Automatic Power Factor Controller Market Report

Published Date: 22 January 2026 | Report Code: automatic-power-factor-controller

Automatic Power Factor Controller Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the Automatic Power Factor Controller market, focusing on its size, growth trends, and industry dynamics from 2023 to 2033. The report encompasses regional analyses and forecasts to equip stakeholders with essential data for strategic planning.

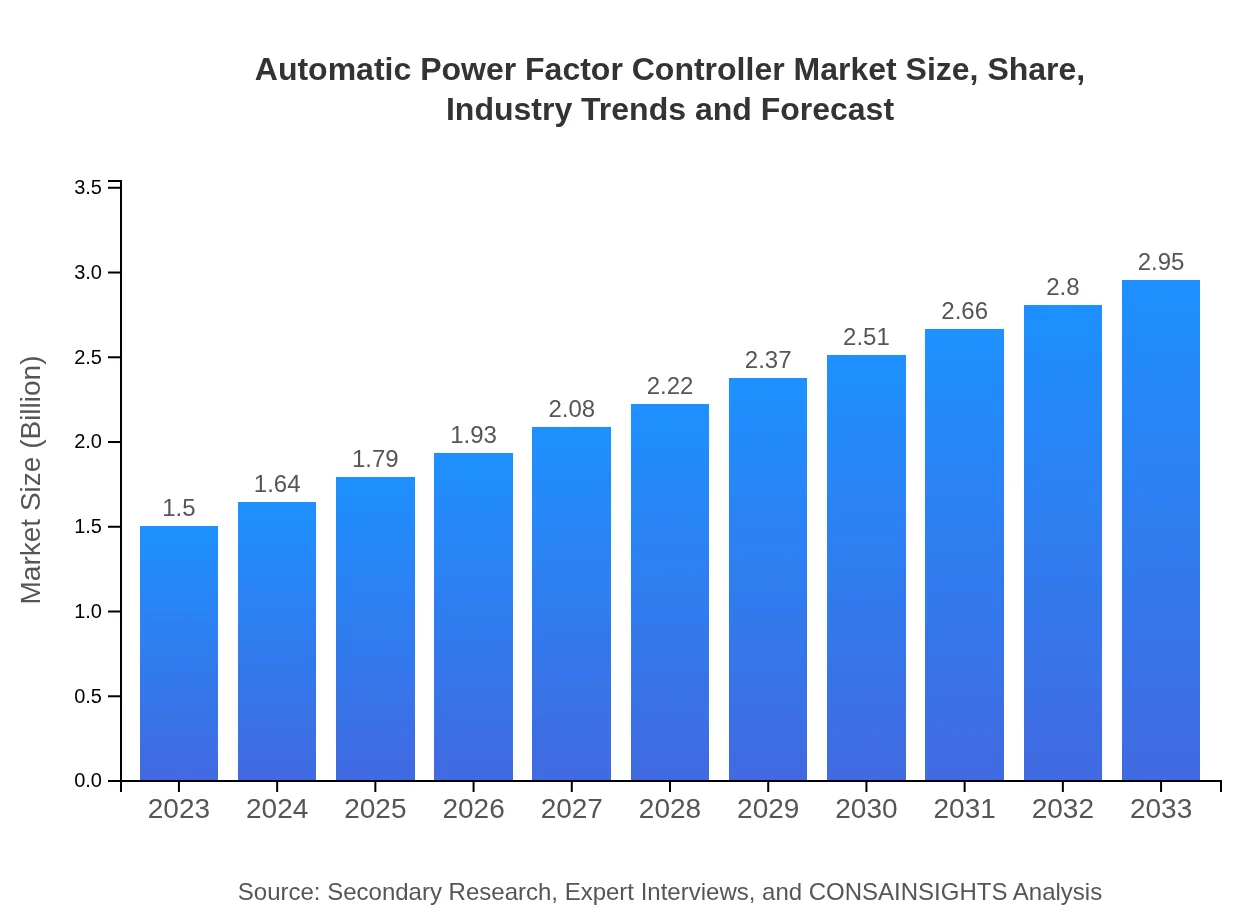

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | Siemens AG, Schneider Electric, Eaton Corporation, ABB Ltd. |

| Last Modified Date | 22 January 2026 |

Automatic Power Factor Controller Market Overview

Customize Automatic Power Factor Controller Market Report market research report

- ✔ Get in-depth analysis of Automatic Power Factor Controller market size, growth, and forecasts.

