Automotive Ahss Market Report

Published Date: 02 February 2026 | Report Code: automotive-ahss

Automotive Ahss Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Ahss market, including market size, growth trends, segmentation, regional insights, and forecasts from 2023 to 2033.

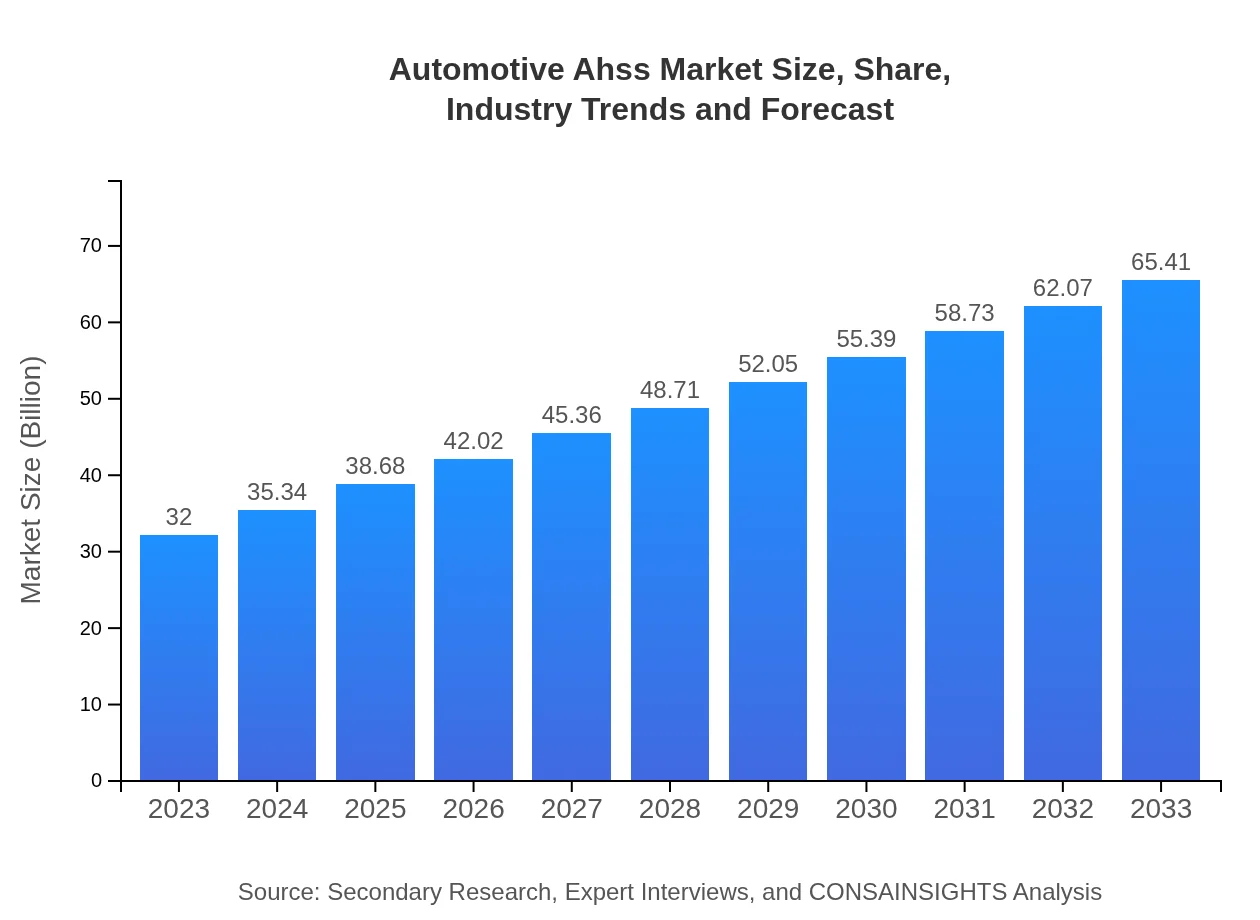

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $32.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $65.41 Billion |

| Top Companies | ArcelorMittal, Nippon Steel Corporation, Thyssenkrupp AG, POSCO |

| Last Modified Date | 02 February 2026 |

Automotive Ahss Market Overview

Customize Automotive Ahss Market Report market research report

- ✔ Get in-depth analysis of Automotive Ahss market size, growth, and forecasts.

