Automotive Lidar Market Report

Published Date: 02 February 2026 | Report Code: automotive-lidar

Automotive Lidar Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Automotive Lidar market, covering essential insights, trends, and forecasts for the period from 2023 to 2033. It examines market size, regional dynamics, and key players, along with technological advancements shaping the industry.

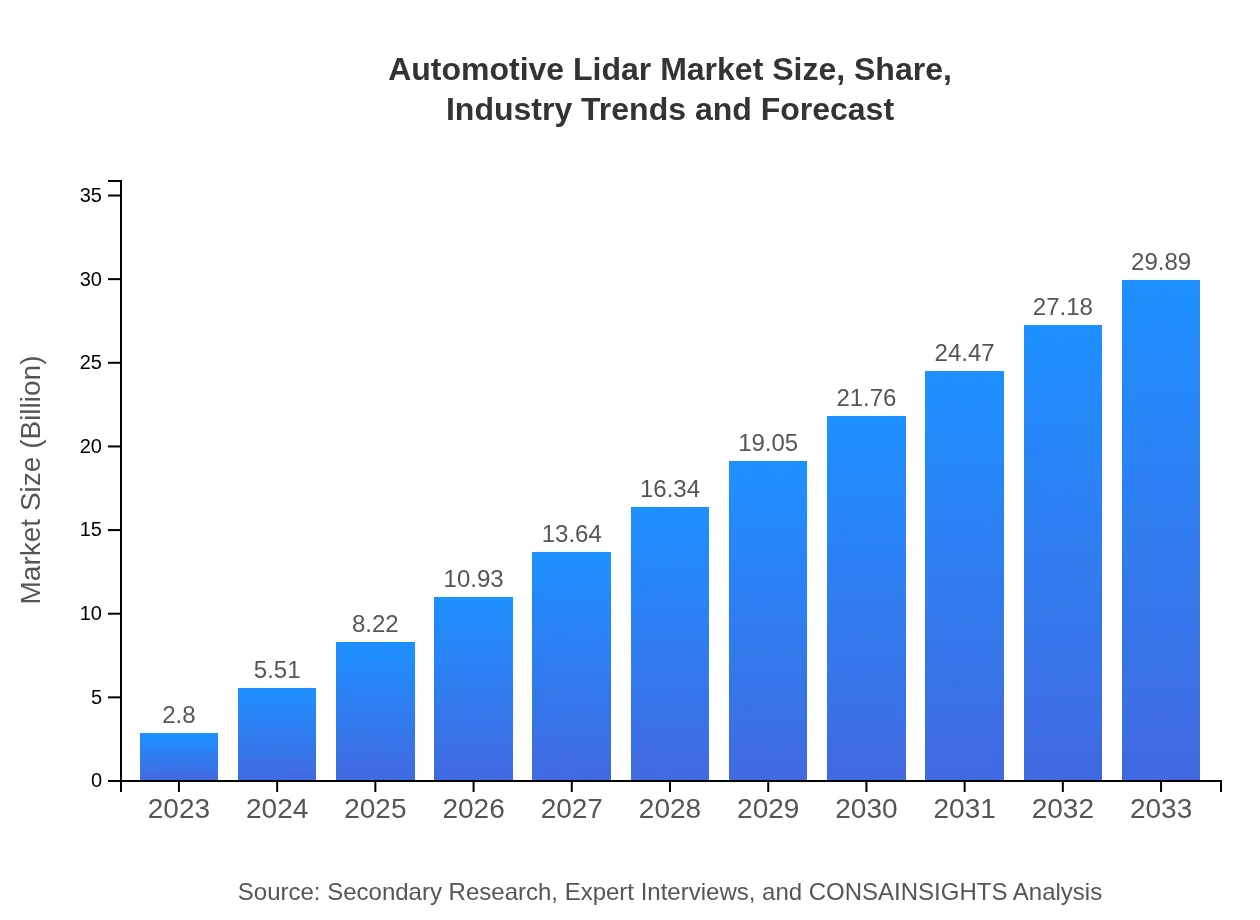

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.80 Billion |

| CAGR (2023-2033) | 25% |

| 2033 Market Size | $29.89 Billion |

| Top Companies | Velodyne Lidar, Inc., Luminar Technologies, Inc., Waymo (Alphabet Inc.), Aptiv PLC, Innoviz Technologies Ltd. |

| Last Modified Date | 02 February 2026 |

Automotive Lidar Market Overview

Customize Automotive Lidar Market Report market research report

- ✔ Get in-depth analysis of Automotive Lidar market size, growth, and forecasts.

