Automotive Ignition System Market Report

Published Date: 22 January 2026 | Report Code: automotive-ignition-system

Automotive Ignition System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Ignition System market from 2023 to 2033, highlighting key insights, trends, and market dynamics along with forecasts for growth across various segments and regions.

| Metric | Value |

|---|---|

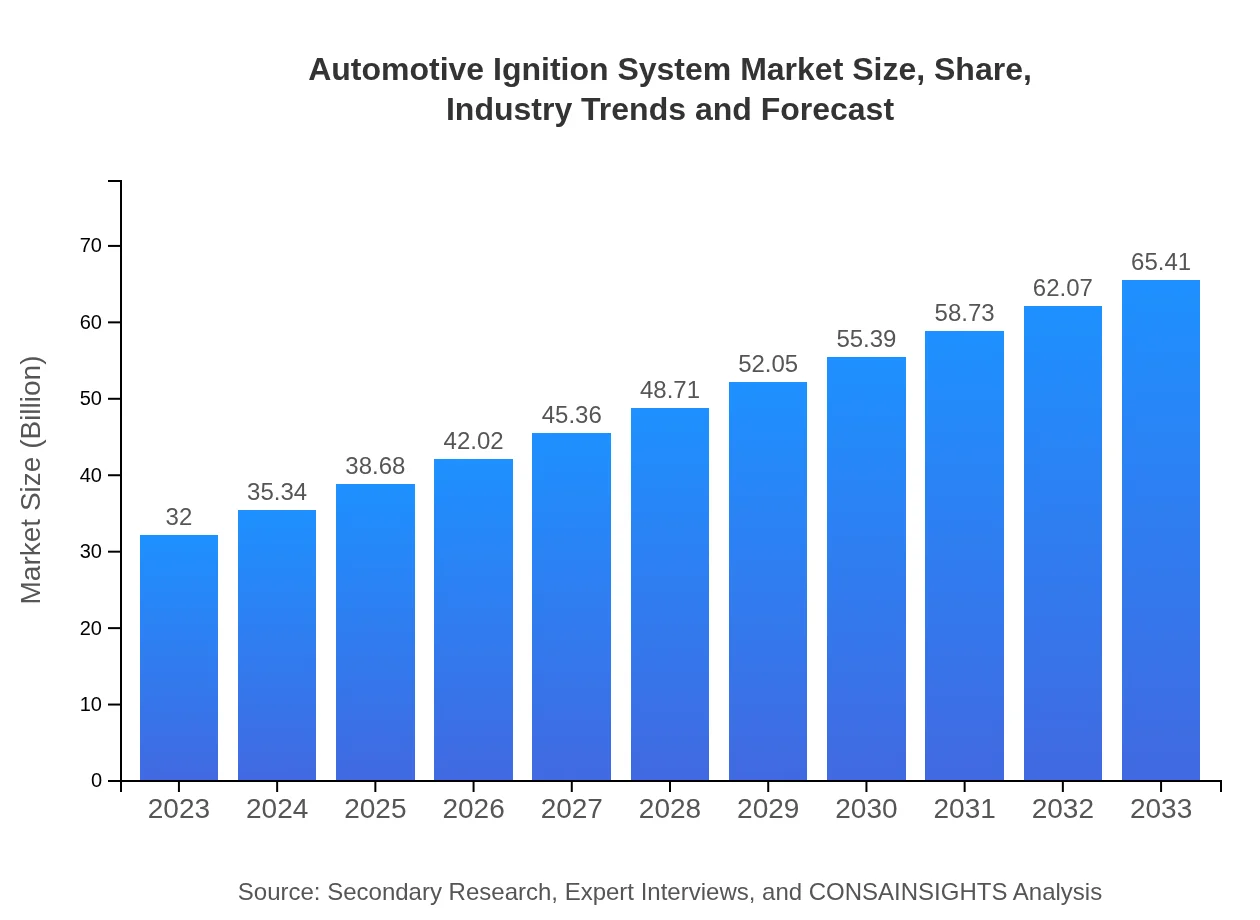

| Study Period | 2023 - 2033 |

| 2023 Market Size | $32.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $65.41 Billion |

| Top Companies | Robert Bosch GmbH, Denso Corporation, NGK Spark Plug Co., Ltd., Delphi Technologies, Federal-Mogul Corporation |

| Last Modified Date | 22 January 2026 |

Automotive Ignition System Market Overview

Customize Automotive Ignition System Market Report market research report

- ✔ Get in-depth analysis of Automotive Ignition System market size, growth, and forecasts.

