Automotive Collision Avoidance Systems Market Report

Published Date: 02 February 2026 | Report Code: automotive-collision-avoidance-systems

Automotive Collision Avoidance Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Collision Avoidance Systems market, including market size, growth forecasts from 2023 to 2033, regional insights, and key trends shaping the industry.

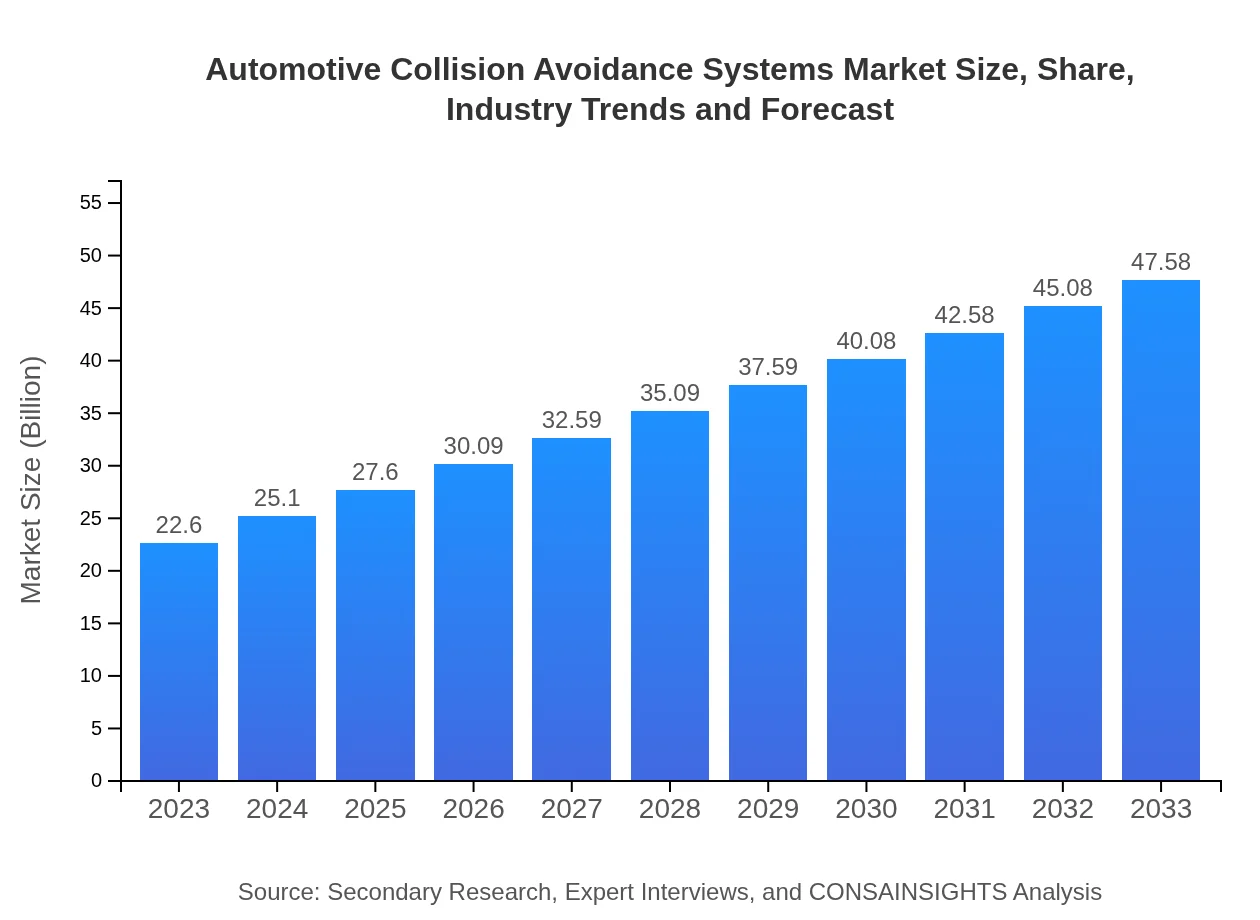

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $22.60 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $47.58 Billion |

| Top Companies | Bosch, Denso Corporation, Continental AG, Mobileye |

| Last Modified Date | 02 February 2026 |

Automotive Collision Avoidance Systems Market Overview

Customize Automotive Collision Avoidance Systems Market Report market research report

- ✔ Get in-depth analysis of Automotive Collision Avoidance Systems market size, growth, and forecasts.

