Automotive Data Monetization Market Report

Published Date: 31 January 2026 | Report Code: automotive-data-monetization

Automotive Data Monetization Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Data Monetization market, covering key insights, market forecasts, and trends from 2023 to 2033, along with information on segmentation, regional analysis, and major industry players.

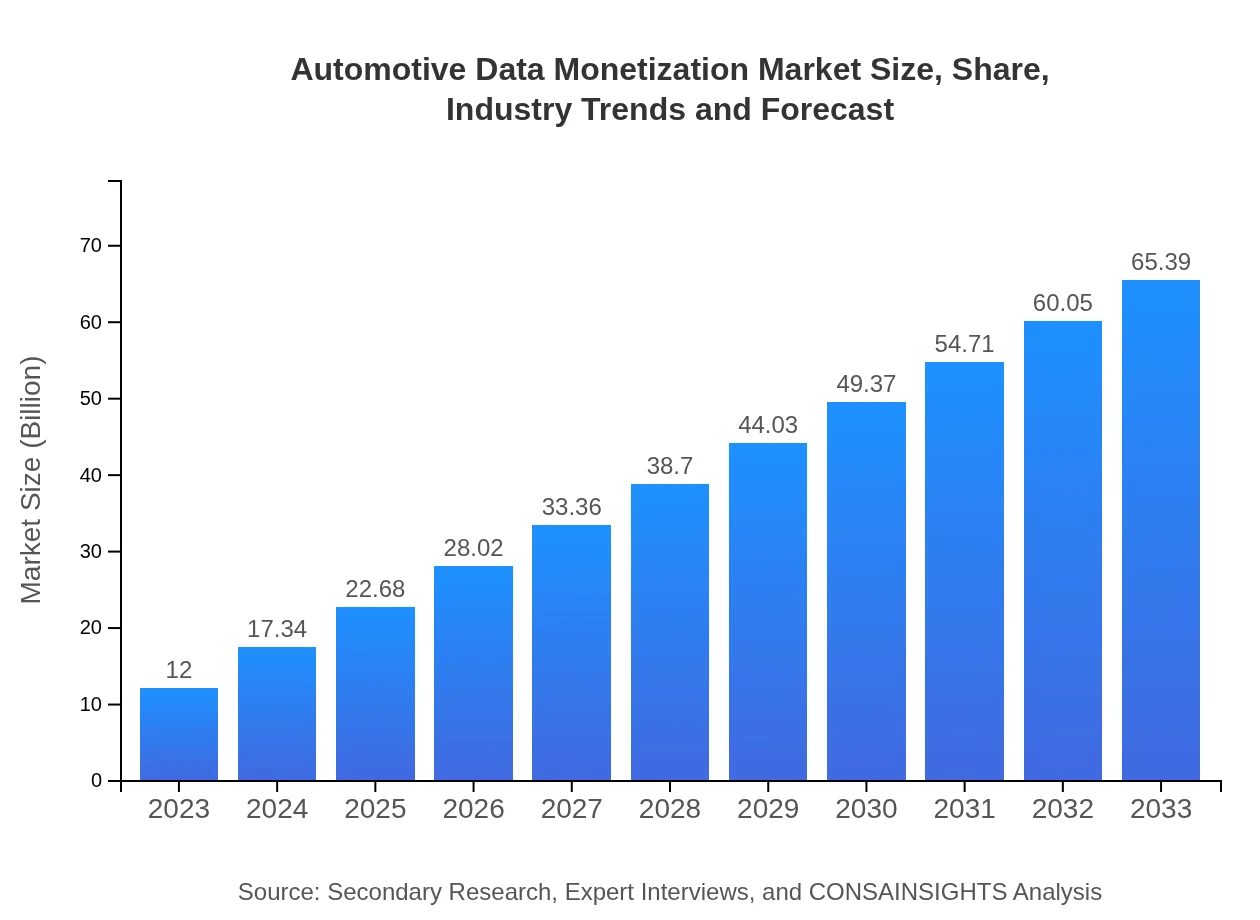

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 17.5% |

| 2033 Market Size | $65.39 Billion |

| Top Companies | IBM, Microsoft, Foursquare, Sierra Wireless, Telefónica |

| Last Modified Date | 31 January 2026 |

Automotive Data Monetization Market Overview

Customize Automotive Data Monetization Market Report market research report

- ✔ Get in-depth analysis of Automotive Data Monetization market size, growth, and forecasts.