- ✔ Understand Automotive Ignition System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Ignition System

What is the Market Size & CAGR of the Automotive Ignition System market in 2023?

Automotive Ignition System Industry Analysis

Automotive Ignition System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Ignition System Market Analysis Report by Region

Europe Automotive Ignition System Market Report:

The European market is valued at $8.45 billion in 2023, with projections of $17.27 billion by 2033. Stringent emission regulations and a substantial shift towards electric vehicles propel growth, leading to the adoption of modern ignition technologies.Asia Pacific Automotive Ignition System Market Report:

The Asia Pacific region holds a significant share, valued at $6.68 billion in 2023 and projected to reach $13.65 billion by 2033. The growth is driven by rising automobile production, increasing disposable incomes, and expanding automotive industries in countries like China and India.North America Automotive Ignition System Market Report:

North America shows a strong market presence, with a valuation of $11.69 billion in 2023, anticipated to reach $23.89 billion by 2033. The region benefits from advanced automotive technologies, a mature automotive market, and a focus on emission control.South America Automotive Ignition System Market Report:

In South America, the market is smaller, with a value of $2.67 billion in 2023, expected to grow to $5.45 billion by 2033. Market growth will be driven by increasing car ownership and infrastructure development in emerging economies.Middle East & Africa Automotive Ignition System Market Report:

The Middle East and Africa showcase a market size of $2.52 billion in 2023, expected to grow to $5.15 billion by 2033. Factors such as economic growth and increasing vehicle sales contribute to the demand for advanced ignition systems.Tell us your focus area and get a customized research report.

