Automotive Fuel Injection Systems Market Report

Published Date: 22 January 2026 | Report Code: automotive-fuel-injection-systems

Automotive Fuel Injection Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Fuel Injection Systems market, including market size, growth forecasts from 2023 to 2033, key trends, regional insights, and competitive landscape.

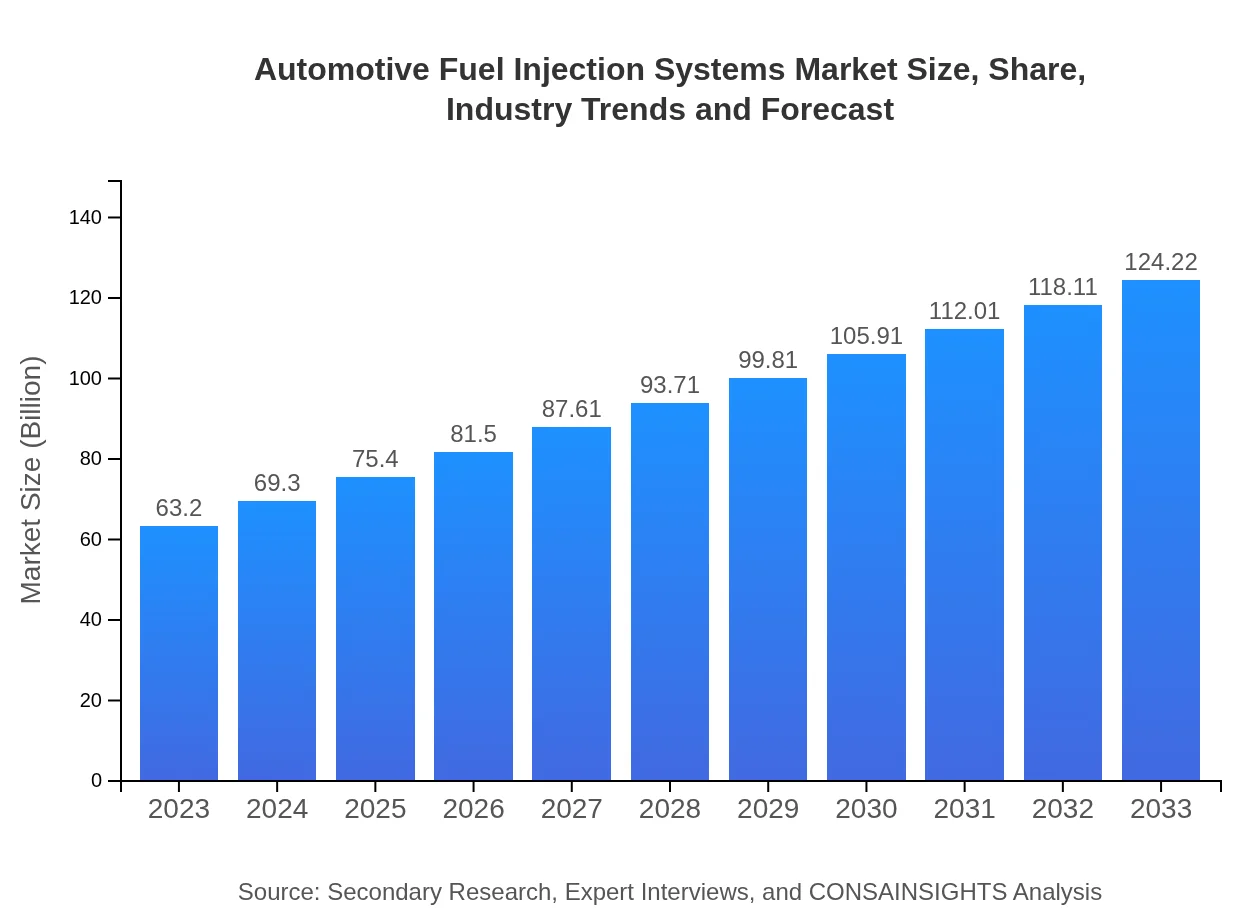

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $63.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $124.22 Billion |

| Top Companies | Bosch, Denso, Delphi Technologies, Continental |

| Last Modified Date | 22 January 2026 |

Automotive Fuel Injection Systems Market Overview

Customize Automotive Fuel Injection Systems Market Report market research report

- ✔ Get in-depth analysis of Automotive Fuel Injection Systems market size, growth, and forecasts.

