Automatic Dependent Surveillance Broadcast Adsb Market Report

Published Date: 22 January 2026 | Report Code: automatic-dependent-surveillance-broadcast-adsb

Automatic Dependent Surveillance Broadcast Adsb Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automatic Dependent Surveillance Broadcast (ADS-B) market from 2023 to 2033, including trends, growth forecasts, and insights into market dynamics. It covers a variety of aspects to give stakeholders a detailed understanding of the landscape.

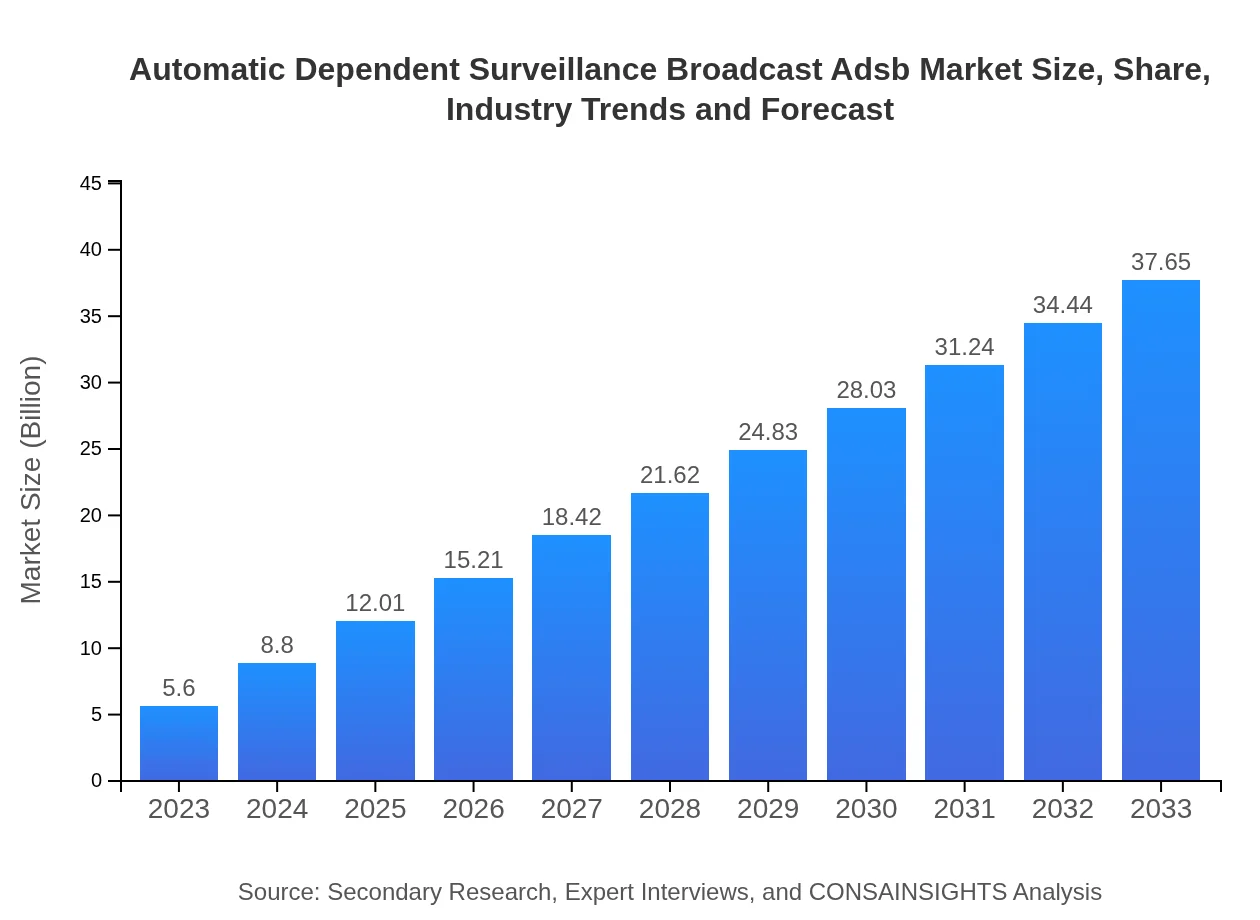

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 19.8% |

| 2033 Market Size | $37.65 Billion |

| Top Companies | Honeywell Aerospace, Garmin International, Northrop Grumman Corporation, Textron Aviation, Avidyne Corporation |

| Last Modified Date | 22 January 2026 |

Automatic Dependent Surveillance Broadcast (ADS-B) Market Overview

Customize Automatic Dependent Surveillance Broadcast Adsb Market Report market research report

- ✔ Get in-depth analysis of Automatic Dependent Surveillance Broadcast Adsb market size, growth, and forecasts.

