Automated Optical Inspection System Market Report

Published Date: 31 January 2026 | Report Code: automated-optical-inspection-system

Automated Optical Inspection System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automated Optical Inspection System market, covering insights on market trends, forecasts up to 2033, and a comprehensive overview of the industry, segmented by applications, technologies, and regions.

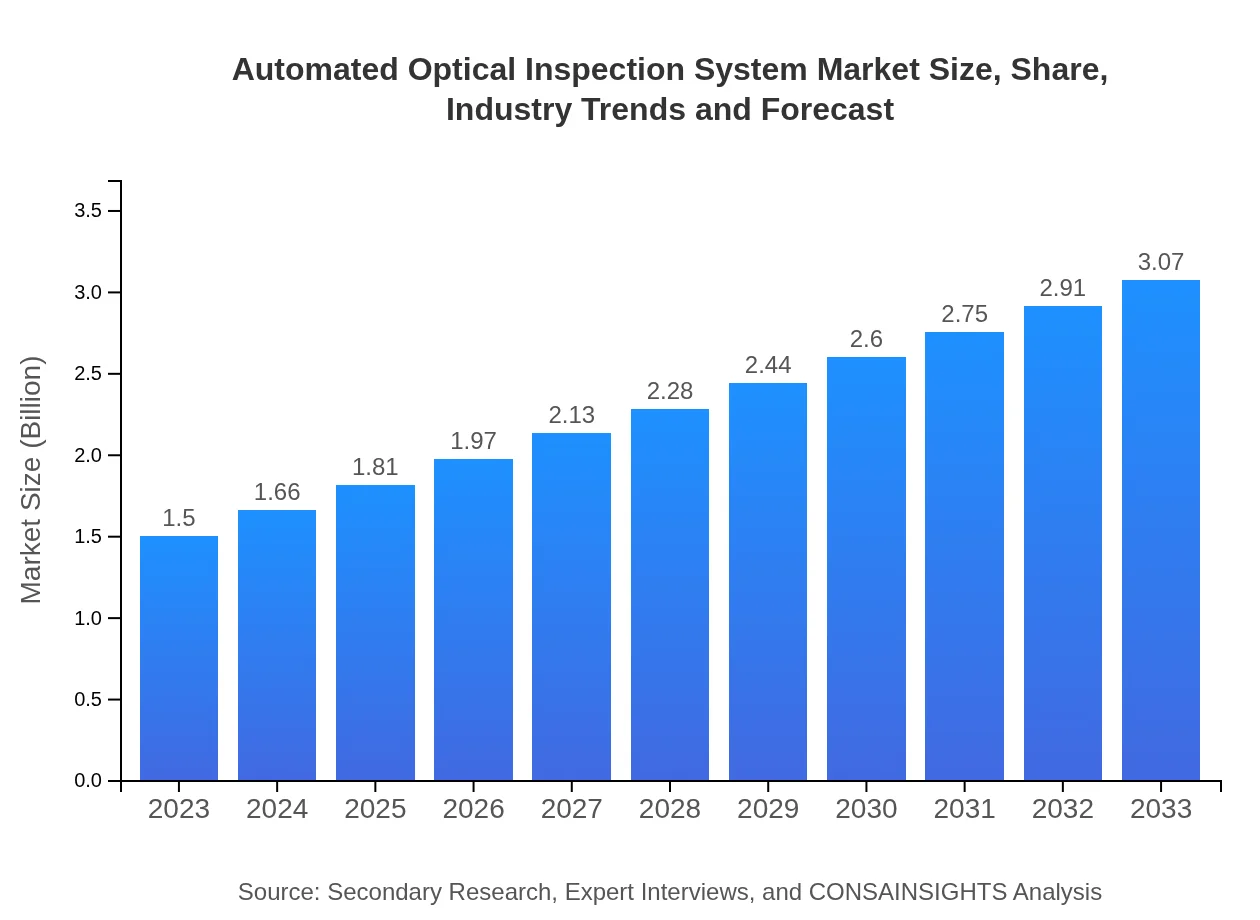

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $3.07 Billion |

| Top Companies | KLA Corporation, Omron Corporation, Cognex Corporation, Acculogic |

| Last Modified Date | 31 January 2026 |

Automated Optical Inspection System Market Overview

Customize Automated Optical Inspection System Market Report market research report

- ✔ Get in-depth analysis of Automated Optical Inspection System market size, growth, and forecasts.

