Automotive Direct Methanol Fuel Cell Market Report

Published Date: 02 February 2026 | Report Code: automotive-direct-methanol-fuel-cell

Automotive Direct Methanol Fuel Cell Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Direct Methanol Fuel Cell market covering current trends, size, forecast growth from 2023 to 2033, and the competitive landscape. It offers insights into market dynamics, technology advancements, and regional developments.

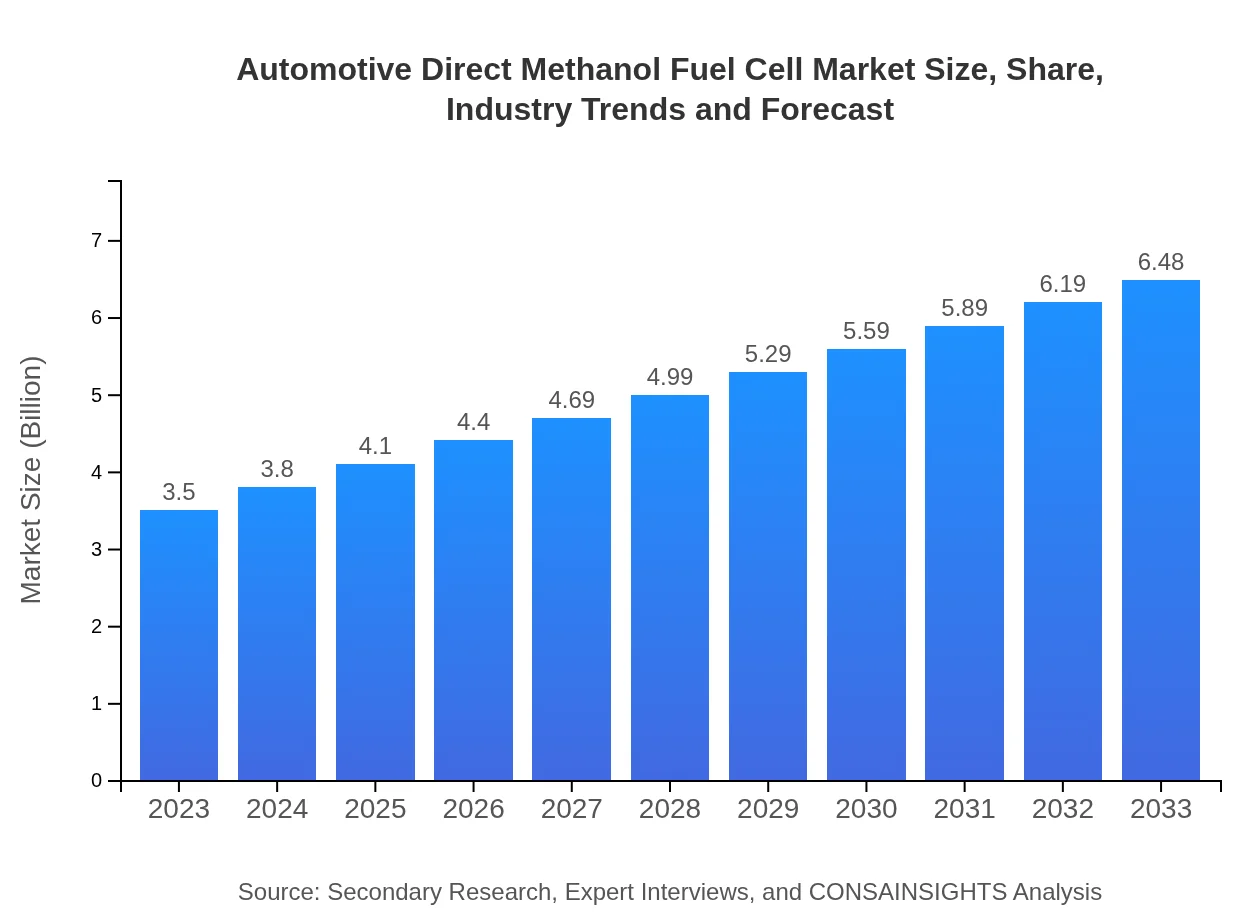

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | Ballard Power Systems, FuelCell Energy, Nissan, Hydrogenics, PowerCell Sweden AB |

| Last Modified Date | 02 February 2026 |

Automotive Direct Methanol Fuel Cell Market Overview

Customize Automotive Direct Methanol Fuel Cell Market Report market research report

- ✔ Get in-depth analysis of Automotive Direct Methanol Fuel Cell market size, growth, and forecasts.

