Automated Teller Machine Market Report

Published Date: 31 January 2026 | Report Code: automated-teller-machine

Automated Teller Machine Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automated Teller Machine market, highlighting market size, growth trends, and forecasts from 2023 to 2033. It includes segmentation by type, technology, end-user, and geography, offering valuable insights for stakeholders in the industry.

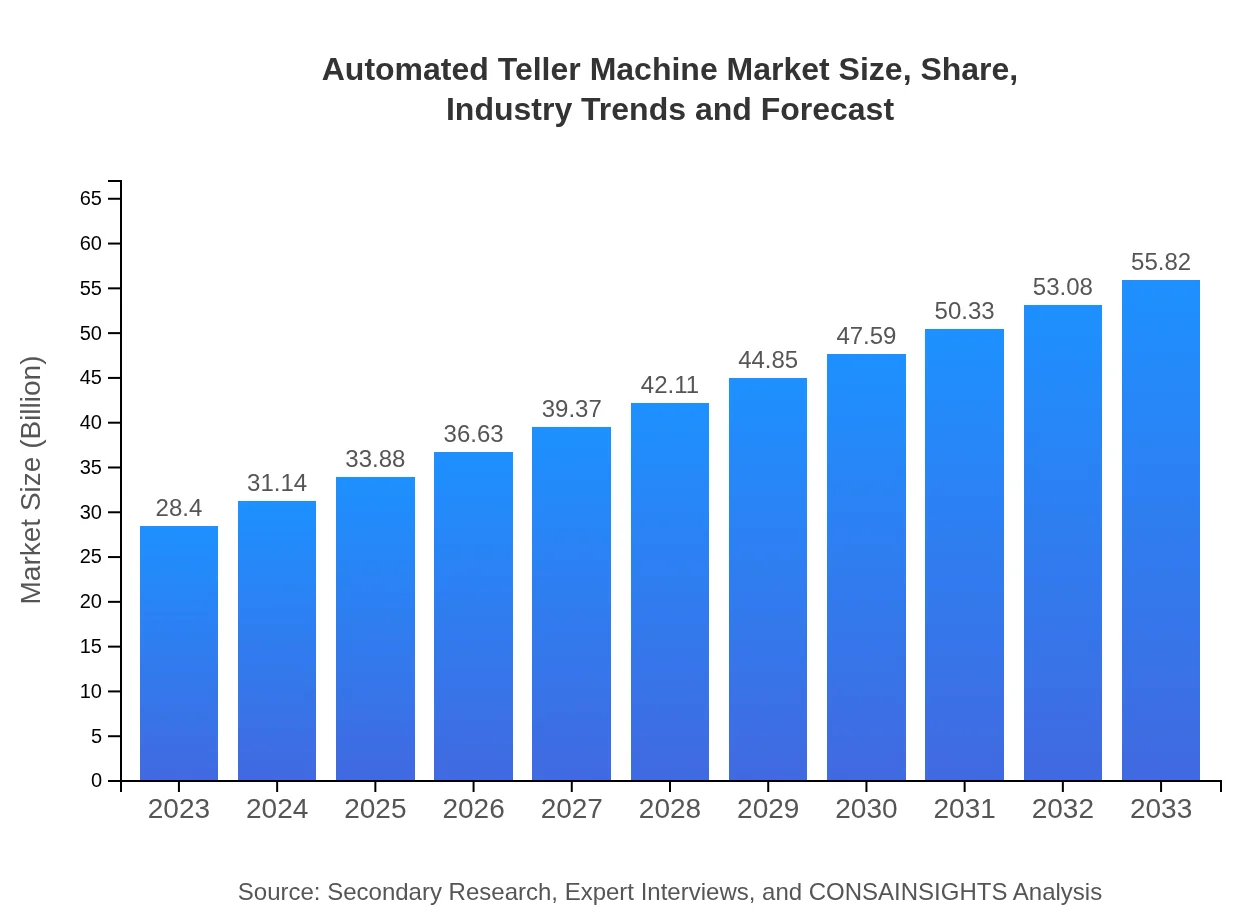

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $28.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $55.82 Billion |

| Top Companies | NCR Corporation, Diebold Nixdorf, GRG Banking, Hitachi-Omron Terminal Solutions, Fujitsu |

| Last Modified Date | 31 January 2026 |

Automated Teller Machine Market Overview

Customize Automated Teller Machine Market Report market research report

- ✔ Get in-depth analysis of Automated Teller Machine market size, growth, and forecasts.