- ✔ Understand Automotive Lidar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Lidar

What is the Market Size & CAGR of Automotive Lidar market in 2023?

Automotive Lidar Industry Analysis

Automotive Lidar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Lidar Market Analysis Report by Region

Europe Automotive Lidar Market Report:

Europe’s Automotive Lidar market is predicted to grow from USD 0.86 billion in 2023 to USD 9.19 billion by 2033. The high penetration of ADAS, stringent regulations promoting safety, and investments in smart mobility solutions across countries like Germany, France, and the UK underpin this robust growth.Asia Pacific Automotive Lidar Market Report:

In 2023, the Automotive Lidar market in Asia Pacific is estimated at USD 0.58 billion, projected to grow to USD 6.19 billion by 2033. The region's growth is driven by countries like China and Japan, leading in automotive innovations and adoption of smart transportation systems. Increasing urbanization and government initiatives to promote autonomous vehicles further fuel this expansion.North America Automotive Lidar Market Report:

North America, with an initial market size of USD 0.94 billion in 2023, is projected to attain USD 10.01 billion by 2033. The United States is leading the charge in Lidar adoption, particularly in the development of autonomous vehicles and smart infrastructure, driven by significant investments from tech companies and automotive giants.South America Automotive Lidar Market Report:

The South American market, valued at USD 0.26 billion in 2023, is forecasted to reach USD 2.80 billion by 2033. Brazil and Argentina are at the forefront of adopting automotive technologies. However, challenges such as infrastructure limitations and budget constraints may slightly hinder expansive growth, yet the potential for increased vehicle safety regulations presents opportunities.Middle East & Africa Automotive Lidar Market Report:

The Middle East and Africa market, starting at USD 0.16 billion in 2023, is expected to rise to USD 1.70 billion by 2033. Growth factors include increasing vehicle safety regulations and a burgeoning interest in autonomous vehicle technologies driven by Gulf countries, particularly in the UAE and Saudi Arabia.Tell us your focus area and get a customized research report.