- ✔ Understand Automatic Dependent Surveillance Broadcast Adsb's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automatic Dependent Surveillance Broadcast Adsb

What is the Market Size & CAGR of the Automatic Dependent Surveillance Broadcast (ADS-B) market in 2023?

Automatic Dependent Surveillance Broadcast (ADS-B) Industry Analysis

Automatic Dependent Surveillance Broadcast (ADS-B) Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automatic Dependent Surveillance Broadcast (ADS-B) Market Analysis Report by Region

Europe Automatic Dependent Surveillance Broadcast Adsb Market Report:

The European market is set to increase from $1.57 billion in 2023 to $10.53 billion by 2033, largely due to EU regulations mandating ADS-B implementation in commercial air travel, enhancing safety and efficiency.Asia Pacific Automatic Dependent Surveillance Broadcast Adsb Market Report:

In the Asia Pacific region, the ADS-B market is projected to grow from $1.16 billion in 2023 to $7.79 billion by 2033. The adoption is driven by increasing air traffic and government initiatives for safer travel.North America Automatic Dependent Surveillance Broadcast Adsb Market Report:

North America has the largest share, expected to expand from $1.93 billion in 2023 to $13.00 billion by 2033. The rapid growth is attributed to stringent FAA requirements and the region's high volume of air traffic.South America Automatic Dependent Surveillance Broadcast Adsb Market Report:

South America's ADS-B market will rise from $0.45 billion in 2023 to $3.01 billion by 2033, spurred by the modernization of its aviation infrastructure and regulatory pressures to enhance safety.Middle East & Africa Automatic Dependent Surveillance Broadcast Adsb Market Report:

The Middle East and Africa's ADS-B market will see growth from $0.49 billion in 2023 to $3.32 billion in 2033, with investments in aviation infrastructure and regulations pushing for better tracking and management systems.Tell us your focus area and get a customized research report.

