Automotive Carpeting Market Report

Published Date: 02 February 2026 | Report Code: automotive-carpeting

Automotive Carpeting Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Carpeting market from 2023 to 2033, highlighting market trends, segmentation, regional insights, and future forecasts. The insights aim to inform stakeholders of growth opportunities and industry dynamics.

| Metric | Value |

|---|---|

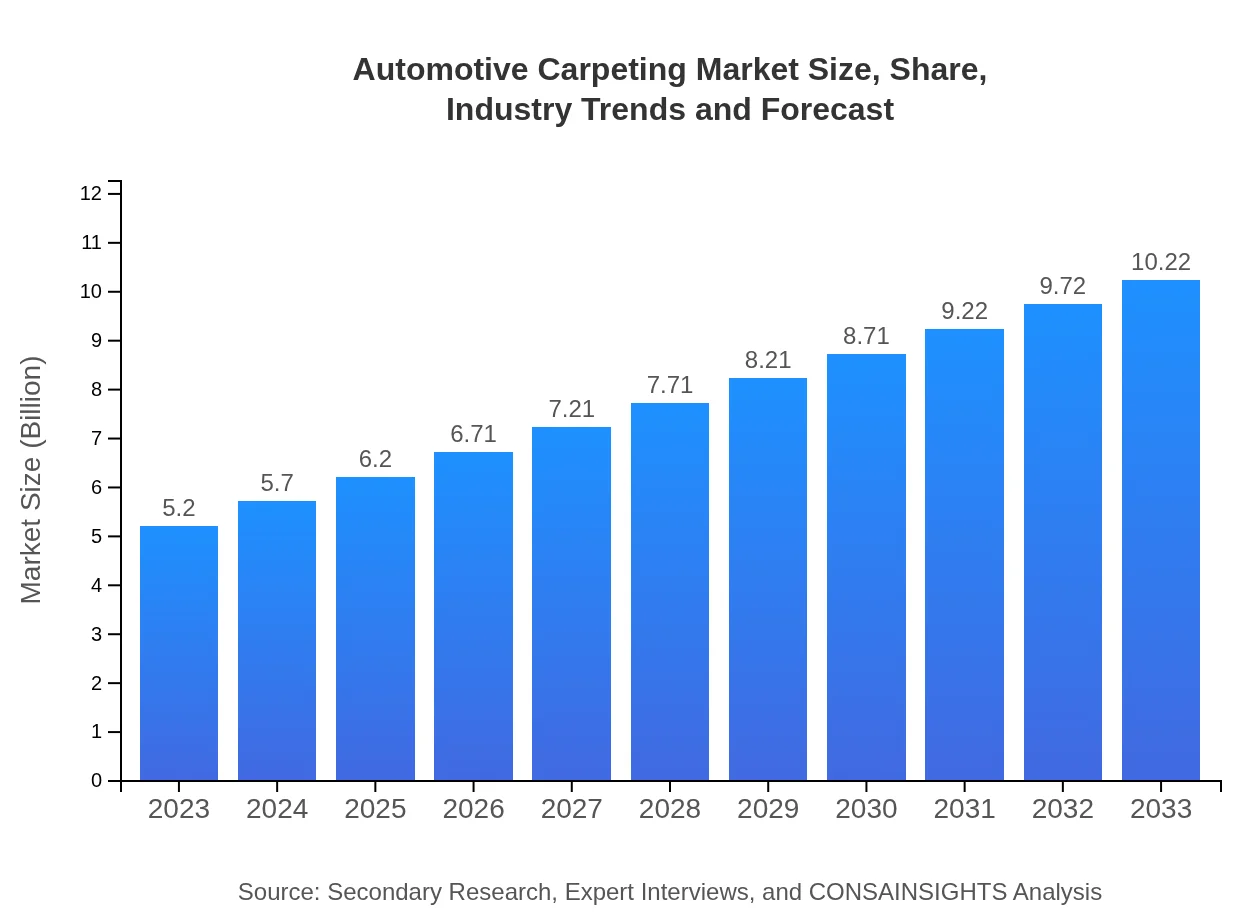

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Mohawk Industries, Inc., BASF SE, DuPont, Continental AG |

| Last Modified Date | 02 February 2026 |

Automotive Carpeting Market Overview

Customize Automotive Carpeting Market Report market research report

- ✔ Get in-depth analysis of Automotive Carpeting market size, growth, and forecasts.