- ✔ Understand Automotive Data Monetization's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Data Monetization

What is the Market Size & CAGR of Automotive Data Monetization market in 2023?

Automotive Data Monetization Industry Analysis

Automotive Data Monetization Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Data Monetization Market Analysis Report by Region

Europe Automotive Data Monetization Market Report:

Europe's Automotive Data Monetization market is set to grow from USD 4.02 billion in 2023 to USD 21.89 billion by 2033. The region is at the forefront of automotive innovation and policies promoting data-driven services will play a vital role in this expansion.Asia Pacific Automotive Data Monetization Market Report:

In the Asia-Pacific region, the market is projected to grow from USD 2.11 billion in 2023 to USD 11.48 billion by 2033. The increasing adoption of connected vehicles, along with rapid urbanization and technological advancements, are driving market growth in countries like China and Japan.North America Automotive Data Monetization Market Report:

In North America, particularly in the United States, the market is anticipated to grow from USD 4.12 billion in 2023 to USD 22.44 billion by 2033. Factors such as widespread connectivity and a mature automotive market are contributing to this rapid growth.South America Automotive Data Monetization Market Report:

The South American market is expected to expand from USD 1.15 billion in 2023 to USD 6.24 billion by 2033. This growth can be attributed to the rising adoption of telematics and an increased focus on vehicle cybersecurity amid improving economic conditions.Middle East & Africa Automotive Data Monetization Market Report:

The Middle East and Africa market, although smaller, is expected to rise from USD 0.61 billion in 2023 to USD 3.35 billion by 2033. Growing investment in connected vehicle technology and increasing demand for smart infrastructure are key drivers.Tell us your focus area and get a customized research report.