- ✔ Understand Automotive Fuel Injection Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Fuel Injection Systems

What is the Market Size & CAGR of Automotive Fuel Injection Systems market in 2023?

Automotive Fuel Injection Systems Industry Analysis

Automotive Fuel Injection Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Fuel Injection Systems Market Analysis Report by Region

Europe Automotive Fuel Injection Systems Market Report:

The European market is projected to grow from $16.60 billion in 2023 to $32.63 billion by 2033. Innovations in fuel injection technologies and a strong push towards electric vehicles are key factors driving this growth.Asia Pacific Automotive Fuel Injection Systems Market Report:

The Asia Pacific region is poised to experience the highest growth due to the booming automotive industry in countries like China and India. The market size is projected to grow from $12.15 billion in 2023 to $23.89 billion by 2033, attributed to rapid urbanization and rising disposable income.North America Automotive Fuel Injection Systems Market Report:

North America is expected to grow significantly from $20.80 billion in 2023 to $40.88 billion by 2033. The presence of major automotive manufacturers and the increasing prevalence of stringent emission standards are influencing market dynamics in this region.South America Automotive Fuel Injection Systems Market Report:

In South America, the market is expected to see growth from $5.85 billion in 2023 to $11.50 billion by 2033. Increasing demand for passenger vehicles and investments in automotive manufacturing are driving market expansion in this region.Middle East & Africa Automotive Fuel Injection Systems Market Report:

The Middle East and Africa region is anticipated to grow from $7.79 billion in 2023 to $15.32 billion by 2033, supported by shifting consumer preferences towards more efficient fuel systems and investments in regional automotive production.Tell us your focus area and get a customized research report.