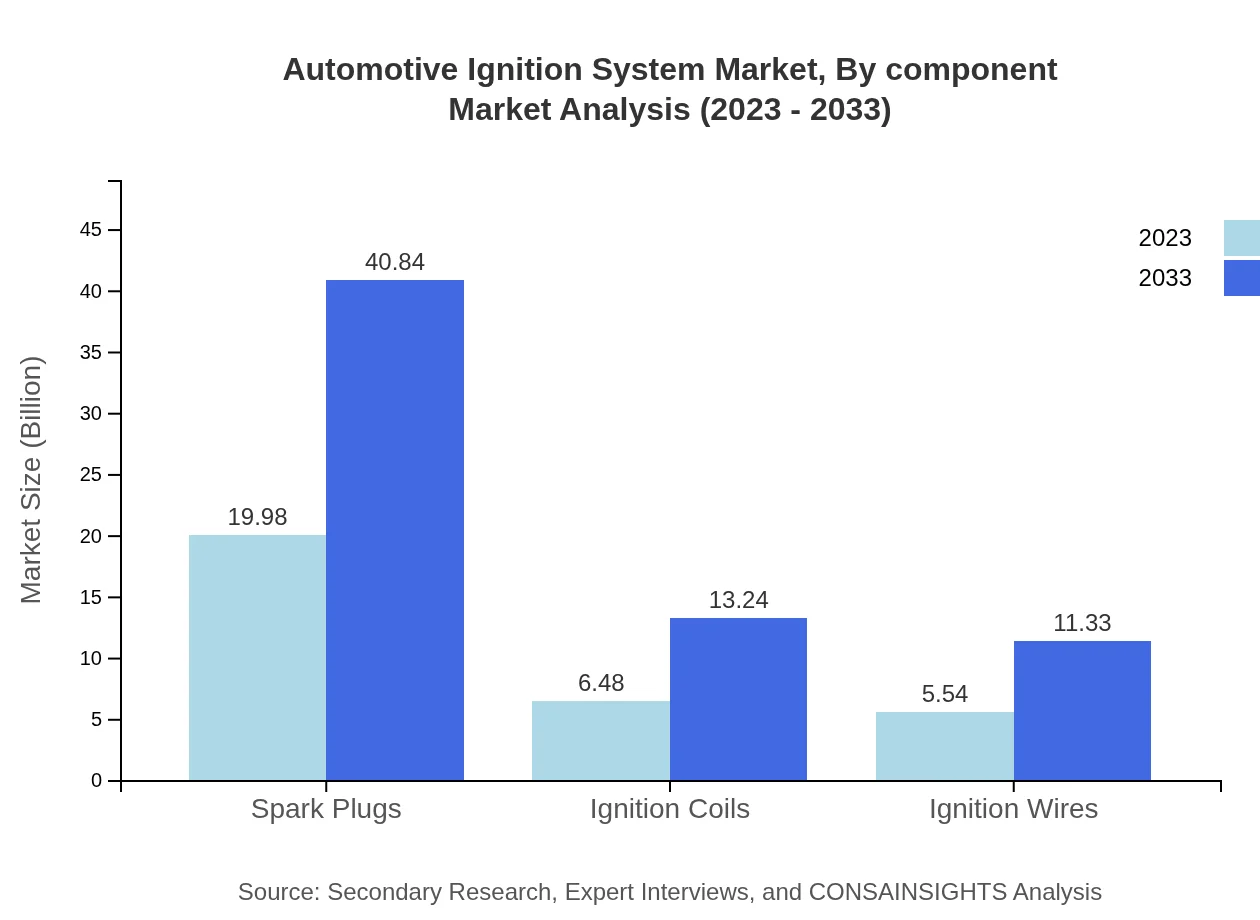

Automotive Ignition System Market Analysis By Component

In the component segment, spark plugs form the largest market share with an estimated value of $19.98 billion in 2023 and anticipated to grow to $40.84 billion by 2033, capturing about 62.44% of the market share. Ignition coils are projected to grow from $6.48 billion to $13.24 billion with a share of 20.24%. Ignition wires are also significant, increasing from $5.54 billion to $11.33 billion, holding a 17.32% market share.

