Automated Storage And Retrieval Systems In Laboratories Market Report

Published Date: 22 January 2026 | Report Code: automated-storage-and-retrieval-systems-in-laboratories

Automated Storage And Retrieval Systems In Laboratories Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automated Storage and Retrieval Systems (ASRS) in laboratories, detailing market trends, growth forecasts, and regional insights from 2023 to 2033. Key segments and technology impacts are also discussed to inform stakeholders.

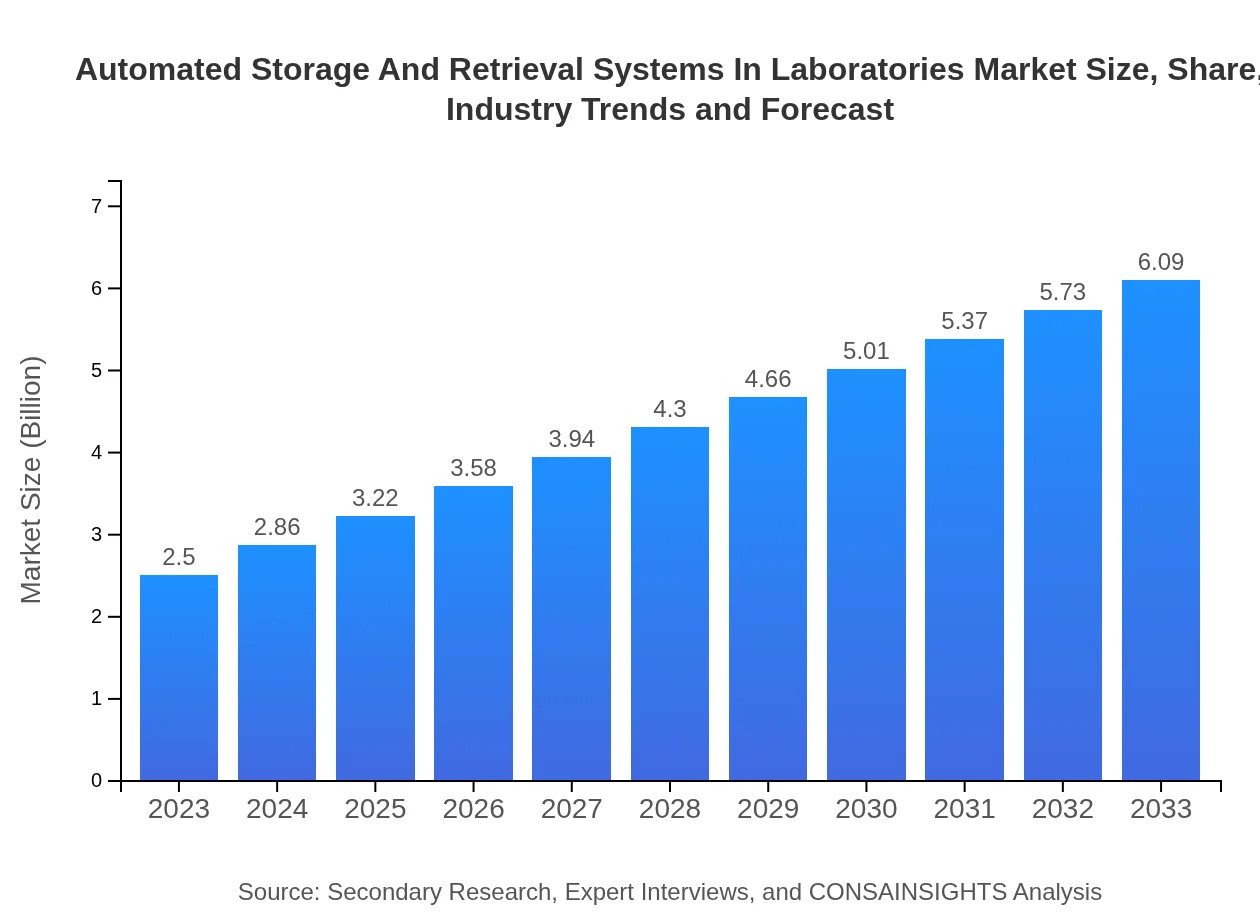

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $6.09 Billion |

| Top Companies | Daifuku Co., Ltd., Swisslog Holding AG, Kardex Remstar, Mecalux, S.A., Honeywell Intelligrated |

| Last Modified Date | 22 January 2026 |

Automated Storage And Retrieval Systems In Laboratories Market Overview

Customize Automated Storage And Retrieval Systems In Laboratories Market Report market research report

- ✔ Get in-depth analysis of Automated Storage And Retrieval Systems In Laboratories market size, growth, and forecasts.