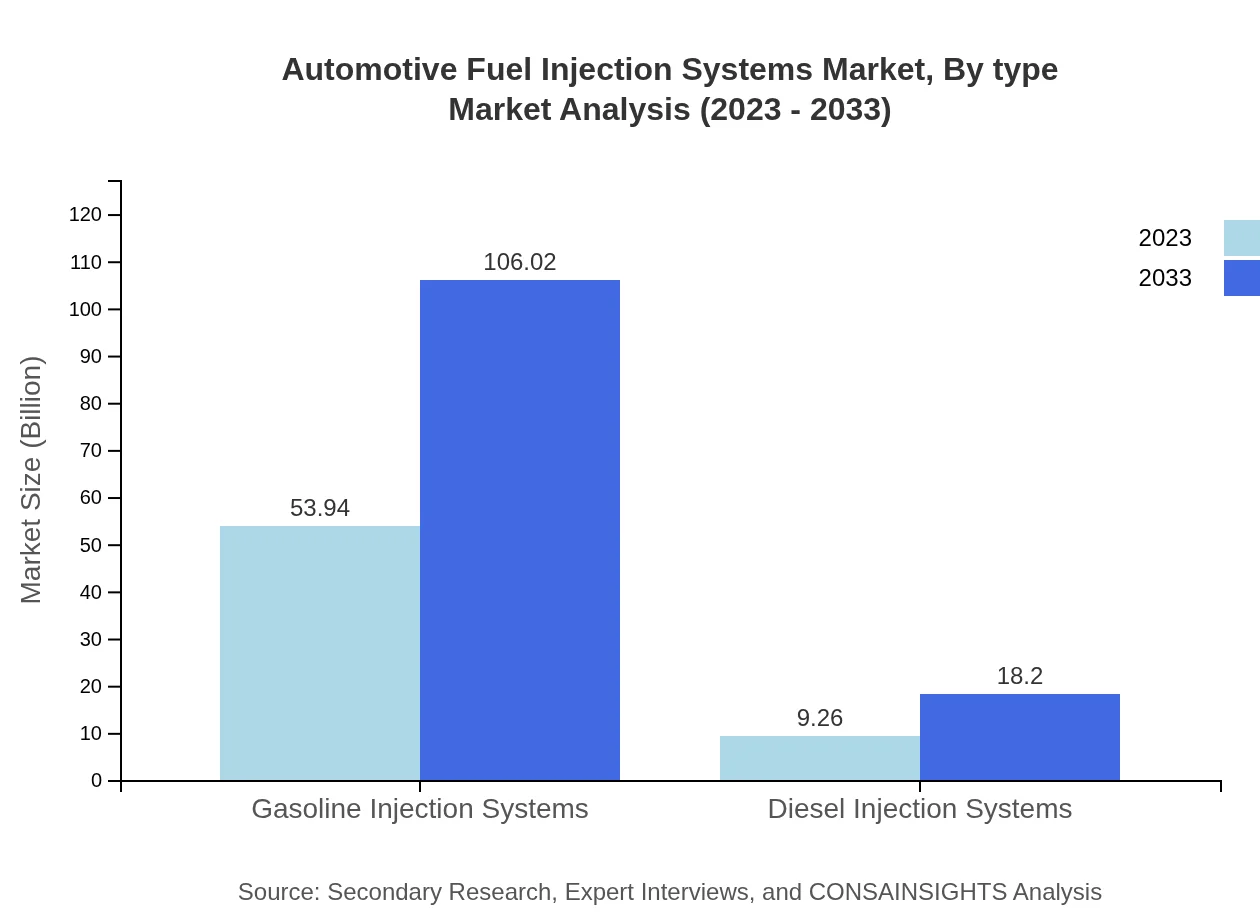

Automotive Fuel Injection Systems Market Analysis By Type

Gasoline Injection Systems dominate the market with a size expected to grow from $53.94 billion in 2023 to $106.02 billion by 2033, holding a market share of 85.35%. Diesel Injection Systems, while smaller at $9.26 billion in 2023, are projected to grow to $18.20 billion, maintaining a share of 14.65%.

