Automotive Foam Market Report

Published Date: 02 February 2026 | Report Code: automotive-foam

Automotive Foam Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Automotive Foam market, focusing on trends, segmentation, and insights for the forecast period from 2023 to 2033, aiming to identify growth opportunities and challenges within key regions and product types.

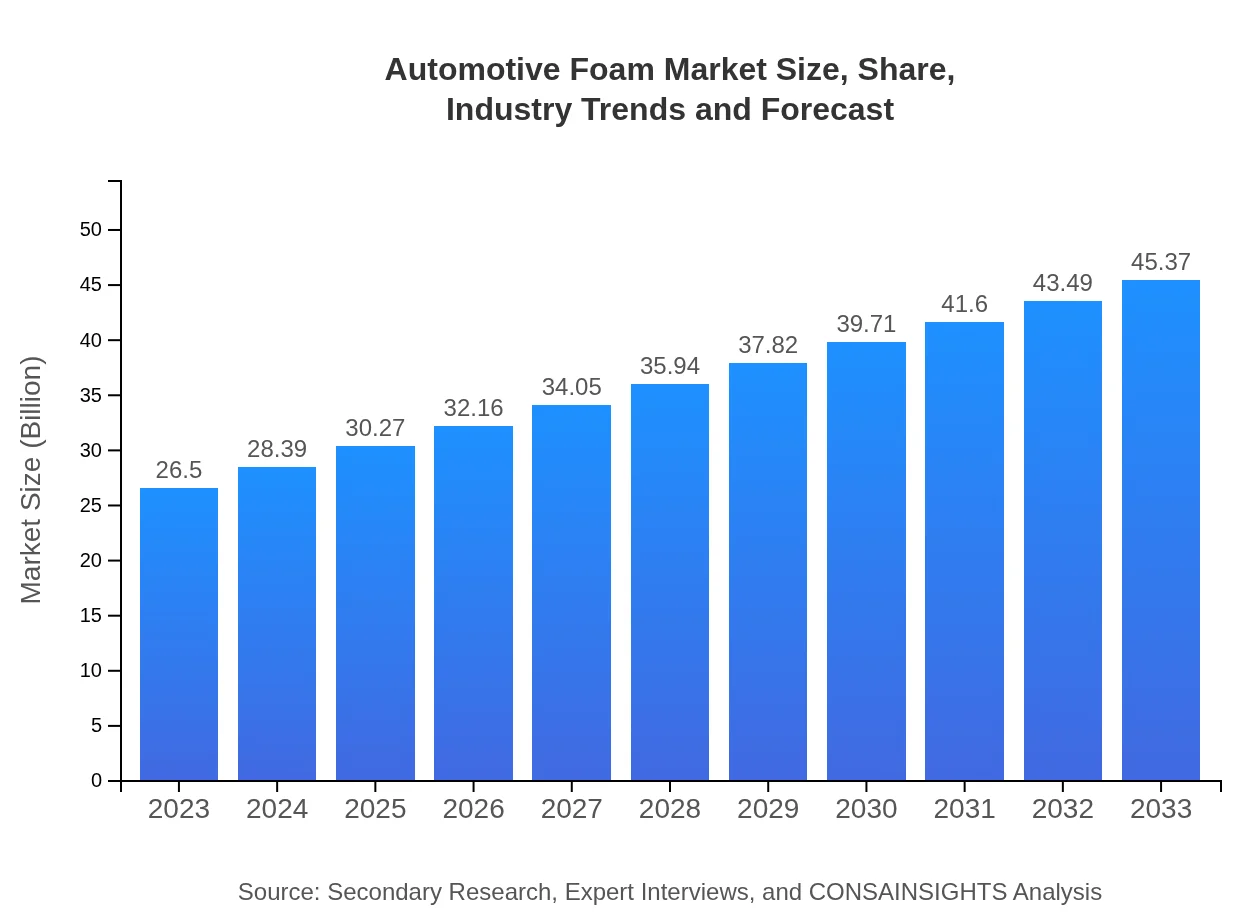

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $26.50 Billion |

| CAGR (2023-2033) | 5.4% |

| 2033 Market Size | $45.37 Billion |

| Top Companies | BASF SE, Huntsman Corporation, The Dow Chemical Company, Lonza, Covestro AG |

| Last Modified Date | 02 February 2026 |

Automotive Foam Market Overview

Customize Automotive Foam Market Report market research report

- ✔ Get in-depth analysis of Automotive Foam market size, growth, and forecasts.

