Automated Storage And Retrieval System Market Report

Published Date: 22 January 2026 | Report Code: automated-storage-and-retrieval-system

Automated Storage And Retrieval System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Automated Storage and Retrieval System (ASRS) market, covering insights on market trends, size projections, technological advancements, and regional assessments for the forecast period from 2023 to 2033.

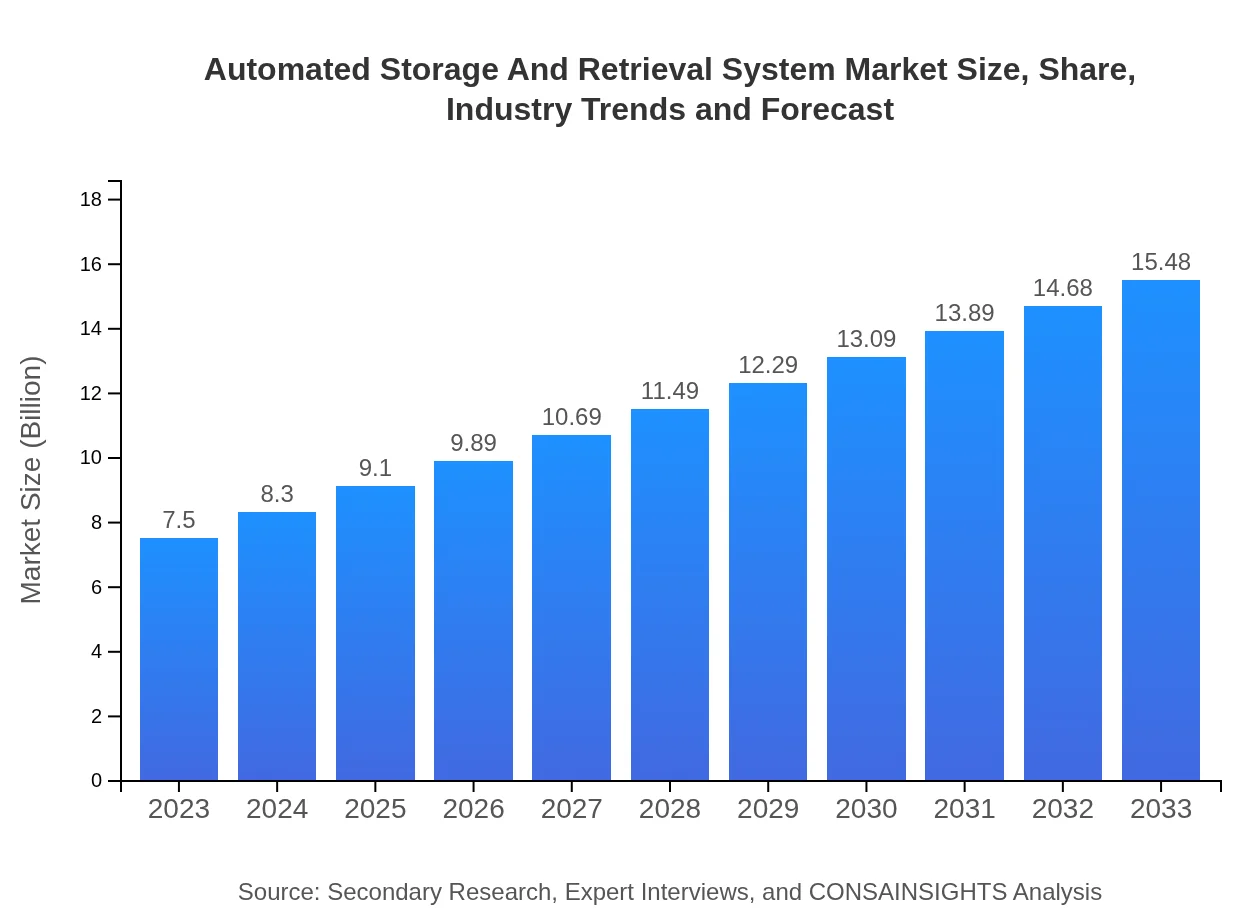

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $15.48 Billion |

| Top Companies | Dematic Corporation, SSI Schaefer, Honeywell Intelligrated, Kardex Remstar |

| Last Modified Date | 22 January 2026 |

Automated Storage And Retrieval System Market Overview

Customize Automated Storage And Retrieval System Market Report market research report

- ✔ Get in-depth analysis of Automated Storage And Retrieval System market size, growth, and forecasts.