- ✔ Understand Automated Teller Machine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automated Teller Machine

What is the Market Size & CAGR of Automated Teller Machine market in 2023?

Automated Teller Machine Industry Analysis

Automated Teller Machine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automated Teller Machine Market Analysis Report by Region

Europe Automated Teller Machine Market Report:

Europe's ATM market is anticipated to grow from $7.59 billion in 2023 to $14.93 billion by 2033, fueled by the adoption of advanced ATMs and regulatory support for cashless transactions.Asia Pacific Automated Teller Machine Market Report:

The Asia-Pacific region's ATM market was valued at approximately $5.52 billion in 2023 and is projected to reach $10.85 billion by 2033, growing at a robust rate due to urbanization and the proliferation of banking services.North America Automated Teller Machine Market Report:

North America is a major player in the ATM market, valued at $10.74 billion in 2023, with a future forecast of $21.11 billion by 2033, driven by technological advancements and customer demand for self-service banking.South America Automated Teller Machine Market Report:

In South America, the market stands at $1.86 billion in 2023, expected to grow to $3.65 billion by 2033. Economic growth and digitalization are boosting ATM installations across the region.Middle East & Africa Automated Teller Machine Market Report:

In the Middle East and Africa, the market size was $2.69 billion in 2023, with projections reaching $5.28 billion by 2033, supported by improving banking infrastructure and increasing ATM deployment.Tell us your focus area and get a customized research report.