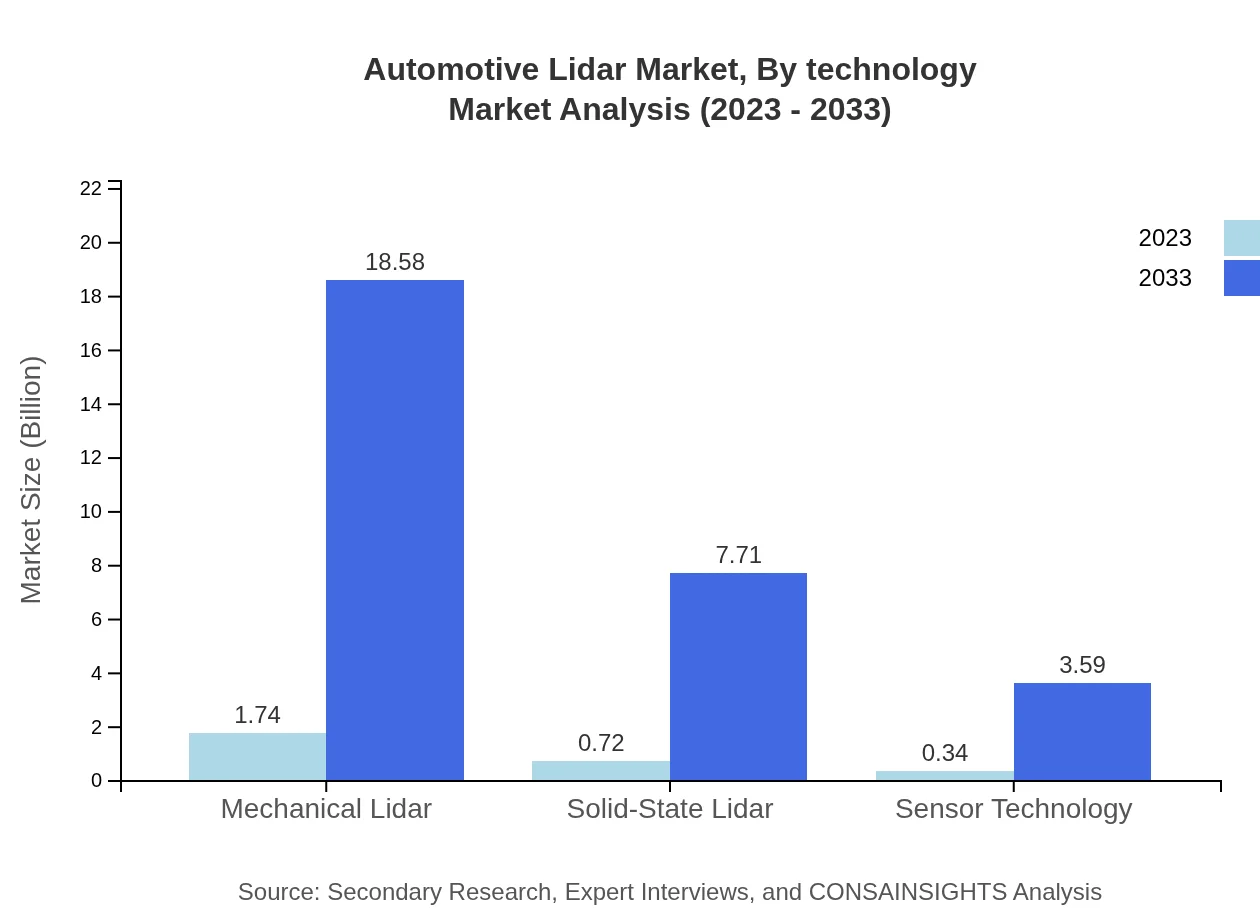

Automotive Lidar Market Analysis By Technology

The Automotive Lidar market by technology is dominated by Mechanical Lidar, significantly contributing to the market size at USD 1.74 billion in 2023 with a projected growth to USD 18.58 billion by 2033. In contrast, Solid-State Lidar starts at USD 0.72 billion and is expected to reach USD 7.71 billion during the same period, reflecting its growing importance in automotive applications due to its compact design and durability.