- ✔ Understand Automotive Ahss's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Ahss

What is the Market Size & CAGR of Automotive Ahss market in 2023?

Automotive Ahss Industry Analysis

Automotive Ahss Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Ahss Market Analysis Report by Region

Europe Automotive Ahss Market Report:

The European market for Automotive AHSS is expected to increase from $10.17 billion in 2023 to $20.79 billion by 2033. This growth is driven by increasing automotive safety regulations, initiatives to reduce vehicle emissions, and advancements in AHSS technologies, making Europe a leader in the automotive steel market.Asia Pacific Automotive Ahss Market Report:

The Asia-Pacific region holds a substantial market for Automotive AHSS, with a size of $5.13 billion in 2023, projected to grow to $10.49 billion by 2033. Rapid industrialization, increasing vehicle production, and growing awareness regarding safety standards are driving this growth. Key players in countries like China, Japan, and India are actively investing in high-strength steel technologies.North America Automotive Ahss Market Report:

North America exhibits a strong presence in the Automotive AHSS market, with a size of $12.04 billion in 2023, projected to expand to $24.61 billion by 2033. The US and Canada are at the forefront of adopting advanced materials, influenced by stringent safety regulations and a shift towards electric vehicles.South America Automotive Ahss Market Report:

In South America, the Automotive AHSS market is smaller, valued at $2.35 billion in 2023 and expected to reach $4.79 billion by 2033. The growth is supported by expanding automotive industries in Brazil and Argentina, where efforts are being made to improve vehicle safety and compliance with international standards.Middle East & Africa Automotive Ahss Market Report:

In the Middle East and Africa, the market size is projected to grow from $2.31 billion in 2023 to $4.73 billion by 2033. While currently smaller, the potential for growth is high due to increasing vehicle production in emerging markets and a growing focus on manufacturing capabilities.Tell us your focus area and get a customized research report.

