Automatic Liquid Filling Market Report

Published Date: 22 January 2026 | Report Code: automatic-liquid-filling

Automatic Liquid Filling Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automatic Liquid Filling market, offering key insights on market trends, growth forecasts from 2023 to 2033, and in-depth evaluations by region and segment. It highlights critical data to support strategic decision-making for stakeholders.

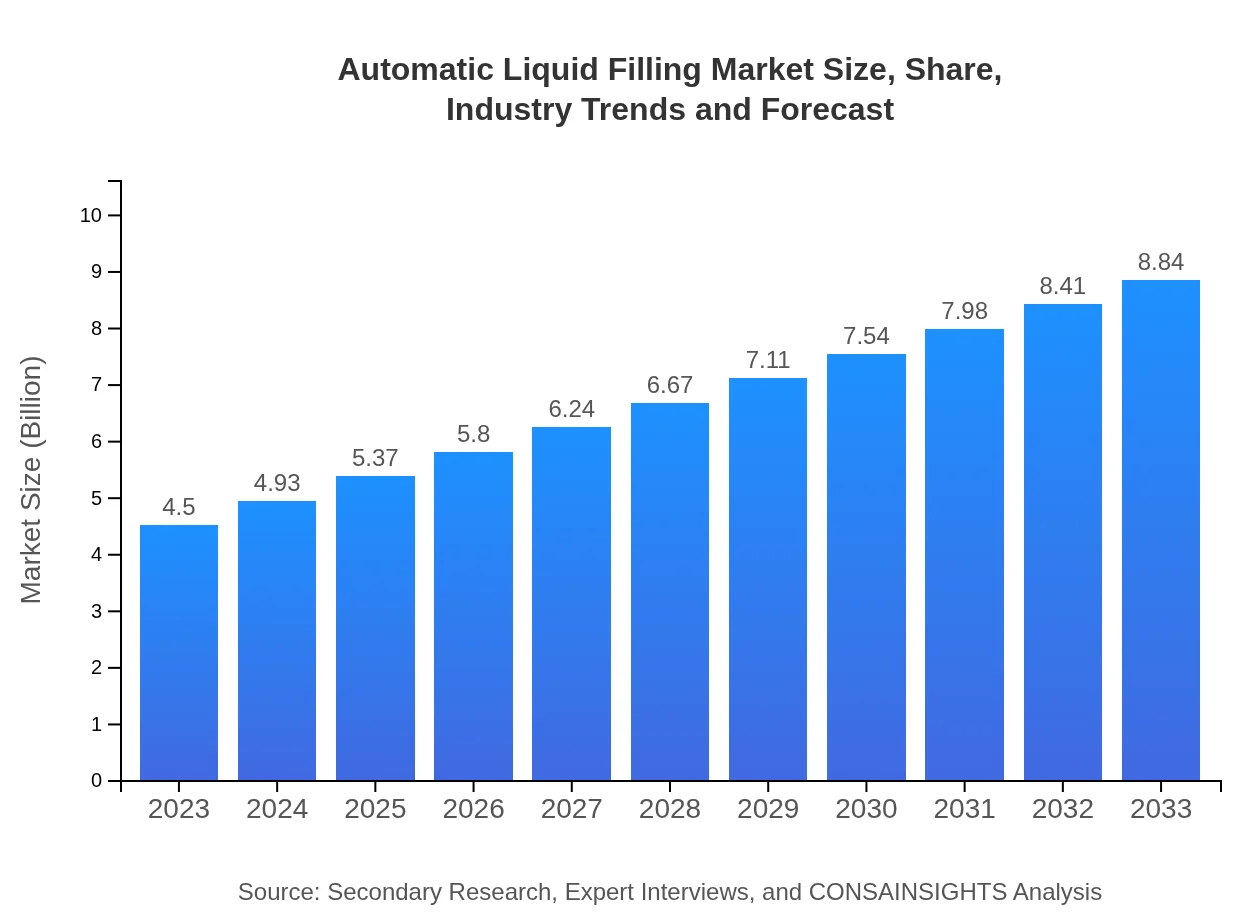

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | Krones AG, Tetra Pak, Bosch Packaging Technology, GEA Group |

| Last Modified Date | 22 January 2026 |

Automatic Liquid Filling Market Overview

Customize Automatic Liquid Filling Market Report market research report

- ✔ Get in-depth analysis of Automatic Liquid Filling market size, growth, and forecasts.