- ✔ Understand Automatic Power Factor Controller's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automatic Power Factor Controller

What is the Market Size & CAGR of Automatic Power Factor Controller market in 2023 and 2033?

Automatic Power Factor Controller Industry Analysis

Automatic Power Factor Controller Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automatic Power Factor Controller Market Analysis Report by Region

Europe Automatic Power Factor Controller Market Report:

The European market is expected to grow from $0.37 billion in 2023 to $0.73 billion by 2033. The region's commitment to sustainability, alongside aggressive energy-saving targets, accelerates the adoption of APFCs.Asia Pacific Automatic Power Factor Controller Market Report:

In 2023, the Automatic Power Factor Controller market in the Asia Pacific region is valued at approximately $0.30 billion, expected to grow to $0.59 billion by 2033. The growth is driven by rising industrial sectors, infrastructural advancements, and government initiatives promoting energy efficiency.North America Automatic Power Factor Controller Market Report:

North America dominates the APFC market with a size of $0.55 billion in 2023, anticipated to grow to $1.08 billion by 2033. The presence of advanced infrastructure, stringent energy regulations, and significant investments in clean energy technologies bolster this growth.South America Automatic Power Factor Controller Market Report:

The South American market, valued at $0.13 billion in 2023, is projected to reach $0.25 billion by 2033. The growth in this region is supported by increasing industrialization and efforts toward electrification and reliability of power supply.Middle East & Africa Automatic Power Factor Controller Market Report:

The Middle East and Africa market is projected to grow from $0.15 billion in 2023 to $0.29 billion by 2033. Increasing investments in renewable energy projects and smart grid initiatives are key drivers of APFC market growth in this region.Tell us your focus area and get a customized research report.