- ✔ Understand Automated Storage And Retrieval Systems In Laboratories's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Storage And Retrieval Systems In Laboratories

What is the Market Size & CAGR of Automated Storage And Retrieval Systems In Laboratories market in 2023?

Automated Storage And Retrieval Systems In Laboratories Industry Analysis

Automated Storage And Retrieval Systems In Laboratories Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Storage And Retrieval Systems In Laboratories Market Analysis Report by Region

Europe Automated Storage And Retrieval Systems In Laboratories Market Report:

The European Automated Storage and Retrieval Systems market is expected to increase from $0.78 billion in 2023 to $1.91 billion by 2033. Innovations in laboratory technologies and a strong focus on research and development are propelling this growth.Asia Pacific Automated Storage And Retrieval Systems In Laboratories Market Report:

The Asia Pacific region is anticipated to witness rapid growth in the ASRS market, with an increase from $0.45 billion in 2023 to $1.09 billion by 2033. Growing investments in laboratory automation across countries like China and Japan are driving this trend, alongside a growing biotechnology sector that demands efficiency.North America Automated Storage And Retrieval Systems In Laboratories Market Report:

North America holds a prominent share of the ASRS market, expected to grow from $0.96 billion in 2023 to $2.34 billion by 2033. The region's advanced healthcare research facilities and stringent regulations advocating for automation are key factors influencing this market expansion.South America Automated Storage And Retrieval Systems In Laboratories Market Report:

In South America, the market is projected to grow from $0.07 billion in 2023 to $0.17 billion by 2033. The gradual adoption of automated systems in Brazil and Argentina's laboratories, driven by a need for enhanced efficiency, supports this growth.Middle East & Africa Automated Storage And Retrieval Systems In Laboratories Market Report:

The Middle East and Africa are expected to see moderate growth, with estimates from $0.24 billion in 2023 to $0.59 billion by 2033. The rising investment in medical and biotechnology labs, particularly in the UAE and South Africa, is expected to fuel this growth.Tell us your focus area and get a customized research report.