- ✔ Understand Automotive Direct Methanol Fuel Cell's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Direct Methanol Fuel Cell

What is the Market Size & CAGR of Automotive Direct Methanol Fuel Cell market in 2023 and 2033?

Automotive Direct Methanol Fuel Cell Industry Analysis

Automotive Direct Methanol Fuel Cell Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Direct Methanol Fuel Cell Market Analysis Report by Region

Europe Automotive Direct Methanol Fuel Cell Market Report:

Europe's market was valued at $1.07 billion in 2023 and is expected to reach $1.99 billion by 2033. The European market is the frontrunner in adopting fuel cell technologies, driven by strict emission regulations, robust infrastructure for alternative fuels, and increasing adoption of public transport solutions such as buses and regional trains using DMFC.Asia Pacific Automotive Direct Methanol Fuel Cell Market Report:

In the Asia Pacific region, the market was valued at $0.66 billion in 2023, with projections of reaching $1.22 billion by 2033. This growth is attributed to robust government initiatives promoting low-emission vehicles, increased investment in renewable energy technologies, and the rising demand for public transportation solutions in major economies like China and Japan.North America Automotive Direct Methanol Fuel Cell Market Report:

North America's Automotive Direct Methanol Fuel Cell market is projected to grow from $1.26 billion in 2023 to $2.33 billion by 2033. Stronger regulations on vehicle emissions and significant investments from key automotive players in alternative fuel technologies drive this expansion. The U.S. and Canada are leading the charge, with increasing adoption of methanol fuel cell vehicles in urban transport.South America Automotive Direct Methanol Fuel Cell Market Report:

The South American market is relatively smaller, with a size of $0.19 billion in 2023 and an anticipated growth to $0.36 billion by 2033. While the market is growing, the pace is slower due to limited infrastructure and market penetration. However, increasing environmental concerns and support for clean energy alternatives are encouraging developments in this region.Middle East & Africa Automotive Direct Methanol Fuel Cell Market Report:

In the Middle East and Africa, the market size is projected to grow from $0.31 billion in 2023 to $0.58 billion by 2033. Though this region faces challenges such as lower awareness of fuel cell technology, recent efforts to diversify economies and develop sustainable investments in transportation are expected to boost market growth.Tell us your focus area and get a customized research report.

