Automotive Logistics Market Report

Published Date: 22 January 2026 | Report Code: automotive-logistics

Automotive Logistics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Logistics market, covering market size, trends, regional insights, and forecasts from 2023 to 2033, along with key industry players and market segmentation.

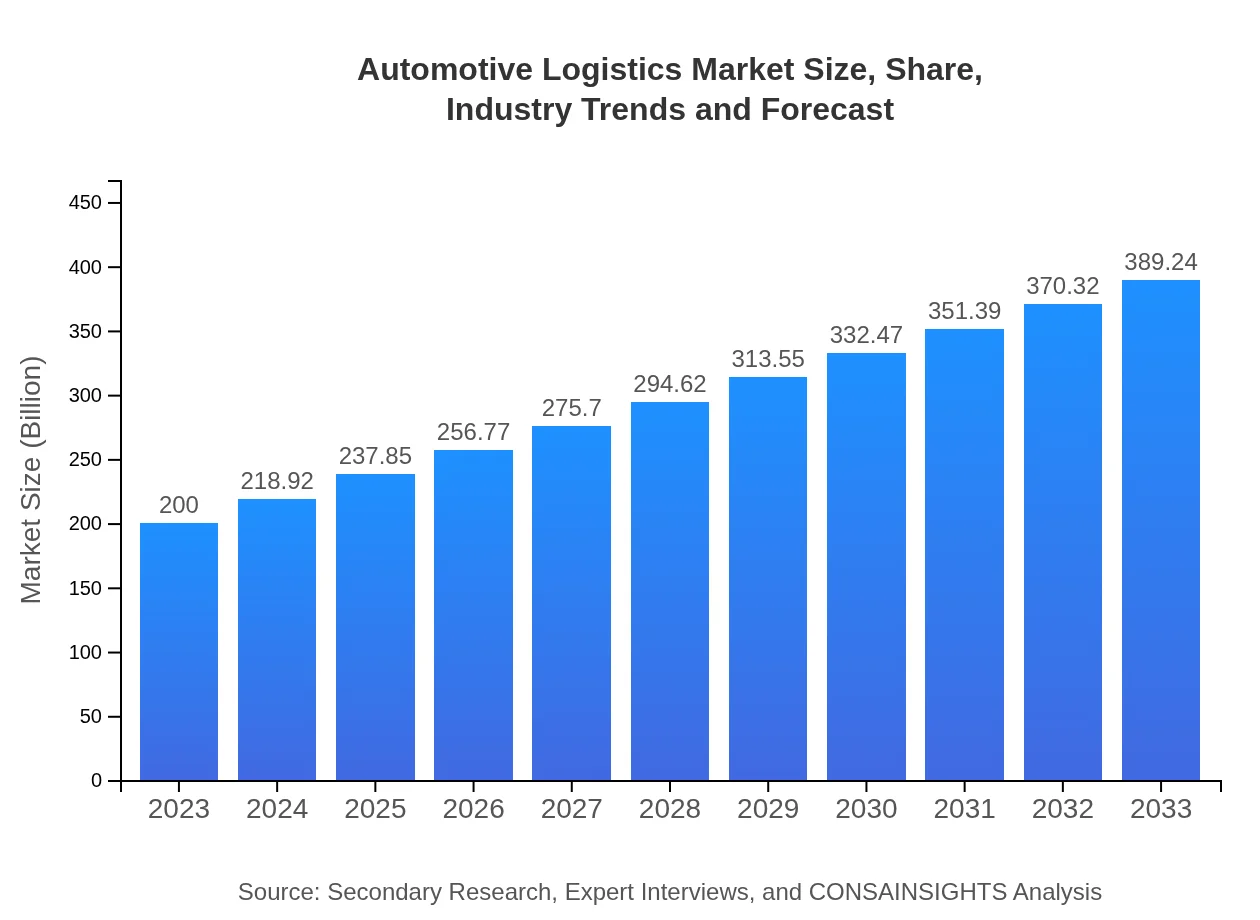

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $389.24 Billion |

| Top Companies | DHL Supply Chain, XPO Logistics, Kuehne + Nagel, FedEx Logistics, C.H. Robinson |

| Last Modified Date | 22 January 2026 |

Automotive Logistics Market Overview

Customize Automotive Logistics Market Report market research report

- ✔ Get in-depth analysis of Automotive Logistics market size, growth, and forecasts.