- ✔ Understand Automated Storage And Retrieval System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Storage And Retrieval System

What is the Market Size & CAGR of Automated Storage And Retrieval System market in 2023?

Automated Storage And Retrieval System Industry Analysis

Automated Storage And Retrieval System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Storage And Retrieval System Market Analysis Report by Region

Europe Automated Storage And Retrieval System Market Report:

Europe's ASRS market is projected to grow from $1.89 billion in 2023 to $3.90 billion in 2033. The region's emphasis on automation and logistics optimization, coupled with the rise of e-commerce, is driving market growth.Asia Pacific Automated Storage And Retrieval System Market Report:

The Asia-Pacific region is projected to witness substantial growth in the ASRS market, increasing from $1.54 billion in 2023 to $3.18 billion by 2033. Factors contributing to this growth include rapid industrialization, the rise of e-commerce, and investments in automation technologies.North America Automated Storage And Retrieval System Market Report:

North America holds the largest share of the ASRS market, anticipated to expand from $2.54 billion in 2023 to $5.25 billion by 2033, fueled by advancements in technology and a strong focus on operational efficiency across industries.South America Automated Storage And Retrieval System Market Report:

In South America, the market size is expected to grow from $0.58 billion in 2023 to $1.19 billion in 2033, driven by the increasing demand for automated solutions in logistics and warehousing, particularly in Brazil and Argentina.Middle East & Africa Automated Storage And Retrieval System Market Report:

The Middle East and Africa region is expected to see growth from $0.95 billion in 2023 to $1.96 billion by 2033, as companies adopt automation technologies to improve their supply chain efficiency.Tell us your focus area and get a customized research report.