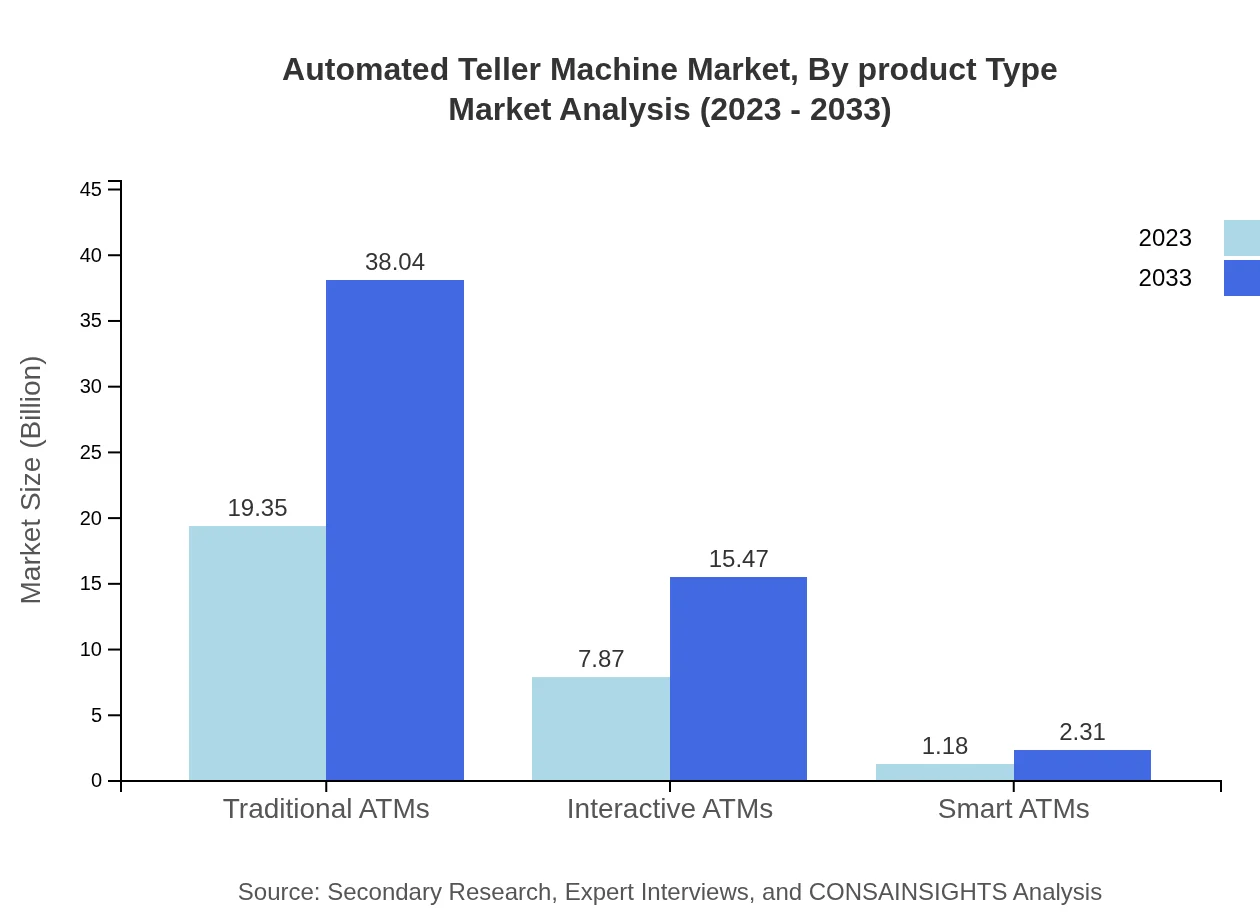

Automated Teller Machine Market Analysis By Product Type

The ATM market by product type features significant segments including mechanical ATMs, electronic ATMs, biometric ATMs, and smart ATMs. Mechanical ATMs dominate the market, accounting for roughly 68.15% share in 2023, valued at $19.35 billion, and forecast to grow to $38.04 billion by 2033. Electronic ATMs follow with a substantial market share, while biometric and smart ATMs are gaining traction due to increasing security concerns and consumer acceptance.

