Automotive Lead Acid Batteries Market Report

Published Date: 02 February 2026 | Report Code: automotive-lead-acid-batteries

Automotive Lead Acid Batteries Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Lead Acid Batteries market from 2023 to 2033, including market size, segmentation, regional insights, trends, and forecasts that will guide stakeholders in their strategic planning.

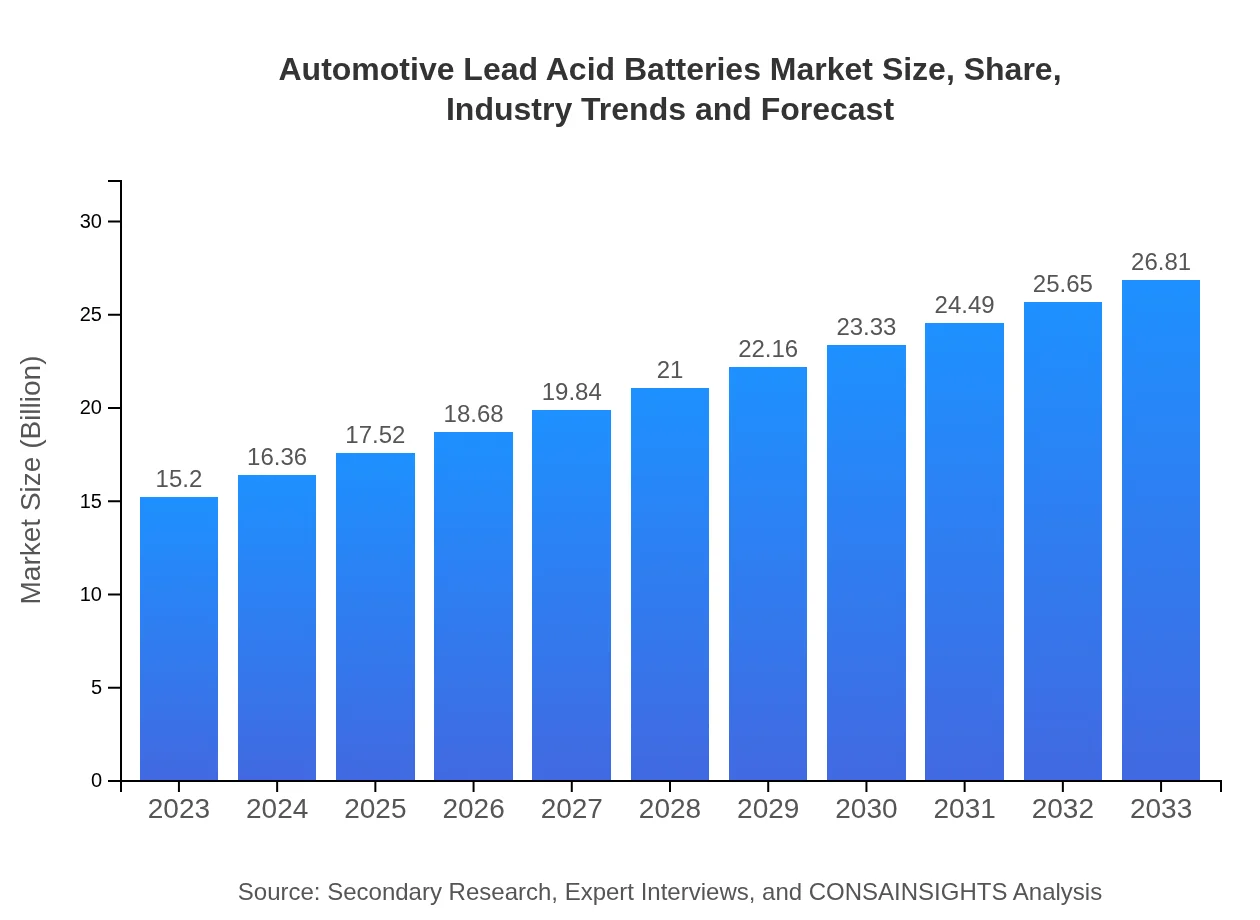

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $26.81 Billion |

| Top Companies | Exide Technologies, Johnson Controls, Yuasa, Bosch, Duracell |

| Last Modified Date | 02 February 2026 |

Automotive Lead Acid Batteries Market Overview

Customize Automotive Lead Acid Batteries Market Report market research report

- ✔ Get in-depth analysis of Automotive Lead Acid Batteries market size, growth, and forecasts.