- ✔ Understand Automotive Logistics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Logistics

What is the Market Size & CAGR of Automotive Logistics market in 2023?

Automotive Logistics Industry Analysis

Automotive Logistics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Logistics Market Analysis Report by Region

Europe Automotive Logistics Market Report:

The European market is set to grow from USD 65.38 billion in 2023 to USD 127.24 billion by 2033, propelled by stringent regulations on emissions and increasing demand for electric vehicles, which require modifications in logistics processes.Asia Pacific Automotive Logistics Market Report:

The Automotive Logistics market in the Asia Pacific region is projected to grow from USD 32.92 billion in 2023 to USD 64.07 billion by 2033, driven by increasing vehicle production and growing demand for efficient distribution networks in emerging economies like China and India.North America Automotive Logistics Market Report:

North America is expected to witness solid growth, with the market size expanding from USD 72.88 billion in 2023 to USD 141.84 billion by 2033. The presence of major automotive manufacturers and emphasis on automation and sustainable practices are key growth drivers in this region.South America Automotive Logistics Market Report:

In South America, the market size is anticipated to increase from USD 16.04 billion in 2023 to USD 31.22 billion by 2033. The growth in this region is supported by rising automotive production, particularly in Brazil and Argentina, alongside advancements in logistics technology.Middle East & Africa Automotive Logistics Market Report:

The Middle East and Africa are forecast to see an increase in market size from USD 12.78 billion in 2023 to USD 24.87 billion by 2033. Growth in urbanization and infrastructure development, coupled with a rising automotive market in countries like South Africa, drive this growth.Tell us your focus area and get a customized research report.

