Automotive Ethernet Market Report

Published Date: 02 February 2026 | Report Code: automotive-ethernet

Automotive Ethernet Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Automotive Ethernet market, encompassing market trends, segmentation, regional analyses, and forecasts from 2023 to 2033, to inform stakeholders about future directions and opportunities.

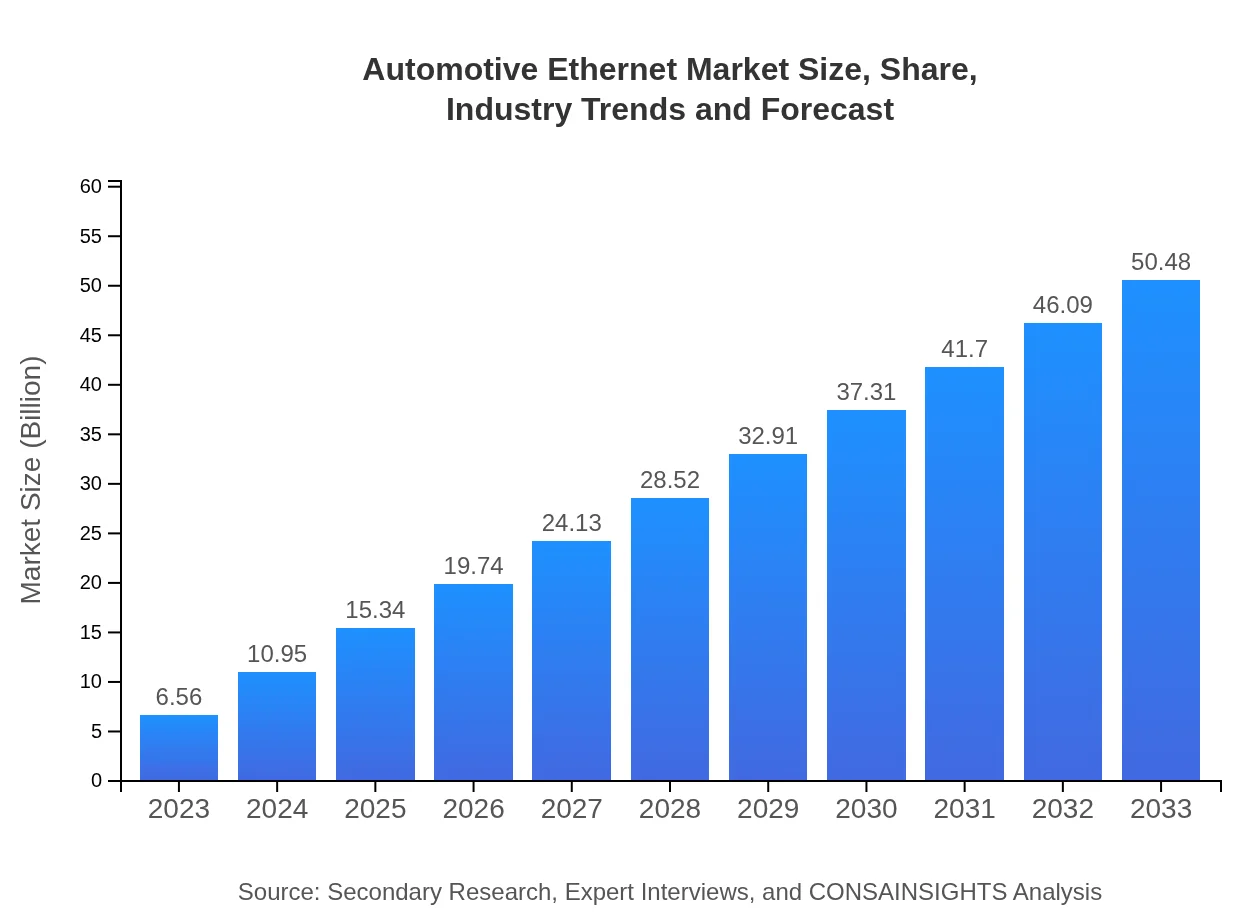

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.56 Billion |

| CAGR (2023-2033) | 21.3% |

| 2033 Market Size | $50.48 Billion |

| Top Companies | Broadcom , NXP Semiconductors, Marvell Technology Group, Texas Instruments |

| Last Modified Date | 02 February 2026 |

Automotive Ethernet Market Overview

Customize Automotive Ethernet Market Report market research report

- ✔ Get in-depth analysis of Automotive Ethernet market size, growth, and forecasts.

