Automotive Mems Sensors Market Report

Published Date: 31 January 2026 | Report Code: automotive-mems-sensors

Automotive Mems Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive MEMS Sensors market, detailing market size, growth rates, trends, and forecasts from 2023 to 2033. It covers various insights into segmentation, regional analysis, and competitive landscape within the industry.

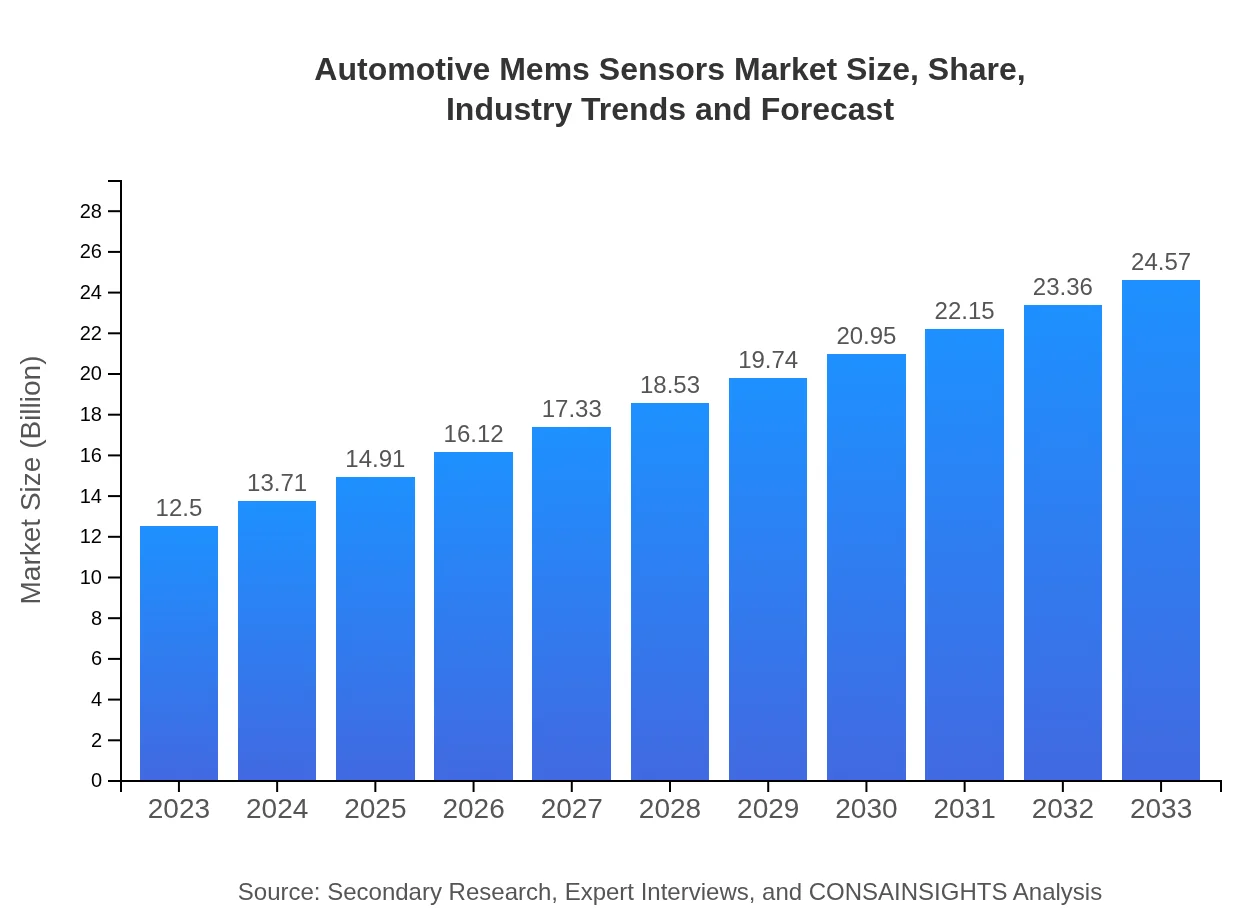

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Bosch Sensortec, STMicroelectronics, Texas Instruments, Analog Devices Inc., Microchip Technology Inc. |

| Last Modified Date | 31 January 2026 |

Automotive Mems Sensors Market Overview

Customize Automotive Mems Sensors Market Report market research report

- ✔ Get in-depth analysis of Automotive Mems Sensors market size, growth, and forecasts.