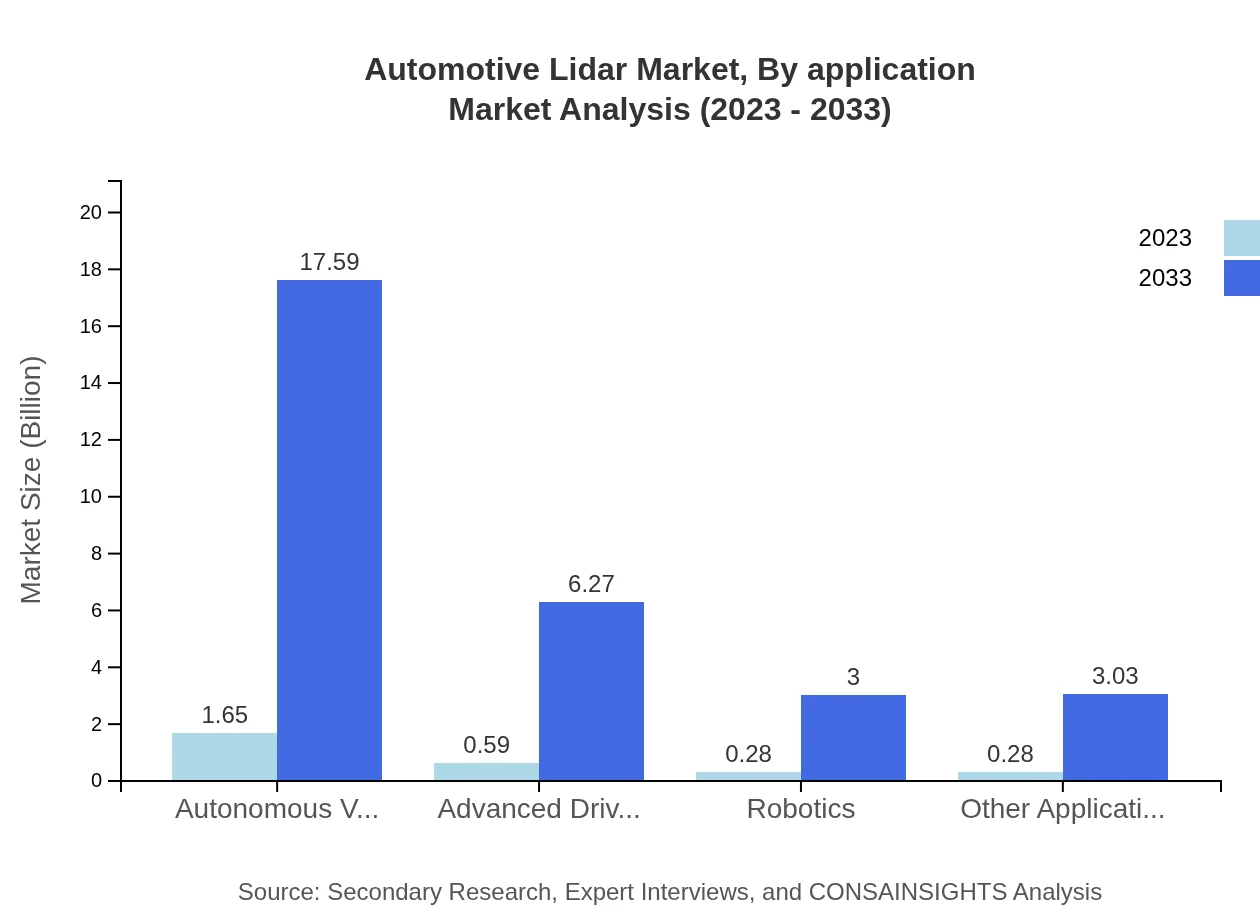

Automotive Lidar Market Analysis By Application

The principal application for Automotive Lidar is in Autonomous Vehicles, which holds a market share of 58.86% in 2023 and is projected to grow to 58.86% by 2033, representing a size increase from USD 1.65 billion to USD 17.59 billion. ADAS is a close second, growing from USD 0.59 billion to USD 6.27 billion, showing the rampant demand for safety technologies.