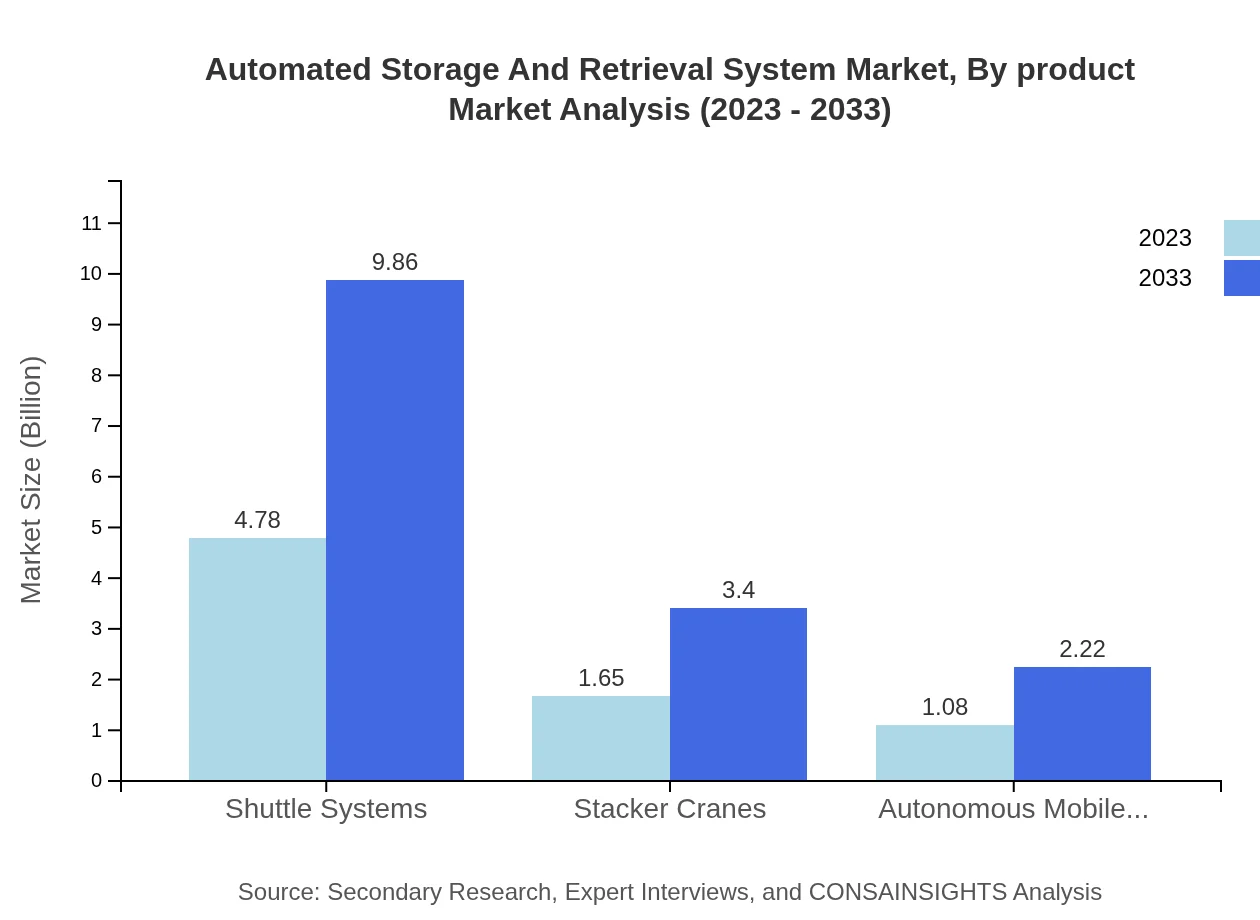

Automated Storage And Retrieval System Market Analysis By Product

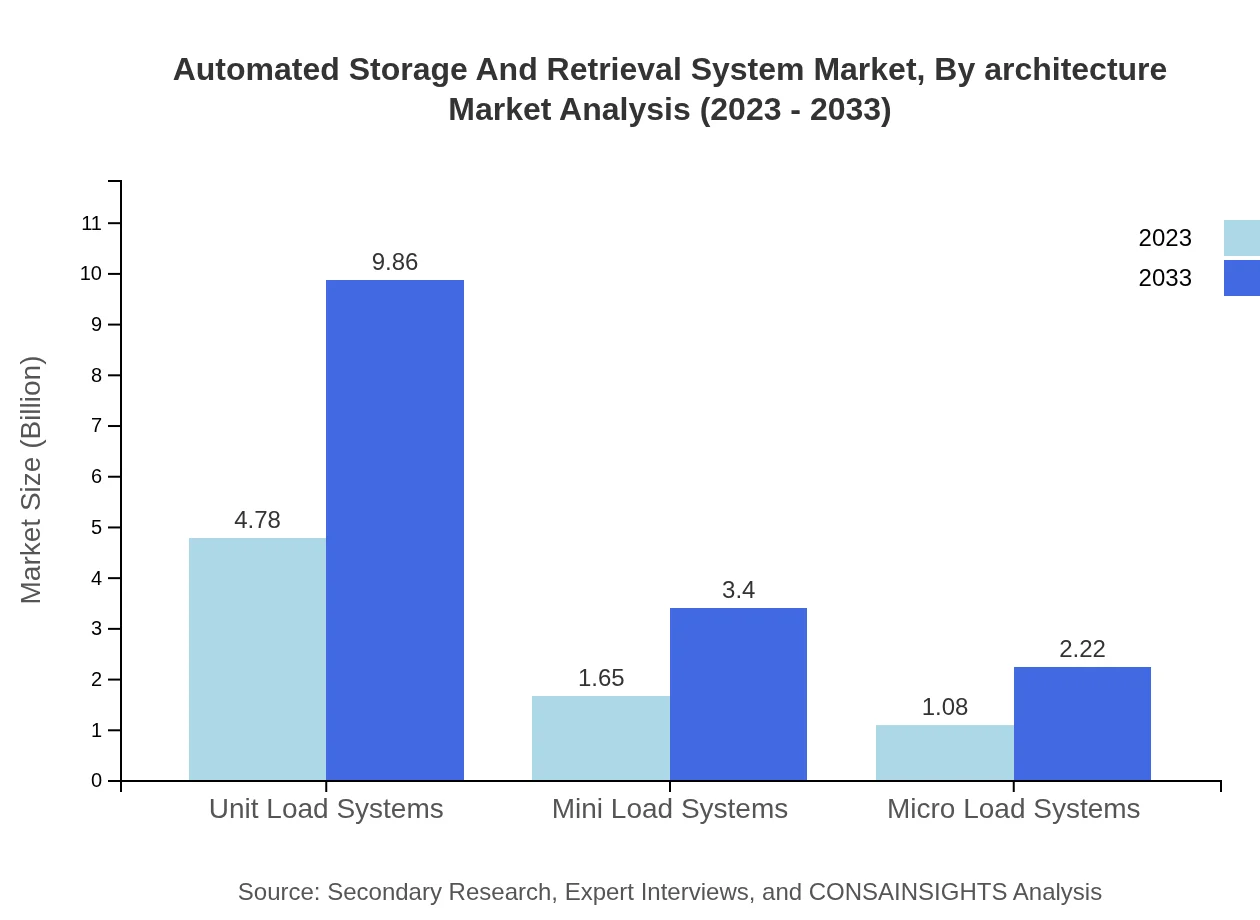

The ASRS market is dominated by Shuttle Systems, which account for a significant share of the market. As of 2023, the size of Shuttle Systems is approximately $4.78 billion, and by 2033, it is expected to grow to $9.86 billion. Stacker Cranes represent another essential product segment, with sizes of $1.65 billion in 2023 and projected growth to $3.40 billion by 2033.