- ✔ Understand Automotive Lead Acid Batteries's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Lead Acid Batteries

What is the Market Size & CAGR of Automotive Lead Acid Batteries market in 2023?

Automotive Lead Acid Batteries Industry Analysis

Automotive Lead Acid Batteries Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Lead Acid Batteries Market Analysis Report by Region

Europe Automotive Lead Acid Batteries Market Report:

Europe's market is growing steadily, starting at USD 3.76 billion in 2023 and projected to reach USD 6.63 billion by 2033. The implementation of stringent environmental regulations is motivating manufacturers to enhance battery efficiency, thus supporting market growth.Asia Pacific Automotive Lead Acid Batteries Market Report:

The Asia Pacific region is projected to experience significant growth, driven by rapidly expanding automotive production and increasing vehicle sales. In 2023, the market size in this region is estimated at USD 3.06 billion, expected to grow to USD 5.40 billion by 2033. Major countries contributing to this growth include China and India, where automotive manufacturing is on the rise.North America Automotive Lead Acid Batteries Market Report:

North America remains a significant market for Automotive Lead Acid Batteries, with a projected size of USD 5.67 billion in 2023, reaching USD 9.99 billion by 2033. This growth is primarily influenced by the strong automotive sector in the United States and ongoing technological advancements in battery manufacturing.South America Automotive Lead Acid Batteries Market Report:

The South American market for Automotive Lead Acid Batteries is relatively smaller, with a size of USD 1.23 billion in 2023, growing to an estimated USD 2.17 billion by 2033. The growth in this region is primarily fueled by increased vehicle ownership rates, particularly in Brazil and Argentina.Middle East & Africa Automotive Lead Acid Batteries Market Report:

The Middle East and Africa region has a market size of USD 1.48 billion in 2023, with growth expected to USD 2.61 billion by 2033. Increased investments in infrastructure, along with rising automotive sales, are key factors in this region's market potential.Tell us your focus area and get a customized research report.