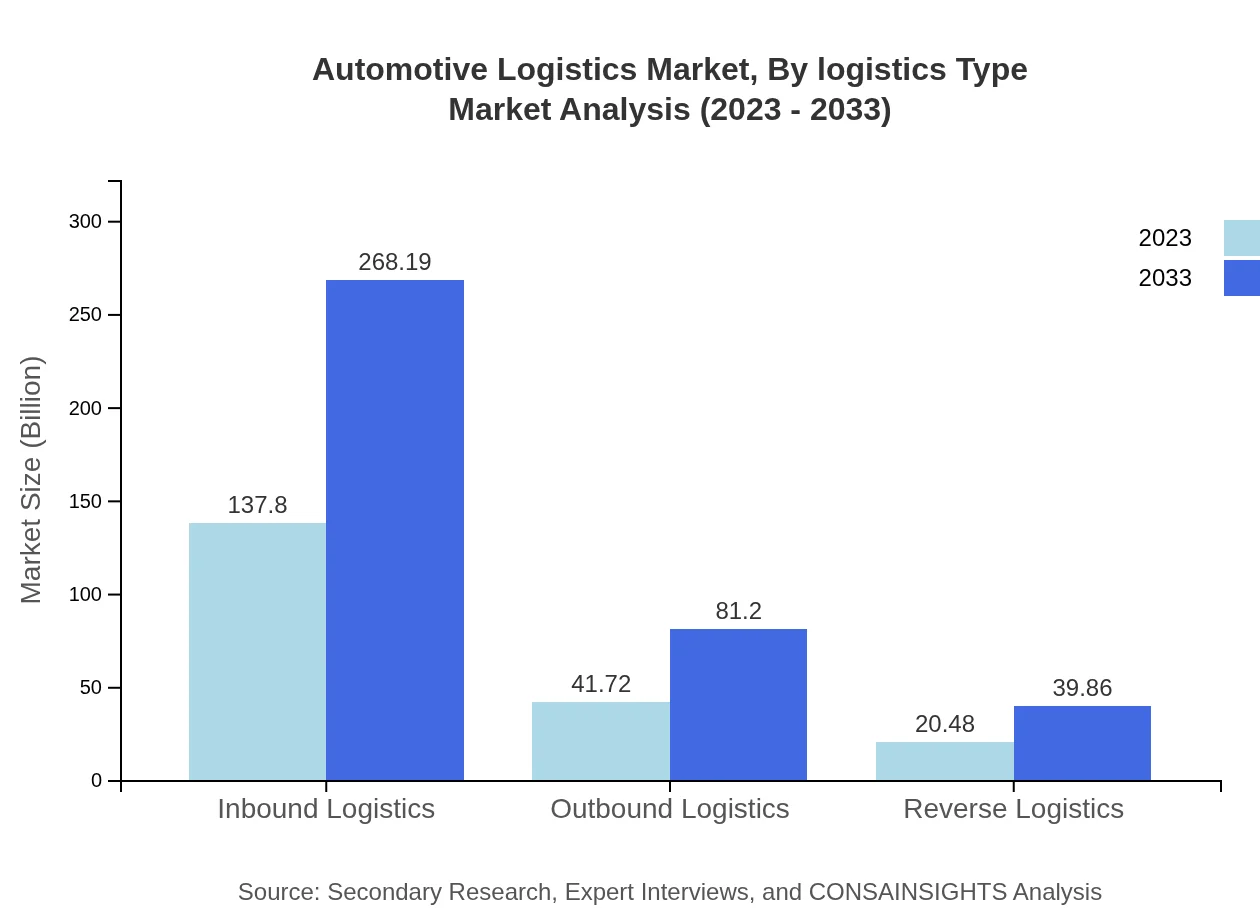

Automotive Logistics Market Analysis By Logistics Type

In 2023, the Automotive Logistics market by logistics type is dominated by inbound logistics, with a market size of USD 137.80 billion. This segment includes the transportation of components to manufacturing plants. Outbound logistics follows with USD 41.72 billion, focusing on delivering finished vehicles to dealerships. Reverse logistics accounted for USD 20.48 billion, addressing the returns and recycling of automotive parts. The growth in these segments is expected to continue as manufacturers optimize their supply chains.