- ✔ Understand Automotive Ethernet's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Ethernet

What is the Market Size & CAGR of Automotive Ethernet market in 2023?

Automotive Ethernet Industry Analysis

Automotive Ethernet Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Ethernet Market Analysis Report by Region

Europe Automotive Ethernet Market Report:

Europe is anticipated to grow from USD 1.61 billion in 2023 to USD 12.41 billion by 2033. The focus on stringent emission regulations and safety standards drives the demand for advanced Ethernet technologies, creating a fertile ground for market growth.Asia Pacific Automotive Ethernet Market Report:

In the Asia Pacific region, the market size is projected to grow from USD 1.37 billion in 2023 to USD 10.52 billion by 2033, fueled by the increasing manufacturing of electric vehicles and investments in smart transportation systems. This region is seeing a surge in automotive technology due to government initiatives aimed at promoting electric mobility.North America Automotive Ethernet Market Report:

North America displays a robust market size expected to reach USD 19.62 billion by 2033, growing from USD 2.55 billion in 2023. The region is a leader in automotive innovation, particularly with the strong presence of key automotive manufacturers and the rapid adoption of connected car technologies.South America Automotive Ethernet Market Report:

South America's Automotive Ethernet market is expected to increase from USD 0.59 billion in 2023 to USD 4.57 billion by 2033. The growth is largely driven by the rising demand for modernized vehicle technologies, despite the economic challenges that have historically plagued the region.Middle East & Africa Automotive Ethernet Market Report:

The Middle East and Africa region will see growth from USD 0.44 billion in 2023 to USD 3.37 billion by 2033, as infrastructural developments and investments in the automotive sector begin to take shape, particularly in oil-rich nations keen on diversifying their economies.Tell us your focus area and get a customized research report.