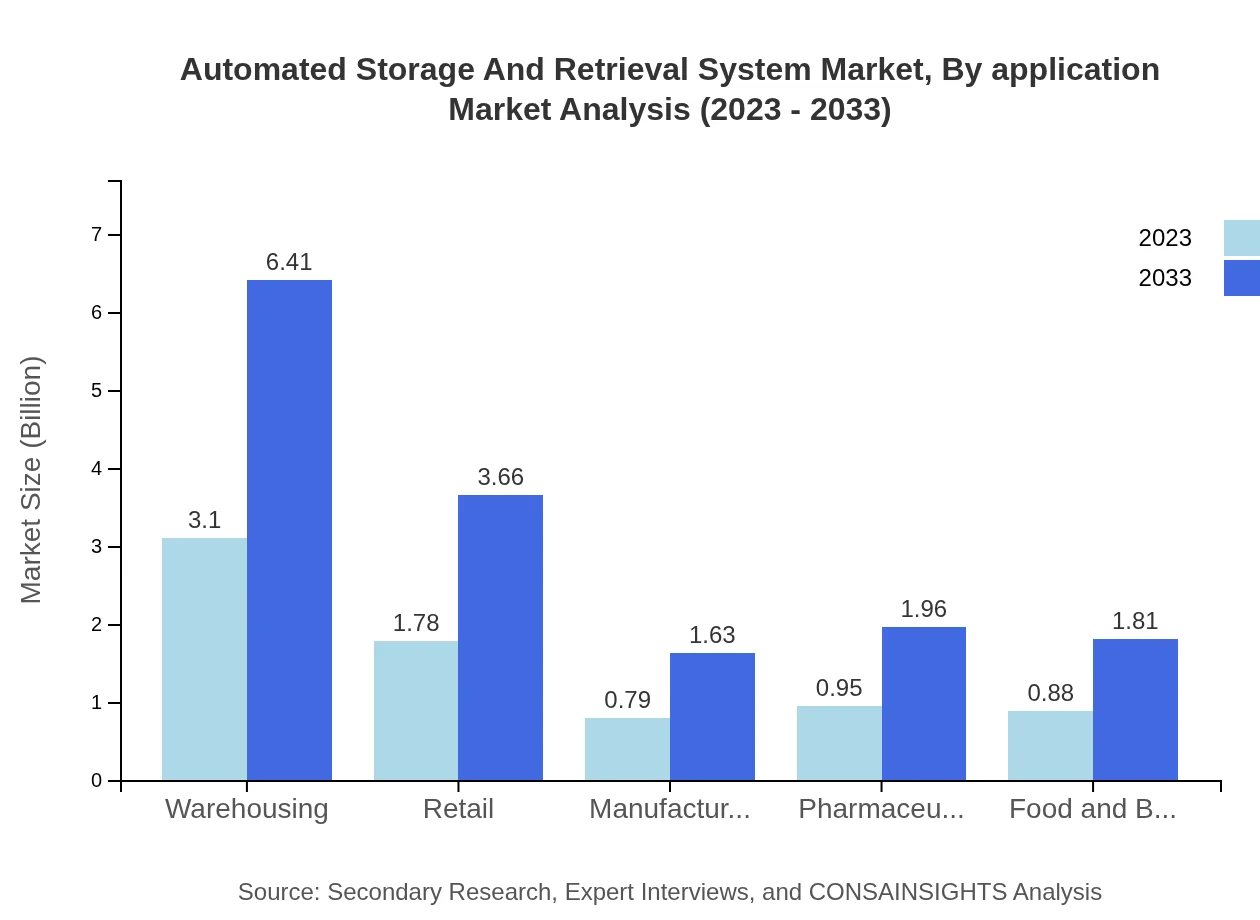

Automated Storage And Retrieval System Market Analysis By Application

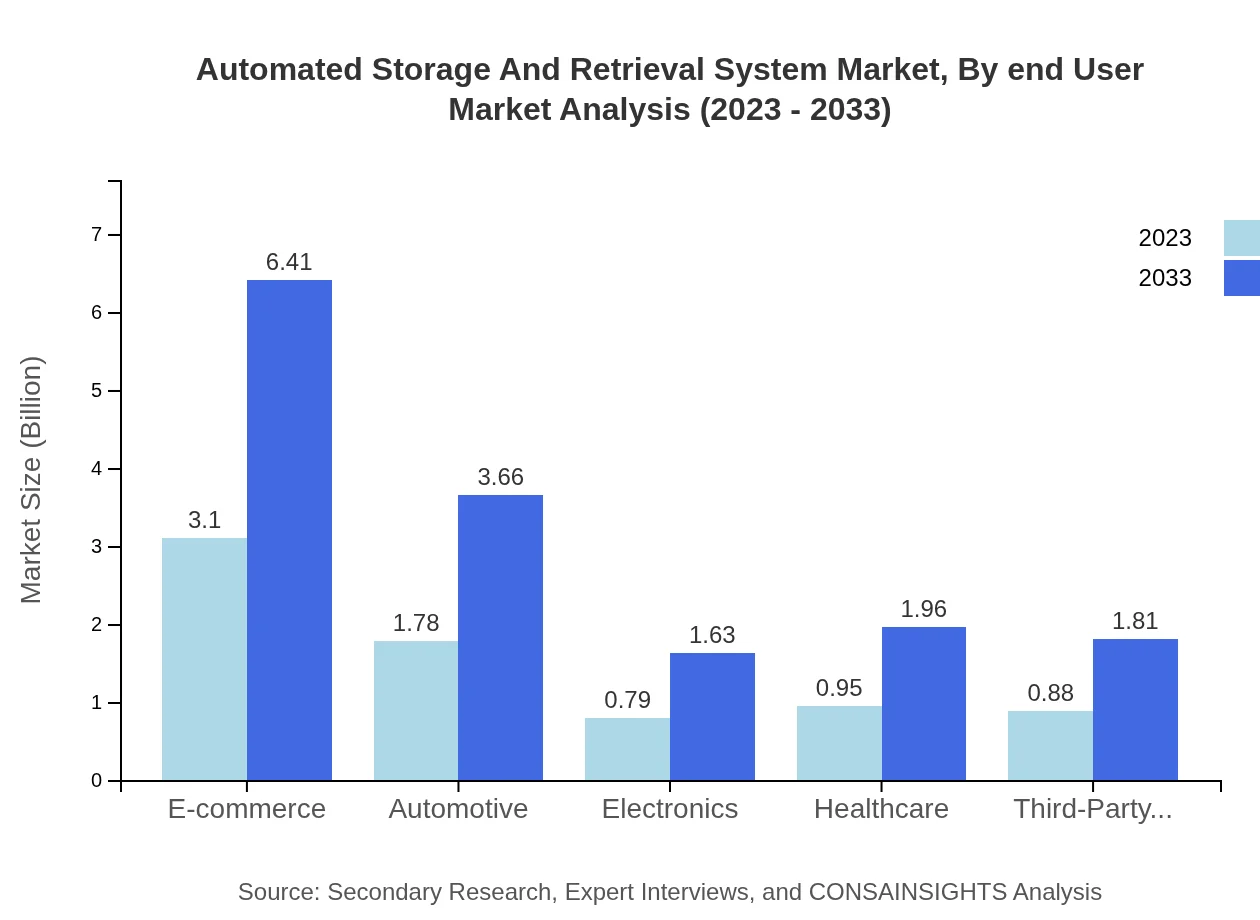

Key applications of ASRS include e-commerce, automotive, electronics, healthcare, and third-party logistics. In 2023, the e-commerce sector accounted for approximately $3.10 billion, with expected growth to $6.41 billion by 2033, highlighting the crucial role of ASRS in enhancing online retail efficiency.