- ✔ Understand Automotive Foam's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Foam

What is the Market Size & CAGR of Automotive Foam market in 2023?

Automotive Foam Industry Analysis

Automotive Foam Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Foam Market Analysis Report by Region

Europe Automotive Foam Market Report:

Europe's Automotive Foam market stands at $8.50 billion in 2023, projected to reach $14.56 billion by 2033. The rise in environmental regulations, the push for sustainable manufacturing, and strong demand for innovative foam solutions contribute to this growth.Asia Pacific Automotive Foam Market Report:

In 2023, the Asia Pacific region holds a market size of approximately $4.98 billion, projected to reach $8.52 billion by 2033. The growth is driven by increased vehicle production, expanding automotive manufacturing in countries like China and India, and the rising adoption of electric vehicles.North America Automotive Foam Market Report:

North America boasts a market size of $9.79 billion in 2023, expected to grow to $16.77 billion by 2033. Factors such as advanced automotive technology, increased consumer spending, and the rapid adoption of electric vehicles drive this market.South America Automotive Foam Market Report:

The South American market for Automotive Foam is estimated to be $1.01 billion in 2023, with a projected increase to $1.73 billion by 2033. The growing demand for affordable and reliable transportation methods encourages industry growth in this region.Middle East & Africa Automotive Foam Market Report:

The Middle East and Africa market is valued at $2.22 billion in 2023, with forecasts suggesting growth to $3.80 billion by 2033. Urbanization and increasing disposable incomes are expected to fuel the demand for more vehicles in these regions.Tell us your focus area and get a customized research report.