- ✔ Understand Automated Optical Inspection System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Optical Inspection System

What is the Market Size & CAGR of Automated Optical Inspection System market in 2023?

Automated Optical Inspection System Industry Analysis

Automated Optical Inspection System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Optical Inspection System Market Analysis Report by Region

Europe Automated Optical Inspection System Market Report:

Europe currently represents a market size of $0.46 billion, expected to grow to $0.94 billion by 2033. The region emphasizes quality assurance and compliance in manufacturing practices, prompting investments in AOI systems across various sectors, particularly in automotive and electronics.Asia Pacific Automated Optical Inspection System Market Report:

In 2023, the Asia Pacific region is expected to hold a market size of approximately $0.27 billion, with predictions for this to grow to $0.54 billion by 2033. The growth is driven by the expansion of electronics manufacturing in countries like China, Japan, and South Korea, as well as increased investments in technological advancements in automation and quality control.North America Automated Optical Inspection System Market Report:

North America, with a market size of $0.58 billion in 2023, is anticipated to reach approximately $1.18 billion by 2033. This growth is attributed to advancements in technology and a strong presence of innovative manufacturers. Increased automation and stringent quality standards in manufacturing processes are significant drivers in this region.South America Automated Optical Inspection System Market Report:

The South American market for Automated Optical Inspection Systems is projected to expand from $0.12 billion in 2023 to $0.24 billion by 2033. Growth in this region is facilitated by increasing industrialization and growing investment in infrastructure, alongside a rising focus on manufacturing quality and reliability.Middle East & Africa Automated Optical Inspection System Market Report:

In the Middle East and Africa region, the market is projected at $0.08 billion in 2023 and is expected to cement itself at $0.15 billion by 2033. The market is stimulated by an increase in manufacturing facilities and a push for quality improvements and automation in production processes.Tell us your focus area and get a customized research report.

