Automotive Coatings Market Report

Published Date: 02 February 2026 | Report Code: automotive-coatings

Automotive Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Automotive Coatings market, providing insights on its current state, future growth projections, and significant trends from 2023 to 2033. It encompasses market size, segmentation, and regional analyses to deliver a comprehensive understanding of this dynamic industry.

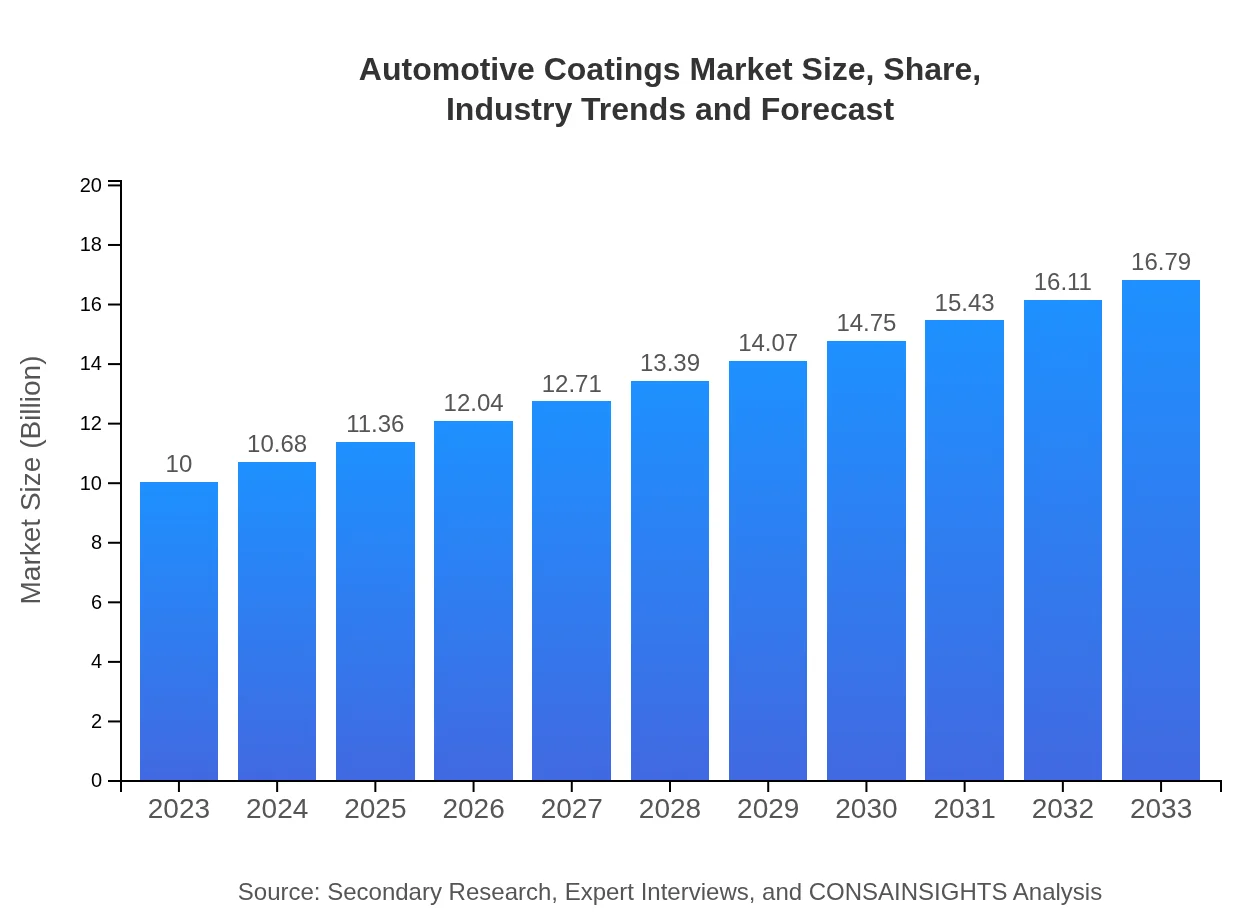

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $16.79 Billion |

| Top Companies | BASF SE, PPG Industries, Inc., Axalta Coating Systems, Sherwin-Williams Company, Kansai Paint Co., Ltd. |

| Last Modified Date | 02 February 2026 |

Automotive Coatings Market Overview

Customize Automotive Coatings Market Report market research report

- ✔ Get in-depth analysis of Automotive Coatings market size, growth, and forecasts.