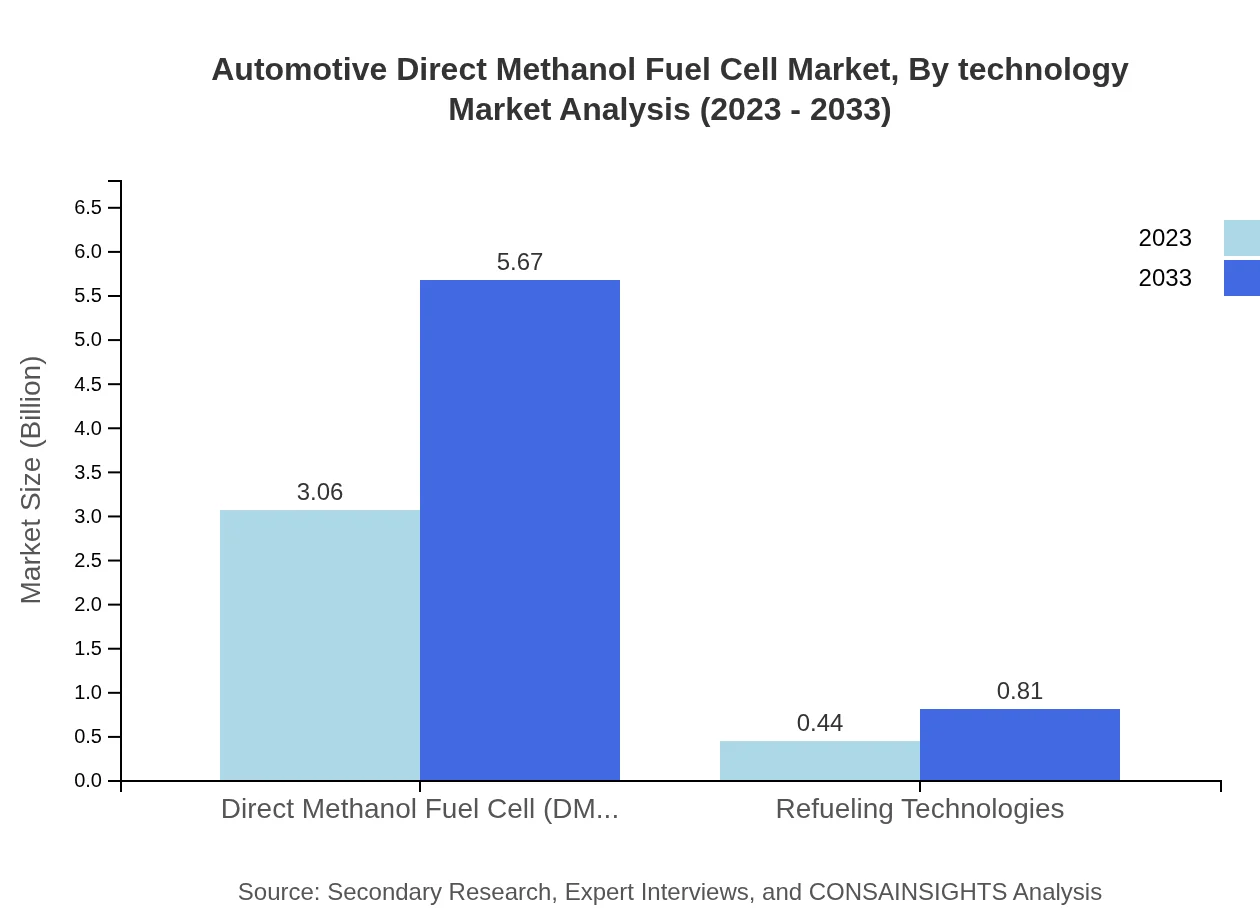

Automotive Direct Methanol Fuel Cell Market Analysis By Technology

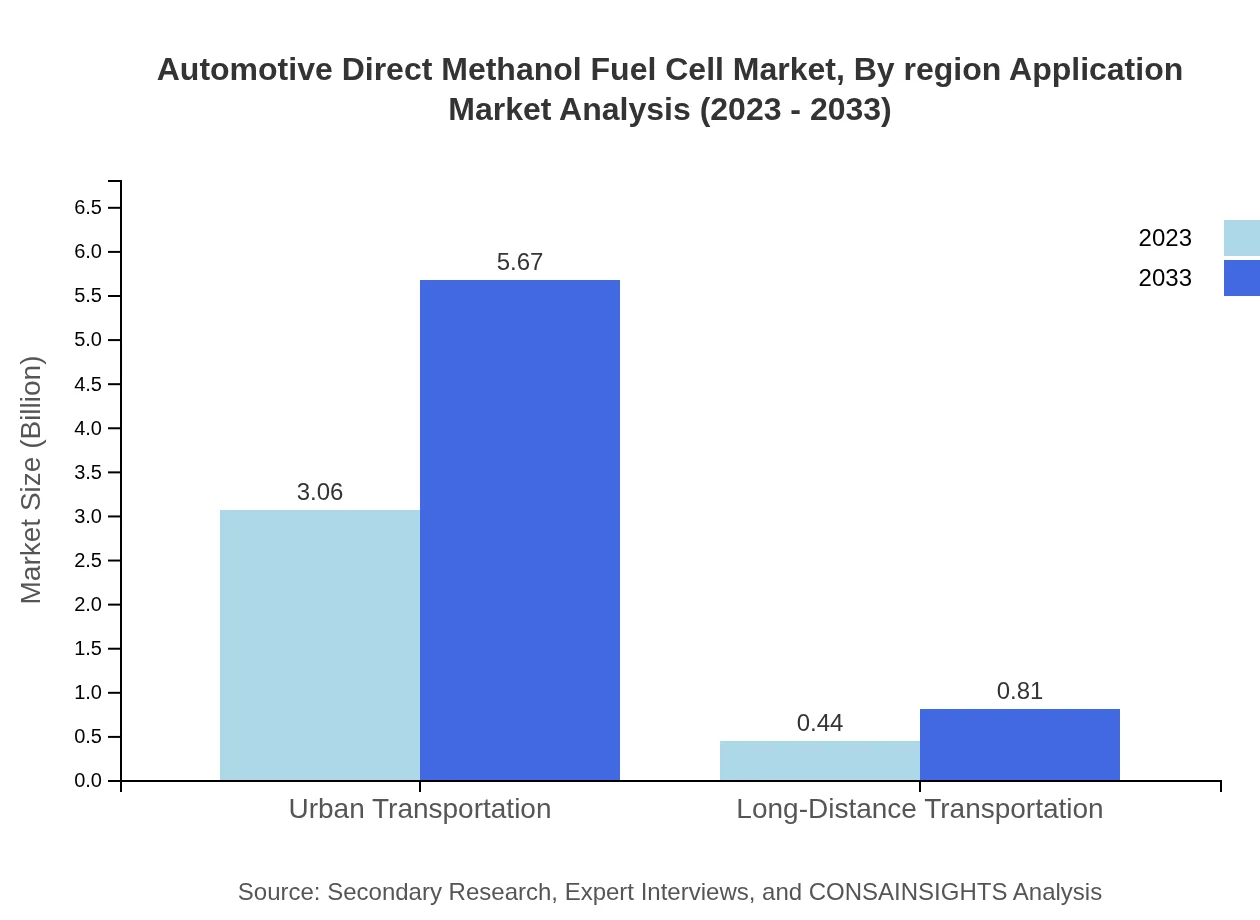

The market comprises Direct Methanol Fuel Cells (DMFC) that dominate with a size of $3.06 billion in 2023 and expected to rise to $5.67 billion by 2033. DMFC technology's ability to convert methanol directly into electricity is a key advantage, making it the preferred choice in this segment.