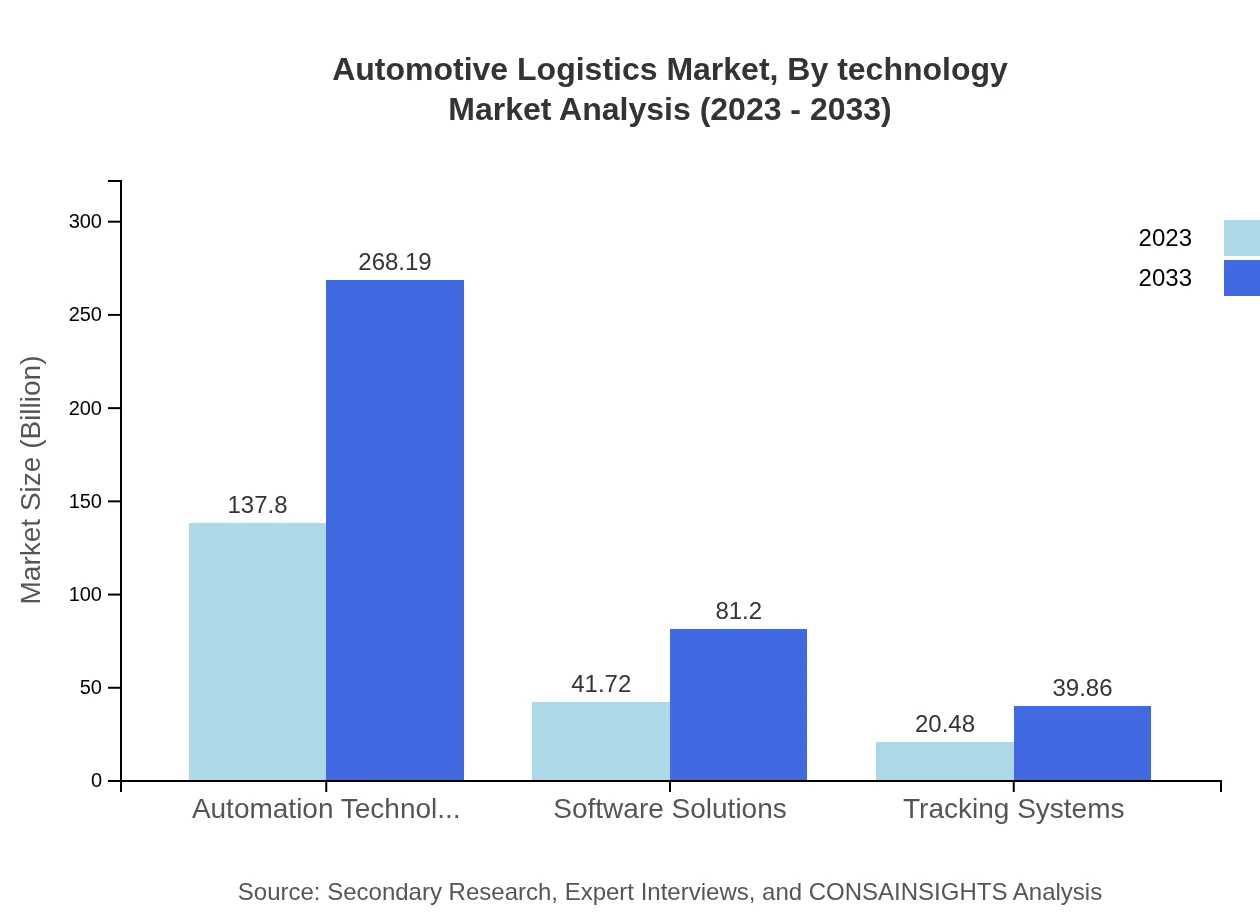

Automotive Logistics Market Analysis By Technology

The market for Automotive Logistics is heavily influenced by advancements in technology. Automation Technologies will see major growth from USD 137.80 billion in 2023 to USD 268.19 billion by 2033, showcasing the push towards efficiency and reduced labor costs. Software Solutions are projected to double from USD 41.72 billion to USD 81.20 billion, as companies invest in enhanced logistics management systems. Tracking Systems also play a crucial role, growing from USD 20.48 billion to USD 39.86 billion, providing essential data for logistics optimization.