- ✔ Understand Automotive Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Coatings

What is the Market Size & CAGR of Automotive Coatings market in 2023?

Automotive Coatings Industry Analysis

Automotive Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Coatings Market Analysis Report by Region

Europe Automotive Coatings Market Report:

Europe, with a market size of $3.42 billion in 2023, is anticipated to grow to $5.75 billion by 2033. The automotive sector in Europe focuses heavily on sustainability, driving the demand for eco-friendly coatings. Stringent environmental regulations further propel the market toward innovation in low VOC and water-based coatings.Asia Pacific Automotive Coatings Market Report:

The Asia Pacific region, with a market size of $1.87 billion in 2023 and projected to grow to $3.14 billion by 2033, is a key player due to the high concentration of automotive manufacturing. Countries like China, Japan, and South Korea are major contributors, leveraging technological advancements and low production costs. The growing population and rising disposable incomes boost vehicle ownership, further expanding the coatings market.North America Automotive Coatings Market Report:

North America has a market size of $3.22 billion in 2023, projected to reach $5.41 billion by 2033. The region is experiencing robust growth driven by the increasing demand for innovative and advanced automotive coatings, supported by notable players in the industry and rising standards for vehicle aesthetics and performance.South America Automotive Coatings Market Report:

In South America, the market is valued at $0.42 billion in 2023, expected to reach $0.71 billion by 2033. Growth is driven by increasing automotive production, particularly in Brazil and Argentina, aligned with rising consumer spending on vehicles. However, economic fluctuations remain a challenge.Middle East & Africa Automotive Coatings Market Report:

The Middle East and Africa market, starting at $1.06 billion in 2023 and expected to progress to $1.78 billion by 2033, reflects potential growth through infrastructural developments and increased automotive sales. However, the market faces limitations such as economic volatility and varying regulatory frameworks across countries.Tell us your focus area and get a customized research report.