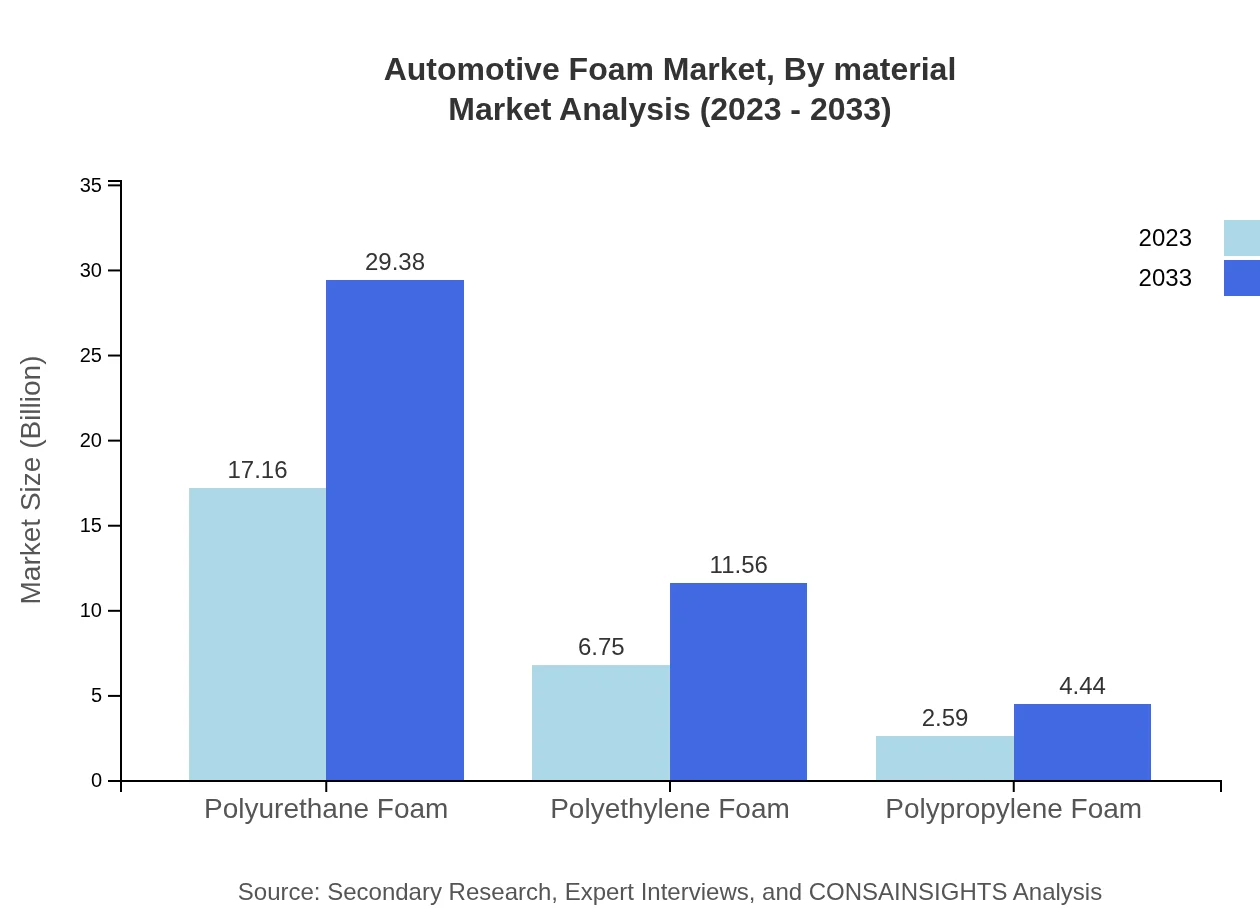

Automotive Foam Market Analysis By Material

The market is predominantly influenced by three types of material: polyurethane, polyethylene, and polypropylene foam. Polyurethane foam is the dominant material, comprising a large market share with a size of $17.16 billion in 2023, projected to grow to $29.38 billion by 2033. Polyethylene and polypropylene foams also play significant roles, with sizes of $6.75 billion and $2.59 billion in 2023, respectively. Their collective growth reflects the industry’s shift towards lightweight and durable materials.