- ✔ Understand Automotive Collision Avoidance Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Collision Avoidance Systems

What is the Market Size & CAGR of Automotive Collision Avoidance Systems market in 2023?

Automotive Collision Avoidance Systems Industry Analysis

Automotive Collision Avoidance Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Collision Avoidance Systems Market Analysis Report by Region

Europe Automotive Collision Avoidance Systems Market Report:

Europe's market is anticipated to grow from $5.69 billion in 2023 to $11.97 billion by 2033. The region is known for its early adoption of cutting-edge technologies and comprehensive regulatory frameworks focused on enhancing road safety, driving growth in collision avoidance systems.Asia Pacific Automotive Collision Avoidance Systems Market Report:

In the Asia Pacific region, the market is expected to grow from $4.54 billion in 2023 to $9.56 billion in 2033. The growth is driven by increasing vehicle production and rising road safety initiatives across countries such as China and India, alongside a growing trend towards smart transportation systems.North America Automotive Collision Avoidance Systems Market Report:

In North America, particularly the U.S., the market will expand from $7.83 billion in 2023 to $16.48 billion in 2033. This substantial increase is largely attributed to stringent safety regulations, high consumer awareness of vehicle safety features, and a cooperative effort between automotive manufacturers and tech companies.South America Automotive Collision Avoidance Systems Market Report:

The South American market is projected to increase from $1.76 billion in 2023 to $3.70 billion in 2033. Although growth is moderate compared to other regions, an increasing number of middle-class consumers are driving demand for safer vehicles, alongside government regulations supporting collision avoidance technologies.Middle East & Africa Automotive Collision Avoidance Systems Market Report:

The Middle East and Africa market is forecasted to see growth from $2.78 billion in 2023 to $5.86 billion in 2033. With increasing urbanization and infrastructure development, the demand for advanced safety features is expected to rise, facilitating market expansion.Tell us your focus area and get a customized research report.