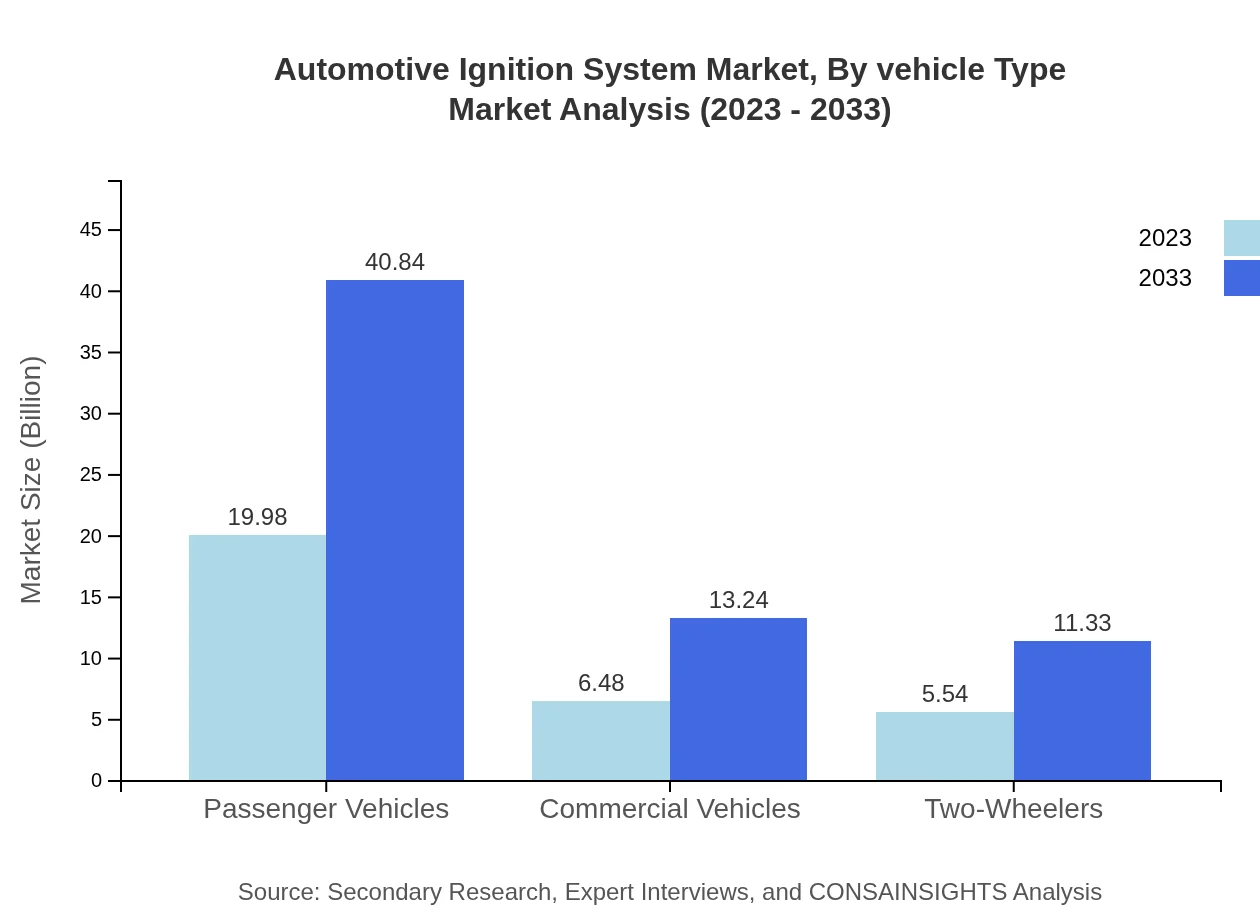

Automotive Ignition System Market Analysis By Vehicle Type

Passenger vehicles dominate the market with a size of $19.98 billion in 2023, expected to reach $40.84 billion by 2033, claiming 62.44% of the market. Commercial vehicles also hold substantial value at $6.48 billion, growing to $13.24 billion (20.24% share), while two-wheelers, valued at $5.54 billion in 2023, are set to increase to $11.33 billion with a 17.32% market share.