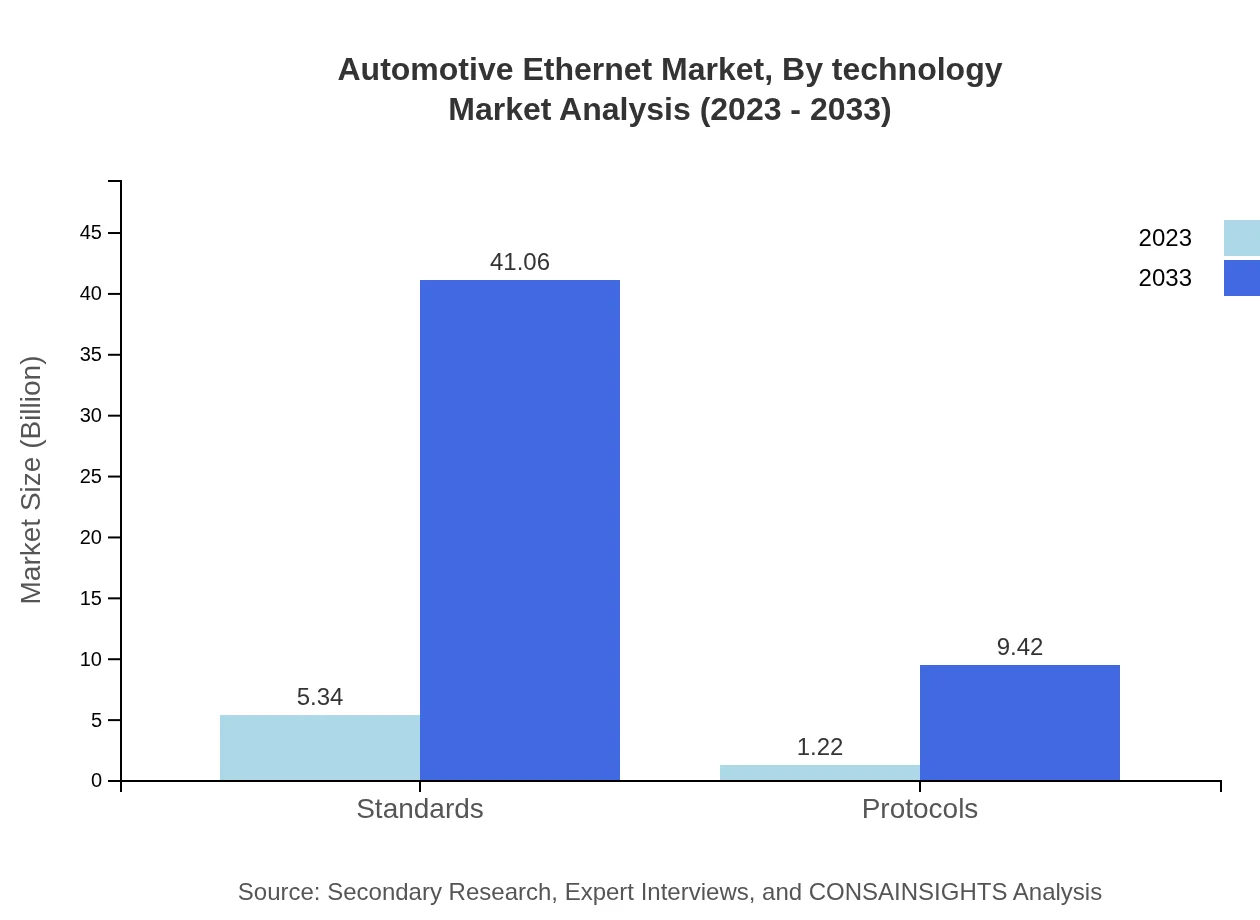

Automotive Ethernet Market Analysis By Technology

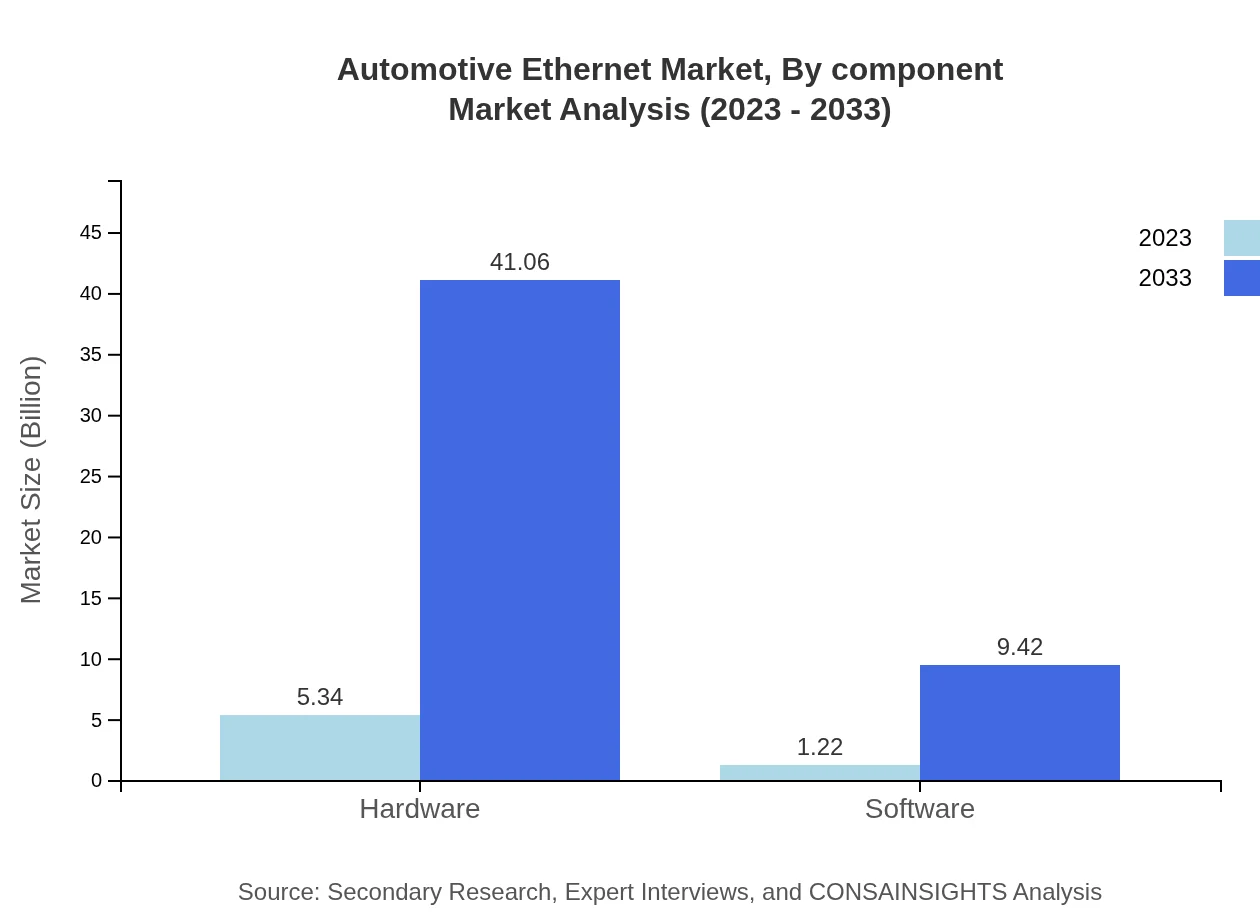

The Automotive Ethernet market is heavily influenced by technology segments including hardware and software solutions. In 2023, hardware components accounted for USD 5.34 billion while software solutions reached USD 1.22 billion. By 2033, hardware is projected to reach USD 41.06 billion, retaining an 81.34% market share, signaling a dominant demand for integrated systems. Software segments will grow to USD 9.42 billion, capturing 18.66% market share.