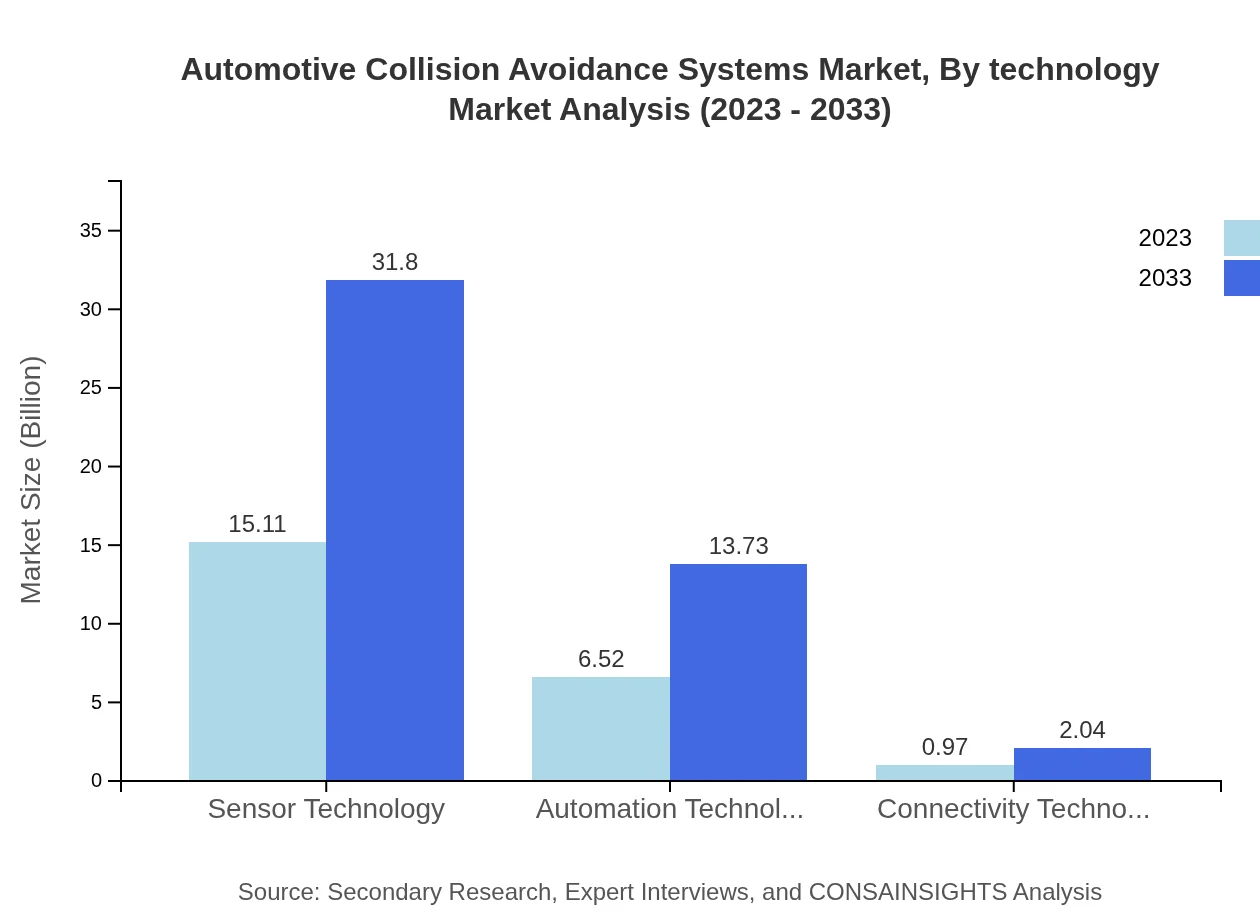

Automotive Collision Avoidance Systems Market Analysis By Technology

The market segmentation by technology includes Sensor Technology, Automation Technology, and Connectivity Technology. Sensor Technology is the largest segment, projected to grow from $15.11 billion in 2023 to $31.80 billion in 2033, capturing a significant market share of 66.84%. Automation Technology is expected to rise from $6.52 billion to $13.73 billion, while Connectivity Technology grows from $0.97 billion to $2.04 billion by 2033.