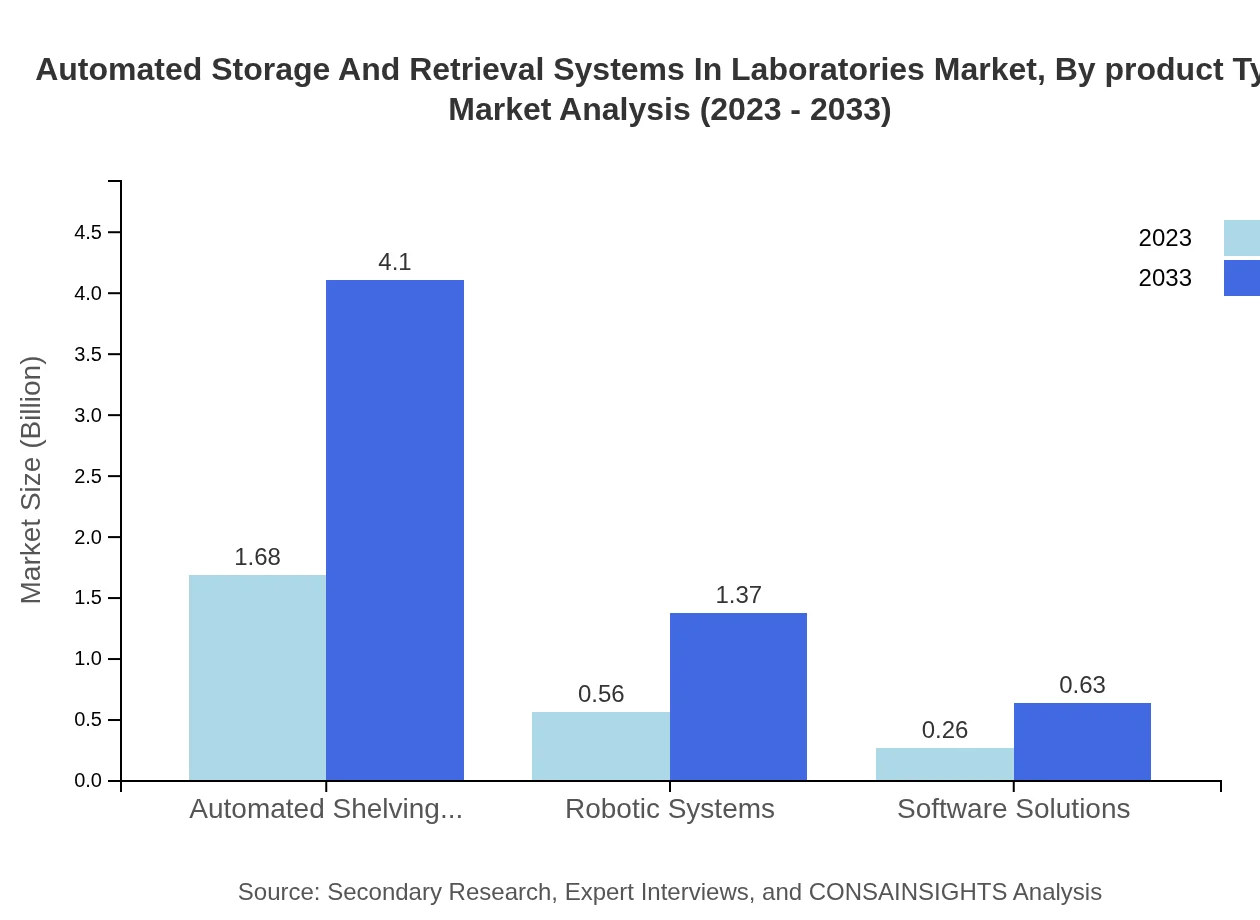

Automated Storage And Retrieval Systems In Laboratories Market Analysis By Product Type

The Automated Storage and Retrieval Systems market can be analyzed by product type, revealing significant insights. Automated Shelving Systems dominate the market with a projected growth from $1.68 billion in 2023 to $4.10 billion by 2033, accounting for 67.27% of the market share. Robotic Systems are also gaining traction, growing from $0.56 billion in 2023 to $1.37 billion by 2033, representing 22.44% of the market share. Software Solutions, alongside barcode scanning and RFID technologies, are crucial as they streamline operations, showing notable growth trends through the forecast period.