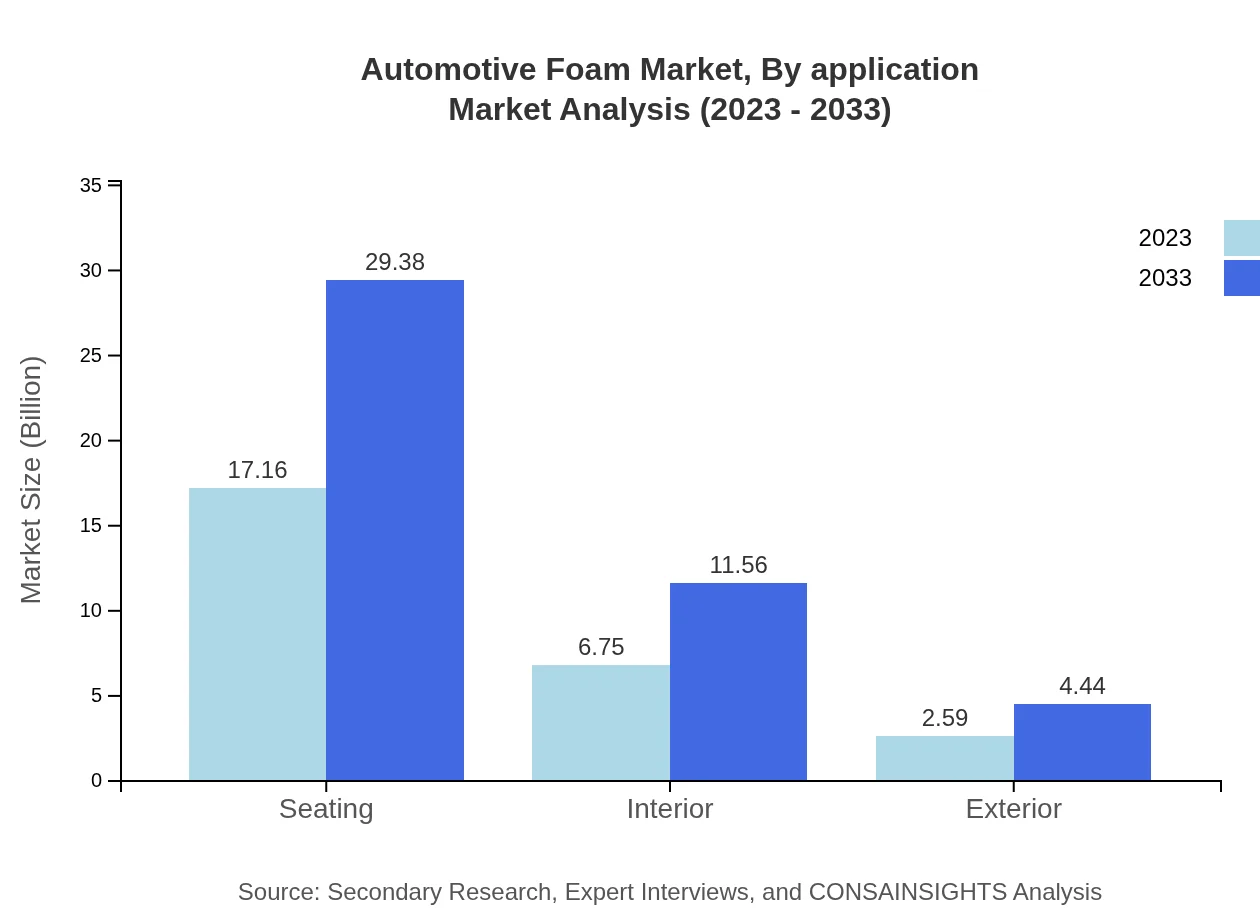

Automotive Foam Market Analysis By Application

In the automotive industry, applications of foam are categorized into seating, interior, and exterior uses, with seating being the largest segment at $17.16 billion in 2023 and projected growth to $29.38 billion by 2033. Interior applications follow with a market size of $6.75 billion (2023) and expected growth to $11.56 billion by 2033, while exterior applications comprise a smaller segment at $2.59 billion, rising to $4.44 billion.

