Automatic Mounter Wafer Equipment Market Report

Published Date: 31 January 2026 | Report Code: automatic-mounter-wafer-equipment

Automatic Mounter Wafer Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automatic Mounter Wafer Equipment market, covering key insights, market sizes, trends, and forecasts from 2023 to 2033. It aims to equip stakeholders with data-driven information for strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

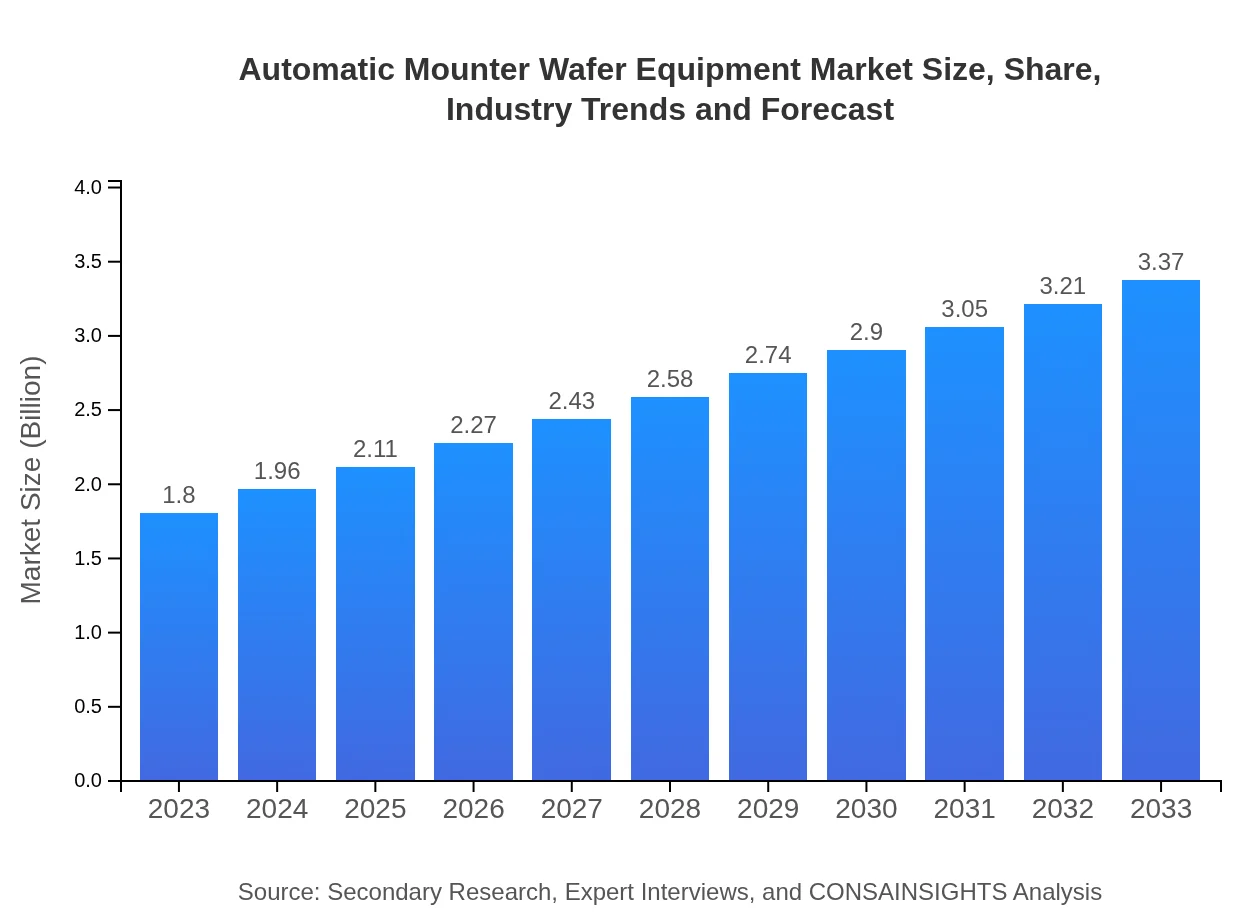

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $3.37 Billion |

| Top Companies | ASM Pacific Technology, K&S (Kahng and Shai), Brewer Science, Teradyne |

| Last Modified Date | 31 January 2026 |

Automatic Mounter Wafer Equipment Market Overview

Customize Automatic Mounter Wafer Equipment Market Report market research report

- ✔ Get in-depth analysis of Automatic Mounter Wafer Equipment market size, growth, and forecasts.