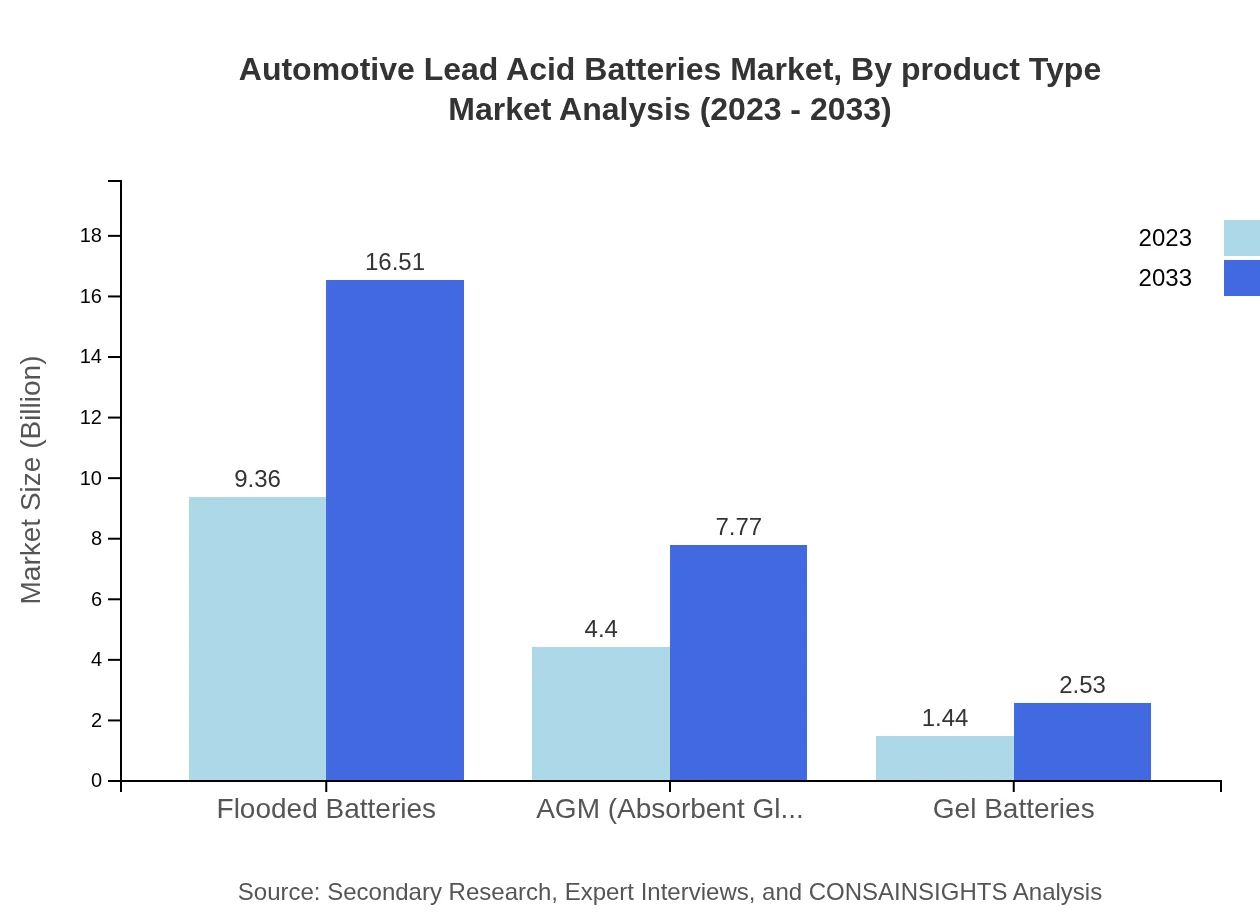

Automotive Lead Acid Batteries Market Analysis By Product Type

The Automotive Lead Acid Batteries market, categorized by product type, includes Conventional Lead Acid Batteries, AGM Batteries, and Gel Batteries. As of 2023, the conventional batteries dominate with a market size of USD 13.15 billion and a market share of 86.52%. AGM Batteries follow with a size of USD 4.40 billion (28.97% share), while Gel Batteries account for USD 1.44 billion (9.45% share).