- ✔ Understand Automotive Carpeting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Carpeting

What is the Market Size & CAGR of Automotive Carpeting market in 2023?

Automotive Carpeting Industry Analysis

Automotive Carpeting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Carpeting Market Analysis Report by Region

Europe Automotive Carpeting Market Report:

The European market is anticipated to grow from $1.36 billion in 2023 to $2.66 billion by 2033. Sustainable practices and innovation in materials are key focuses in this region, driven by stringent environmental regulations and consumer demand for eco-friendly products.Asia Pacific Automotive Carpeting Market Report:

In 2023, the Automotive Carpeting market in the Asia Pacific region is valued at approximately $1.14 billion and is projected to reach $2.23 billion by 2033. The significant growth is driven by the rapid increase in vehicle production in countries like China and India, alongside rising consumer preferences for vehicle interiors.North America Automotive Carpeting Market Report:

North America is projected to see a rise from $1.71 billion in 2023 to $3.36 billion by 2033. The market is supported by a strong automotive sector, including a high demand for luxury sedans and SUVs, which typically feature advanced carpeting technologies and materials.South America Automotive Carpeting Market Report:

The South American automotive carpeting market is expected to grow from $0.34 billion in 2023 to $0.67 billion by 2033. The region is experiencing a gradual increase in automotive production, significantly influenced by changes in consumer lifestyles and expectations for vehicle aesthetics.Middle East & Africa Automotive Carpeting Market Report:

The Middle East and Africa region will likely expand from $0.66 billion in 2023 to $1.29 billion by 2033, as improving economic conditions and growing automotive production in countries like South Africa enhance the demand for automotive carpeting.Tell us your focus area and get a customized research report.