- ✔ Understand Automatic Mounter Wafer Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automatic Mounter Wafer Equipment

What is the Market Size & CAGR of Automatic Mounter Wafer Equipment market in 2023?

Automatic Mounter Wafer Equipment Industry Analysis

Automatic Mounter Wafer Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automatic Mounter Wafer Equipment Market Analysis Report by Region

Europe Automatic Mounter Wafer Equipment Market Report:

Europe's market for Automatic Mounter Wafer Equipment is expected to rise from USD 0.45 billion in 2023 to USD 0.85 billion by 2033. The growth is supported by stringent regulatory requirements for high-quality electronics and innovations in automotive technologies.Asia Pacific Automatic Mounter Wafer Equipment Market Report:

In Asia Pacific, the market was valued at USD 0.35 billion in 2023 and is projected to grow to USD 0.66 billion by 2033, reflecting a strong CAGR. Countries like China, Japan, and South Korea lead this growth, driven by their robust semiconductor manufacturing sectors.North America Automatic Mounter Wafer Equipment Market Report:

North America, valued at USD 0.68 billion in 2023, is anticipated to reach USD 1.28 billion by 2033. The growth in this region is driven by the high demand for semiconductor products and the presence of major technology companies.South America Automatic Mounter Wafer Equipment Market Report:

The South American market for Automatic Mounter Wafer Equipment is expected to grow from USD 0.17 billion in 2023 to USD 0.32 billion by 2033. This growth is underpinned by increasing investments in technology infrastructure and the adoption of advanced manufacturing processes.Middle East & Africa Automatic Mounter Wafer Equipment Market Report:

The Middle East and Africa market is projected to grow from USD 0.14 billion in 2023 to USD 0.26 billion by 2033. This growth is facilitated by the increasing adoption of electronics in various sectors and regional efforts to boost technological capabilities.Tell us your focus area and get a customized research report.