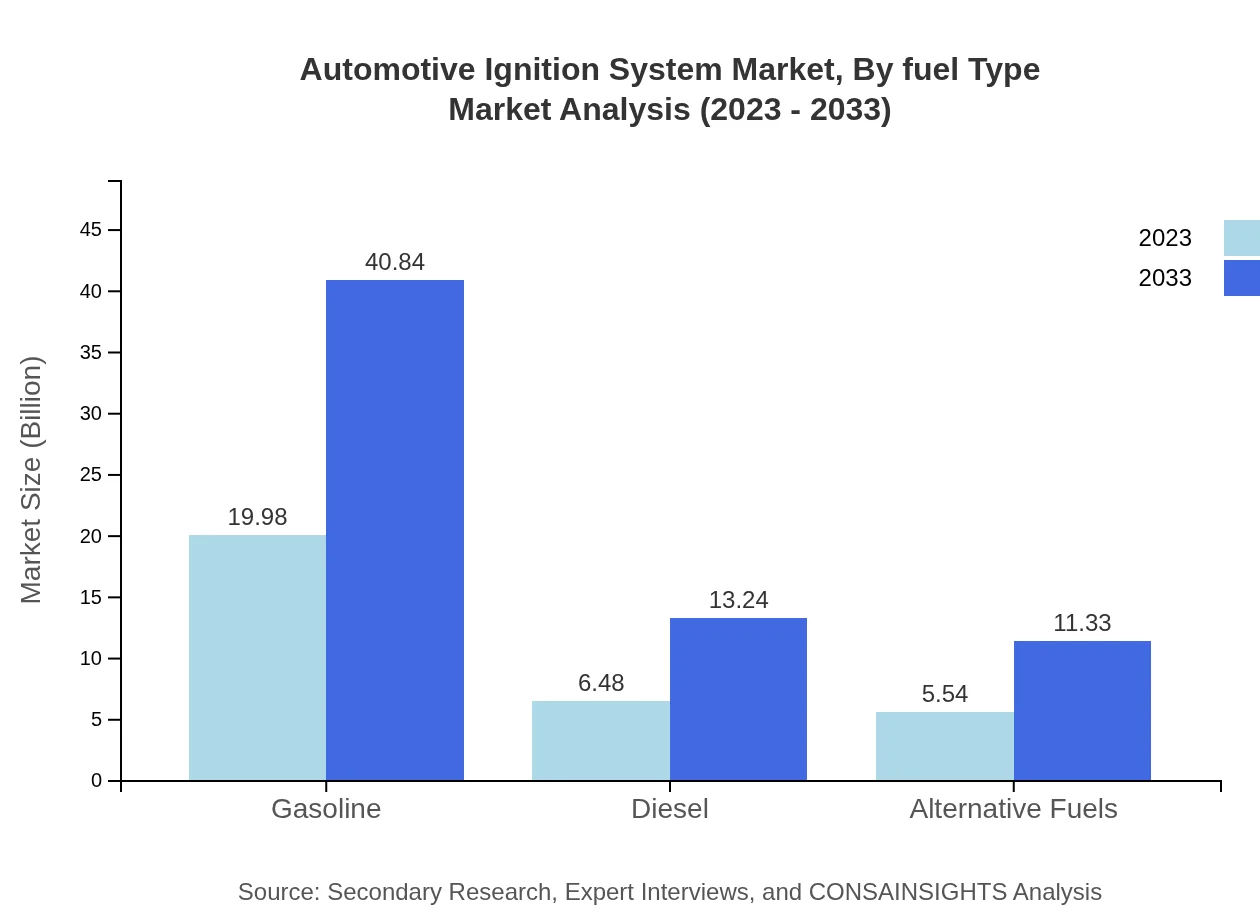

Automotive Ignition System Market Analysis By Fuel Type

In terms of fuel type, gasoline accounts for the largest share, valued at $19.98 billion in 2023 and expected to hit $40.84 billion by 2033, representing 62.44% of the market. Diesel ignitions are valued at $6.48 billion and expected to rise to $13.24 billion (20.24% share), while alternative fuels, starting at $5.54 billion, are set to grow to $11.33 billion holding a 17.32% market share.