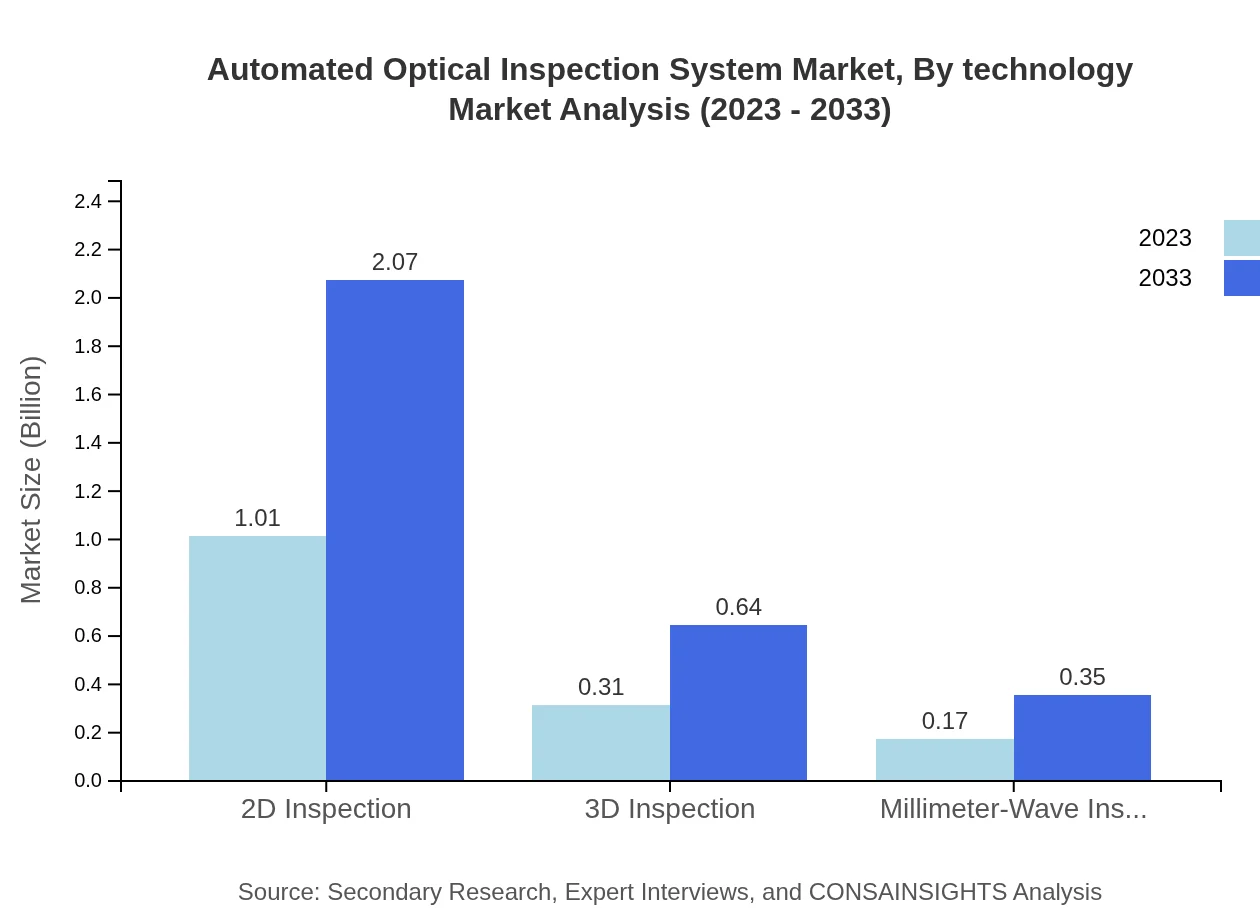

Automated Optical Inspection System Market Analysis By Technology

The market shows a significant preference for 2D inspection techniques, capturing about 67.57% of the market share in 2023, while projected advancements in 3D inspection technologies are expected to refine defect detection and enhance overall efficiency. The integration of innovative methodologies in millimeter-wave inspection is also gaining traction, addressing complexities in component inspection.