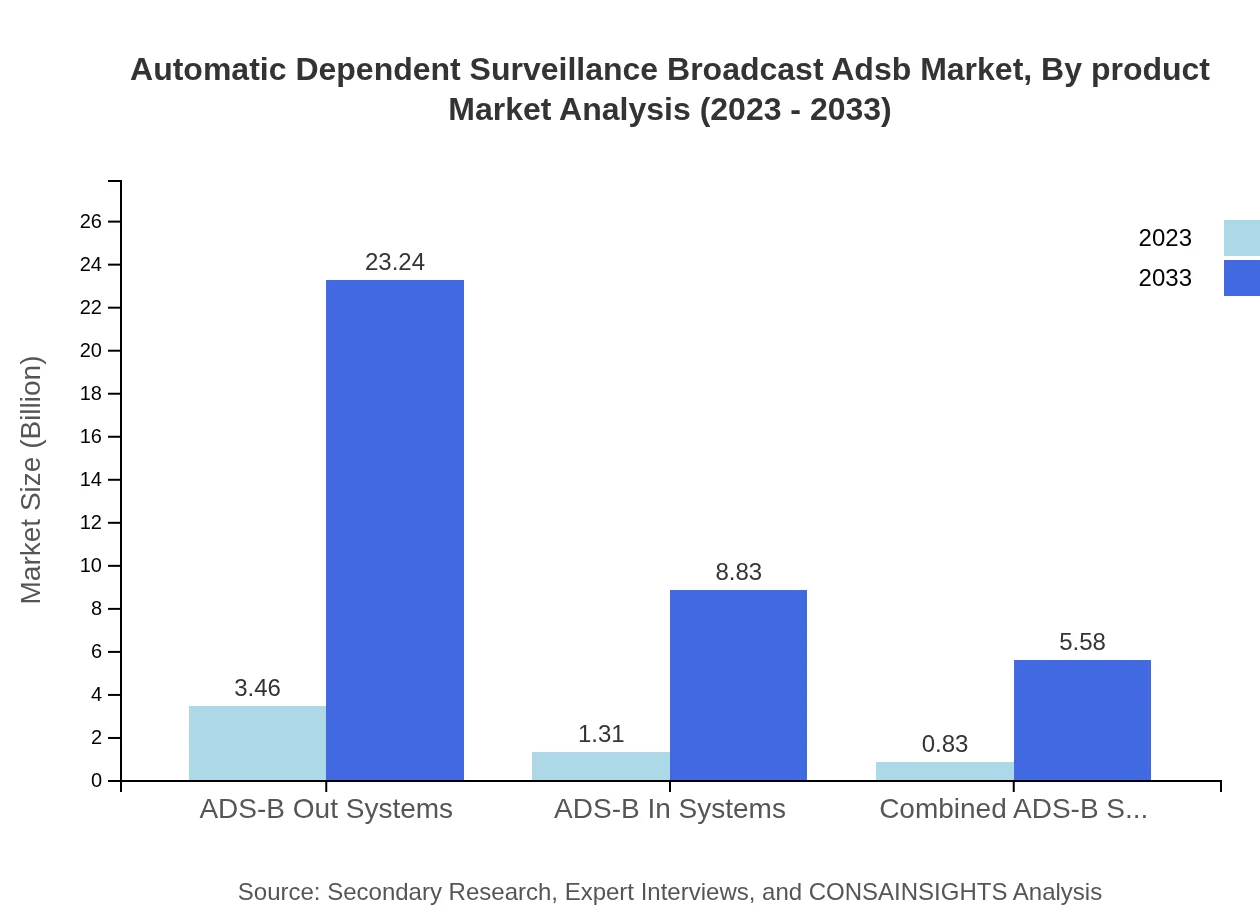

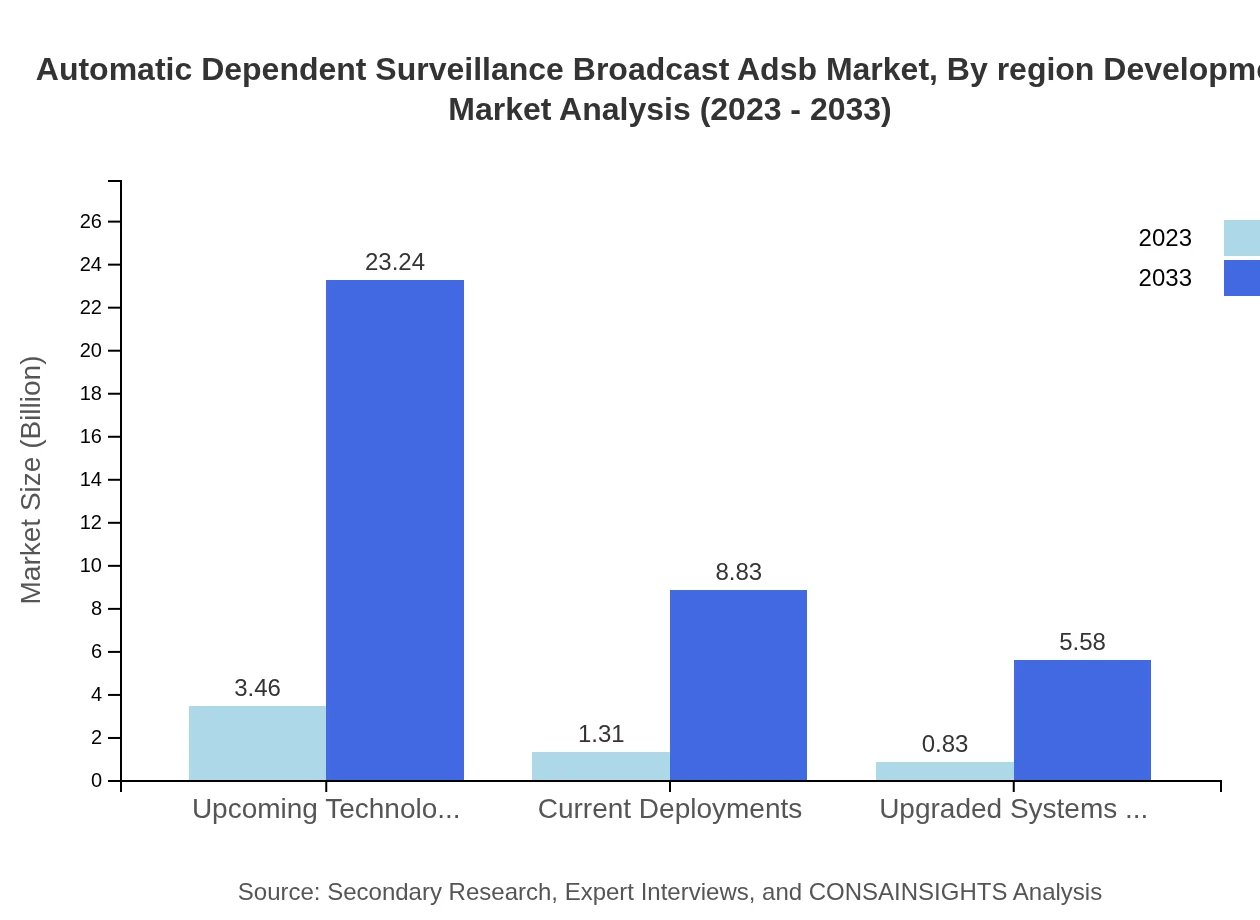

Automatic Dependent Surveillance Broadcast Adsb Market Analysis By Product

The ADS-B market is primarily segmented into ADS-B Out Systems, ADS-B In Systems, and Combined ADS-B Systems. In 2023, the ADS-B Out Systems contribute significantly, with a market size of $3.46 billion, projected to reach $23.24 billion by 2033. Similarly, ADS-B In Systems today stand at $1.31 billion and are expected to grow to $8.83 billion by 2033.