- ✔ Understand Automotive Mems Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Mems Sensors

What is the Market Size & CAGR of Automotive Mems Sensors market in 2023?

Automotive Mems Sensors Industry Analysis

Automotive Mems Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Mems Sensors Market Analysis Report by Region

Europe Automotive Mems Sensors Market Report:

In Europe, the automotive MEMS sensors market was valued at around 3.79 billion USD in 2023 and is projected to grow to 7.46 billion USD by 2033. The region’s commitment to automotive safety and sustainability, backed by stringent regulatory requirements, is enhancing the market's attractiveness for MEMS technology.Asia Pacific Automotive Mems Sensors Market Report:

In the Asia Pacific region, the automotive MEMS sensors market was valued at approximately 2.36 billion USD in 2023 and is forecasted to reach around 4.63 billion USD by 2033. This region is expected to experience significant growth due to the rise of automotive manufacturing hubs in countries like China and Japan, alongside the increasing demand for electric vehicles.North America Automotive Mems Sensors Market Report:

North America accounted for approximately 4.73 billion USD in the automotive MEMS sensors market in 2023, with expectations to grow to 9.29 billion USD by 2033. The region is characterized by a strong focus on innovation, particularly in safety technologies, which has led to a higher demand for MEMS sensors.South America Automotive Mems Sensors Market Report:

The South American market for automotive MEMS sensors represented about 1.06 billion USD in 2023, with projections reaching 2.09 billion USD by 2033. The growth is primarily driven by increasing vehicle production and advancements in automotive technologies, despite economic challenges in some countries.Middle East & Africa Automotive Mems Sensors Market Report:

The Middle East and Africa market for automotive MEMS sensors was valued at approximately 0.56 billion USD in 2023, with forecasts suggesting it will expand to about 1.10 billion USD by 2033. The growth trajectory is influenced by increasing vehicle sales and investments in infrastructure improvements in various countries.Tell us your focus area and get a customized research report.