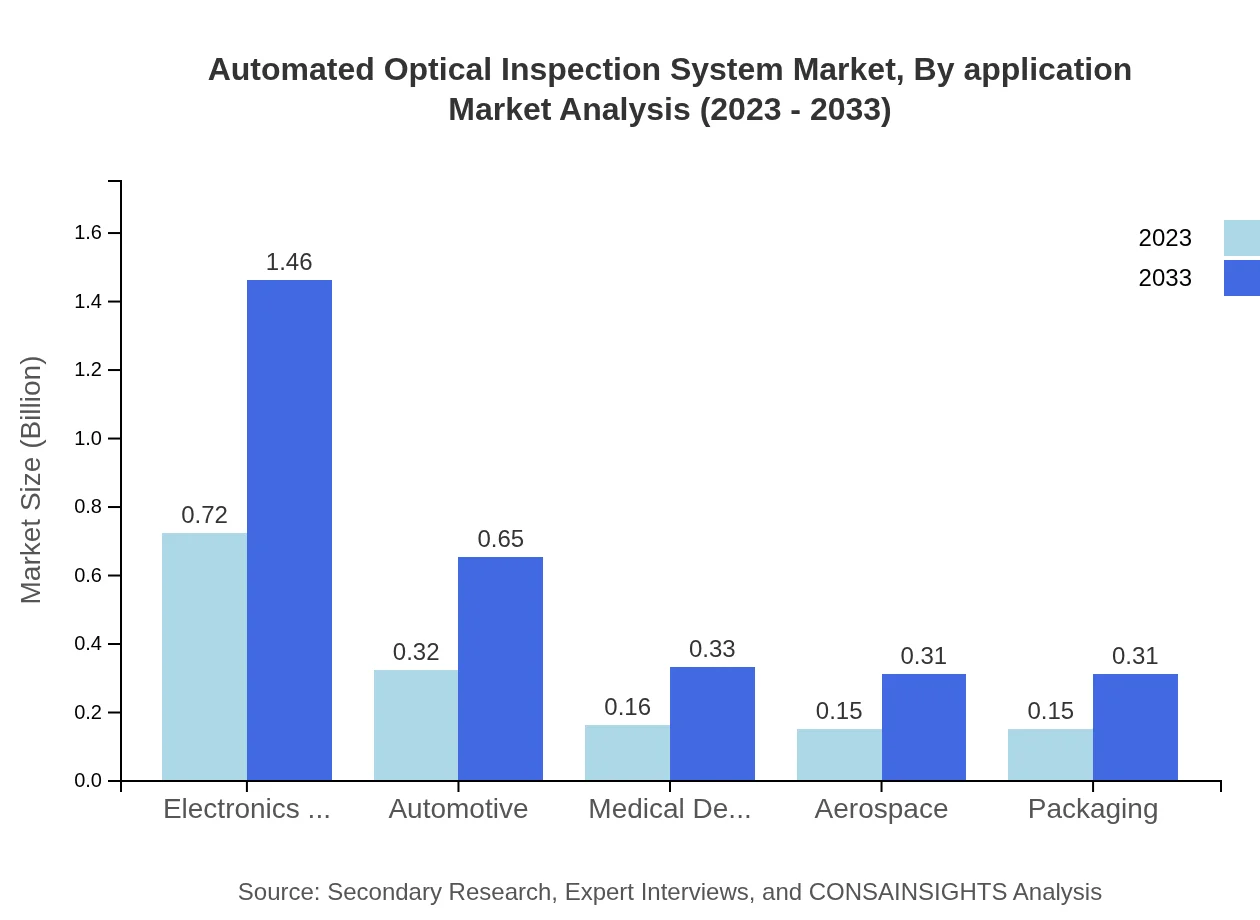

Automated Optical Inspection System Market Analysis By Application

The AOI market is extensively dominated by electronics manufacturing, holding a market size of $0.72 billion in 2023, with an expected growth to $1.46 billion by 2033. The automotive sector is also a crucial contributor, presenting a growing market segment due to rising vehicle complexities and regulatory requirements.