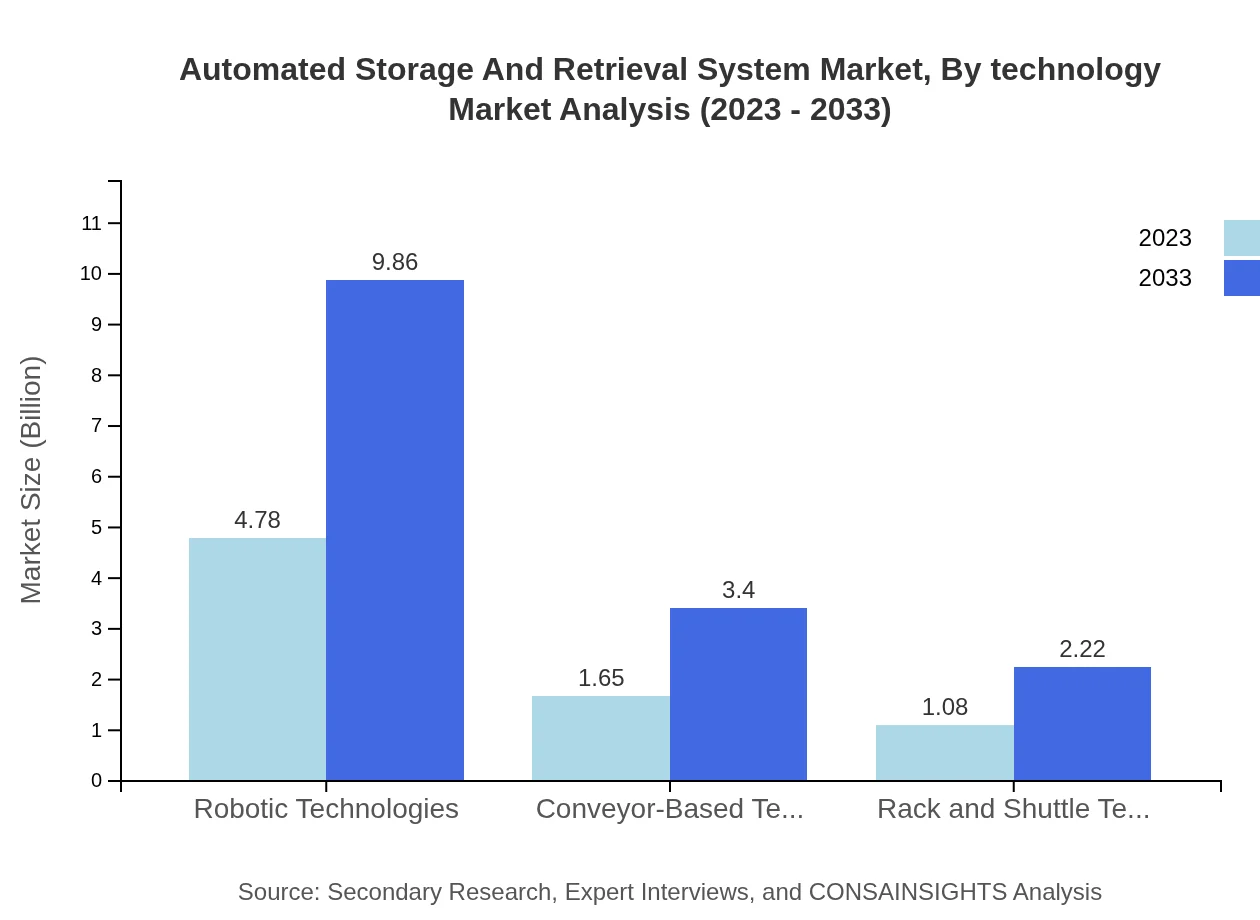

Automated Storage And Retrieval System Market Analysis By Technology

Technological advancements continue to shape the ASRS market, with innovations such as IoT, robotics, and AI-driven solutions becoming increasingly common. Robotic Technologies lead the market with a size of $4.78 billion in 2023, expected to rise to $9.86 billion by 2033.

Automated Storage And Retrieval System Market Analysis By End User

The end-user segments of the ASRS market include manufacturing, retail, food and beverage, and pharmaceuticals. The manufacturing sector, in particular, is projected to grow from $0.79 billion in 2023 to $1.63 billion by 2033, driven by increased automation demands.

Automated Storage And Retrieval System Market Analysis By Architecture

The architecture of ASRS solutions, including unit load systems, mini load systems, and micro load systems, influences market dynamics. Unit Load Systems dominate the market, with projections of $4.78 billion in 2023 growing to $9.86 billion by 2033.

Automated Storage And Retrieval System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Storage And Retrieval System Industry

Dematic Corporation:

Dematic is a leading provider of intelligent automated solutions and services for supply chain optimization, renowned for its innovative ASRS systems.SSI Schaefer:

SSI Schaefer specializes in providing logistics solutions and has a robust portfolio of ASRS products that enhance operational efficiency across various industries.Honeywell Intelligrated:

Honeywell Intelligrated offers a comprehensive range of automation solutions, including advanced ASRS technologies aimed at improving warehouse operations.Kardex Remstar:

Kardex Remstar focuses on providing automated storage solutions that maximize space and improve retrieval efficiency within warehouses.We're grateful to work with incredible clients.

FAQs

What is the market size of Automated Storage and Retrieval System?

The Automated Storage and Retrieval System (ASRS) market is valued approximately at $7.5 billion in 2023 and is projected to grow with a CAGR of 7.3%, reflecting significant growth potential and buyer interest over the next decade.

What are the key market players or companies in this Automated Storage and Retrieval System industry?

Major players in the ASRS market include KION Group AG, Toyota Industries Corporation, Daifuku Co., Ltd., Murata Machinery, Ltd., and Swisslog AG, among others, who are pioneering innovations and technology advancements in warehouse automation.

What are the primary factors driving the growth in the Automated Storage and Retrieval System industry?

Growth in the ASRS industry is driven by increasing demand for automation in warehouses, the growth of e-commerce, advancements in robotics and AI technologies, the need for efficient inventory management, and enhanced operational efficiency across various sectors.

Which region is the fastest Growing in Automated Storage and Retrieval System?

Among the regions, North America is the fastest-growing market for ASRS, expected to rise from $2.54 billion in 2023 to $5.25 billion by 2033. Europe and Asia Pacific are also witnessing substantial growth in this space.

Does ConsInsights provide customized market report data for the Automated Storage and Retrieval System industry?

Yes, ConsInsights offers customized market report data tailored to specific needs and requirements, enabling clients to access detailed insights on the Automated Storage and Retrieval System sector that are relevant to their business objectives.

What deliverables can I expect from this Automated Storage and Retrieval System market research project?

Deliverables from the ASRS market research project include comprehensive market analysis, competitor profiling, growth forecasts, trends identification, regional insights, and strategic recommendations to enhance decision-making and investment strategies.

What are the market trends of Automated Storage and Retrieval System?

Current trends in the ASRS market include the integration of artificial intelligence for real-time data processing, increased adoption of IoT-enabled systems, a shift towards sustainable practices, and continuous innovation in robotics enhancing efficiency and flexibility.