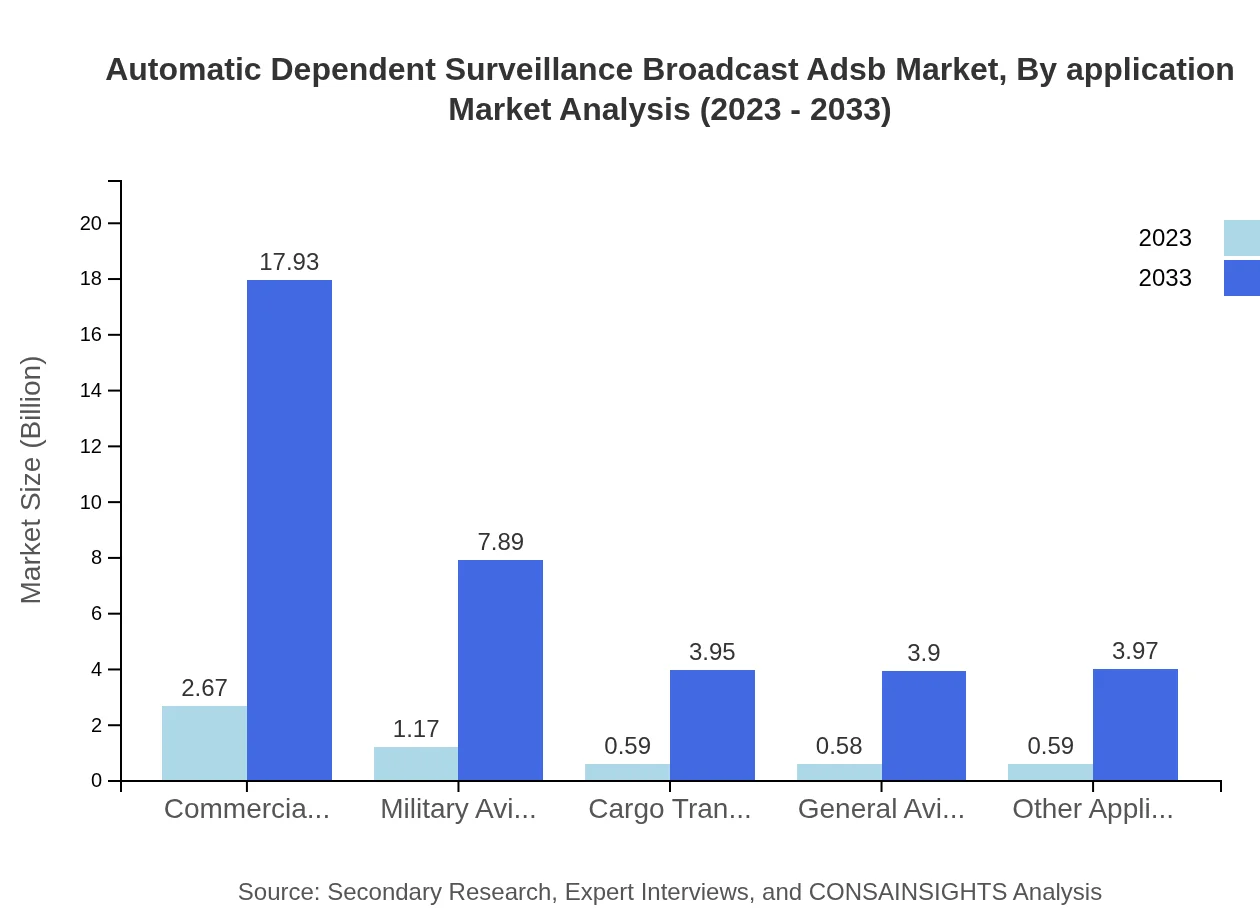

Automatic Dependent Surveillance Broadcast Adsb Market Analysis By Application

Applications of ADS-B technology span across commercial aviation, military aviation, cargo transport, and other utilities. The commercial aviation segment will see significant momentum, growing from a size of $2.67 billion in 2023 to $17.93 billion by 2033, affirming its central role in the aviation ecosystem.