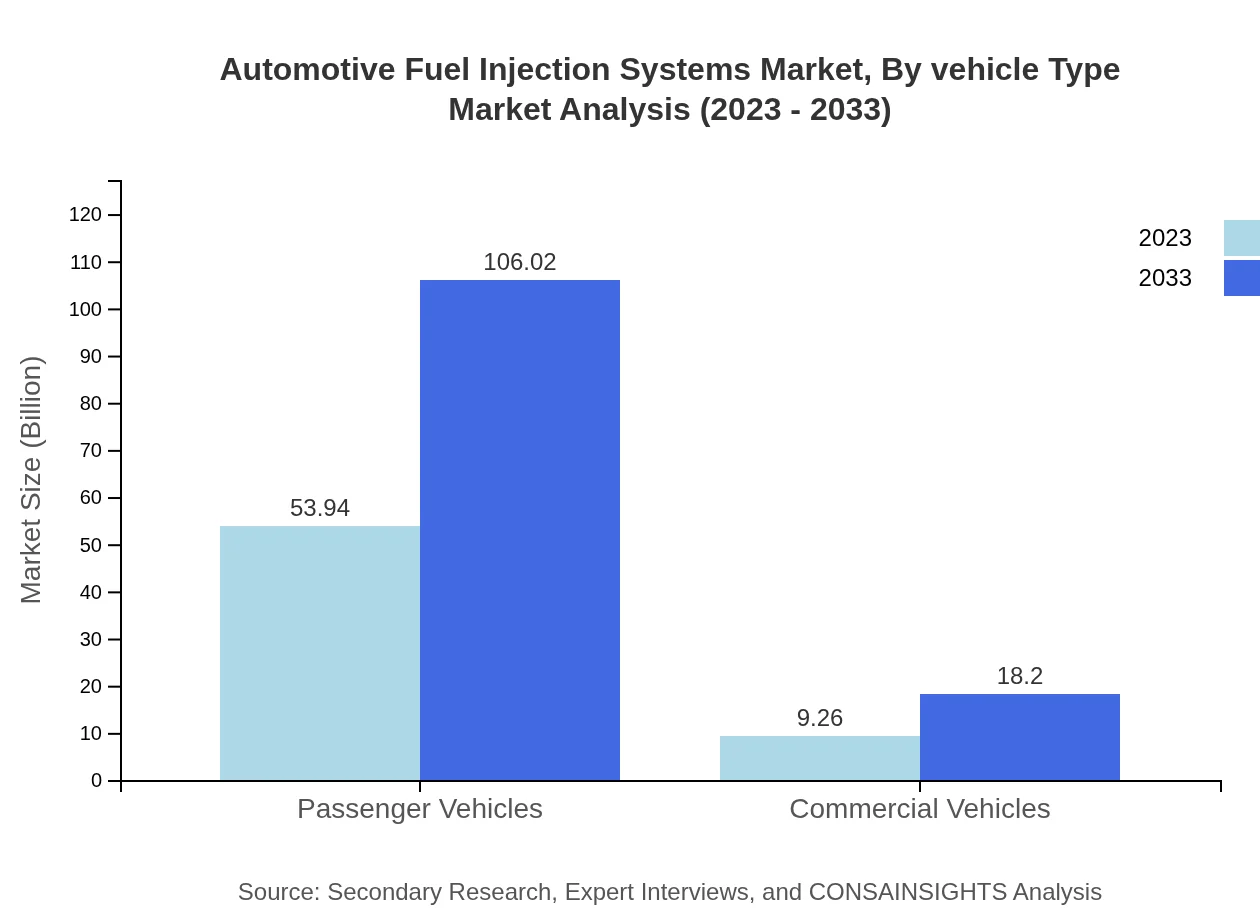

Automotive Fuel Injection Systems Market Analysis By Vehicle Type

Passenger Vehicles account for a significant portion of the market, with a size of $53.94 billion in 2023 and expected to reach $106.02 billion by 2033. Commercial Vehicles are also growing, projected to grow from $9.26 billion to $18.20 billion during the same period.