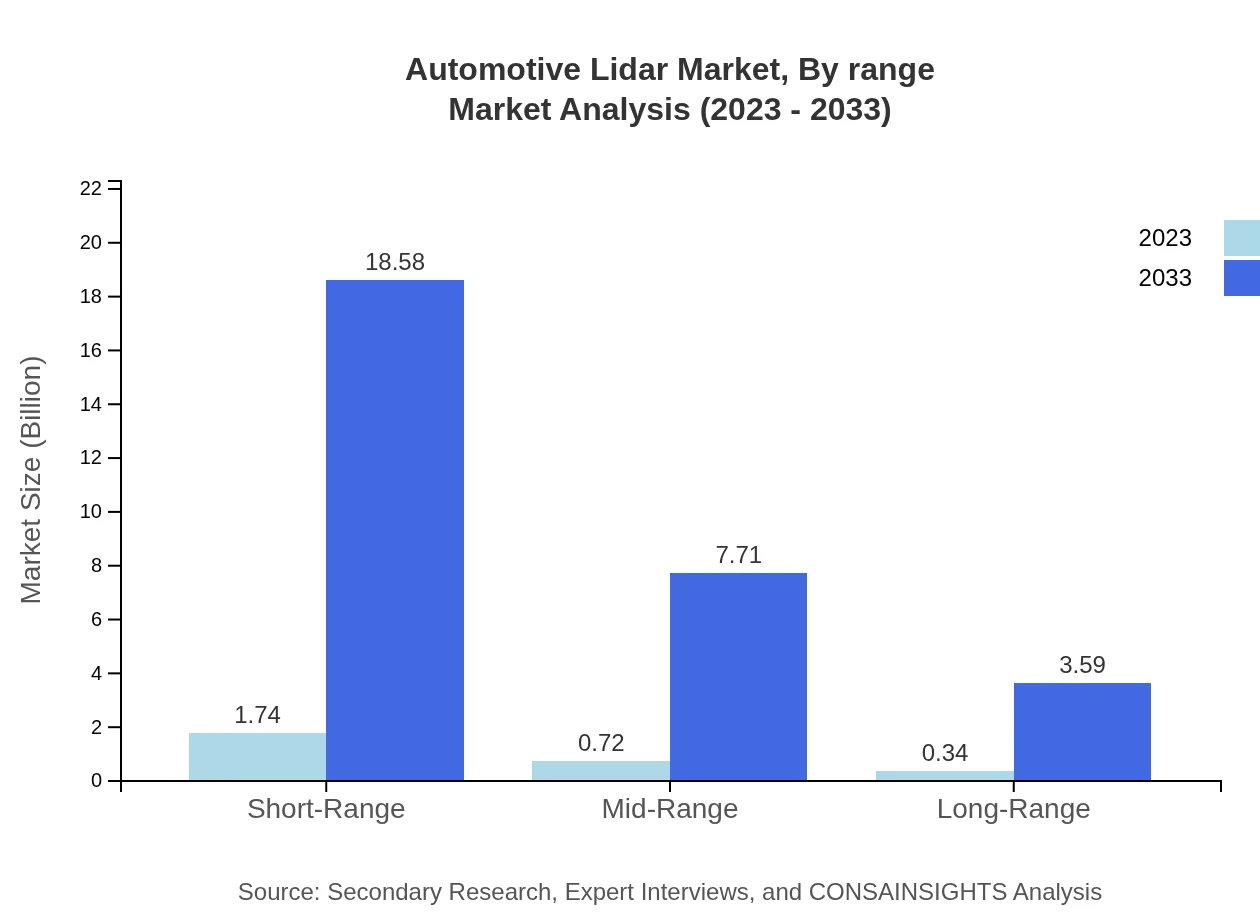

Automotive Lidar Market Analysis By Range

The market is segmented into Short-Range, Mid-Range, and Long-Range categories. Short-Range Lidar accounts for the largest size of USD 1.74 billion in 2023 with a forecast reaching USD 18.58 billion by 2033. Mid-Range and Long-Range Lidar show growth paths but hold smaller market shares, indicating specialization in their application and significant room for advancement.