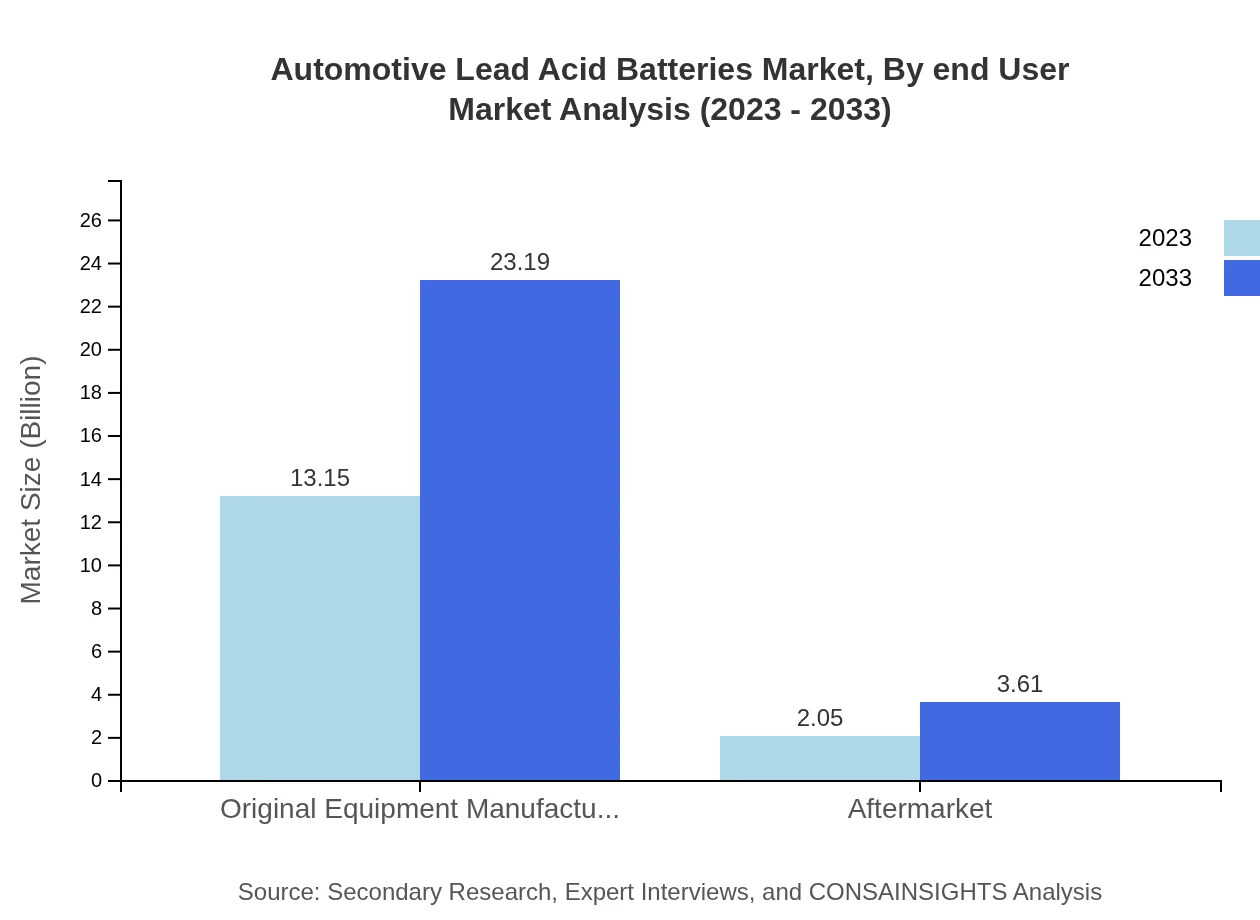

Automotive Lead Acid Batteries Market Analysis By End User

The essential segments categorized by end-users include OEMs and the aftermarket. The OEM segment holds a significant share with a market size of USD 13.15 billion (86.52% share) in 2023, projected to grow to USD 23.19 billion by 2033. The aftermarket is smaller, starting at USD 2.05 billion (13.48% share) and expanding to USD 3.61 billion by 2033.