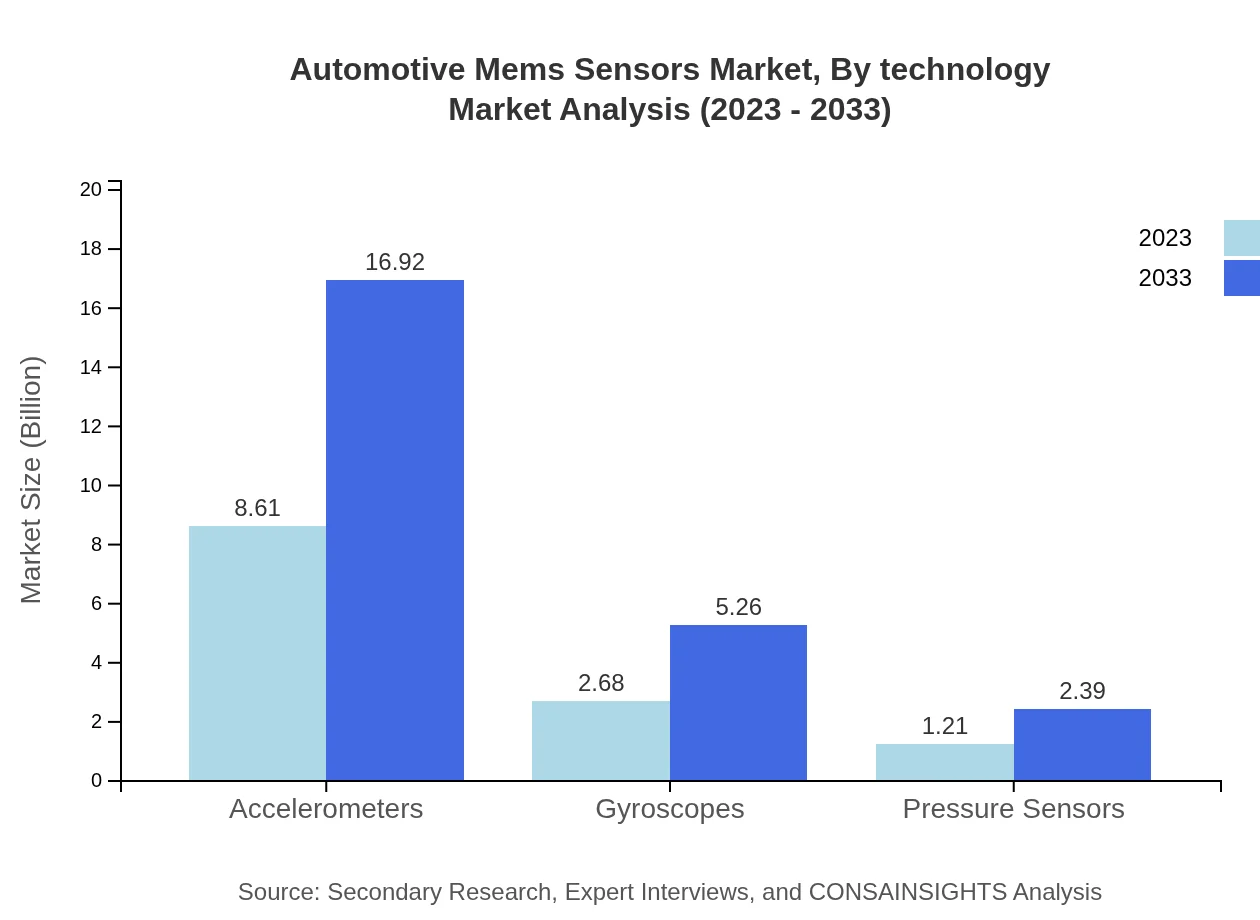

Automotive Mems Sensors Market Analysis By Technology

The automotive MEMS sensors market, segmented by technology, includes accelerometers, gyroscopes, pressure sensors, and safety systems. Accelerometers dominate the market with a size of 8.61 billion USD in 2023, projected to grow to 16.92 billion USD by 2033, capturing 68.88% of market share. Gyroscopes follow with a size of 2.68 billion USD in 2023, reaching 5.26 billion USD by 2033, maintaining a share of 21.41%. Pressure sensors, valued at 1.21 billion USD in 2023, are estimated to reach 2.39 billion USD by 2033 with a 9.71% market share.