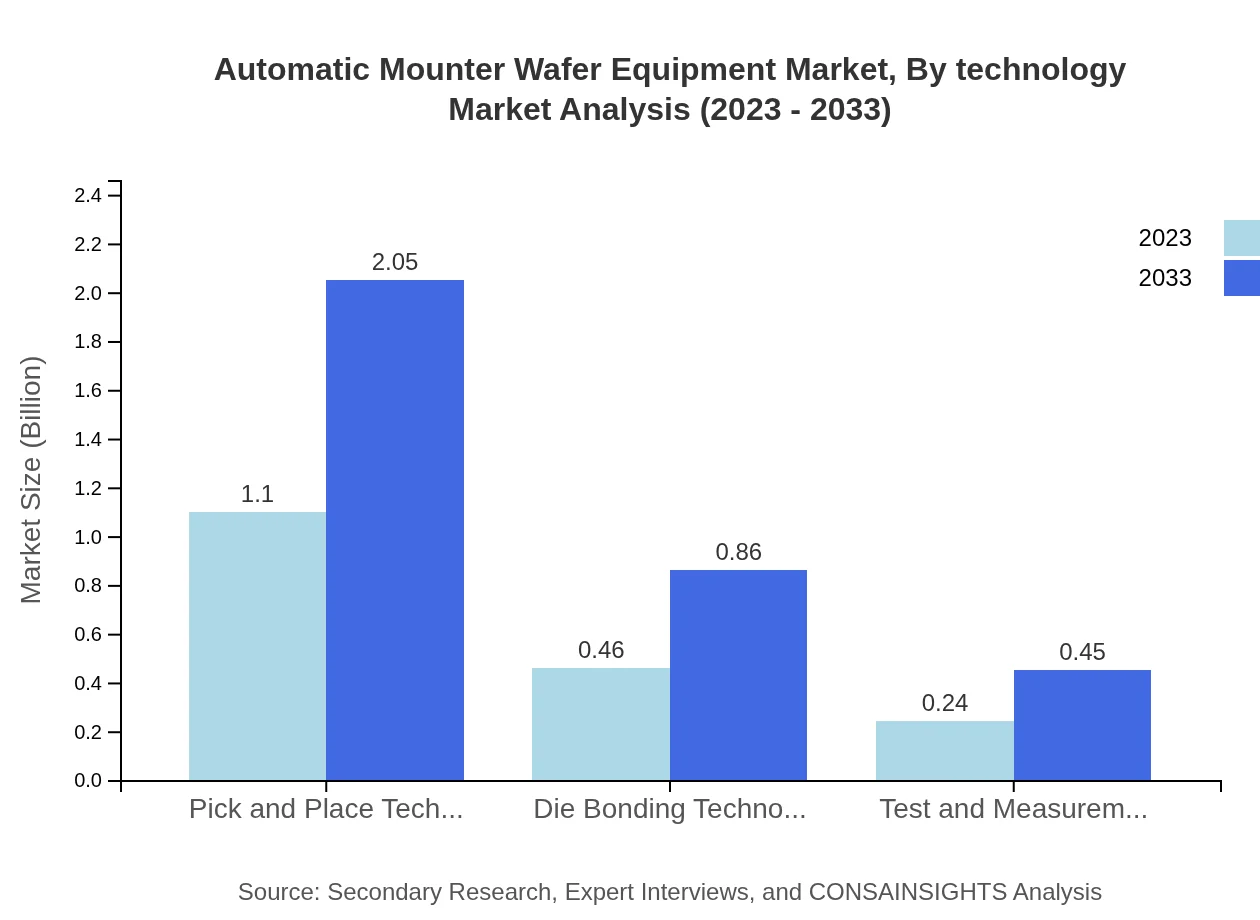

Automatic Mounter Wafer Equipment Market Analysis By Technology

The Automatic Mounter Wafer Equipment market is segmented by technology into Pick and Place Technology, Die Bonding Technology, and Test and Measurement Technology. Each segment plays a vital role in ensuring efficient mounting processes. Pick and Place Technology leads in market share due to its high speed and accuracy, accounting for a market size of USD 1.10 billion in 2023 and expected to rise to USD 2.05 billion by 2033.