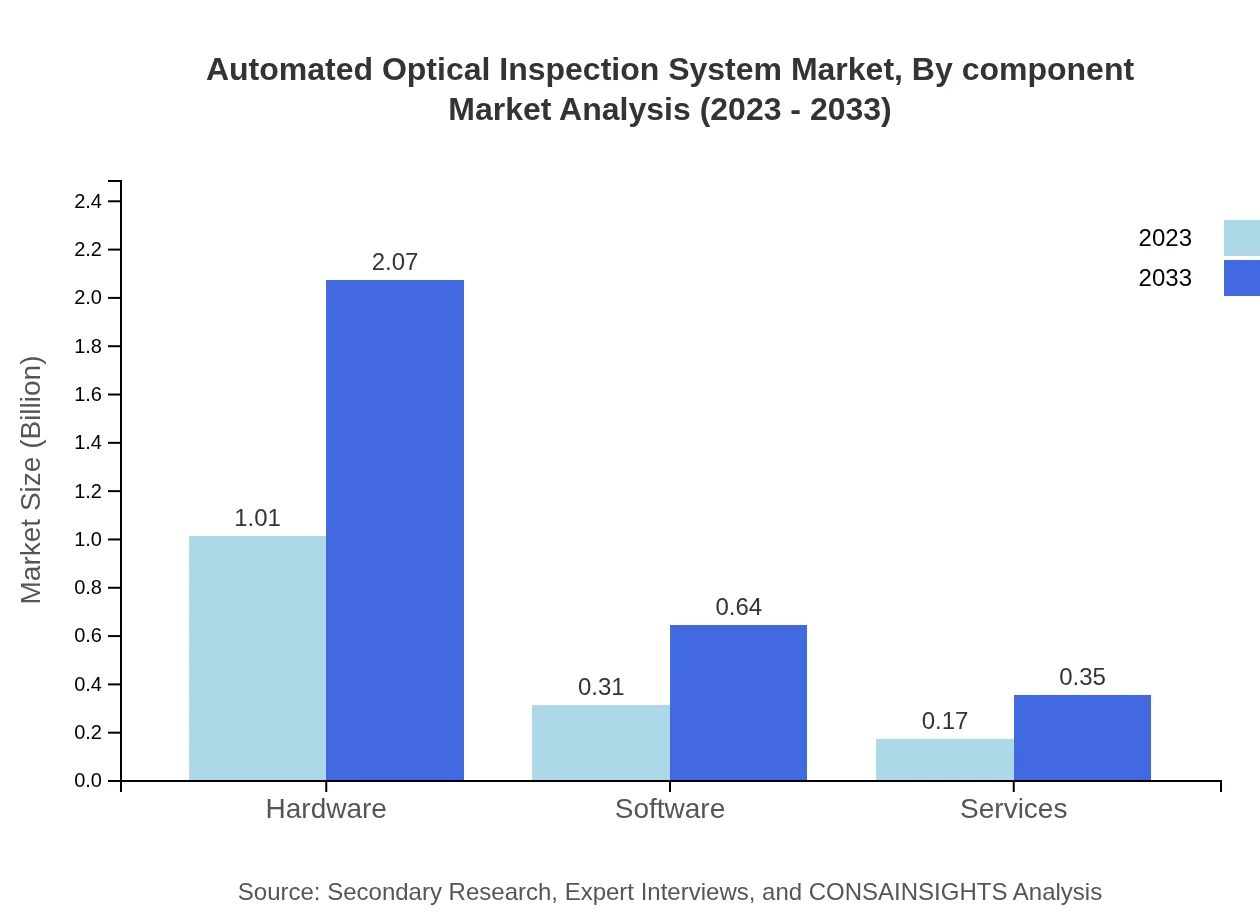

Automated Optical Inspection System Market Analysis By Component

Hardware components lead the market, comprising 67.57% in 2023. Software solutions are increasingly significant as manufacturers seek integrated software systems to complement hardware. The rise of cloud-based solutions offers enhanced accessibility and data management capabilities, which are becoming vital in modern manufacturing.