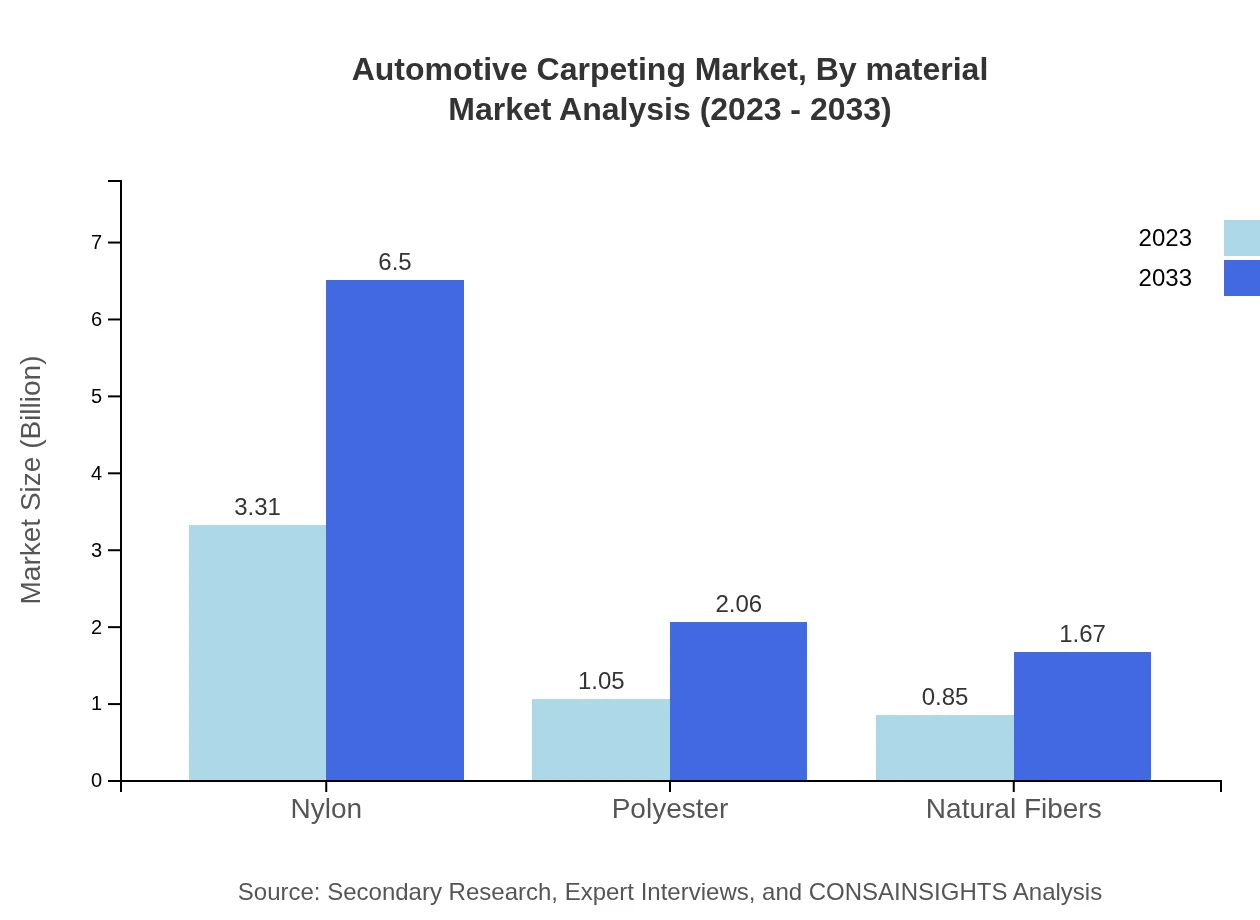

Automotive Carpeting Market Analysis By Material

The material segment of the automotive carpeting market is dominated by nylon, accounting for around 63.56% of the market share in 2023 and continuing to represent the majority through 2033. Polyester and natural fibers follow, reflecting significant shares of 20.11% and 16.33% respectively. The preference for nylon is driven by its durability and maintenance properties.