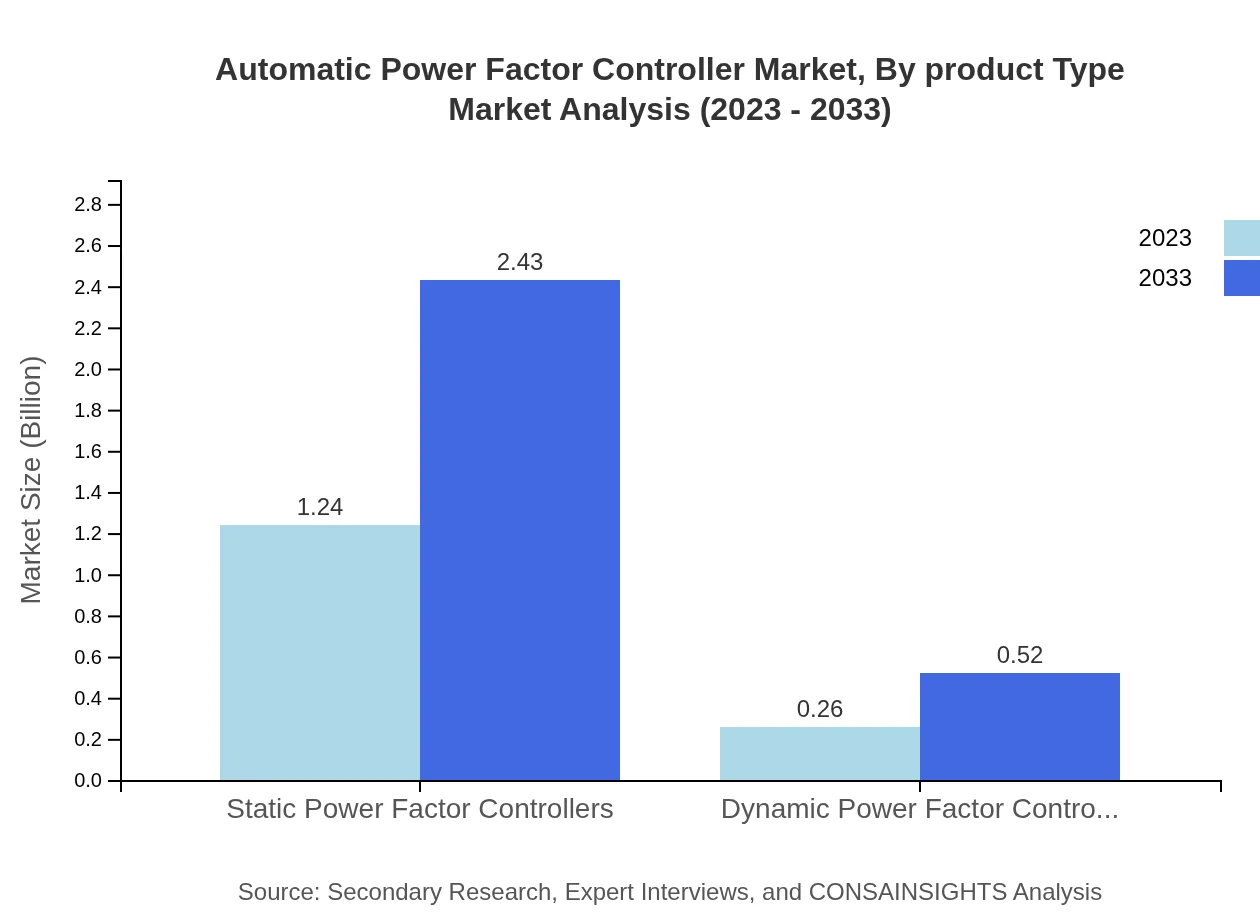

Automatic Power Factor Controller Market Analysis By Product Type

In 2023, Static Power Factor Controllers dominate the market with a size of $1.24 billion, expected to double to $2.43 billion by 2033. Meanwhile, Dynamic Power Factor Controllers show growth from $0.26 billion to $0.52 billion within the same period, indicating a shift towards more sophisticated and adaptable solutions.