- ✔ Understand Automatic Liquid Filling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automatic Liquid Filling

What is the Market Size & CAGR of the Automatic Liquid Filling market in 2023?

Automatic Liquid Filling Industry Analysis

Automatic Liquid Filling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automatic Liquid Filling Market Analysis Report by Region

Europe Automatic Liquid Filling Market Report:

The European market is also on an upward trajectory, projected to grow from $1.41 billion in 2023 to $2.77 billion by 2033, due to stringent regulations for quality control in pharmaceuticals and increasing adoption of automation technologies in food processing.Asia Pacific Automatic Liquid Filling Market Report:

In the Asia Pacific region, the Automatic Liquid Filling market is anticipated to grow from $0.85 billion in 2023 to $1.68 billion in 2033. The growth is fueled by increasing investments in industrial automation and rising consumer demand in the food and beverage sector.North America Automatic Liquid Filling Market Report:

North America, particularly the United States, is expected to witness significant growth, reaching $3.10 billion by 2033 from $1.58 billion in 2023. The region's focus on pharmaceutical innovations and a strong inclination towards automation are major contributors.South America Automatic Liquid Filling Market Report:

South America is projected to see growth from $0.27 billion in 2023 to $0.53 billion in 2033, driven by expanding pharmaceutical industries and the need for efficient production processes, particularly in Brazil and Argentina.Middle East & Africa Automatic Liquid Filling Market Report:

The Middle East and Africa market is forecasted to expand from $0.39 billion in 2023 to $0.76 billion by 2033, influenced by increasing manufacturing activities and improvements in logistics and supply chain management.Tell us your focus area and get a customized research report.

