Automotive Lightweight Materials Market Report

Published Date: 02 February 2026 | Report Code: automotive-lightweight-materials

Automotive Lightweight Materials Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Automotive Lightweight Materials market, providing insights on market size, trends, and forecasts from 2023 to 2033. It explores regional dynamics, industry analyses, and leading players, offering a comprehensive overview for stakeholders.

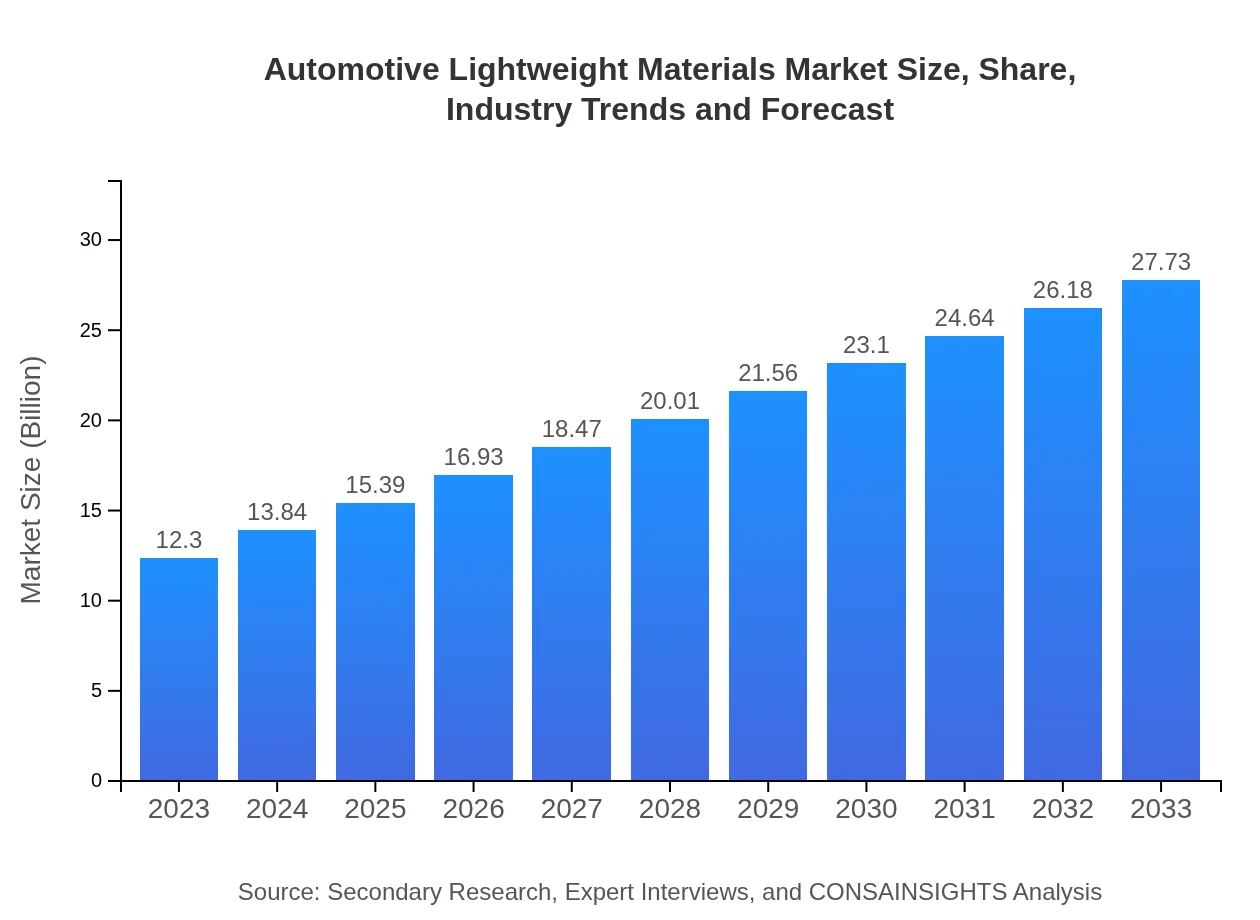

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.30 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $27.73 Billion |

| Top Companies | BASF SE, Alcoa Corporation, Toray Industries, Inc., Novelis Inc., Dupont |

| Last Modified Date | 02 February 2026 |

Automotive Lightweight Materials Market Overview

Customize Automotive Lightweight Materials Market Report market research report

- ✔ Get in-depth analysis of Automotive Lightweight Materials market size, growth, and forecasts.