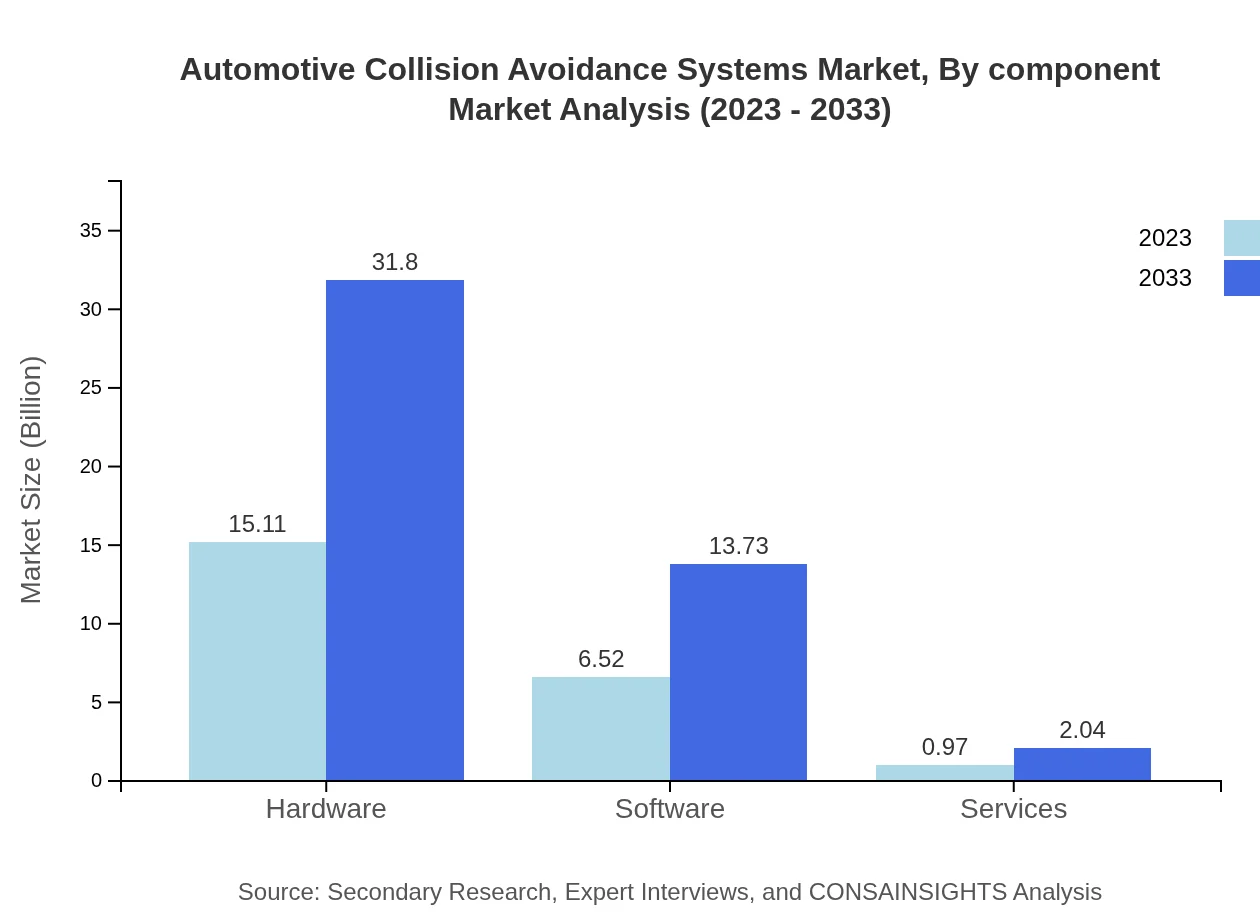

Automotive Collision Avoidance Systems Market Analysis By Component

In terms of market segmentation by component, Hardware, Software, and Services are primary categories. Hardware dominates, with revenue growing from $15.11 billion in 2023 to $31.80 billion in 2033, maintaining a strong 66.84% market share. Software and Services are growing as well, with Software expected to increase from $6.52 billion to $13.73 billion, while Services will see growth from $0.97 billion to $2.04 billion.

