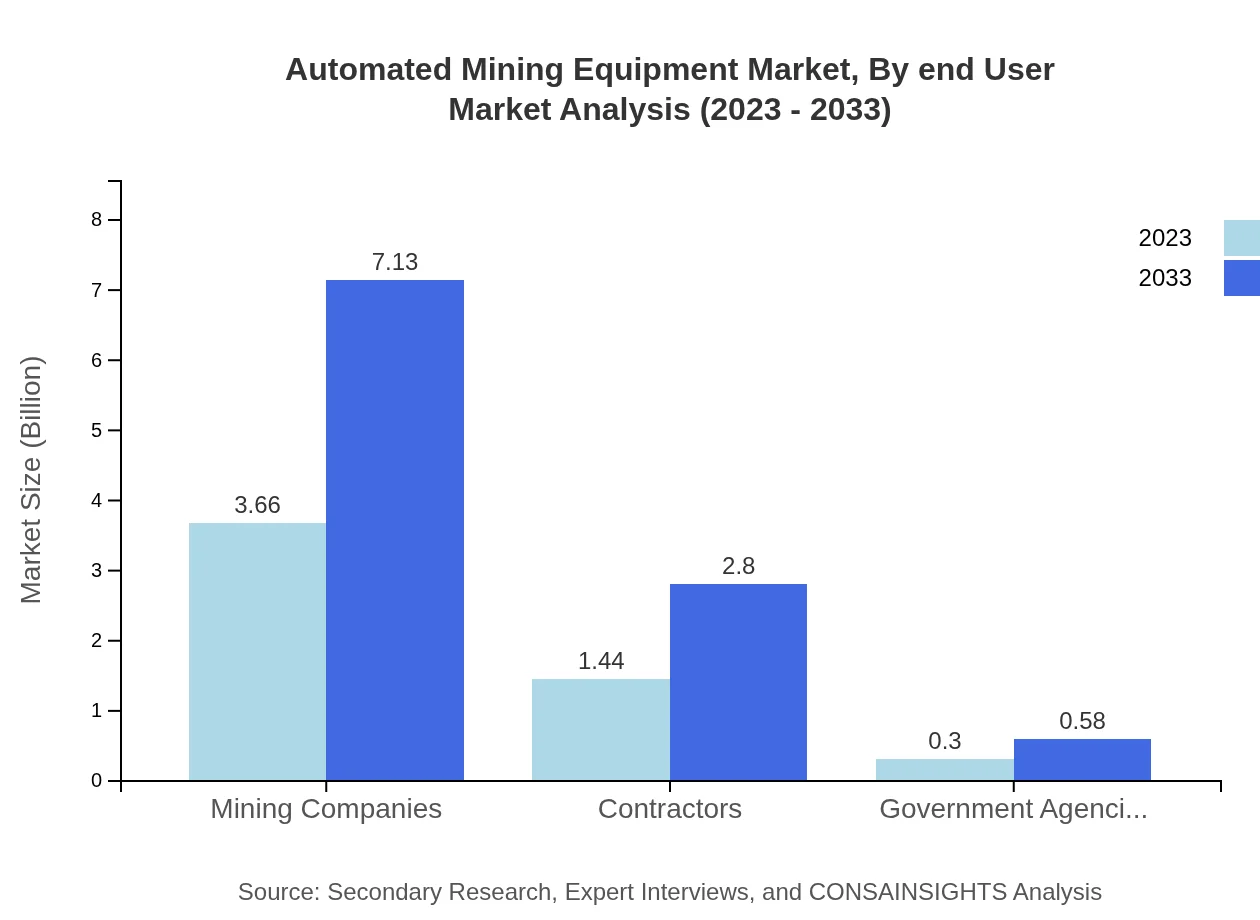

Automated Mining Equipment Market Analysis By End User

Mining companies represent the largest end-user group, with a market size of $3.66 billion (67.82% market share) in 2023, growing to $7.13 billion by 2033. Contractors and government agencies also contribute, with respective shares of 26.62% and 5.56%, underscoring the vital role of automation in different segments of the mining industry.