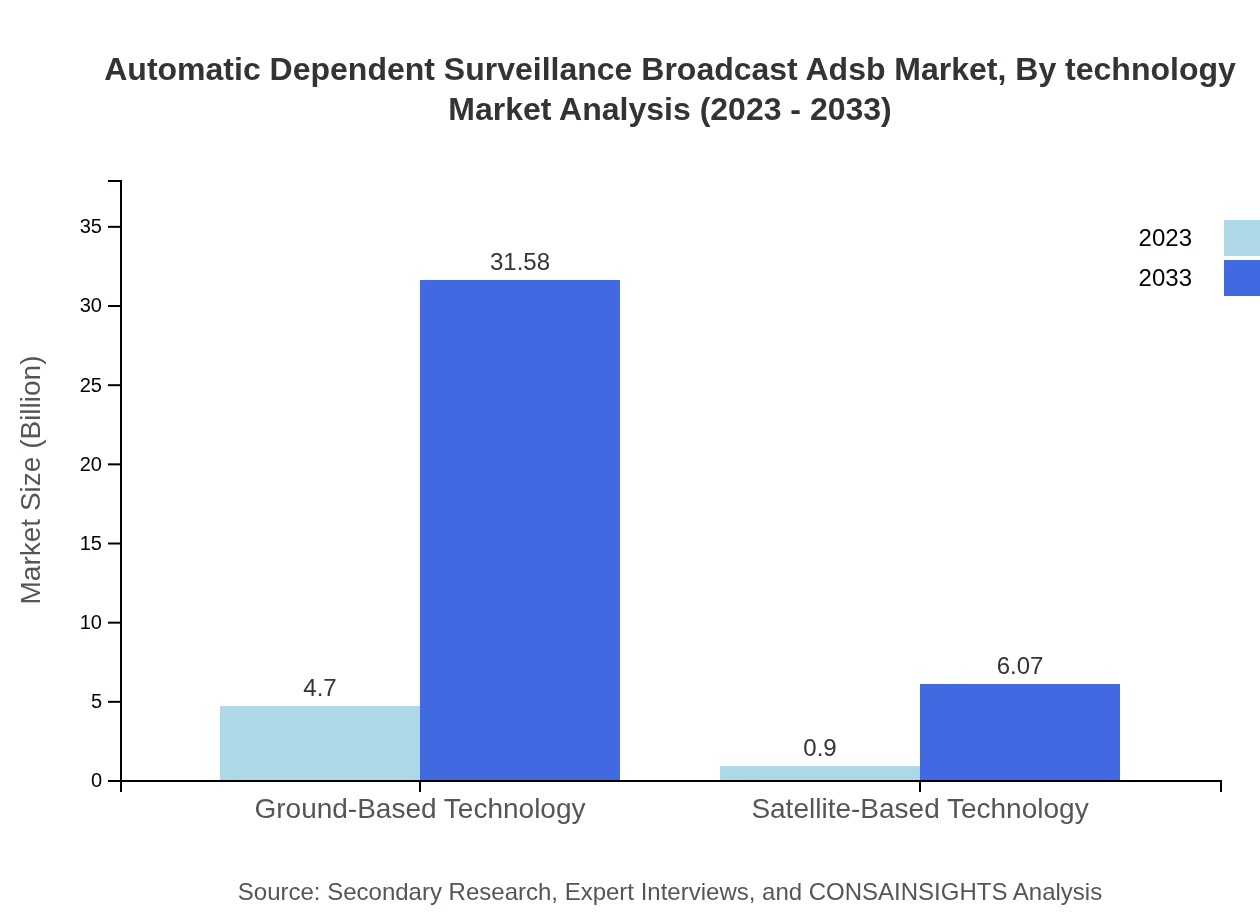

Automatic Dependent Surveillance Broadcast Adsb Market Analysis By Technology

The technological front is divided into Ground-Based Technology and Satellite-Based Technology. Ground-based systems dominate the market, currently valued at $4.70 billion, growing to $31.58 billion by 2033, while the satellite-based segment may rise from $0.90 billion to $6.07 billion in the same period.