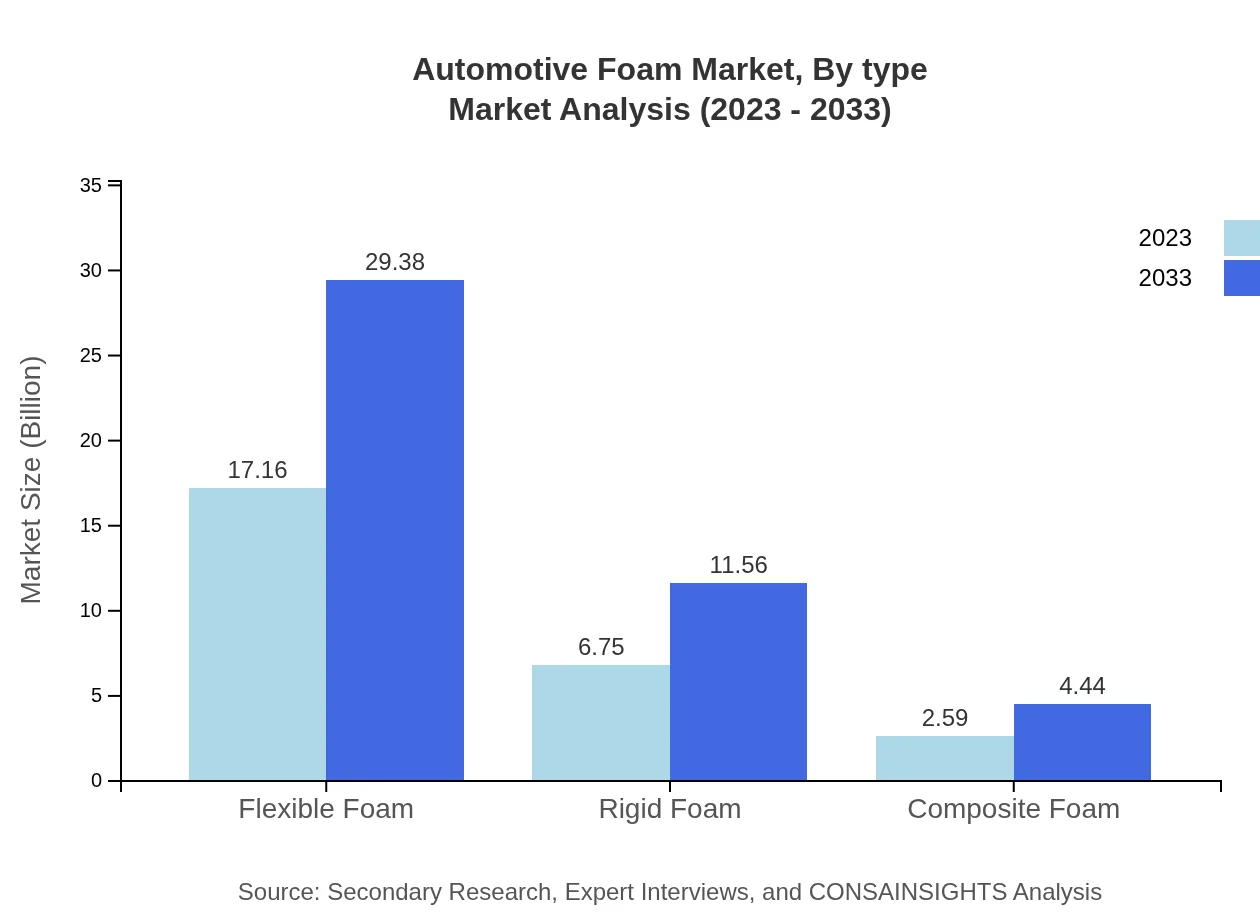

Automotive Foam Market Analysis By Type

The market exhibits a clear inclination towards flexible foam applications, which dominate the market with a 64.75% share in 2023. In terms of market size, flexible foam is at $17.16 billion, set to expand to $29.38 billion by 2033. Rigid foam displays noteworthy statistics, with a market size of $6.75 billion in 2023, increasing to $11.56 billion. Composite foams, while smaller in presence, are gaining traction as their size grows from $2.59 billion to $4.44 billion over the same period.