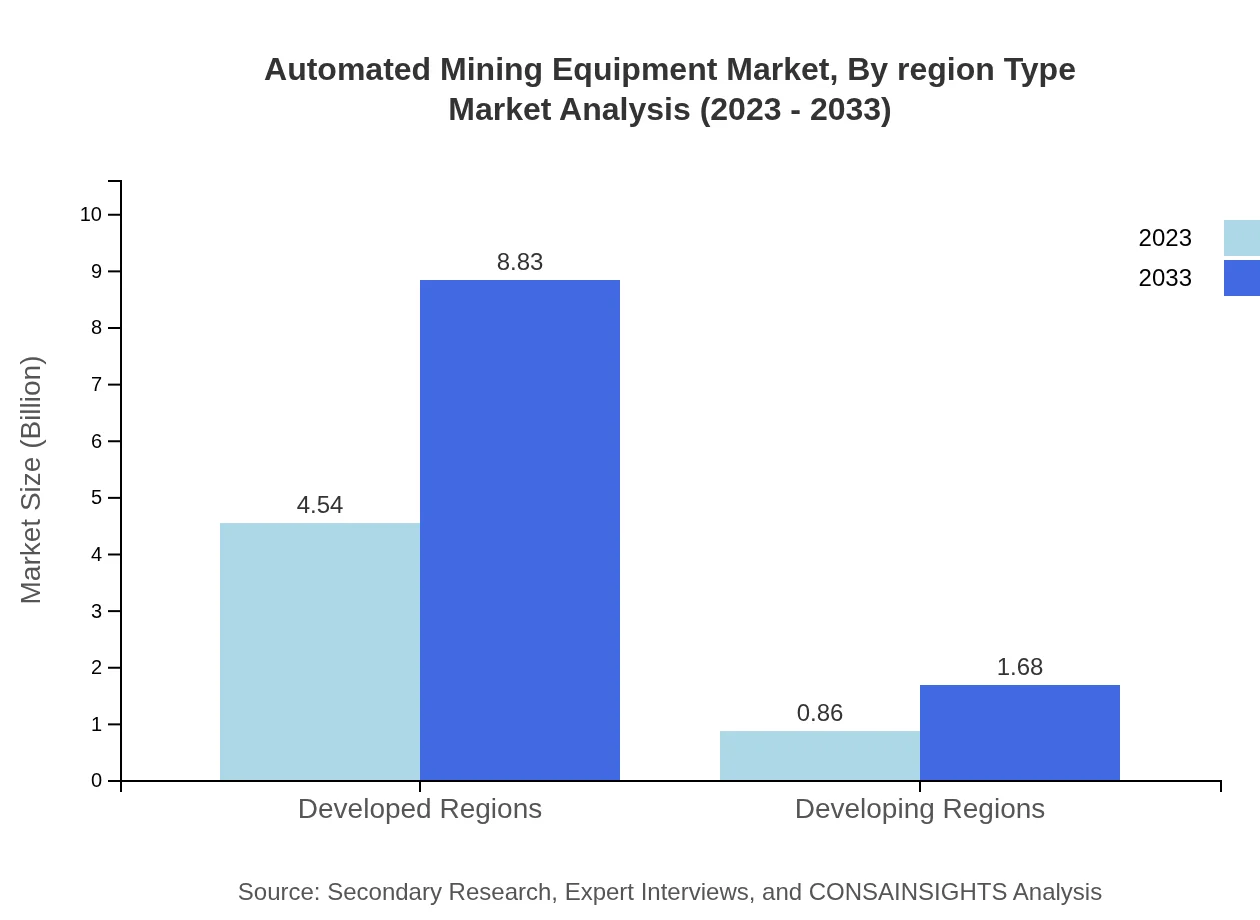

Automated Mining Equipment Market Analysis By Region Type

The analysis of the market by region underscores the dominance of developed regions, which collectively account for over 84% of the market share in 2023, standing at $4.54 billion, with growth expected up to $8.83 billion by 2033. Developing regions are also showing growth, with a significant rise from $0.86 billion in 2023 to $1.68 billion by 2033.

Automated Mining Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Mining Equipment Industry

Caterpillar Inc.:

A leader in construction and mining equipment, Caterpillar is known for its cutting-edge technology and automation solutions that optimize mining efficiency.Komatsu Ltd.:

Komatsu is a prominent manufacturer of mining and construction equipment, offering advanced automated solutions that significantly enhance operational productivity.Atlas Copco AB:

Atlas Copco specializes in mining equipment and automation technology, focusing on innovative solutions for sustainable mining practices.Sandvik AB:

Sandvik is renowned for its automated mining equipment and technology, providing advanced solutions aimed at improving safety and productivity.We're grateful to work with incredible clients.

FAQs

What is the market size of automated Mining Equipment?

The automated mining equipment market is currently valued at $5.4 billion, with a projected growth rate (CAGR) of 6.7%. By 2033, the market is expected to expand significantly, driven by advances in technology and increased automation in mining operations.

What are the key market players or companies in this automated Mining Equipment industry?

Key players in the automated mining equipment market include companies like Caterpillar, Komatsu, and Sandvik. These firms lead the industry with their innovative technology solutions, significant market shares, and comprehensive product portfolios tailored for mining operations.

What are the primary factors driving the growth in the automated Mining Equipment industry?

The growth of the automated mining equipment industry is driven by rising demand for efficiency, safety concerns, labor shortages, and technological advancements. Automation enhances productivity while minimizing risks, which appeals to mining companies seeking lower operational costs.

Which region is the fastest Growing in the automated Mining Equipment?

The fastest-growing region for automated mining equipment is Europe, with a market size expected to grow from $1.77 billion in 2023 to $3.44 billion by 2033. Other regions showing promise include Asia Pacific and North America, contributing to global growth.

Does ConsaInsights provide customized market report data for the automated Mining Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the automated mining equipment industry. These reports provide in-depth analyses, insights, and forecasts based on specific requirements and market dynamics.

What deliverables can I expect from this automated Mining Equipment market research project?

From the automated mining equipment market research project, you can expect detailed reports, market analyses, segmentation data, growth forecasts, and competitive landscapes tailored to your requirements. Deliverables will also include insights on emerging trends and technologies.

What are the market trends of automated Mining Equipment?

Current market trends in automated mining equipment include a focus on sustainability, the rise of remote operation technology, and the integration of autonomous systems. There is also an increasing emphasis on smart mining systems that utilize data analytics for operational improvements.