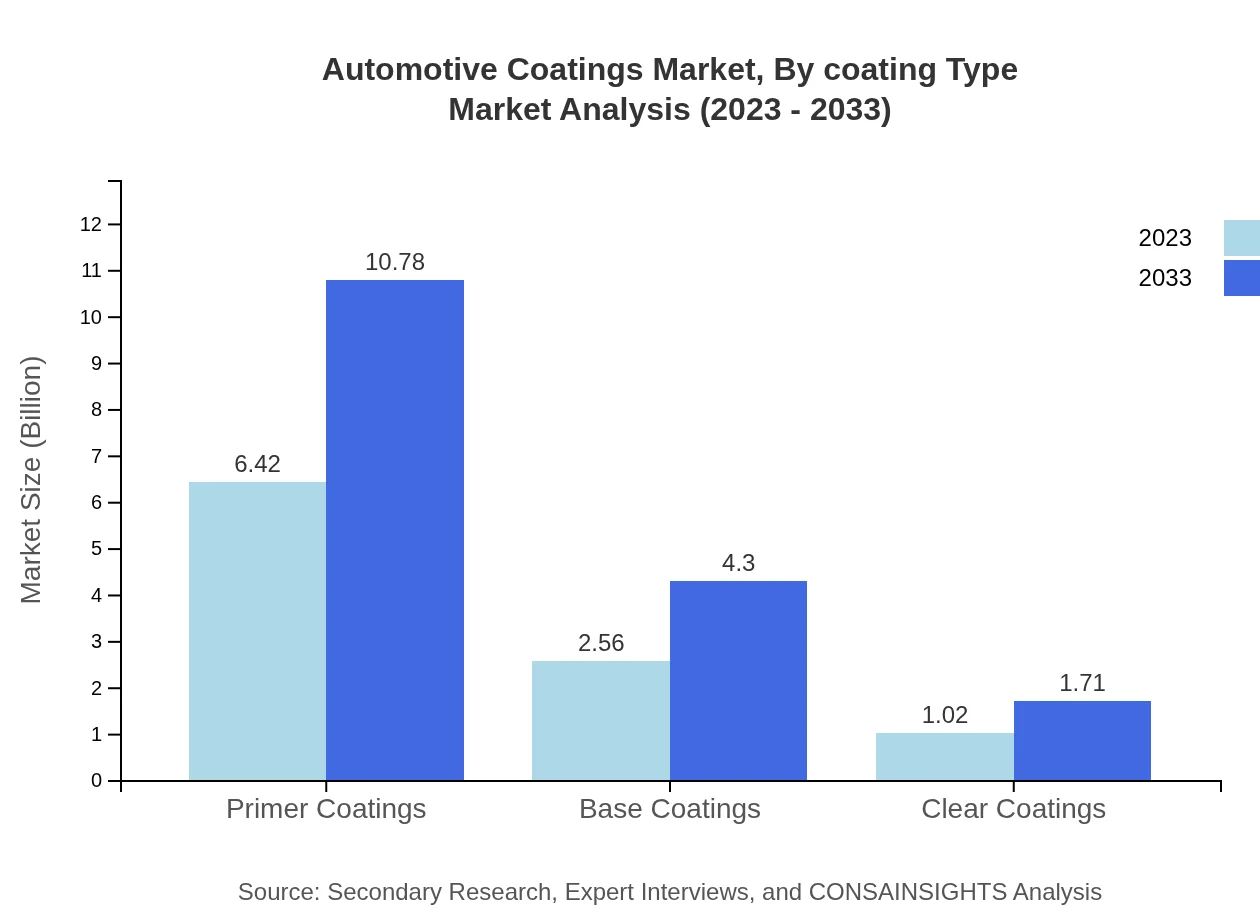

Automotive Coatings Market Analysis By Coating Type

The coating type segment includes Solvent-Borne, Water-Borne, and Powder Coatings. In 2023, the Solvent-Borne segment holds a significant market share of approximately 64.22%. This segment is expected to display robust growth, reaching $10.78 billion by 2033. Water-Borne coatings follow with a 25.61% share, projected to grow from $2.56 billion to $4.30 billion, reflecting the industry's shift towards eco-friendly solutions. Powder Coatings, while smaller at $1.02 billion in 2023, are expected to rise to $1.71 billion, driven by their efficiencies and environmental benefits.