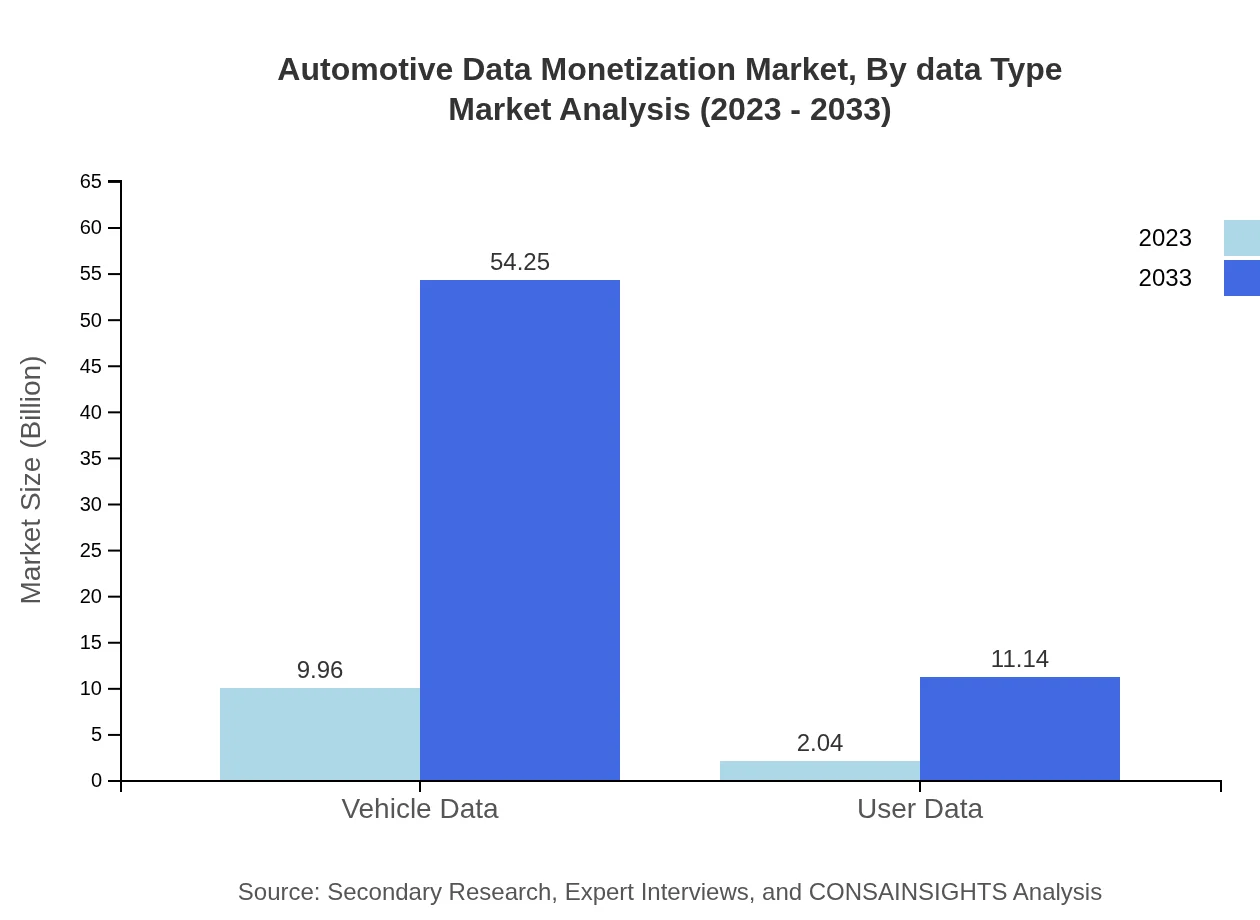

Automotive Data Monetization Market Analysis By Data Type

The vehicle data segment dominates the Automotive Data Monetization market, reporting a size of USD 9.96 billion in 2023 and predicted to rise to USD 54.25 billion by 2033, accounting for 82.97% market share. User data, predictive analytics, and prescriptive analytics also play significant roles, reflecting the growing importance of analytics in decision-making across sectors.