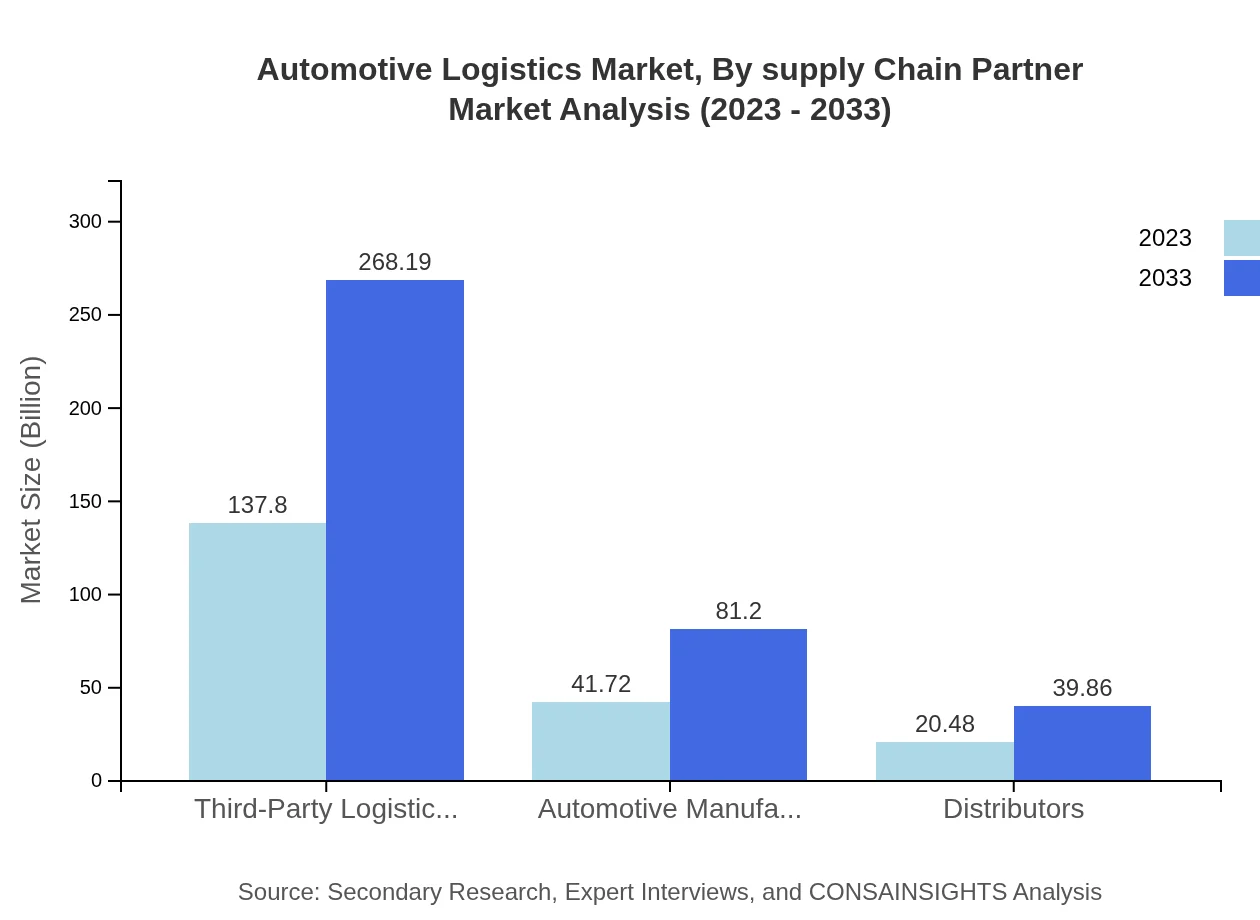

Automotive Logistics Market Analysis By Supply Chain Partner

Among the supply chain partners, Third-Party Logistics Providers are pivotal, dominating this segment with USD 137.80 billion in 2023. Automotive Manufacturers, while significantly involved, represent a smaller segment at USD 41.72 billion, focusing internally on logistics for efficiency. Distributors also contribute meaningfully with USD 20.48 billion. The trend indicates a growing reliance on 3PL providers for streamlined operations and expertise in logistics.