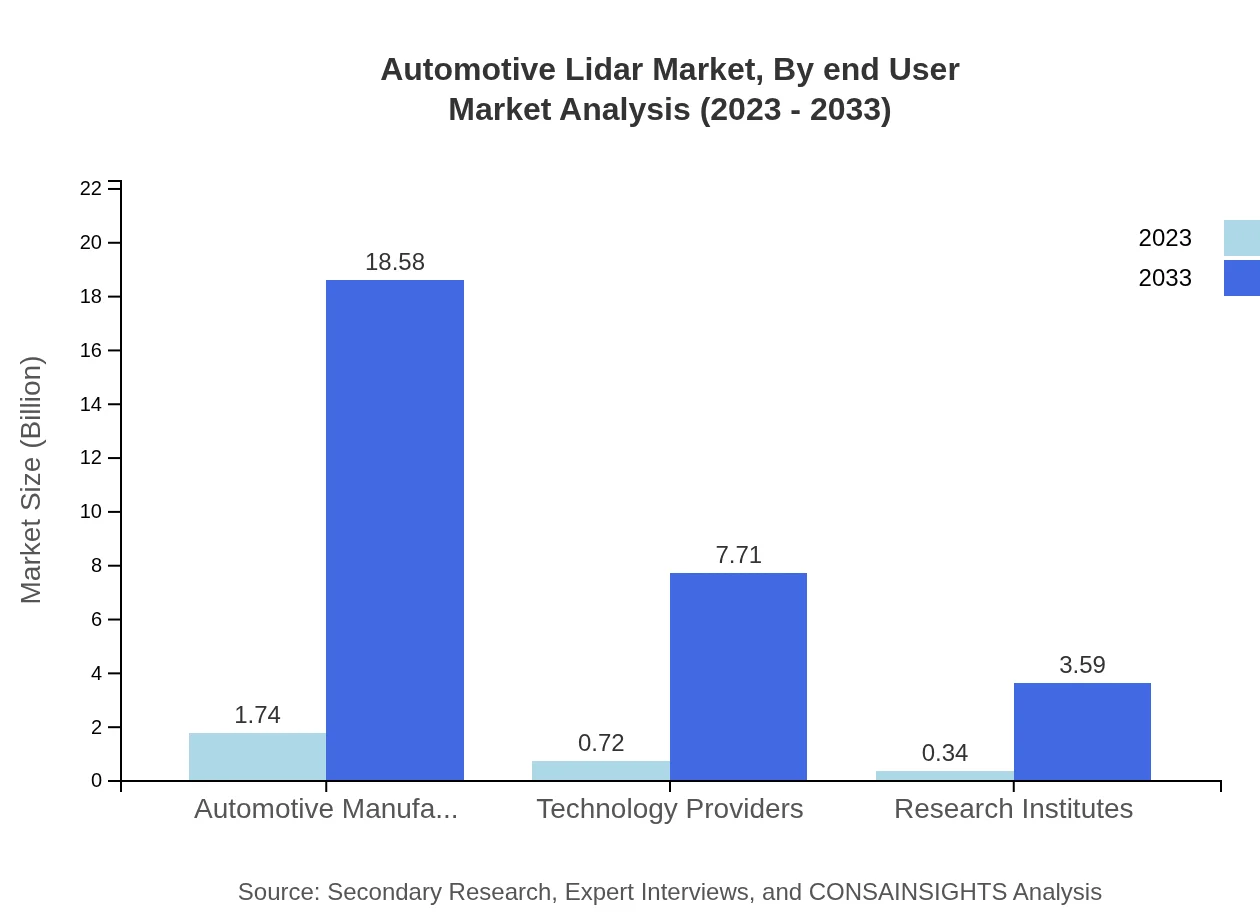

Automotive Lidar Market Analysis By End User

Major end-users in the Automotive Lidar market include Automotive Manufacturers, with a size of USD 1.74 billion projected to grow to USD 18.58 billion by 2033. Technology Providers also play a critical role with a projected growth trend from USD 0.72 billion to USD 7.71 billion, illustrating the vital collaboration with automotive firms.