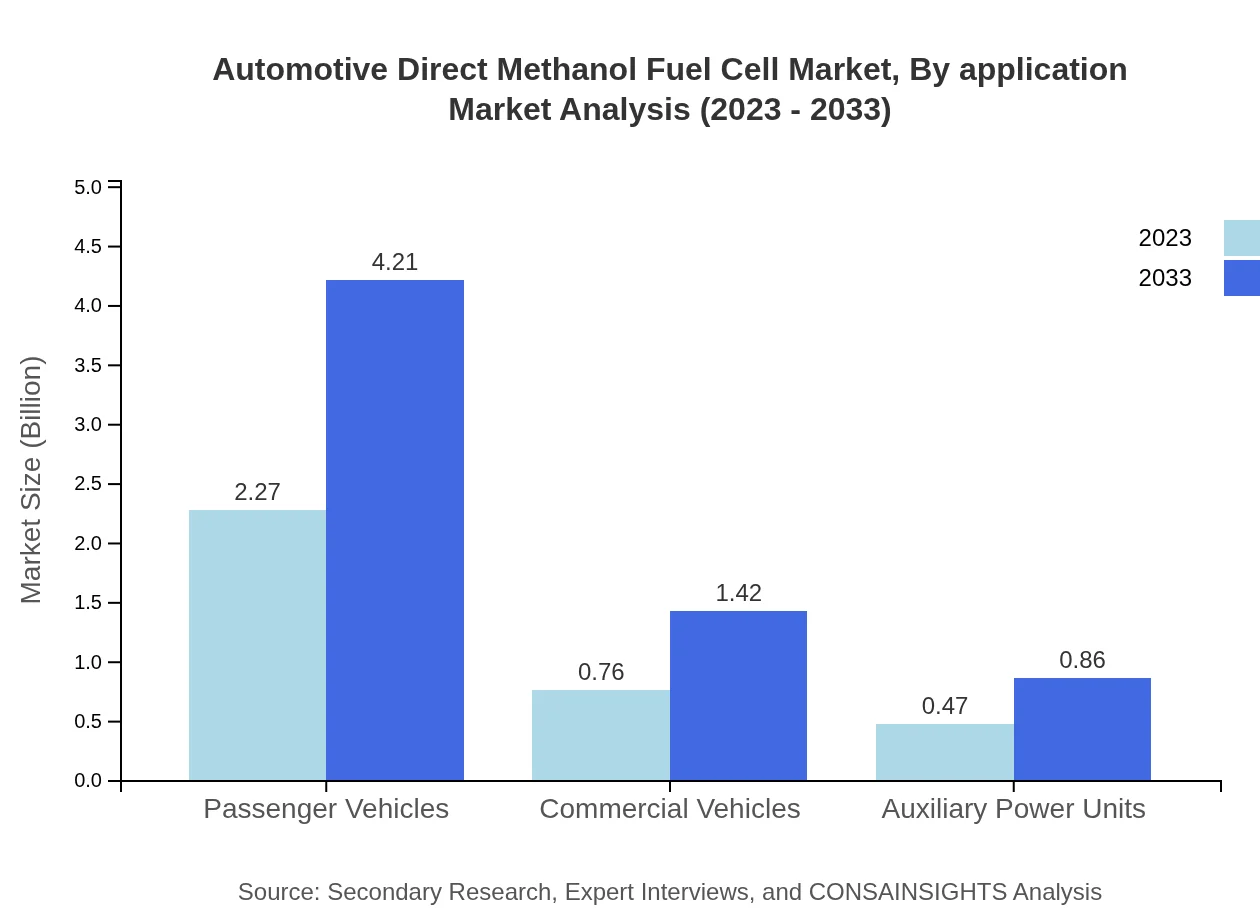

Automotive Direct Methanol Fuel Cell Market Analysis By Application

Upon analyzing the application perspective, passenger vehicles command a significant share, accounting for $2.27 billion in 2023 and expected to grow to $4.21 billion by 2033. Urban transportation applications represent a critical market segment with anticipated growth aligned to increasing public transport needs.