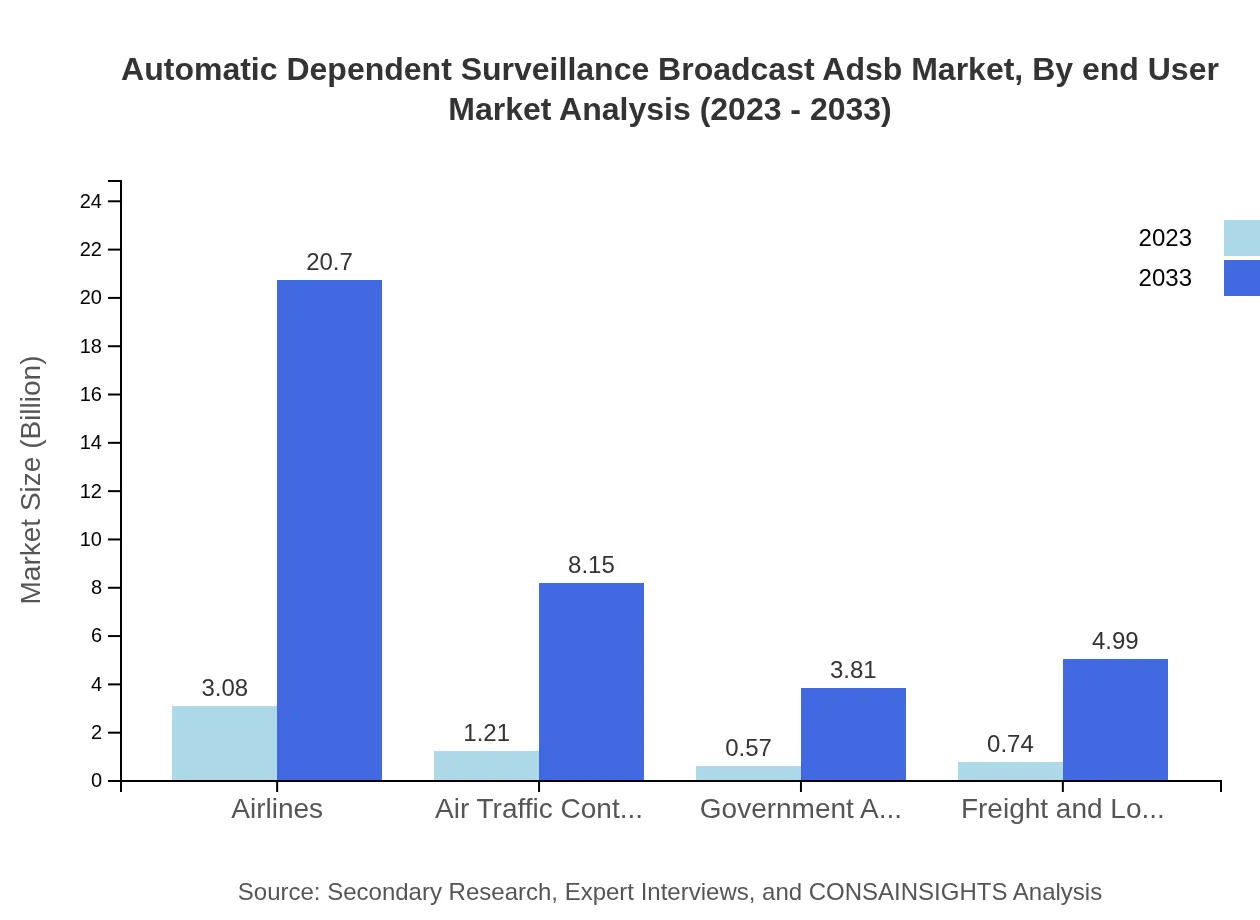

Automatic Dependent Surveillance Broadcast Adsb Market Analysis By End User

End-users include airlines, air traffic control organizations, government agencies, and freight and logistics companies. Airlines represent the largest market share, growing from $3.08 billion in 2023 to $20.70 billion by 2033, reflecting the increased safety protocols in commercial fleets.

Automatic Dependent Surveillance Broadcast Adsb Market Analysis By Region Development

Development stages highlight ongoing and planned implementations globally. Current deployments size at $1.31 billion in 2023, expected to reach $8.83 billion by 2033, while upcoming technologies take precedence, growing from $3.46 billion to $23.24 billion, showcasing the innovation pipeline.

Automatic Dependent Surveillance Broadcast (ADS-B) Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automatic Dependent Surveillance Broadcast (ADS-B) Industry

Honeywell Aerospace:

A leading provider of aerospace products and services, Honeywell is instrumental in revolutionizing surveillance technologies with their ADS-B compliant solutions, enhancing safety and operational efficiency.Garmin International:

Known for its cutting-edge GPS and avionics technology, Garmin is a significant player in the ADS-B market, providing reliable systems that promote safer navigation and flight operations.Northrop Grumman Corporation:

As a major defense contractor, Northrop Grumman delivers advanced ADS-B technologies focused on enhancing military aviation and maintaining high safety standards.Textron Aviation:

Textron, through its Cessna and Beechcraft brands, is known for incorporating ADS-B technologies in its aircraft, pushing for modern aviation solutions.Avidyne Corporation:

Specializing in avionics, Avidyne manufactures innovative ADS-B systems that enhance situational awareness, providing a competitive edge in the market.We're grateful to work with incredible clients.

FAQs

What is the market size of Automatic Dependent Surveillance Broadcast (ADS-B)?

The Automatic Dependent Surveillance Broadcast (ADS-B) market is projected to reach a size of $5.6 billion by 2033, growing at a CAGR of 19.8%. This expansion reflects increasing adoption in aviation, particularly for tracking and safety applications.

What are the key market players or companies in the ADS-B industry?

Key players in the ADS-B market include significant aerospace companies such as Honeywell, Collins Aerospace, Garmin, and Thales. These companies lead the industry with innovations in surveillance technology and systems integration.

What are the primary factors driving the growth in the ADS-B industry?

The growth in the ADS-B industry is primarily driven by heightened safety regulations in aviation, advancements in air traffic management technologies, and an increasing number of commercial flights necessitating improved surveillance systems.

Which region is the fastest Growing in the ADS-B market?

The fastest-growing region in the ADS-B market is North America, with its market expected to grow from $1.93 billion in 2023 to $13.00 billion by 2033, fueled by major aviation hubs and regulatory support.

Does ConsaInsights provide customized market report data for the ADS-B industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the ADS-B industry. This allows businesses to gain insights relevant to their strategic objectives.

What deliverables can I expect from the ADS-B market research project?

Deliverables from the ADS-B market research project include comprehensive reports covering market size, growth projections, competitive analysis, regional breakdowns, and segmentation insights to guide business strategies.

What are the market trends of ADS-B?

Current trends in the ADS-B market include a shift towards integrated surveillance solutions, increased investment in ground and satellite-based technologies, and a focus on automation in air traffic management systems.