Automotive Axle And Propeller Shaft Market Report

Published Date: 02 February 2026 | Report Code: automotive-axle-and-propeller-shaft

Automotive Axle And Propeller Shaft Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Axle and Propeller Shaft market, offering insights into market size, growth trends, and regional dynamics, with a particular focus on the forecast period from 2023 to 2033.

| Metric | Value |

|---|---|

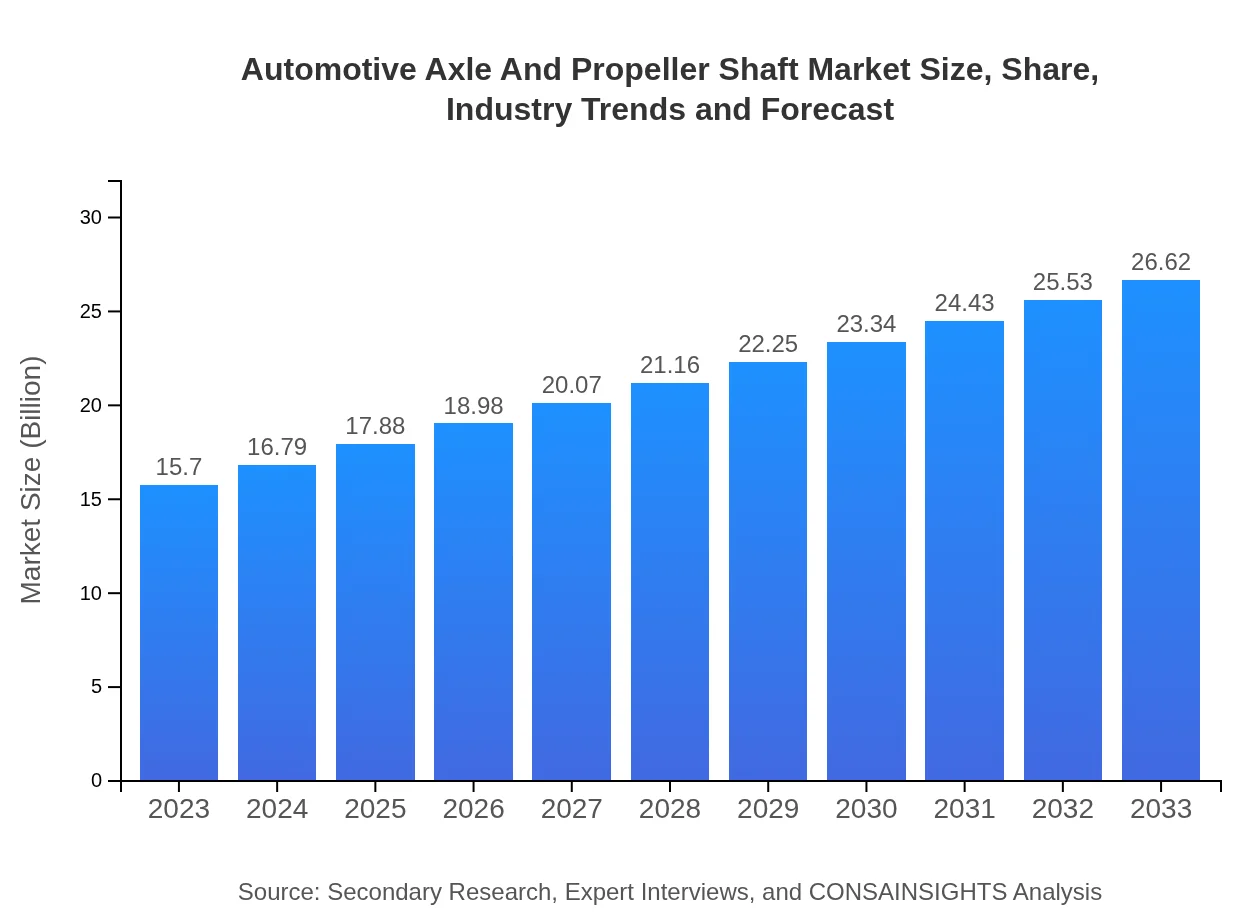

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $26.62 Billion |

| Top Companies | GKN Automotive, Dana Incorporated |

| Last Modified Date | 02 February 2026 |

Automotive Axle And Propeller Shaft Market Overview

Customize Automotive Axle And Propeller Shaft Market Report market research report

- ✔ Get in-depth analysis of Automotive Axle And Propeller Shaft market size, growth, and forecasts.