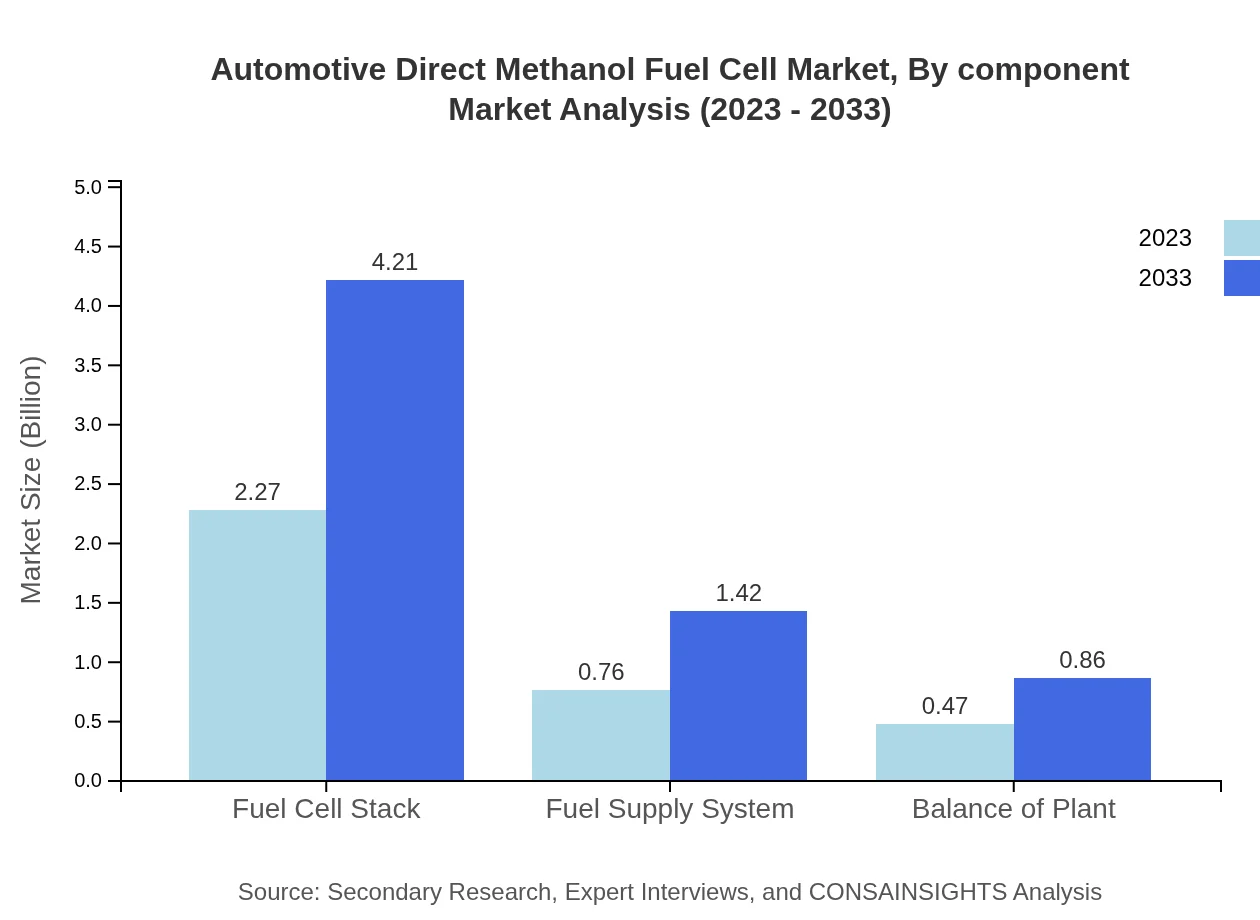

Automotive Direct Methanol Fuel Cell Market Analysis By Component

The Fuel Cell Stack component currently dominates this category, comprising a market size of $2.27 billion in 2023, which will likely grow to $4.21 billion by 2033. This segment accounts for almost 64.86% market share in both years, underlining its essential role in the functionality of fuel cells.