- ✔ Understand Automotive Lightweight Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Lightweight Materials

What is the Market Size & CAGR of Automotive Lightweight Materials market in 2023?

Automotive Lightweight Materials Industry Analysis

Automotive Lightweight Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Lightweight Materials Market Analysis Report by Region

Europe Automotive Lightweight Materials Market Report:

Europe’s market is expected to grow from $3.48 billion in 2023 to $7.84 billion by 2033. European manufacturers are leading the charge in adopting advanced materials, driven by regulatory mandates and a strong focus on sustainability and innovation.Asia Pacific Automotive Lightweight Materials Market Report:

The Asia Pacific region is witnessing strong growth with a market size expected to increase from $2.44 billion in 2023 to $5.50 billion by 2033. Rising automotive production and urbanization drive demand, alongside increasing investments in electric vehicle technology.North America Automotive Lightweight Materials Market Report:

North America shows significant prospects with the market expanding from $4.51 billion in 2023 to $10.17 billion by 2033. This growth is propelled by stringent regulatory frameworks and high consumer demand for fuel-efficient and environmentally friendly vehicles.South America Automotive Lightweight Materials Market Report:

In South America, the market is projected to grow from $0.30 billion in 2023 to $0.67 billion by 2033. Brazil remains the key player, with increasing awareness of sustainability and the adoption of lightweight materials in local automotive industries.Middle East & Africa Automotive Lightweight Materials Market Report:

The Middle East and Africa market is projected to rise from $1.57 billion in 2023 to $3.54 billion by 2033. Growth is anticipated due to increasing vehicle production and government initiatives aimed at improving energy efficiency in the automotive sector.Tell us your focus area and get a customized research report.