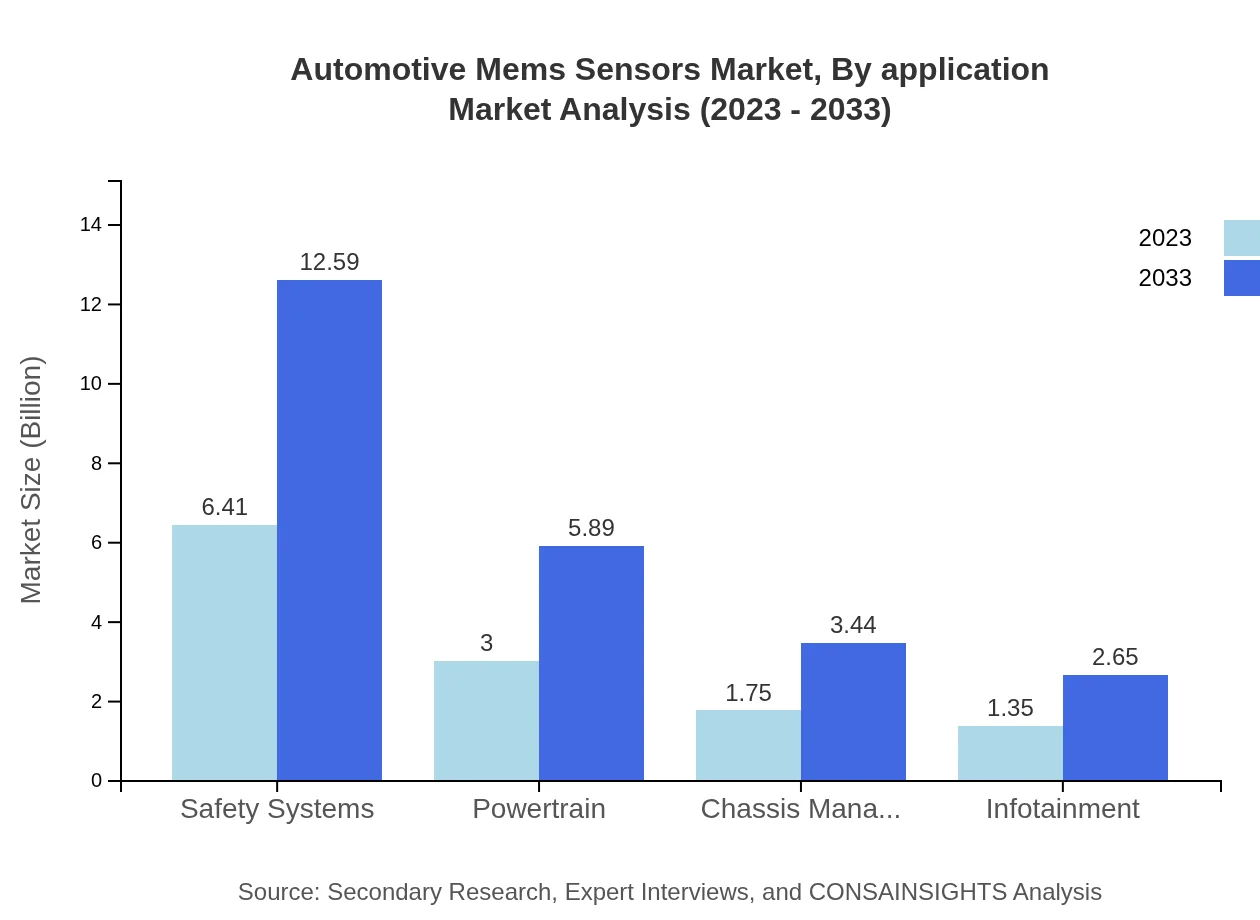

Automotive Mems Sensors Market Analysis By Application

In terms of application, the Automotive MEMS Sensors market focuses on several key areas: safety systems, powertrain management, and infotainment. Safety systems lead the segment with a market size of 6.41 billion USD in 2023 and expected growth to 12.59 billion USD by 2033, holding a 51.25% share. Powertrain applications account for 3.00 billion USD, projected to increase to 5.89 billion USD (23.97% share), while infotainment systems represent a smaller segment at 1.35 billion USD, growing to 2.65 billion USD (10.78% share) over the same period.