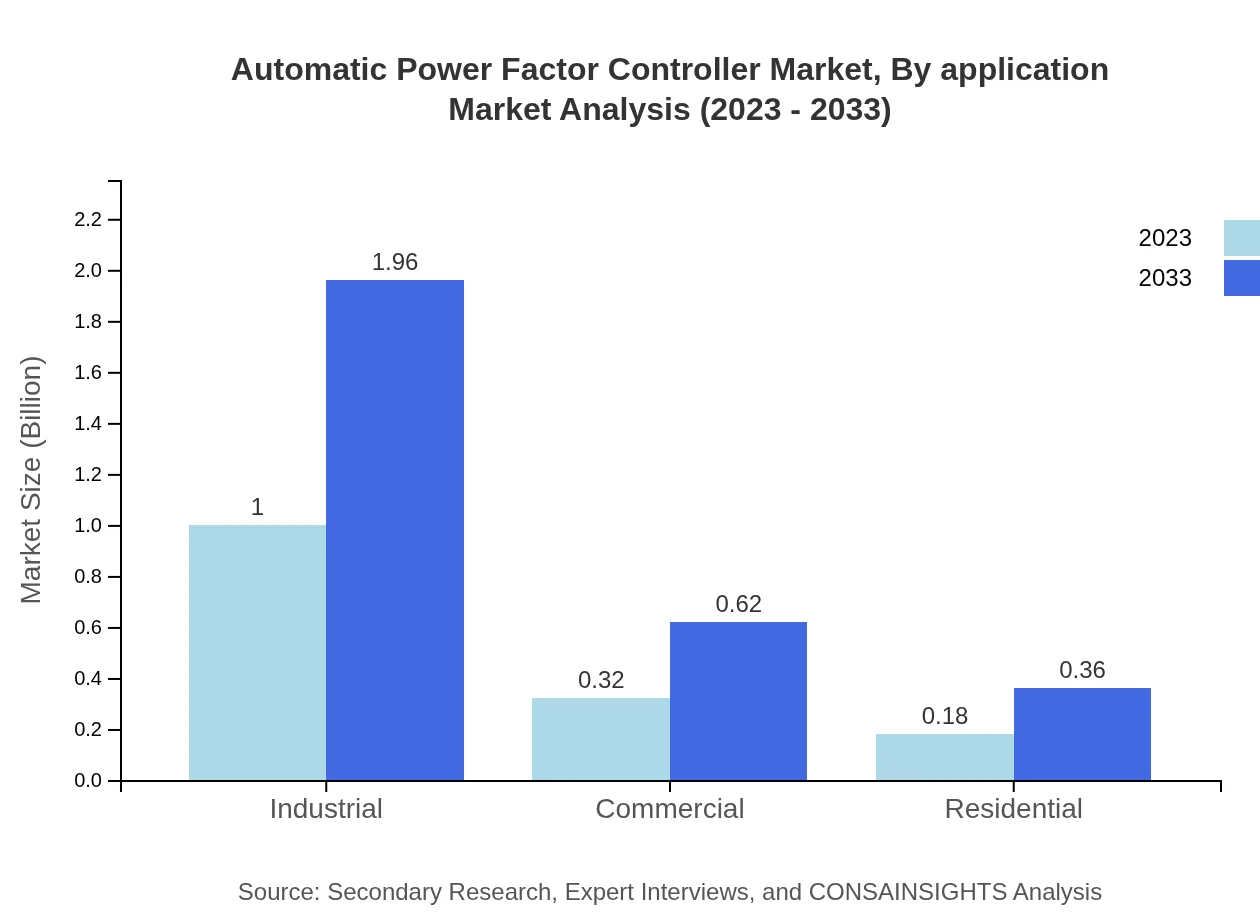

Automatic Power Factor Controller Market Analysis By Application

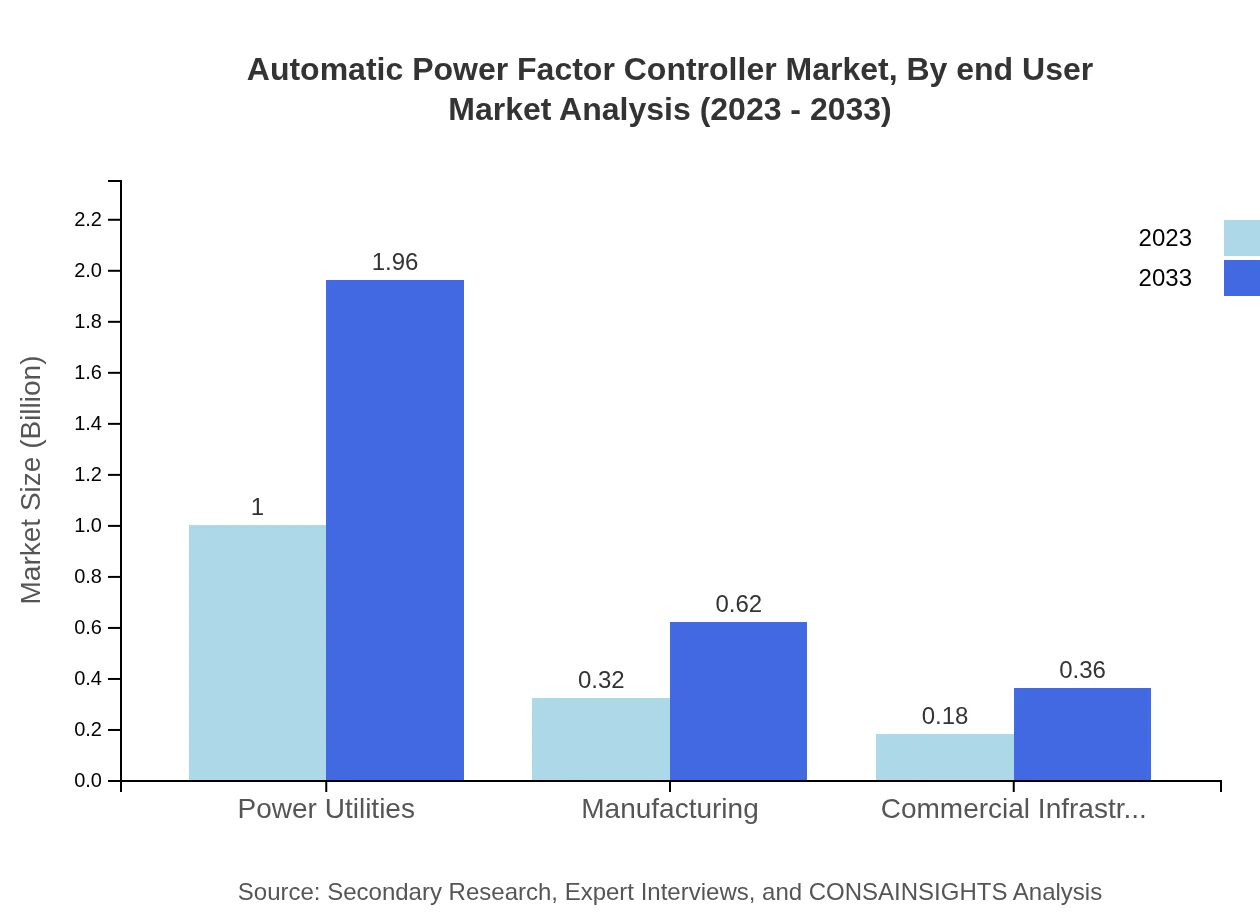

Power Utilities hold the largest market share at $1.00 billion in 2023, projected to increase to $1.96 billion by 2033. Other sectors like Manufacturing and Commercial Infrastructure are vital, with sizes of $0.32 billion and $0.18 billion in 2023, respectively, indicating significant potential for expansion.

