Automotive Interior Components Market Report

Published Date: 31 January 2026 | Report Code: automotive-interior-components

Automotive Interior Components Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Interior Components market, spanning a forecast period from 2023 to 2033. It includes insights on market size, segmentation, regional analysis, industry trends, and profiles of key global players.

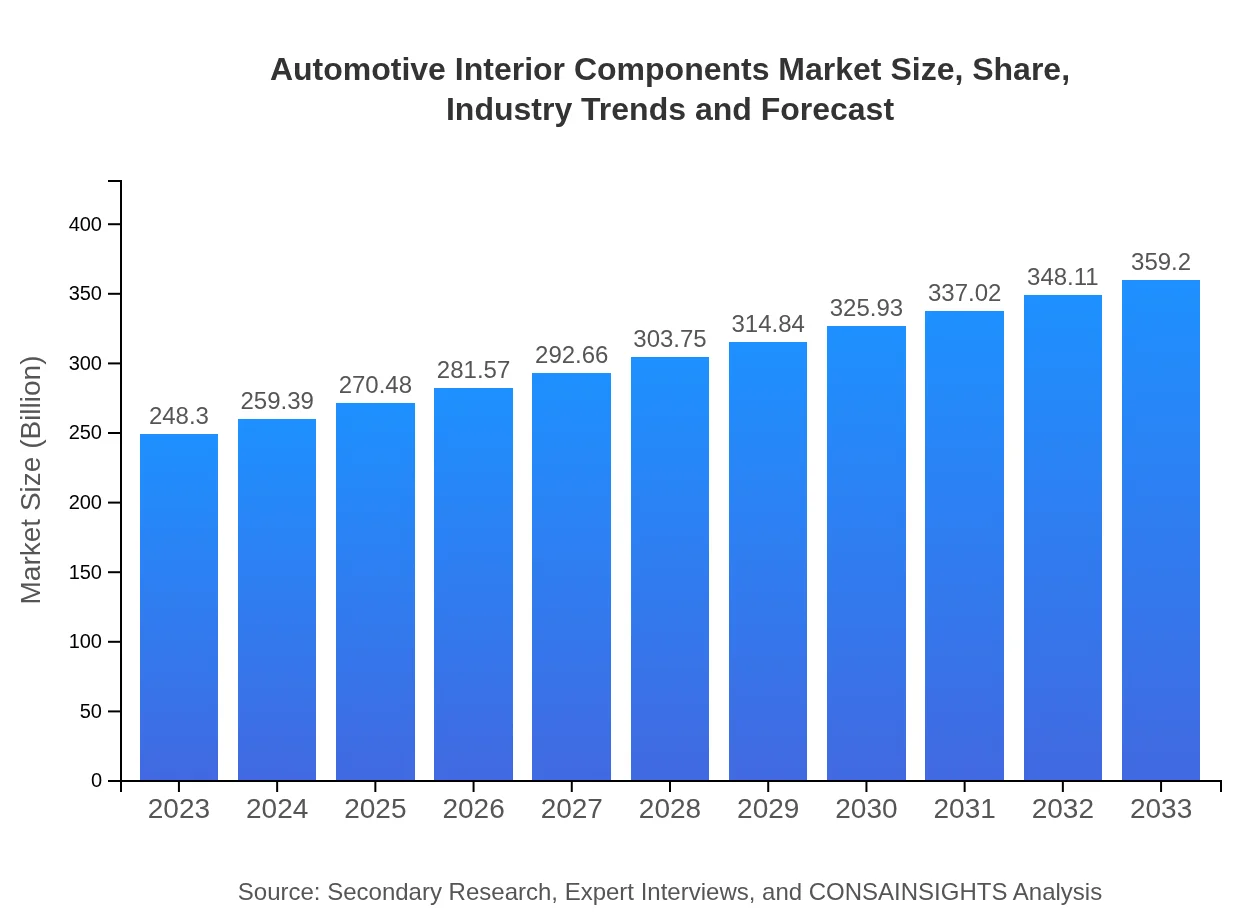

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $248.30 Billion |

| CAGR (2023-2033) | 3.7% |

| 2033 Market Size | $359.20 Billion |

| Top Companies | Lear Corporation, Adient plc, BorgWarner Inc., Magna International Inc. |

| Last Modified Date | 31 January 2026 |

Automotive Interior Components Market Overview

Customize Automotive Interior Components Market Report market research report

- ✔ Get in-depth analysis of Automotive Interior Components market size, growth, and forecasts.