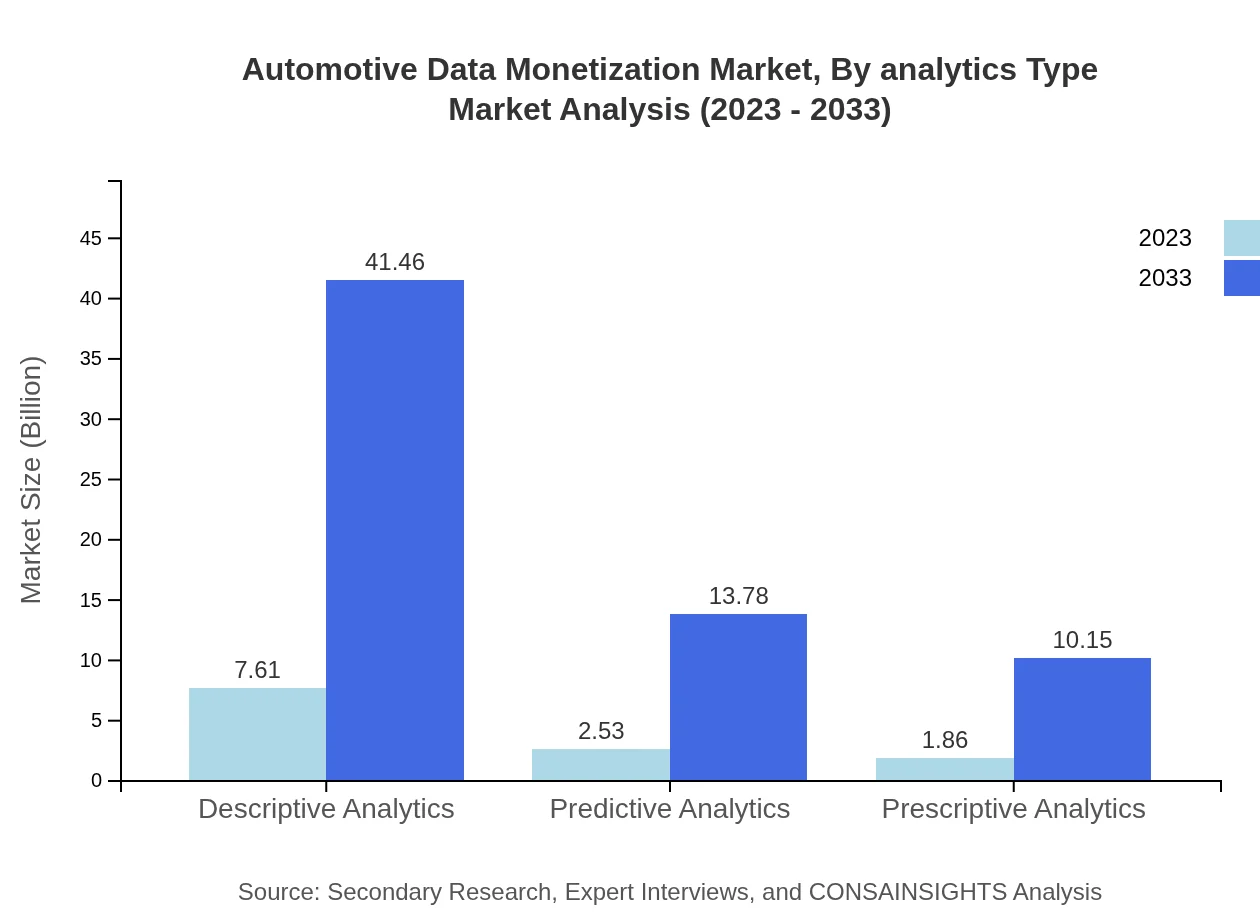

Automotive Data Monetization Market Analysis By Analytics Type

Descriptive Analytics is expected to capture the highest market share in 2023 at 63.41%, with a size of USD 7.61 billion, forecasted to reach USD 41.46 billion by 2033. Meanwhile, predictive and prescriptive analytics are anticipated to increase as businesses demand more advanced decision-making capabilities, showcasing a trend towards increased reliance on data analytics.