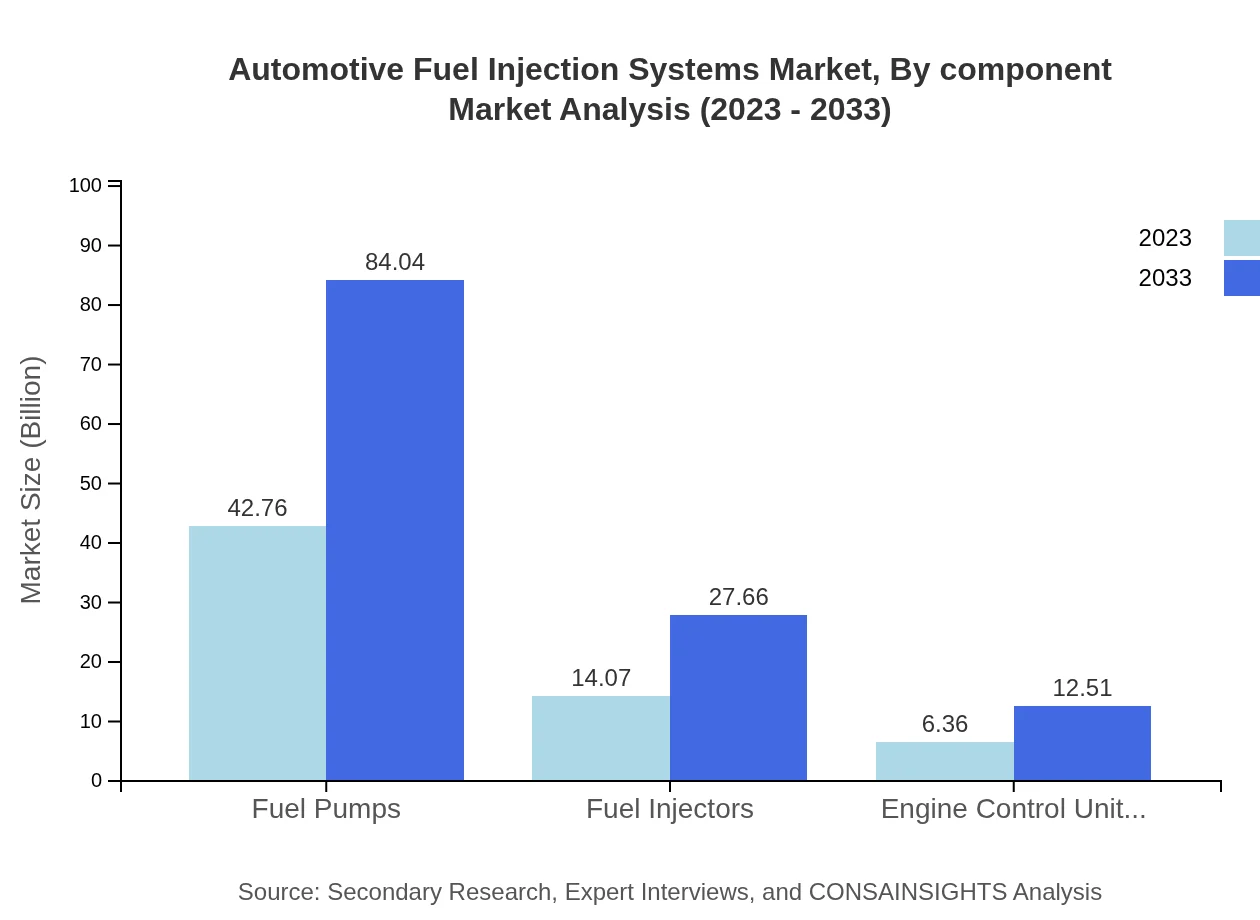

Automotive Fuel Injection Systems Market Analysis By Component

Fuel Pumps are vital components with a market size of $42.76 billion in 2023, expected to double to $84.04 billion by 2033. Fuel Injectors and Engine Control Units also play critical roles, with sizes of $14.07 billion and $6.36 billion, respectively, in 2023.