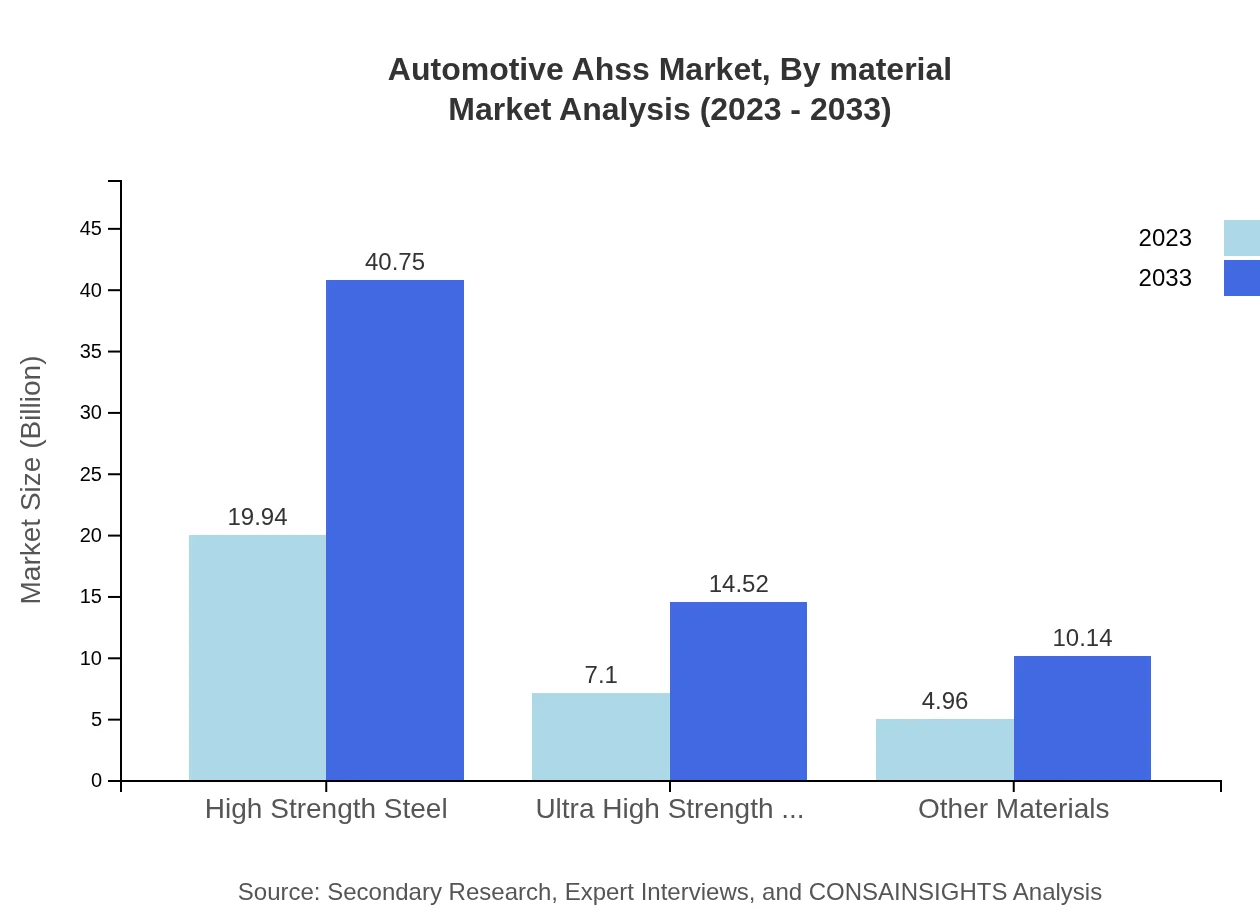

Automotive Ahss Market Analysis By Material

In terms of materials, High Strength Steel (HSS) dominates the market with a size of $19.94 billion in 2023, expected to reach $40.75 billion by 2033, maintaining a share of 62.3%. Ultra High Strength Steel (UHSS) also shows growth, projected to expand from $7.10 billion to $14.52 billion, holding a 22.2% share.