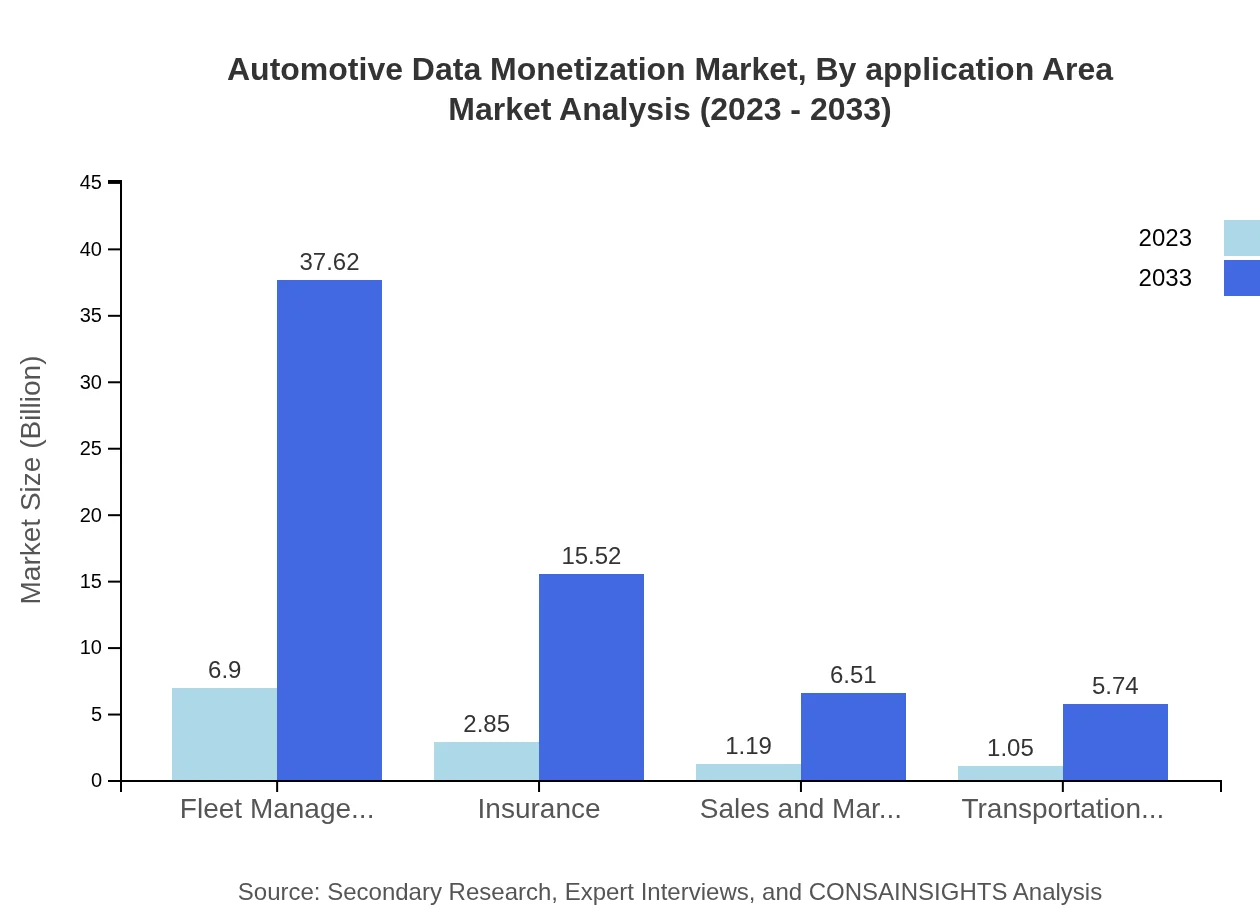

Automotive Data Monetization Market Analysis By Application Area

The Fleet Management segment will see substantial growth, from USD 6.90 billion in 2023 to USD 37.62 billion by 2033, mirroring a shift in business strategies towards data utilization in optimizing fleet operations and logistics.