- ✔ Understand Automotive Axle And Propeller Shaft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Axle And Propeller Shaft

What is the Market Size & CAGR of Automotive Axle And Propeller Shaft market in 2023?

Automotive Axle And Propeller Shaft Industry Analysis

Automotive Axle And Propeller Shaft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Axle And Propeller Shaft Market Analysis Report by Region

Europe Automotive Axle And Propeller Shaft Market Report:

The European market for Automotive Axle and Propeller Shaft is anticipated to rise significantly from $4.78 billion in 2023 to $8.10 billion by 2033. The region's emphasis on reducing carbon emissions, coupled with strong demand for electric and hybrid vehicles, is shaping this growth, making it a key player in automotive innovation.Asia Pacific Automotive Axle And Propeller Shaft Market Report:

In the Asia Pacific region, the Automotive Axle and Propeller Shaft market is expected to grow from $2.94 billion in 2023 to $4.99 billion by 2033, driven by rising vehicle production levels and a growing demand for electric vehicles. Countries like China and India are pivotal players in this growth, with significant investments in automotive infrastructure.North America Automotive Axle And Propeller Shaft Market Report:

In North America, the market is estimated to expand from $5.71 billion in 2023 to $9.68 billion in 2033. The region's strong automotive manufacturing base, along with innovations focused on electric vehicles, supports this trend. Additionally, consumer preferences are shifting towards environmentally sustainable vehicles, contributing to market expansion.South America Automotive Axle And Propeller Shaft Market Report:

The South American market, although smaller in size, is projected to increase from $0.54 billion in 2023 to $0.92 billion by 2033. Factors influencing this growth include increasing urbanization, improved economic conditions, and a rising middle class, leading to higher vehicle ownership rates.Middle East & Africa Automotive Axle And Propeller Shaft Market Report:

In the Middle East and Africa, the market is projected to grow from $1.73 billion in 2023 to $2.93 billion by 2033. Factors such as increasing disposable income, urbanization, and infrastructural developments in the automotive sector are driving this market.Tell us your focus area and get a customized research report.