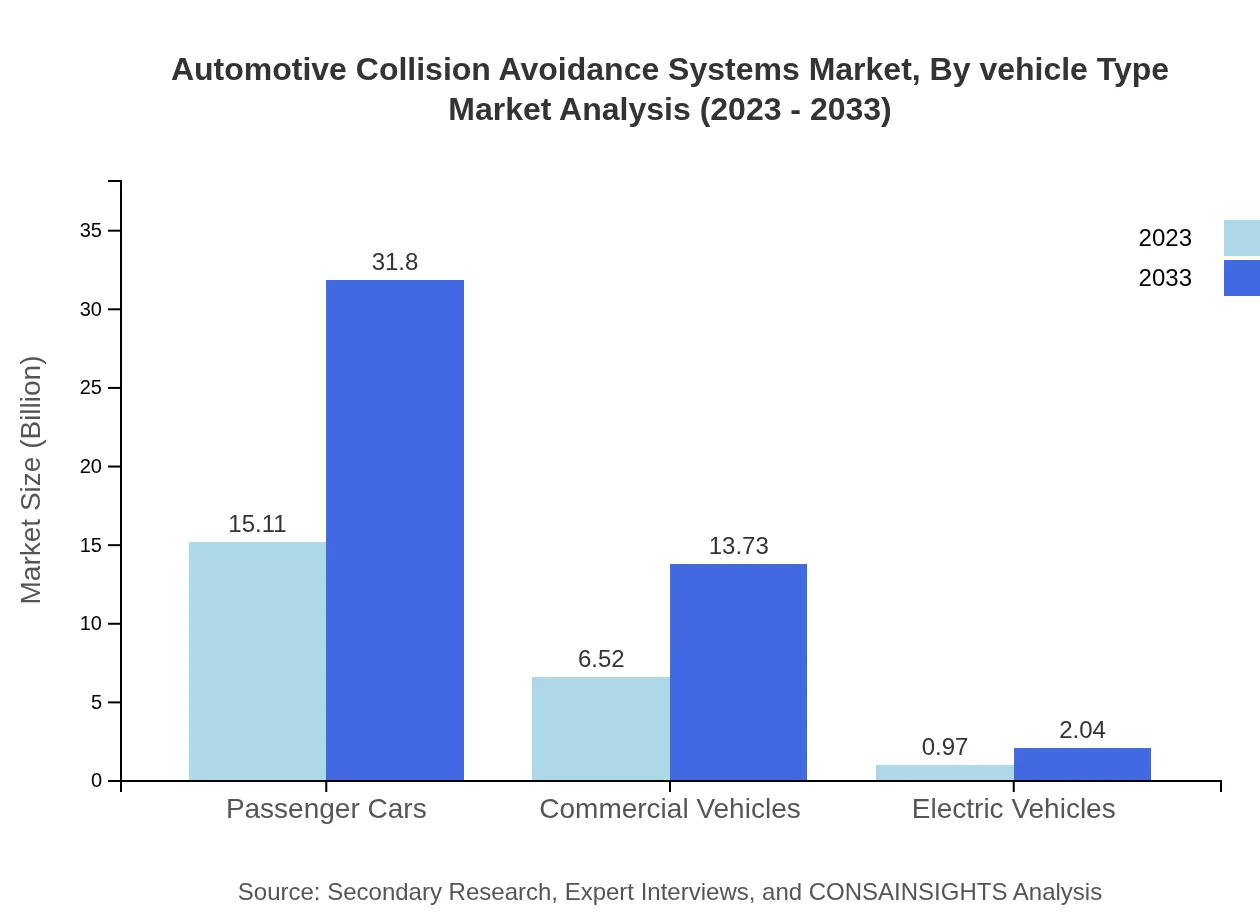

Automotive Collision Avoidance Systems Market Analysis By Vehicle Type

The vehicle type segmentation identifies Passenger Cars, Commercial Vehicles, and Electric Vehicles. Passenger Cars represent the largest segment, moving from $15.11 billion in 2023 to $31.80 billion by 2033. Commercial Vehicles are also expanding, with revenue rising from $6.52 billion to $13.73 billion, while Electric Vehicles grow modestly from $0.97 billion to $2.04 billion.