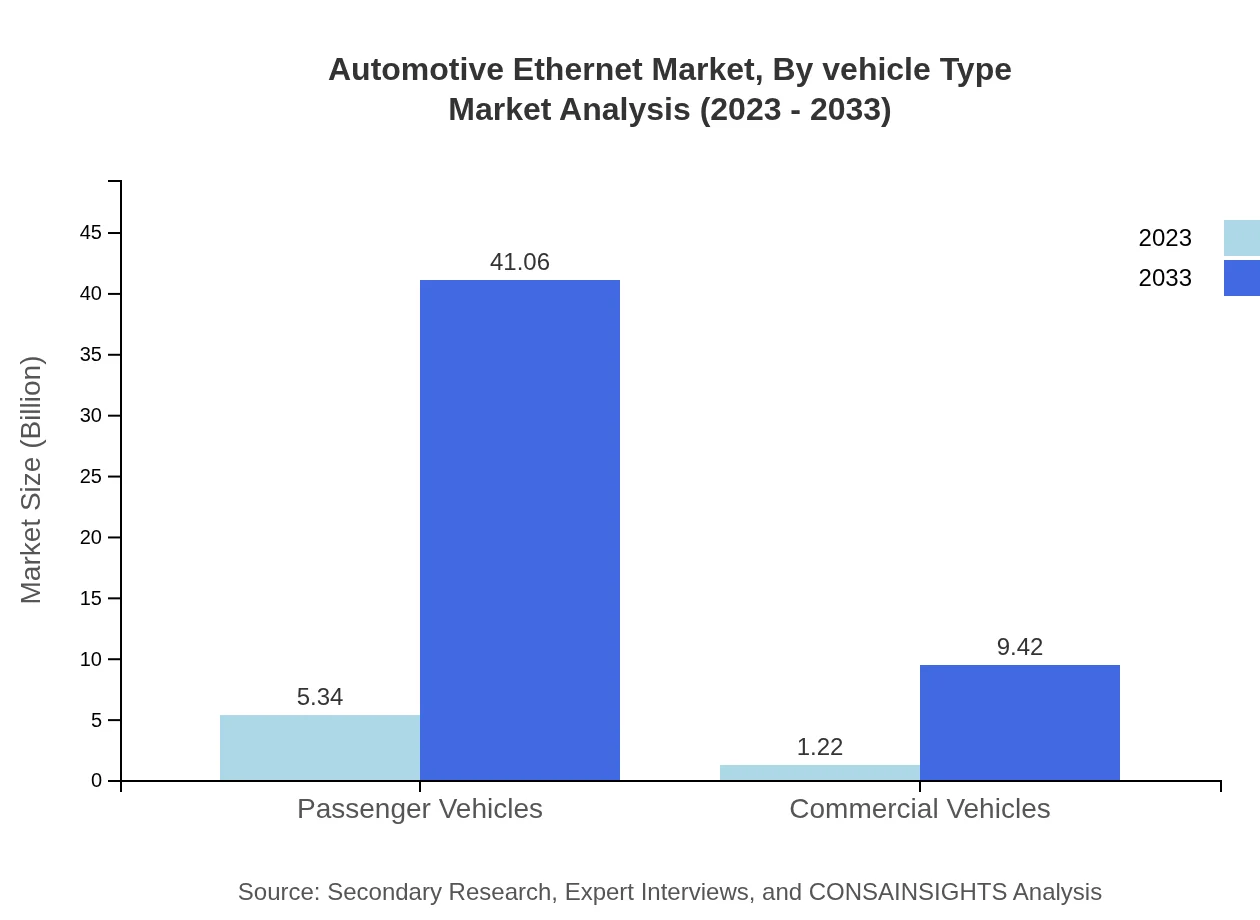

Automotive Ethernet Market Analysis By Vehicle Type

Passenger vehicles are the primary segment within the Automotive Ethernet market, expected to hold a significant share of 81.34% in 2023, growing from USD 5.34 billion to USD 41.06 billion by 2033. Conversely, commercial vehicles, which currently represent an 18.66% market share, are forecasted to evolve from USD 1.22 billion to USD 9.42 billion in the same period.