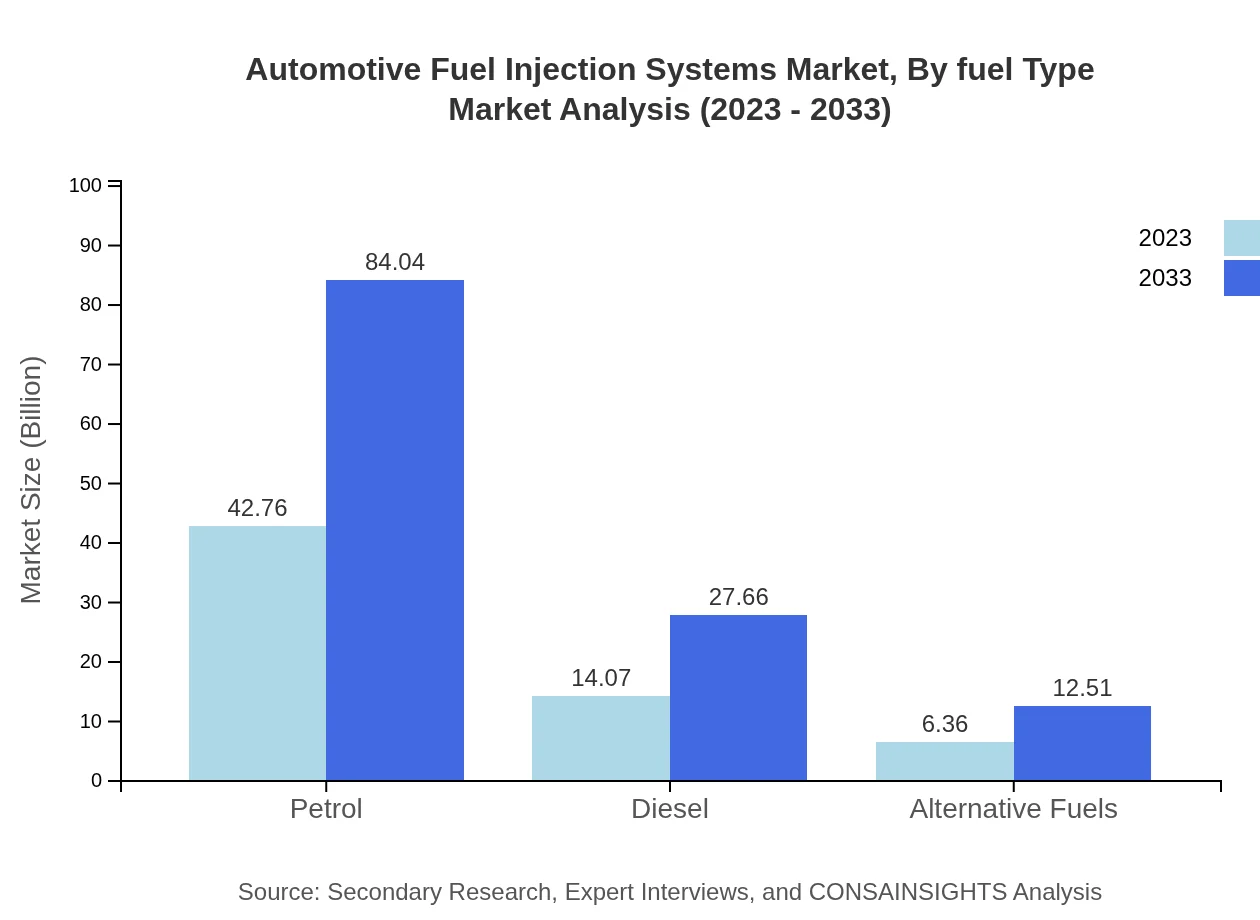

Automotive Fuel Injection Systems Market Analysis By Fuel Type

Petrol retains a significant share of the market, projected to grow from $42.76 billion in 2023 to $84.04 billion by 2033. Diesel and Alternative Fuels are expected to follow, with sizes of $14.07 billion and $6.36 billion in 2023.