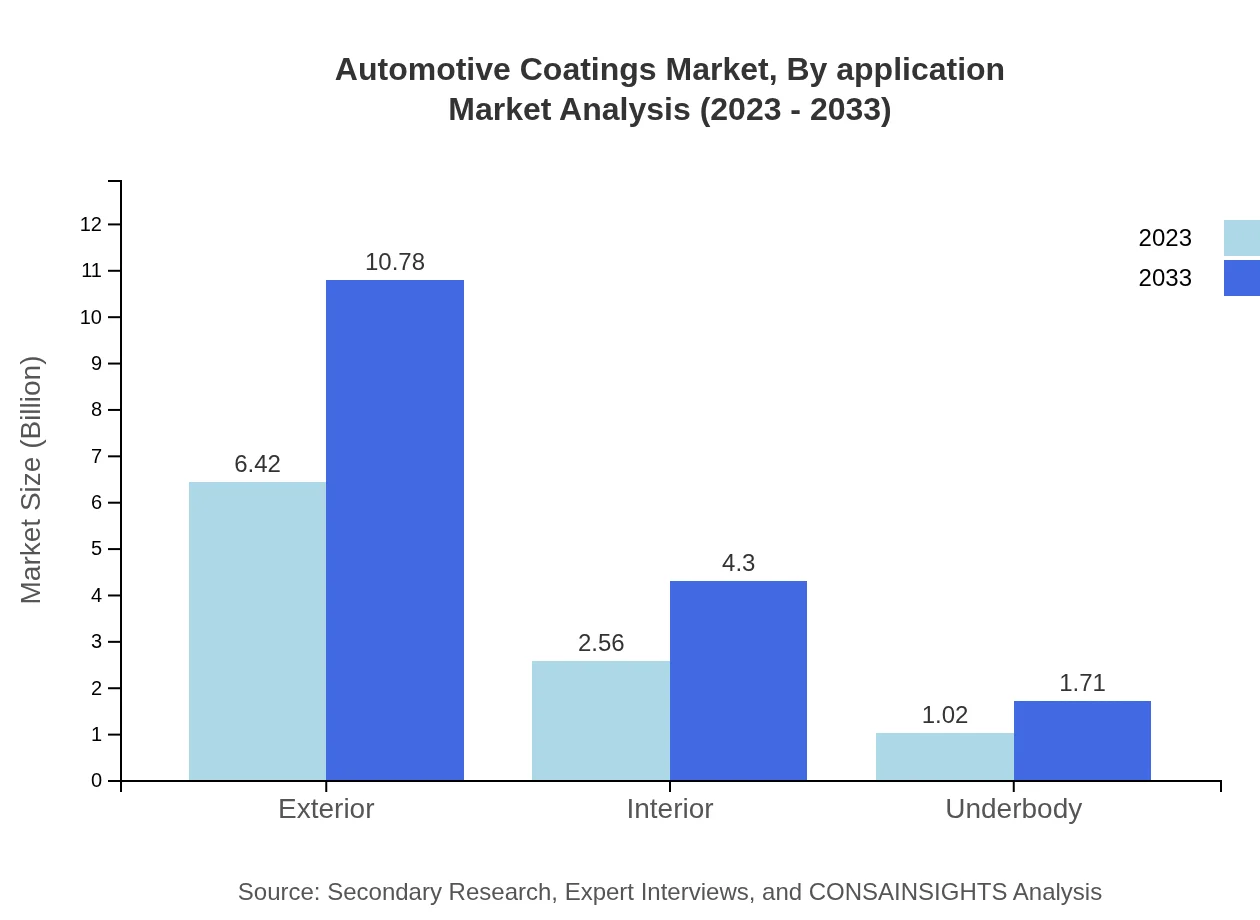

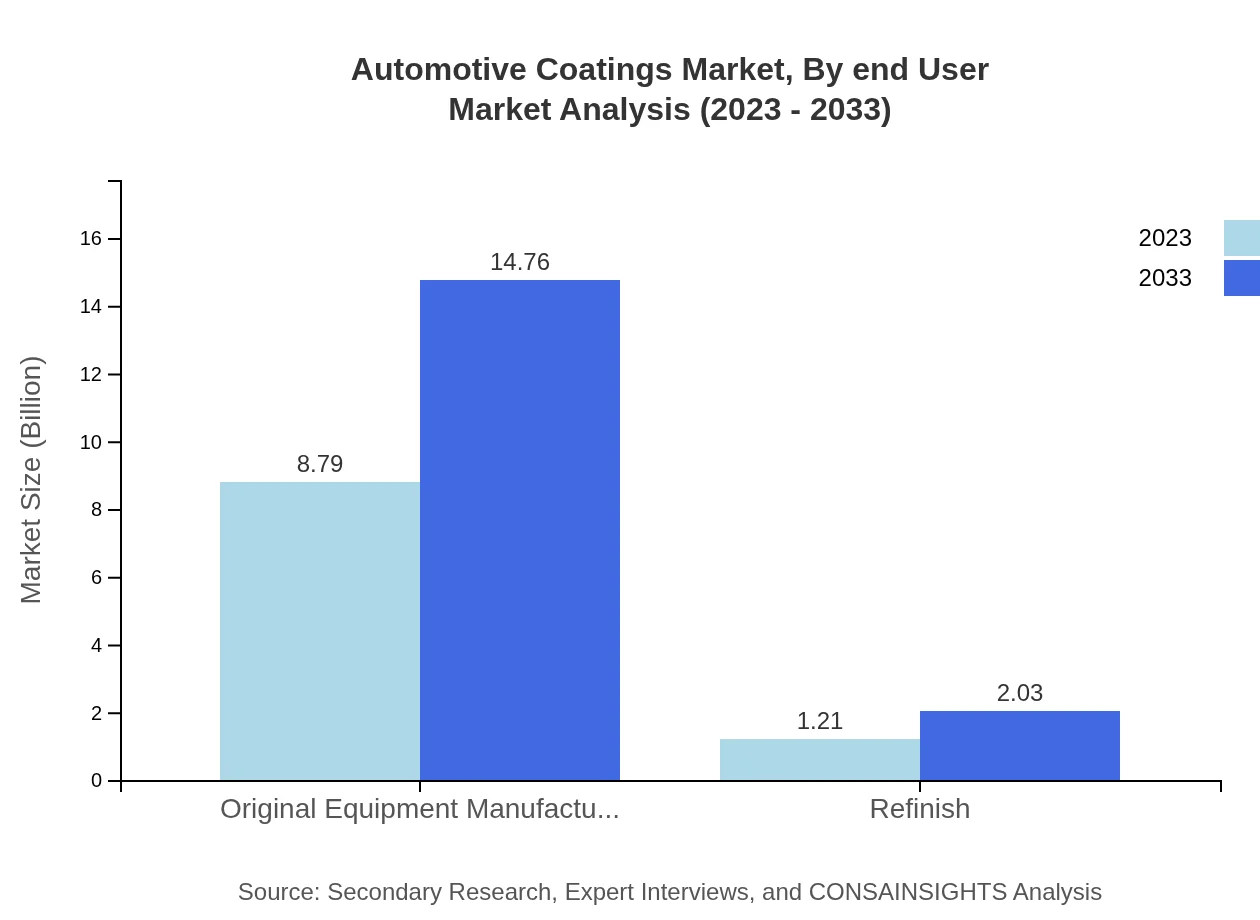

Automotive Coatings Market Analysis By Application

This segment includes Original Equipment Manufacturers (OEM) and Refinish applications. The OEM segment leads with a market size of $8.79 billion in 2023, reaching $14.76 billion by 2033. Conversely, the Refinish segment, valued at $1.21 billion in 2023, anticipates growth to $2.03 billion. The substantial growth in OEM is a reflection of increasing vehicle production and technological advancements in vehicle finishes.