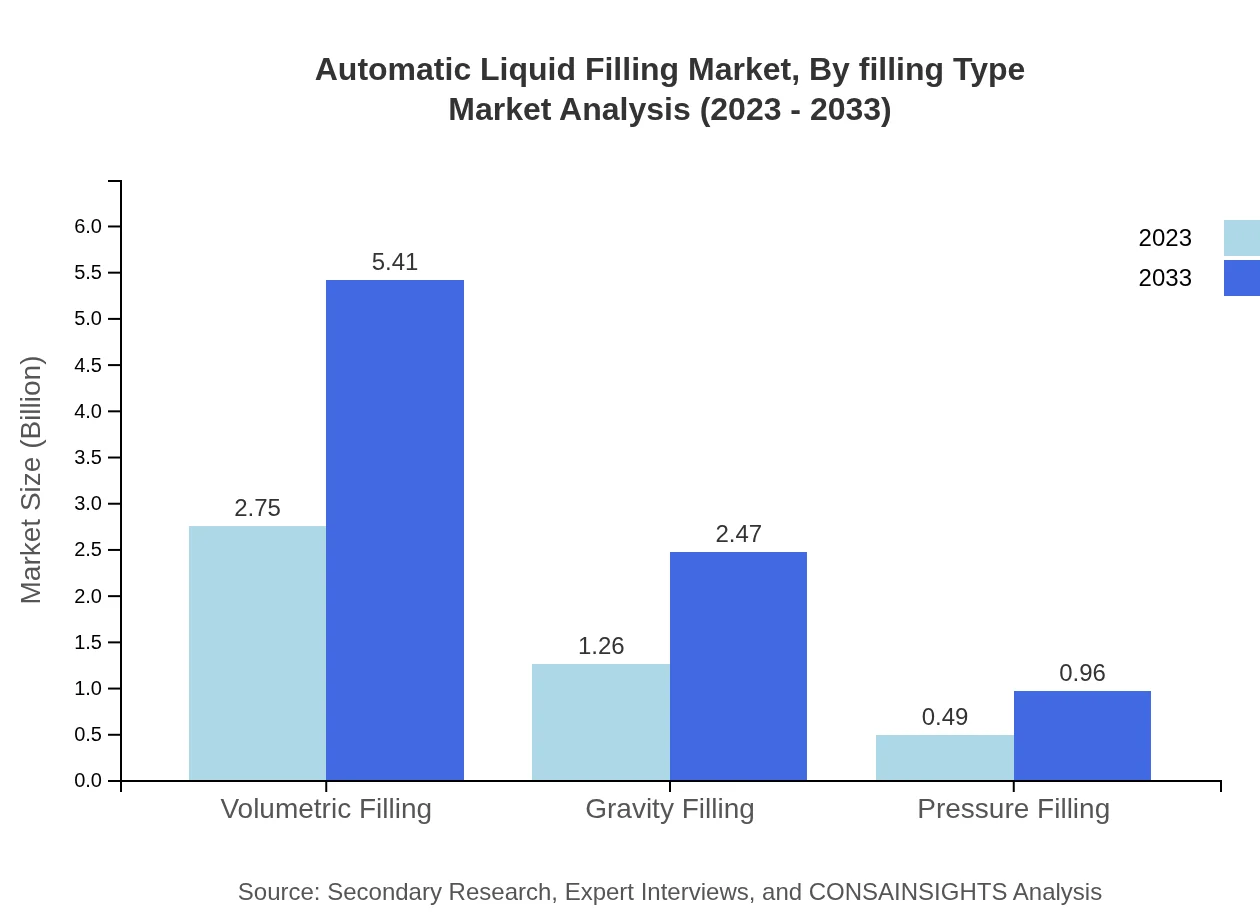

Automatic Liquid Filling Market Analysis By Filling Type

Significant segments include Volumetric Filling, which holds a market share of 61.2% in 2023 at $2.75 billion, expected to grow to $5.41 billion by 2033; followed by Gravity Filling at a 27.93% share, projected to reach $2.47 billion in 2033; and Pressure Filling, which contributes 10.87% with a forecast of $0.96 billion by 2033.