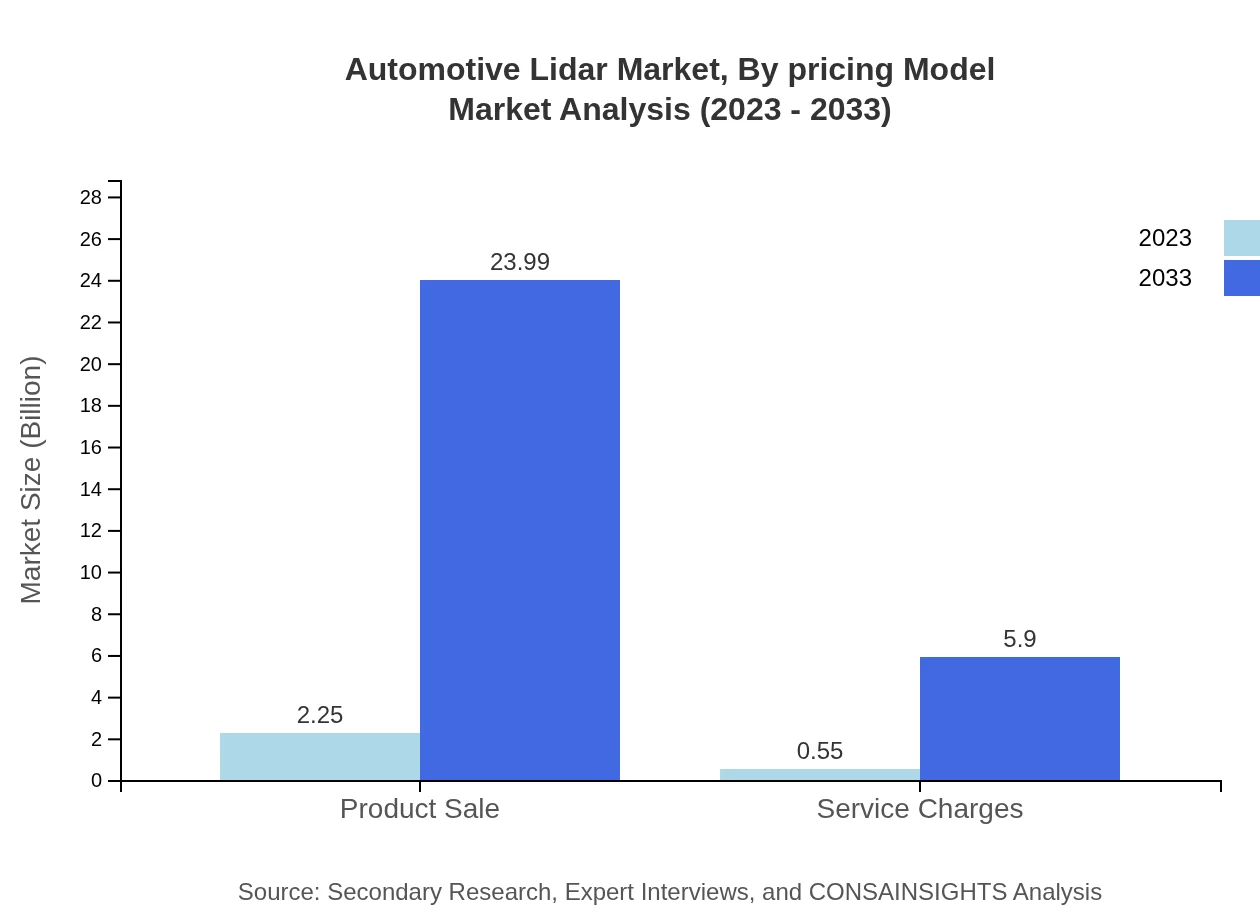

Automotive Lidar Market Analysis By Pricing Model

The pricing model analysis reveals that product sales dominate the market significantly, starting at USD 2.25 billion in 2023 and predicted to rise to USD 23.99 billion by 2033. Service charges also contribute substantially with projections of growth from USD 0.55 billion to USD 5.90 billion, indicating a consistent need for aftermarket services in addition to product sales.

Automotive Lidar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Lidar Industry

Velodyne Lidar, Inc.:

A pioneer in Lidar sensor technology, Velodyne focuses on various applications including autonomous driving and robotics, supporting a wide range of industries with its advanced solutions.Luminar Technologies, Inc.:

Specializing in automotive Lidar technology, Luminar provides high-performance sensors designed for safe autonomous cars, elevating industry standards in vehicle safety and functionality.Waymo (Alphabet Inc.):

Waymo leads in autonomous vehicle technology and research, integrating advanced Lidar systems into its self-driving cars, informing industry advancements and pushing regulation discussions.Aptiv PLC:

Aptiv focuses on intelligent vehicle architecture and offers Lidar solutions tailored for enhanced vehicle safety, connecting manufacturers with innovative automotive technologies.Innoviz Technologies Ltd.:

Innoviz provides high-performance Lidar sensors that enhance perception capabilities for autonomous driving applications, chiefly servicing partnerships with major automotive manufacturers.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Lidar?

The global automotive lidar market is valued at approximately $2.8 billion in 2023. It is anticipated to grow significantly, with a compound annual growth rate (CAGR) of 25%, reaching substantial market size by 2033.

What are the key market players or companies in the automotive Lidar industry?

Key players in the automotive lidar market include prominent technology firms and automotive manufacturers. These companies are pivotal in driving advancements in lidar technology for enhanced vehicle safety and autonomous navigation.

What are the primary factors driving the growth in the automotive Lidar industry?

Growth in the automotive-lidar industry is driven by increasing demand for autonomous vehicles, advancements in sensor technologies, and the implementation of advanced driver-assistance systems (ADAS) which require precise environmental perception capabilities.

Which region is the fastest Growing in the automotive Lidar?

The fastest-growing region for automotive lidar is Europe, projected to increase from $0.86 billion in 2023 to $9.19 billion by 2033. Other notable regions include Asia Pacific and North America, also showing rapid growth in market size.

Does ConsaInsights provide customized market report data for the automotive Lidar industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the automotive-lidar industry, enabling them to access relevant and insightful data that fits their business objectives.

What deliverables can I expect from this automotive Lidar market research project?

Expect comprehensive deliverables, including detailed market analysis, forecasts, competitor assessments, regional breakdowns, and insights into key segments. These deliverables will support strategic decision-making in the automotive-lidar landscape.

What are the market trends of automotive Lidar?

Current trends in the automotive-lidar market include a shift towards short-range lidar technology, increasing focus on solid-state designs, and expanding applications in both autonomous vehicles and advanced driver-assistance systems (ADAS).