Automotive Ahss Market Analysis By Application

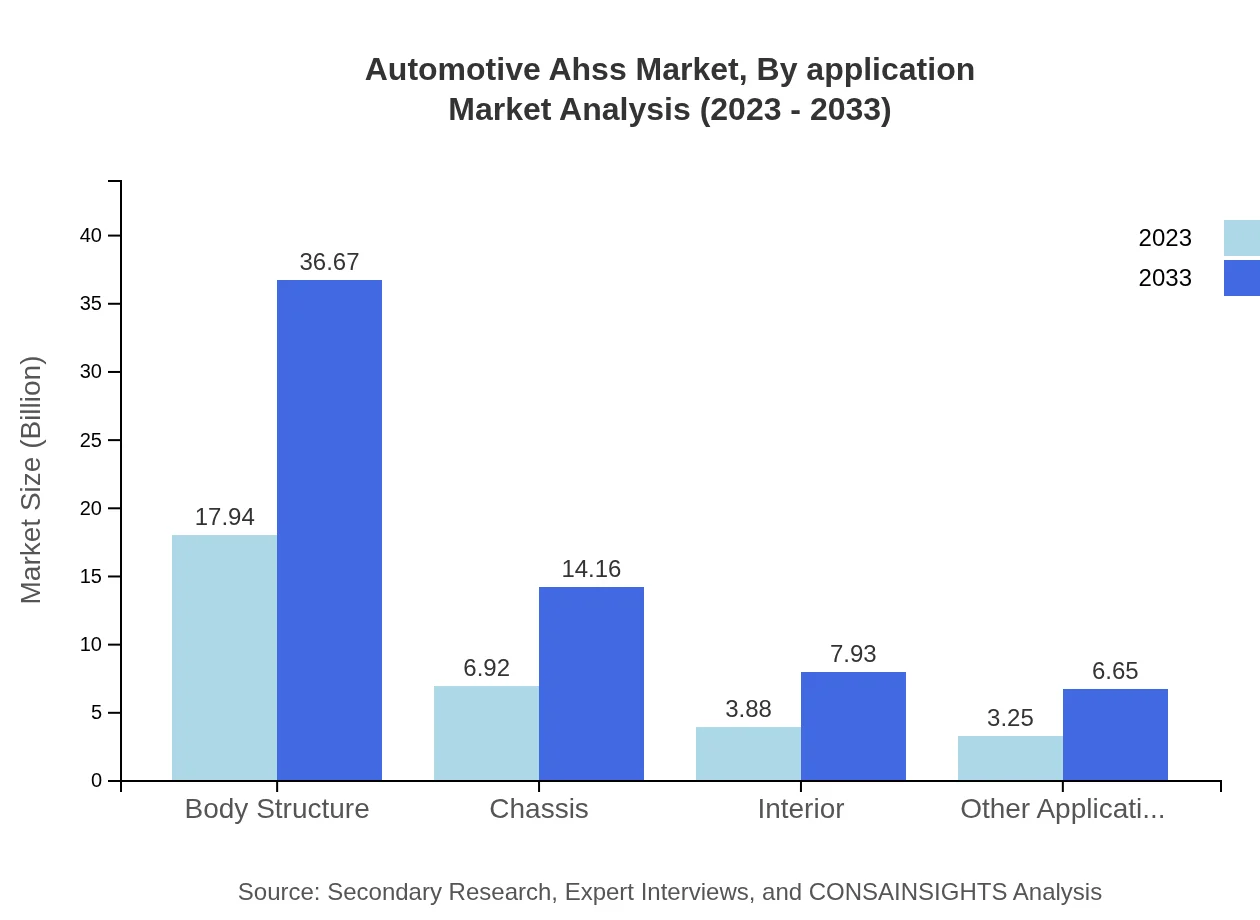

The application segment highlights Body Structure as the prominent category with a size of $17.94 billion in 2023 and expected to grow to $36.67 billion by 2033. Chassis and interior applications also contribute significantly, with market sizes of $6.92 billion and $3.88 billion respectively in 2023.