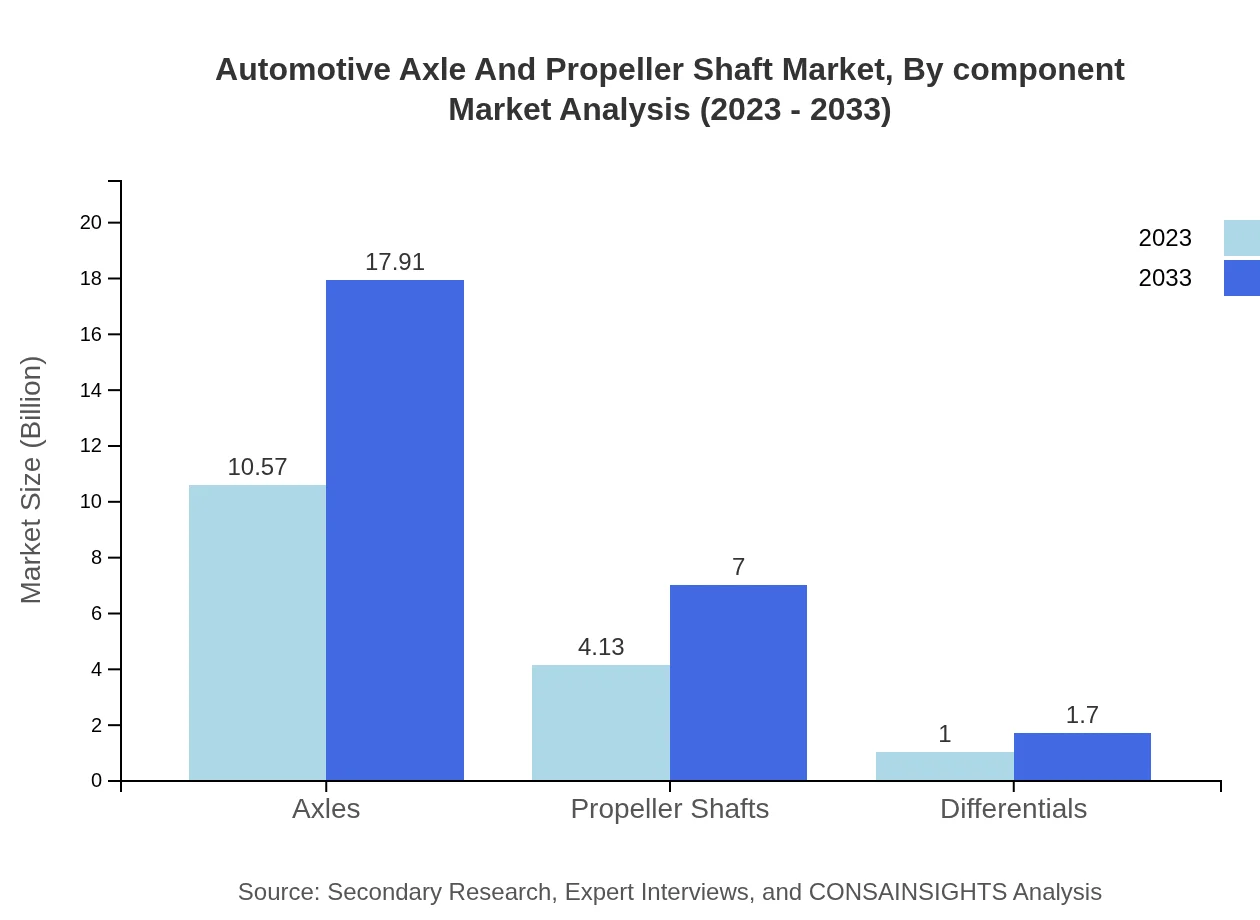

Automotive Axle And Propeller Shaft Market Analysis By Component

The market is primarily dominated by axles, which comprise a significant portion of overall sales, reflecting their crucial role in vehicle dynamics. The segment of propeller shafts is also gaining traction due to increased production of all-wheel and four-wheel-drive vehicles.