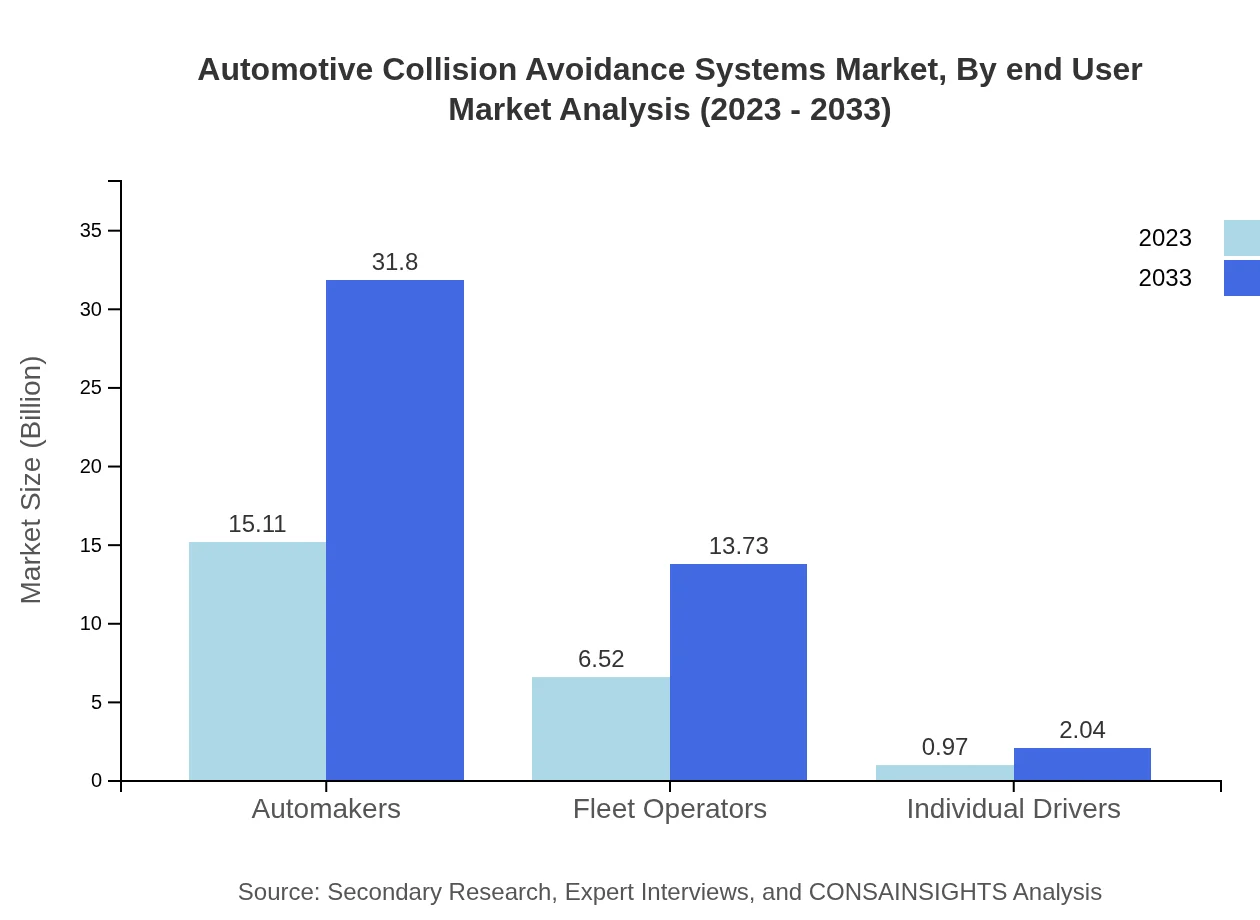

Automotive Collision Avoidance Systems Market Analysis By End User

Key end-user categories are Automakers, Fleet Operators, and Individual Drivers. Automakers hold the largest share, with market values evolving from $15.11 billion to $31.80 billion, while Fleet Operators see growth from $6.52 billion to $13.73 billion. Individual Drivers represent a smaller aspect of the market, growing from $0.97 billion to $2.04 billion.

Automotive Collision Avoidance Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Collision Avoidance Systems Industry

Bosch:

A leading automotive supplier, Bosch develops advanced driver-assistance systems that reduce collision risks.Denso Corporation:

Denso provides various automotive components, including innovative collision avoidance technologies.Continental AG:

Continental specializes in automotive technologies, focusing on enhancing vehicle safety features through collision avoidance systems.Mobileye:

An Intel company, Mobileye develops vision-based advanced driver-assistance systems, pivotal in collision avoidance.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Collision Avoidance Systems?

The automotive collision avoidance systems market is valued at approximately $22.6 billion in 2023, growing at a CAGR of 7.5%. This expansion reflects the increasing demand for safety features in vehicles, projected to reach significant heights in the coming years.

What are the key market players or companies in the automotive Collision Avoidance Systems industry?

The automotive collision avoidance systems market features major players such as Bosch, Continental AG, Delphi Technologies, and Denso Corporation. These companies lead the market with innovative technologies and collaborative approaches to enhance road safety.

What are the primary factors driving the growth in the automotive Collision Avoidance Systems industry?

Key drivers of growth in the automotive collision avoidance systems industry include stringent government regulations, rising awareness of road safety, and advancements in sensor technologies. Additionally, increasing demand for autonomous vehicles significantly boosts market potential.

Which region is the fastest Growing in the automotive Collision Avoidance Systems?

North America emerges as the fastest-growing region for automotive collision avoidance systems, with a market value of $7.83 billion in 2023 expected to rise to $16.48 billion by 2033. Europe's market is also expanding, indicating robust growth patterns.

Does ConsaInsights provide customized market report data for the automotive Collision Avoidance Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the automotive collision avoidance systems industry. Clients can request specific insights and analyses to meet their unique needs and objectives.

What deliverables can I expect from this automotive Collision Avoidance Systems market research project?

Deliverables from the automotive collision avoidance systems market research project include comprehensive market reports, competitor analysis, trend forecasts, and graphical data presentations to aid in strategic decision-making.

What are the market trends of automotive Collision Avoidance Systems?

Current market trends in automotive collision avoidance systems reveal a shift towards integrating advanced driver-assistance systems (ADAS), increased focus on connectivity technologies, and a growing emphasis on sustainability, particularly in electric vehicles.