Automotive Ahss Market Analysis By Vehicle Type

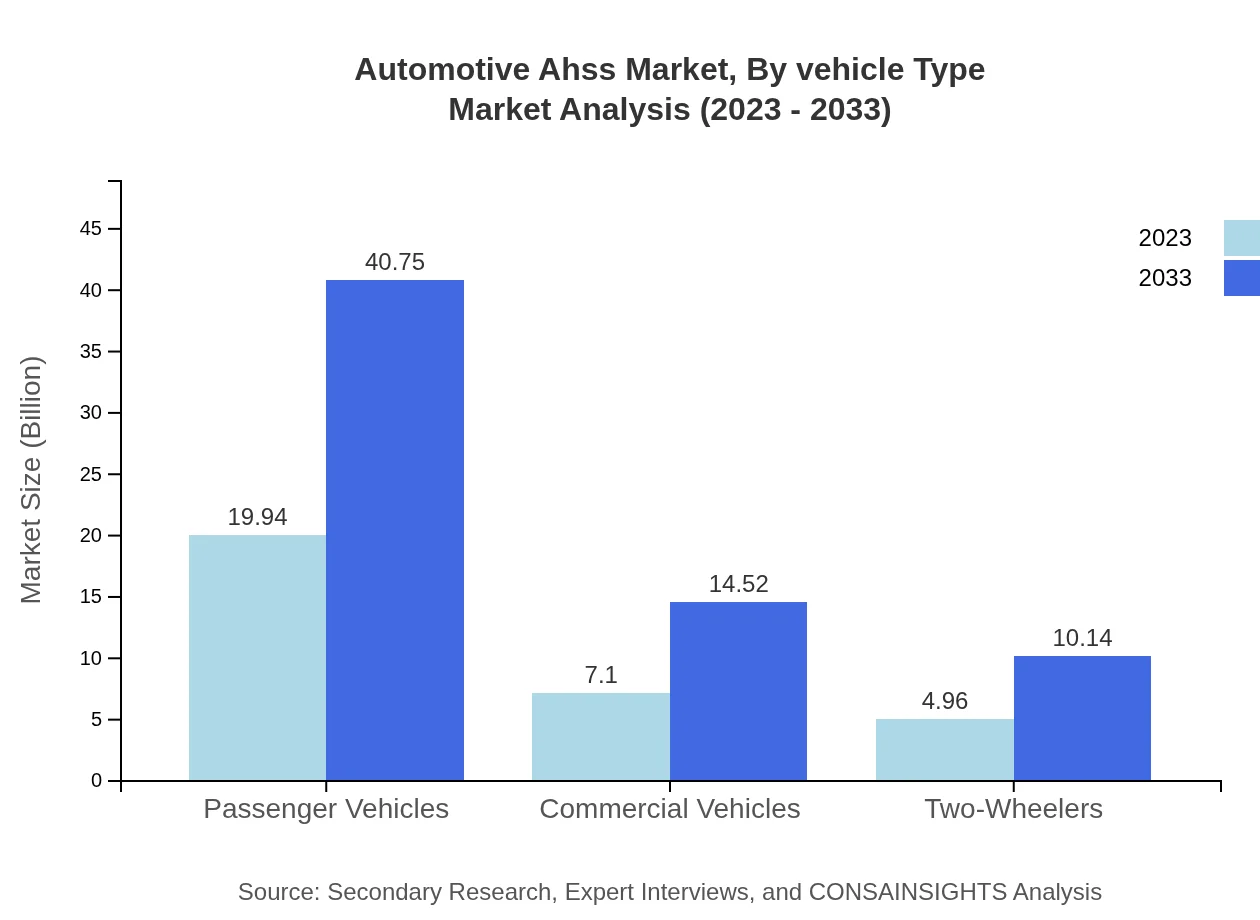

Passenger vehicles are the most significant segment, with a market size of $19.94 billion in 2023 and expected to reach $40.75 billion by 2033, holding a consistent share of 62.3%. Commercial vehicles and two-wheelers also play essential roles, with market sizes of $7.10 billion and $4.96 billion respectively.