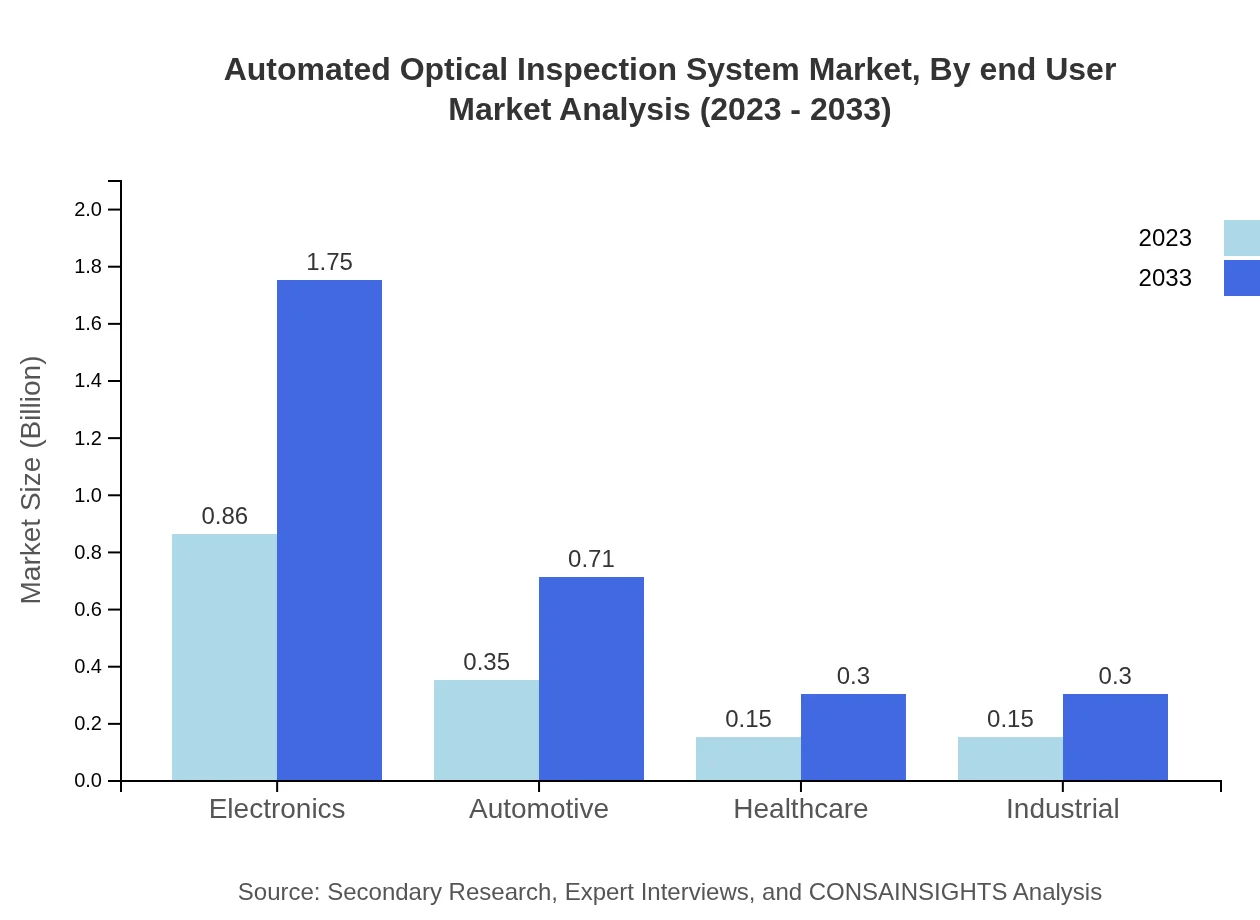

Automated Optical Inspection System Market Analysis By End User

Key end-user industries include electronics, automotive, healthcare, and aerospace. Electronics manufacturing commands the largest share due to the high volume of production and quality assurance processes, whereas the aerospace sector is witnessing increased adoption as manufacturers prioritize safety and reliability.