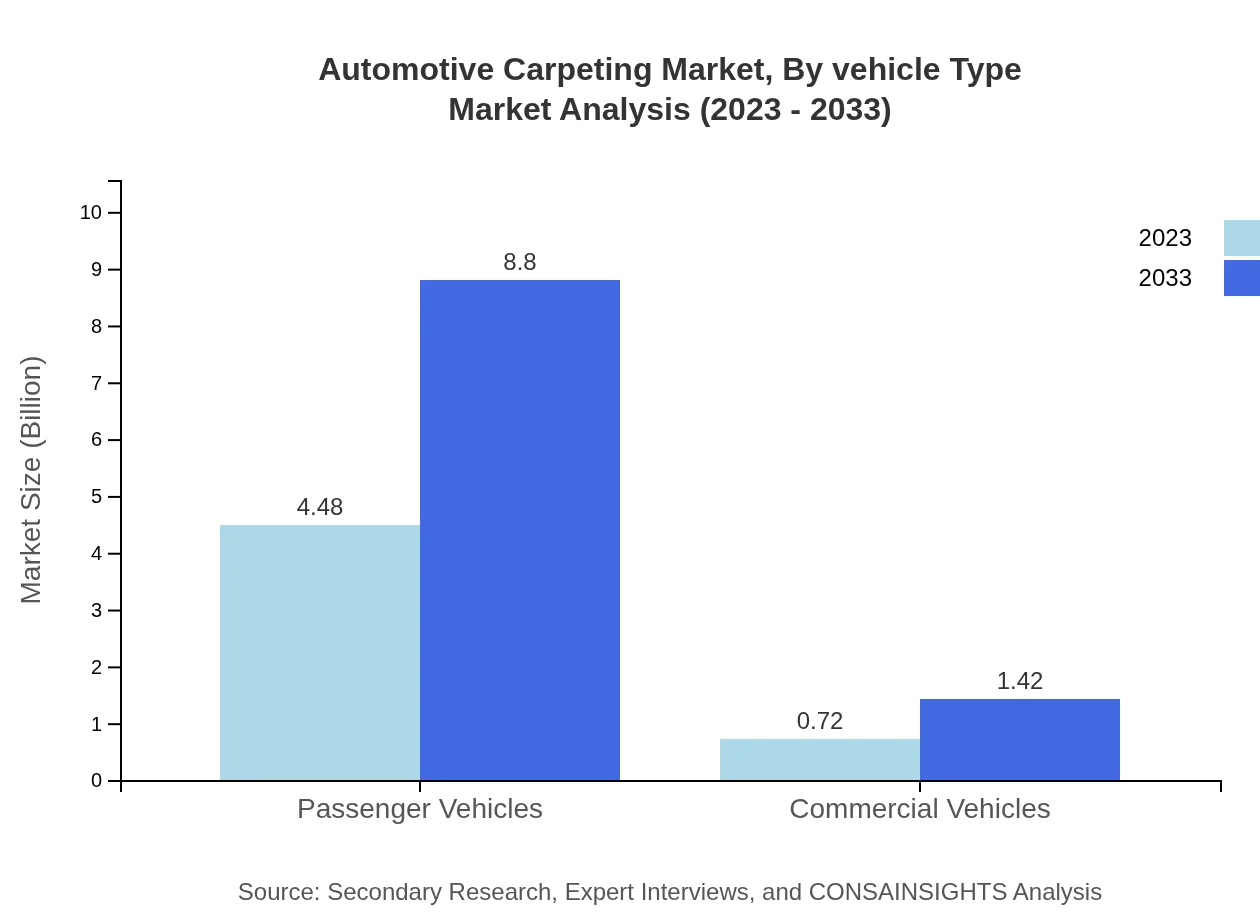

Automotive Carpeting Market Analysis By Vehicle Type

Passenger vehicles represent the largest segment of the automotive carpeting market. In 2023, this segment's market size is about $4.48 billion, and it is expected to grow to $8.80 billion by 2033. In contrast, the commercial vehicles segment, while smaller, is also experiencing growth, increasing from $0.72 billion in 2023 to $1.42 billion by 2033.