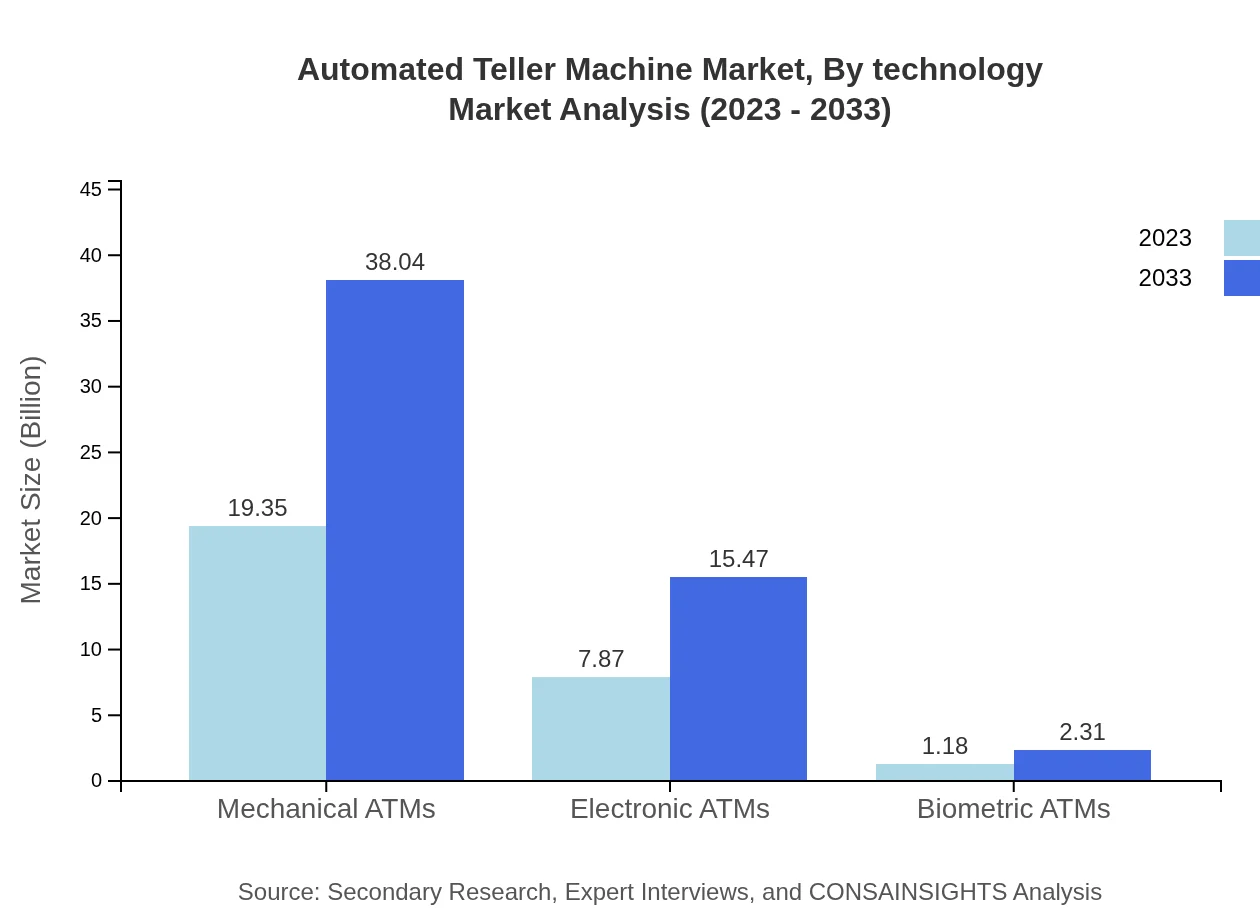

Automated Teller Machine Market Analysis By Technology

In terms of technology, traditional ATMs lead the market, supported by their wide deployment in urban locations. Interactive ATMs are also emerging as a popular choice due to their enhanced user experience features. The dive into advanced tech, like biometric ATMs, is anticipated to drive growth, with security applications being a primary concern for consumers and financial service providers alike.