- ✔ Understand Automotive Interior Components's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Interior Components

What is the Market Size & CAGR of Automotive Interior Components market in 2023?

Automotive Interior Components Industry Analysis

Automotive Interior Components Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Interior Components Market Analysis Report by Region

Europe Automotive Interior Components Market Report:

The European market for automotive interiors is projected to increase from $76.10 billion in 2023 to $110.10 billion by 2033. The adoption of advanced safety materials and the push for sustainable components are major growth factors in this mature market.Asia Pacific Automotive Interior Components Market Report:

In 2023, the Asia-Pacific market for automotive interior components is valued at $49.06 billion and is projected to rise to $70.98 billion by 2033. This region is witnessing rapid growth thanks to the increasing production of automobiles, rising disposable incomes, and a burgeoning consumer market for luxury and technologically advanced vehicle interiors.North America Automotive Interior Components Market Report:

In North America, the automotive interior components market is valued at $84.72 billion in 2023 and is anticipated to grow to $122.56 billion by 2033. The region is characterized by high consumer spending on vehicles, coupled with strong regulatory requirements aimed at enhancing safety and emissions reduction.South America Automotive Interior Components Market Report:

The South American automotive interior components market is valued at $17.60 billion in 2023, expected to expand to $25.47 billion by 2033. Growth in this region is driven by improvements in manufacturing capabilities and growth in urbanization, prompting demand for better vehicle interiors.Middle East & Africa Automotive Interior Components Market Report:

The Middle East and Africa market is valued at $20.81 billion in 2023, with expectations to reach $30.10 billion by 2033. Growth in this region is largely supported by increasing investments in automotive manufacturing facilities and a growing emphasis on personal luxury vehicles.Tell us your focus area and get a customized research report.