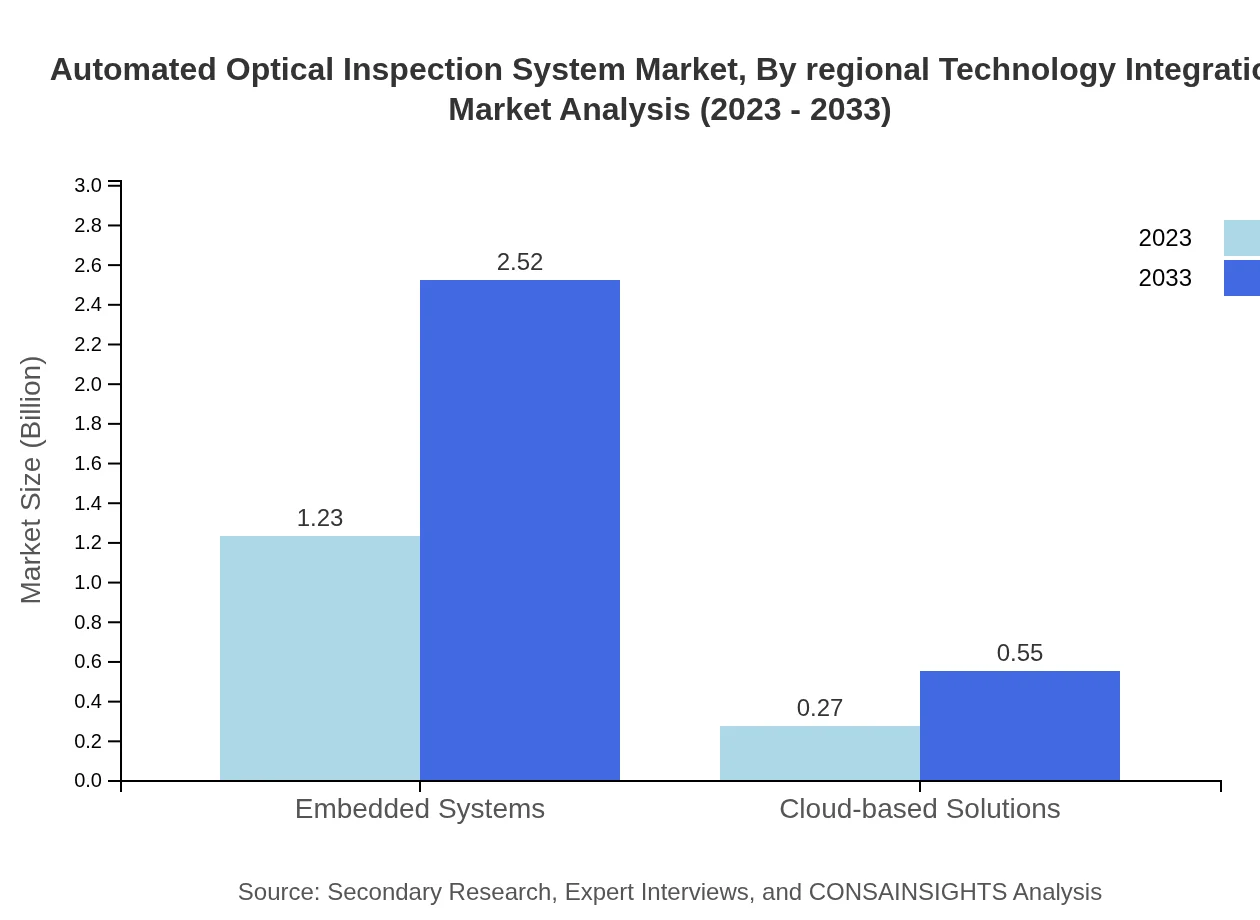

Automated Optical Inspection System Market Analysis By Regional Technology Integration

The integration of advanced technology varies by region, with Asia Pacific leading in the adoption of automation solutions, followed by North America. Europe is notable for its stringent quality standards, driving technological investments accordingly. The Middle East and Africa are increasingly integrating automated systems to enhance manufacturing capabilities.

Automated Optical Inspection System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Optical Inspection System Industry

KLA Corporation:

KLA Corporation is a leader in process control and yield management solutions, specializing in defect inspection and classification technologies and providing advanced systems for the semiconductor, electronics, and data storage industries.Omron Corporation:

Omron is renowned for its process automation solutions, offering high-performance AOI systems that leverage advanced imaging, AI-based inspection, and industrial automation technologies to enhance quality control.Cognex Corporation:

Cognex Corporation is recognized for its machine vision and industrial barcode reading technology, providing vision systems that enhance productivity and accuracy in manufacturing, while being pivotal in AOI applications.Acculogic:

Acculogic specializes in automated test equipment and AOI systems for electronics manufacturing, supporting innovation in quality assurance and reliability testing.We're grateful to work with incredible clients.

FAQs

What is the market size of the Automated Optical Inspection System?

The Automated Optical Inspection System market was valued at approximately $1.5 billion in 2023 and is expected to grow at a CAGR of 7.2%, reaching around $3 billion by 2033.

What are the key market players or companies in the Automated Optical Inspection System industry?

Some notable companies in the Automated Optical Inspection System market include Omron Corporation, Cognex Corporation, and Keyence Corporation, all of which contribute significantly to technological advancements and market share.

What are the primary factors driving the growth in the Automated Optical Inspection System industry?

Key drivers for growth include the increasing demand for high-quality inspection in manufacturing, advancements in machine vision technologies, and the rapid expansion of the electronics and automotive sectors.

Which region is the fastest Growing in the Automated Optical Inspection System?

North America is currently the fastest-growing region, with a market size projected to grow from $0.58 billion in 2023 to $1.18 billion by 2033, driven by technological innovation and adoption.

Does ConsaInsights provide customized market report data for the Automated Optical Inspection System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Automated Optical Inspection System industry, providing insights that are relevant and actionable.

What deliverables can I expect from this Automated Optical Inspection System market research project?

Expect detailed market reports including in-depth analysis of market size, trends, competitive landscape, along with segmented data and actionable insights for strategic decision-making.

What are the market trends of Automated Optical Inspection System?

Key trends include increasing automation in manufacturing, a shift towards AI-driven inspection technologies, and a growing emphasis on quality assurance across various industries.