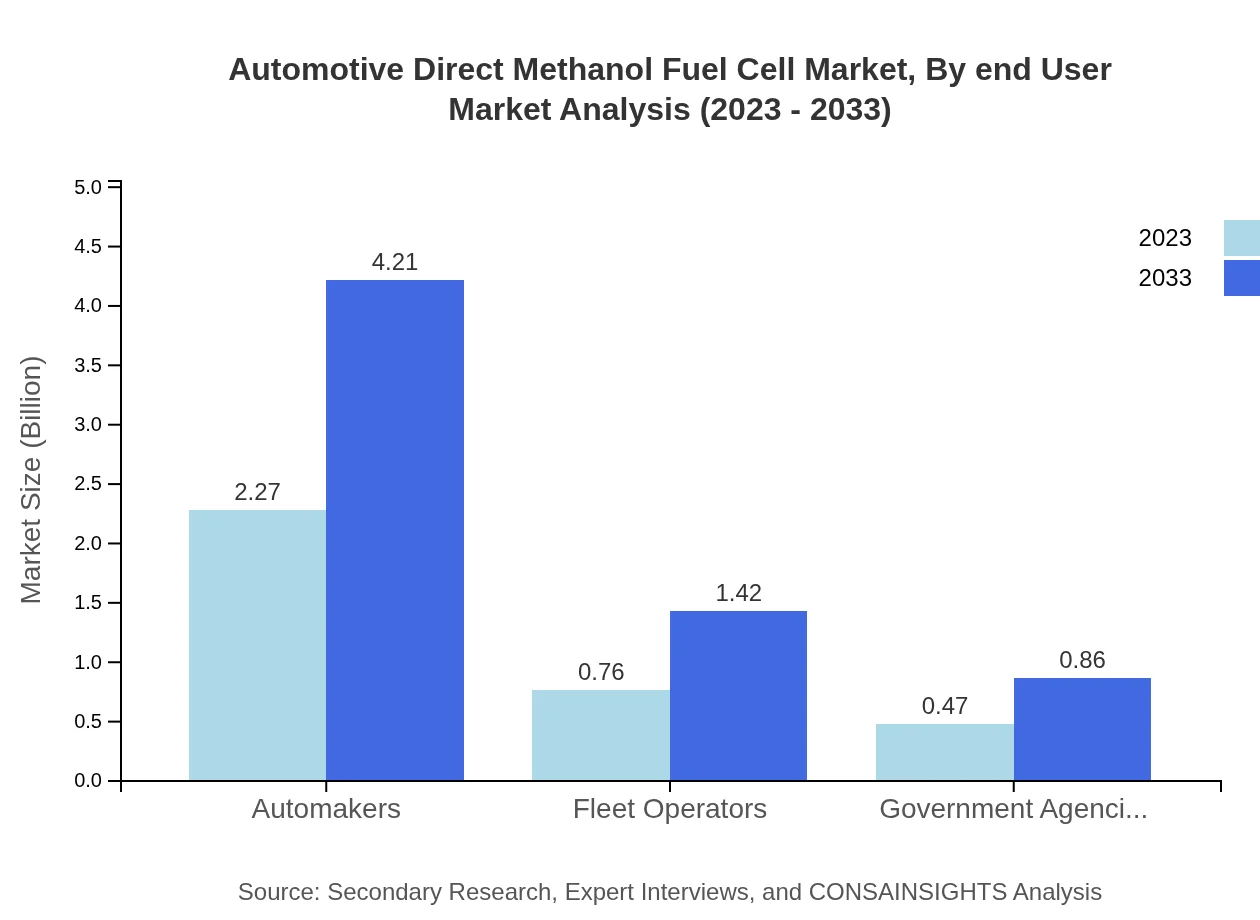

Automotive Direct Methanol Fuel Cell Market Analysis By End User

Automakers remain the primary end-users with expansive market share, recorded at $2.27 billion in 2023 and projected to hit $4.21 billion by 2033. These figures solidify the industry's reliance on automakers for future market growth.

Automotive Direct Methanol Fuel Cell Market Analysis By Region Application

Reviewing regional applications, particularly in passenger and commercial transportation, reveals strong growth potential. The passenger vehicle application, in particular, holds 64.86% of the market share as of 2023 and is poised for continued expansion in response to growing urban populations.

Automotive Direct Methanol Fuel Cell Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Direct Methanol Fuel Cell Industry

Ballard Power Systems:

A leading developer of fuel cell technology, Ballard Power focuses on building clean energy systems for transportation and stationary power applications.FuelCell Energy:

FuelCell Energy designs and manufactures fuel cell power plants, leveraging their capabilities to provide efficient, clean, and sustainable energy solutions.Nissan:

Nissan has been a pioneer in integrating fuel cell technologies in vehicles, prominently advancing its development of methanol-based vehicles.Hydrogenics:

With expertise in fuel cell products and hydrogen generation, Hydrogenics contributes significantly to the automotive fuel cell landscape.PowerCell Sweden AB:

PowerCell specializes in fuel cell stacks and systems for the automotive sector, enhancing fuel efficiency and reducing emissions in vehicles.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Direct Methanol Fuel Cell?

The automotive direct methanol fuel cell market is projected to reach a size of $3.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.2% from 2023.

What are the key market players or companies in this automotive Direct Methanol Fuel Cell industry?

Key players in the automotive direct methanol fuel cell sector include various automotive manufacturers and technology developers that specialize in fuel cell systems, including top automakers and emerging startups focused on renewable energy solutions.

What are the primary factors driving the growth in the automotive Direct Methanol Fuel Cell industry?

Growth drivers include the increasing demand for clean energy solutions, government regulations promoting sustainable transport, advancements in fuel cell technology, and the growing need for efficient energy systems in vehicles.

Which region is the fastest Growing in the automotive Direct Methanol Fuel Cell?

North America is the fastest-growing region within the automotive direct methanol fuel cell market, projected to grow from $1.26 billion in 2023 to $2.33 billion by 2033, driven by technological advancements and supportive regulatory frameworks.

Does ConsaInsights provide customized market report data for the automotive Direct Methanol Fuel Cell industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the automotive direct methanol fuel cell industry, ensuring clients receive relevant insights that align with their strategic goals.

What deliverables can I expect from this automotive Direct Methanol Fuel Cell market research project?

Deliverables include comprehensive market analysis reports, segmentation data, regional insights, competitive landscape assessments, and future trend forecasts to support strategic decision-making for clients.

What are the market trends of automotive Direct Methanol Fuel Cell?

Current market trends include the rise of direct methanol fuel cells in urban transportation, increased investment in fuel cell technology, a shift towards sustainability in vehicle design, and enhancing refueling infrastructure.