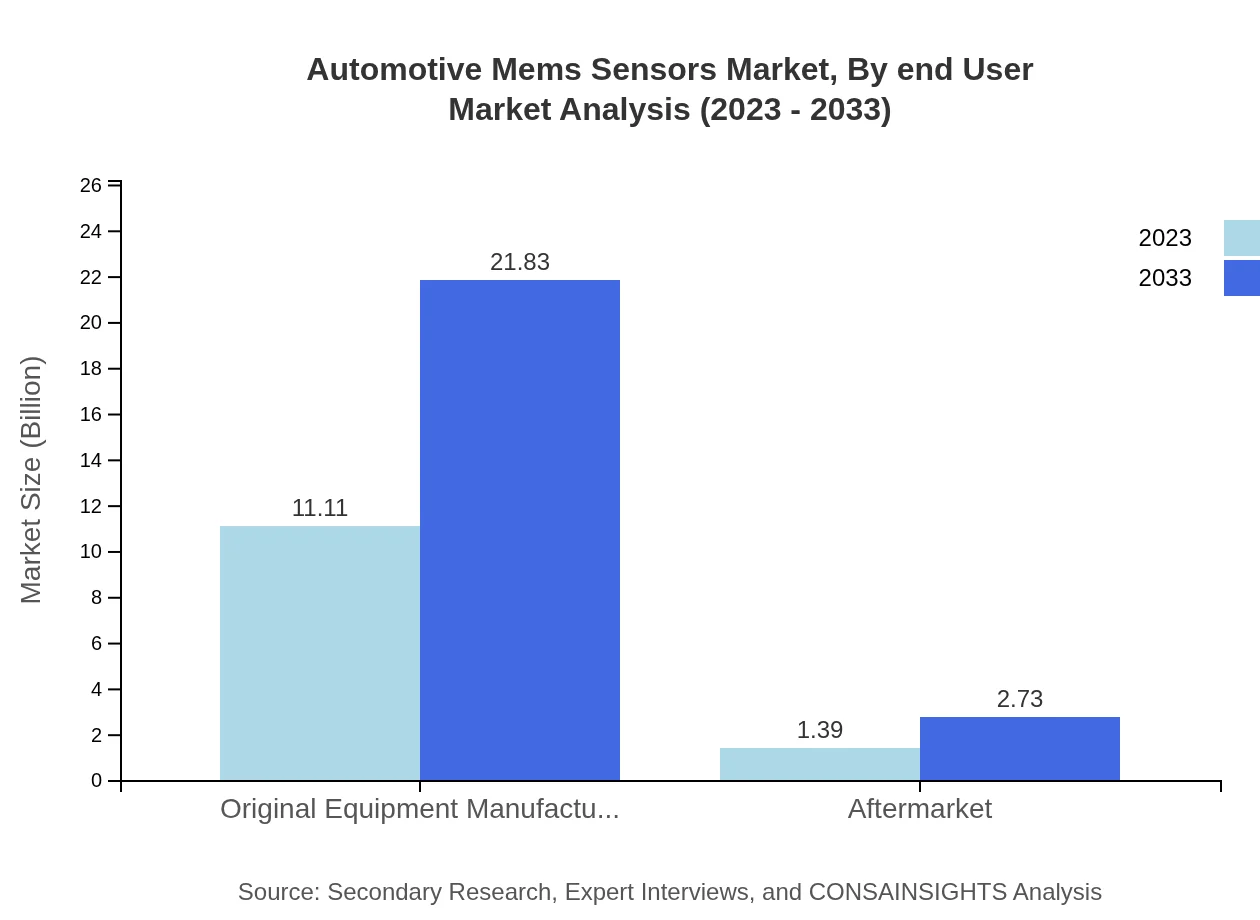

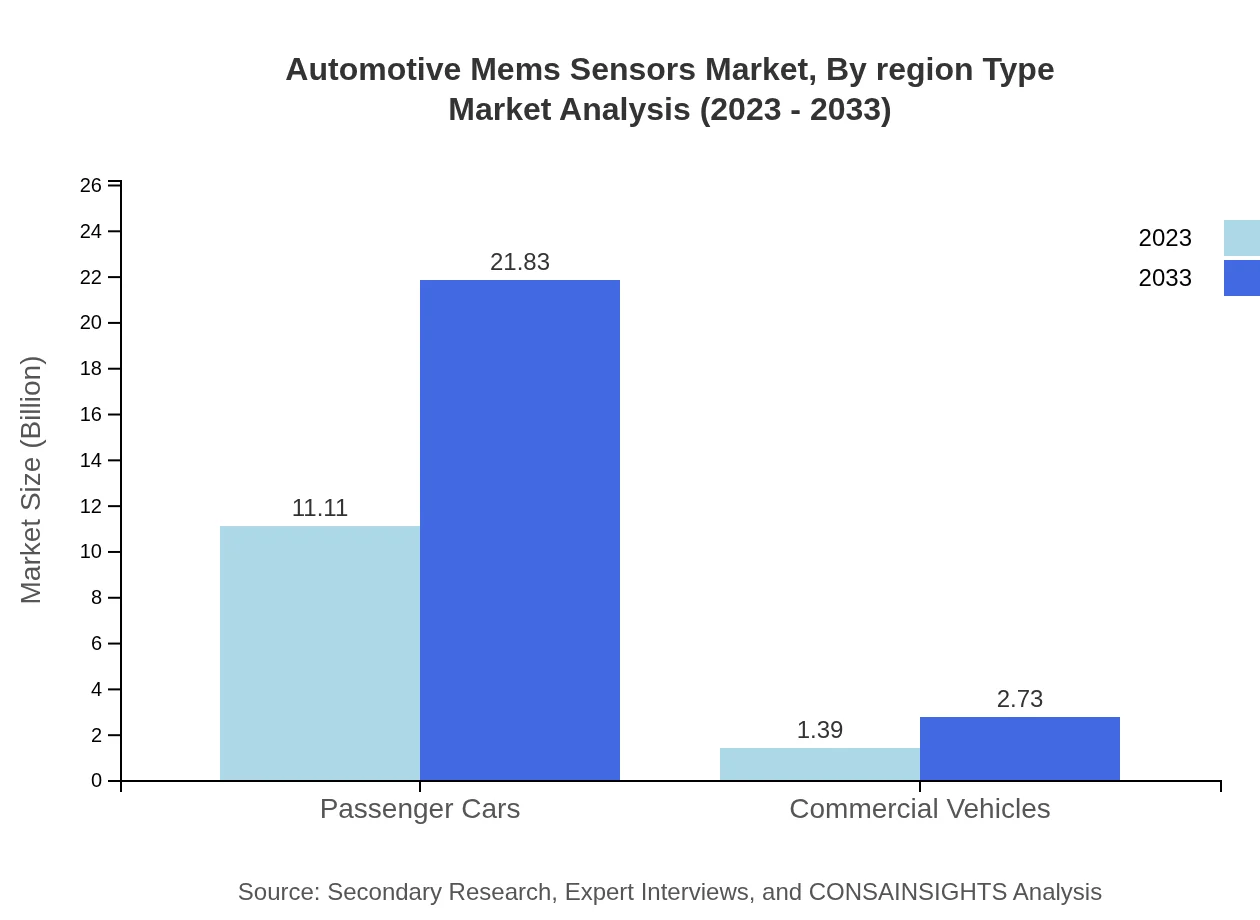

Automotive Mems Sensors Market Analysis By End User

The Automotive MEMS Sensors market is categorized by end-user segments including OEMs and aftermarket sales. OEMs dominate the market significantly with a size of 11.11 billion USD in 2023, anticipated to reach 21.83 billion USD by 2033, accounting for 88.87% of the market share. The aftermarket segment, valued at 1.39 billion USD in 2023, is set to grow to 2.73 billion USD by 2033, comprising 11.13% of the share, reflecting an increasing emphasis on vehicle safety and maintenance.

Automotive Mems Sensors Market Analysis By Region Type

Geographically, the Automotive MEMS Sensors market reflects diverse growth trends. North America leads with substantial technological advancements and safety applications, followed closely by Europe, where stringent regulations favor MEMS integration. Asia Pacific shows rapid production growth, particularly in electric vehicles, while South America and the Middle East & Africa are expected to expand due to improving automotive infrastructure and increasing domestic consumption.

Automotive Mems Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Mems Sensors Industry

Bosch Sensortec:

Bosch Sensortec is a leading provider of MEMS sensors, consistently innovating in pressure and motion sensors for automotive applications. The company is known for its stringent quality standards and technological advancements.STMicroelectronics:

STMicroelectronics is a key player in the MEMS sensor market, delivering comprehensive solutions for automotive applications, especially in safety and navigational technologies. Their focus on R&D has positioned them as a market leader.Texas Instruments:

Texas Instruments is renowned for its MEMS sensor technology, providing a vast array of sensors for various automotive applications, focusing on precision and reliability.Analog Devices Inc.:

Analog Devices specializes in high-performance MEMS sensors aimed at automotive safety and control systems, leveraging innovative technology and global reach.Microchip Technology Inc.:

Microchip Technology provides a diverse range of MEMS sensors for automotive applications, focusing on enhancing safety and efficiency in vehicle systems.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Mems Sensors?