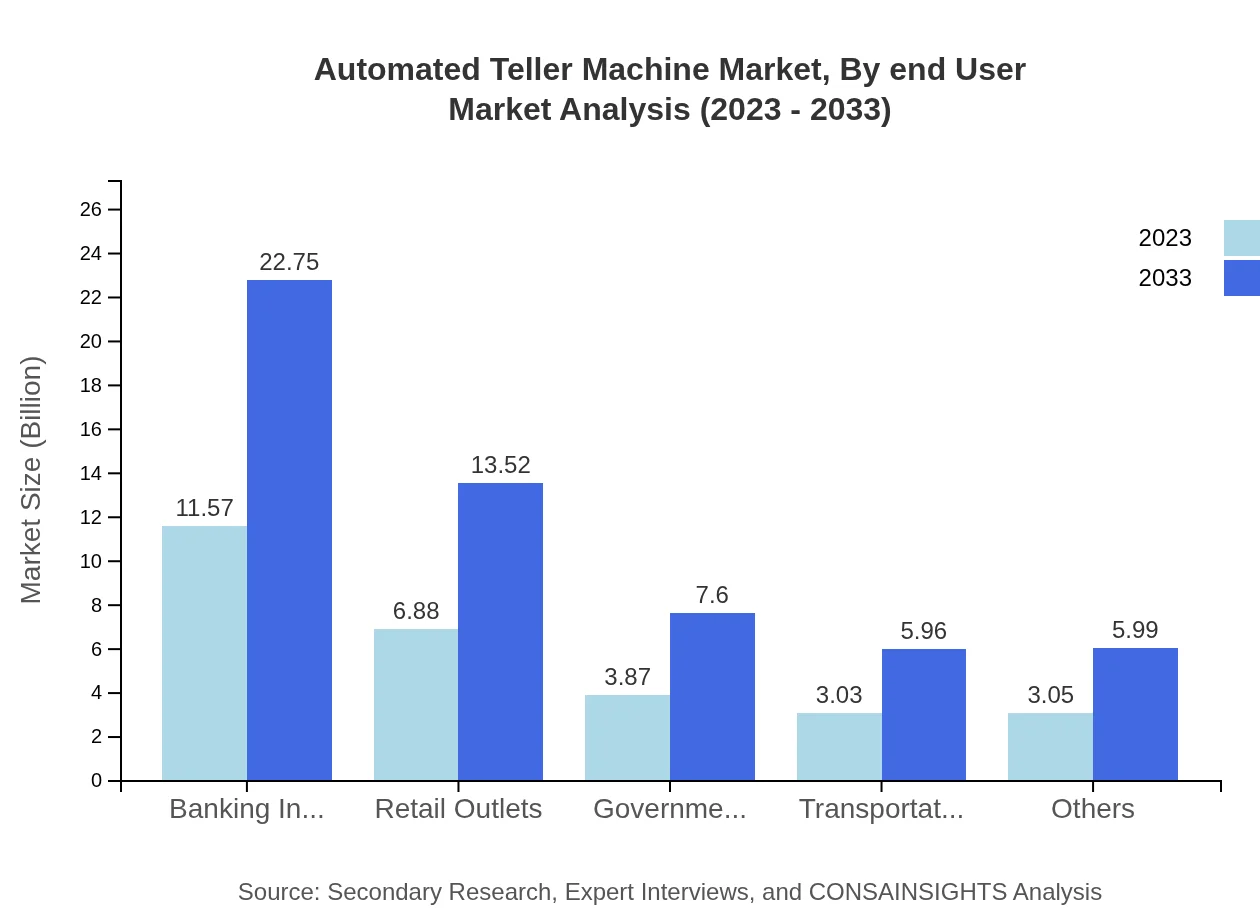

Automated Teller Machine Market Analysis By End User

The end-user segmentation includes banking institutions, retail outlets, government entities, and transportation hubs, with banking institutions leading the market at 40.75% share, valued at $11.57 billion in 2023. Retail outlets, government entities, and transportation hubs each play crucial roles, reflecting the diverse nature of ATM deployments based on location and consumer needs.