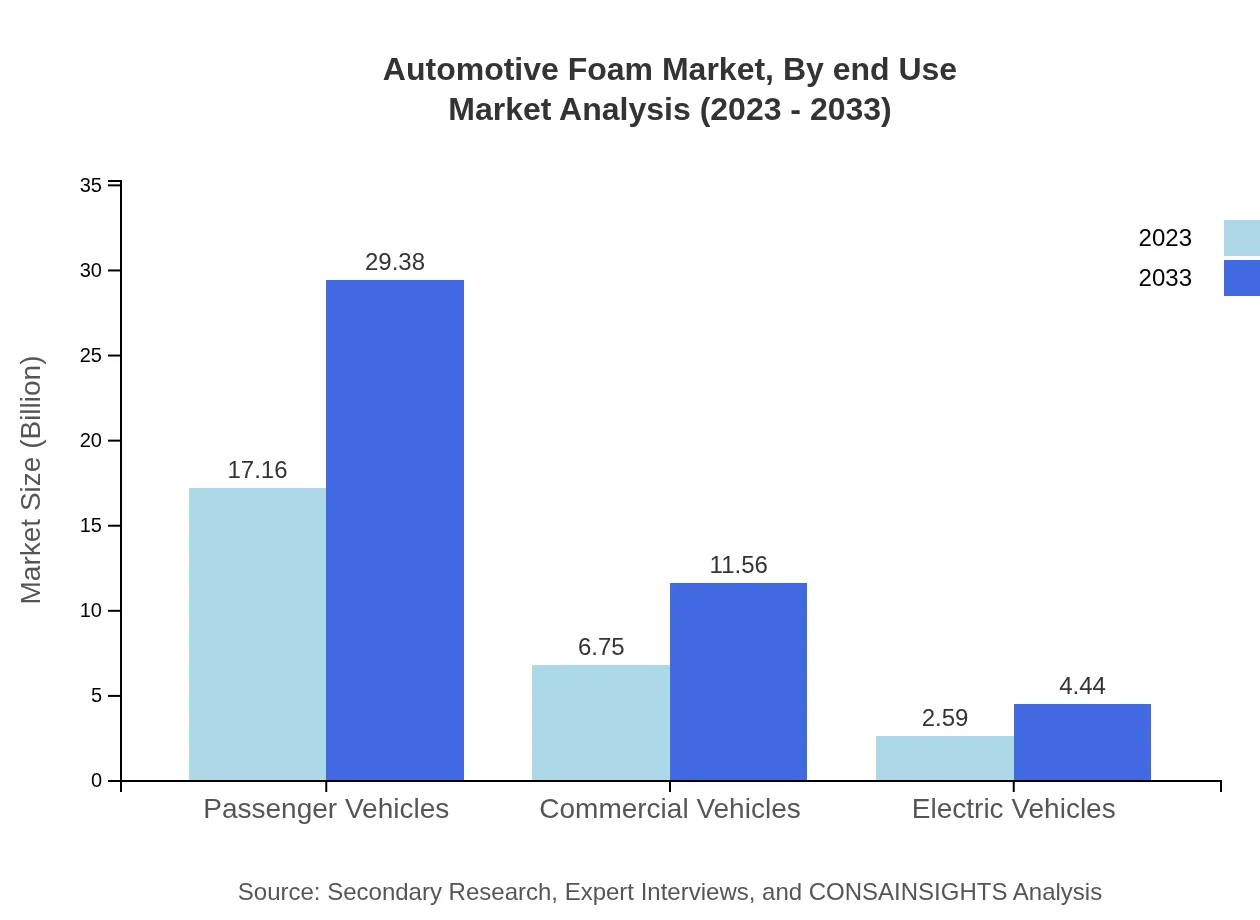

Automotive Foam Market Analysis By End Use

Seating applications capture the majority market share, amounting to $17.16 billion in 2023 and projecting to reach $29.38 billion by 2033. Commercial vehicles account for a size of $6.75 billion, with projections leading to $11.56 billion due to increasing demand in logistics and transportation sectors. Electric vehicle applications, though smaller ($2.59 billion in 2023), are rising rapidly as demand for sustainable mobility solutions expands.

Automotive Foam Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Foam Industry

BASF SE:

BASF is a global leader in production and supply of chemicals, including automotive foams, focusing on innovation and sustainable solutions.Huntsman Corporation:

Huntsman is a prominent manufacturer of specialty chemicals and a key supplier of polyurethane foams for the automotive industry.The Dow Chemical Company:

Dow is known for its advanced material solutions, including automotive foams that enhance performance and sustainability.Lonza:

Lonza supplies high-performance foams, focusing on customization and innovative solutions tailored to automotive applications.Covestro AG:

Covestro offers sustainable foam solutions, emphasizing circular economy principles and innovative material applications.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Foam?

The automotive foam market is projected to reach a size of $26.5 billion by 2033, with a compound annual growth rate (CAGR) of 5.4% from 2023 to 2033. This growth reflects increasing demand across various vehicle types.

What are the key market players or companies in this automotive foam industry?

Key players in the automotive foam industry include large manufacturers such as BASF SE, The Dow Chemical Company, and Huntsman Corporation, among others. These companies play significant roles in innovation and supply chain management.

What are the primary factors driving the growth in the automotive foam industry?

Growth in the automotive foam industry is driven by rising vehicle production, increasing use of lightweight materials, and a growing focus on enhancing passenger comfort and safety features in automobiles.

Which region is the fastest Growing in the automotive foam?

Currently, North America is the fastest-growing region in the automotive foam market, with a projected increase from $9.79 billion in 2023 to $16.77 billion by 2033, fueled by high automotive production rates.

Does ConsaInsights provide customized market report data for the automotive foam industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the automotive foam industry, including specialized insights and detailed market information.

What deliverables can I expect from this automotive foam market research project?

Deliverables from the automotive foam market research project include detailed market analysis, segment insights, regional data, forecasts, and strategic recommendations tailored to the client's requirements.

What are the market trends of automotive foam?

Market trends in automotive foam include the increasing adoption of flexible foam types, a rise in electric vehicle production, and demand for sustainable materials, reflecting an industry shift towards eco-friendly practices.