The automotive MEMS sensors market is currently valued at approximately $12.5 billion in 2023. It is projected to grow at a CAGR of 6.8%, reaching significant milestones by 2033, driven by advancements in automotive technology and increasing demand for enhanced vehicle safety and efficiency.

What are the key market players or companies in the automotive Mems Sensors industry?

Key players in the automotive MEMS sensors market include Bosch, STMicroelectronics, and Analog Devices, among others. These companies are recognized for their innovative sensor technologies aimed at improving vehicle performance, safety, and overall driving experience, representing a competitive landscape.

What are the primary factors driving the growth in the automotive Mems Sensors industry?

Growth in the automotive MEMS sensors industry is primarily driven by the rising demand for advanced driver-assistance systems (ADAS), increased vehicle electrification, and growing consumer preference for enhanced safety features, alongside stringent government regulations on vehicle emissions.

Which region is the fastest Growing in the automotive Mems Sensors?

The fastest-growing region for automotive MEMS sensors is North America, projected to grow from $4.73 billion in 2023 to $9.29 billion by 2033. This growth is fueled by advanced automotive technologies and a strong emphasis on safety and efficiency in vehicles.

Does ConsaInsights provide customized market report data for the automotive Mems Sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the automotive MEMS sensors industry. This includes detailed analysis and insights focusing on market trends, key players, and technological advancements.

What deliverables can I expect from this automotive Mems Sensors market research project?

From the automotive MEMS sensors market research project, you can expect comprehensive reports detailing market size, segment analysis, competitive landscape, geographic trends, and actionable insights aimed at helping stakeholders make informed decisions in this industry.

What are the market trends of automotive Mems Sensors?

Current trends in the automotive MEMS sensors market include increasing adoption of connected vehicles, advancements in sensor miniaturization, a shift towards electric vehicles, and enhanced focus on safety technologies, indicating a dynamic landscape aimed at improving drive experience.