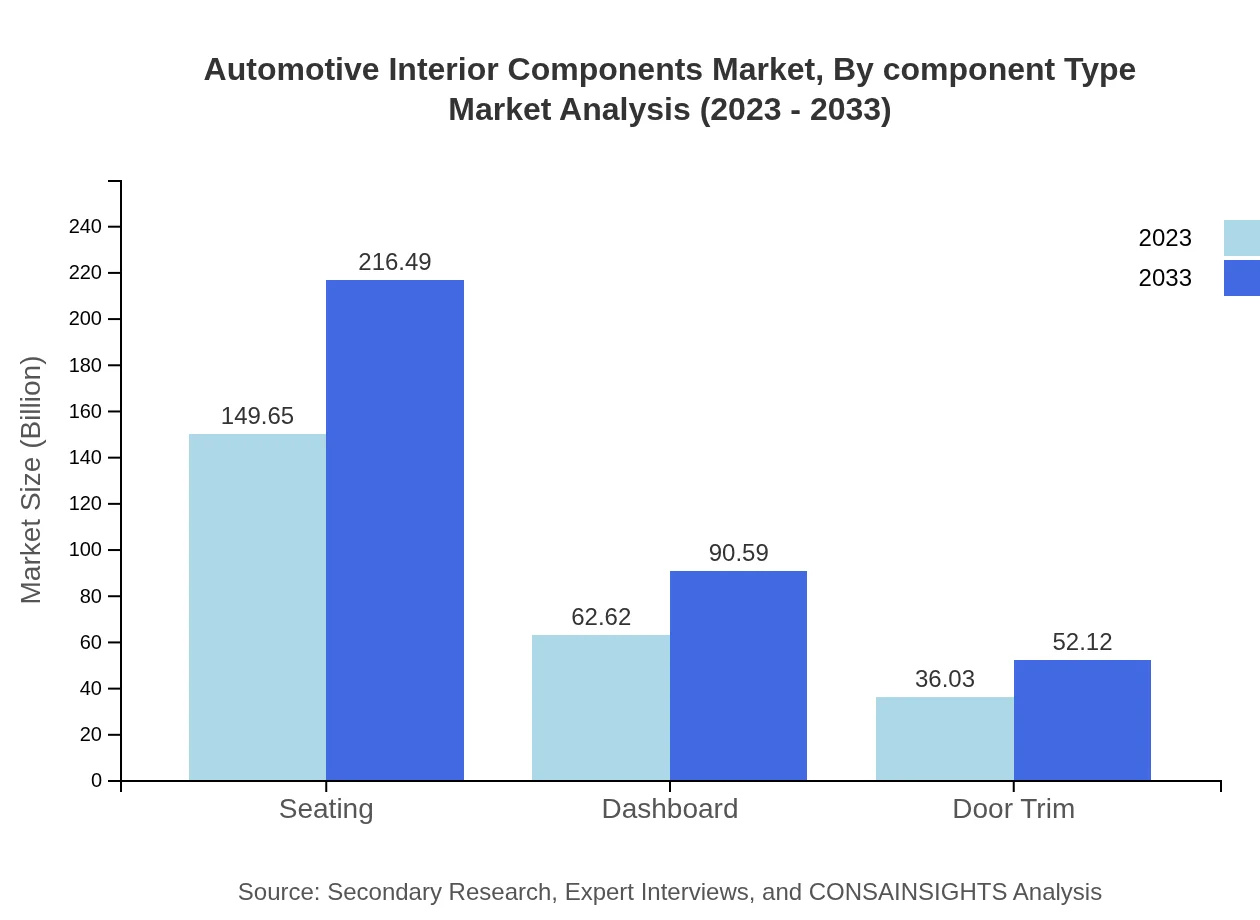

Automotive Interior Components Market Analysis By Component Type

The analysis of the Automotive Interior Components market by component type reveals significant variations in market size. In 2023, the seating segment is valued at $149.65 billion, expected to reach $216.49 billion by 2033. Dashboard components are currently valued at $62.62 billion, poised to grow to $90.59 billion, highlighting the increasing emphasis on multifunctional and tech-integrated dashboards.