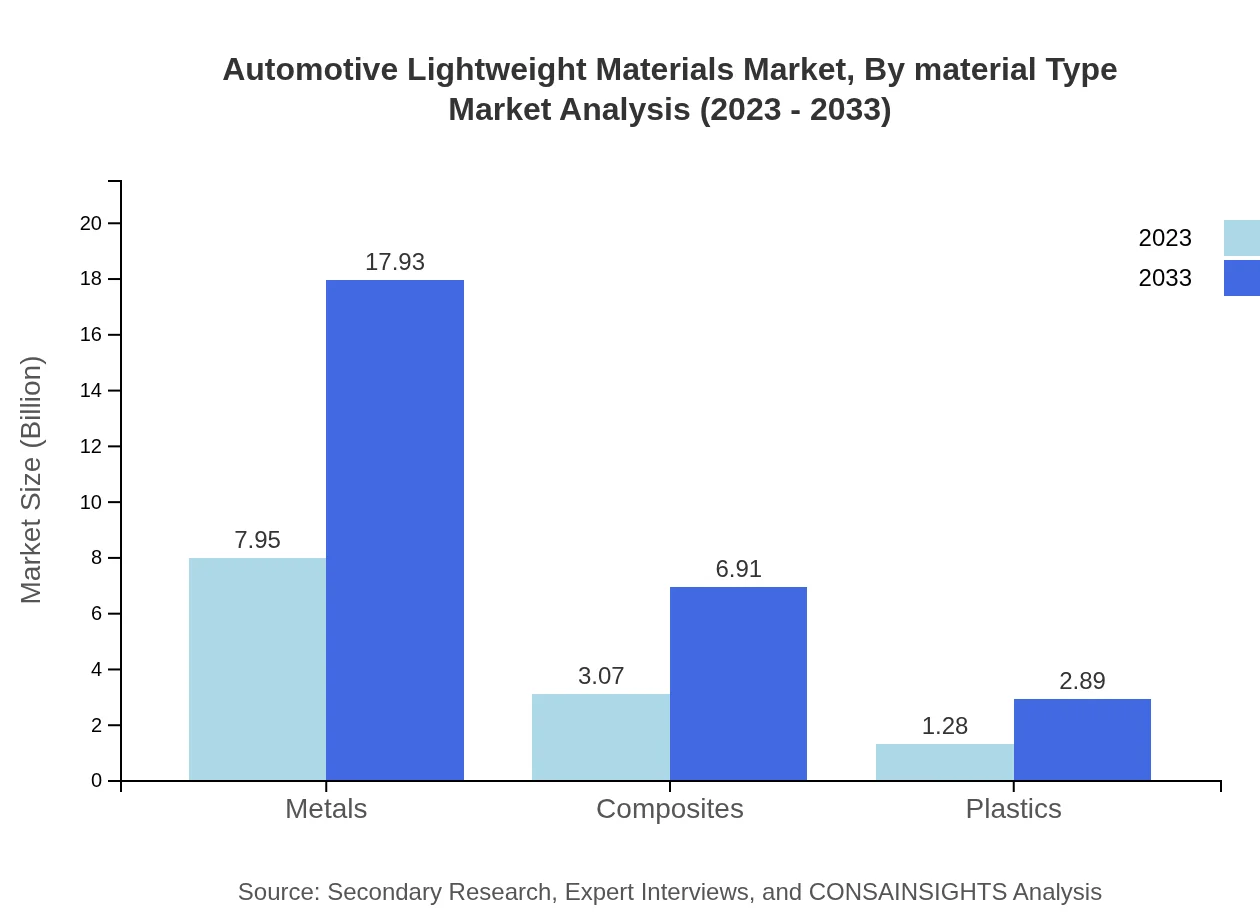

Automotive Lightweight Materials Market Analysis By Material Type

The market is predominantly segmented into metals, composites, and plastics. In 2023, metals dominated the market size at $7.95 billion, projected to reach $17.93 billion by 2033, constituting a market share of 64.66%. Composites follow with $3.07 billion in 2023, forecasted to increase to $6.91 billion by 2033 (24.92% share). Plastics are also gaining traction, starting at $1.28 billion and expected to grow to $2.89 billion, representing 10.42% in 2033.