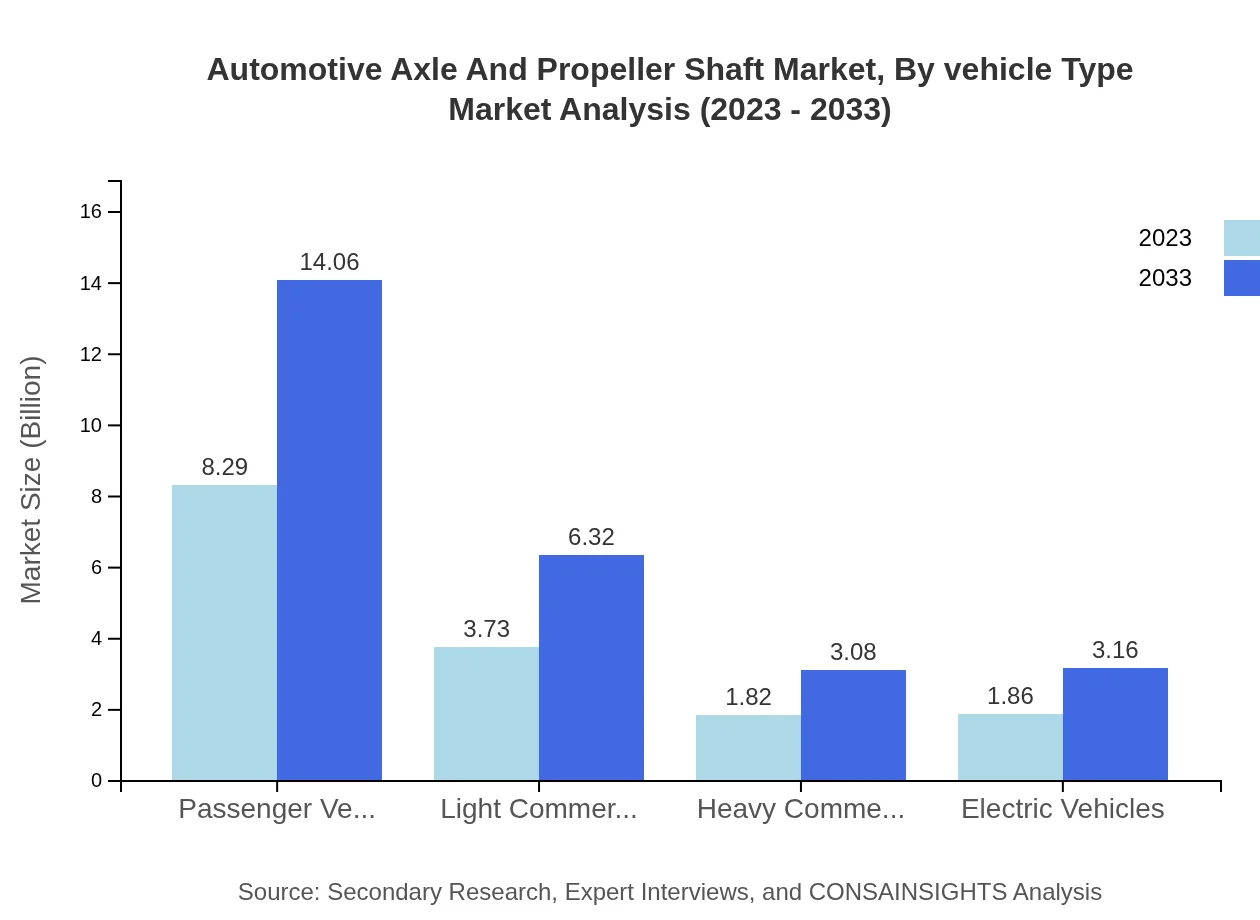

Automotive Axle And Propeller Shaft Market Analysis By Vehicle Type

Passenger vehicles dominate this market segment, accounting for 52.82% of the total share in 2023, with expectations to reach 14.06 billion by 2033. Light commercial and heavy commercial vehicles also represent significant shares due to rising logistics and transportation activities worldwide.