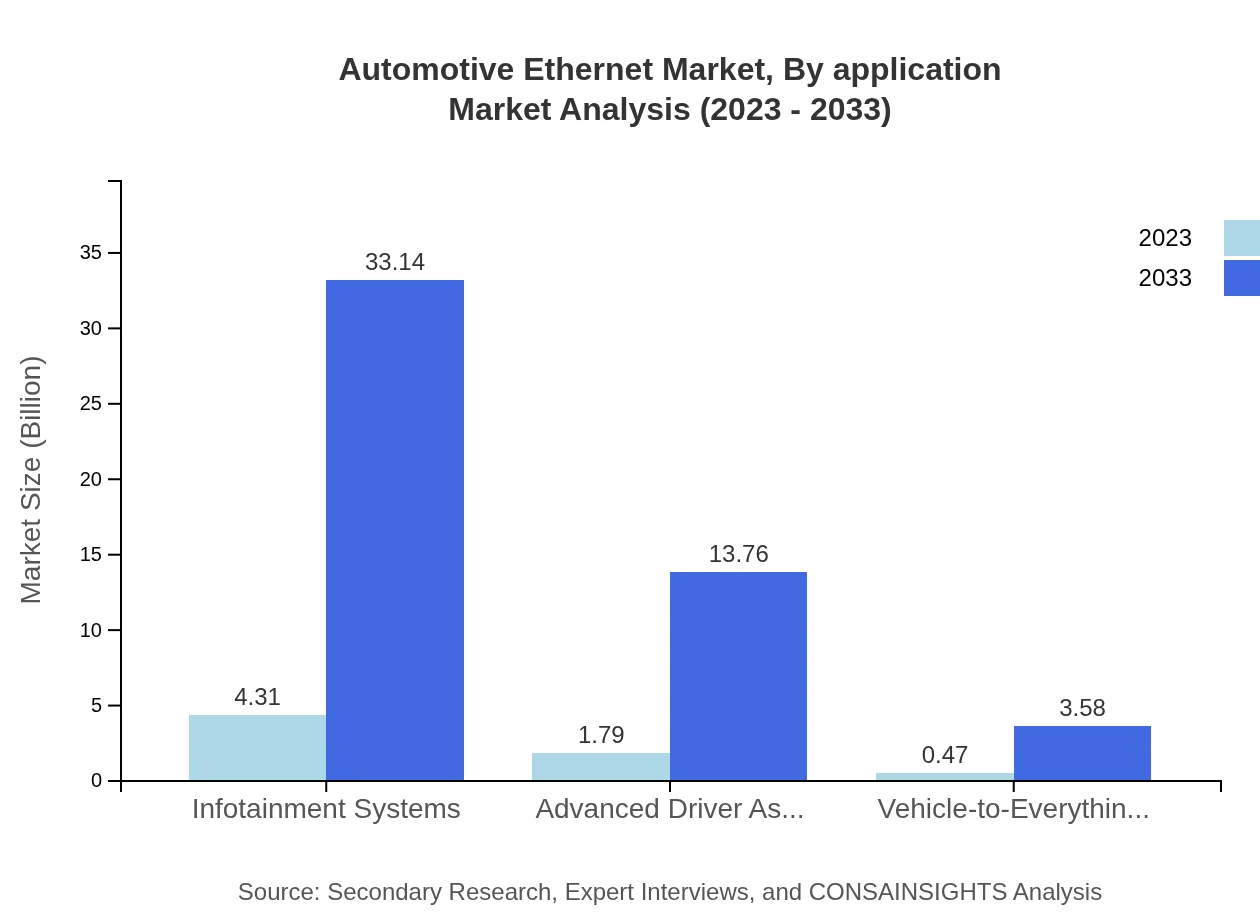

Automotive Ethernet Market Analysis By Application

Application segments such as infotainment systems and ADAS are growing rapidly, with infotainment systems holding 65.65% market share in 2023 at USD 4.31 billion and projected to grow to USD 33.14 billion by 2033. ADAS and V2X applications are vital as they reflect the increasing demand for safety features in vehicles.