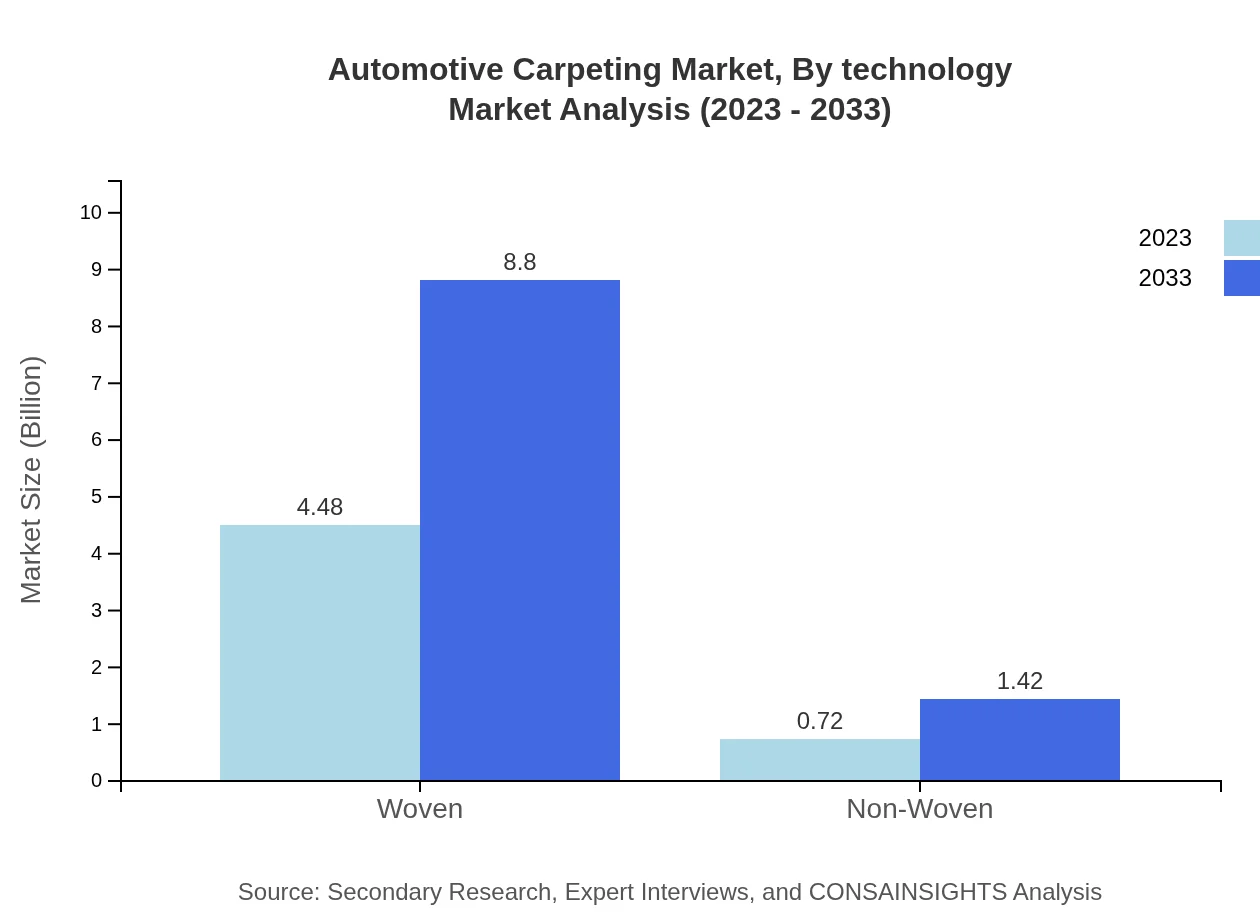

Automotive Carpeting Market Analysis By Technology

The automotive carpeting market is influenced heavily by ongoing technological developments. Innovations in materials such as sound-dampening carpets and environmentally friendly options are becoming increasingly popular. Companies are investing in R&D to enhance the longevity, functionality, and aesthetic appeal of their products.