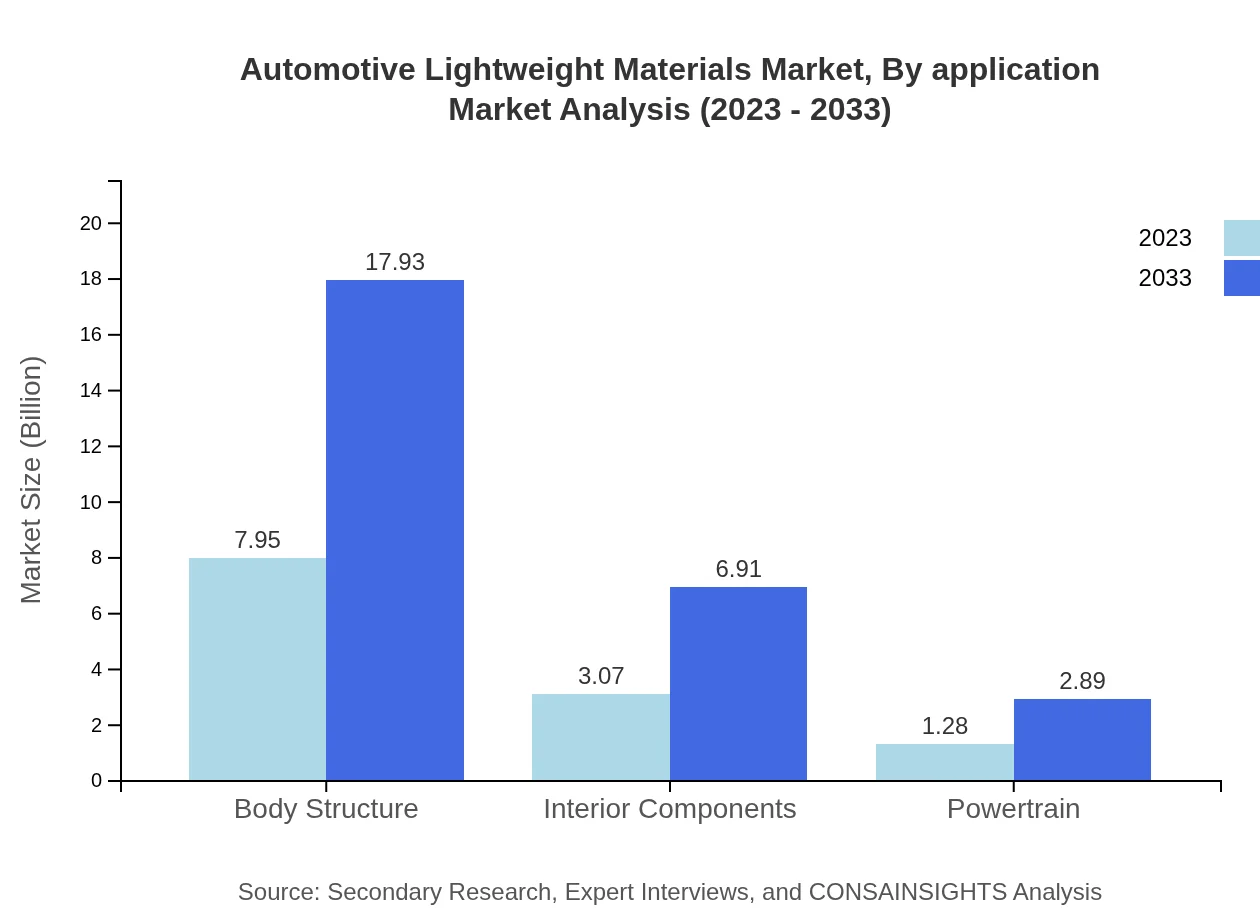

Automotive Lightweight Materials Market Analysis By Application

Key applications include body structure, interior components, and powertrain. The body structure segment represents the largest share at a size of $7.95 billion in 2023, projected to rise to $17.93 billion by 2033. Interior components start at $3.07 billion, increasing to $6.91 billion, while powertrain components are anticipated to grow from $1.28 billion to $2.89 billion.