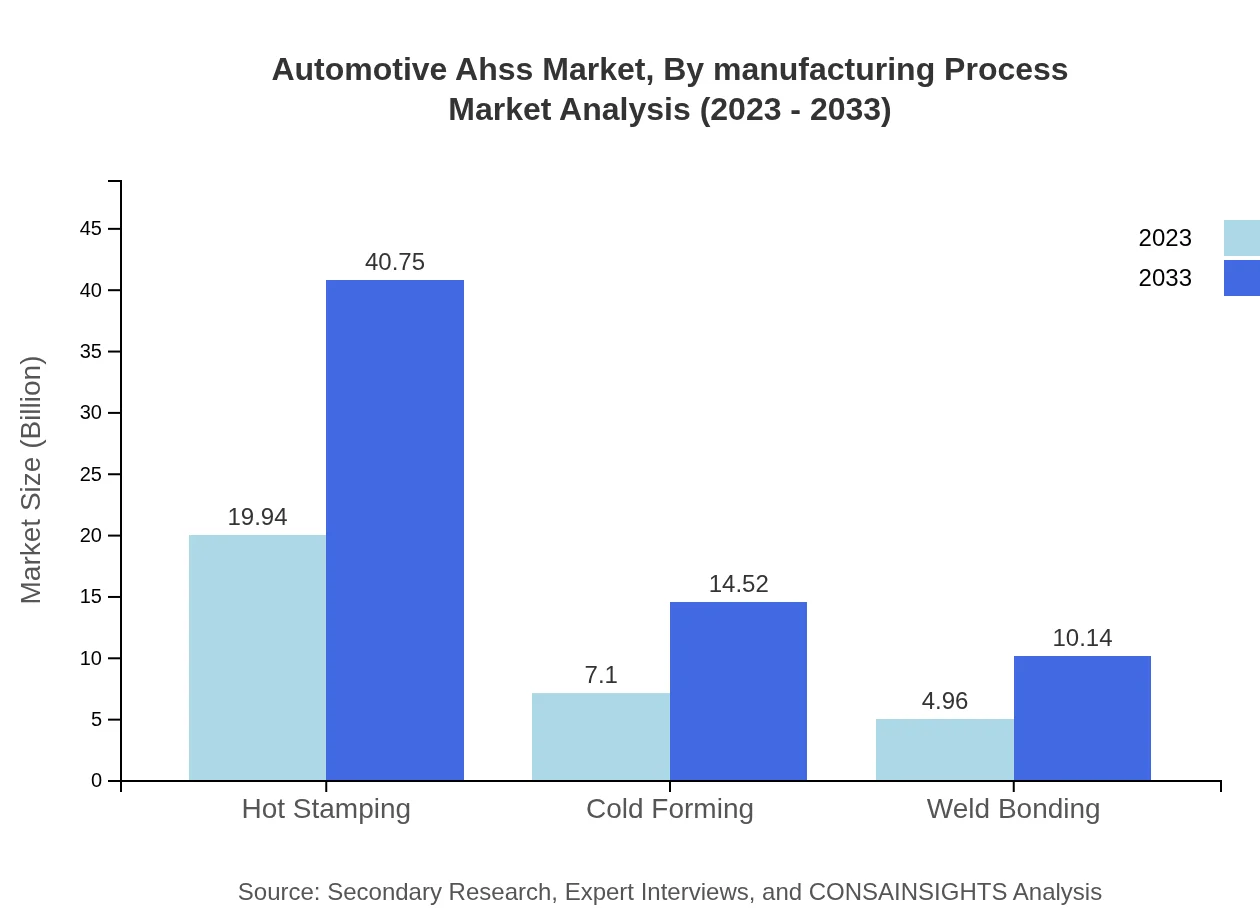

Automotive Ahss Market Analysis By Manufacturing Process

Hot stamping processes lead the market, valued at $19.94 billion in 2023 and projected to expand to $40.75 billion by 2033, representing a substantial share of 62.3%. Other methods such as cold forming and weld bonding are also notable, targeting specialized applications within the automotive sector.