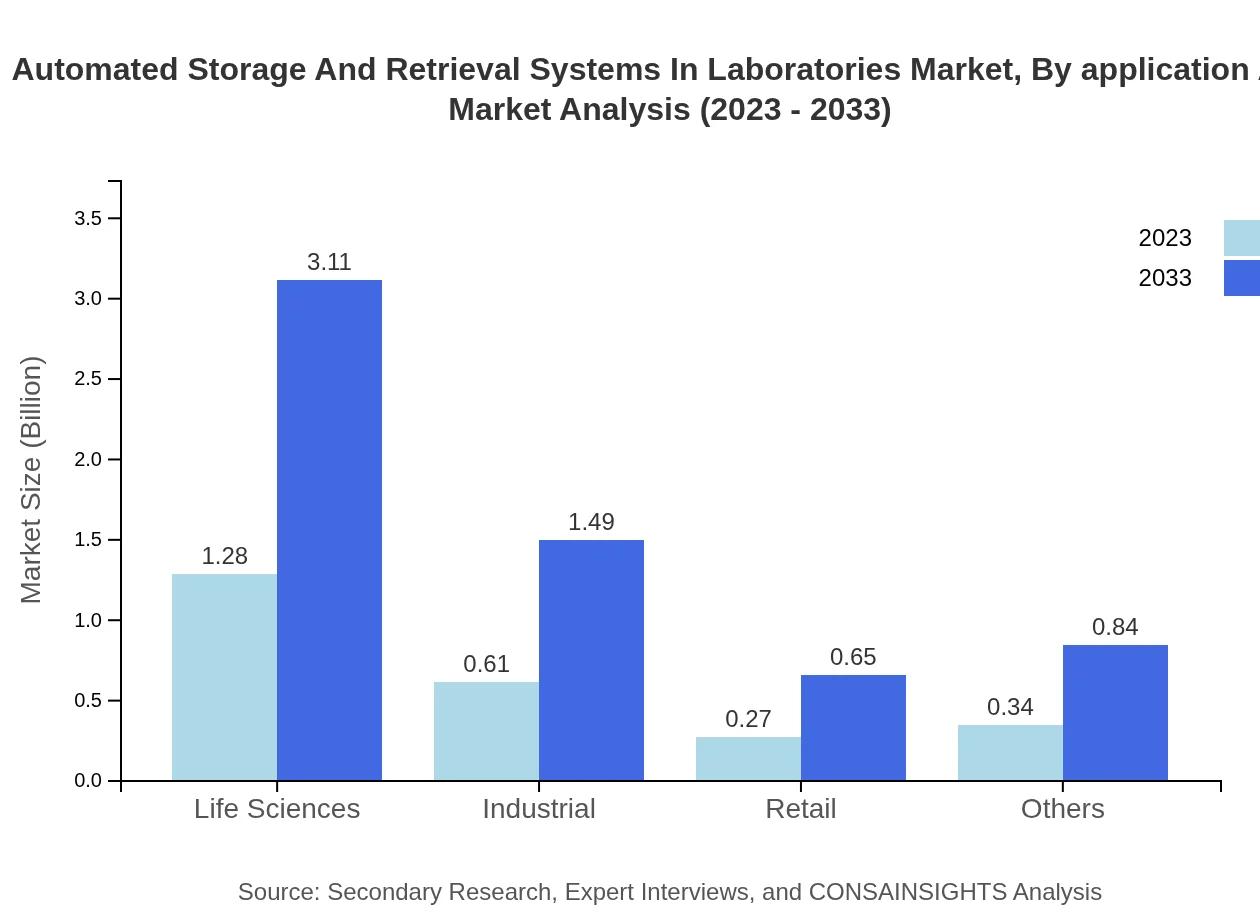

Automated Storage And Retrieval Systems In Laboratories Market Analysis By Application Area