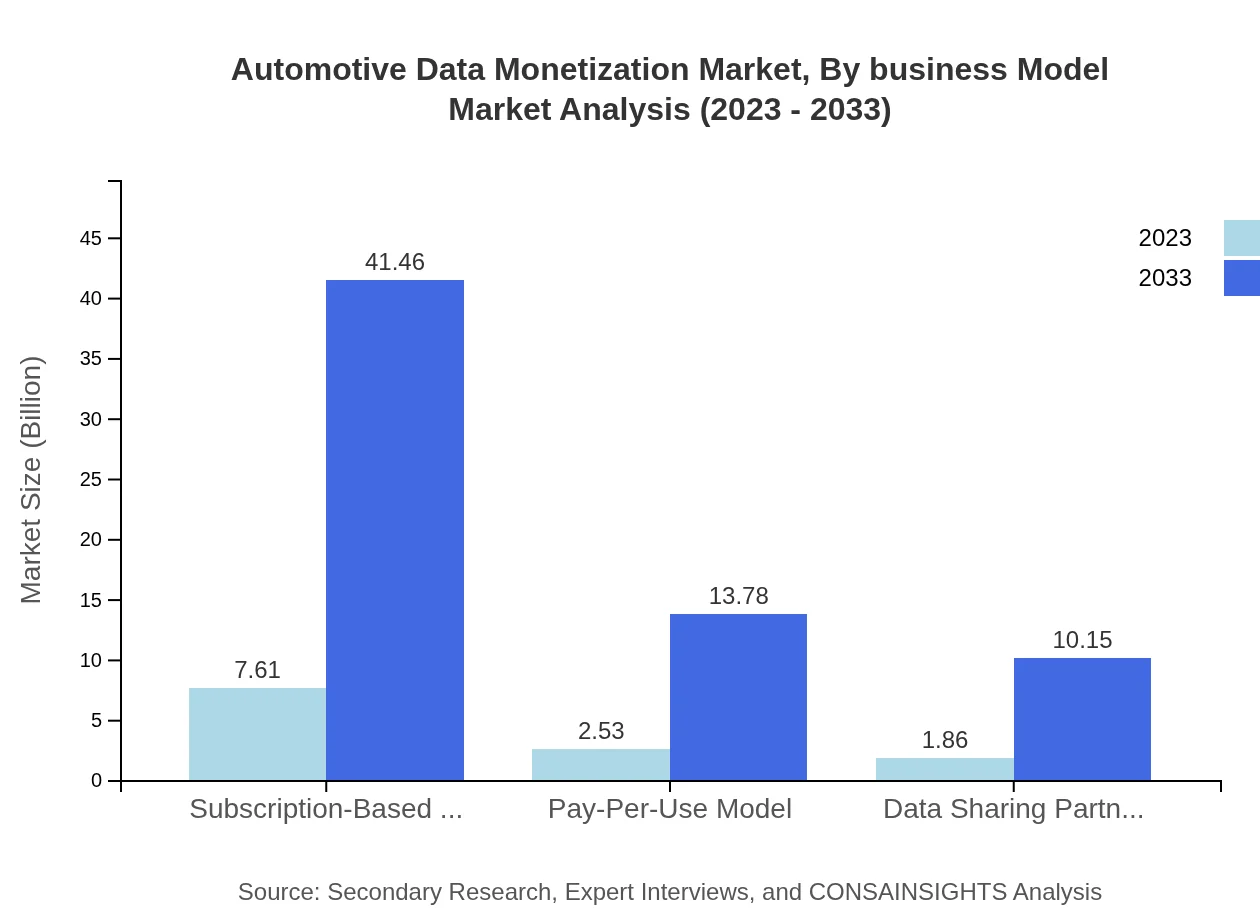

Automotive Data Monetization Market Analysis By Business Model

The Subscription-Based Model will dominate in 2023 with a size of USD 7.61 billion, and is expected to rise dramatically to USD 41.46 billion by 2033, reflecting a shift in customer engagement towards continuous data service offerings.