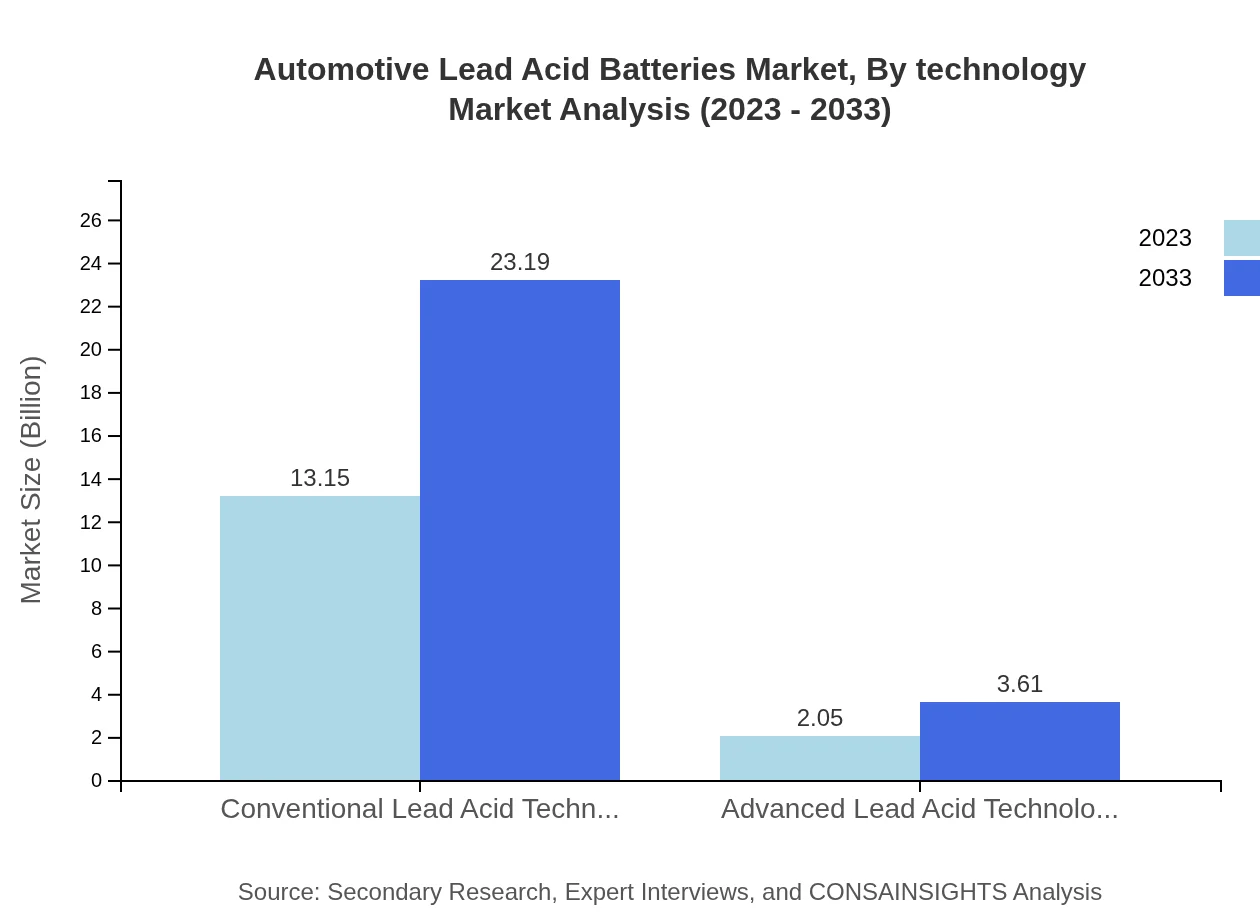

Automotive Lead Acid Batteries Market Analysis By Technology

Technologies in the Automotive Lead Acid Batteries market include Conventional Lead Acid Technology and Advanced Lead Acid Technology. The conventional segment leads with a 2023 market size of USD 13.15 billion (86.52% share), while advanced options total USD 2.05 billion (13.48% share). Both segments are expected to show promising growth trajectories.