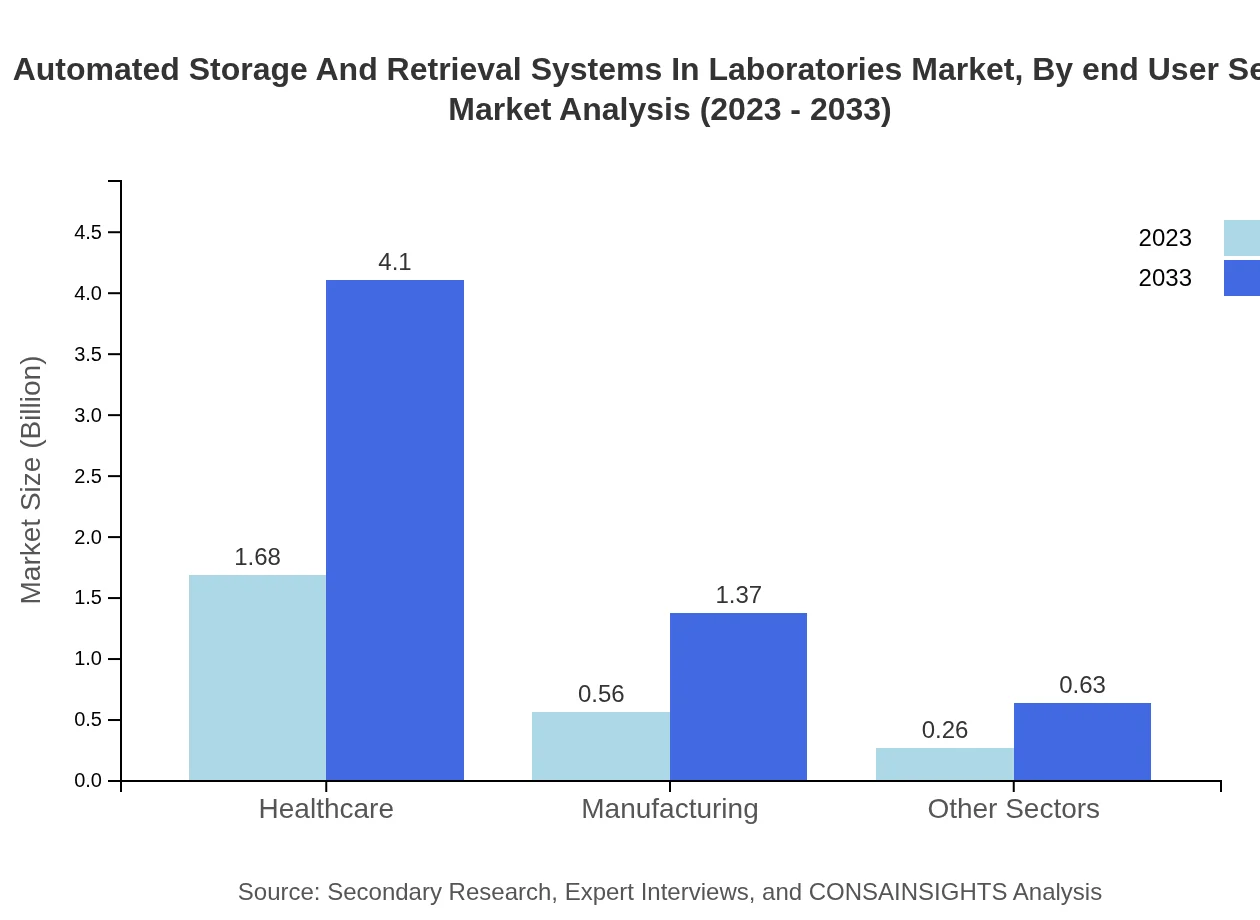

Segmentation by application area shows that healthcare holds the largest share in the Automated Storage and Retrieval Systems market, with sizes of $1.68 billion in 2023 and $4.10 billion in 2033. Life sciences follow closely, expanding from $1.28 billion to $3.11 billion. Other sectors such as manufacturing, industrial, and retail also contribute significantly but reflect smaller growth percentages compared to healthcare and life sciences, indicating a concentrated investment in these primary sectors.

