Automotive Digital Mapping Market Report

Published Date: 31 January 2026 | Report Code: automotive-digital-mapping

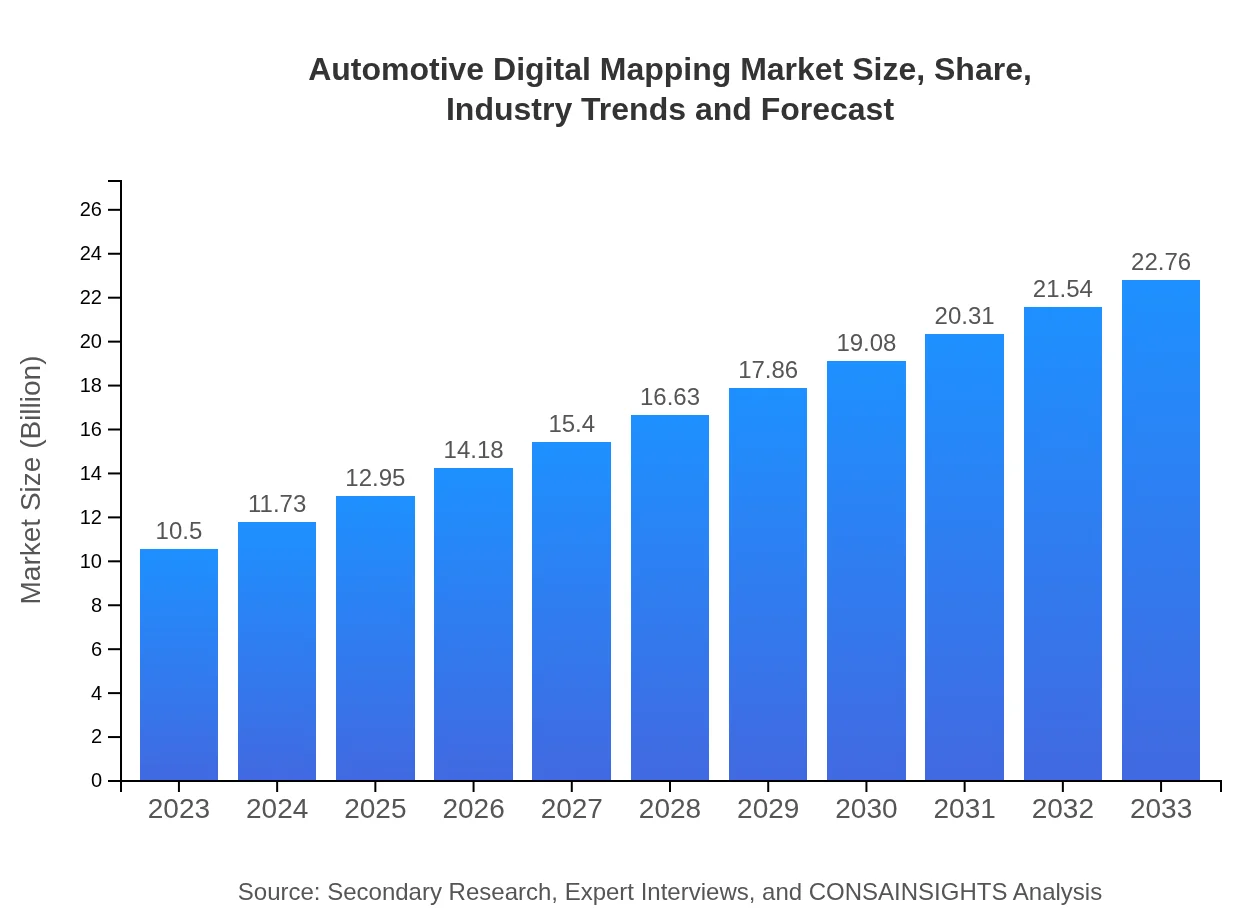

Automotive Digital Mapping Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Digital Mapping market, covering key trends, market size, regional insights, and future forecasts for 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | HERE Technologies, TomTom, Google, Navteq, Apple |

| Last Modified Date | 31 January 2026 |

Automotive Digital Mapping Market Overview

Customize Automotive Digital Mapping Market Report market research report

- ✔ Get in-depth analysis of Automotive Digital Mapping market size, growth, and forecasts.

- ✔ Understand Automotive Digital Mapping's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Digital Mapping

What is the Market Size & CAGR of Automotive Digital Mapping market in 2023?

Automotive Digital Mapping Industry Analysis

Automotive Digital Mapping Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Digital Mapping Market Analysis Report by Region

Europe Automotive Digital Mapping Market Report:

In Europe, the market is projected to grow from $3.16 billion in 2023 to $6.85 billion by 2033. European countries are at the forefront of regulatory initiatives for integrating smart mobility solutions, enhancing the need for advanced digital mapping technologies in automotive applications.Asia Pacific Automotive Digital Mapping Market Report:

The Asia Pacific region is expected to see significant growth in the Automotive Digital Mapping market, with a projected market size of $4.97 billion by 2033, up from $2.29 billion in 2023. The growth is driven by increasing urbanization, advancements in infrastructure, and rising adoption of connected vehicles, with China and India being key contributors.North America Automotive Digital Mapping Market Report:

North America’s Automotive Digital Mapping market is set to expand significantly, with an expected increase from $3.45 billion in 2023 to approximately $7.48 billion by 2033. The U.S. is a leader in technological advances and early adoption of digital mapping solutions in automotive applications, contributing substantially to the overall growth.South America Automotive Digital Mapping Market Report:

In South America, the Automotive Digital Mapping market is projected to grow from $0.58 billion in 2023 to $1.26 billion by 2033. This growth is fueled by rising demand for navigation solutions amidst improving automotive technology and infrastructure across major markets such as Brazil and Argentina.Middle East & Africa Automotive Digital Mapping Market Report:

The Middle East and Africa region is anticipated to grow from $1.02 billion in 2023 to about $2.20 billion by 2033, driven by increasing investment in smart city projects and a growing need for efficient transportation solutions across urban centers.Tell us your focus area and get a customized research report.

Automotive Digital Mapping Market Analysis Automakers

Global Automotive Digital Mapping Market, By End-User (Automakers) (2023 - 2033)

The automakers segment is projected to generate $10.50 billion by 2033, up from $4.84 billion in 2023, holding a 46.11% market share throughout the forecast period. This growth stems from the increasing proliferation of connected car features and the adoption of navigation technologies.

Automotive Digital Mapping Market Analysis Fleet_operators

Global Automotive Digital Mapping Market, By End-User (Fleet Operators) (2023 - 2033)

The fleet operators segment, with a market size of $5.08 billion by 2033, up from $2.34 billion in 2023, represents a market share of 22.33%. The rise of logistics technologies and demand for efficient route planning is facilitating this growth.

Automotive Digital Mapping Market Analysis Logistics_companies

Global Automotive Digital Mapping Market, By End-User (Logistics Companies) (2023 - 2033)

The logistics companies segment is expected to grow from $1.20 billion in 2023 to $2.60 billion by 2033. This category, holding an 11.41% share, will benefit from heightened demand for GPS tracking and route optimization.

Automotive Digital Mapping Market Analysis Public_sector

Global Automotive Digital Mapping Market, By End-User (Public Sector) (2023 - 2033)

The public sector segment aims to grow from $1.06 billion in 2023 to $2.30 billion by 2033, representing a 10.09% market share. Investments in infrastructure and urban planning initiatives are driving demand for effective digital mapping solutions.

Automotive Digital Mapping Market Analysis Individual_consumers

Global Automotive Digital Mapping Market, By End-User (Individual Consumers) (2023 - 2033)

Individual consumers' share in the market, while smaller, is projected to rise from $1.06 billion in 2023 to $2.29 billion by 2033, capturing a market share of 10.06%. The growing trend of smartphone integration in vehicles suggests increased demand for consumer-facing mapping technologies.

Automotive Digital Mapping Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Digital Mapping Industry

HERE Technologies:

A leading provider of mapping and location data, HERE Technologies delivers an advanced mapping platform utilized by various automotive companies for real-time navigation data.TomTom:

TomTom is a prominent player in the automotive mapping space, known for high-quality navigation solutions and advanced traffic data services.Google:

Google Maps is a critical tool for automotive mapping, offering extensive geospatial data along with regular updates that enhance navigation features globally.Navteq:

Navteq, a subsidiary of HERE Technologies, specializes in high-definition mapping and is essential for enabling autonomous vehicle navigation.Apple :

Apple Maps continues to evolve with improved features targeting automotive and mobile applications, significantly contributing to digital mapping solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Digital Mapping?

The automotive digital mapping market is currently valued at approximately $10.5 billion in 2023, with a compound annual growth rate (CAGR) of 7.8%. This growth reflects the increasing integration of digital mapping technologies in automotive applications.

What are the key market players or companies in this automotive Digital Mapping industry?

Key players in the automotive digital mapping industry include established technology firms and innovative startups. Companies like Google, HERE Technologies, and TomTom are significant contributors, leveraging advanced algorithms and GPS technologies to enhance mapping accuracy and performance.

What are the primary factors driving the growth in the automotive digital mapping industry?

The growth in the automotive digital mapping industry is primarily driven by advancements in GPS technology, increasing demand for navigation systems, and the rise of autonomous vehicles. Additionally, smart city initiatives and urbanization continue to fuel this sector's development.

Which region is the fastest Growing in the automotive digital mapping?

The fastest-growing region in the automotive digital mapping market is North America, projected to grow from $3.45 billion in 2023 to $7.48 billion by 2033. Europe also shows significant growth, increasing from $3.16 billion to $6.85 billion in the same period.

Does ConsaInsights provide customized market report data for the automotive Digital Mapping industry?

Yes, ConsaInsights offers customized market report data tailored to the unique requirements of clients in the automotive digital mapping industry, ensuring insights are aligned with specific business needs and market dynamics.

What deliverables can I expect from this automotive Digital Mapping market research project?

Deliverables from the automotive digital mapping market research project typically include detailed market analysis reports, growth forecasts, competitive landscape insights, and trend analysis, all structured to support strategic decision-making.

What are the market trends of automotive Digital Mapping?

Current market trends in automotive digital mapping indicate a strong focus on integration with V2X technology, increasing adoption of LiDAR for enhanced mapping, and a shift towards real-time data solutions, enhancing user experience and navigation accuracy.