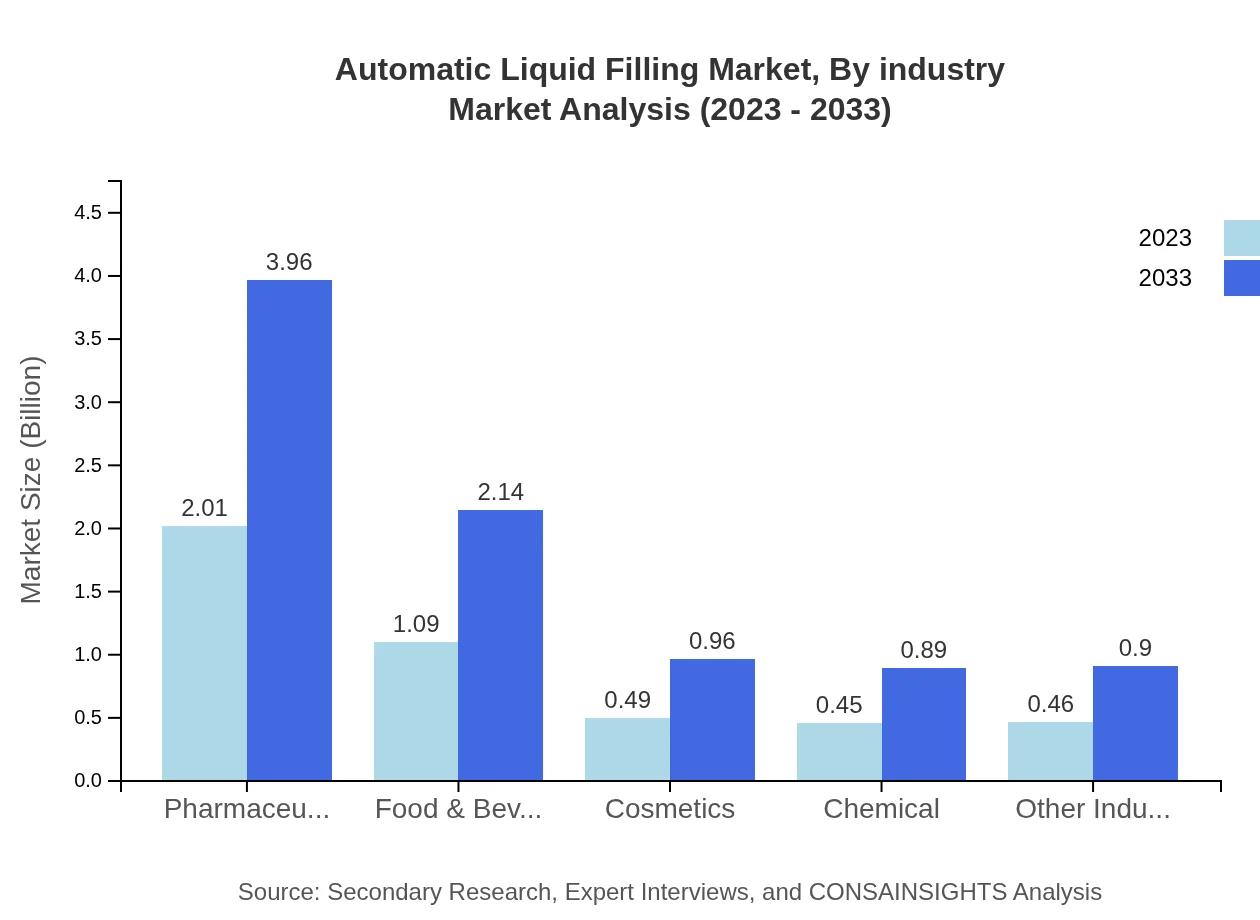

Automatic Liquid Filling Market Analysis By Industry

The Pharmaceuticals sector commands a significant share of the market at 44.73% in 2023, translating to $2.01 billion and forecasted to grow to $3.96 billion by 2033. The Food & Beverage sector, holding a 24.15% share, is anticipated to reach $2.14 billion. Other sectors include Cosmetics and Chemicals, contributing 10.91% and 10.07%, respectively.