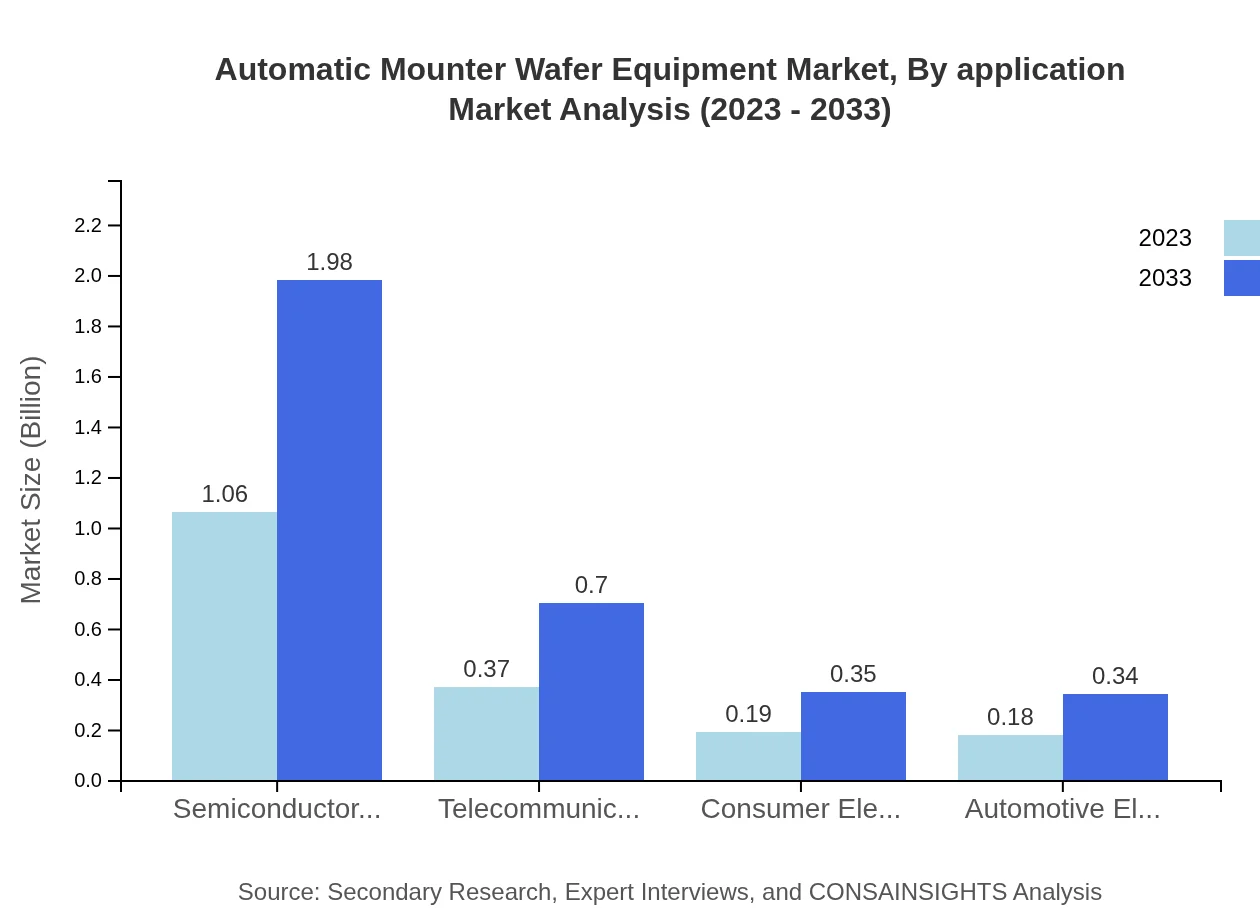

Automatic Mounter Wafer Equipment Market Analysis By Application

The segmentation by application includes semiconductor manufacturing, telecommunications, consumer electronics, automotive electronics, and more. Semiconductor manufacturing remains the largest segment, expected to grow from USD 1.06 billion in 2023 to USD 1.98 billion by 2033, driven by the demand for chips crucial for modern technology.