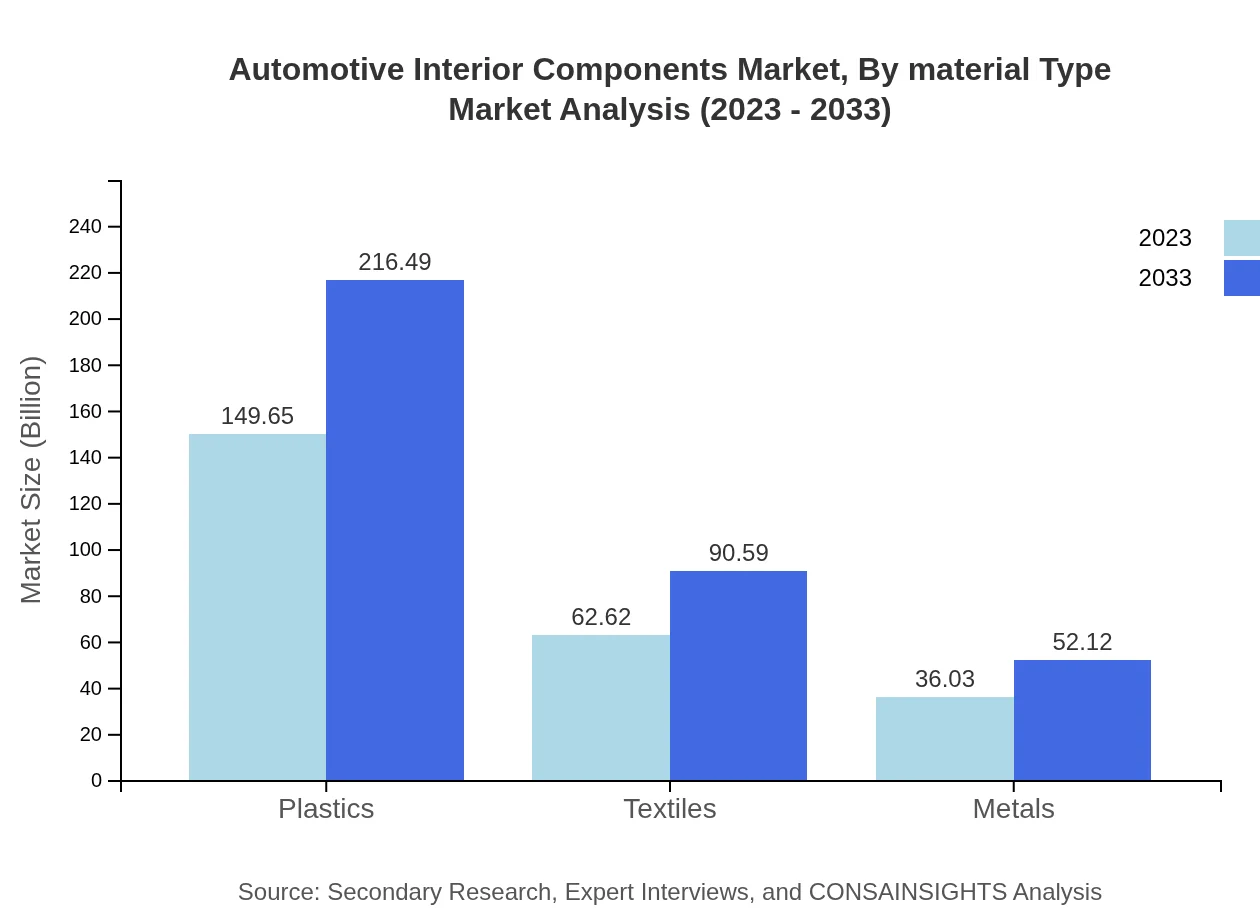

Automotive Interior Components Market Analysis By Material Type

Materials used in automotive interiors are categorized into plastics, textiles, metals, and eco-friendly materials. Plastics dominate the segment with a market share valued at $149.65 billion in 2023, growing to $216.49 billion by 2033. The textile segment is anticipated to see growth from $62.62 billion to $90.59 billion, reflecting trends towards comfortable, high-quality materials.