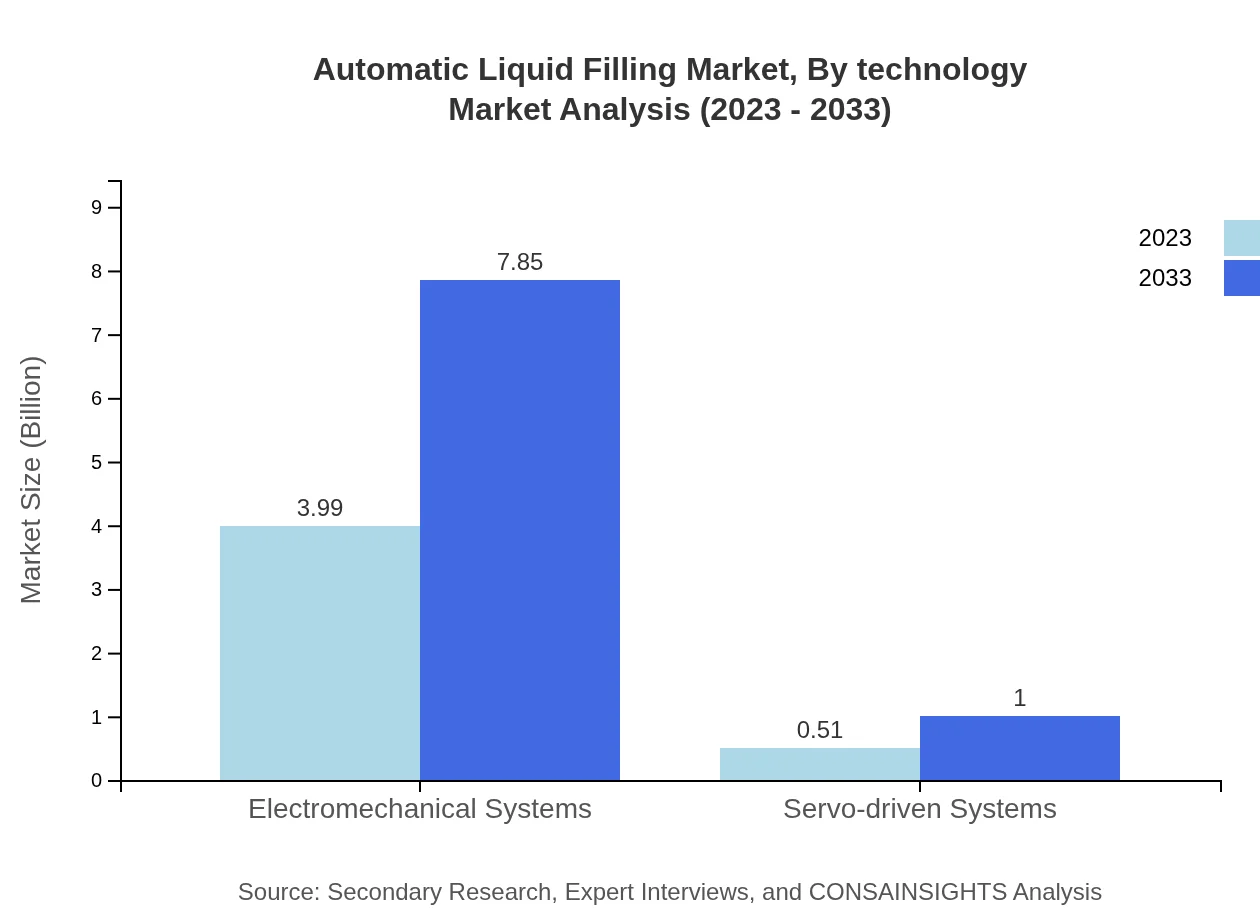

Automatic Liquid Filling Market Analysis By Technology

Electromechanical Systems dominate with an 88.7% share at $3.99 billion in 2023, expected to grow to $7.85 billion by 2033. Servo-driven Systems capture 11.3% with increasing adoption rates in modern filling lines.