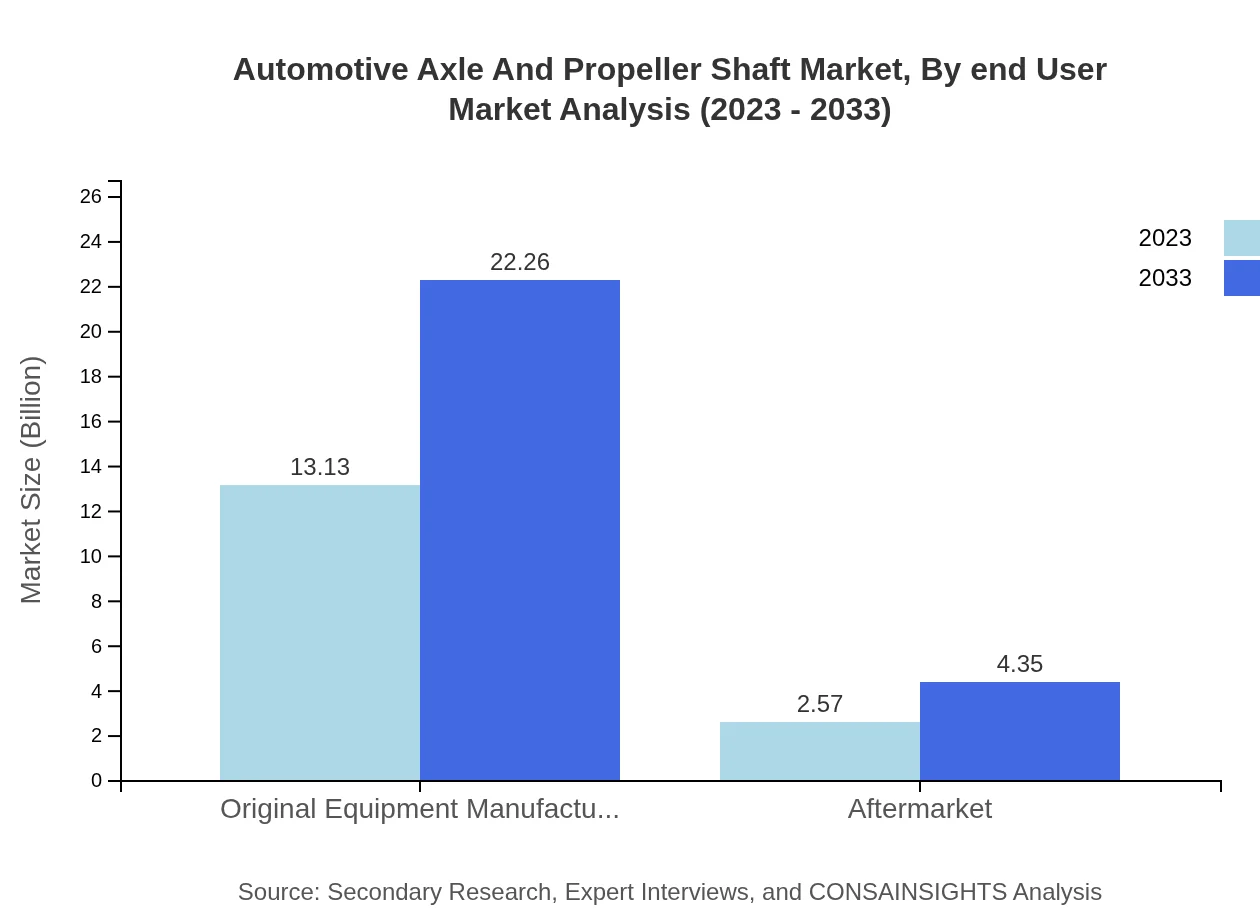

Automotive Axle And Propeller Shaft Market Analysis By End User

The Original Equipment Manufacturer (OEM) segment is the largest in the market, with an 83.64% share in 2023 and expected growth to 22.26 billion by 2033. The aftermarket segment follows, with a focus on servicing and replacement parts reflecting growth in vehicle longevity and repairs.