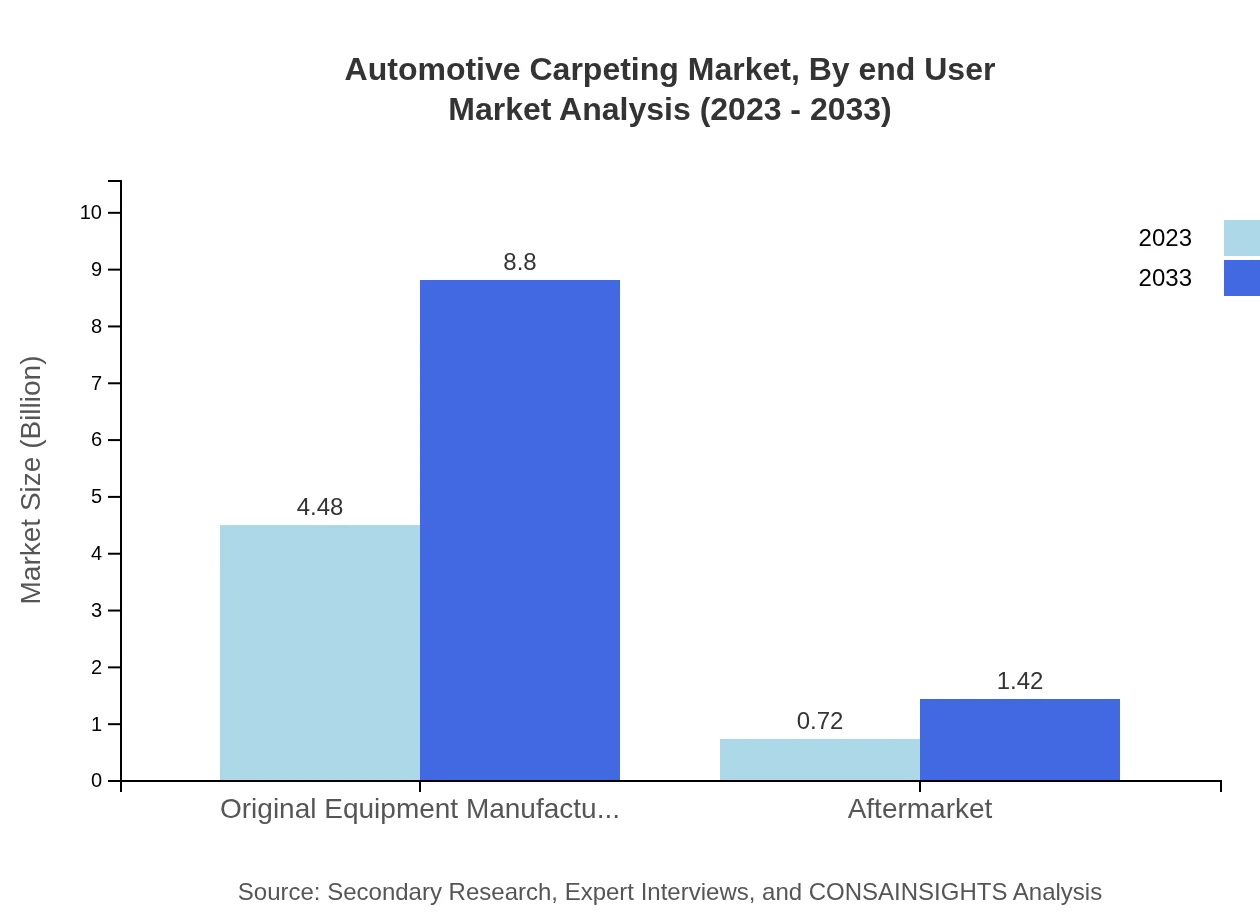

Automotive Carpeting Market Analysis By End User

The automotive carpeting market is primarily segmented into OEMs and aftermarket services. OEMs hold a significant market share, approximately 86.1% in 2023, with expectations of remaining steady through 2033. The aftermarket segment, while smaller at 13.9%, is growing as consumers seek replacement options and custom carpeting solutions.