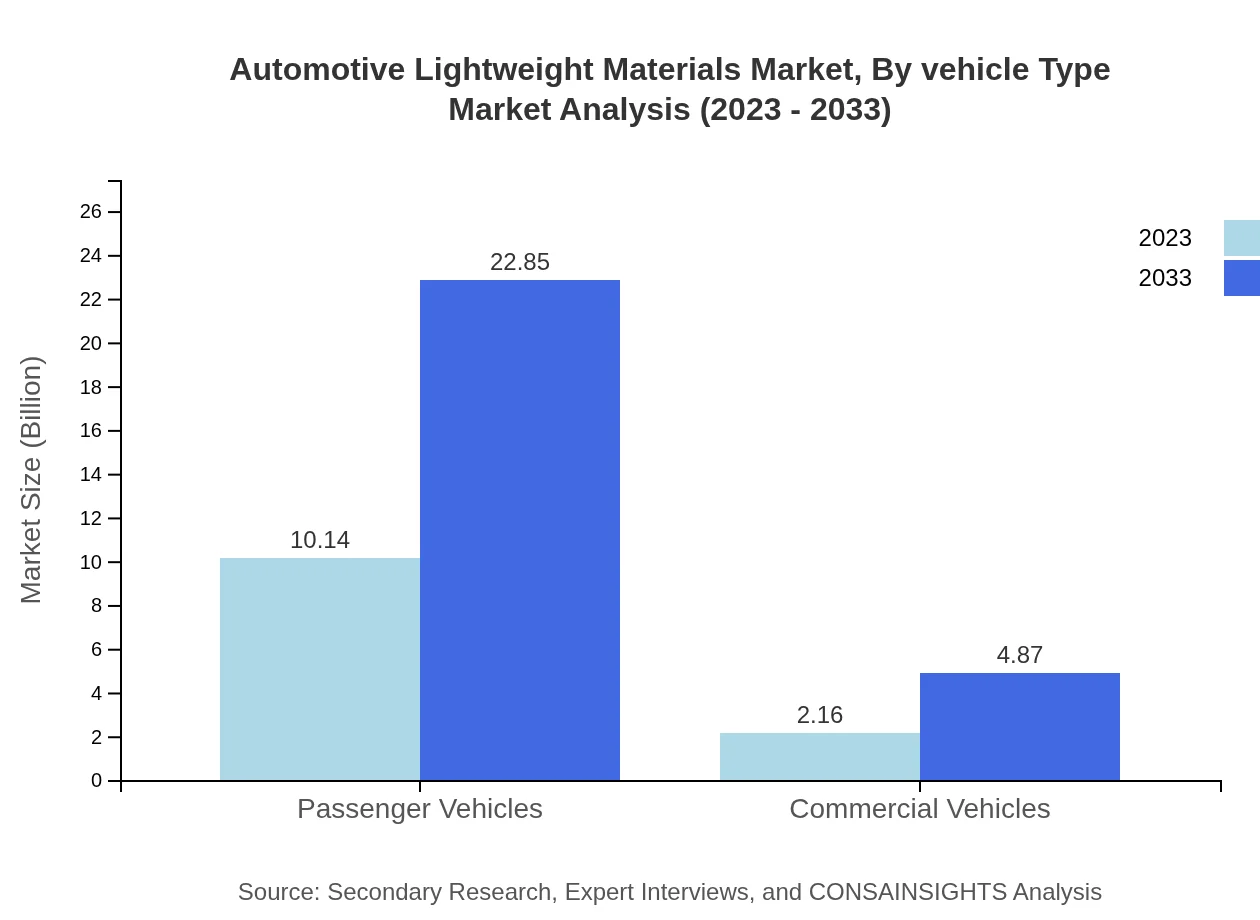

Automotive Lightweight Materials Market Analysis By Vehicle Type

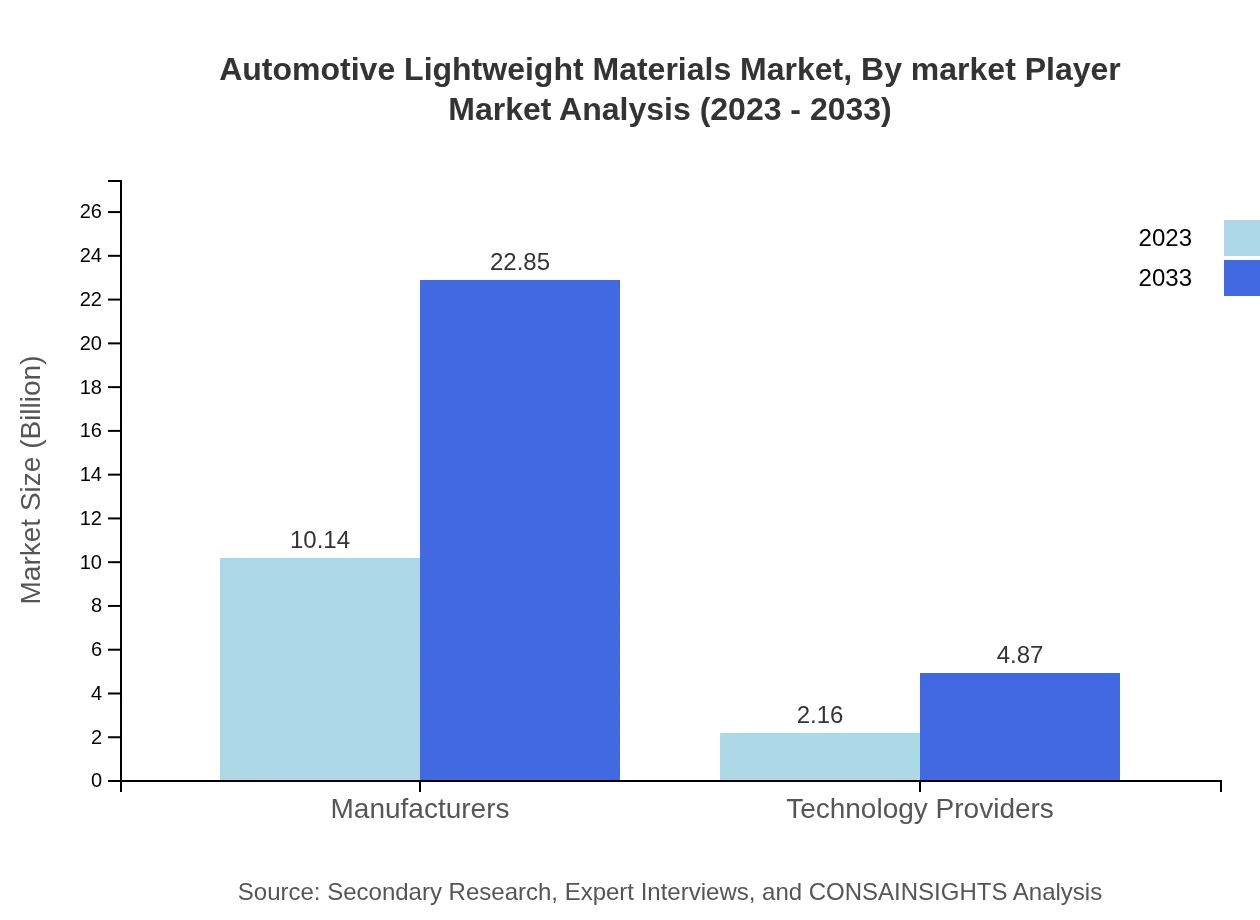

Passenger vehicles lead the market with a size of $10.14 billion in 2023, increasing to $22.85 billion by 2033, capturing 82.42% of the share. Commercial vehicles, on the other hand, exhibit a growth from $2.16 billion to $4.87 billion, holding 17.58% market share.