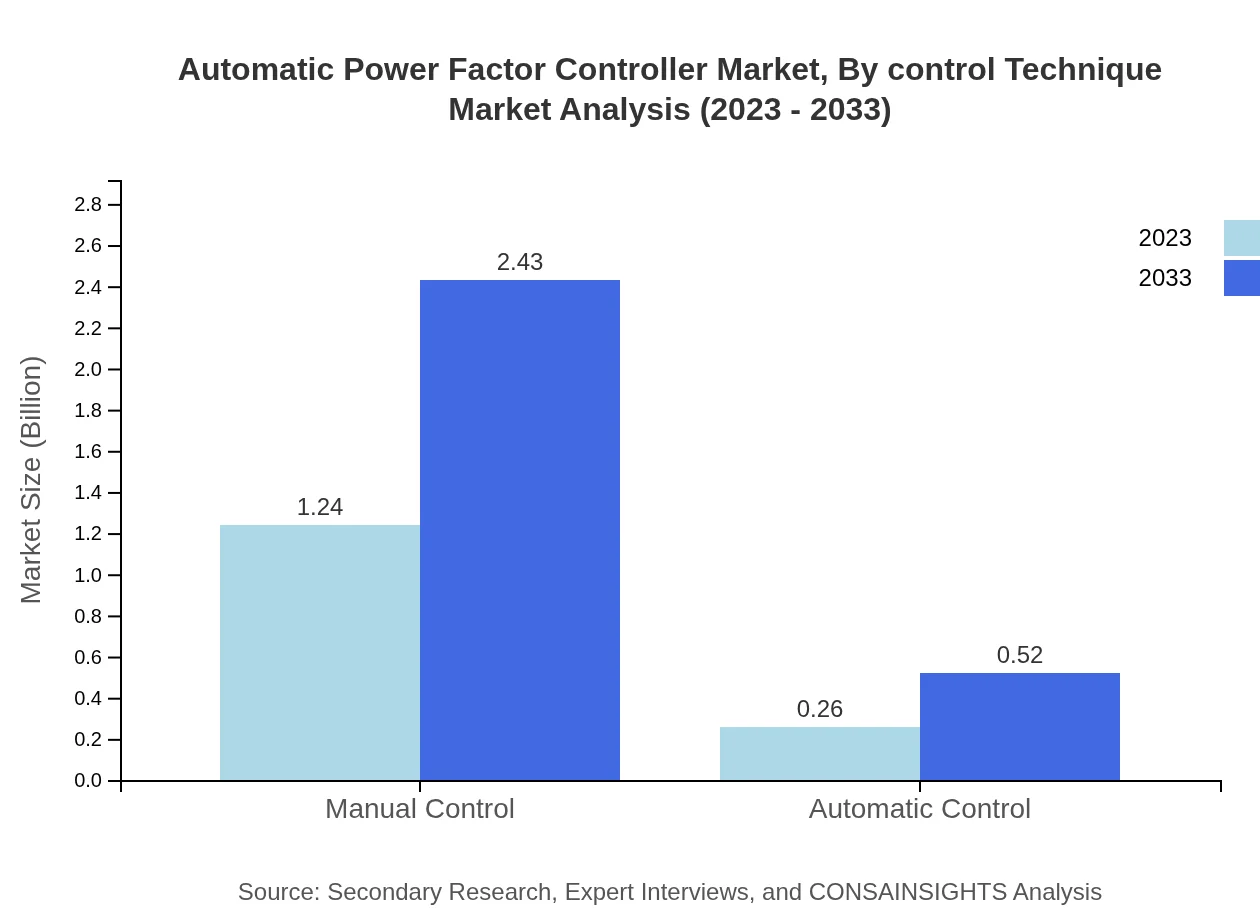

Automatic Power Factor Controller Market Analysis By Control Technique

Manual Control types represent a significant portion of the market, valued at $1.24 billion in 2023, while Automatic Control solutions show increasing adoption, growing from $0.26 billion to $0.52 billion by 2033, reflecting the trend towards automation.

Automatic Power Factor Controller Market Analysis By End User

Industrials account for $1.00 billion in 2023, with a growth trajectory to $1.96 billion by 2033, indicating substantial sector growth. Other end-users include commercial establishments and residential sectors, each showing stable growth patterns.

Automatic Power Factor Controller Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automatic Power Factor Controller Industry

Siemens AG:

Siemens AG is a global technology company known for its innovation in electrical engineering, including advanced power factor correction technologies that optimize electrical performance across numerous applications.Schneider Electric:

Schneider Electric specializes in energy management and automation solutions, providing automated power factor correction systems aiming at enhancing energy efficiency in industrial setups.Eaton Corporation:

Eaton Corporation is a leader in power management technologies, focusing on innovations in APFC systems that reduce energy costs and improve the sustainability of electrical resources.ABB Ltd.:

ABB is renowned for its high-tech equipment in power generation and distribution, offering innovative APFC products that cater to diverse sectors including utilities and industries.We're grateful to work with incredible clients.

FAQs

What is the market size of automatic power factor controller?

The global Automatic Power Factor Controller market is projected to reach approximately $1.5 billion by 2033, growing at a CAGR of 6.8%. This growth reflects increasing energy efficiency demands and advancements in power electronics.

What are the key market players or companies in this automatic power factor controller industry?

Key players in the Automatic Power Factor Controller industry include Schneider Electric, Siemens, and General Electric. These companies lead the market by leveraging innovative technologies and expanding their product offerings to meet consumer demands.

What are the primary factors driving the growth in the automatic power factor controller industry?

The growth of the Automatic Power Factor Controller industry is driven by rising energy costs, a focus on energy efficiency, and stricter government regulations for power quality. Additionally, the increased adoption of automation in industrial and commercial sectors fuels this growth.

Which region is the fastest Growing in the automatic power factor controller market?

The North American region is the fastest-growing market for Automatic Power Factor Controllers, with market size projected to grow from $0.55 billion in 2023 to $1.08 billion in 2033, driven by a shift towards energy-efficient systems and smart grid technologies.

Does ConsaInsights provide customized market report data for the automatic power factor controller industry?

Yes, ConsaInsights offers customized market report data for the Automatic Power Factor Controller industry, allowing clients to tailor insights to their specific business needs and focus areas, ensuring relevant and actionable market information.

What deliverables can I expect from this automatic power factor controller market research project?

Deliverables from the Automatic Power Factor Controller market research project include comprehensive market analysis reports, segmentation studies, region-wise data insights, and trend forecasts, all tailored to provide strategic insights for effective business planning.

What are the market trends of automatic power factor controller?

Market trends in the Automatic Power Factor Controller industry include increased adoption of automated solutions, rising investments in renewable energy technologies, and a notable shift towards the integration of smart technologies to enhance power quality and efficiency.