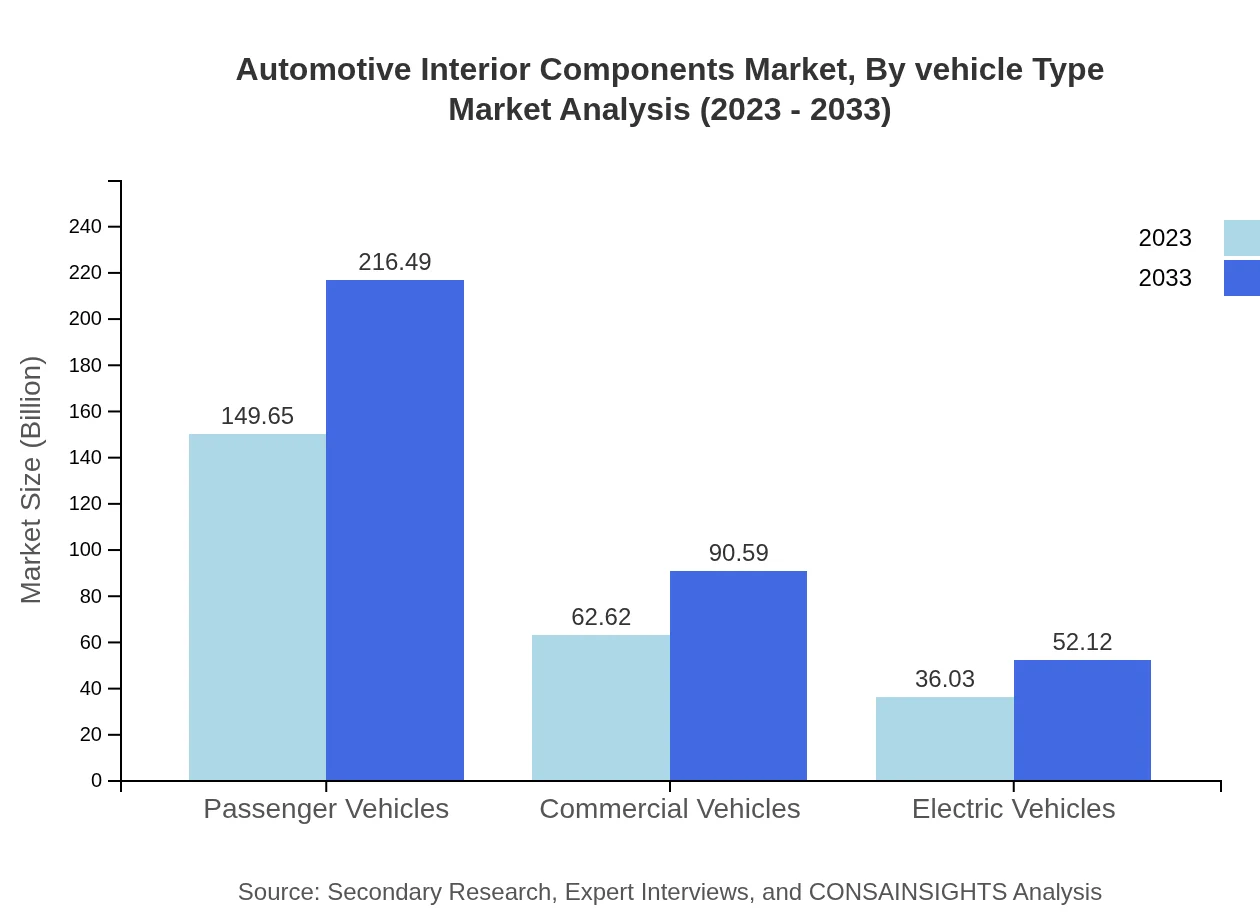

Automotive Interior Components Market Analysis By Vehicle Type

The market segmentation by vehicle type shows that passenger vehicles account for a significant share, with a market size of $149.65 billion in 2023, expected to increase to $216.49 billion by 2033. Commercial vehicles follow with a market of $62.62 billion, forecasted to rise to $90.59 billion, fueled by growing logistics and transportation requirements.