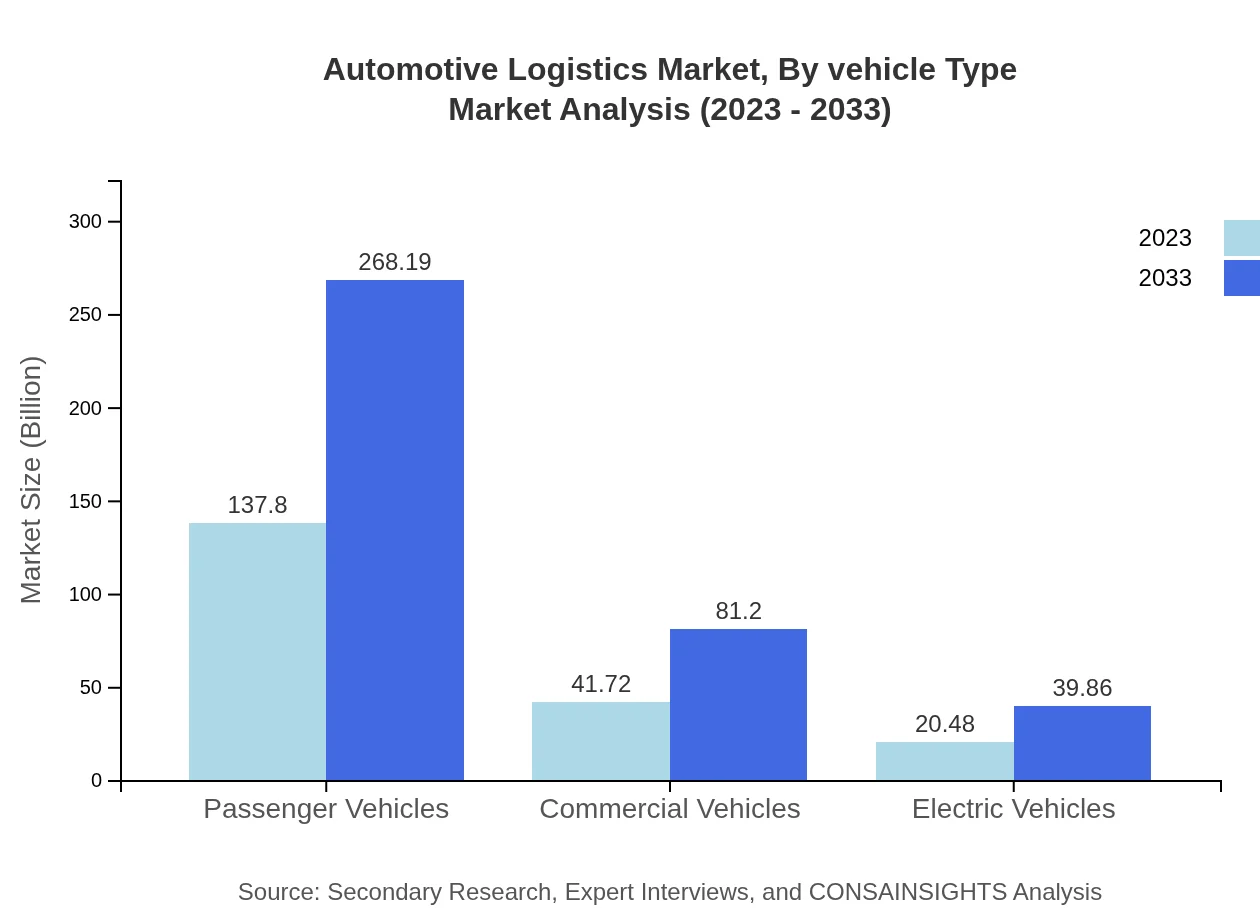

Automotive Logistics Market Analysis By Vehicle Type

In 2023, the market for Automotive Logistics by vehicle type shows Passenger Vehicles leading with USD 137.80 billion, highlighting the mass production and distribution of conventional vehicles. Commercial Vehicles follow closely at USD 41.72 billion. The rise of Electric Vehicles, albeit at USD 20.48 billion, suggests a growing segment with specific logistics needs regarding battery transport and recycling. This diversification in vehicle types indicates a shift towards more complex logistics strategies.

Automotive Logistics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Logistics Industry

DHL Supply Chain:

A global leader in logistics services, DHL Supply Chain offers tailored automotive logistics solutions that integrate transportation, warehousing, and distribution services with state-of-the-art technology.XPO Logistics:

XPO Logistics is recognized for its comprehensive supply chain solutions and technology-driven approaches tailored specifically for the automotive sector, enhancing delivery efficiency and speed.Kuehne + Nagel:

Specialized in integrated logistics, Kuehne + Nagel supports the automotive industry with customized solutions, leveraging their extensive global network to facilitate smoother transit.FedEx Logistics:

FedEx Logistics specializes in international and domestic shipping, providing crucial logistics support to automotive manufacturers and distributors for timely vehicle and parts delivery.C.H. Robinson:

C.H. Robinson provides a wide range of logistics solutions, ensuring streamlined supply chains for the automotive sector with a focus on efficiency and cost-effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive logistics?

The automotive logistics market is valued at approximately $200 billion in 2023, with a projected CAGR of 6.7%, suggesting growth will elevate the market significantly by 2033.

What are the key market players or companies in the automotive logistics industry?

Key players in the automotive logistics sector include major logistics companies, automotive OEMs, and third-party logistics providers, who work collaboratively to streamline operations and improve efficiency in the supply chain.

What are the primary factors driving the growth in the automotive logistics industry?

Growth in the automotive logistics industry is driven by factors such as increased demand for innovative supply chain solutions, the rise of electric vehicles, advancements in tracking technology, and globalization of the automotive supply chain.

Which region is the fastest Growing in automotive logistics?

The North America region is projected to experience the fastest growth in automotive logistics, expanding from a market size of $72.88 billion in 2023 to $141.84 billion by 2033, showcasing remarkable demand increases.

Does ConsaInsights provide customized market report data for the automotive logistics industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the automotive logistics industry, ensuring detailed and relevant insights for stakeholders.

What deliverables can I expect from this automotive logistics market research project?

Deliverables from the automotive logistics market research project typically include comprehensive reports, segmented market analysis, growth forecasts, competitor analysis, and strategic recommendations for market entry.

What are the market trends of automotive logistics?

Current trends in automotive logistics include the increasing automation of logistics processes, the adoption of sustainable practices, a shift toward digital supply chain solutions, and emerging technologies like AI and IoT to optimize logistics operations.