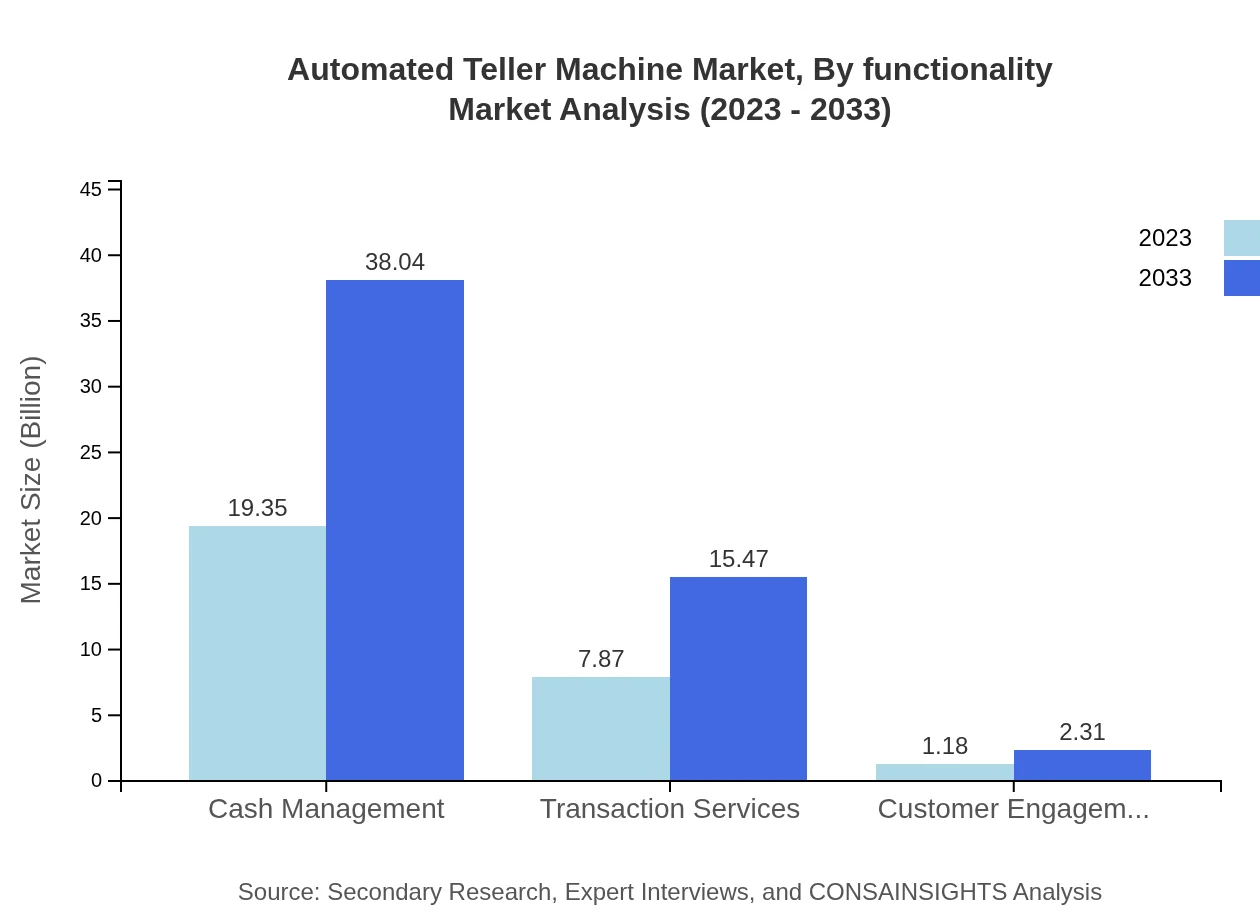

Automated Teller Machine Market Analysis By Functionality

Functionality-wise, segments include cash management, transaction services, and customer engagement services. Cash management remains a robust segment, holding 68.15% market share, while transaction services are gaining ground as consumers become more engaged in electronic banking. Customer engagement services are also growing in importance as personalization becomes a key differentiator in customer experience.