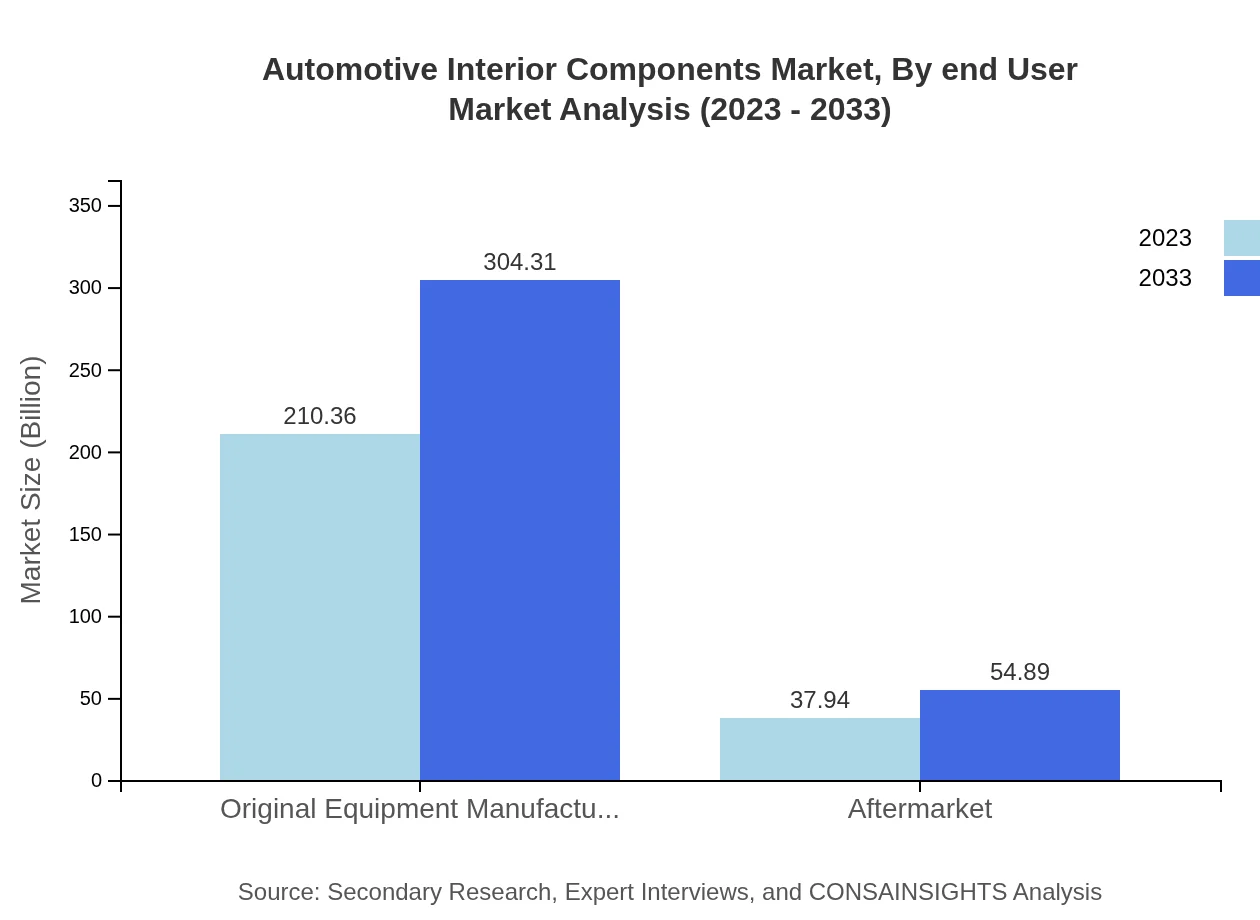

Automotive Interior Components Market Analysis By End User

The end-user market is divided largely between OEMs and the aftermarket. OEMs hold a dominant position with a market of $210.36 billion in 2023, expanding to $304.31 billion by 2033. The aftermarket is anticipated to experience growth as well, from $37.94 billion to $54.89 billion, as vehicle aging and customization trends drive demand.