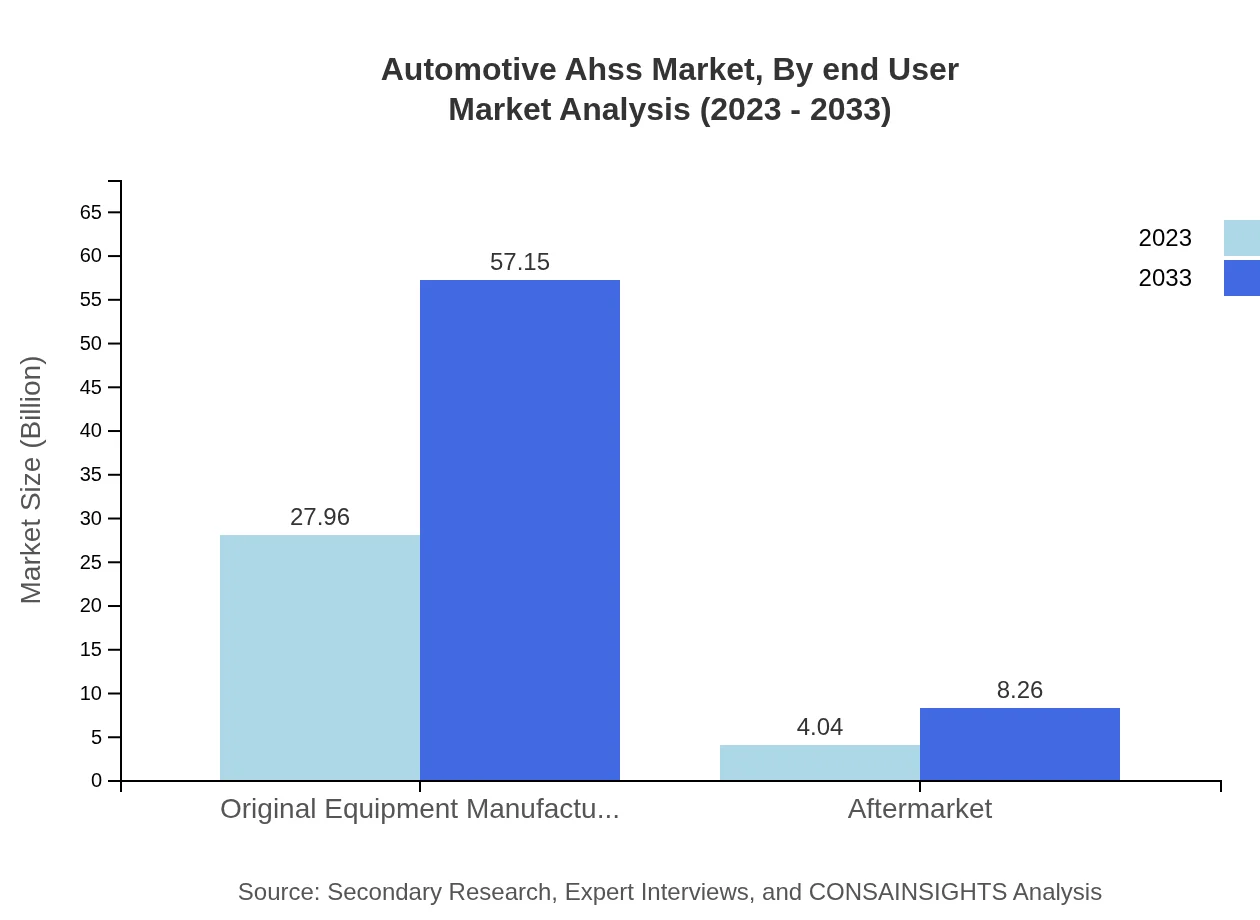

Automotive Ahss Market Analysis By End User

Original Equipment Manufacturers (OEMs) dominate the market with a size of $27.96 billion in 2023 and expected to reach $57.15 billion by 2033, securing a market share of 87.37%. The aftermarket segment also shows growth potential from $4.04 billion to $8.26 billion, although it holds a smaller share.

Automotive Ahss Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Ahss Industry

ArcelorMittal:

A global leader in steel manufacturing, ArcelorMittal focuses on supplying high-strength steel for automotive applications, supporting innovations in lightweight vehicle structures.Nippon Steel Corporation:

Nippon Steel Corporation specializes in producing advanced high-strength steels, contributing significantly to the automotive sector's push for more efficient and safer vehicles.Thyssenkrupp AG:

This steel giant is heavily involved in the automotive supply chain, providing AHSS solutions tailored to meet the specifications of various vehicle manufacturers.POSCO:

POSCO is known for its innovative steel products, focusing on high-strength steel development to cater to the automotive market's evolving demands.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Ahss?

The automotive AHSS market is currently valued at $32 billion and is projected to grow at a CAGR of 7.2% from 2023 to 2033, reflecting increasing demand in the automotive sector.

What are the key market players or companies in this automotive Ahss industry?

Key players in the automotive AHSS industry include major manufacturers such as ArcelorMittal, U.S. Steel, and Thyssenkrupp, who are recognized for their advanced steel production and innovation.

What are the primary factors driving the growth in the automotive Ahss industry?

The automotive AHSS industry is primarily driven by the need for lightweight materials to enhance fuel efficiency, stringent safety regulations, and an increasing shift towards electric vehicles requiring advanced steel solutions.

Which region is the fastest Growing in the automotive Ahss?

North America is the fastest-growing region in the automotive AHSS market, projected to expand from $12.04 billion in 2023 to $24.61 billion in 2033, emphasizing technological advancements and infrastructure investments.

Does ConsaInsights provide customized market report data for the automotive Ahss industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and parameters within the automotive AHSS industry, allowing clients to gain precise insights.

What deliverables can I expect from this automotive Ahss market research project?

Deliverables from the automotive AHSS market research project include detailed reports, market segmentation data, growth forecasts, and regional insights, ensuring comprehensive coverage for informed decision-making.

What are the market trends of automotive Ahss?

Current trends in the automotive AHSS market include the growing adoption of hot stamping techniques, rising demand for high-strength steel, and increased focus on sustainable manufacturing practices.