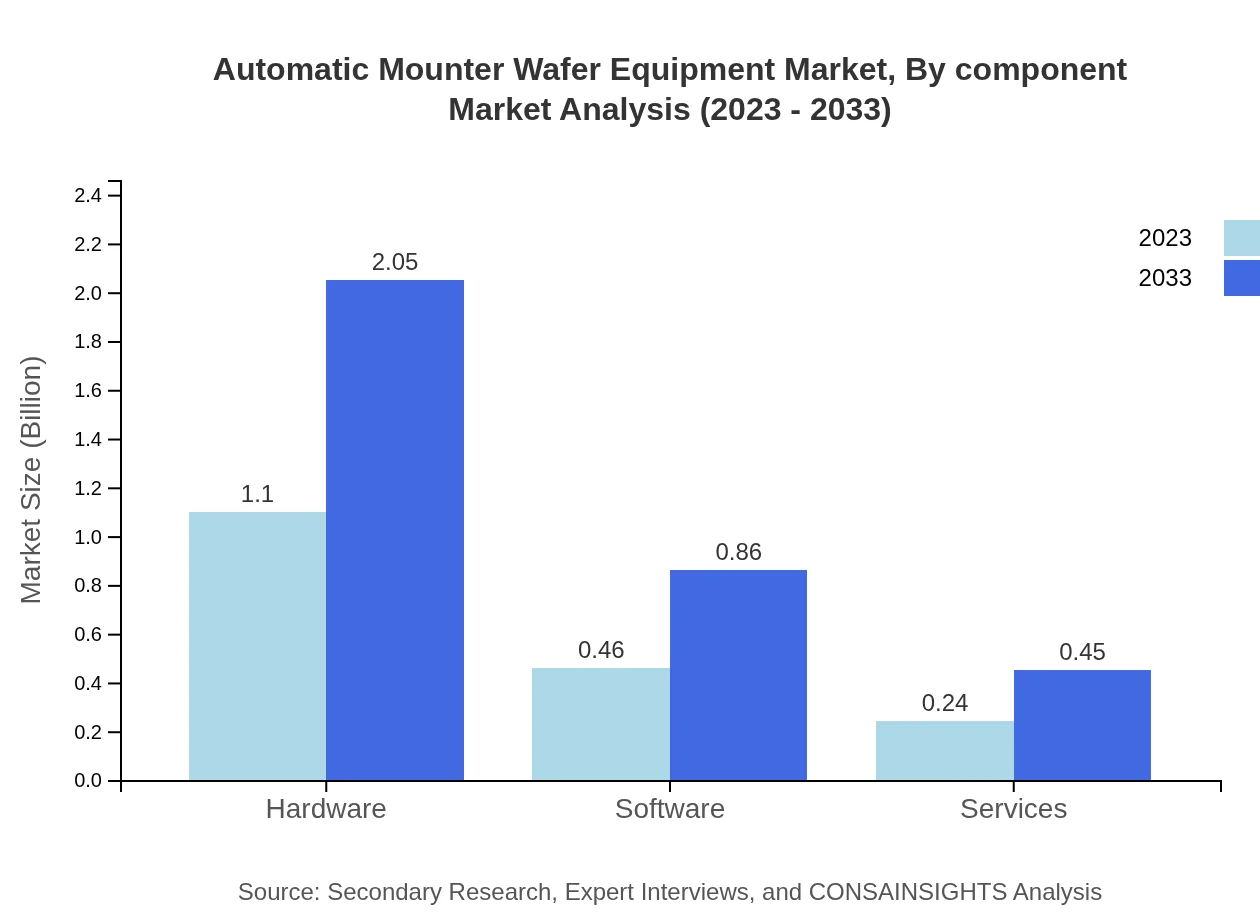

Automatic Mounter Wafer Equipment Market Analysis By Component

This segment includes hardware, software, and services. Hardware holds the majority share of the market, with a size of USD 1.10 billion in 2023, dominated by critical components needed for operation. In contrast, software and services are smaller segments but are growing due to the increasing need for integration and ongoing support.