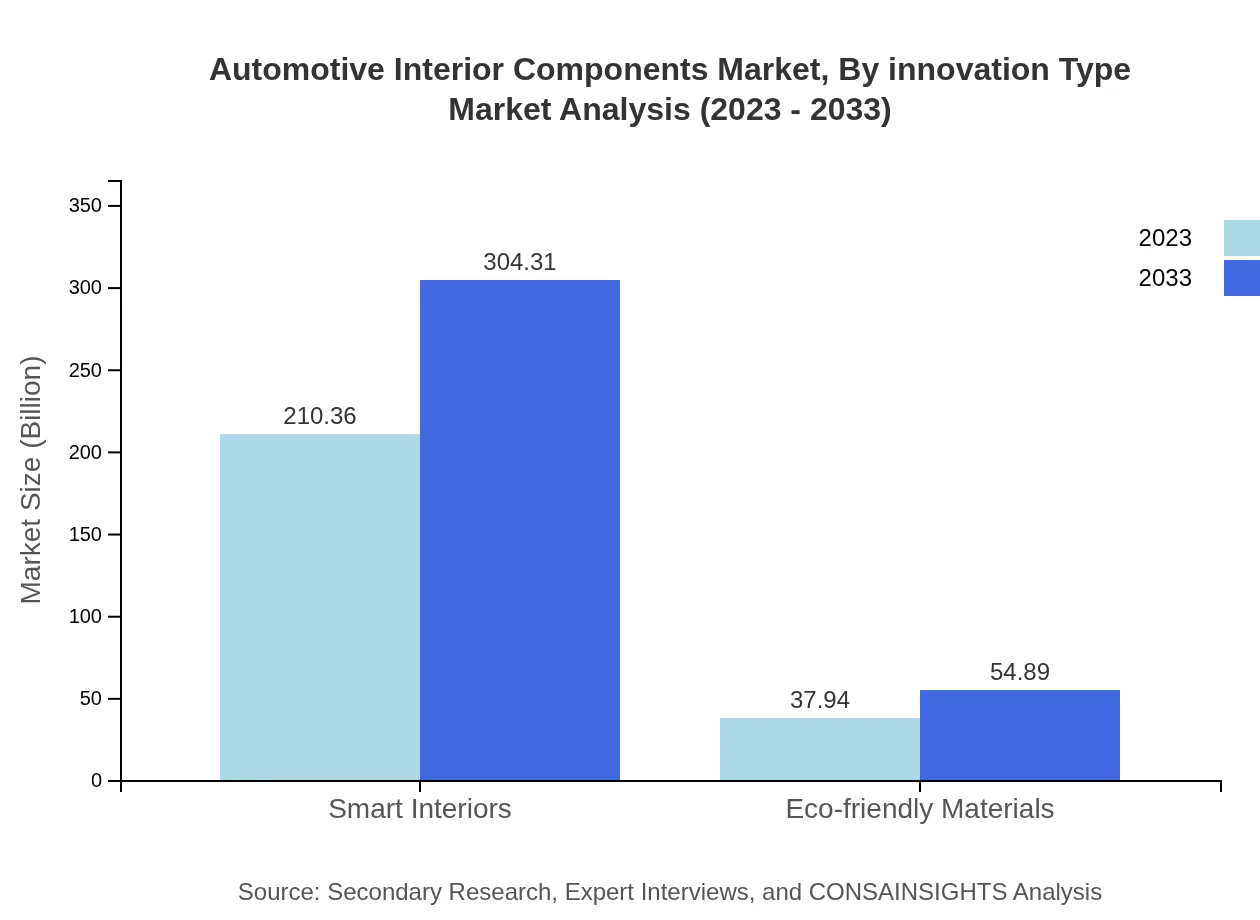

Automotive Interior Components Market Analysis By Innovation Type

Innovations such as smart interiors and eco-friendly materials are shaping the future of automotive interiors. Smart interiors are projected to see continuous growth, with advancements in connectivity and driver assistance technologies. Eco-friendly materials are also on the rise, with a shift towards sustainable options as consumers become more environmentally conscious.

Automotive Interior Components Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Interior Components Industry

Lear Corporation:

A global leader in automotive seating and electrical systems, Lear Corporation focuses on innovations in sustainable solutions and advanced materials for enhanced vehicle interiors.Adient plc:

Known for its industry-leading seating solutions, Adient emphasizes manufacturing excellence and innovative designs that improve both comfort and functionality in vehicle interiors.BorgWarner Inc.:

BorgWarner provides advanced technologies for fuel-efficient and intelligent products, playing a significant role in the automotive interior components market with smart solutions.Magna International Inc.:

Magna is a key player offering a comprehensive range of automotive components, including modular and integrated solutions that cater to modern vehicle design requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive interior components?

The automotive interior components market is valued at approximately $248.3 billion in 2023, with a projected CAGR of 3.7%, indicating steady growth as the automotive industry evolves over the next decade.

What are the key market players or companies in the automotive interior components industry?

Key players in the automotive interior components market include globally recognized manufacturers such as Lear Corporation, Adient, Yanfeng Automotive Interiors, and Faurecia, who are known for innovative designs and sustainable production practices.

What are the primary factors driving the growth in the automotive interior components industry?

Growth in the automotive interior components market is driven by rising consumer demand for comfort and customization, advancements in technology, the push for sustainability, and the increasing production of electric and hybrid vehicles.

Which region is the fastest Growing in the automotive interior components market?

North America is the fastest-growing region in the automotive interior components market, with a market size projected to rise from $84.72 billion in 2023 to $122.56 billion by 2033, reflecting a strong automotive sector.

Does ConsaInsights provide customized market report data for the automotive interior components industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the automotive interior components industry, helping clients access relevant data and insights for decision-making.

What deliverables can I expect from this automotive interior components market research project?

Clients can expect comprehensive market analysis reports, segmented data, trend insights, and forecasts that cover regions and key players in the automotive interior components market, aiding strategic planning.

What are the market trends of automotive interior components?

Trends in the automotive interior components market include a shift towards eco-friendly materials, increased demand for smart interiors, and the integration of technology for enhanced user experiences, particularly in passenger vehicles.