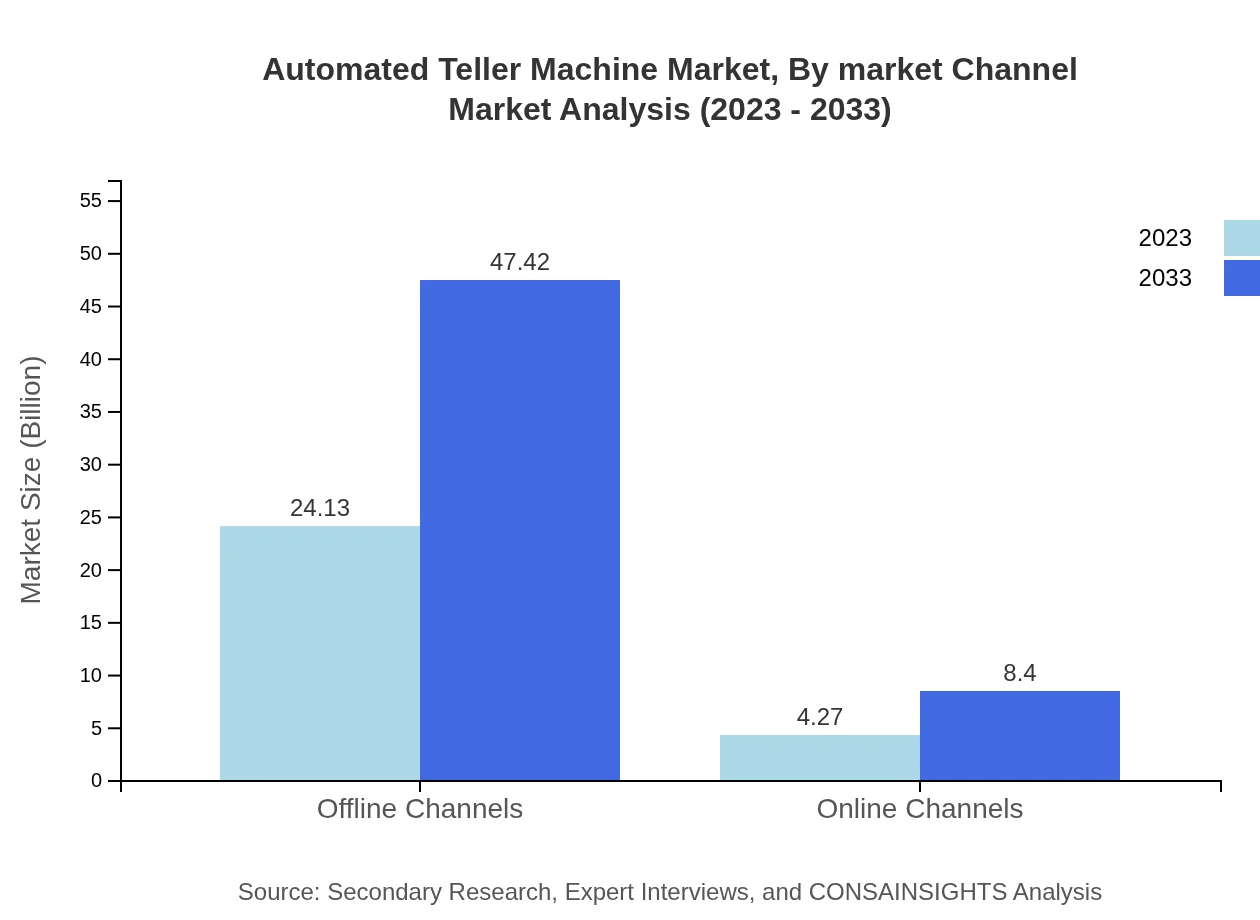

Automated Teller Machine Market Analysis By Market Channel

Market channels for ATMs encompass offline and online channels. Offline channels account for 84.95% share in 2023, reflecting traditional banking practices, while online channels are showing growth potential as digital transformations occur. The importance of integrating both channels is becoming increasingly recognized as a strategy for maximizing reach and efficiency.

Automated Teller Machine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automated Teller Machine Industry

NCR Corporation:

NCR Corporation is a leading provider of ATMs and technology solutions, known for its innovation in banking automation and customer engagement technologies.Diebold Nixdorf:

Diebold Nixdorf offers a range of ATM products and services, focusing on enhancing the efficiency and security of financial transactions.GRG Banking:

GRG Banking is recognized for its technologically advanced ATM solutions and is a significant player in the Asian market.Hitachi-Omron Terminal Solutions:

A subsidiary of Hitachi, Hitachi-Omron specializes in manufacturing ATMs and providing integrated banking solutions worldwide.Fujitsu:

Fujitsu is involved in the development of ATMs with a focus on innovation and integration of inquiry and transaction capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of automated Teller Machine?

The global Automated Teller Machine (ATM) market is valued at approximately $28.4 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%, potentially reaching significant growth in the coming decade.

What are the key market players or companies in this automated Teller Machine industry?

Key players in the automated teller machine industry include major financial technology firms and ATM manufacturers. Notable companies often include NCR Corporation, Diebold Nixdorf, and Hitachi-Omron Terminal Solutions, dominating various segments with innovative ATM solutions.

What are the primary factors driving the growth in the automated Teller Machine industry?

The growth in the ATM industry is driven by increased cash transactions, evolving banking habits of consumers, enhanced ATM functionalities, and the need for financial inclusion, especially in emerging markets enhancing their ATM deployment.

Which region is the fastest Growing in the automated Teller Machine?

The Asia Pacific region is the fastest-growing area in the ATM market, projected to expand from $5.52 billion in 2023 to $10.85 billion by 2033, highlighting increasing financial activities and technological advances.

Does ConsaInsights provide customized market report data for the automated Teller Machine industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the ATM industry, ensuring businesses receive relevant and detailed insights aligned with their strategic planning.

What deliverables can I expect from this automated Teller Machine market research project?

Expect comprehensive reports offering in-depth analysis, market forecasts, competitive landscape assessments, and segment-specific insights tailored to both global and regional ATM market dynamics.

What are the market trends of automated Teller Machine?

Key trends in the ATM market include the rise of contactless transactions, integration of digital banking services, and the adoption of biometric technologies, shaping the future of self-service banking.