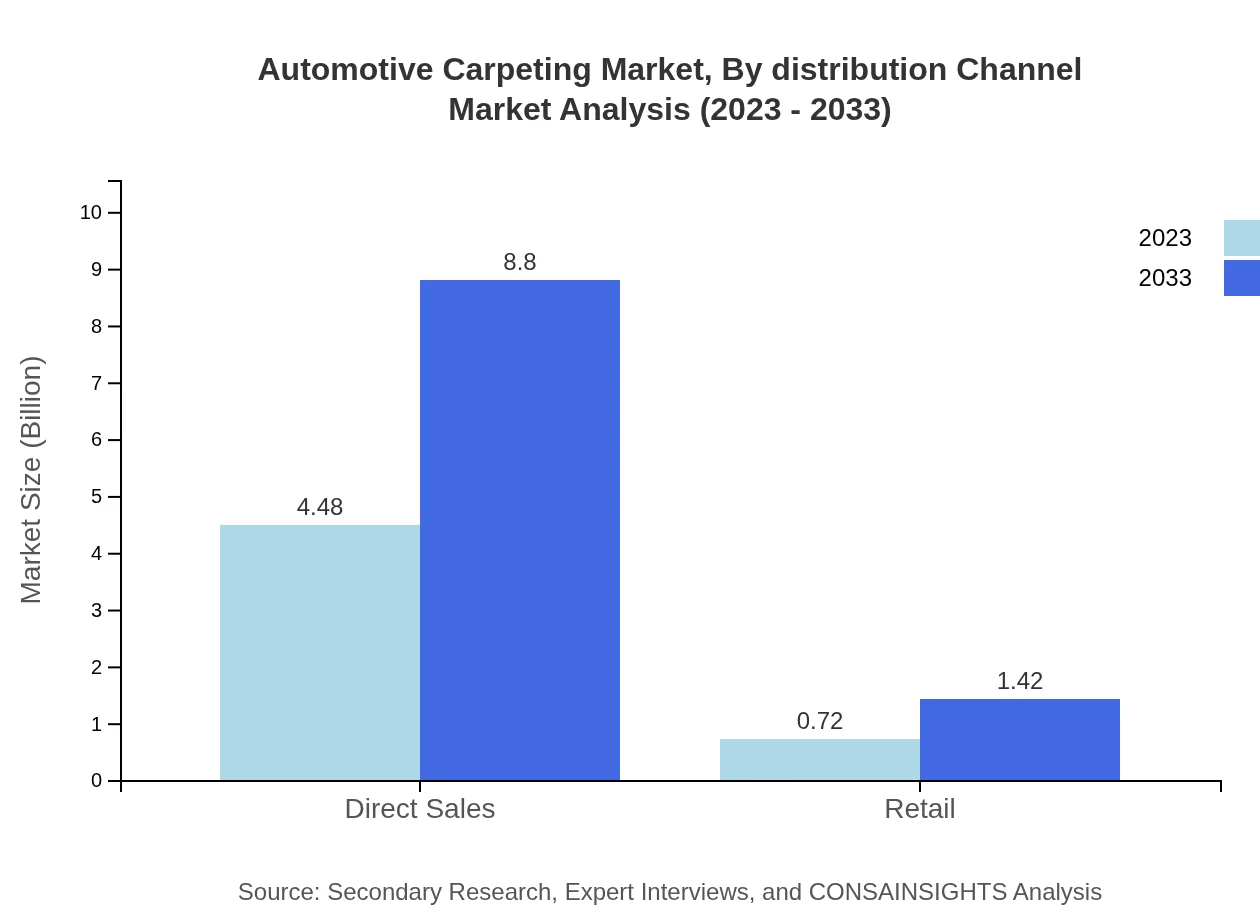

Automotive Carpeting Market Analysis By Distribution Channel

Distribution channels for automotive carpeting include direct sales and retail outlets. The direct sales channel is the predominant method, accounting for 86.1% of sales in 2023, driven by partnerships with vehicle manufacturers. Retail channels are also witnessing growth as consumers seek tailored solutions.

Automotive Carpeting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Carpeting Industry

Mohawk Industries, Inc.:

A leader in flooring products, Mohawk offers a comprehensive range of automotive carpeting that emphasizes durability and eco-friendly materials.BASF SE:

Known for its innovations in chemical products, BASF supplies advanced materials for automotive carpeting, focusing on sustainability and enhanced performance.DuPont:

Specializing in the development of nylon and advanced materials, DuPont plays a crucial role in providing high-performance carpeting for various vehicle types.Continental AG:

As a major automotive supplier, Continental integrates innovative carpeting solutions into its broader automotive offerings, enhancing both interior style and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive carpeting?

The automotive carpeting market is valued at $5.2 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, indicating significant growth potential over the next decade.

What are the key market players or companies in the automotive carpeting industry?

Key players in the automotive carpeting market include leading manufacturers and suppliers who provide various types of carpets for OEMs and aftermarket uses. Their competitive strategies help shape the industry's direction and innovation.

What are the primary factors driving the growth in the automotive carpeting industry?

Growth in the automotive carpeting industry is driven by increasing vehicle production, rising demand for luxury vehicle interiors, and advancements in materials used in automotive carpeting that enhance durability and comfort.

Which region is the fastest Growing in the automotive carpeting market?

In the automotive carpeting market, North America is the fastest-growing region, with a projected increase from $1.71 billion in 2023 to $3.36 billion by 2033, reflecting strong automotive sales and production.

Does ConsaInsights provide customized market report data for the automotive carpeting industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the automotive carpeting industry, allowing businesses to gain strategic insights and data-driven decisions for their unique requirements.

What deliverables can I expect from this automotive carpeting market research project?

Deliverables from this automotive carpeting market research project may include detailed market analysis, regional breakdowns, segmentation insights, and actionable recommendations tailored to support business strategies.

What are the market trends of automotive carpeting?

Key trends in the automotive carpeting market include a shift towards sustainable materials, increased customization options for consumers, and innovations in manufacturing processes to enhance product quality and reduce waste.