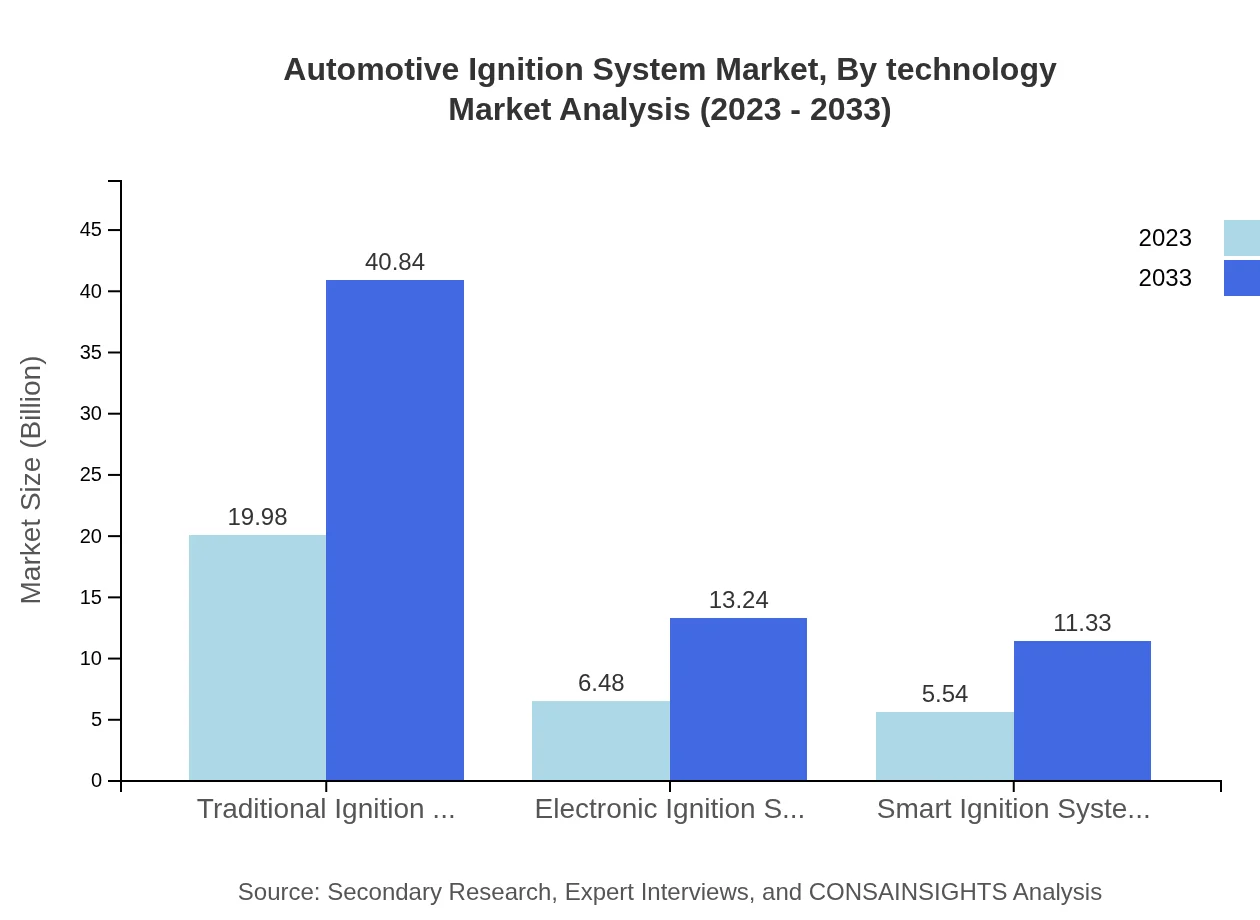

Automotive Ignition System Market Analysis By Technology

Traditional ignition systems still hold a considerable market presence with a size of $19.98 billion, projected to grow to $40.84 billion by 2033 (62.44% share). Electronic ignition systems are valued at $6.48 billion, expanding to $13.24 billion with a 20.24% market share, and smart ignition systems represent $5.54 billion in 2023 with projections of $11.33 billion (17.32% share) by 2033.

Automotive Ignition System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Ignition System Industry

Robert Bosch GmbH:

A leading global supplier of automotive components, Bosch specializes in ignition systems, offering advanced solutions for fuel efficiency and emissions reduction.Denso Corporation:

Denso is a prominent player in the automotive industry, focusing on ignition systems, with a commitment to sustainability and innovative technology.NGK Spark Plug Co., Ltd.:

A well-known manufacturer of spark plugs and ignition components, NGK provides high-quality products that enhance vehicle performance.Delphi Technologies:

Delphi specializes in electrical and electronic components, including ignition systems, contributing to enhanced vehicle efficiency.Federal-Mogul Corporation:

Federal-Mogul, part of Tenneco, is a renowned supplier of ignition systems and components, focusing on performance and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive ignition system?

The global automotive ignition system market is projected to reach $32 billion by 2033, with a compound annual growth rate (CAGR) of 7.2% from 2023. This growth reflects increased demand for efficient ignition technologies in vehicles.

What are the key market players or companies in this automotive ignition system industry?

Key players in the automotive ignition system market include Bosch, DENSO, NGK Spark Plug, and Delphi Technologies. These companies are leaders in technology development and supply ignition components for various vehicle types.

What are the primary factors driving the growth in the automotive ignition system industry?

Growth drivers include rising vehicle production, increasing demand for advanced ignition technologies, and the transition towards electric and hybrid vehicles that require efficient ignition systems for optimal performance.

Which region is the fastest Growing in the automotive ignition system?

North America is the fastest-growing region, with a market size projected to increase from $11.69 billion in 2023 to $23.89 billion by 2033. This growth is fueled by increased automotive production and technological advancements.

Does ConsaInsights provide customized market report data for the automotive ignition system industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing detailed insights and analysis that address unique business challenges within the automotive ignition system industry.

What deliverables can I expect from this automotive ignition system market research project?

Expect deliverables such as comprehensive market reports, trend analysis, competitive landscape assessments, forecasts, and insights into consumer preferences and technological developments in the ignition system market.

What are the market trends of automotive ignition system?

Current market trends include the shift toward smart ignition systems, increased focus on fuel efficiency, and the integration of digital technologies to enhance vehicle performance and reliability.