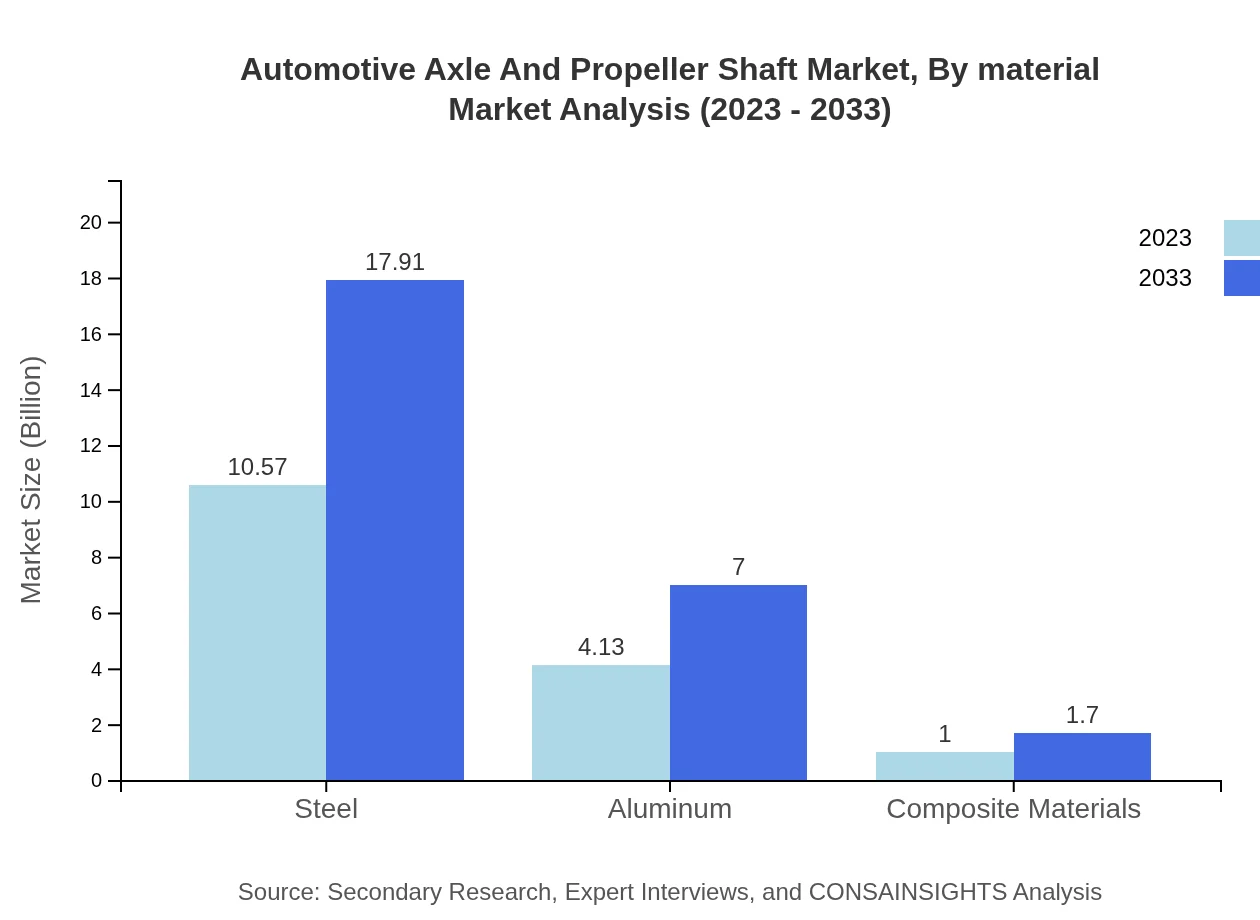

Automotive Axle And Propeller Shaft Market Analysis By Material

The steel segment makes up approximately 67.3% of the total materials used in manufacturing axles and propeller shafts due to its strength and durability. However, the aluminum segment is gaining ground, driven by demands for reduced vehicle weight and improved fuel economy.