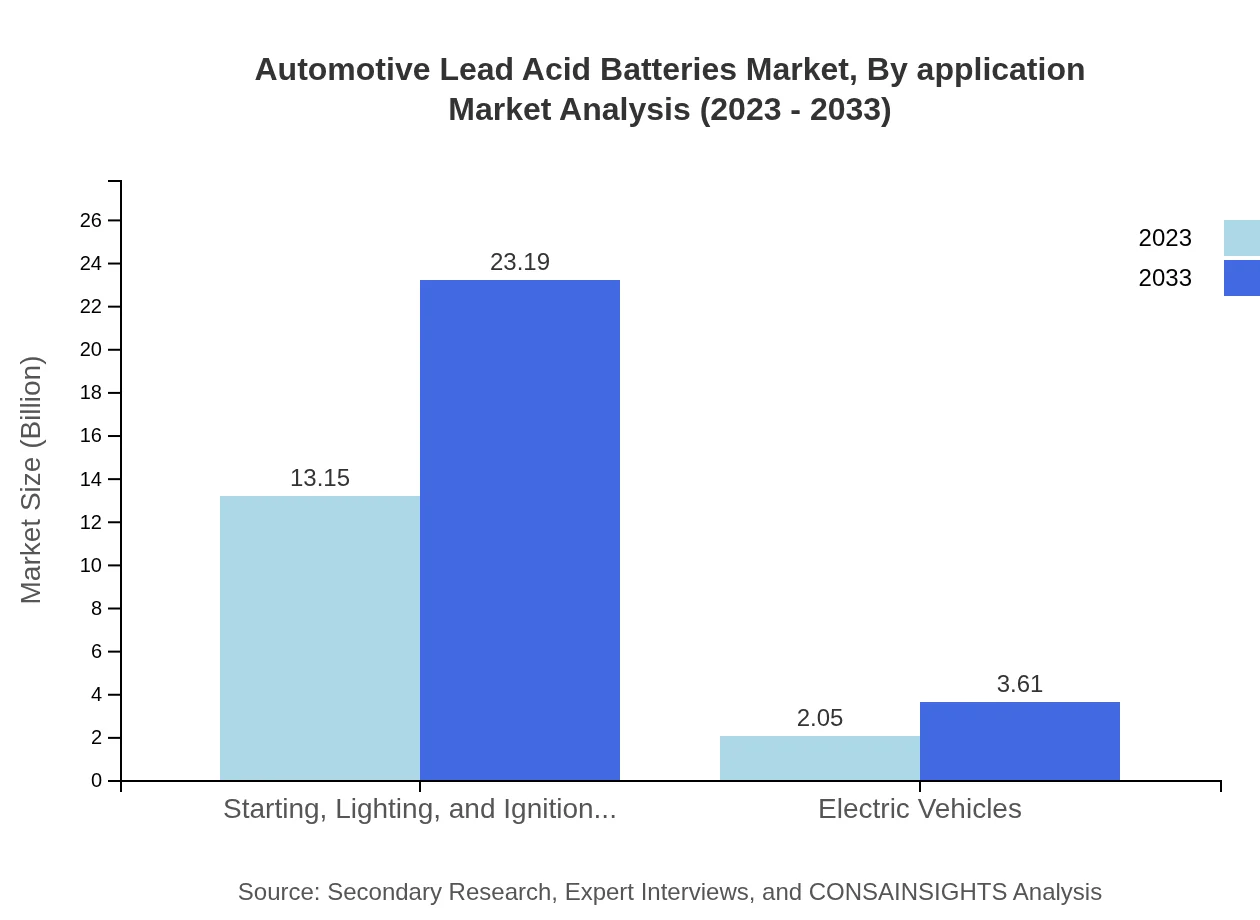

Automotive Lead Acid Batteries Market Analysis By Application

The primary application area for Automotive Lead Acid Batteries is in Starting, Lighting, and Ignition (SLI) systems, which account for USD 13.15 billion (86.52% share) in 2023. The Electric Vehicle segment represents a growing market of USD 2.05 billion (13.48%), indicating a shift in automotive technology.