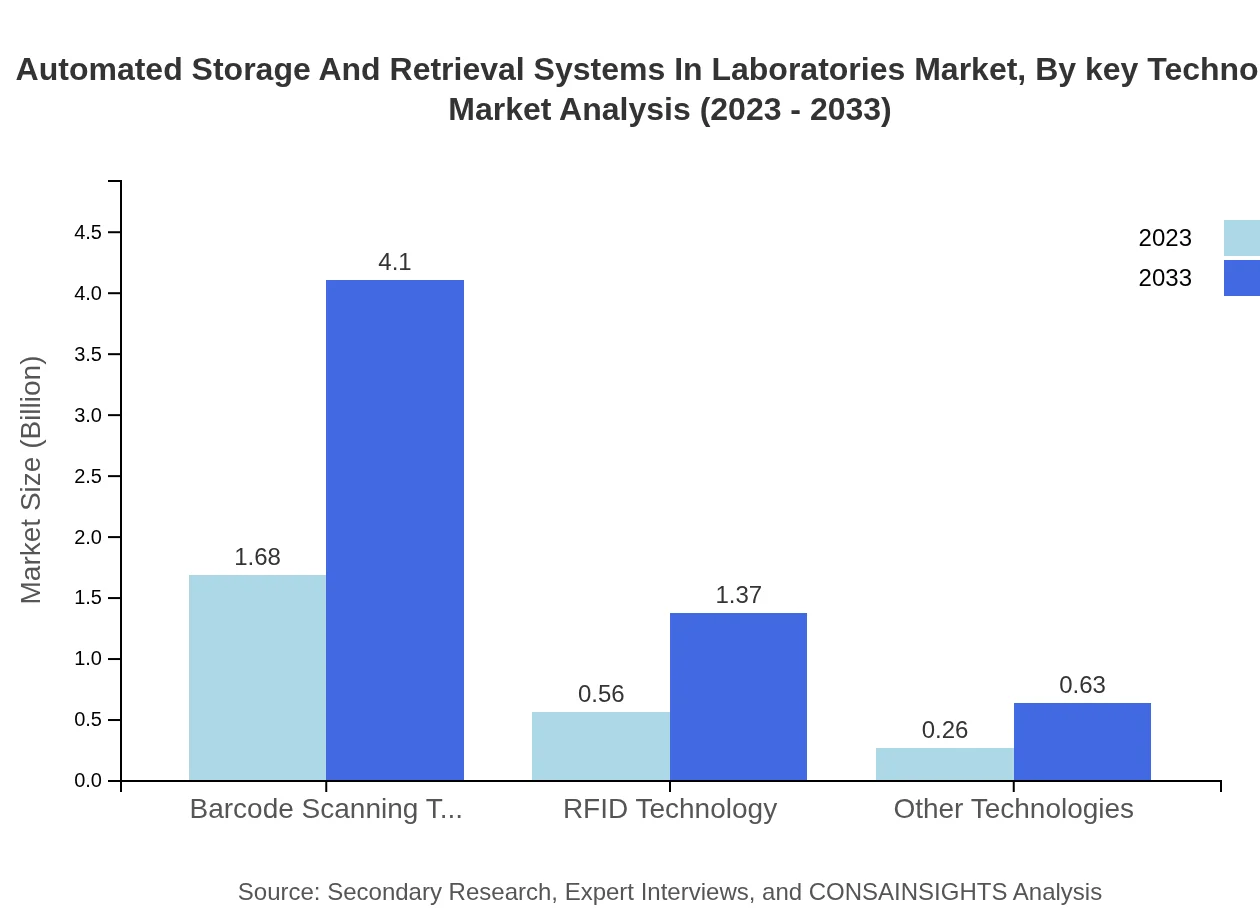

Automated Storage And Retrieval Systems In Laboratories Market Analysis By Key Technology

Key technologies influencing the Automated Storage and Retrieval Systems market include barcode scanning and RFID technology, both expected to expand concurrently with market demand. Barcode scanning systems are projected to grow from $1.68 billion in 2023 to $4.10 billion in 2033, while RFID systems grow from $0.56 billion to $1.37 billion within the same period. These technologies enhance inventory accuracy and operational speed, fostering efficiency within laboratory environments.

Automated Storage And Retrieval Systems In Laboratories Market Analysis By End User Sector

The end-user sector segmentation indicates strong adoption in life sciences, accounting for 51.12% of the market with growth from $1.28 billion in 2023 to $3.11 billion in 2033. Healthcare utilizes approximately 67.27% of the segment, reinforcing the need for automation in critical operational areas. Meanwhile, sectors such as retail and manufacturing are experiencing gradual adoption, reflecting the broader trend of automation across various industries.

Automated Storage And Retrieval Systems In Laboratories Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Storage And Retrieval Systems In Laboratories Industry

Daifuku Co., Ltd.:

Daifuku is a leading provider of automated systems, renowned for its innovative solutions tailored for laboratory environments, enhancing material handling and storage efficiency.Swisslog Holding AG:

Swisslog offers advanced warehouse automation solutions and is recognized for its technology integration to optimize laboratory workflows.Kardex Remstar:

Kardex specializes in storage solutions with a focus on compact storage systems that significantly improve space utilization in laboratories.Mecalux, S.A.:

Mecalux designs and manufactures storage solutions aimed at enhancing supply chain efficiency, catering to laboratory automation needs.Honeywell Intelligrated:

Honeywell Intelligrated provides smart warehouse solutions and is integral in merging software with storage technology to optimize logistics in laboratories.We're grateful to work with incredible clients.

FAQs

What is the market size of Automated Storage and Retrieval Systems in Laboratories?

The global market size for Automated Storage and Retrieval Systems in Laboratories is estimated to reach $2.5 billion by 2033, with a compound annual growth rate (CAGR) of 9% from 2023 to 2033.

What are the key market players or companies in this Automated Storage and Retrieval Systems in Laboratories industry?

Key players in the Automated Storage and Retrieval Systems market include major technology firms and specialized manufacturers. They focus on innovative solutions that enhance efficiency and safety in laboratory environments.

What are the primary factors driving the growth in the Automated Storage and Retrieval Systems industry?

Growth in this industry is driven by rising demand for automation in laboratories, increased efficiency, reduced human error, and the necessity for better inventory management, especially in healthcare and life sciences.

Which region is the fastest Growing in the Automated Storage and Retrieval Systems market?

North America is the fastest-growing region, projected to grow from $0.96 billion in 2023 to $2.34 billion by 2033. Europe follows closely, with growth from $0.78 billion to $1.91 billion in the same period.

Does ConsaInsights provide customized market report data for the Automated Storage and Retrieval Systems industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, ensuring insights are relevant and actionable for stakeholders in the Automated Storage and Retrieval Systems sector.

What deliverables can I expect from this Automated Storage and Retrieval Systems market research project?

Upon completion of the market research project, clients can expect detailed reports including market size, growth forecasts, competitive analysis, and insights on various segments, ensuring comprehensive market understanding.

What are the market trends of Automated Storage and Retrieval Systems?

Current trends include increased integration of AI and IoT in automation systems, growing adoption in healthcare and life sciences, and emphasis on sustainability and energy efficiency in product development.