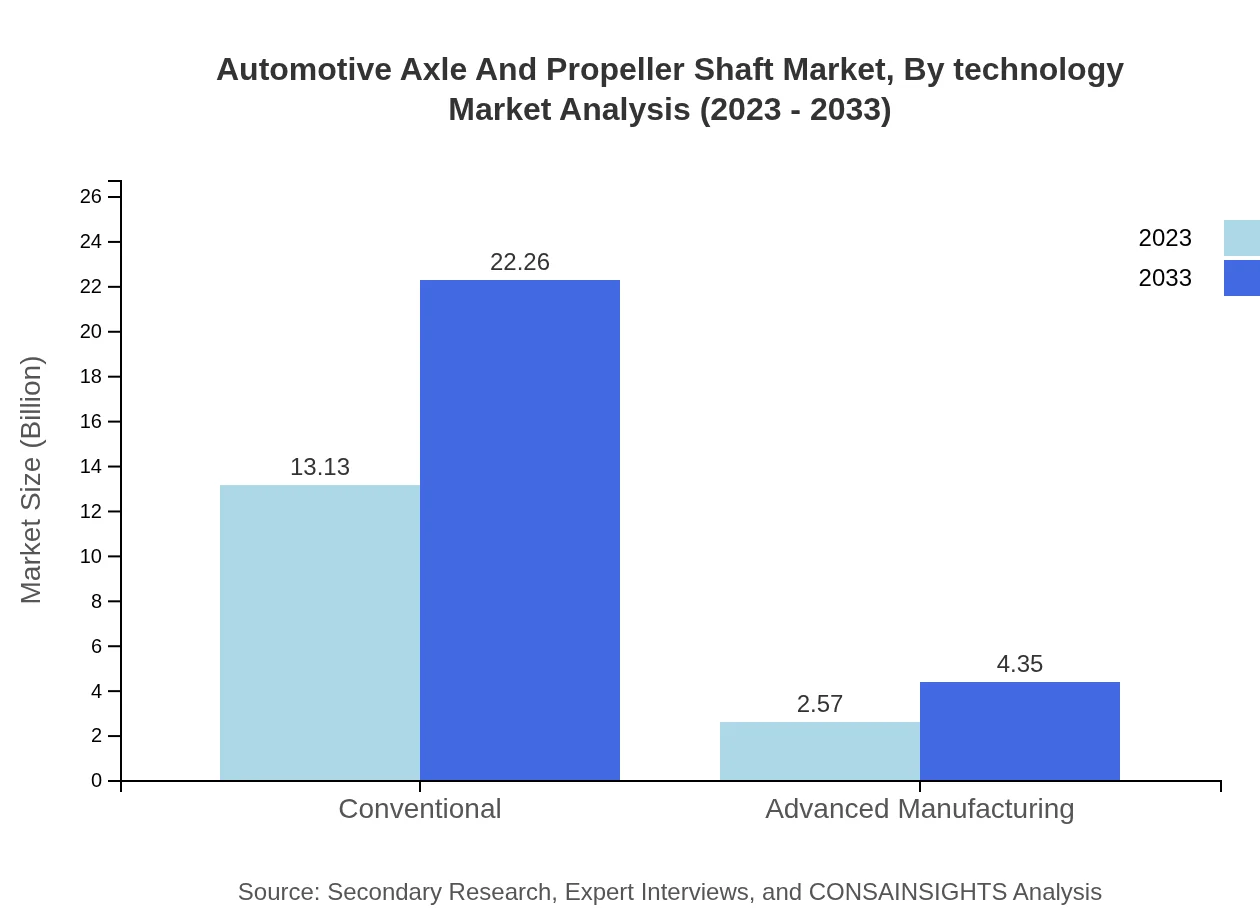

Automotive Axle And Propeller Shaft Market Analysis By Technology

Conventional manufacturing techniques currently dominate, holding an 83.64% market share. However, advanced manufacturing processes are emerging, focusing on efficiency and precision, projected to grow as the demand for innovative solutions increases.

Automotive Axle And Propeller Shaft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Axle And Propeller Shaft Industry

GKN Automotive:

A leading engineering company focusing on the manufacturing of driveline systems, renowned for its innovation in propeller shafts and axles.Dana Incorporated:

Specializes in axles and propeller shafts, providing advanced technologies and integrated solutions for some of the world's foremost automotive manufacturers.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Axle And Propeller Shaft?

The automotive axle and propeller shaft market is valued at approximately $15.7 billion in 2023, with a projected CAGR of 5.3% from 2023 to 2033, indicating substantial growth opportunities over the next decade.

What are the key market players or companies in the automotive Axle And Propeller Shaft industry?

Key players in the automotive axle and propeller shaft market include major manufacturers such as GKN, Dana Incorporated, and ZF Friedrichshafen AG, who dominate through innovation and strategic alliances, driving competitive advantages.

What are the primary factors driving the growth in the automotive Axle And Propeller Shaft industry?

Factors driving growth include the increasing demand for vehicles, advancements in automotive technology, rising production of electric vehicles, and the need for enhanced vehicle efficiency and performance in the automotive sector.

Which region is the fastest Growing in the automotive Axle And Propeller Shaft market?

The Asia Pacific region is poised to be the fastest-growing market, reaching a size of $4.99 billion by 2033, driven by a booming automotive industry, rising consumer demand, and increasing investments in vehicle manufacturing.

Does ConsaInsights provide customized market report data for the automotive Axle And Propeller Shaft industry?

Yes, ConsaInsights delivers comprehensive customized reports tailored to client needs in the automotive axle and propeller shaft industry, encompassing detailed insights, market dynamics, and forecasts.

What deliverables can I expect from this automotive Axle And Propeller Shaft market research project?

Key deliverables include in-depth market analysis, segmentation breakdown, competitive landscape assessments, growth forecasts, and actionable insights tailored to your business decision-making processes.

What are the market trends of automotive Axle And Propeller Shaft?

Current trends include increasing adoption of lightweight materials like aluminum and composites, the rise of electric vehicles, and innovations in axle efficiency, significantly shaping the automotive axle and propeller shaft market.