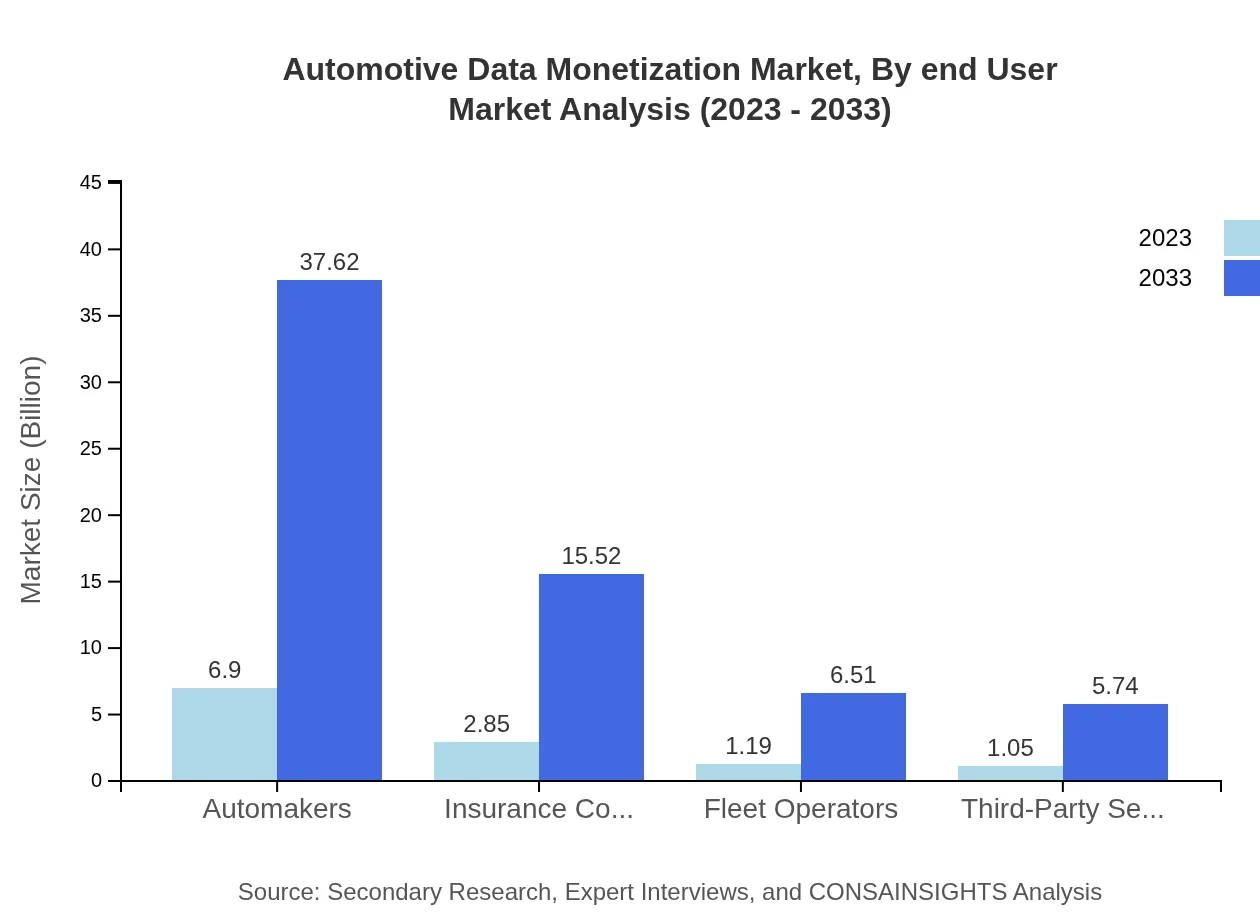

Automotive Data Monetization Market Analysis By End User

Automakers will continue to lead the market by size, presenting substantial growth from USD 6.90 billion in 2023 to USD 37.62 billion by 2033. Insurance companies and fleet operators are also rising in importance, leveraging data for improved service offerings and customer insights.

Automotive Data Monetization Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Data Monetization Industry

IBM:

IBM offers robust cloud-based analytics and data management solutions that enable automotive companies to extract value from vehicle data efficiently.Microsoft:

Microsoft provides a platform for automotive data monetization through Azure, which supports predictive analytics and data sharing capabilities for businesses.Foursquare:

Foursquare specializes in location data and analytics, providing automotive companies insights on user behavior and driving patterns.Sierra Wireless:

Sierra Wireless delivers IoT connectivity solutions that are crucial for enabling data transmission from vehicles to cloud environments for analysis.Telefónica:

Telefónica’s offerings in connected car services facilitate data monetization opportunities for automakers and third-party service providers.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Data Monetization?

In 2023, the automotive data monetization market is valued at $12 billion with a projected compound annual growth rate (CAGR) of 17.5% over the next decade, indicating substantial growth opportunities through 2033.

What are the key market players or companies in this automotive Data Monetization industry?

Key players in the automotive data monetization sector include leading automakers, insurance companies, and third-party service providers. These companies innovate in data analytics and apply monetization strategies to enhance customer experiences and operational efficiencies.

What are the primary factors driving the growth in the automotive Data Monetization industry?

The growth in automotive data monetization is driven by increased vehicle connectivity, demand for advanced analytics, and rising importance of data in decision-making processes for manufacturers and service providers alike.

Which region is the fastest Growing in the automotive Data Monetization?

The fastest-growing region in automotive data monetization is North America, projected to grow from $4.12 billion in 2023 to $22.44 billion by 2033, highlighting a substantial expansion of data monetization practices.

Does ConsaInsights provide customized market report data for the automotive Data Monetization industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the automotive data monetization industry, ensuring clients receive actionable insights relevant to their operational goals.

What deliverables can I expect from this automotive Data Monetization market research project?

From this automotive data monetization market research project, you can expect comprehensive reports featuring market sizes, trends, and player analyses, alongside segmented data and future forecasts to support strategic decision-making.

What are the market trends of automotive Data Monetization?

Current market trends in automotive data monetization include a shift towards subscription-based models, enhanced data sharing partnerships, and an increasing emphasis on predictive analytics to drive operational efficiencies in the evolving automotive landscape.