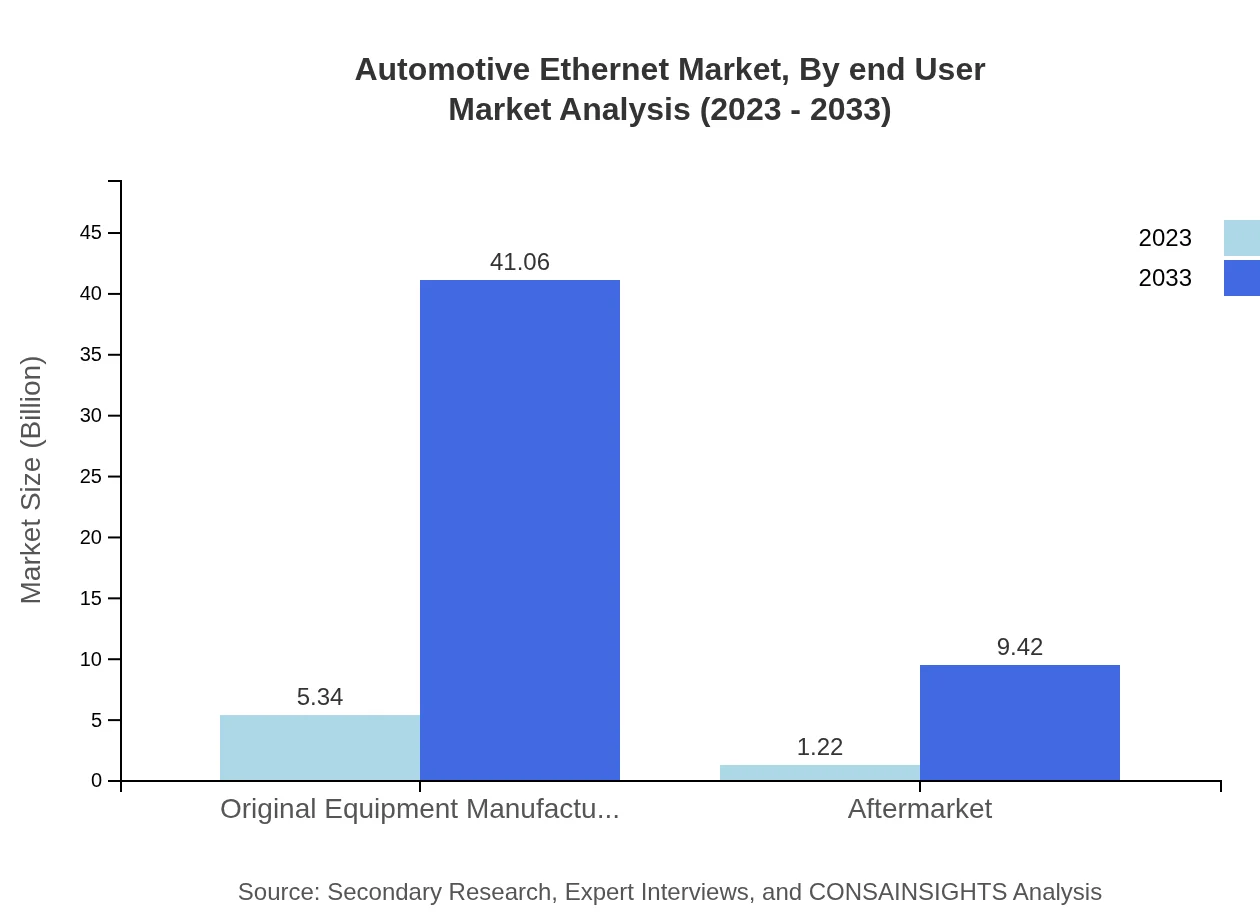

Automotive Ethernet Market Analysis By End User

The Automotive Ethernet market's end-users include OEMs and aftermarket segments. OEMs are anticipated to maintain dominance with 81.34% market share in 2023, projected to wholly expand to USD 41.06 billion by 2033. The aftermarket is expected to experience growth from USD 1.22 billion to USD 9.42 billion, capturing an 18.66% share.

Automotive Ethernet Market Analysis By Component

Components such as protocols, standards, and physical hardware dominate the Automotive Ethernet landscape. The segmentation indicates that protocols (USD 1.22 billion in 2023) will grow to USD 9.42 billion, while standards and the entire ecosystem's interaction will approximate USD 5.34 billion rising to USD 41.06 billion by 2033.

Automotive Ethernet Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Ethernet Industry

Broadcom :

A key player in providing Ethernet technology, Broadcom contributes comprehensive networking solutions that cater to automotive applications, including high-speed network interface controllers and Ethernet switches.NXP Semiconductors:

NXP is instrumental in advancing automotive electronics with its high-performance microcontrollers and Ethernet solutions, enabling smart and secure vehicle communications.Marvell Technology Group:

Marvell specializes in storage, processing, and Ethernet connectivity solutions, playing a vital role in shaping the next generation of in-vehicle networking architectures.Texas Instruments:

With a focus on embedded processing and analog technologies, Texas Instruments supports automotive designers in integrating Ethernet technology seamlessly into their systems.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Ethernet?

The automotive Ethernet market is valued at approximately $6.56 billion in 2023, with a robust CAGR of 21.3% projected through 2033. This indicates significant growth and expansion potential in the automotive technology sector.

What are the key market players or companies in this automotive Ethernet industry?

Key players in the automotive Ethernet market include established names like Bosch, NXP Semiconductors, and Broadcom, among others. These companies drive innovation and deployment of Ethernet technologies in modern vehicles.

What are the primary factors driving the growth in the automotive Ethernet industry?

Growth in the automotive Ethernet market is primarily driven by the rise in vehicle automation, increasing demand for in-vehicle networking, and advancements in connected vehicle technologies, enhancing overall vehicle performance.

Which region is the fastest Growing in the automotive Ethernet?

The fastest-growing region in the automotive Ethernet market is North America, projected to increase from $2.55 billion in 2023 to $19.62 billion by 2033, reflecting a strong focus on technological innovation.

Does ConsaInsights provide customized market report data for the automotive Ethernet industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of stakeholders in the automotive Ethernet industry, ensuring insightful and relevant analysis for decision-making.

What deliverables can I expect from this automotive Ethernet market research project?

Deliverables from the automotive Ethernet market research project include comprehensive reports, market forecasts, competitive landscape analyses, and strategic insights tailored to your business objectives.

What are the market trends of automotive Ethernet?

Key trends in the automotive Ethernet market include increased adoption of ADAS and V2X technologies, rising demand for infotainment systems, and a focus on hardware advancements, shaping the future of automotive connectivity.