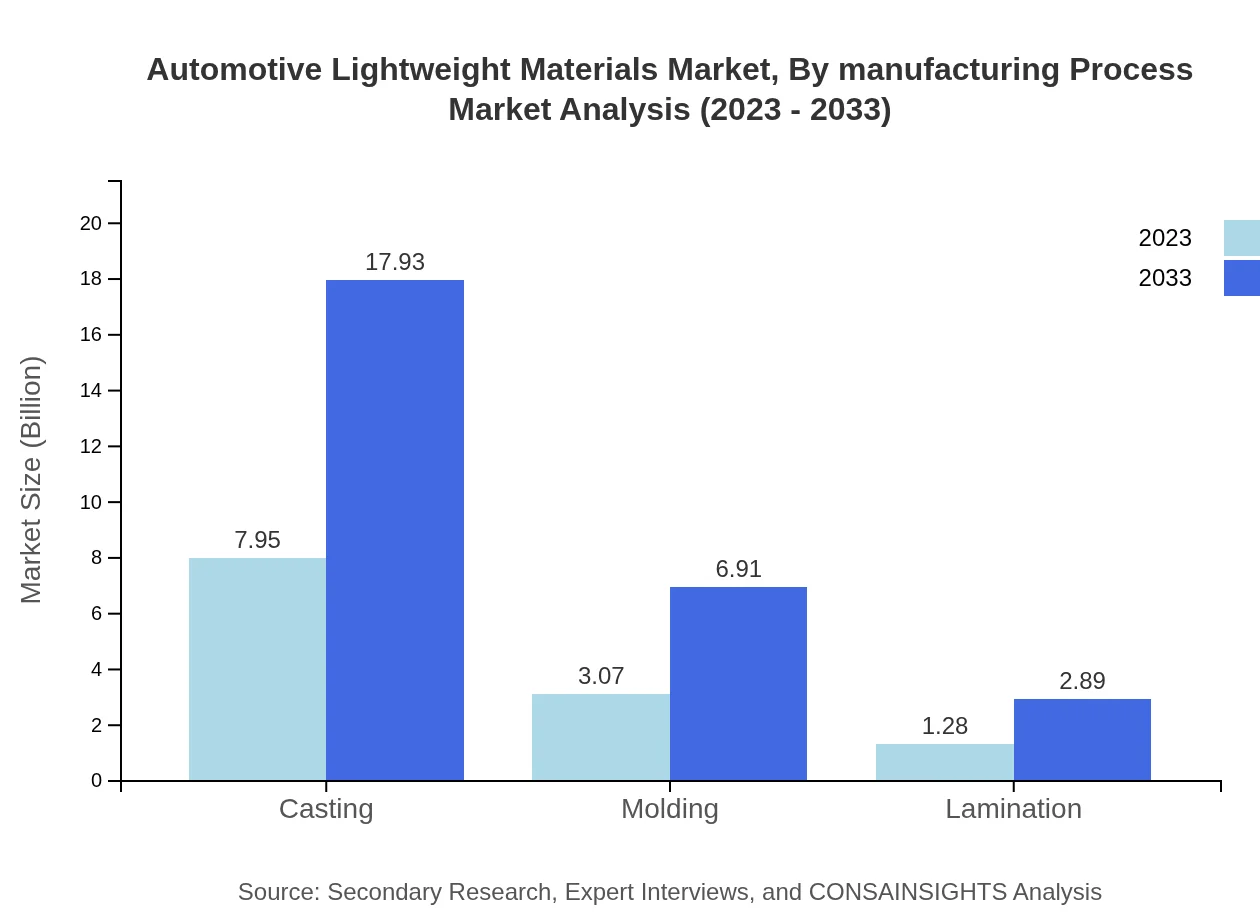

Automotive Lightweight Materials Market Analysis By Manufacturing Process

The manufacturing processes are segmented into casting, molding, and lamination. Casting captures a significant portion, starting at $7.95 billion in 2023, growing to $17.93 billion by 2033. Molding and lamination processes also show growth, from $3.07 billion to $6.91 billion and $1.28 billion to $2.89 billion respectively.

Automotive Lightweight Materials Market Analysis By Market Player

The market shares analysis applies to manufacturers like tech providers and specialized lightweight material manufacturers. As of 2023, manufacturers account for $10.14 billion, while technology providers sit at $2.16 billion, with both expected to solidify their shares in the forecast period.

Automotive Lightweight Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Lightweight Materials Industry

BASF SE:

A leading global chemical company that offers innovative lightweight material solutions for the automotive industry, focusing on enhancing vehicle performance and sustainability.Alcoa Corporation:

A key player in aluminum production, promoting lightweight aluminum solutions tailored for automotive applications to support fuel efficiency and reduced emissions.Toray Industries, Inc.:

A pioneer in advanced materials, particularly carbon fiber composites that are used extensively in high-performance automotive applications.Novelis Inc.:

The world's largest recycler of aluminum, providing lightweight aluminum products that meet the automotive industry's high standards for performance and sustainability.Dupont:

A global science and technology company that develops innovative materials, including lightweight engineering polymers for automotive applications.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive lightweight materials?

The global automotive lightweight materials market is valued at approximately $12.3 billion in 2023, with a projected CAGR of 8.2%. This growth indicates a robust demand for lightweight materials across automotive sectors, enhancing vehicle performance and efficiency.

What are the key market players or companies in the automotive lightweight materials industry?

Key players in the automotive lightweight materials industry include major manufacturers such as BASF SE, DowDuPont, Corning Inc., and ArcelorMittal. These companies focus on innovation and sustainable practices to enhance their market positions and capture consumer interest.

What are the primary factors driving the growth in the automotive lightweight materials industry?

The growth of the automotive lightweight materials industry is primarily driven by the increasing demand for fuel-efficient vehicles, stringent regulations on emissions, and technological advancements in material processing and composites that enhance lightweight applications.

Which region is the fastest Growing in the automotive lightweight materials market?

Among the regions, North America is the fastest-growing market for automotive lightweight materials, projected to expand from $4.51 billion in 2023 to approximately $10.17 billion by 2033, reflecting a significant shift towards fuel-efficient technologies.

Does ConsaInsights provide customized market report data for the automotive lightweight materials industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the automotive lightweight materials industry, ensuring valuable insights that reflect unique business requirements and market conditions.

What deliverables can I expect from this automotive lightweight materials market research project?

Deliverables from this market research project typically include comprehensive market analysis, trend identification, competitive landscape overview, regional insights, and segment-specific data, all designed to assist in strategic decision-making.

What are the market trends of automotive lightweight materials?

Current market trends in the automotive lightweight materials sector include an increasing adoption of advanced composites and metals, an emphasis on sustainability, growing investment in R&D, and a shift towards electrification that calls for lighter vehicle structures.