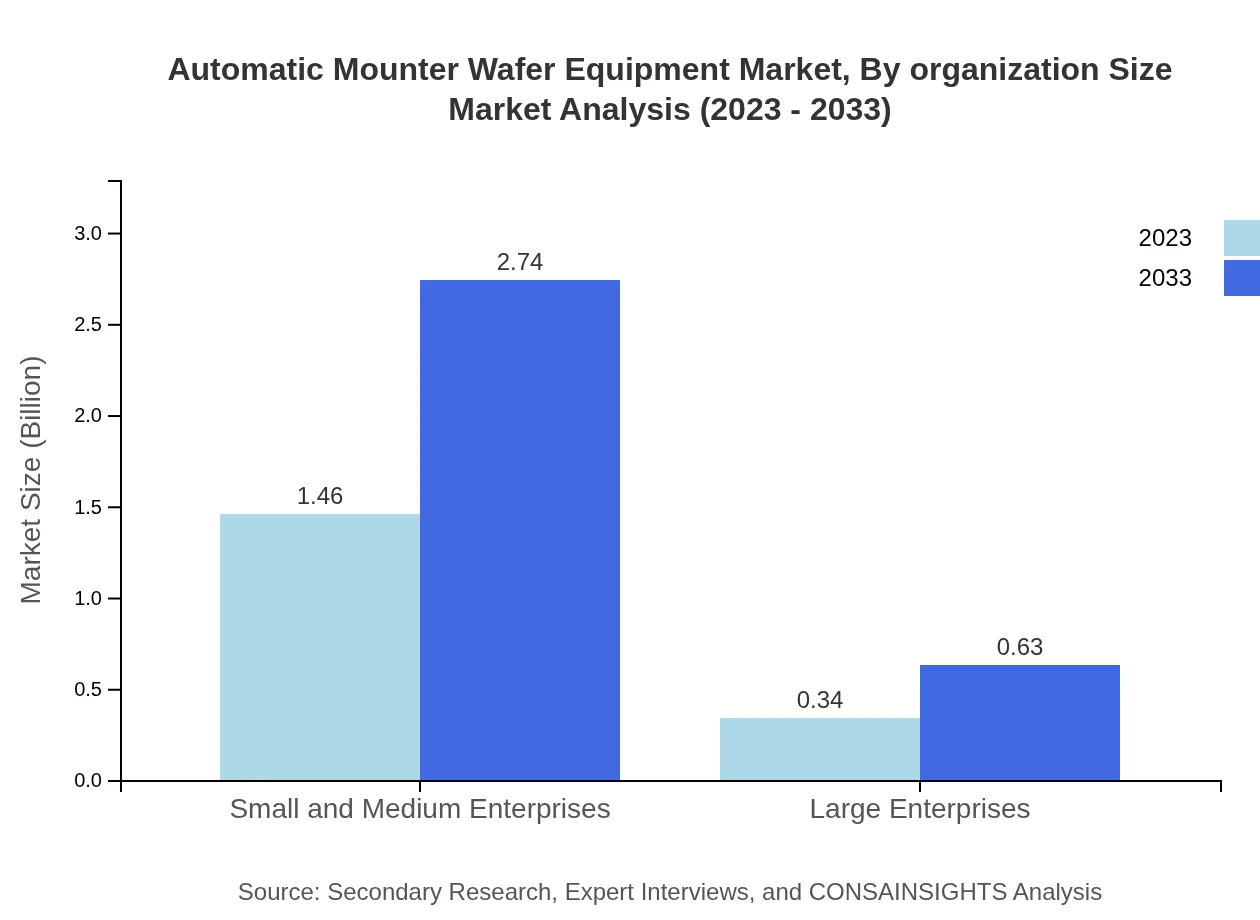

Automatic Mounter Wafer Equipment Market Analysis By Organization Size

The market can also be analyzed by organization size, comprising small and medium enterprises, as well as large enterprises. Small and medium enterprises account for a substantial share, valued at USD 1.46 billion in 2023 and forecasted to reach USD 2.74 billion by 2033, reflecting a growing trend of automation adoption among smaller firms.

Automatic Mounter Wafer Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automatic Mounter Wafer Equipment Industry

ASM Pacific Technology:

A leading provider of semiconductor equipment and solutions, offering advanced mounter systems that enhance manufacturing efficiency.K&S (Kahng and Shai):

Specializes in die bonding and packaging solutions, recognized for high-quality automatic mounter systems in the semiconductor industry.Brewer Science:

Known for innovative coating solutions for the semiconductor industry, also involved in developing advanced mounter technologies.Teradyne:

A major player in testing and automation solutions, contributing significantly to the development of effective mounter systems.We're grateful to work with incredible clients.

FAQs

What is the market size of automatic Mounter Wafer Equipment?

The market size for automatic mounter wafer equipment is projected at $1.8 billion in 2023, with a projected CAGR of 6.3% over the next decade, indicating strong growth as technology advances in semiconductor manufacturing.

What are the key market players or companies in this automatic Mounter Wafer Equipment industry?

Key players in the automatic mounter wafer equipment market include leading semiconductor equipment manufacturers known for innovation and reliability, though specific names are not highlighted in the provided data.

What are the primary factors driving the growth in the automatic Mounter Wafer Equipment industry?

Factors driving growth include rising semiconductor demand, advances in technology automation, and the increasing complexity of electronic devices requiring precise manufacturing solutions in wafer processing.

Which region is the fastest Growing in the automatic Mounter Wafer Equipment?

The fastest-growing region for automatic mounter wafer equipment is North America, projected to grow from a market size of $0.68 billion in 2023 to $1.28 billion by 2033, showcasing substantial market expansion.

Does ConsaInsights provide customized market report data for the automatic Mounter Wafer Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the automatic mounter wafer equipment industry, allowing businesses to make informed decisions based on bespoke insights.

What deliverables can I expect from this automatic Mounter Wafer Equipment market research project?

Deliverables include comprehensive market analysis reports, data on trends and forecasts, competitive landscape summaries, and recommendations for market entry strategies or product development.

What are the market trends of automatic Mounter Wafer Equipment?

Current trends include increased automation, enhanced efficiency in semiconductor production, and a shift towards advanced technologies like AI integration in wafer mounting processes, driving demand.