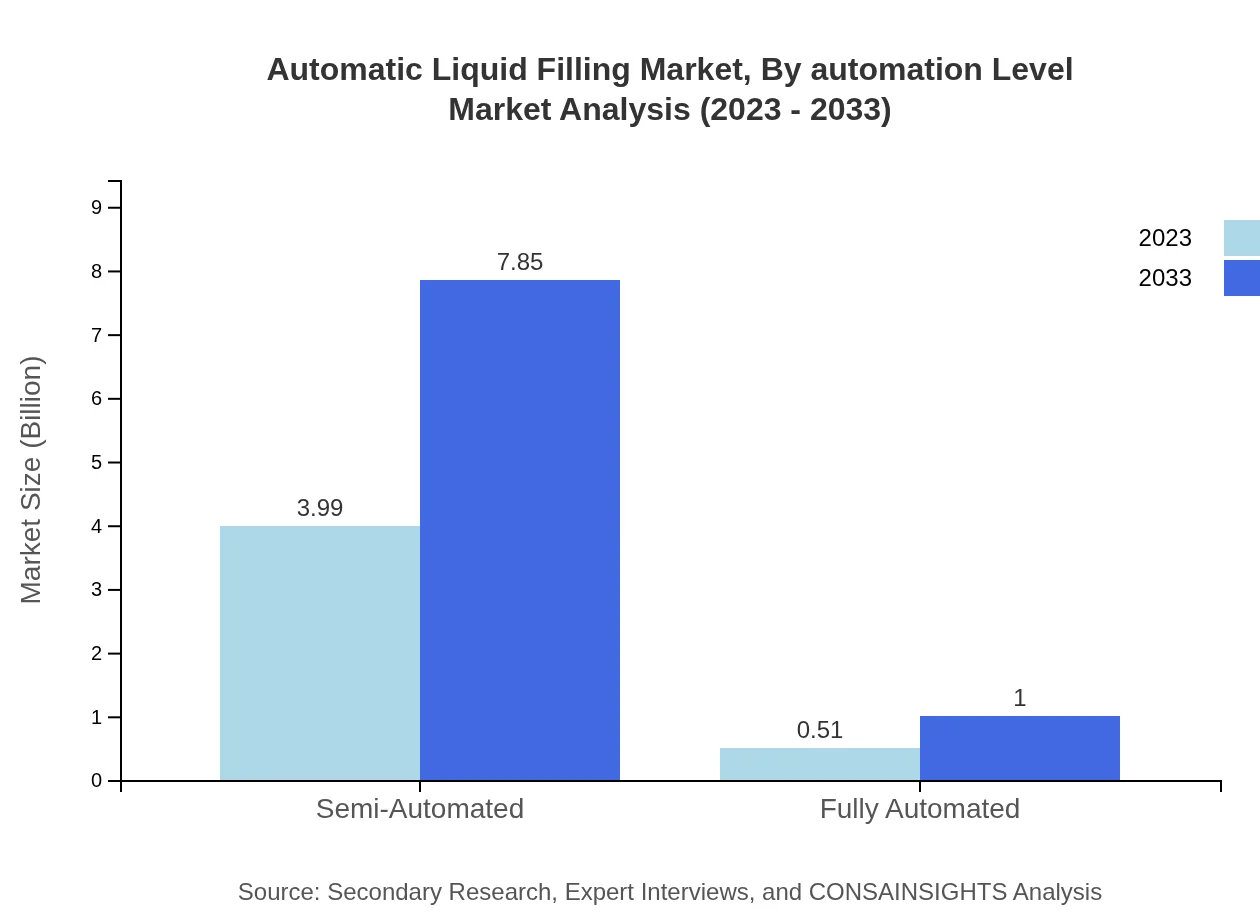

Automatic Liquid Filling Market Analysis By Automation Level

The Semi-Automated segment leads with 88.7% market share at $3.99 billion in 2023 and is anticipated to grow to $7.85 billion by 2033. The Fully Automated segment, currently at 11.3%, is also expected to show substantial growth.