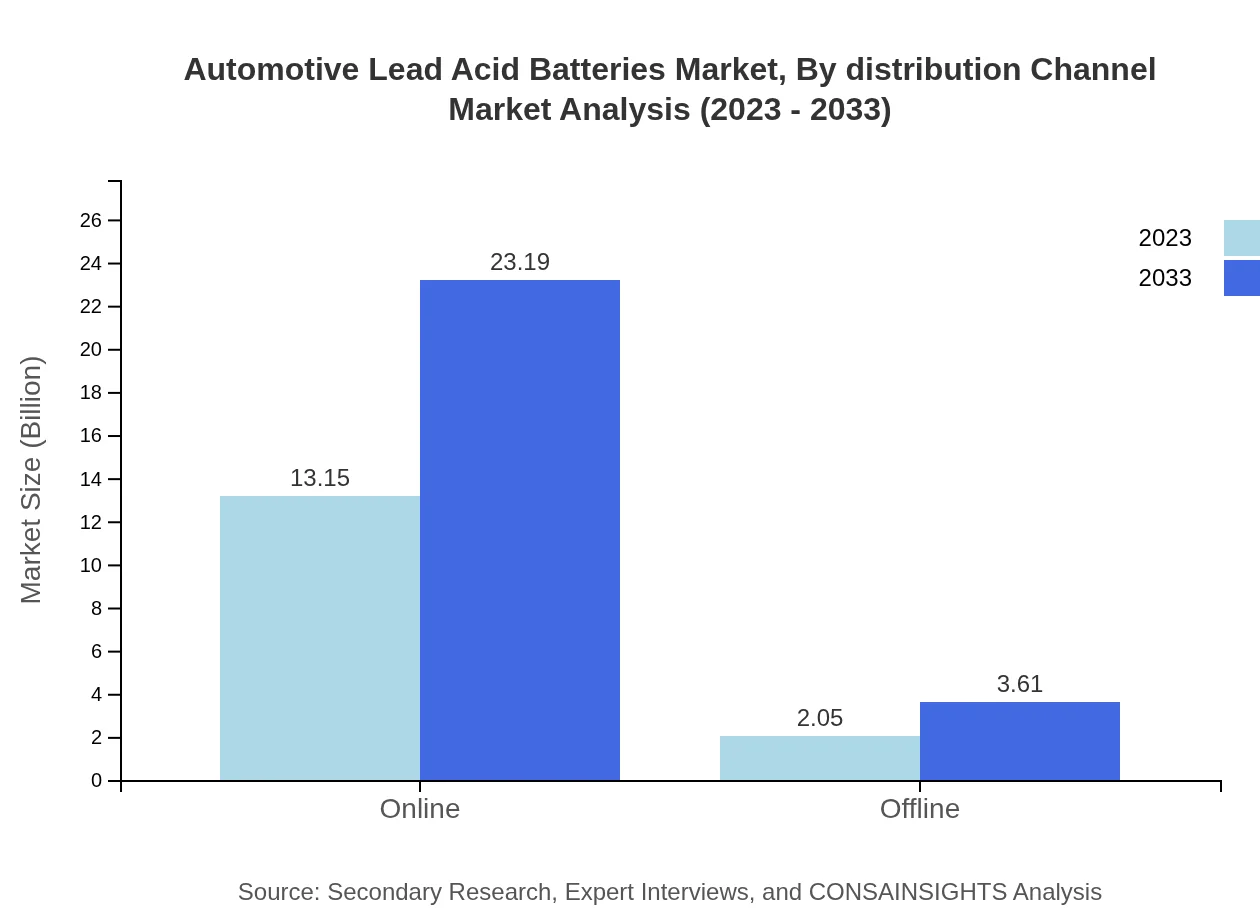

Automotive Lead Acid Batteries Market Analysis By Distribution Channel

Distribution channels for Automotive Lead Acid Batteries include online and offline sales. The online channel commands a significant portion of the market with USD 13.15 billion (86.52% share), while offline distribution covers USD 2.05 billion (13.48% share).

Automotive Lead Acid Batteries Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Lead Acid Batteries Industry

Exide Technologies:

Exide Technologies is a leading manufacturer of lead-acid batteries, providing a wide range of automotive batteries for OEMs and the aftermarket, focusing on innovative battery technologies.Johnson Controls:

Johnson Controls, a global leader in secure battery solutions, offers automotive lead-acid batteries and has a strong market presence due to its extensive distribution channels and product portfolio.Yuasa:

GS Yuasa Corporation specializes in high-performance lead-acid batteries for automotive applications, renowned for its commitment to sustainability and advancements in battery technology.Bosch:

Robert Bosch GmbH is recognized for manufacturing reliable automotive batteries, including lead-acid variants, while emphasizing innovation and commitment to environmental standards.Duracell:

Duracell, while primarily known for consumer batteries, has expanded into the automotive sector providing reliable lead-acid battery solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive lead acid batteries?

The global automotive lead acid batteries market is valued at approximately $15.2 billion in 2023, with a projected CAGR of 5.7% from 2023 to 2033, indicating significant growth potential in the coming years.

What are the key market players or companies in the automotive lead acid batteries industry?

Key players in the automotive lead acid batteries industry include well-established companies such as Exide Technologies, Johnson Controls, and Yuasa Battery. These companies dominate the market, leveraging advanced technology and extensive distribution networks.

What are the primary factors driving the growth in the automotive lead acid batteries industry?

Factors driving growth include the increasing demand for vehicles, the rise in electric vehicle production, and advancements in battery technology that enhance performance and durability, contributing to the market's expansion.

Which region is the fastest Growing in the automotive lead acid batteries?

North America emerges as the fastest-growing region, with its market projected to rise from $5.67 billion in 2023 to $9.99 billion by 2033, fueled by rising automotive production and a shift towards electric vehicles.

Does ConsaInsights provide customized market report data for the automotive lead acid batteries industry?

Yes, ConsaInsights offers tailored market report data specific to the automotive lead acid batteries industry, providing insights that meet unique client needs for better decision-making.

What deliverables can I expect from this automotive lead acid batteries market research project?

Deliverables typically include comprehensive reports containing market size, share analysis by segments, forecasts, regional analysis, and strategic insights that help inform businesses in decision-making.

What are the market trends of automotive lead acid batteries?

Trends in the automotive lead acid battery market include a shift towards more efficient technologies, increased use in electric vehicles, and growing adoption of AGM and flooded batteries due to their enhanced performance.