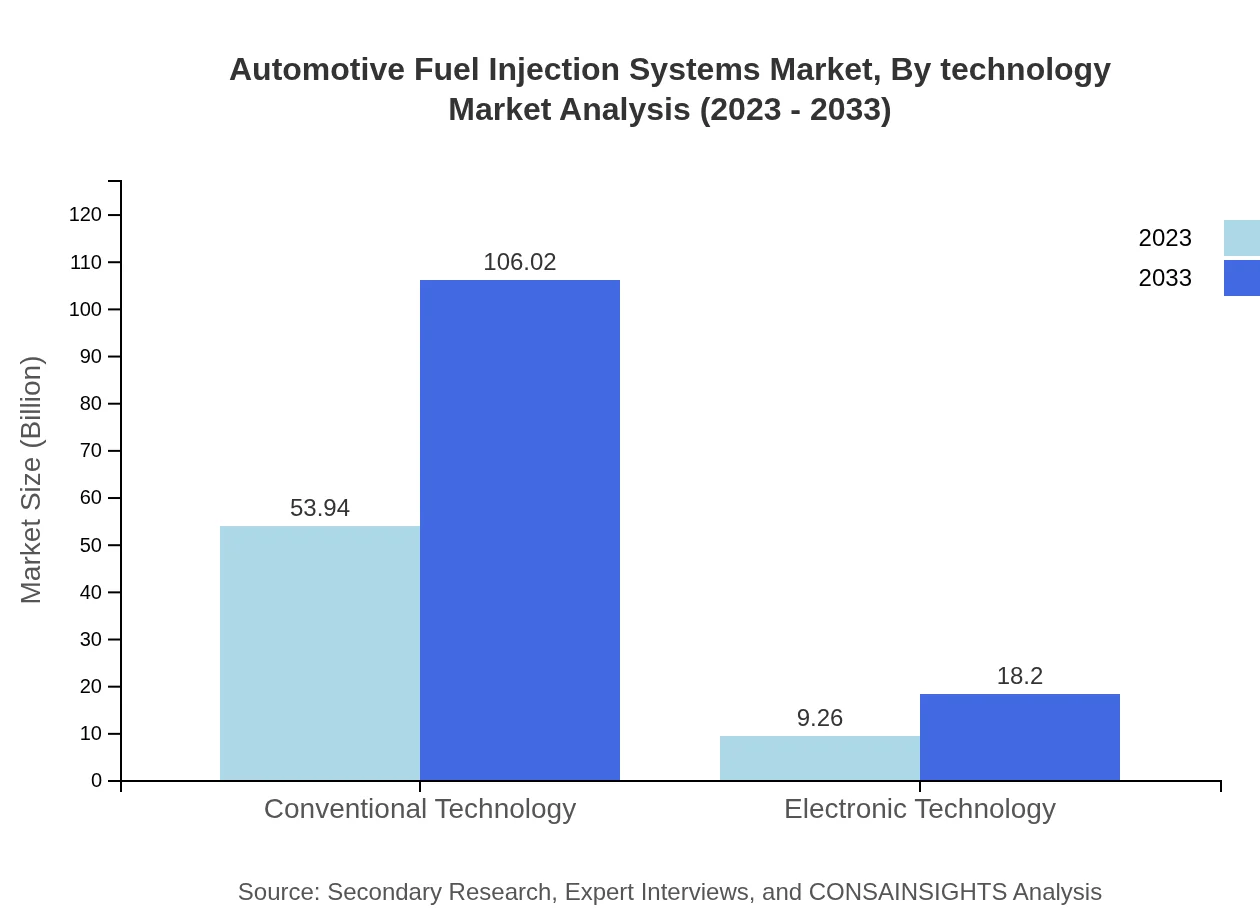

Automotive Fuel Injection Systems Market Analysis By Technology

Conventional Technology leads with a size of $53.94 billion in 2023, expected to double in size by 2033. Electronic Technology, currently at $9.26 billion, is projected to grow to $18.20 billion, driven by advancements in vehicle connectivity and efficiency.

Automotive Fuel Injection Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Fuel Injection Systems Industry

Bosch:

Bosch is a leading player in the automotive industry, renowned for its innovative fuel injection technologies that enhance engine performance and fuel efficiency.Denso:

Denso Corporation focuses on manufacturing advanced automotive systems, contributing significantly to the fuel injection systems market through its expertise in electronic fuel injection technologies.Delphi Technologies:

Delphi Technologies offers innovative fuel management technologies, widely recognized for its contributions to making fuel injection systems more efficient and environmentally friendly.Continental:

Continental is an automotive supplier that has made significant advancements in fuel injection systems, driving market innovation to meet the growing demand for fuel-efficient technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive fuel injection systems?

The global market size for automotive fuel injection systems is projected to reach $63.2 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% from 2023. This growth reflects increasing automotive production and technological advancements.

What are the key market players or companies in the automotive fuel injection systems industry?

Key players in the automotive fuel injection systems market include Bosch, Denso Corporation, Continental AG, Delphi Technologies, and Magneti Marelli. These companies drive innovation and competition globally, enhancing product offerings and market reach.

What are the primary factors driving the growth in the automotive fuel injection systems industry?

Factors driving growth include increasing vehicle production rates, rising demand for fuel-efficient systems, stringent emission regulations, and technological advancements like electronic control units and advanced fuel management systems.

Which region is the fastest Growing in the automotive fuel injection systems?

Asia-Pacific is the fastest-growing region for automotive fuel injection systems. The market size is expected to grow from $12.15 billion in 2023 to $23.89 billion by 2033, driven by solid automotive manufacturing and rising consumer demand.

Does ConsaInsights provide customized market report data for the automotive fuel injection systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the automotive fuel injection systems industry. This flexibility allows for detailed insights aligned with particular business strategies and market conditions.

What deliverables can I expect from this automotive fuel injection systems market research project?

Deliverables include detailed market size analysis, forecasts, segment data, competitive landscape assessments, regional analyses, and insights into emerging trends affecting the automotive fuel injection systems market.

What are the market trends of automotive fuel injection systems?

Trends include a shift toward electronic fuel injection technologies, increased adoption of hybrid and electric vehicles, the rise of alternative fuels, and advancements in injector technologies to enhance performance and efficiency.