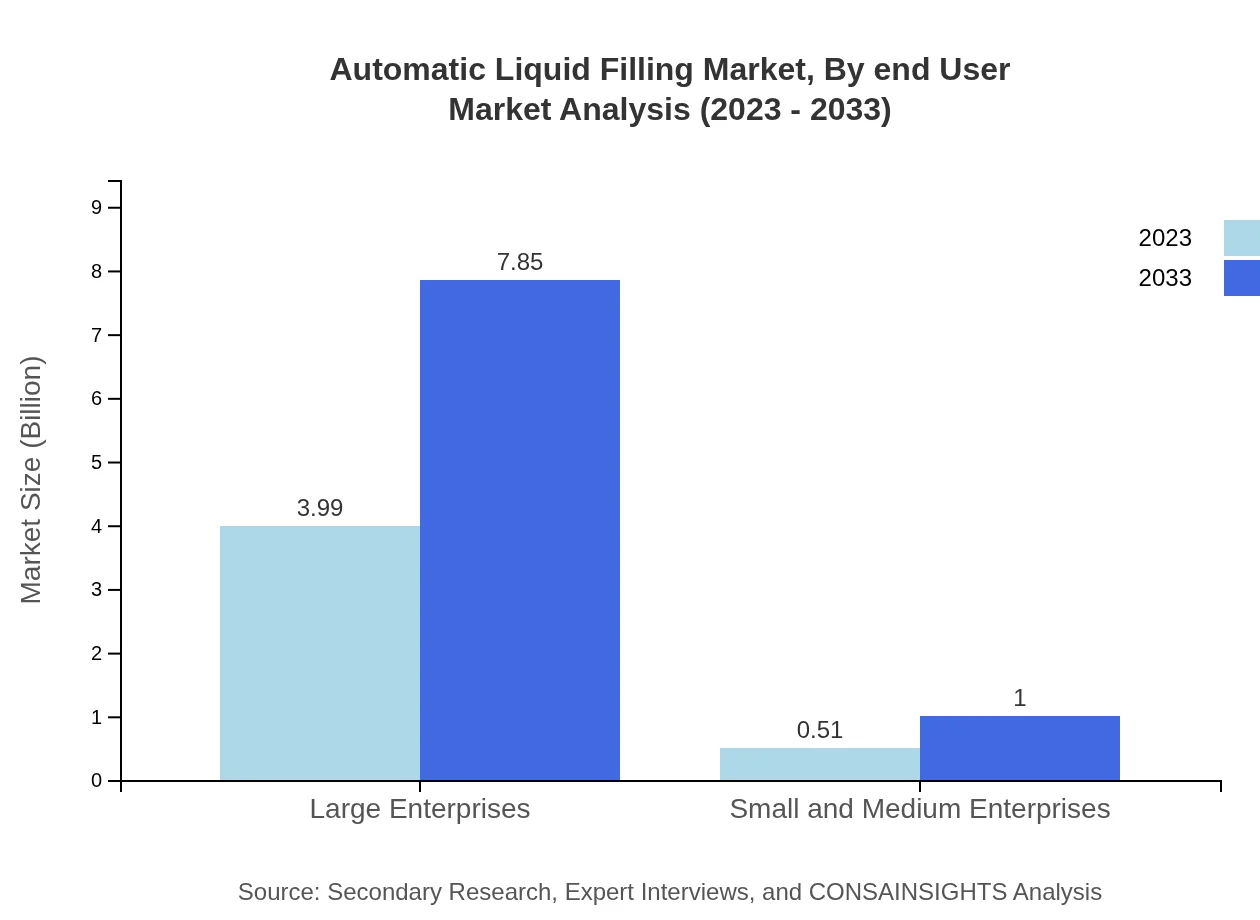

Automatic Liquid Filling Market Analysis By End User

The agricultural and packaging industries are emerging as substantial end-users of automatic filling solutions, responding to increases in production rates and quality control's importance across product lines.

Automatic Liquid Filling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automatic Liquid Filling Industry

Krones AG:

Krones AG specializes in manufacturing machinery and turnkey lines for the beverage industry, offering comprehensive liquid filling solutions.Tetra Pak:

Tetra Pak is a leader in food processing and packaging solutions, known for its innovative technologies in automated liquid filling systems designed to enhance productivity.Bosch Packaging Technology:

Bosch provides advanced packaging solutions with a focus on automation and digital technology integration in the liquid filling process.GEA Group:

GEA Group is renowned for providing equipment and engineering solutions across multiple sectors, including offering automated solutions for liquid filling in food and beverage.We're grateful to work with incredible clients.

FAQs

What is the market size of automatic Liquid Filling?

The automatic liquid filling market is valued at $4.5 billion in 2023, with a projected CAGR of 6.8%. Expected to grow significantly, the market is poised for expansion over the next decade, reaching new heights by 2033.

What are the key market players or companies in this automatic Liquid Filling industry?

The automatic liquid filling industry features numerous key players, including major manufacturers and suppliers of filling machinery. Companies lead through innovative technology adaptations and a diverse product offering tailored for industries like pharmaceuticals, food, and cosmetics.

What are the primary factors driving the growth in the automatic Liquid Filling industry?

Key drivers for growth in the automatic liquid filling industry include rising consumer demand for packaged goods, advancements in filling technology, regulatory compliance in sectors such as pharmaceuticals, and the increasing prevalence of automated production lines in manufacturing.

Which region is the fastest Growing in the automatic Liquid Filling?

North America emerges as the fastest-growing region in the automatic liquid filling market, expanding from $1.58 billion in 2023 to $3.10 billion by 2033. This growth is fueled by technological advancements and high adoption rates among industries.

Does ConsaInsights provide customized market report data for the automatic Liquid Filling industry?

Yes, ConsaInsights offers customized market report data tailored to the automatic liquid filling industry. Clients can leverage specific analytics, forecasts, and insights, providing a comprehensive understanding of market dynamics and consumer trends.

What deliverables can I expect from this automatic Liquid Filling market research project?

Upon completing the automatic liquid filling market research project, clients can expect deliverables such as in-depth market analysis, detailed segment breakdown, competitive landscape insights, regional growth projections, and strategic recommendations for market entry and growth.

What are the market trends of automatic Liquid Filling?

Market trends in the automatic liquid filling sector indicate growing investments in fully automated systems, increasing adoption of volumetric filling technologies, and a shift towards sustainability in packaging, driving significant changes in product offerings.