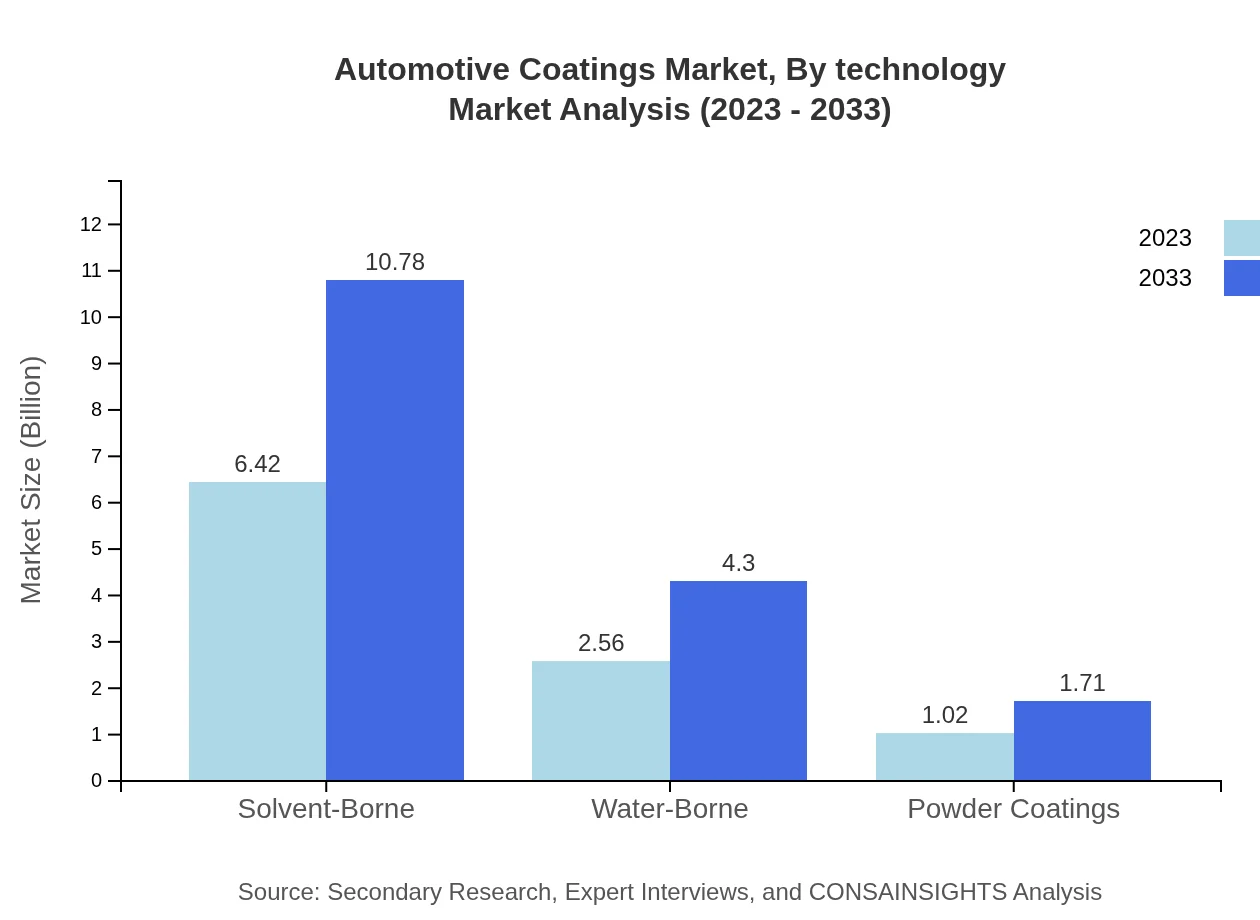

Automotive Coatings Market Analysis By Technology

Technological innovations in coatings are pivotal for market growth. Smart coatings, which can self-heal and enhance aesthetics significantly, are gaining popularity. The integration of nanotechnology to provide added strength and durability is also on the rise. The market is experiencing a shift towards sustainable technologies that reduce environmental impact while optimizing performance. The focus on advanced application processes such as spray and electrostatic coating contributes to greater efficiency in the industry.

Automotive Coatings Market Analysis By End User

The primary end-users of automotive coatings include manufacturers of cars, trucks, and commercial vehicles. The heavy investment in R&D by OEMs to improve vehicle performance and aesthetic appeal drives this segment's growth. Refurbishment and collision repair centers are significant players in the refinish segment, bolstered by increasing accidents and a greater focus on vehicle maintenance, further propelling demand.

Automotive Coatings Market Analysis By Region Type

This segment encompasses regional market analysis, focusing on North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, highlighting distinct demand patterns driven by regional automotive production rates, consumption trends, and regulatory frameworks shaping the coatings industry landscape.

Automotive Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Coatings Industry

BASF SE:

BASF is one of the largest chemical manufacturers in the world, providing innovative automotive coatings that enhance vehicle life and performance while promoting sustainability.PPG Industries, Inc.:

PPG is known for its comprehensive portfolio of automotive coatings. Its focus on advanced technologies and eco-friendly solutions positions it prominently in the market.Axalta Coating Systems:

Axalta specializes in high-performance coatings for the automotive sector, with a strong emphasis on research and development to meet market demands efficiently.Sherwin-Williams Company:

Sherwin-Williams provides a wide range of coating solutions highlighting superior quality and innovation, addressing the specific requirements of OEMs and refinish markets.Kansai Paint Co., Ltd.:

Kansai Paint is a prominent player in the automotive coatings market, focusing on technological advancements and environmental sustainability across its product lines.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive coatings?

The global automotive coatings market is currently valued at approximately $10 billion. With a projected CAGR of 5.2%, it is expected to grow significantly by 2033, indicating a robust demand in the automotive sector.

What are the key market players or companies in the automotive coatings industry?

Key players in the automotive coatings industry include major companies such as PPG Industries, AkzoNobel, BASF, Sherwin-Williams, and RPM International. These companies dominate through innovation, extensive product ranges, and strategic partnerships.

What are the primary factors driving the growth in the automotive coatings industry?

Growth in the automotive coatings industry is primarily driven by increasing vehicle production, demand for aesthetic enhancement, advancements in coating technologies, and stringent regulations on vehicle emissions and surface protectiveness.

Which region is the fastest Growing in the automotive coatings?

The Asia Pacific region is the fastest-growing market for automotive coatings, projected to grow from $1.87 billion in 2023 to $3.14 billion by 2033, driven by rising automotive production and demand in countries like China and India.

Does ConsaInsights provide customized market report data for the automotive coatings industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the automotive coatings industry. Clients can request unique insights based on market segments, regions, and other parameters to inform their business strategies.

What deliverables can I expect from this automotive coatings market research project?

Deliverables from the automotive coatings market research project typically include detailed market analysis reports, segment forecasts, competitive landscape reviews, insights on consumer behavior, and strategic recommendations for market entry or expansion.

What are the market trends of automotive coatings?

Current market trends in automotive coatings include a shift towards eco-friendly materials, increasing demand for advanced coatings with protective and aesthetic properties, and the adoption of digital technologies in coating applications.